Reports

Reports

Analysts’ Viewpoint on Laser Diode Market Scenario

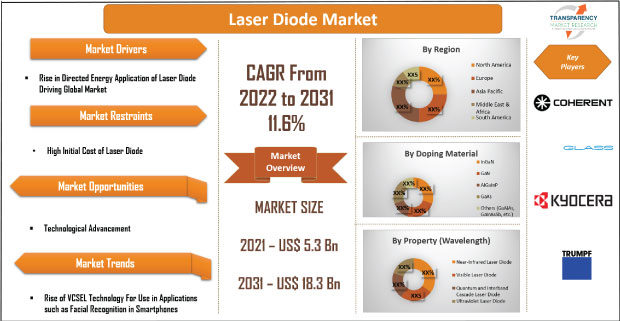

In the telecommunication industry, laser diode plays a vital role in the broadband communication system and data centers. Laser diode is employed as fast speed transmitter in digital and analog fiber optic networks to pump lasers in Erbium doped amplifiers (EDFAs), or as high-power pulsed lasers in test and measurement sector. Companies in the laser diode market are focusing on high-growth end-use industries such as automotive and IT & telecommunication to keep their businesses growing post the COVID-19 pandemic. Accordingly, the market is estimated to expand at a CAGR of 11.6% during the forecast period, owing to its numerous beneficial properties such as simple economic design, high optical powers, good modulation property, and increased coupling capacity. Moreover, the growth is estimated to be majorly driven by the increase in demand for industrial applications such as precision cutting of metals, welding, heat treating, and cladding. Manufacturers should also tap into incremental opportunities in laser products to broaden their revenue streams.

A laser diode is a semiconductor device that generates coherent radiation (at the same frequency and phase) in the visible or infrared(IR) spectrum when current passes through it. This type of diode is used in optical fiber systems, laser printers, compact disc players, remote-control devices and intrusion detection systems. They are also available in a variety of output powers, wavelengths, and beam shapes. Thus, the global laser diode market is projected to grow at a decent growth rate from 2022 to 2031, owing to its favorable properties such as high monochromaticity, coherence, and directionality, as compared to ordinary light source.

Furthermore, laser diodes are used in various devices, including motion sensors, laser printer, 3D depth sensors, sensor, and optical disk pickup. Demand for solid state lasers for data storage is rising, as the loss of data due to the aging of drive is lesser in optical data storage.

Increasing usage of laser diode in autonomous vehicles for LIDAR and radar systems, and other purposes is one of the significant factors driving the market. In the absence of a driver in self-driving vehicles, a LIDAR system becomes the eyes of a vehicle and regularly checks its surrounding environment to safely guide the vehicle to its destination. Most self- driving vehicles, currently, use a combination of LiDAR, radar, and cameras to create a 3D map of the surroundings. The LiDAR system uses laser pulses that bounce off objects and return to the sensor in order to measure distances and develop a detailed 3D map. These systems comprise a laser source, a data processing electronics, photodetector, and motion-control equipment.

The increasing demand for laser diode is majorly due to its lower price than that of other laser devices. Autonomous vehicles find extensive orientation by comparing camera data and acceleration, speed, and GPS data. Various new initiatives in terms of new product development, mergers & acquisitions, etc., are being observed in this market. For instance, in April 2022, Power Technology, Inc. launched a new 532 nm high-power diode module for OEM applications. However, there are some limitations to LIDAR system. Pulse power must be limited, as this wavelength can dangerous to the eye, which means that this system does not work properly in bad weather. The low pulse power also reduces the range of the detection system to around 100 m.

Moreover, rise in demand for autonomous vehicles in developed as well as developing countries is a key factor estimated to boost the laser diode market during the forecast period. Furthermore, growing investment toward the development of autonomous vehicles and continuous technological innovations in the automotive industry have fueled the laser diode market growth.

Aerospace and defense is a crucial end-use industry segment of the market for laser diode. The aerospace & defense industry has been using laser diodes as pump sources for solid-state systems for the past few decades. This continues to be the biggest application for laser diodes, with the conventional format being laser diode arrays and high power laser diode bars.

Major manufacturers offer a highly competitive range of high power laser diodes suitable for aerospace and defense applications. Laser diodes have high reliability, superior brightness, and improved power levels due to its compactness, modular design, and advanced quantum well intermixing process. Various applications of laser diodes in the aerospace & defense industry include range finding, target selection, and illumination.

Favorable government regulations boosting the adoption of advanced technologies and technological advancements are fueling the aerospace & defense industry growth, which, in turn, is propelling the demand for laser diode.

In terms of technology, the global laser diode market has been segregated into distributed feedback laser diodes, double hetero structure laser diodes, quantum dot cascade laser diodes, VCSEL diodes, and others (separate confinement hetero structure [SCH] laser diodes and VECSEL diodes). The distributed feedback laser diodes segment held a major share of 35% of the of laser diode market in 2021. The preference for distributed feedback laser diodes is primarily due to its simple design, better modulation capability, and their ability to operate at high temperature. Moreover, distributed feedback laser diodes have higher efficiency and lower threshold current as well as single wavelength characteristics. Distributed feedback laser (DFB) is used in several applications such as a light source for metro, long-haul, and undersea applications due to its narrow spectral width and wavelength stability, which, in turn, is estimated to drive the market during the forecast period.

In terms of property (wavelength), the global laser diode has been classified into near-infrared laser diode, visible laser diode, quantum and interband cascade laser diode, and ultraviolet laser. Quantum and interband cascade laser diode is a semiconductor laser that emits in the mid- and long-wave IR bands, and is being extensively utilized in precision sensing, spectroscopy, military, and medical applications. The wide range and instant response time of quantum, and interband cascade laser diodes enable compact trace element detectors and gas analyzers to detect rapidly and more precisely; consequently, they are replacing slower and larger FTIR. Furthermore, some of the major companies offer quantum and interband cascade laser diode products, which, in turn, drive the market. For instance, Thorlabs' quantum and interband cascade lasers are made of several quantum well heterostructures, and use intersubband and interband transitions to access the mid-infrared spectral region. The product has a wavelength range of 3.00 m to 11.00 m and is designed for OEM applications and system integration.

However, the near-infrared laser diode segment is projected to grow at a rapid pace during the forecast period due to rise in demand for near-infrared laser diode for medical and remote sensing applications. Near Infrared (NIR) laser is one of the most diverse categories of solid-state lasers. Near IR laser wavelengths, commonly between 750 to 1400 nm, pose a specially eye safety hazard, as wavelengths within this range are easily transmitted through the eye to be focused on the retina.

In terms of doping material, InGaN, GaN, AIGaInP, GaAs, and Others (GaAIAs, GaInAsSb, etc.). The GaAs segment is projected to grow at rapid pace during the forecast period. The growth is likely to be ascribed to its increasing demand for a wide range of applications from blue-ray players to commercial lighting and displays to copper welding. GaAs is a diode laser material and is relatively insensitive to overheating due to its wider energy band gap, and it also produces less noise in electronic circuits than silicon devices, particularly at high frequencies. Unlike numerous other semiconductors, GaAs has a direct bandgap, implying that it can emit light with high efficiency. The laser diode is composed of two layers of doped gallium arsenide. One doped gallium arsenide layer would create an n-type semiconductor, while another would create a p-type semiconductor.

In terms of volume, Asia Pacific held 34% share of the global laser diode market in 2021. The growth can be majorly attributed to significantly high demand for laser diodes in the automotive and consumer electronics industries, which held a significant share of the total consumption in Asia Pacific. China accounted for a key share of the laser diode market in Asia Pacific.

North America and Europe are also prominent markets for laser diode, and the regions held value shares of 31% and 24%, respectively, of the global market in 2021. Increased demand for laser diode in IT & telecommunication and automotive industries in the region drives the market in North America.

Middle East & Africa is a larger market for laser diodes as compared to Latin American; however, the market in Latin America is estimated to grow at a rapid pace as compared to the market in Middle East & Africa.

The global laser diode market is consolidated with a small number of large-scale vendors controlling the majority of the market share. Key firms are spending significantly on comprehensive research and development, and new product development. Expansion of product portfolios and mergers & acquisitions are strategies adopted by key players. BluGlass Limited, Frankfurt Laser Company, Infineon Technologies AG, IPG Photonics Corp., Kyocera Corp., Newport Corp, Rofin-Sinar Technologies Inc., ROHM Co., Ltd., Sharp Corporation, Sumitomo Electric Industries, Ltd., Trumpf GmbH + Co. KG, Power Technology, Inc., and Thorlabs, Inc. are the prominent entities operating in the market.

Each of these players has been profiled in the laser diode market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 6.2 Bn |

|

Market Forecast Value in 2031 |

US$ 18.3 Bn |

|

Growth Rate (CAGR) |

11.6% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The revenue of laser diode stood over US$ 6.2 Bn in 2021

The laser diode market is projected to grow at a CAGR of 11.6% by 2031

The market size for laser diode market will value more than US$ 18.3 Bn in 2031

Prominent players operating in the laser diode market include BluGlass Limited, Frankfurt Laser Company, Infineon Technologies AG, IPG Photonics Corp., Kyocera Corp., Newport Corp, Rofin-Sinar Technologies Inc., ROHM Co., Ltd., Sharp Corporation, Sumitomo Electric Industries, Ltd., Trumpf GmbH + Co. KG, Power Technology, Inc., and Thorlabs, Inc.

In 2021, the U.S. catered approximately 23% of share of the laser diode market

Based on end-use industry, automotive segment is estimated to hold around 27% share of the laser diode market in 2021

Growing usage of VCSEL technology for applications such as facial recognition in smartphones is the prominent trend in the laser diode market

Asia Pacific region is more lucrative in the laser diode market

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Laser Diode Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Diode Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Laser Diode Market Analysis, by Doping Materials

5.1. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Doping Materials, 2022‒2031

5.1.1. InGaN

5.1.2. GaN

5.1.3. AIGaInP

5.1.4. GaAs

5.1.5. Others (GaAIAs, GaInAsSb, etc.)

5.2. Others Market Attractiveness Analysis, by Doping Materials

6. Laser Diode Market Analysis, by Property (Wavelength)

6.1. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Property (Wavelength), 2022‒2031

6.1.1. Near-Infrared Laser Diode

6.1.2. Visible Laser Diode

6.1.3. Quantum and Interband Cascade Laser Diode

6.1.4. Ultraviolet Laser Diode

6.2. Market Attractiveness Analysis, by Property (Wavelength)

7. Laser Diode Market Analysis, by Technology

7.1. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by Technology, 2022‒2031

7.1.1. Distributed Feedback Laser Diodes

7.1.2. Double Hetero Structure Laser Diodes

7.1.3. Quantum Dot Cascade Laser Diodes

7.1.4. VCSEL Diodes

7.1.5. Others (Separate Confinement Hetero structure (SCH) Laser Diodes, VECSEL Diodes)

7.2. Market Attractiveness Analysis, by Technology

8. Laser Diode Market Analysis, by End-use Industry

8.1. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2022‒2031

8.1.1. Aerospace & Defense

8.1.2. Automotive

8.1.3. Consumer Electronics

8.1.4. Electronics & Semiconductors

8.1.5. IT & Telecommunication

8.1.6. Others

8.2. Market Attractiveness Analysis, by End-use Industry

9. Laser Diode Market Analysis and Forecast, by Region

9.1. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2022‒2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, by Region

10. North America Laser Diode Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Doping Materials, 2022‒2031

10.3.1. InGaN

10.3.2. GaN

10.3.3. AIGaInP

10.3.4. GaAs

10.3.5. Others (GaAIAs, GaInAsSb, etc.)

10.4. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Property (Wavelength), 2022‒2031

10.4.1. Near-Infrared Laser Diode

10.4.2. Visible Laser Diode

10.4.3. Quantum and Interband Cascade Laser Diode

10.4.4. Ultraviolet Laser Diode

10.5. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by Technology, 2022‒2031

10.5.1. Distributed Feedback Laser Diodes

10.5.2. Double Hetero Structure Laser Diodes

10.5.3. Quantum Dot Cascade Laser Diodes

10.5.4. VCSEL Diodes

10.5.5. Others (Separate Confinement Hetero structure (SCH) Laser Diodes, VECSEL Diodes)

10.6. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2022‒2031

10.6.1. Aerospace & Defense

10.6.2. Automotive

10.6.3. Consumer Electronics

10.6.4. Electronics & Semiconductors

10.6.5. IT & Telecommunication

10.6.6. Others

10.7. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-Region, 2022‒2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Doping Materials

10.8.2. By Property (Wavelength)

10.8.3. By Technology

10.8.4. By End-use Industry

10.8.5. By Country & Sub-region

11. Europe Laser Diode Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Doping Materials, 2022‒2031

11.3.1. InGaN

11.3.2. GaN

11.3.3. AIGaInP

11.3.4. GaAs

11.3.5. Others (GaAIAs, GaInAsSb, etc.)

11.4. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Property (Wavelength), 2022‒2031

11.4.1. Near-Infrared Laser Diode

11.4.2. Visible Laser Diode

11.4.3. Quantum and Interband Cascade Laser Diode

11.4.4. Ultraviolet Laser Diode

11.5. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by Technology, 2022‒2031

11.5.1. Distributed Feedback Laser Diodes

11.5.2. Double Hetero Structure Laser Diodes

11.5.3. Quantum Dot Cascade Laser Diodes

11.5.4. VCSEL Diodes

11.5.5. Others (Separate Confinement Hetero structure (SCH) Laser Diodes, VECSEL Diodes)

11.6. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2022‒2031

11.6.1. Aerospace & Defense

11.6.2. Automotive

11.6.3. Consumer Electronics

11.6.4. Electronics & Semiconductors

11.6.5. IT & Telecommunication

11.6.6. Others

11.7. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-Region, 2022‒2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Doping Materials

11.8.2. By Property (Wavelength)

11.8.3. By Technology

11.8.4. By End-use Industry

11.8.5. By Country & Sub-region

12. Asia Pacific Laser Diode Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Doping Materials, 2022‒2031

12.3.1. InGaN

12.3.2. GaN

12.3.3. AIGaInP

12.3.4. GaAs

12.3.5. Others (GaAIAs, GaInAsSb, etc.)

12.4. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Property (Wavelength), 2022‒2031

12.4.1. Near-Infrared Laser Diode

12.4.2. Visible Laser Diode

12.4.3. Quantum and Interband Cascade Laser Diode

12.4.4. Ultraviolet Laser Diode

12.5. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by Technology, 2022‒2031

12.5.1. Distributed Feedback Laser Diodes

12.5.2. Double Hetero Structure Laser Diodes

12.5.3. Quantum Dot Cascade Laser Diodes

12.5.4. VCSEL Diodes

12.5.5. Others (Separate Confinement Hetero structure (SCH) Laser Diodes, VECSEL Diodes)

12.6. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2022‒2031

12.6.1. Aerospace & Defense

12.6.2. Automotive

12.6.3. Consumer Electronics

12.6.4. Electronics & Semiconductors

12.6.5. IT & Telecommunication

12.6.6. Others

12.7. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-Region, 2022‒2031

12.7.1. China

12.7.2. Japan

12.7.3. India

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Doping Materials

12.8.2. By Property (Wavelength)

12.8.3. By Technology

12.8.4. By End-use Industry

12.8.5. By Country & Sub-region

13. Middle East and Africa Laser Diode Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Doping Materials, 2022‒2031

13.3.1. InGaN

13.3.2. GaN

13.3.3. AIGaInP

13.3.4. GaAs

13.3.5. Others (GaAIAs, GaInAsSb, etc.)

13.4. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Property (Wavelength), 2022‒2031

13.4.1. Near-Infrared Laser Diode

13.4.2. Visible Laser Diode

13.4.3. Quantum and Interband Cascade Laser Diode

13.4.4. Ultraviolet Laser Diode

13.5. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by Technology, 2022‒2031

13.5.1. Distributed Feedback Laser Diodes

13.5.2. Double Hetero Structure Laser Diodes

13.5.3. Quantum Dot Cascade Laser Diodes

13.5.4. VCSEL Diodes

13.5.5. Others (Separate Confinement Hetero structure (SCH) Laser Diodes, VECSEL Diodes)

13.6. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2022‒2031

13.6.1. Aerospace & Defense

13.6.2. Automotive

13.6.3. Consumer Electronics

13.6.4. Electronics & Semiconductors

13.6.5. IT & Telecommunication

13.6.6. Others

13.7. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-Region, 2022‒2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of Middle East and Africa

13.8. Market Attractiveness Analysis

13.8.1. By Doping Materials

13.8.2. By Property (Wavelength)

13.8.3. By Technology

13.8.4. By End-use Industry

13.8.5. By Country & Sub-region

14. South America Laser Diode Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Doping Materials, 2022‒2031

14.3.1. InGaN

14.3.2. GaN

14.3.3. AIGaInP

14.3.4. GaAs

14.3.5. Others (GaAIAs, GaInAsSb, etc.)

14.4. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Property (Wavelength), 2022‒2031

14.4.1. Near-Infrared Laser Diode

14.4.2. Visible Laser Diode

14.4.3. Quantum and Interband Cascade Laser Diode

14.4.4. Ultraviolet Laser Diode

14.5. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by Technology, 2022‒2031

14.5.1. Distributed Feedback Laser Diodes

14.5.2. Double Hetero Structure Laser Diodes

14.5.3. Quantum Dot Cascade Laser Diodes

14.5.4. VCSEL Diodes

14.5.5. Others (Separate Confinement Hetero structure (SCH) Laser Diodes, VECSEL Diodes)

14.6. Laser Diode Market Value (US$ Bn) Analysis & Forecast, by End-use Industry, 2022‒2031

14.6.1. Aerospace & Defense

14.6.2. Automotive

14.6.3. Consumer Electronics

14.6.4. Electronics & Semiconductors

14.6.5. IT & Telecommunication

14.6.6. Others

14.7. Laser Diode Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country & Sub-Region, 2022‒2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Doping Materials

14.8.2. By Property (Wavelength)

14.8.3. By Technology

14.8.4. By End-use Industry

14.8.5. By Country & Sub-region

15. Competition Assessment

15.1. Global Laser Diode Market Competition Matrix - a Dashboard View

15.1.1. Global Laser Diode Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Coherent Inc.

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. BluGlass Limited

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Frankfurt Laser Company

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Infineon Technologies AG

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. IPG Photonics Corp.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Kyocera Corp.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Newport Corp.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Rofin-Sinar Technologies Inc.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. ROHM Co., Ltd.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Sharp Corporation

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Sumitomo Electric Industries, Ltd.

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Trumpf GmbH + Co. KG

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Power Technology, Inc.

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

16.14. Thorlabs, Inc.

16.14.1. Overview

16.14.2. Product Portfolio

16.14.3. Sales Footprint

16.14.4. Key Subsidiaries or Distributors

16.14.5. Strategy and Recent Developments

16.14.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Doping Materials

17.1.2. By Property (Wavelength)

17.1.3. By Technology

17.1.4. By End-use Industry

17.1.5 Region

List of Tables

Table 01: Global Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2017‒2031

Table 02: Global Laser Diode Market Size & Forecast, by Doping Material, Volume (Million Units), 2017‒2031

Table 03: Global Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2017‒2031

Table 04: Global Laser Diode Market Size & Forecast, by Property (Wavelength), Volume (US$ Bn), 2017‒2031

Table 05: Global Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Table 06: Global Laser Diode Market Size & Forecast, by Technology, Volume (US$ Bn), 2017‒2031

Table 07: Global Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 08: Global Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2017‒2031

Table 09: Global Laser Diode Market Size & Forecast, by Region, Volume (Million Units), 2017‒2031

Table 10: North America Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2017‒2031

Table 11: North America Laser Diode Market Size & Forecast, by Doping Material, Volume (Million Units), 2017‒2031

Table 12: North America Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2017‒2031

Table 13: North America Laser Diode Market Size & Forecast, by Property (Wavelength), Volume (US$ Bn), 2017‒2031

Table 14: North America Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Table 15: North America Laser Diode Market Size & Forecast, by Technology, Volume (US$ Bn), 2017‒2031

Table 16: North America Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 17: North America Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 18: North America Laser Diode Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 19: Europe Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2017‒2031

Table 20: Europe Laser Diode Market Size & Forecast, by Doping Material, Volume (Million Units), 2017‒2031

Table 21: Europe Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2017‒2031

Table 22: Europe Laser Diode Market Size & Forecast, by Property (Wavelength), Volume (US$ Bn), 2017‒2031

Table 23: Europe Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Table 24: Europe Laser Diode Market Size & Forecast, by Technology, Volume (US$ Bn), 2017‒2031

Table 25: Europe Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 26: Europe Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 27: Europe Laser Diode Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 28: Asia Pacific Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2017‒2031

Table 29: Asia Pacific Laser Diode Market Size & Forecast, by Doping Material, Volume (Million Units), 2017‒2031

Table 30: Asia Pacific Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2017‒2031

Table 31: Asia Pacific Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Table 32: Asia Pacific Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 33: Asia Pacific Laser Diode Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 34: Middle East & Africa Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2017‒2031

Table 35: Middle East & Africa Laser Diode Market Size & Forecast, by Doping Material, Volume (Million Units), 2017‒2031

Table 36: Middle East & Africa Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2017‒2031

Table 37: Middle East & Africa Laser Diode Market Size & Forecast, by Property (Wavelength), Volume (US$ Bn), 2017‒2031

Table 38: Middle East & Africa Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Table 39: Middle East & Africa Laser Diode Market Size & Forecast, by Technology, Volume (US$ Bn), 2017‒2031

Table 40: Middle East & Africa Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 41: Middle East & Africa Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 42: Middle East & Africa Laser Diode Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

Table 43: South America Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2017‒2031

Table 44: South America Laser Diode Market Size & Forecast, by Doping Material, Volume (Million Units), 2017‒2031

Table 45: South America Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2017‒2031

Table 46: South America Laser Diode Market Size & Forecast, by Property (Wavelength), Volume (US$ Bn), 2017‒2031

Table 47: South America Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Table 48: South America Laser Diode Market Size & Forecast, by Technology, Volume (US$ Bn), 2017‒2031

Table 49: South America Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2017‒2031

Table 50: South America Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2017‒2031

Table 51: South America Laser Diode Market Size & Forecast, by Country & Sub-region, Volume (Million Units), 2017‒2031

List of Figures

Figure 01: Global Laser Diode Price Trend Analysis (Average Price, US$)

Figure 02: Global Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 03: Global Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 04: Global Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 05: Global Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 06: Global Laser Diode Market Size & Forecast, by Doping Material, Revenue (US$ Bn), 2017‒2031

Figure 07: Global Laser Diode Market Attractiveness, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 08: Global Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 09: Global Laser Diode Market Size & Forecast, by Property (Wavelength), Revenue (US$ Bn), 2017‒2031

Figure 10: Global Laser Diode Market Attractiveness, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 11: Global Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 12: Global Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 13: Global Laser Diode Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 14: Global Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 15: Global Laser Diode Market Attractiveness, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 16: Global Laser Diode Market Attractiveness, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 17: Global Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 18: Global Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 19: Global Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 20: Global Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 21: North America Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 22: North America Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 23: North America Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 24: North America Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 25: North America Laser Diode Market Size & Forecast, by Doping Material, Revenue (US$ Bn), 2017‒2031

Figure 26: North America Laser Diode Market Attractiveness, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 27: North America Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 28: North America Laser Diode Market Size & Forecast, by Property (Wavelength), Revenue (US$ Bn), 2017‒2031

Figure 29: North America Laser Diode Market Attractiveness, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 30: North America Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 31: North America Laser Diode Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017‒2031

Figure 32: North America Laser Diode Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 33: North America Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2017‒2031

Figure 34: North America Laser Diode Market Size & Forecast, by End-use industry, Revenue (US$ Bn), 2017‒2031

Figure 35: North America Laser Diode Market Attractiveness, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 36: North America Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 37: North America Laser Diode Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2021‒2031

Figure 38: North America Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 39: North America Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 40: Europe Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 41: Europe Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 42: Europe Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 43: Europe Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 44: Europe Laser Diode Market Size & Forecast, by Doping Material, Revenue (US$ Bn), 2017‒2031

Figure 45: Europe Laser Diode Market Attractiveness, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 46: Europe Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 47: Europe Laser Diode Market Size & Forecast, by Property (Wavelength), Revenue (US$ Bn), 2017‒2031

Figure 48: Europe Laser Diode Market Attractiveness, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 49: Europe Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 50: Europe Laser Diode Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017‒2031

Figure 51: Europe Laser Diode Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 52: Europe Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 53: Europe Laser Diode Market Size & Forecast, by End-use industry, Revenue (US$ Bn), 2017‒2031

Figure 54: Europe Laser Diode Market Attractiveness, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 55: Europe Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 56: Europe Laser Diode Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 57: Europe Laser Diode Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 58: Europe Laser Diode Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2021‒2031

Figure 59: Europe Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 60: Europe Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 61: Asia Pacific Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 62: Asia Pacific Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 63: Asia Pacific Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 64: Asia Pacific Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 65: Asia Pacific Laser Diode Market Size & Forecast, by Doping Material, Revenue (US$ Bn), 2017‒2031

Figure 66: Asia Pacific Laser Diode Market Attractiveness, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 67: Asia Pacific Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 68: Asia Pacific Laser Diode Market Size & Forecast, by Property (Wavelength), Revenue (US$ Bn), 2017‒2031

Figure 69: Asia Pacific Laser Diode Market Attractiveness, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 70: Asia Pacific Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 71: Asia Pacific Laser Diode Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017‒2031

Figure 72: Asia Pacific Laser Diode Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 73: Asia Pacific Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 74: Asia Pacific Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 75: Asia Pacific Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 76: Asia Pacific Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 77: Asia Pacific Laser Diode Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 78: Asia Pacific Laser Diode Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 79: Asia Pacific Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 80: Middle East & Africa Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 81: Middle East & Africa Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 82: Middle East & Africa Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 83: Middle East & Africa Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 84: Middle East & Africa Laser Diode Market Size & Forecast, by Doping Material, Revenue (US$ Bn), 2017‒2031

Figure 85: Middle East & Africa Laser Diode Market Attractiveness, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 86: Middle East & Africa Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 87: Middle East & Africa Laser Diode Market Size & Forecast, by Property (Wavelength), Revenue (US$ Bn), 2017‒2031

Figure 88: Middle East & Africa Laser Diode Market Attractiveness, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 89: Middle East & Africa Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 90: Middle East & Africa Laser Diode Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017‒2031

Figure 91: Middle East & Africa Laser Diode Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 92: Middle East & Africa Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 93: Middle East & Africa Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 94: Middle East & Africa Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 95: Middle East & Africa Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 96: Middle East & Africa Laser Diode Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 97: Middle East & Africa Laser Diode Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 98: Middle East & Africa Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 99: South America Laser Diode Market Size & Forecast, by Region, Value (US$ Bn), 2021‒2031

Figure 100: South America Laser Diode Market, Value (US$ Bn), 2017‒2031

Figure 101: South America Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 102: South America Laser Diode Market, Volume (Million Units), 2017‒2031

Figure 103: South America Laser Diode Market Size & Forecast, by Doping Material, Revenue (US$ Bn), 2017‒2031

Figure 104: South America Laser Diode Market Attractiveness, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 105: South America Laser Diode Market Size & Forecast, by Doping Material, Value (US$ Bn), 2021‒2031

Figure 106: South America Laser Diode Market Size & Forecast, by Property (Wavelength), Revenue (US$ Bn), 2017‒2031

Figure 107: South America Laser Diode Market Attractiveness, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 108: South America Laser Diode Market Size & Forecast, by Property (Wavelength), Value (US$ Bn), 2021‒2031

Figure 109: South America Laser Diode Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017‒2031

Figure 110: South America Laser Diode Market Attractiveness, by Technology, Value (US$ Bn), 2021‒2031

Figure 111: South America Laser Diode Market Size & Forecast, by Technology, Value (US$ Bn), 2021‒2031

Figure 112: South America Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 113: South America Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 114: South America Laser Diode Market Size & Forecast, by End-use industry, Value (US$ Bn), 2021‒2031

Figure 115: South America Laser Diode Market Size & Forecast, by Country & Sub-region, Revenue (US$ Bn), 2017‒2031

Figure 116: South America Laser Diode Market Attractiveness, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 117: South America Laser Diode Market Size & Forecast, by Country & Sub-region, Value (US$ Bn), 2021‒2031

Figure 118: Global Laser Diode Market Share Analysis, by Company