Reports

Reports

Independent lubricant manufacturers usually do not have their own refineries. They purchase base oils from major oil suppliers. Manufacturers then blend these oils with additives to make lubricants for industrial manufacturing customers and automobile makers. Independent lubricant manufacturers primarily focus on manufacturing and marketing lubricants for specialties and niche businesses.

Independent lubricant manufacturers offer services to end-user industries such as automotive, aerospace, marine, and industrial. The lubricants required in these end-user industries chiefly comprise of engine oils, gear oils, hydraulics fluids, transmission fluids, greases, heat transfer fluids, coolants, and cleaners. Lubricants are also required in industries such as personal care, agriculture, and railway.

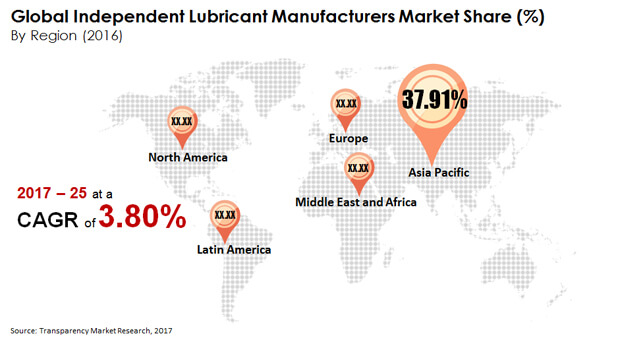

According to the report, the global independent lubricant manufacturers market was valued at US$6,800.79 mn in 2016 and is estimated to reach US$9,454.04 mn by 2025, expanding at a CAGR of 3.80% between 2017 and 2025.

In terms of the end users served by independent lubricant manufacturers, the report examines the growth prospects of the independent lubricant manufacturers market across the automotive, aerospace, marine, and industrial sectors. Of these, the automotive sector is presently the leading contributor of revenue to the global market. The segment accounted for a massive 67.4% of the global market in 2016 and is expected to remain the key consumer of lubricants manufactured by independent manufacturers.

Rise in demand for automotive is anticipated to drive the demand for automotive lubricants in the next few years as well. Increase in environmental awareness and implementation of strict government regulations are expected to boost the demand for high-quality and greener lubricants in the automotive industry in the next few years. As the global appetite for automobiles continues to rise, led by the growth in disposable income of consumers, the demand for products from independent lubricant manufacturers is also expected to rise significantly in the next few years.

In terms of geography, Asia Pacific is expected to observe a growth in its share during the forecast period, while there is expected to be a decline in the shares for the rest of the regions. Expansion in the independent lubricant manufacturers market in Asia Pacific is primarily ascribed to the expansion of emerging economies and the ever-developing automotive industry in the region. Asia Pacific shows strong potential for the independent lubricant manufacturers market in the forecast period due to the availability of raw materials to produce lubricants, low-cost of labor, and the number of major players that provide base oils as well as additives to the regional independent lubricant manufacturers.

The demand for lubricants in Europe is primarily led by countries such as Germany, France, U.K., and Russia. The market in Western Europe is comparatively mature than Eastern Europe, but the latter is anticipated to show comparatively higher promise in terms of growth potential for the independent lubricant manufacturers market.

North America and Europe are considered mature markets due to the presence of well-established key players and developed economies in these regions, which enables independent lubricant manufacturers in these regions to establish their presence in their respective local markets. The U.S. market accounts for the dominant share of the independent lubricant manufacturers market in North America. The well-established civil aviation industry, coupled with defense sector in the region, is primarily viewed as a key driver for the overall demand for lubricants manufactured by independent lubricants manufacturers.

Some of the leading companies operating in the global independent lubricant manufacturers market are FUCHS, ADDINOL Lube Oil GmbH, AMSOIL INC., BVA Oil, Carlube, Forsythe Lubrication, and Motul.

Advent of New Additives Help Players in Lubricant Market Capture Sustainable Value among Consumers

Lubricants have become commonplace chemicals used in reducing friction and wear caused by the relative motion of solid bodies or surfaces. A wide assortment of formulations in the lubricants market are present to meet the objectives of internal and external lubrication in manufacturing and production plants across industries. The choice of the chemistry, including the use of additives, depends on the various criteria the user needs to serve in an application. For instance, internal lubricants are used to boost flow and weld line strength, reduce sink marks, and manage the operating temperature and pressure. They are used to reduce coefficient of friction between the various machinery parts in end-use industries such as between bearings and gears. Both the types have undergone some remarkable changes, improving the tribology of the materials. Recent years have seen pioneers leveraging the nanotribology to meet the environmental parameters, in response to changing market trends.

The COVID-19 pandemic and the consequent outbreaks have shaken the economies across the world. The end-use industries suffered lack of economic activities. Many had to halt their production in months of 2020 to help combat the spread of the virus and also due to lack of labor. Nevertheless, production activities in various industries have seen an increase over the last few months, supported by government regulations and a positive consumer sentiment in some developing and developed economies. Thus, the demand for new formulations in lubricants has been boosting the growth. Advent of advanced formulations to meet the demands in industrial oils, automotive, and marine oils has expanded the revenue prospects in the lubricant market over the past few years. In the coming years, as for environment protection in the lubricant market is likely to gain worldwide traction, extensive research and development in the products will shape the investment avenues for new entrants. The demand for improving the performance of automotive is one of the key trends expected to spur product development in the market.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Secondary Sources and Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Market Snapshot

3.2. Top Trends

4. Market Overview

4.1. Product Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Drivers and Restraints Snapshot Analysis

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunities

4.5. Global Independent Lubricant Manufacturers Market Analysis and Forecast

4.6. Porter’s Analysis

4.6.1. Threat of Substitutes

4.6.2. Bargaining Power of Buyers

4.6.3. Bargaining Power of Suppliers

4.6.4. Threat of New Entrants

4.6.5. Degree of Competition

4.7. Value Chain Analysis

4.8. Global Demand-Supply Scenario

4.9. Global Independent Lubricant Manufacturers Market Outlook, 2016

4.10. Regulatory Scenario

4.11. Global Independent Lubricant Manufacturers Market: SWOT Analysis

5. Independent Lubricant Manufacturers Market Analysis, by Product

5.1. Introduction

5.2. Key Findings

5.3. Global Independent Lubricant Manufacturers Market Value Share Analysis, by Product

5.4. Global Independent Lubricant Manufacturers Market Forecast and Analysis, By Product

5.4.1. Mineral lubricants

5.4.2. Synthetic lubricants

5.4.3. Bio-based lubricants

5.5. Global Independent Lubricant Manufacturers Market Attractiveness Analysis, by Product

5.6. Market Trends

6. Independent Lubricant Manufacturers Market Analysis, by End-user

6.1. Introduction

6.2. Key Findings

6.3. Global Independent Lubricant Manufacturers Market Value Share Analysis, by End-user

6.4. Global Independent Lubricant Manufacturers Market Forecast and Analysis, by End-user

6.4.1. Automotive

6.4.2. Aerospace

6.4.3. Marine

6.4.4. Industrial

6.4.5. Others

6.5. Global Independent Lubricant Manufacturers Market Attractiveness Analysis, by End-user

7. Global Independent Lubricant Manufacturers Market Analysis by Region

7.1. Global Market Size (Kilo Tons) in 2016 and Growth Scenario, by Region

7.2. Key Findings

7.3. Global Independent Lubricant Manufacturers Market Value Share Analysis, by Region

7.4. Global Independent Lubricant Manufacturers Market Forecast, by Region

7.4.1. North America

7.4.2. Latin America

7.4.3. Europe

7.4.4. Asia Pacific

7.4.5. Middle East and Africa

7.5. Global Independent Lubricant Manufacturers Market Attractiveness Analysis, by Region

8. North America Independent Lubricant Manufacturers Market Analysis

8.1. Key Findings

8.2. North America Independent Lubricant Manufacturers Market Overview

8.3. North America Independent Lubricant Manufacturers Market Value Share Analysis, by Product

8.4. North America Independent Lubricant Manufacturers Market Forecast, by Product

8.5. North America Independent Lubricant Manufacturers Market Value Share Analysis, by End-user

8.6. North America Independent Lubricant Manufacturers Market Forecast, by End-user

8.7. North America Independent Lubricant Manufacturers Market Value Share Analysis, by Country

8.8. North America Independent Lubricant Manufacturers Market Forecast, by Country

8.8.1. U.S. Independent Lubricant Manufacturers Market Analysis

8.8.2. U.S. Independent Lubricant Manufacturers Market Forecast, by Product

8.8.3. U.S. Independent Lubricant Manufacturers Market Forecast, by End-user

8.8.4. Canada Independent Lubricant Manufacturers Market Analysis

8.8.5. Canada Independent Lubricant Manufacturers Market Forecast, by Product

8.8.6. Canada Independent Lubricant Manufacturers Market Forecast, by End-user

8.9. Product to Country Comparison Matrix, 2016

8.10. End-user to Country Comparison Matrix, 2016

8.11. North America PEST Analysis

9. Latin America Independent Lubricant Manufacturers Market Analysis

9.1. Key Findings

9.2. Latin America Independent Lubricant Manufacturers Market Overview

9.3. Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by Product

9.4. Latin America Independent Lubricant Manufacturers Market Forecast, by Product

9.5. Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by End-user

9.6. Latin America Independent Lubricant Manufacturers Market Forecast, by End-user

9.7. Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by Country

9.8. Latin America Independent Lubricant Manufacturers Market Forecast, by Country

9.8.1. Brazil Independent Lubricant Manufacturers Market Analysis

9.8.2. Brazil Independent Lubricant Manufacturers Market Forecast, by Product

9.8.3. Brazil Independent Lubricant Manufacturers Market Forecast, by End-user

9.8.4. Mexico Independent Lubricant Manufacturers Market Analysis

9.8.5. Mexico Independent Lubricant Manufacturers Market Forecast, by Product

9.8.6. Mexico Independent Lubricant Manufacturers Market Forecast, by End-user

9.8.7. Rest of Latin America Independent Lubricant Manufacturers Market Analysis

9.8.8. Rest of Latin America Independent Lubricant Manufacturers Market Forecast, by Product

9.8.9. Rest of Latin America Independent Lubricant Manufacturers Market Forecast, by End-user

9.9. Product to Country Comparison Matrix, 2016

9.10. End-user to Country Comparison Matrix, 2016

9.11. Latin America PEST Analysis

10. Europe Independent Lubricant Manufacturers Market Analysis

10.1. Key Findings

10.2. Europe Independent Lubricant Manufacturers Market Overview

10.3. Europe Independent Lubricant Manufacturers Market Value Share Analysis, by Product

10.4. Europe Independent Lubricant Manufacturers Market Forecast, by Product

10.5. Europe Independent Lubricant Manufacturers Market Value Share Analysis, by End-user

10.6. Europe Independent Lubricant Manufacturers Market Forecast, by End-user

10.7. Europe Independent Lubricant Manufacturers Market Value Share Analysis, by Country

10.8. Europe Independent Lubricant Manufacturers Market Forecast, by Country

10.8.1. Germany Independent Lubricant Manufacturers Market Analysis

10.8.2. Germany Independent Lubricant Manufacturers Market Forecast, by Product

10.8.3. Germany Independent Lubricant Manufacturers Market Forecast, by End-user

10.8.4. France Independent Lubricant Manufacturers Market Analysis

10.8.5. France Independent Lubricant Manufacturers Market Forecast, by Product

10.8.6. France Independent Lubricant Manufacturers Market Forecast, by End-user

10.8.7. U.K. Independent Lubricant Manufacturers Market Analysis

10.8.8. U.K. Independent Lubricant Manufacturers Market Forecast, by Product

10.8.9. U.K. Independent Lubricant Manufacturers Market Forecast, by End-user

10.8.10. Spain Independent Lubricant Manufacturers Market Analysis

10.8.11. Spain Independent Lubricant Manufacturers Market Forecast, by Product

10.8.12. Spain Independent Lubricant Manufacturers Market Forecast, by End-user

10.8.13. Italy Independent Lubricant Manufacturers Market Analysis

10.8.14. Italy Independent Lubricant Manufacturers Market Forecast, by Product

10.8.15. Italy Independent Lubricant Manufacturers Market Forecast, by End-user

10.8.16. Rest of Europe Independent Lubricant Manufacturers Market Analysis

10.8.17. Rest of Europe Independent Lubricant Manufacturers Market Forecast, by Product

10.8.18. Rest of Europe Independent Lubricant Manufacturers Market Forecast, by End-user

10.9. Product to Country Comparison Matrix, 2016

10.10. End-user to Country Comparison Matrix, 2016

10.11. Europe PEST Analysis

11. Asia Pacific Independent Lubricant Manufacturers Market Analysis

11.1. Key Findings

11.2. Asia Pacific Independent Lubricant Manufacturers Market Overview

11.3. Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by Product

11.4. Asia Pacific Independent Lubricant Manufacturers Market Forecast, by Product

11.5. Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by End-user

11.6. Asia Pacific Independent Lubricant Manufacturers Market Forecast, by End-user

11.7. Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by Country

11.8. Asia Pacific Independent Lubricant Manufacturers Market Forecast, by Country

11.8.1. China Independent Lubricant Manufacturers Market Analysis

11.8.2. China Independent Lubricant Manufacturers Market Forecast, by Product

11.8.3. China Independent Lubricant Manufacturers Market Forecast, by End-user

11.8.4. Japan Independent Lubricant Manufacturers Market Analysis

11.8.5. Japan Independent Lubricant Manufacturers Market Forecast, by Product

11.8.6. Japan Independent Lubricant Manufacturers Market Forecast, by End-user

11.8.7. India Independent Lubricant Manufacturers Market Analysis

11.8.8. India Independent Lubricant Manufacturers Market Forecast, by Product

11.8.9. India Independent Lubricant Manufacturers Market Forecast, by End-user

11.8.10. ASEAN Independent Lubricant Manufacturers Market Analysis

11.8.11. ASEAN Independent Lubricant Manufacturers Market Forecast, by Product

11.8.12. ASEAN Independent Lubricant Manufacturers Market Forecast, by End-user

11.8.13. Rest of Asia Pacific Independent Lubricant Manufacturers Market Analysis

11.8.14. Rest of Asia Pacific Independent Lubricant Manufacturers Market Forecast, by Product

11.8.15. Rest of Asia Pacific Independent Lubricant Manufacturers Market Forecast, by End-user

11.9. Product to Country Comparison Matrix, 2016

11.10. End-user to Country Comparison Matrix, 2016

11.11. Asia Pacific PEST Analysis

12. Middle East & Africa Independent Lubricant Manufacturers Market Analysis

12.1. Key Findings

12.2. Middle East & Africa Independent Lubricant Manufacturers Market Overview

12.3. Middle East & Africa Independent Lubricant Manufacturers Market Value Share Analysis, by Product

12.4. Middle East & Africa Independent Lubricant Manufacturers Market Forecast, by Product

12.5. Middle East & Africa Independent Lubricant Manufacturers Market Value Share Analysis, by End-user

12.6. Middle East & Africa Independent Lubricant Manufacturers Market Forecast, by End-user

12.7. Middle East & Africa Independent Lubricant Manufacturers Market Value Share Analysis, by Country

12.8. Middle East & Africa Independent Lubricant Manufacturers Market Forecast, by Country

12.8.1. GCC Independent Lubricant Manufacturers Market Analysis

12.8.2. GCC Independent Lubricant Manufacturers Market Forecast, by Product

12.8.3. GCC Independent Lubricant Manufacturers Market Forecast, by End-user

12.8.4. South Africa Independent Lubricant Manufacturers Market Analysis

12.8.5. South Africa Independent Lubricant Manufacturers Market Forecast, by Product

12.8.6. South Africa Independent Lubricant Manufacturers Market Forecast, by End-user

12.8.7. Rest of Middle East & Africa Independent Lubricant Manufacturers Market Analysis

12.8.8. Rest of Middle East & Africa Independent Lubricant Manufacturers Market Forecast, by Product

12.8.9. Rest of Middle East & Africa Independent Lubricant Manufacturers Market Forecast, by End-user

12.9. Product to Country Comparison Matrix, 2016

12.10. End-user to Country Comparison Matrix, 2016

12.11. Middle East & Africa PEST Analysis

13. Competition Landscape

13.1. Independent Lubricant Manufacturers Market Share Analysis, by Company, 2016

13.2. Competition Matrix

13.3. Product Mapping

13.4. Company Profiles

13.4.1. ADDINOL Lube Oil GmbH

13.4.1.1. Company Description

13.4.1.2. Business Overview

13.4.2. AMSOIL INC.

13.4.2.1. Company Description

13.4.2.2. Business Overview

13.4.3. BVA Oil

13.4.3.1. Company Description

13.4.3.2. Business Overview

13.4.4. Carlube

13.4.4.1. Company Description

13.4.4.2. Business Overview

13.4.5. CRP Industries Inc.

13.4.5.1. Company Description

13.4.5.2. Business Overview

13.4.6. Forsythe Lubrication

13.4.6.1. Company Description

13.4.6.2. Business Overview

13.4.7. FUCHS

13.4.7.1. Company Description

13.4.7.2. Business Overview

13.4.7.3. SWOT Analysis

13.4.7.4. Strategic Overview

13.4.8. LIQUI MOLY GmbH

13.4.8.1. Company Description

13.4.8.2. Business Overview

13.4.9. Lucas Oil Products, Inc.

13.4.9.1. Company Description

13.4.9.2. Business Overview

13.4.10. Motul

13.4.10.1. Company Description

13.4.10.2. Business Overview

13.4.11. Royal Purple LLC

13.4.11.1. Company Description

13.4.11.2. Business Overview

13.4.12. The Maxol Group

13.4.12.1. Company Description

13.4.12.2. Business Overview

13.4.13. Tulco Oils

13.4.13.1. Company Description

13.4.13.2. Business Overview

13.4.14. Unil-Opal S.A.S

13.4.14.1. Company Description

13.4.14.2. Business Overview

14. Primary Research – Key Insights

List of Tables

Table 01: Global Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 02: Global Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 03: Global Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Region, 2016–2025

Table 04: North America Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 05: North America Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 06: North America Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country, 2016–2025

Table 07: U.S. Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 08: U.S. Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 09: Canada Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 10: Canada Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 11: Latin America Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 12: Latin America Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 13: Latin America Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country/Sub-region, 2016–2025

Table 14: Brazil Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 15: Brazil Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 16: Mexico Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 17: Mexico Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 18: Rest of Latin America Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 19: Rest of Latin America Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 20: Europe Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 21: Europe Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 22: Europe Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country/ Sub-region, 2016–2025

Table 22: Europe Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country/ Sub-region, 2016–2025

Table 23: Germany Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 24: Germany Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 25: France Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 26: France Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 27: U.K. Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 28: U.K. Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 29: Spain Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 30: Spain Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 31: Italy Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 32: Italy Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 33: Rest of Europe Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 34: Rest of Europe Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 35: Asia Pacific Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 36: Asia Pacific Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 37: Asia Pacific Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country/Sub-region, 2016–2025

Table 38: China Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 39: China Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 40: Japan Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 41: Japan Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 42: India Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 43: India Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 44: ASEAN Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 45: ASEAN Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 46: Rest of Asia Pacific Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 47: Rest of Asia Pacific Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 48: MEA Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Product, 2016–2025

Table 49: Middle East & Africa Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 50: MEA Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by Country/Sub-region, 2016–2025

Table 51: GCC Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 52: GCC Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 53: South Africa Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 54: South Africa Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

Table 55: Rest of Middle East & Africa Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo tons) Forecast, by Product, 2016–2025

Table 56: Rest of Middle East & Africa Independent Lubricant Manufacturers Market Volume (Kilo Tons) and Revenue (US$ Mn) Forecast, by End-user, 2016–2025

List of Figures

Figure 01: Market Snapshot

Figure 01: Proportion by Region, 2016

Figure 01: Share of Asia Pacific in Terms of Consumption, 2016–2025

Figure 02: Global Automobile Sales (Million), 2012–2016

Figure 03: Global Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Analysis, 2016–2025

Figure 04: Global Independent Lubricant Manufacturers Market Size and Volume, Y-o-Y Growth Projection, 2016–2025

Figure 05: Global Independent Lubricant Manufacturers Market, Pricing – Actual & Projection (US$/Ton), 2016–2025

Figure 06: Global Independent Lubricant Manufacturers Market Volume Share, by Product, 2016

Figure 07: Global Independent Lubricant Manufacturers Market Value Share, by End-user, 2016

Figure 08: Global Independent Lubricant Manufacturers Market Volume Share, by Region, 2016

Figure 09: Global Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 10: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis, by Mineral lubricants, 2016–2025

Figure 11: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis, by Synthetic lubricants, 2016–2025

Figure 12: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis, by Bio-based lubricants, 2016–2025

Figure 13: Global Independent Lubricant Manufacturers Market Attractiveness Analysis, by Product

Figure 14: Global Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 15: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis for Automotive, 2016–2025

Figure 16: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis for Aerospace, 2016–2025

Figure 17: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis for Marine, 2016–2025

Figure 18: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis for Industrial, 2016–2025

Figure 19: Global Independent Lubricant Manufacturers Market Revenue (US$ Mn) and Volume (Kilo Tons) Analysis for Others, 2016–2025

Figure 20: Global Independent Lubricant Manufacturers Market Attractiveness Analysis, by End-user

Figure 21: Global Independent Lubricant Manufacturers Market Value Share Analysis, by Region, 2016 and 2025

Figure 22: Global Independent Lubricant Manufacturers Market Attractiveness Analysis, by Region

Figure 23: North America Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 24: North America Independent Lubricant Manufacturers Market Attractiveness Analysis, by Country

Figure 25: North America Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 26: North America Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 27: North America Independent Lubricant Manufacturers Market Value Share Analysis, by Country, 2016 and 2025

Figure 28: U.S. Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 29: U.S. Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 30: U.S. Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 31: Canada Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 32: Canada Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 33: Canada Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 34: Latin America Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 35: Latin America Independent Lubricant Manufacturers Market Attractiveness Analysis, by Country/Sub-region

Figure 36: Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 37: Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 38: Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 39: Brazil Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 40: Brazil Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 41: Brazil Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 42: Mexico Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 43: Mexico Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 44: Mexico Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 45: Rest of Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 46: Rest of Latin America Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 47: Rest of Latin America Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 48: Europe Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 49: Europe Independent Lubricant Manufacturers Market Attractiveness Analysis, by Country/Sub-region

Figure 50: Europe Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 51: Europe Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 52: Europe Independent Lubricant Manufacturers Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 53: Germany Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 54: Germany Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 55: Germany Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 56: France Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 57: France Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 58: France Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 59: U.K. Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 60: U.K. Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 61: U.K. Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 62: Spain Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 63: Spain Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 64: Spain Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 65: Italy Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 66: Italy Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 67: Italy Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 68: Rest of Europe Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 69: Rest of Europe Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 70: Rest of Europe Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 71: Asia Pacific Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 72: Asia Pacific Independent Lubricant Manufacturers Market Attractiveness Analysis, by Country/Sub-region

Figure 73: Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 74: Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 75: Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 76: China Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 77: China Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 78: China Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 79: Japan Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 80: Japan Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 81: Japan Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 82: India Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 83: India Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 84: India Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 85: ASEAN Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 86: ASEAN Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 87: ASEAN Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 88: Rest of Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 89: Rest of Asia Pacific Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 90: Rest of Asia Pacific Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 91: MEA Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 92: MEA Independent Lubricant Manufacturers Market Attractiveness Analysis, by Country/Sub-region

Figure 93: MEA Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 94: MEA Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 95: MEA Independent Lubricant Manufacturers Market Value Share Analysis, by Country/Sub-region, 2016 and 2025

Figure 96: GCC Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 97: GCC Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 98: GCC Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 99: South Africa Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 100: South Africa Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 101: South Africa Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 102: Rest of Middle East & Africa Independent Lubricant Manufacturers Market Value Share Analysis, by Product, 2016 and 2025

Figure 103: Rest of Middle East & Africa Independent Lubricant Manufacturers Market Value Share Analysis, by End-user, 2016 and 2025

Figure 104: Rest of Middle East & Africa Independent Lubricant Manufacturers Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2016–2025

Figure 105: Global Independent Lubricant Manufacturers Market Share Analysis, by Company, 2016