Analysts’ Viewpoint on Liquefied Petroleum Gas Market Scenario

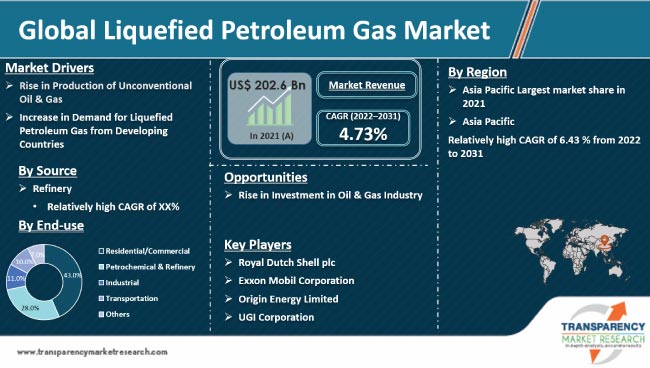

Rise in production of unconventional oil & gas and increase in demand for liquefied petroleum gas are driving the global liquefied petroleum gas market. Increase in investment in the oil & gas industry is estimated to boost the production of liquefied petroleum gas. Demand for liquefied petroleum gas is also expected to increase in the near future owing to economic prosperity of consumers. Automotive liquefied petroleum gas is also referred to as autogas. Environmental benefits and stringent government policies to reduce carbon emissions have led to the rapid adoption of autogas as a preferred fuel around the world. Governments of various countries across the globe are also providing subsidies, including tax benefits, to promote the use of autogas in vehicles. Adoption of liquefied petroleum gas for cooking is presently increasing in rural areas, worldwide, due to a rise in awareness about its benefits and various government initiatives. Thus, an increase in demand for liquefied petroleum gas for cooking proposes is estimated to propel the market during the forecast period.

Liquefied petroleum gas, also known as liquid petroleum gas, is a flammable mixture of hydrocarbon gases used as a fuel in various end-use industries. It is produced from fossil fuels, during the refining of petroleum crude oil and natural gas. The global liquefied petroleum gas market is projected to rise at a steady pace during the forecast period, as liquefied petroleum gas is widely used in various applications in hospitals, agriculture, construction, and automotive sectors. A major use of liquid petroleum gas is for cooking in residential and commercial establishments, as it is cost-effective and efficient.

Request a sample to get extensive insights into the Liquefied Petroleum Gas Market

Natural gas is produced by burying dead plants and animals. Intense heat and pressure caused by burying dead plants and animals trigger a reaction, which leads to the creation of natural gas. Special or advanced production techniques are used to extract natural gas. The gas is termed unconventional gas. Unconventional gases include shale gas, tight gas, gas hydrates, and coal bed methane. Unconventional oil & gas has been an important breakthrough for the global oil industry.

According to The World Energy Council, the U.S. has 1,161 trillion cubic feet of technically recoverable unconventional gas. China has 1,115 trillion cubic feet of unconventional gas. The U.S. was the leading country in terms of the production of unconventional gas in 2019. The annual production of unconventional gas in the U.S stood at 25 trillion cubic feet in 2019. China’s production output stood at 12 trillion cubic feet in the same year.

Advanced technologies are needed to extract unconventional fuels. Companies are investing significantly in research and development activities to develop cost-effective methods to extract these fuels. Moreover, the availability of liquefied petroleum gas has also increased in the last few years due to an increase in the production of unconventional gas. Thus, a rise in production of unconventional oil & gas is expected to drive the revenue of liquefied petroleum gas market in the near future.

Globalization, industrialization, and urbanization have increased significantly across the globe in the last few years. However, the flow of investment has changed from developed nations to developing nations due to lower infrastructure and labor costs. Environmental rules and regulations are also not stringent in developing countries. This provides an added advantage to a company. An increase in investment in industrialization and urbanization has led to a rise in household income as well as the disposable income of the middle class and lower middle-class population. This has resulted in the adoption of liquefied petroleum gas in the residential and transportation sectors.

Earlier, kerosene and solid fuels, such as coal and wood, were used for cooking. These types of fuels led to serious health and environmental issues. However, an increase in awareness about health and environmental issues, such as carbon emission and air pollution, has propelled the demand for liquefied petroleum gas in developing countries.

Governments of various countries are taking initiatives to promote the use of liquefied petroleum gas. This is also a key factor that is boosting the demand for liquefied petroleum gas. For instance, the Government of India has taken various initiatives such as providing subsidies and free liquefied petroleum gas connection for poor families. This has significantly boosted the number of liquefied petroleum gas users in the country in the last two to three years. According to the Petroleum Planning & Analysis Cell, the number of registered liquefied petroleum gas connections in India increased from 106 million in 2008/09 to 263 million in 2017/18.

An increase in awareness about environment-related issues and the implementation of stringent rules and regulations by regulatory authorities of governments have compelled companies to look for green solutions. Recent developments in the liquefied petroleum gas market indicate that LPG is increasingly being used as a substitute for gasoline and diesel. Liquefied petroleum gas is a clean fuel. The usage of liquefied petroleum gas offers a cost-effective solution to companies. Thus, a rise in demand for liquefied petroleum gas in developing countries such as India, Indonesia, Brazil, Mexico, and Nigeria for cooking, transportation, and various other industrial uses is projected to drive the liquefied petroleum gas market during the forecast period.

Request a custom report on Liquefied Petroleum Gas Market

In terms of source, the global liquefied petroleum gas market has been classified into refinery, associated gas, and non-associated gas. The refinery segment held a major share of 38.8% of the global market in 2021. Liquefied petroleum gas is produced by stripping it from the raw natural gas stream during natural gas processing and during the crude refinery process. The refinery segment is expected to dominate the market during the forecast period. The associated gas and non-associated segments are estimated to grow at a steady pace during the forecast period.

In terms of end-user, the global liquefied petroleum gas market has been segregated into residential/commercial, petrochemical & refinery, industrial, transportation, and others. The residential/commercial segment held a major share of 43.8% of the global market in 2021. This is because liquefied petroleum gas can serve as fuel for cooking, central heating, and water heating, and it is a particularly cost-effective and efficient way to heat off-grid homes. The petrochemical & refinery segment accounted for a 28.2% share of the market in 2021. This is because it burns more cleanly than petrol or fuel oil and is especially free of the particulates present in the latter. The petrochemical & refinery segment is estimated to grow at a steady pace during the forecast period.

Asia Pacific accounted for a prominent share of 35.04% of the global market in 2021. The region is estimated to be the fastest growing market for liquefied petroleum gas, globally, during the forecast period. China is a major market for liquefied petroleum gas in Asia Pacific, holding more than 34.6% share of the market in the region. Governments of countries in the region having been promoting LPG for cooking in rural areas for the last few years, which in turn is projected to boost the future market demand for liquefied petroleum gas. For instance, the Government of India is providing subsidies and free liquefied petroleum gas cylinders in rural areas in the country. North America is also a key market for liquefied petroleum gas, and the region held a 25.7% share of the global market in 2021.

The global liquefied petroleum gas market is consolidated with a small number of large-scale vendors controlling a majority of the market share. A majority of organizations are spending a significant amount on comprehensive research and development. Key players operating in liquefied petroleum gas market are Royal Dutch Shell plc, Exxon Mobil Corporation, bp p.l.c., UGI Corporation, Origin Energy Limited, Kleenheat, China Gas Holdings Ltd, Copagaz, Repsol S.A., and SHV Energy.

Each of these players has been profiled in the liquefied petroleum gas market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 202.6 Bn |

|

Market Forecast Value in 2031 |

US$ 321.6 Bn |

|

Growth Rate (CAGR) |

4.73% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value & Thousand Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global liquefied petroleum gas market stood at US$ 202.6 Bn in 2021

The liquefied petroleum gas market is expected to grow at a CAGR of 4.73% from 2022 to 2031

Rise in production of unconventional oil & gas and increase in demand for liquefied petroleum gas from developing countries

The refinery segment accounted for 38.8% share of the liquefied petroleum gas market in 2021

Asia Pacific is more attractive for vendors in the liquefied petroleum gas market

Royal Dutch Shell plc, Exxon Mobil Corporation, bp p.l.c., UGI Corporation, Origin Energy Limited, Kleenheat, China Gas Holdings Ltd, Copagaz, Repsol S.A. and SHV Energy.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of LPG Producers

2.6.2. List of Distributors

2.6.3. List of End-user

2.7. Product Specification Analysis

2.8. Overview of Manufacturing Process

2.9. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of Liquefied Petroleum Gas Sector

3.2. Impact on the Liquefied Petroleum Gas Market – Pre & Post Crisis

4. Production Output Analysis, 2020

5. Price Trend Analysis

6. Global Liquefied Petroleum Gas Market Analysis and Forecast, by Source, 2020–2031

6.1. Introduction and Definitions

6.2. Global Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

6.2.1. Refinery

6.2.2. Associated Gas

6.2.3. Non-associated Gas

6.3. Global Liquefied Petroleum Gas Market Attractiveness, by Source

7. Global Liquefied Petroleum Gas Market Analysis and Forecast, by End-use, 2020–2031

7.1. Introduction and Definitions

7.2. Global Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

7.2.1. Residential/Commercial

7.2.2. Petrochemical & Refinery

7.2.3. Industrial

7.2.4. Transportation

7.2.5. Others

7.3. Global Liquefied Petroleum Gas Market Attractiveness, by End-use

8. Global Liquefied Petroleum Gas Market Analysis and Forecast, by Region, 2020–2031

8.1. Key Findings

8.2. Global Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Region, 2020–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Liquefied Petroleum Gas Market Attractiveness, by Region

9. North America Liquefied Petroleum Gas Market Analysis and Forecast, 2020–2031

9.1. Key Findings

9.2. North America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

9.3. North America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4. North America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country, 2020–2031

9.4.1. U.S. Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

9.4.2. U.S. Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.4.3. Canada Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

9.4.4. Canada Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

9.5. North America Liquefied Petroleum Gas Market Attractiveness Analysis

10. Europe Liquefied Petroleum Gas Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.3. Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4. Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

10.4.1. Germany Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.4.2. Germany Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.3. France Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.4.4. France Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.5. U.K. Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.4.6. U.K. Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.7. Sweden Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.4.8. Sweden Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.9. Russia & CIS Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.4.10. Russia & CIS Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.4.11. Rest of Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

10.4.12. Rest of Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

10.5. Europe Liquefied Petroleum Gas Market Attractiveness Analysis

11. Asia Pacific Liquefied Petroleum Gas Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.3. Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4. Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. China Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4.2. China Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.3. Japan Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4.4. Japan Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.5. India Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4.6. India Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.7. Australia Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4.8. Australia Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.9. ASEAN Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4.10. ASEAN Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.4.11. Rest of Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

11.4.12. Rest of Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

11.5. Asia Pacific Liquefied Petroleum Gas Market Attractiveness Analysis

12. Latin America Liquefied Petroleum Gas Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.3. Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.4. Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

12.4.1. Brazil Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.4.2. Brazil Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.4.3. Mexico Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.4.4. Mexico Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.4.5. Rest of Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

12.4.6. Rest of Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

12.5. Latin America Liquefied Petroleum Gas Market Attractiveness Analysis

13. Middle East & Africa Liquefied Petroleum Gas Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.3. Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.4. Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2020-2031

13.4.1. GCC Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.4.2. GCC Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.4.3. South Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.4.4. South Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.4.5. Rest of Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by Source, 2020–2031

13.4.6. Rest of Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) and Value (US$ Bn) Forecast, by End-use, 2020–2031

13.5. Middle East & Africa Liquefied Petroleum Gas Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Liquefied Petroleum Gas Company Market Share Analysis, 2020

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Royal Dutch Shell plc.

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. Exxon Mobil Corporation

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. bp p.l.c.

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. UGI Corporation

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Origin Energy Limited

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. Kleenheat

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. Copagaz

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. Repsol S.A.

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. SHV Energy

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.9.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 2: Global Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 3: Global Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 4: Global Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 5: Global Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Region, 2020–2031

Table 6: Global Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Region, 2020–2031

Table 7: North America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 8: North America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 9: North America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 10: North America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 11: North America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Country, 2020–2031

Table 12: North America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Country, 2020–2031

Table 13: U.S. Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 14: U.S. Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 15: U.S. Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 16: U.S. Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 17: Canada Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 18: Canada Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 19: Canada Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 20: Canada Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 21: Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 22: Europe Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 23: Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 24: Europe Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 25: Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 28: Germany Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 29: Germany Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 30: Germany Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 31: France Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 32: France Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 33: France Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 34: France Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 35: U.K. Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 36: U.K. Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 37: U.K. Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 38: U.K. Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 39: Sweden Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 40: Sweden Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 41: Sweden Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 42: Sweden Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 43: Russia & CIS Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 44: Russia & CIS Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 45: Russia & CIS Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 46: Russia & CIS Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 47: Rest of Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 48: Rest of Europe Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 49: Rest of Europe Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 50: Rest of Europe Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 51: Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 52: Asia Pacific Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 53: Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 54: Asia Pacific Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 55: Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 56: Asia Pacific Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 57: China Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 58: China Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 59: China Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 60: China Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 61: Japan Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 62: Japan Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 63: Japan Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 64: Japan Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 65: India Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 66: India Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 67: India Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 68: India Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 69: Australia Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 70: Australia Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 71: Australia Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 72: ASEAN Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 73: ASEAN Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 74: ASEAN Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 75: ASEAN Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 76: Rest of Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 77: Rest of Asia Pacific Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 78: Rest of Asia Pacific Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 79: Rest of Asia Pacific Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 80: Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 81: Latin America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 82: Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 83: Latin America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 84: Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 85: Latin America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 86: Brazil Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 87: Brazil Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 88: Brazil Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 89: Brazil Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 90: Mexico Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 91: Mexico Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 92: Mexico Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 93: Mexico Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 94: Rest of Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 95: Rest of Latin America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 96: Rest of Latin America Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 97: Rest of Latin America Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 98: Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 99: Middle East & Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 100: Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 101: Middle East & Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 102: Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Country and Sub-region, 2020–2031

Table 103: Middle East & Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020–2031

Table 104: GCC Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 105: GCC Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 106: GCC Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 107: GCC Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 108: South Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 109: South Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 110: South Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–2031

Table 111: South Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

Table 112: Rest of Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by Source, 2020–2031

Table 113: Rest of Middle East & Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by Source, 2020–2031

Table 114: Rest of Middle East & Africa Liquefied Petroleum Gas Market Volume (Thousand Tons) Forecast, by End-use, 2020–20

Table 115: Rest of Middle East & Africa Liquefied Petroleum Gas Market Value (US$ Bn) Forecast, by End-use, 2020–2031

List of Figures

Figure 1: Global Liquefied Petroleum Gas Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 2: Global Liquefied Petroleum Gas Market Attractiveness, by Source

Figure 3: Global Liquefied Petroleum Gas Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 4: Global Liquefied Petroleum Gas Market Attractiveness, by End-use

Figure 5: Global Liquefied Petroleum Gas Market Volume Share Analysis, by Region, 2020, 2025, and 2031

Figure 6: Global Liquefied Petroleum Gas Market Attractiveness, by Region

Figure 7: North America Liquefied Petroleum Gas Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 8: North America Liquefied Petroleum Gas Market Attractiveness, by Source

Figure 9: North America Liquefied Petroleum Gas Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 10: North America Liquefied Petroleum Gas Market Attractiveness, by End-use

Figure 11: North America Liquefied Petroleum Gas Market Attractiveness, by Country

Figure 12: Europe Liquefied Petroleum Gas Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 13: Europe Liquefied Petroleum Gas Market Attractiveness, by Source

Figure 14: Europe Liquefied Petroleum Gas Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 15: Europe Liquefied Petroleum Gas Market Attractiveness, by End-use

Figure 16: Europe Liquefied Petroleum Gas Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 17: Europe Liquefied Petroleum Gas Market Attractiveness, by Country and Sub-region

Figure 18: Asia Pacific Liquefied Petroleum Gas Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 19: Asia Pacific Liquefied Petroleum Gas Market Attractiveness, by Source

Figure 20: Asia Pacific Liquefied Petroleum Gas Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 21: Asia Pacific Liquefied Petroleum Gas Market Attractiveness, by End-use

Figure 22: Asia Pacific Liquefied Petroleum Gas Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 23: Asia Pacific Liquefied Petroleum Gas Market Attractiveness, by Country and Sub-region

Figure 24: Latin America Liquefied Petroleum Gas Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 25: Latin America Liquefied Petroleum Gas Market Attractiveness, by Source

Figure 26: Latin America Liquefied Petroleum Gas Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 27: Latin America Liquefied Petroleum Gas Market Attractiveness, by End-use

Figure 28: Latin America Liquefied Petroleum Gas Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 29: Latin America Liquefied Petroleum Gas Market Attractiveness, by Country and Sub-region

Figure 30: Middle East & Africa Liquefied Petroleum Gas Market Volume Share Analysis, by Source, 2020, 2025, and 2031

Figure 31: Middle East & Africa Liquefied Petroleum Gas Market Attractiveness, by Source

Figure 32: Middle East & Africa Liquefied Petroleum Gas Market Volume Share Analysis, by End-use, 2020, 2025, and 2031

Figure 33: Middle East & Africa Liquefied Petroleum Gas Market Attractiveness, by End-use

Figure 34: Middle East & Africa Liquefied Petroleum Gas Market Volume Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 35: Middle East & Africa Liquefied Petroleum Gas Market Attractiveness, by Country and Sub-region