Reports

Reports

Need for Safety Fuels Growth of Industrial Control For Process Manufacturing Market

The pressing need to ensure uniformity in manufactured goods by various industries has been driving the global industrial control for process manufacturing market. Large number of industries such as healthcare, chemicals, oil and gas, power, textiles, and food and beverages have been deploying industrial control for process manufacturing technologies to ensure safety in complex manufacturing processes as well. The growth of manufacturing activities in the developing regions such as India and China have given this market a much-needed impetus. The growing demand for consistent products in terms of both quality and quantity has also propelled the adoption of technologies used in the global market such as supervisory control and data acquisition (SCADA), manufacturing execution systems (MES), programmable logic (controller), and distributed control systems (DCS).

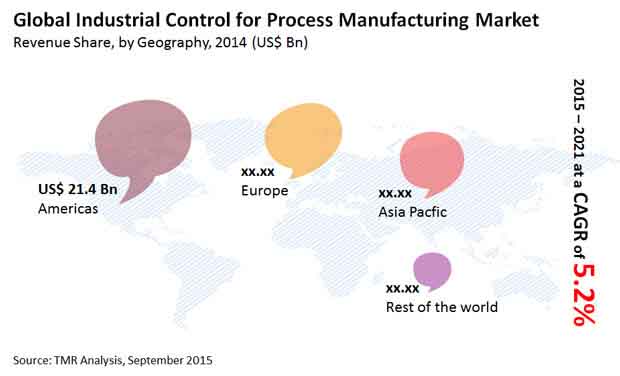

According to a research report published by Transparency Market Research, the opportunity in the global industrial control for process manufacturing market was worth USS$61.23 bn in 2014 and is anticipated to reach US$96.20 bn by the end of 2021. During the forecast period, the overall market is expected to expand at a CAGR of 5.2%. This growth will largely be determined by the rising demand for safety measures in manufacturing units. The ability of process control systems to monitor failures and defects in manufacturing activities to avoid longer lead time or accidents has worked in benefit of this market. The only factor hampering the growth of this market is the maturing industries in the developed regions that are no longer investing in the industrial control for process manufacturing systems.

Americas Lead Global Market as Oil and Gas Sector Flourishes

The Americas have held a dominant position in the global industrial control for process manufacturing since 2014. In that year, the region held a share of 35% in the overall market in terms of revenue. The growth of the industrial control for process manufacturing in the Americas is a result of ongoing replacement of current industrial control systems with modern ones to bring in advanced processing solutions. The growing oil and gas industry of the Americas has also been responsible for this unprecedented growth as the industry requires advanced industrial controls for processing and manufacturing final products. Owing to these reasons, the industrial control for process manufacturing market in the Americas will expand at a CAGR of 4.8% between 2015 and 2021, reaching a valuation of US$32.46 bn by 2021.

On the other hand, Asia Pacific industrial control for process manufacturing market will rise at a CAGR of 6.2% as expenditure on infrastructure increases. Furthermore, the growing activities in the oil and gas industry are also expected to fuel this regional market in the coming years. The growing demand for electricity in China and India and development of smart grid infrastructure will be largely responsible for burgeoning demand for SCADA systems in these countries.

DCS Solutions Remain a Preferred Choice amongst End-use Industries

According to TMR analysts, the distributed control systems (DCS) segment has been leading the overall market. Analysts anticipate that this segment will rise at a CAGR of 4.7% between 2015 and 2021. The demand for DCS has been growing due to their ability control production lines across a wide range of industrial verticals. Furthermore, their ability to control sprawling plant areas in central control room is also boosting this market. However, the SCADA systems segment is expected to be the fastest-growing segment as they are known to be far more advanced than DCS solutions.

Some of the key players in the global industrial control for process manufacturing are Honeywell International Inc., ABB Ltd., Emerson Electric Co., Siemens AG, and Schneider Electric S.E. The report states that companies will have to drive their shares through innovative solutions pertaining to automation that make tasks simpler and safer. Furthermore, companies will also have to focus on mergers and acquisitions to improve their international presence and product portfolio.

Rising Application by Chemical and Energy Sectors to Augment Growth of Industrial Control for Process Manufacturing Market

An enormous number of ventures like oil and gas, substance, drug, force and medical care, and food and drinks look for proficient strategies while fabricating a wide scope of items. To diminish the wastage during these cycles and guarantee consistency in the last yield measure, control frameworks are utilized. Accordingly, the developing interest for steady items has been driving the by and large mechanical control for measure producing market. The market is additionally being pushed by expanding interest for proficiency, wellbeing, and insignificant inconstancy.

Future growth opportunity for the global industrial control for process manufacturing exist in re-designing of industrial controls with cutting edge industrial controls for process manufacturing in these districts. Expanding intricacies in manufacturing processes is prompting interest for cutting edge industrial control for process manufacturing arrangements. Central members in this market are continually zeroing in on innovative work exercises to satisfy the rising need for cutting edge controls from clients. Rising number of businesses in Asia Pacific and RoW district is clearing new freedoms for new and existing parts on the lookout.

Normalization of cycles in different ventures has additionally been answerable for the developing interest for modern control for measure producing arrangements. Moreover, the capacity of these answers for manage factors to meet the necessities of the ideal outcome is likewise boosting their interest. The developing wellbeing and security worries in assembling units and interaction businesses are expected to fuel the mechanical control for measure producing market.

The oil and gas, chemical, and energy and force areas are significant supporters of the worldwide industrial control for process manufacturing market. Capacity of DCS and SCADA answers for continuous checking and controlling of manufacturing offices is boosting the general market development. Also, decrease in wastage of crude materials in process enterprises is driving the interest for industrial controls for process manufacturing arrangements. In any case, danger from digital assault and security issues is retraining the development of SCADA and DCS arrangements.

List of Figures

FIG. 1 Market segmentation: Global Industrial Control For Process Manufacturing Market

FIG. 2 Global Industrial Control For Process Manufacturing Market Attractiveness, by Application

FIG. 3 Market share by key industrial control for process manufacturing vendors, 2014 (Value %)

FIG. 4 Global Industrial Control For Process Manufacturing market share and forecast by Technology, 2014 vs. 2021 (Value %)

FIG. 5 Supervisory control & data acquisition (SCADA) market size and forecast, 2014 – 2021 (USD billion)

FIG. 6 Programmable logic controller (PLC) market size and forecast, 2014 – 2021 (USD billion)

FIG. 7 Manufacturing execution systems (MES) market size and forecast, 2014 – 2021 (USD billion)

FIG. 8 Distributed control systems market size and forecast, 2014 – 2021 (USD billion)

FIG. 9 Global Industrial Control For Process Manufacturing market share and forecast by application, 2014 vs. 2021 (Value %)

FIG. 10 Chemicals market size and forecast, 2014 – 2021 (USD billion)

FIG. 11 Healthcare market size and forecast, 2014 – 2021 (USD billion)

FIG. 12 Oil & gas market size and forecast, 2014 – 2021 (USD billion)

FIG. 13 Food & beverages market size and forecast, 2014 – 2021 (USD billion)

FIG. 14 Power market size and forecast, 2014 – 2021 (USD billion)

FIG. 15 Textiles market size and forecast, 2014 – 2021 (USD billion)

FIG. 16 Global Industrial Control For Process Manufacturing Market Trend by Geography, 2014 - 2021 (USD billion)

FIG. 17 Americas Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 18 U.S Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 19 Canada Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 20 Mexico Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 21 South America Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 22 Europe Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 23 United Kingdom Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 24 Germany Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 25 France Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 26 Italy Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 27 Rest of Europe Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 28 Asia Pacific Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 29 China Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 30 Japan Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 31 India Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 32 Taiwan Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 33 South Korea Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 34 Rest of Asia Pacific Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 35 RoW Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 36 Middle East Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)

FIG. 37 Africa Industrial Control For Process Manufacturing Market Size and Forecast, 2014 – 2021 (USD billion)