Analysts’ Viewpoint on Mattress Market Scenario

The global mattress market is expected to grow at a substantial rate due to the rise in demand for comfortable and advanced mattresses across the globe. Increase in awareness about the quality of materials used in sleeping mattresses is encouraging market players to develop advanced mattresses. Manufacturers are using advanced technologies and better materials to provide an enhanced sleep experience to their customers. Rise in demand for organic and natural materials in mattresses has encouraged companies to focus on using natural materials for manufacturing mattresses. Additionally, companies must focus on leveraging online platforms to increase sales. This strategy is also likely to help them stay abreast with the ongoing trends in the market.

The evolution of the bedding industry dates back to millions of years and has differed from culture to culture. The mattress component industry has undergone significant changes; in the olden days, mattresses were meant mainly for the elite, and as time went by, they became easily available to the masses. In the 20th century, the mattress market went through a revolution, as different types of mattresses were introduced into the market. During this period, innerspring and memory foam mattresses gained popularity, and their demand skyrocketed. Mattresses have come a long way since the most primitive grass-lined beds. However, the basic concept has remained unaffected; a cozy, comfortable, and safe spot to sleep and restore one’s energies all through the night. Increase in usage of comfort bedding products for resting and quality sleep is driving the global mattress market.

Request a sample to get extensive insights into the Mattress Market

Rise in demand for natural and organic mattresses is one of the revolutionary market trends in the global mattress market. Demand for organic products has increased significantly over the years. Manufacturers are now offering different varieties of organic mattresses that are made from hypoallergenic materials. Rise in awareness about the harmful effects of synthetic mattresses has shifted customer preference toward organic mattresses. People suffering from breathing issues prefer organic mattresses to avoid health issues caused by synthetic materials.

Pesticides and toxic chemicals are not used in organic mattresses, which helps in enhancing sleep quality with minimum effect on the skin and hair, and reduces the chances of skin allergies. Latex, wool, and cotton are widely used as natural materials in the manufacture of organic mattresses. Increase in demand for organic and natural mattresses has encouraged large numbers of players to use organic materials in the manufacture of their products. However, customers who prefer organic mattresses face a few challenges such as high price and limited availability. Furthermore, fewer players offer organic mattresses in the market.

Prominent players in the global mattress market are focussing on smart mattresses that provide better sleep with increased comfort. Mattress manufacturers are keen on adopting effective foam technology. Additionally, biometric sensor technology has caught the attention of manufacturers, as it tracks an individual’s sleep patterns during the night. Customers are also increasingly adopting advanced technologies that help in monitoring their sleep. Advanced digital technologies with access to IoT-based devices are being widely incorporated by mattress manufacturers into their products.

Product innovation through advanced research and development is a key element in the mattress industry value chain. Plant-based foam mattress technology is one of the notable technologies that uses bamboo, soy, and aloe vera. Mattresses made from these materials release heat 10 times faster than polyurethane foam mattresses, and are ideal for people suffering from back problems and related issues. They are also widely used in colder regions around the world. This technology has gained widespread attention and is gradually being incorporated by market players on a large scale.

Request a custom report on Mattress Market

In terms of size, the global mattress market is dominated by twin or single mattresses. Queen size beds are ideal for teenagers, young adults, and single individuals of any age. Rapid growth in the youth population across the globe is expected to fuel the demand for twin or single-size mattresses during the forecast period.

Individuals opting for better comfort and quality rest prefer queen size mattresses. Queen size is gaining popularity across the globe owing to its multiple benefits. Queen mattresses are mostly preferred by couples.

Increase in number of beds in hospitality and healthcare sectors is boosting the demand for mattresses. Key mattress trends of 2022 are being witnessed in the rapidly growing hospitality and healthcare sectors. This is significantly driving the global mattress market.

People are increasingly becoming conscious about the interior design of their homes. They opt to replace old household furnishings with new items to match the interior design of their residences. This is expected to augment the demand for mattresses during the forecast period. Rise in preference for mattresses has encouraged key players to innovate and develop new products.

Countries with high population base and increase in spending capacity are key markets for mattresses. Asia Pacific, with two highly-populated countries: China and India, is the most lucrative region of the global mattress market.

Half of the world’s population resides in Southeast Asia. Therefore, mattress manufacturers can concentrate on these regions to gain larger customer base. Improvement in standard of living, high purchasing capacity, and huge population base have boosted the demand for mattresses in the region. Rise in urbanization has further augmented the demand for foam mattresses. On the other hand, the U.S. mattress market is projected to grow owing to the high demand for air mattresses and spring mattresses in the country.

The mattress market is influenced by the presence of several local and regional players. Key players are primarily investing in research & development activities and product innovation to strengthen their presence in the market. Sleep Number Corporation, Simmons Bedding Company, Leggett & Platt Incorporated, Serta Simmons Bedding, LLC, Tempur Sealy International Inc., and King Koil are the prominent entities operating in the market.

Each of these players have been profiled in the mattress market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

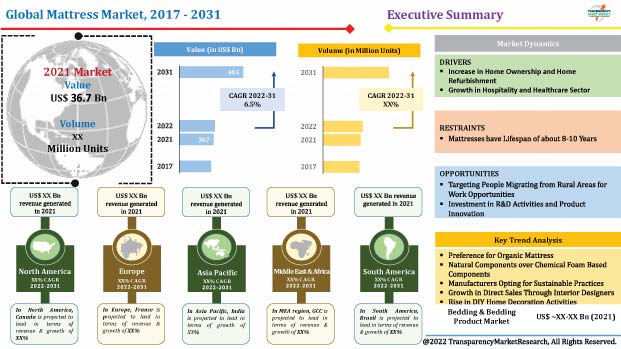

Mattress Market Value in 2021 |

US$ 36.7 Bn |

|

Market Forecast Value in 2031 |

US$ 68.5 Bn |

|

Growth Rate (CAGR) |

6.5% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

Includes cross-segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The mattress market stood at US$ 36.7 Bn in 2021.

The mattress market is estimated to grow at a CAGR of 6.5% from 2022 to 2031.

The mattress market is likely to reach US$ 68.5 Bn by 2031.

Increase in home ownership and home refurbishment; growth in hospitality and healthcare sector; and rise in Preference for comfort resting products.

The innerspring segment accounted for around 52.9% share of the market in 2021.

Asia Pacific is likely to be the most lucrative region of the global mattress market.

Sleep Number Corporation, Simmons Bedding Company, Leggett & Platt Incorporated, Serta Simmons Bedding, LLC, Tempur Sealy International Inc., and King Koil.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Bedding& Bedding Products Industry Overview

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Standards & Regulatory Frameworks

5.9. Trade Analysis (HS Code- 9404)

5.9.1. Top 10 Export Countries

5.9.2. Top 10 Import Countries

5.10. Global Mattress Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Million Units)

6. Global Mattress Market Analysis and Forecast, By Product Type

6.1. Mattress Market Size (US$ Bn and Million Units), By Product Type, 2017 - 2031

6.1.1. Foam Mattress

6.1.2. Hybrid Mattress

6.1.3. Innerspring Mattress

6.1.4. Latex Mattress

6.1.5. Others

6.2. Incremental Opportunity, By Product Type

7. Global Mattress Market Analysis and Forecast, By Component

7.1. Mattress Market Size (US$ Bn and Million Units), By Component, 2017 - 2031

7.1.1. Foam

7.1.1.1. Polyurethane

7.1.1.2. Polyethylene

7.1.1.3. Memory

7.1.1.4. Gel

7.1.1.5. Polyester

7.1.1.6. Latex

7.1.1.7. Convoluted

7.1.1.8. Evlon

7.1.2. Innerspring

7.1.2.1. Bonnel Coils

7.1.2.2. Pocket Coils

7.1.2.3. Continuous Coils

7.1.2.4. Offset Coils

7.1.3. Latex

7.1.3.1. Natural

7.1.3.2. Synthetic

7.1.4. Fillings

7.1.4.1. Coir

7.1.4.2. Wool

7.1.4.3. Cotton

7.1.4.4. Others

7.1.5. Ticking

7.2. Incremental Opportunity, By Component

8. Global Mattress Market Analysis and Forecast, By Size

8.1. Mattress Market Size (US$ Bn and Million Units), By Size, 2017 - 2031

8.1.1. Twin or Single Size

8.1.2. Twin XL Size

8.1.3. Full or Double Size

8.1.4. Queen Size

8.1.5. Other Sizes

8.2. Incremental Opportunity, By Size

9. Global Mattress Market Analysis and Forecast, By Pricing

9.1. Mattress Market Size (US$ Bn and Million Units), By Pricing, 2017 - 2031

9.1.1. Mass

9.1.2. Premium

9.2. Incremental Opportunity, By Pricing

10. Global Mattress Market Analysis and Forecast, By End-user

10.1. Mattress Market Size (US$ Bn and Million Units), By End-user , 2017 - 2031

10.1.1. Residential

10.1.2. Commercial

10.1.2.1. Healthcare

10.1.2.2. Hotel & Accommodation Centers

10.1.2.3. Others

10.2. Incremental Opportunity, By End-user

11. Global Mattress Market Analysis and Forecast, By Distribution Channel

11.1. Mattress Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

11.1.1. Online

11.1.1.1. Company Websites

11.1.1.2. E-Commerce Sites

11.1.2. Offline

11.1.2.1. Mega Retail Store

11.1.2.2. Specialty Store

11.1.2.3. Others

11.2. Incremental Opportunity, By Distribution Channel

12. Global Mattress Market Analysis and Forecast, by Region

12.1. Mattress Market Size (US$ Bn and Million Units), By Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Mattress Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Key Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.5. Demographic Overview

13.6. Key Trends Analysis

13.6.1. Demand Side Analysis

13.6.2. Supply Side Analysis

13.7. Mattress Market Size (US$ Bn and Million Units), By Product Type, 2017 - 2031

13.7.1. Foam Mattress

13.7.2. Hybrid Mattress

13.7.3. Innerspring Mattress

13.7.4. Latex Mattress

13.7.5. Others

13.8. Mattress Market Size (US$ Bn and Million Units), By Component, 2017 - 2031

13.8.1. Foam

13.8.1.1. Polyurethane

13.8.1.2. Polyethylene

13.8.1.3. Memory

13.8.1.4. Gel

13.8.1.5. Polyester

13.8.1.6. Latex

13.8.1.7. Convoluted

13.8.1.8. Evlon

13.8.2. Innerspring

13.8.2.1. Bonnel Coils

13.8.2.2. Pocket Coils

13.8.2.3. Continuous Coils

13.8.2.4. Offset Coils

13.8.3. Latex

13.8.3.1. Natural

13.8.3.2. Synthetic

13.8.4. Fillings

13.8.4.1. Coir

13.8.4.2. Wool

13.8.4.3. Cotton

13.8.4.4. Others

13.8.5. Ticking

13.9. Mattress Market Size (US$ Bn and Million Units), By Size, 2017 - 2031

13.9.1. Twin or Single Size

13.9.2. Twin XL Size

13.9.3. Full or Double Size

13.9.4. Queen Size

13.9.5. Other Sizes

13.10. Mattress Market Size (US$ Bn and Million Units), By Pricing, 2017 - 2031

13.10.1. Mass

13.10.2. Premium

13.11. Mattress Market Size (US$ Bn and Million Units), By End-user , 2017 - 2031

13.11.1. Residential

13.11.2. Commercial

13.11.2.1. Healthcare

13.11.2.2. Hotel & Accommodation Centers

13.11.2.3. Others

13.12. Mattress Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

13.12.1. Online

13.12.1.1. Company Websites

13.12.1.2. E-Commerce Sites

13.12.2. Offline

13.12.2.1. Mega Retail Store

13.12.2.2. Specialty Store

13.12.2.3. Others

13.13. Mattress Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

13.13.1. The U.S.

13.13.2. Canada

13.13.3. Rest of North America

13.14. Incremental Opportunity Analysis

14. Europe Mattress Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.5. Demographic Overview

14.6. Key Trends Analysis

14.6.1. Demand Side Analysis

14.6.2. Supply Side Analysis

14.7. Mattress Market Size (US$ Bn and Million Units), By Product Type, 2017 - 2031

14.7.1. Foam Mattress

14.7.2. Hybrid Mattress

14.7.3. Innerspring Mattress

14.7.4. Latex Mattress

14.7.5. Others

14.8. Mattress Market Size (US$ Bn and Million Units), By Component, 2017 - 2031

14.8.1. Foam

14.8.1.1. Polyurethane

14.8.1.2. Polyethylene

14.8.1.3. Memory

14.8.1.4. Gel

14.8.1.5. Polyester

14.8.1.6. Latex

14.8.1.7. Convoluted

14.8.1.8. Evlon

14.8.2. Innerspring

14.8.2.1. Bonnel Coils

14.8.2.2. Pocket Coils

14.8.2.3. Continuous Coils

14.8.2.4. Offset Coils

14.8.3. Latex

14.8.3.1. Natural

14.8.3.2. Synthetic

14.8.4. Fillings

14.8.4.1. Coir

14.8.4.2. Wool

14.8.4.3. Cotton

14.8.4.4. Others

14.8.5. Ticking

14.9. Mattress Market Size (US$ Bn and Million Units), By Size, 2017 - 2031

14.9.1. Twin or Single Size

14.9.2. Twin XL Size

14.9.3. Full or Double Size

14.9.4. Queen Size

14.9.5. Other Sizes

14.10. Mattress Market Size (US$ Bn and Million Units), By Pricing, 2017 - 2031

14.10.1. Mass

14.10.2. Premium

14.11. Mattress Market Size (US$ Bn and Million Units), By End-user , 2017 - 2031

14.11.1. Residential

14.11.2. Commercial

14.11.2.1. Healthcare

14.11.2.2. Hotel & Accommodation Centers

14.11.2.3. Others

14.12. Mattress Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

14.12.1. Online

14.12.1.1. Company Websites

14.12.1.2. E-Commerce Sites

14.12.2. Offline

14.12.2.1. Mega Retail Store

14.12.2.2. Specialty Store

14.12.2.3. Others

14.13. Mattress Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

14.13.1. U.K.

14.13.2. Germany

14.13.3. France

14.13.4. Rest of Europe

14.14. Incremental Opportunity Analysis

15. Asia Pacific Mattress Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Brand Analysis

15.4. Consumer Buying Behavior Analysis

15.5. Demographic Overview

15.6. Key Trends Analysis

15.6.1. Demand Side Analysis

15.6.2. Supply Side Analysis

15.7. Mattress Market Size (US$ Bn and Million Units), By Product Type, 2017 - 2031

15.7.1. Foam Mattress

15.7.2. Hybrid Mattress

15.7.3. Innerspring Mattress

15.7.4. Latex Mattress

15.7.5. Others

15.8. Mattress Market Size (US$ Bn and Million Units), By Component, 2017 - 2031

15.8.1. Foam

15.8.1.1. Polyurethane

15.8.1.2. Polyethylene

15.8.1.3. Memory

15.8.1.4. Gel

15.8.1.5. Polyester

15.8.1.6. Latex

15.8.1.7. Convoluted

15.8.1.8. Evlon

15.8.2. Innerspring

15.8.2.1. Bonnel Coils

15.8.2.2. Pocket Coils

15.8.2.3. Continuous Coils

15.8.2.4. Offset Coils

15.8.3. Latex

15.8.3.1. Natural

15.8.3.2. Synthetic

15.8.4. Fillings

15.8.4.1. Coir

15.8.4.2. Wool

15.8.4.3. Cotton

15.8.4.4. Others

15.8.5. Ticking

15.9. Mattress Market Size (US$ Bn and Million Units), By Size, 2017 - 2031

15.9.1. Twin or Single Size

15.9.2. Twin XL Size

15.9.3. Full or Double Size

15.9.4. Queen Size

15.9.5. Other Sizes

15.10. Mattress Market Size (US$ Bn and Million Units), By Pricing, 2017 - 2031

15.10.1. Mass

15.10.2. Premium

15.11. Mattress Market Size (US$ Bn and Million Units), By End-user , 2017 - 2031

15.11.1. Residential

15.11.2. Commercial

15.11.2.1. Healthcare

15.11.2.2. Hotel & Accommodation Centers

15.11.2.3. Others

15.12. Mattress Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

15.12.1. Online

15.12.1.1. Company Websites

15.12.1.2. E-Commerce Sites

15.12.2. Offline

15.12.2.1. Mega Retail Store

15.12.2.2. Specialty Store

15.12.2.3. Others

15.13. Mattress Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

15.13.1. China

15.13.2. India

15.13.3. Japan

15.13.4. Rest of Asia Pacific

15.14. Incremental Opportunity Analysis

16. Middle East & Africa Mattress Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Key Brand Analysis

16.4. Consumer Buying Behavior Analysis

16.5. Demographic Overview

16.6. Key Trends Analysis

16.6.1. Demand Side Analysis

16.6.2. Supply Side Analysis

16.7. Mattress Market Size (US$ Bn and Million Units), By Product Type, 2017 - 2031

16.7.1. Foam Mattress

16.7.2. Hybrid Mattress

16.7.3. Innerspring Mattress

16.7.4. Latex Mattress

16.7.5. Others

16.8. Mattress Market Size (US$ Bn and Million Units), By Component, 2017 - 2031

16.8.1. Foam

16.8.1.1. Polyurethane

16.8.1.2. Polyethylene

16.8.1.3. Memory

16.8.1.4. Gel

16.8.1.5. Polyester

16.8.1.6. Latex

16.8.1.7. Convoluted

16.8.1.8. Evlon

16.8.2. Innerspring

16.8.2.1. Bonnel Coils

16.8.2.2. Pocket Coils

16.8.2.3. Continuous Coils

16.8.2.4. Offset Coils

16.8.3. Latex

16.8.3.1. Natural

16.8.3.2. Synthetic

16.8.4. Fillings

16.8.4.1. Coir

16.8.4.2. Wool

16.8.4.3. Cotton

16.8.4.4. Others

16.8.5. Ticking

16.9. Mattress Market Size (US$ Bn and Million Units), By Size, 2017 - 2031

16.9.1. Twin or Single Size

16.9.2. Twin XL Size

16.9.3. Full or Double Size

16.9.4. Queen Size

16.9.5. Other Sizes

16.10. Mattress Market Size (US$ Bn and Million Units), By Pricing, 2017 - 2031

16.10.1. Mass

16.10.2. Premium

16.11. Mattress Market Size (US$ Bn and Million Units), By End-user , 2017 - 2031

16.11.1. Residential

16.11.2. Commercial

16.11.2.1. Healthcare

16.11.2.2. Hotel & Accommodation Centers

16.11.2.3. Others

16.12. Mattress Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

16.12.1. Online

16.12.1.1. Company Websites

16.12.1.2. E-Commerce Sites

16.12.2. Offline

16.12.2.1. Mega Retail Store

16.12.2.2. Specialty Store

16.12.2.3. Others

16.13. Mattress Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

16.13.1. GCC

16.13.2. South Africa

16.13.3. Rest of Middle East & Africa

16.14. Incremental Opportunity Analysis

17. South America Mattress Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Selling Price (US$)

17.3. Key Brand Analysis

17.4. Consumer Buying Behavior Analysis

17.5. Demographic Overview

17.6. Key Trends Analysis

17.6.1. Demand Side Analysis

17.6.2. Supply Side Analysis

17.7. Mattress Market Size (US$ Bn and Million Units), By Product Type, 2017 - 2031

17.7.1. Foam Mattress

17.7.2. Hybrid Mattress

17.7.3. Innerspring Mattress

17.7.4. Latex Mattress

17.7.5. Others

17.8. Mattress Market Size (US$ Bn and Million Units), By Component, 2017 - 2031

17.8.1. Foam

17.8.1.1. Polyurethane

17.8.1.2. Polyethylene

17.8.1.3. Memory

17.8.1.4. Gel

17.8.1.5. Polyester

17.8.1.6. Latex

17.8.1.7. Convoluted

17.8.1.8. Evlon

17.8.2. Innerspring

17.8.2.1. Bonnel Coils

17.8.2.2. Pocket Coils

17.8.2.3. Continuous Coils

17.8.2.4. Offset Coils

17.8.3. Latex

17.8.3.1. Natural

17.8.3.2. Synthetic

17.8.4. Fillings

17.8.4.1. Coir

17.8.4.2. Wool

17.8.4.3. Cotton

17.8.4.4. Others

17.8.5. Ticking

17.9. Mattress Market Size (US$ Bn and Million Units), By Size, 2017 - 2031

17.9.1. Twin or Single Size

17.9.2. Twin XL Size

17.9.3. Full or Double Size

17.9.4. Queen Size

17.9.5. Other Sizes

17.10. Mattress Market Size (US$ Bn and Million Units), By Pricing, 2017 - 2031

17.10.1. Mass

17.10.2. Premium

17.11. Mattress Market Size (US$ Bn and Million Units), By End-user , 2017 - 2031

17.11.1. Residential

17.11.2. Commercial

17.11.2.1. Healthcare

17.11.2.2. Hotel & Accommodation Centers

17.11.2.3. Others

17.12. Mattress Market Size (US$ Bn and Million Units), By Distribution Channel, 2017 - 2031

17.12.1. Online

17.12.1.1. Company Websites

17.12.1.2. E-Commerce Sites

17.12.2. Offline

17.12.2.1. Mega Retail Store

17.12.2.2. Specialty Store

17.12.2.3. Others

17.13. Mattress Market Size (US$ Bn and Million Units), By Country & Sub-region, 2017 - 2031

17.13.1. Brazil

17.13.2. Rest of South America

17.14. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player – Competition Dashboard

18.2. Market Share Analysis (%), 2021

18.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

18.3.1. Comfur Mattresses

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Financial/Revenue

18.3.1.4. Strategy & Business Overview

18.3.1.5. Sales Channel Analysis

18.3.1.6. Size Portfolio

18.3.2. Englander Mattress

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Financial/Revenue

18.3.2.4. Strategy & Business Overview

18.3.2.5. Sales Channel Analysis

18.3.2.6. Size Portfolio

18.3.3. Kaiserkorp Sdn.Bhd. (King Koil)

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Financial/Revenue

18.3.3.4. Strategy & Business Overview

18.3.3.5. Sales Channel Analysis

18.3.3.6. Size Portfolio

18.3.4. Leggett & Platt Incorporated

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Financial/Revenue

18.3.4.4. Strategy & Business Overview

18.3.4.5. Sales Channel Analysis

18.3.4.6. Size Portfolio

18.3.5. Owen & Company Limited (Kingsdown Inc.)

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Financial/Revenue

18.3.5.4. Strategy & Business Overview

18.3.5.5. Sales Channel Analysis

18.3.5.6. Size Portfolio

18.3.6. Puffy Mattress

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Financial/Revenue

18.3.6.4. Strategy & Business Overview

18.3.6.5. Sales Channel Analysis

18.3.6.6. Size Portfolio

18.3.7. Sealy Corporation

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Financial/Revenue

18.3.7.4. Strategy & Business Overview

18.3.7.5. Sales Channel Analysis

18.3.7.6. Size Portfolio

18.3.8. Serta Simmons Bedding LLC

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Financial/Revenue

18.3.8.4. Strategy & Business Overview

18.3.8.5. Sales Channel Analysis

18.3.8.6. Size Portfolio

18.3.9. Simmons Bedding Company

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Financial/Revenue

18.3.9.4. Strategy & Business Overview

18.3.9.5. Sales Channel Analysis

18.3.9.6. Size Portfolio

18.3.10. Sleep Number Corporation

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Financial/Revenue

18.3.10.4. Strategy & Business Overview

18.3.10.5. Sales Channel Analysis

18.3.10.6. Size Portfolio

18.3.11. Tempur-Pedic International, Inc.

18.3.11.1. Company Overview

18.3.11.2. Sales Area/Geographical Presence

18.3.11.3. Financial/Revenue

18.3.11.4. Strategy & Business Overview

18.3.11.5. Sales Channel Analysis

18.3.11.6. Size Portfolio

19. Key Takeaway

19.1. Identification of Potential Market Spaces

19.1.1. Product Type

19.1.2. Component

19.1.3. Size

19.1.4. Pricing

19.1.5. End-user

19.1.6. Distribution Channel

19.1.7. Region

19.2. Understanding the Buying Behavior of Consumers

19.3. Preferred Sales & Marketing Strategy

19.4. Prevailing Market Risk & Challenges

List of Tables

Table 1: Global Mattress Market Value Size & Forecast – by Product Type (US$ Bn)

Table 2: Global Mattress Market Volume Size & Forecast – by Product Type (Million Units)

Table 3: Global Mattress Market Value Size & Forecast – by Component (US$ Bn)

Table 4: Global Mattress Market Volume Size & Forecast – by Component (Million Units)

Table 5: Global Mattress Market Value Size & Forecast – by Size (US$ Bn)

Table 6: Global Mattress Market Volume Size & Forecast – by Size (Million Units)

Table 7: Global Mattress Market Value Size & Forecast – by Pricing (US$ Bn)

Table 8: Global Mattress Market Volume Size & Forecast – by Pricing (Million Units)

Table 9: Global Mattress Market Value Size & Forecast – by End-user (US$ Bn)

Table 10: Global Mattress Market Volume Size & Forecast – by End-user (Million Units)

Table 11: Global Mattress Market Value Size & Forecast – By Distribution Channel (US$ Bn)

Table 12: Global Mattress Market Volume Size & Forecast – By Distribution Channel (Million Units)

Table 13: Global Mattress Market Value Size & Forecast – By Region (US$ Bn)

Table 14: Global Mattress Market Volume Size & Forecast – By Region (Million Units)

Table 15: North America Mattress Market Value Size & Forecast – by Product Type (US$ Bn)

Table 16: North America Mattress Market Volume Size & Forecast – by Product Type (Million Units)

Table 17: North America Mattress Market Value Size & Forecast – by Component (US$ Bn)

Table 18: North America Mattress Market Volume Size & Forecast – by Component (Million Units)

Table 19: North America Mattress Market Value Size & Forecast – by Size (US$ Bn)

Table 20: North America Mattress Market Volume Size & Forecast – by Size (Million Units)

Table 21: North America Mattress Market Value Size & Forecast – by Pricing (US$ Bn)

Table 22: North America Mattress Market Volume Size & Forecast – by Pricing (Million Units)

Table 23: North America Mattress Market Value Size & Forecast – by End-user (US$ Bn)

Table 24: North America Mattress Market Volume Size & Forecast – by End-user (Million Units)

Table 25: North America Mattress Market Value Size & Forecast – By Distribution Channel (US$ Bn)

Table 26: North America Mattress Market Volume Size & Forecast – By Distribution Channel (Million Units)

Table 27: North America Mattress Market Value Size & Forecast – By Country (US$ Bn)

Table 28: North America Mattress Market Volume Size & Forecast – By Country (Million Units)

Table 29: Europe Mattress Market Value Size & Forecast – by Product Type (US$ Bn)

Table 30: Europe Mattress Market Volume Size & Forecast – by Product Type (Million Units)

Table 31: Europe Mattress Market Value Size & Forecast – by Component (US$ Bn)

Table 32: Europe Mattress Market Volume Size & Forecast – by Component (Million Units)

Table 33: Europe Mattress Market Value Size & Forecast – by Size (US$ Bn)

Table 34: Europe Mattress Market Volume Size & Forecast – by Size (Million Units)

Table 35: Europe Mattress Market Value Size & Forecast – by Pricing (US$ Bn)

Table 36: Europe Mattress Market Volume Size & Forecast – by Pricing (Million Units)

Table 37: Europe Mattress Market Value Size & Forecast – by End-user (US$ Bn)

Table 38: Europe Mattress Market Volume Size & Forecast – by End-user (Million Units)

Table 39: Europe Mattress Market Value Size & Forecast – By Distribution Channel (US$ Bn)

Table 40: Europe Mattress Market Volume Size & Forecast – By Distribution Channel (Million Units)

Table 41: Europe Mattress Market Value Size & Forecast – By Country (US$ Bn)

Table 42: Europe Mattress Market Volume Size & Forecast – By Country (Million Units)

Table 43: Asia Pacific Mattress Market Value Size & Forecast – by Product Type (US$ Bn)

Table 44: Asia Pacific Mattress Market Volume Size & Forecast – by Product Type (Million Units)

Table 45: Asia Pacific Mattress Market Value Size & Forecast – by Component (US$ Bn)

Table 46: Asia Pacific Mattress Market Volume Size & Forecast – by Component (Million Units)

Table 47: Asia Pacific Mattress Market Value Size & Forecast – by Size (US$ Bn)

Table 48: Asia Pacific Mattress Market Volume Size & Forecast – by Size (Million Units)

Table 49: Asia Pacific Mattress Market Value Size & Forecast – by Pricing (US$ Bn)

Table 50: Asia Pacific Mattress Market Volume Size & Forecast – by Pricing (Million Units)

Table 51: Asia Pacific Mattress Market Value Size & Forecast – by End-user (US$ Bn)

Table 52: Asia Pacific Mattress Market Volume Size & Forecast – by End-user (Million Units)

Table 53: Asia Pacific Mattress Market Value Size & Forecast – By Distribution Channel (US$ Bn)

Table 54: Asia Pacific Mattress Market Volume Size & Forecast – By Distribution Channel (Million Units)

Table 55: Asia Pacific Mattress Market Value Size & Forecast – By Country (US$ Bn)

Table 56: Asia Pacific Mattress Market Volume Size & Forecast – By Country (Million Units)

Table 57: Middle East & Africa Mattress Market Value Size & Forecast – by Product Type (US$ Bn)

Table 58: Middle East & Africa Mattress Market Volume Size & Forecast – by Product Type (Million Units)

Table 59: Middle East & Africa Mattress Market Value Size & Forecast – by Component (US$ Bn)

Table 60: Middle East & Africa Mattress Market Volume Size & Forecast – by Component (Million Units)

Table 61: Middle East & Africa Mattress Market Value Size & Forecast – by Size (US$ Bn)

Table 62: Middle East & Africa Mattress Market Volume Size & Forecast – by Size (Million Units)

Table 63: Middle East & Africa Mattress Market Value Size & Forecast – by Pricing (US$ Bn)

Table 64: Middle East & Africa Mattress Market Volume Size & Forecast – by Pricing (Million Units)

Table 65: Middle East & Africa Mattress Market Value Size & Forecast – by End-user (US$ Bn)

Table 66: Middle East & Africa Mattress Market Volume Size & Forecast – by End-user (Million Units)

Table 67: Middle East & Africa Mattress Market Value Size & Forecast – By Distribution Channel (US$ Bn)

Table 68: Middle East & Africa Mattress Market Volume Size & Forecast – By Distribution Channel (Million Units)

Table 69: Middle East & Africa Mattress Market Value Size & Forecast – By Country (US$ Bn)

Table 70: Middle East & Africa Mattress Market Volume Size & Forecast – By Country (Million Units)

Table 71: South America Mattress Market Value Size & Forecast – by Product Type (US$ Bn)

Table 72: South America Mattress Market Volume Size & Forecast – by Product Type (Million Units)

Table 73: South America Mattress Market Value Size & Forecast – by Component (US$ Bn)

Table 74: South America Mattress Market Volume Size & Forecast – by Component (Million Units)

Table 75: South America Mattress Market Value Size & Forecast – by Size (US$ Bn)

Table 76: South America Mattress Market Volume Size & Forecast – by Size (Million Units)

Table 77: South America Mattress Market Value Size & Forecast – by Pricing (US$ Bn)

Table 78: South America Mattress Market Volume Size & Forecast – by Pricing (Million Units)

Table 79: South America Mattress Market Value Size & Forecast – by End-user (US$ Bn)

Table 80: South America Mattress Market Volume Size & Forecast – by End-user (Million Units)

Table 81: South America Mattress Market Value Size & Forecast – By Distribution Channel (US$ Bn)

Table 82: South America Mattress Market Volume Size & Forecast – By Distribution Channel (Million Units)

Table 83: South America Mattress Market Value Size & Forecast – By Country (US$ Bn)

Table 84: South America Mattress Market Volume Size & Forecast – By Country (Million Units)

List of Figures

Figure 1: Global Mattress Market Projections by Product Type, US$ Bn, 2017-2031

Figure 2: Global Mattress Market Projections by Product Type, Million Units, 2017-2031

Figure 3: Global Mattress Market, Incremental Opportunity, by Product Type, US$ Bn

Figure 4: Global Mattress Market Projections by Component, US$ Bn, 2017-2031

Figure 5: Global Mattress Market Projections by Component, Million Units, 2017-2031

Figure 6: Global Mattress Market, Incremental Opportunity, by Component, US$ Bn

Figure 7: Global Mattress Market Projections by Size, US$ Bn, 2017-2031

Figure 8: Global Mattress Market Projections by Size, Million Units, 2017-2031

Figure 9: Global Mattress Market, Incremental Opportunity, by Size, US$ Bn

Figure 10: Global Mattress Market Projections by Pricing, US$ Bn, 2017-2031

Figure 11: Global Mattress Market Projections by Pricing, Million Units, 2017-2031

Figure 12: Global Mattress Market, Incremental Opportunity, by Pricing, US$ Bn

Figure 13: Global Mattress Market Projections by End-user , US$ Bn, 2017-2031

Figure 14: Global Mattress Market Projections by End-user , Million Units, 2017-2031

Figure 15: Global Mattress Market, Incremental Opportunity, by End-user , US$ Bn

Figure 16: Global Mattress Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 17: Global Mattress Market Projections by Distribution Channel, Million Units, 2017-2031

Figure 18: Global Mattress Market, Incremental Opportunity, by Distribution Channel, US$ Bn

Figure 19: Global Mattress Market Projections by Region, US$ Bn, 2017-2031

Figure 20: Global Mattress Market Projections by Region, Million Units, 2017-2031

Figure 21: Global Mattress Market, Incremental Opportunity, by Region, US$ Bn

Figure 22: North America Mattress Market Projections by Product Type, US$ Bn, 2017-2031

Figure 23: North America Mattress Market Projections by Product Type, Million Units, 2017-2031

Figure 24: North America Mattress Market, Incremental Opportunity, by Product Type, US$ Bn

Figure 25: North America Mattress Market Projections by Component, US$ Bn, 2017-2031

Figure 26: North America Mattress Market Projections by Component, Million Units, 2017-2031

Figure 27: North America Mattress Market, Incremental Opportunity, by Component, US$ Bn

Figure 28: North America Mattress Market Projections by Size, US$ Bn, 2017-2031

Figure 29: North America Mattress Market Projections by Size, Million Units, 2017-2031

Figure 30: North America Mattress Market, Incremental Opportunity, by Size, US$ Bn

Figure 31: North America Mattress Market Projections by Pricing, US$ Bn, 2017-2031

Figure 32: North America Mattress Market Projections by Pricing, Million Units, 2017-2031

Figure 33: North America Mattress Market, Incremental Opportunity, by Pricing, US$ Bn

Figure 34: North America Mattress Market Projections by End-user , US$ Bn, 2017-2031

Figure 35: North America Mattress Market Projections by End-user , Million Units, 2017-2031

Figure 36: North America Mattress Market, Incremental Opportunity, by End-user , US$ Bn

Figure 37: North America Mattress Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 38: North America Mattress Market Projections by Distribution Channel, Million Units, 2017-2031

Figure 39: North America Mattress Market, Incremental Opportunity, by Distribution Channel, US$ Bn

Figure 40: North America Mattress Market Projections by Country, US$ Bn, 2017-2031

Figure 41: North America Mattress Market Projections by Country, Million Units, 2017-2031

Figure 42: North America Mattress Market, Incremental Opportunity, by Country, US$ Bn

Figure 43: Europe Mattress Market Projections by Product Type, US$ Bn, 2017-2031

Figure 44: Europe Mattress Market Projections by Product Type, Million Units, 2017-2031

Figure 45: Europe Mattress Market, Incremental Opportunity, by Product Type, US$ Bn

Figure 46: Europe Mattress Market Projections by Component, US$ Bn, 2017-2031

Figure 47: Europe Mattress Market Projections by Component, Million Units, 2017-2031

Figure 48: Europe Mattress Market, Incremental Opportunity, by Component, US$ Bn

Figure 49: Europe Mattress Market Projections by Size, US$ Bn, 2017-2031

Figure 50: Europe Mattress Market Projections by Size, Million Units, 2017-2031

Figure 51: Europe Mattress Market, Incremental Opportunity, by Size, US$ Bn

Figure 52: Europe Mattress Market Projections by Pricing, US$ Bn, 2017-2031

Figure 53: Europe Mattress Market Projections by Pricing, Million Units, 2017-2031

Figure 54: Europe Mattress Market, Incremental Opportunity, by Pricing, US$ Bn

Figure 55: Europe Mattress Market Projections by End-user , US$ Bn, 2017-2031

Figure 56: Europe Mattress Market Projections by End-user , Million Units, 2017-2031

Figure 57: Europe Mattress Market, Incremental Opportunity, by End-user , US$ Bn

Figure 58: Europe Mattress Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 59: Europe Mattress Market Projections by Distribution Channel, Million Units, 2017-2031

Figure 60: Europe Mattress Market, Incremental Opportunity, by Distribution Channel, US$ Bn

Figure 61: Europe Mattress Market Projections by Country, US$ Bn, 2017-2031

Figure 62: Europe Mattress Market Projections by Country, Million Units, 2017-2031

Figure 63: Europe Mattress Market, Incremental Opportunity, by Country, US$ Bn

Figure 64: Asia Pacific Mattress Market Projections by Product Type, US$ Bn, 2017-2031

Figure 65: Asia Pacific Mattress Market Projections by Product Type, Million Units, 2017-2031

Figure 66: Asia Pacific Mattress Market, Incremental Opportunity, by Product Type, US$ Bn

Figure 67: Asia Pacific Mattress Market Projections by Component, US$ Bn, 2017-2031

Figure 68: Asia Pacific Mattress Market Projections by Component, Million Units, 2017-2031

Figure 69: Asia Pacific Mattress Market, Incremental Opportunity, by Component, US$ Bn

Figure 70: Asia Pacific Mattress Market Projections by Size, US$ Bn, 2017-2031

Figure 71: Asia Pacific Mattress Market Projections by Size, Million Units, 2017-2031

Figure 72: Asia Pacific Mattress Market, Incremental Opportunity, by Size, US$ Bn

Figure 73: Asia Pacific Mattress Market Projections by Pricing, US$ Bn, 2017-2031

Figure 74: Asia Pacific Mattress Market Projections by Pricing, Million Units, 2017-2031

Figure 75: Asia Pacific Mattress Market, Incremental Opportunity, by Pricing, US$ Bn

Figure 76: Asia Pacific Mattress Market Projections by End-user , US$ Bn, 2017-2031

Figure 77: Asia Pacific Mattress Market Projections by End-user , Million Units, 2017-2031

Figure 78: Asia Pacific Mattress Market, Incremental Opportunity, by End-user, US$ Bn

Figure 79: Asia Pacific Mattress Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 80: Asia Pacific Mattress Market Projections by Distribution Channel, Million Units, 2017-2031

Figure 81: Asia Pacific Mattress Market, Incremental Opportunity, by Distribution Channel, US$ Bn

Figure 82: Asia Pacific Mattress Market Projections by Country, US$ Bn, 2017-2031

Figure 83: Asia Pacific Mattress Market Projections by Country, Million Units, 2017-2031

Figure 84: Asia Pacific Mattress Market, Incremental Opportunity, by Country, US$ Bn

Figure 85: Middle East & Africa Mattress Market Projections by Product Type, US$ Bn, 2017-2031

Figure 86: Middle East & Africa Mattress Market Projections by Product Type, Million Units, 2017-2031

Figure 87: Middle East & Africa Mattress Market, Incremental Opportunity, by Product Type, US$ Bn

Figure 88: Middle East & Africa Mattress Market Projections by Component, US$ Bn, 2017-2031

Figure 89: Middle East & Africa Mattress Market Projections by Component, Million Units, 2017-2031

Figure 90: Middle East & Africa Mattress Market, Incremental Opportunity, by Component, US$ Bn

Figure 91: Middle East & Africa Mattress Market Projections by Size, US$ Bn, 2017-2031

Figure 92: Middle East & Africa Mattress Market Projections by Size, Million Units, 2017-2031

Figure 93: Middle East & Africa Mattress Market, Incremental Opportunity, by Size, US$ Bn

Figure 94: Middle East & Africa Mattress Market Projections by Pricing, US$ Bn, 2017-2031

Figure 95: Middle East & Africa Mattress Market Projections by Pricing, Million Units, 2017-2031

Figure 96: Middle East & Africa Mattress Market, Incremental Opportunity, by Pricing, US$ Bn

Figure 97: Middle East & Africa Mattress Market Projections by End-user , US$ Bn, 2017-2031

Figure 98: Middle East & Africa Mattress Market Projections by End-user , Million Units, 2017-2031

Figure 99: Middle East & Africa Mattress Market, Incremental Opportunity, by End-user , US$ Bn

Figure 100: Middle East & Africa Mattress Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 101: Middle East & Africa Mattress Market Projections by Distribution Channel, Million Units, 2017-2031

Figure 102: Middle East & Africa Mattress Market, Incremental Opportunity, by Distribution Channel, US$ Bn

Figure 103: Middle East & Africa Mattress Market Projections by Country, US$ Bn, 2017-2031

Figure 104: Middle East & Africa Mattress Market Projections by Country, Million Units, 2017-2031

Figure 105: Middle East & Africa Mattress Market, Incremental Opportunity, by Country, US$ Bn

Figure 106: South America Mattress Market Projections by Product Type, US$ Bn, 2017-2031

Figure 107: South America Mattress Market Projections by Product Type, Million Units, 2017-2031

Figure 108: South America Mattress Market, Incremental Opportunity, by Product Type, US$ Bn

Figure 109: South America Mattress Market Projections by Component, US$ Bn, 2017-2031

Figure 110: South America Mattress Market Projections by Component, Million Units, 2017-2031

Figure 111: South America Mattress Market, Incremental Opportunity, by Component, US$ Bn

Figure 112: South America Mattress Market Projections by Size, US$ Bn, 2017-2031

Figure 113: South America Mattress Market Projections by Size, Million Units, 2017-2031

Figure 114: South America Mattress Market, Incremental Opportunity, by Size, US$ Bn

Figure 115: South America Mattress Market Projections by Pricing, US$ Bn, 2017-2031

Figure 116: South America Mattress Market Projections by Pricing, Million Units, 2017-2031

Figure 117: South America Mattress Market, Incremental Opportunity, by Pricing, US$ Bn

Figure 118: South America Mattress Market Projections by End-user , US$ Bn, 2017-2031

Figure 119: South America Mattress Market Projections by End-user , Million Units, 2017-2031

Figure 120: South America Mattress Market, Incremental Opportunity, by End-user , US$ Bn

Figure 121: South America Mattress Market Projections by Distribution Channel, US$ Bn, 2017-2031

Figure 122: South America Mattress Market Projections by Distribution Channel, Million Units, 2017-2031

Figure 123: South America Mattress Market, Incremental Opportunity, by Distribution Channel, US$ Bn

Figure 124: South America Mattress Market Projections by Country, US$ Bn, 2017-2031

Figure 125: South America Mattress Market Projections by Country, Million Units, 2017-2031

Figure 126: South America Mattress Market, Incremental Opportunity, by Country, US$ Bn