Reports

Reports

Analysts’ Viewpoint

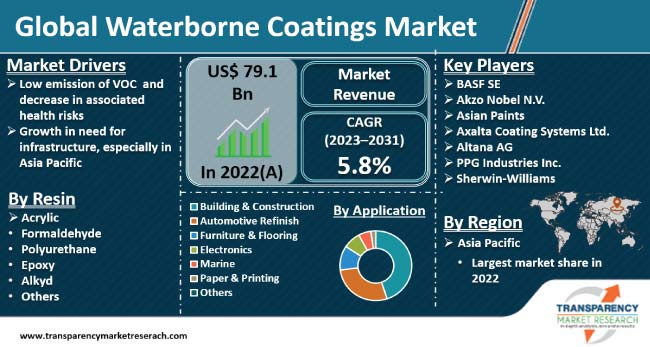

Low emission of volatile organic compounds (VOC) and decrease in associated health risks are prominent factors driving the global waterborne coatings market value. Significant rise in need for infrastructure, especially in Asia Pacific, is also augmenting market progress. Waterborne coatings applications in the building & construction sector have evolved substantially over the last few years. Coatings today have varying raw material bases as well as environmental profiles and qualities. A range of factors, including paint formulations and ecological restrictions, has influenced these market developments.

Companies are increasingly transitioning from oil-based to waterborne paints, as the latter are environmentally friendly surface coatings. They are following the latest waterborne coatings market trends and introducing innovative coatings with improved film properties such as dirt pickup resistance and rain resistance to increase their industry share.

Waterborne coatings are surface coatings or finishes that use water as solvent to disperse resin. Composition of waterborne coatings varies; some of these include up to 80% water with other solvents such as glycol ether. This makes waterborne coatings environmentally-friendly and easy to apply.

Waterborne coatings provide strong surface properties such as anti-sealing effects, high gloss, and rub resistance. These coatings are excellent primers due to their resistance to heat and abrasion. Waterborne coatings create strong adhesion and are used in thick or thin coats.

Waterborne coatings find applications on inner and outer surfaces. These coatings provide corrosion resistance, high gloss, wetting, and stabilization. Waterborne coatings are used to increase surface resistance from weathering and rust. They are also used to improve esthetics and durability of structures. Thus, rise in application of waterborne coatings in various industries is boosting market dynamics.

Companies producing solutions for diverse markets have created new prospects for end-users of aqueous coatings. Demand for waterborne coatings has been shifting from the building & construction sector to the industrial sector.

Waterborne coating is a technique that has the potential to lower VOC emissions when compared to standard solvent-borne solutions. Demand for waterborne coatings has been rising in various industries due to their strong performance in several applications, environmental benefits, and improvement in safety profiles.

Waterborne acrylics are currently employed in a wide range of light and medium load industrial applications. Overall, the waterborne coatings market growth has been steady owing to a number of factors such as compliance with VOC regulations, ease of clean-up, less hazardous waste disposal, decrease in associated costs, and lower risk of health hazards.

Surge in population across the globe, especially in developing countries such as India and Brazil, is driving the need for infrastructure projects. Efficient infrastructure plays a key role in supply of goods and services from one place to another.

Investment in infrastructure has been rising steadily since the last few years. Governments of various countries across the globe are increasing their investments in infrastructure projects to meet the significant rise in demand.

Waterborne coatings are used extensively in building & construction and infrastructure industries. This rise in usage of waterborne coatings in infrastructure projects across the globe is creating lucrative waterborne coatings market opportunities for companies operating in the industry.

Asia Pacific accounted for significant waterborne coatings market share in 2022. The region's market expansion is largely driven by the increase in infrastructure requirements in residential, non-residential, and commercial sectors. The building & construction sector in Asia Pacific is expected to grow rapidly in the near future.

Increase in demand for ornamental paints & coatings in India and China and growth in awareness about sustainable coatings are also boosting the waterborne coatings industry in Asia Pacific. VOC emission regulations are becoming increasingly stringent in countries such as China and India. This has driven manufacturers to adopt environmentally-friendly technologies. Thus, the trend of using waterborne coatings is expected to gain momentum in the region.

The global waterborne coatings market forecast projects intense competition in this industry. Leading players are focusing on expanding their business through establishment of new production facilities and strategic acquisitions.

As per waterborne coatings market analysis, BASF SE, Akzo Nobel N.V., Asian Paints, Axalta Coating Systems Ltd., Altana AG, PPG Industries Inc., and Sherwin-Williams are the leading players operating in the global landscape.

The market report outlines these companies in terms of parameters such as company overview, business segments, product portfolio, business strategies, financial overview, and recent developments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 79.1 Bn |

| Market Forecast Value in 2031 | US$ 131.8 Bn |

| Growth Rate (CAGR) | 5.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Regions Covered |

|

| Countries Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 79.1 Bn in 2022

It is likely to grow at a CAGR of 5.8% from 2023 to 2031

Low emission of VOC and decrease in associated health risks, and growth in need for infrastructure, especially in Asia Pacific

Building & construction segment commands a bulk of the share in terms of application

Asia Pacific was the leading region in 2022

BASF SE, Akzo Nobel N.V., Asian Paints, Axalta Coating Systems Ltd., Altana AG, PPG Industries Inc., and Sherwin-Williams

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Waterborne Coatings Market Analysis and Forecast, 2023-2031

2.6.1. Global Waterborne Coatings Market Volume (Kilo Tons)

2.6.2. Global Waterborne Coatings Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Waterborne Coatings

3.2. Impact on Demand for Waterborne Coatings – Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Resin

6.2. Price Trend Analysis by Region

7. Waterborne Coatings Market Analysis and Forecast, by Resin, 2023–2031

7.1. Introduction and Definitions

7.2. Global Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

7.2.1. Acrylic

7.2.2. Formaldehyde

7.2.3. Polyurethane

7.2.4. Epoxy

7.2.5. Alkyd

7.2.6. Others

7.3. Global Waterborne Coatings Market Attractiveness, by Resin

8. Global Waterborne Coatings Market Analysis and Forecast, by Application, 2023–2031

8.1. Introduction and Definitions

8.2. Global Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

8.2.1. Building & Construction

8.2.2. Automotive Refinish

8.2.3. Furniture & Flooring

8.2.4. Electronics

8.2.5. Marine

8.2.6. Paper & Printing

8.2.7. Others

8.3. Global Waterborne Coatings Market Attractiveness, by Application

9. Global Waterborne Coatings Market Analysis and Forecast, by Region, 2023–2031

9.1. Key Findings

9.2. Global Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Region, 2023–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Waterborne Coatings Market Attractiveness, by Region

10. North America Waterborne Coatings Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. North America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

10.3. North America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

10.4. North America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country, 2023–2031

10.4.1. U.S. Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

10.4.2. U.S. Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

10.4.3. Canada Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

10.4.4. Canada Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

10.5. North America Waterborne Coatings Market Attractiveness Analysis

11. Europe Waterborne Coatings Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Europe Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.3. Europe Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.4. Europe Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

11.4.1. Germany Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.4.2. Germany. Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.4.3. France Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.4.4. France. Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.4.5. U.K. Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.4.6. U.K. Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.4.7. Italy Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.4.8. Italy Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.4.9. Russia & CIS Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.4.10. Russia & CIS Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.4.11. Rest of Europe Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

11.4.12. Rest of Europe Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

11.5. Europe Waterborne Coatings Market Attractiveness Analysis

12. Asia Pacific Waterborne Coatings Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin

12.3. Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

12.4. Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

12.4.1. China Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

12.4.2. China Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

12.4.3. Japan Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

12.4.4. Japan Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

12.4.5. India Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

12.4.6. India Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

12.4.7. ASEAN Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

12.4.8. ASEAN Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

12.4.9. Rest of Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

12.4.10. Rest of Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

12.5. Asia Pacific Waterborne Coatings Market Attractiveness Analysis

13. Latin America Waterborne Coatings Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Latin America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

13.3. Latin America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

13.4. Latin America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.4.1. Brazil Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

13.4.2. Brazil Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

13.4.3. Mexico Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

13.4.4. Mexico Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

13.4.5. Rest of Latin America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

13.4.6. Rest of Latin America Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

13.5. Latin America Waterborne Coatings Market Attractiveness Analysis

14. Middle East & Africa Waterborne Coatings Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

14.3. Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

14.4. Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.4.1. GCC Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

14.4.2. GCC Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

14.4.3. South Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

14.4.4. South Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

14.4.5. Rest of Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Resin, 2023–2031

14.4.6. Rest of Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) and Value (US$ Bn) Forecast, by Application, 2023–2031

14.5. Middle East & Africa Waterborne Coatings Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Waterborne Coatings Company Market Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. BASE SE

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. Akzo Nobel N.V.

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. Asian Paints

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. Axalta Coating Systems Ltd.

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. Altana AG

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. PPG Industries Inc.

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. Sherwin-Williams

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 2: Global Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 3: Global Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 4: Global Waterborne Coatings Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 5: Global Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 6: Global Waterborne Coatings Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 7: North America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 8: North America Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 9: North America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 10: North America Waterborne Coatings Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 11: North America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 12: North America Waterborne Coatings Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 13: U.S. Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 14: U.S. Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 15: U.S. Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 16: U.S. Waterborne Coatings Market Value (US$ Bn) Forecast, by Application, 2023–2031

Table 17: Canada Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 18: Canada Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 19: Canada Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 20: Canada Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 21: Europe Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 22: Europe Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 23: Europe Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 24: Europe Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 25: Europe Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 26: Europe Waterborne Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 27: Germany Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 28: Germany Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 29: Germany Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 30: Germany Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 31: France Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 32: France Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 33: France Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 34: France Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 35: U.K. Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 36: U.K. Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 37: U.K. Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 38: U.K. Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 39: Italy Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 40: Italy Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 41: Italy Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 42: Italy Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 43: Spain Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 44: Spain Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 45: Spain Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 46: Spain Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 47: Russia & CIS Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 48: Russia & CIS Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 49: Russia & CIS Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 50: Russia & CIS Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 51: Rest of Europe Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 52: Rest of Europe Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 53: Rest of Europe Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 54: Rest of Europe Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 55: Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 56: Asia Pacific Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 57: Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 58: Asia Pacific Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 59: Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 60: Asia Pacific Waterborne Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 61: China Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 62: China Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin 2023–2031

Table 63: China Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 64: China Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 65: Japan Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 66: Japan Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 67: Japan Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 68: Japan Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 69: India Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 70: India Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 71: India Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 72: India Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 73: ASEAN Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 74: ASEAN Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 75: ASEAN Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 76: ASEAN Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 77: Rest of Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 78: Rest of Asia Pacific Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 79: Rest of Asia Pacific Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 80: Rest of Asia Pacific Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 81: Latin America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 82: Latin America Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 83: Latin America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 84: Latin America Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 85: Latin America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 86: Latin America Waterborne Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 87: Brazil Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 88: Brazil Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 89: Brazil Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 90: Brazil Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 91: Mexico Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 92: Mexico Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 93: Mexico Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 94: Mexico Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 95: Rest of Latin America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 96: Rest of Latin America Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 97: Rest of Latin America Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 98: Rest of Latin America Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 99: Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 100: Middle East & Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 101: Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 102: Middle East & Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 103: Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 104: Middle East & Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 105: GCC Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 106: GCC Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 107: GCC Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 108: GCC Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 109: South Africa Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 110: South Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 111: South Africa Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 112: South Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

Table 113: Rest of Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Resin, 2023–2031

Table 114: Rest of Middle East & Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Resin, 2023–2031

Table 115: Rest of Middle East & Africa Waterborne Coatings Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 116: Rest of Middle East & Africa Waterborne Coatings Market Value (US$ Bn) Forecast, by Application 2023–2031

List of Figures

Figure 1: Global Waterborne Coatings Market Volume Share Analysis, by Resin, 2022, 2027, and 2031

Figure 2: Global Waterborne Coatings Market Attractiveness, by Resin

Figure 3: Global Waterborne Coatings Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Global Waterborne Coatings Market Attractiveness, by Application

Figure 5: Global Waterborne Coatings Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 6: Global Waterborne Coatings Market Attractiveness, by Region

Figure 7: North America Waterborne Coatings Market Volume Share Analysis, by Resin, 2022, 2027, and 2031

Figure 8: North America Waterborne Coatings Market Attractiveness, by Resin

Figure 9: North America Waterborne Coatings Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: North America Waterborne Coatings Market Attractiveness, by Application

Figure 11: North America Waterborne Coatings Market Volume Share Analysis, by Country

Figure 12: North America Waterborne Coatings Market Attractiveness, by Country

Figure 13: Europe Waterborne Coatings Market Volume Share Analysis, by Resin, 2022, 2027, and 2031

Figure 14: Europe Waterborne Coatings Market Attractiveness, by Resin

Figure 15: Europe Waterborne Coatings Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Waterborne Coatings Market Attractiveness, by Application

Figure 17: Europe Waterborne Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Waterborne Coatings Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Waterborne Coatings Market Volume Share Analysis, by Resin, 2022, 2027, and 2031

Figure 20: Asia Pacific Waterborne Coatings Market Attractiveness, by Resin

Figure 21: Asia Pacific Waterborne Coatings Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Waterborne Coatings Market Attractiveness, by Application

Figure 23: Asia Pacific Waterborne Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Waterborne Coatings Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Waterborne Coatings Market Volume Share Analysis, by Resin, 2022, 2027, and 2031

Figure 26: Latin America Waterborne Coatings Market Attractiveness, by Resin

Figure 27: Latin America Waterborne Coatings Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Waterborne Coatings Market Attractiveness, by Application

Figure 29: Latin America Waterborne Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Waterborne Coatings Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Waterborne Coatings Market Volume Share Analysis, by Resin, 2022, 2027, and 2031

Figure 32: Middle East & Africa Waterborne Coatings Market Attractiveness, by Resin

Figure 33: Middle East & Africa Waterborne Coatings Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Waterborne Coatings Market Attractiveness, by Application

Figure 35: Middle East & Africa Waterborne Coatings Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Waterborne Coatings Market Attractiveness, by Country and Sub-region