Reports

Reports

Increasing stringent government regulations and demand for local representation are major factors driving regulatory affairs outsourcing market demand. As companies strive to accelerate product approvals and navigate complex, region-specific regulations, outsourcing regulatory functions has become a strategic necessity. Additionally, the demand for localized expertise and on-the-ground presence in emerging markets such as Asia Pacific, Latin America, and the Middle East is a key factor propelling market expansion.

.jpg)

In line with the latest regulatory affairs outsourcing market trends, leading firms are broadening their service offerings to include end-to-end regulatory consulting, clinical trial support, pharmacovigilance, and compliance management to cater to diverse client needs and become one-stop solutions.

Regulatory affairs outsourcing involves partnering with specialized third-party service providers to manage and navigate the complex regulatory requirements that govern the development, approval, and marketing of pharmaceutical, biotechnology, and medical device products. This strategy enables companies to leverage external expertise in regulatory submissions, compliance monitoring, and documentation management, ensuring adherence to global regulatory standards.

Outsourcing regulatory affairs helps organizations reduce operational costs, accelerate product approvals, and mitigate risks associated with regulatory non-compliance. It is especially beneficial for small to mid-sized companies lacking in-house regulatory resources or for large firms aiming to optimize efficiency. With increasing regulatory complexity and evolving guidelines worldwide, regulatory affairs outsourcing is becoming a critical component in the successful commercialization of healthcare products.

| Attribute | Detail |

|---|---|

| Regulatory Affairs Outsourcing Market Drivers |

|

As new tech, medicines, and medical gadgets keep popping up quickly, the rules around them are getting more complicated and stricter. For companies in pharma and biotech, it’s really hard to keep up with all these changing rules and make sure they’re following everything at every step - from developing to selling their products. The approval process is taking longer now because of more data needed. Missing a step or making a mistake can cause delays in launching new products and slow down business. Many companies choose to outsource some of their regulatory work.

This way, they can work with experts who keep up with the latest rules and regulations all the time. These specialists understand the changing guidelines through ongoing research and talking to stakeholders. They can help guide companies ahead of time and make sure all submissions are up-to-date, speeding up approval times. By outsourcing the routine regulatory tasks, companies can free up their staff to focus on more strategic priorities and grow their business more effectively.

For instance, in November 2024, the Medical Device Coordination Group (MDCG) issued Q&A addressing practical aspects of the gradual roll-out of Eudamed under Regulations (EU) 2017/745 (MDR) and (EU) 2017/746 (IVDR), as amended by Regulation (EU) 2024/1860. The Q&A specify that Eudamed includes six modules and clarify that the obligations and requirements for each module will become applicable six months after the publication of the notice confirming the functionality of the module in the Official Journal.

As new markets emerge globally, companies are increasingly seeking international expansion. However, regulatory rules and approval processes vary significantly across countries due to differences in healthcare systems, policies, and cultural factors. To comply with each country’s requirements, companies need a thorough understanding of local regulations along with on-site support, including facilities and staff. This poses a considerable challenge for multinational companies managing global operations. Regulatory outsourcing addresses this by providing access to experts well-versed in local laws. These outsourcing partners establish local offices and hire native representatives who can liaise directly with local authorities on their behalf.

Moreover, the expansion of outsourcing services by key market players is expected to drive growth in the regulatory affairs outsourcing industry sector. For example, in March 2025, ICON PLC expanded its outsourcing services within the Asia Pacific region. This strategic move responds directly to the growing demand for regulatory consultation and clinical trial support in rapidly developing markets such as China and India.

Product registration and clinical trial applications segment is expected to lead service type market segment of the regulatory affairs outsourcing industry. The growth is attributed owing to the increasing number of clinical trials across the globe, stringent regulations in developed markets, and legal/regulatory reforms in emerging markets such as Asia Pacific are driving the outsourcing trend for clinical trial applications. The segment growth is owing to increasing demand for legal representatives worldwide on account of the globalization of medical devices and pharmaceutical companies.

The regulations are very complex and ever-changing. The changing regulatory landscape in regions such as Asia Pacific, MEA, and Latin America increases the demand for local experts for legal representation for obtaining regulatory approvals and custom clearance. These factors are promoting the demand for legal representation services across the world.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest regulatory affairs outsourcing market analysis North America region is expected to dominate the market share with an estimated market share of 39.4% in 2024. Presence of established pharmaceutical companies, stringent regulations such as FDA and presence of leading contract research organizations (CROs) offering end-to-end regulatory solutions are some of the major factors driving market growth. Furthermore, high concentration of clinical trials in this region increases the need for regulatory expertise. Additionally, Asia Pacific region is also poised to be the fastest growing market during the forecast period.

Countries like China, India and Japan are emerging as global sourcing destinations for regulatory affairs due to increasing investments in healthcare infrastructure and pharmaceutical manufacturing capabilities. In addition, Asia Pacific companies are actively enhancing their global regulatory networks to cater growing international marketing authorizations for their products. While pricing of services is relatively lower compared to mature markets, the region offers high future growth potential backed by improving quality standards.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Accell Clinical Research, LLC, Genpact, CRITERIUM, INC, Promedica International, WuXi AppTec, Medpace, Charles River Laboratories, ICON plc, Labcorp Drug Development, Parexel International Corporation, Freyr, PHARMALEX GMBH, and other prominent players are the prominent regulatory affairs outsourcing market players.

Each of these players has been have been profiled in the regulatory affairs outsourcing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

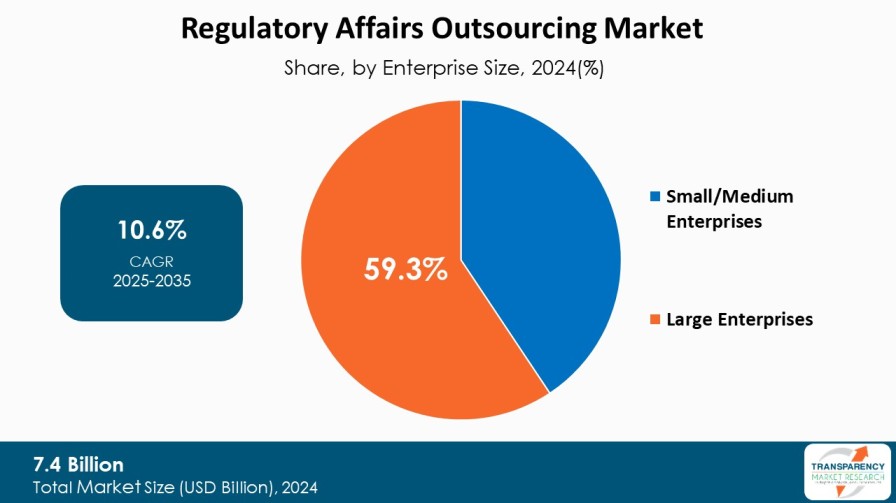

| Size in 2024 | US$ 7.4 Bn |

| Forecast Value in 2035 | More than US$ 22.3 Bn |

| CAGR | 10.6% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global regulatory affairs outsourcing market was valued at US$ 7.4 Bn in 2024.

Regulatory affairs outsourcing business is projected to cross US$ 22.3 Bn by the end of 2035.

Increasing stringent government regulations and demand for local representation to expand into new high potential markets worldwide.

The CAGR is anticipated to be 10.6% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Accell Clinical Research, LLC, Genpact, CRITERIUM, INC, Promedica International, WuXi AppTec, Medpace, Charles River Laboratories, ICON plc, Labcorp Drug Development, Parexel International Corporation, Freyr, and PHARMALEX GMBH are the prominent Regulatory Affairs Outsourcing market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Regulatory Affairs Outsourcing Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Overview on Current Trends in Regulatory Affairs Outsourcing Market Models

5.2. PORTER’s Five Forces Analysis

5.3. PESTEL Analysis

5.4. Regulatory Scenario across Key Regions/Country

5.5. Service Launches/Approvals by the Major Players/Regulatory Authority

5.6. Mergers and Acquisition Scenario for Regulatory Affairs Outsourcing Market

5.7. Benchmarking of the Services Offered by the Competitors

5.8. Investment Trends in Regulatory Affairs Outsourcing Services

5.9. Go-to-Market Strategy for New Market Entrants

6. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, By Service Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Service Type, 2020 to 2035

6.3.1. Regulatory Consulting and Legal Representation

6.3.2. Product Registration and Clinical Trial Applications

6.3.3. Regulatory Writing and Publishing

6.3.4. Regulatory Submission

6.3.5. Regulatory Operations

6.3.6. Others

6.4. Market Attractiveness By Service Type

7. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, By Product Development Stage

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Product Development Stage, 2020 to 2035

7.3.1. Preclinical

7.3.2. Clinical

7.3.3. PMA (Post Market Authorization)

7.4. Market Attractiveness By Product Development Stage

8. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, By Enterprise Size

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Enterprise Size, 2020 to 2035

8.3.1. Small/Medium Enterprises

8.3.2. Large Enterprises

8.4. Market Attractiveness By Enterprise Size

9. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, By Therapeutic Area

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By Therapeutic Area, 2020 to 2035

9.3.1. Oncology

9.3.2. Neurology

9.3.3. Cardiology

9.3.4. Immunology

9.3.5. Dermatology

9.3.6. Others

9.4. Market Attractiveness By Therapeutic Area

10. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, By End-user

10.1. Introduction & Definition

10.2. Key Findings / Developments

10.3. Market Value Forecast By End-user, 2020 to 2035

10.3.1. Medical Device Companies

10.3.2. Biopharma & Pharmaceutical Companies

10.3.3. Others

10.4. Market Attractiveness By End-user

11. Global Regulatory Affairs Outsourcing Market Analysis and Forecasts, By Region

11.1. Key Findings

11.2. Market Value Forecast By Region

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Market Attractiveness By Region

12. North America Regulatory Affairs Outsourcing Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Service Type, 2020 to 2035

12.2.1. Regulatory Consulting and Legal Representation

12.2.2. Product Registration and Clinical Trial Applications

12.2.3. Regulatory Writing and Publishing

12.2.4. Regulatory Submission

12.2.5. Regulatory Operations

12.2.6. Others

12.3. Market Value Forecast By Product Development Stage, 2020 to 2035

12.3.1. Preclinical

12.3.2. Clinical

12.3.3. PMA (Post Market Authorization)

12.4. Market Value Forecast By Enterprise Size, 2020 to 2035

12.4.1. Small/Medium Enterprises

12.4.2. Large Enterprises

12.5. Market Value Forecast By Therapeutic Area, 2020 to 2035

12.5.1. Oncology

12.5.2. Neurology

12.5.3. Cardiology

12.5.4. Immunology

12.5.5. Dermatology

12.5.6. Others

12.6. Market Value Forecast By End-user, 2020 to 2035

12.6.1. Medical Device Companies

12.6.2. Biopharma & Pharmaceutical Companies

12.6.3. Others

12.7. Market Value Forecast By Country, 2020 to 2035

12.7.1. U.S.

12.7.2. Canada

12.8. Market Attractiveness Analysis

12.8.1. By Service Type

12.8.2. By Product Development Stage

12.8.3. By Enterprise Size

12.8.4. By Therapeutic Area

12.8.5. By End-user

12.8.6. By Country

13. Europe Regulatory Affairs Outsourcing Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Service Type, 2020 to 2035

13.2.1. Regulatory Consulting and Legal Representation

13.2.2. Product Registration and Clinical Trial Applications

13.2.3. Regulatory Writing and Publishing

13.2.4. Regulatory Submission

13.2.5. Regulatory Operations

13.2.6. Others

13.3. Market Value Forecast By Product Development Stage, 2020 to 2035

13.3.1. Preclinical

13.3.2. Clinical

13.3.3. PMA (Post Market Authorization)

13.4. Market Value Forecast By Enterprise Size, 2020 to 2035

13.4.1. Small/Medium Enterprises

13.4.2. Large Enterprises

13.5. Market Value Forecast By Therapeutic Area, 2020 to 2035

13.5.1. Oncology

13.5.2. Neurology

13.5.3. Cardiology

13.5.4. Immunology

13.5.5. Dermatology

13.5.6. Others

13.6. Market Value Forecast By End-user, 2020 to 2035

13.6.1. Medical Device Companies

13.6.2. Biopharma & Pharmaceutical Companies

13.6.3. Others

13.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.7.1. Germany

13.7.2. UK

13.7.3. France

13.7.4. Italy

13.7.5. Spain

13.7.6. Switzerland

13.7.7. The Netherlands

13.7.8. Rest of Europe

13.8. Market Attractiveness Analysis

13.8.1. By Service Type

13.8.2. By Product Development Stage

13.8.3. By Enterprise Size

13.8.4. By Therapeutic Area

13.8.5. By End-user

13.8.6. By Country/Sub-region

14. Asia Pacific Regulatory Affairs Outsourcing Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Service Type, 2020 to 2035

14.2.1. Regulatory Consulting and Legal Representation

14.2.2. Product Registration and Clinical Trial Applications

14.2.3. Regulatory Writing and Publishing

14.2.4. Regulatory Submission

14.2.5. Regulatory Operations

14.2.6. Others

14.3. Market Value Forecast By Product Development Stage, 2020 to 2035

14.3.1. Preclinical

14.3.2. Clinical

14.3.3. PMA (Post Market Authorization)

14.4. Market Value Forecast By Enterprise Size, 2020 to 2035

14.4.1. Small/Medium Enterprises

14.4.2. Large Enterprises

14.5. Market Value Forecast By Therapeutic Area, 2020 to 2035

14.5.1. Oncology

14.5.2. Neurology

14.5.3. Cardiology

14.5.4. Immunology

14.5.5. Dermatology

14.5.6. Others

14.6. Market Value Forecast By End-user, 2020 to 2035

14.6.1. Medical Device Companies

14.6.2. Biopharma & Pharmaceutical Companies

14.6.3. Others

14.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.7.1. China

14.7.2. Japan

14.7.3. India

14.7.4. Australia & New Zealand

14.7.5. South Korea

14.7.6. Rest of Asia Pacific

14.8. Market Attractiveness Analysis

14.8.1. By Service Type

14.8.2. By Product Development Stage

14.8.3. By Enterprise Size

14.8.4. By Therapeutic Area

14.8.5. By End-user

14.8.6. By Country/Sub-region

15. Latin America Regulatory Affairs Outsourcing Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Service Type, 2020 to 2035

15.2.1. Regulatory Consulting and Legal Representation

15.2.2. Product Registration and Clinical Trial Applications

15.2.3. Regulatory Writing and Publishing

15.2.4. Regulatory Submission

15.2.5. Regulatory Operations

15.2.6. Others

15.3. Market Value Forecast By Product Development Stage, 2020 to 2035

15.3.1. Preclinical

15.3.2. Clinical

15.3.3. PMA (Post Market Authorization)

15.4. Market Value Forecast By Enterprise Size, 2020 to 2035

15.4.1. Small/Medium Enterprises

15.4.2. Large Enterprises

15.5. Market Value Forecast By Therapeutic Area, 2020 to 2035

15.5.1. Oncology

15.5.2. Neurology

15.5.3. Cardiology

15.5.4. Immunology

15.5.5. Dermatology

15.5.6. Others

15.6. Market Value Forecast By End-user, 2020 to 2035

15.6.1. Medical Device Companies

15.6.2. Biopharma & Pharmaceutical Companies

15.6.3. Others

15.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

15.7.1. Brazil

15.7.2. Mexico

15.7.3. Argentina

15.7.4. Rest of Latin America

15.8. Market Attractiveness Analysis

15.8.1. By Service Type

15.8.2. By Product Development Stage

15.8.3. By Enterprise Size

15.8.4. By Therapeutic Area

15.8.5. By End-user

15.8.6. By Country/Sub-region

16. Middle East & Africa Regulatory Affairs Outsourcing Market Analysis and Forecast

16.1. Introduction

16.1.1. Key Findings

16.2. Market Value Forecast By Service Type, 2020 to 2035

16.2.1. Regulatory Consulting and Legal Representation

16.2.2. Product Registration and Clinical Trial Applications

16.2.3. Regulatory Writing and Publishing

16.2.4. Regulatory Submission

16.2.5. Regulatory Operations

16.2.6. Others

16.3. Market Value Forecast By Product Development Stage, 2020 to 2035

16.3.1. Preclinical

16.3.2. Clinical

16.3.3. PMA (Post Market Authorization)

16.4. Market Value Forecast By Enterprise Size, 2020 to 2035

16.4.1. Small/Medium Enterprises

16.4.2. Large Enterprises

16.5. Market Value Forecast By Therapeutic Area, 2020 to 2035

16.5.1. Oncology

16.5.2. Neurology

16.5.3. Cardiology

16.5.4. Immunology

16.5.5. Dermatology

16.5.6. Others

16.6. Market Value Forecast By End-user, 2020 to 2035

16.6.1. Medical Device Companies

16.6.2. Biopharma & Pharmaceutical Companies

16.6.3. Others

16.7. Market Value Forecast By Country/Sub-region, 2020 to 2035

16.7.1. GCC Countries

16.7.2. South Africa

16.7.3. Rest of Middle East & Africa

16.8. Market Attractiveness Analysis

16.8.1. By Service Type

16.8.2. By Product Development Stage

16.8.3. By Enterprise Size

16.8.4. By Therapeutic Area

16.8.5. By End-user

16.8.6. By Country/Sub-region

17. Competition Landscape

17.1. Market Player – Competition Matrix (By Tier and Size of companies)

17.2. Market Share Analysis By Company (2024)

17.3. Company Profiles

17.3.1. Accell Clinical Research, LLC

17.3.1.1. Company Overview

17.3.1.2. Financial Overview

17.3.1.3. Financial Overview

17.3.1.4. Business Strategies

17.3.1.5. Recent Developments

17.3.2. Genpact

17.3.2.1. Company Overview

17.3.2.2. Financial Overview

17.3.2.3. Financial Overview

17.3.2.4. Business Strategies

17.3.2.5. Recent Developments

17.3.3. CRITERIUM, INC

17.3.3.1. Company Overview

17.3.3.2. Financial Overview

17.3.3.3. Financial Overview

17.3.3.4. Business Strategies

17.3.3.5. Recent Developments

17.3.4. Promedica International

17.3.4.1. Company Overview

17.3.4.2. Financial Overview

17.3.4.3. Financial Overview

17.3.4.4. Business Strategies

17.3.4.5. Recent Developments

17.3.5. WuXi AppTec

17.3.5.1. Company Overview

17.3.5.2. Financial Overview

17.3.5.3. Financial Overview

17.3.5.4. Business Strategies

17.3.5.5. Recent Developments

17.3.6. Medpace

17.3.6.1. Company Overview

17.3.6.2. Financial Overview

17.3.6.3. Financial Overview

17.3.6.4. Business Strategies

17.3.6.5. Recent Developments

17.3.7. Charles River Laboratories

17.3.7.1. Company Overview

17.3.7.2. Financial Overview

17.3.7.3. Financial Overview

17.3.7.4. Business Strategies

17.3.7.5. Recent Developments

17.3.8. ICON plc

17.3.8.1. Company Overview

17.3.8.2. Financial Overview

17.3.8.3. Financial Overview

17.3.8.4. Business Strategies

17.3.8.5. Recent Developments

17.3.9. Parexel International Corporation

17.3.9.1. Company Overview

17.3.9.2. Financial Overview

17.3.9.3. Financial Overview

17.3.9.4. Business Strategies

17.3.9.5. Recent Developments

17.3.10. Freyr

17.3.10.1. Company Overview

17.3.10.2. Financial Overview

17.3.10.3. Financial Overview

17.3.10.4. Business Strategies

17.3.10.5. Recent Developments

17.3.11. PHARMALEX GMBH

17.3.11.1. Company Overview

17.3.11.2. Financial Overview

17.3.11.3. Financial Overview

17.3.11.4. Business Strategies

17.3.11.5. Recent Developments

17.3.12. Labcorp Drug Development

17.3.12.1. Company Overview

17.3.12.2. Financial Overview

17.3.12.3. Financial Overview

17.3.12.4. Business Strategies

17.3.12.5. Recent Developments

17.3.13. Other Prominent Players

17.3.13.1. Company Overview

17.3.13.2. Financial Overview

17.3.13.3. Financial Overview

17.3.13.4. Business Strategies

17.3.13.5. Recent Developments

List of Tables

Table 01: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Service Type, 2020 to 2035

Table 02: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Product Development Stage, 2020 to 2035

Table 03: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 04: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 05: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 09: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Product Development Stage, 2020 to 2035

Table 10: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 11: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 12: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 14: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 15: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Product Development Stage, 2020 to 2035

Table 16: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 17: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 18: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 20: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 21: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Product Development Stage, 2020 to 2035

Table 22: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 23: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 24: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 26: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 27: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Product Development Stage, 2020 to 2035

Table 28: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 29: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 30: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 32: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2020 to 2035

Table 33: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Product Development Stage, 2020 to 2035

Table 34: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Enterprise Size, 2020 to 2035

Table 35: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By Therapeutic Area, 2020 to 2035

Table 36: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Regulatory Affairs Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 03: Global Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 04: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Regulatory Consulting and Legal Representation, 2020 to 2035

Figure 05: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Product Registration and Clinical Trial Product Development Stages, 2020 to 2035

Figure 06: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Regulatory Writing and Publishing, 2020 to 2035

Figure 07: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Regulatory Submission, 2020 to 2035

Figure 08: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Regulatory Operations, 2020 to 2035

Figure 09: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 10: Global Regulatory Affairs Outsourcing Market Value Share Analysis, By Product Development Stage, 2024 and 2035

Figure 11: Global Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Product Development Stage, 2025 to 2035

Figure 12: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Preclinical, 2020 to 2035

Figure 13: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Clinical, 2020 to 2035

Figure 14: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by PMA (Post Market Authorization), 2020 to 2035

Figure 15: Global Regulatory Affairs Outsourcing Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 16: Global Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 17: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Small/Medium Enterprises, 2020 to 2035

Figure 18: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 19: Global Regulatory Affairs Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 20: Global Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 21: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Oncology, 2020 to 2035

Figure 22: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 23: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Cardiology, 2020 to 2035

Figure 24: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Immunology, 2020 to 2035

Figure 25: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Dermatology, 2020 to 2035

Figure 26: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 27: Global Regulatory Affairs Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 28: Global Regulatory Affairs Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 29: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Medical Device Companies, 2020 to 2035

Figure 30: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Biopharma & Pharmaceutical Companies, 2020 to 2035

Figure 31: Global Regulatory Affairs Outsourcing Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 32: Global Regulatory Affairs Outsourcing Market Value Share Analysis, By Region, 2024 and 2035

Figure 33: Global Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 34: North America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 35: North America Regulatory Affairs Outsourcing Market Value Share Analysis, by Country, 2024 and 2035

Figure 36: North America Regulatory Affairs Outsourcing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 37: North America Regulatory Affairs Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 38: North America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 39: North America Regulatory Affairs Outsourcing Market Value Share Analysis, By Product Development Stage, 2024 and 2035

Figure 40: North America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Product Development Stage, 2025 to 2035

Figure 41: North America Regulatory Affairs Outsourcing Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 42: North America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 43: North America Regulatory Affairs Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 44: North America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 45: North America Regulatory Affairs Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: North America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 47: Europe Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 48: Europe Regulatory Affairs Outsourcing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Europe Regulatory Affairs Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 50: Europe Regulatory Affairs Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 51: Europe Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 52: Europe Regulatory Affairs Outsourcing Market Value Share Analysis, By Product Development Stage, 2024 and 2035

Figure 53: Europe Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Product Development Stage, 2025 to 2035

Figure 54: Europe Regulatory Affairs Outsourcing Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 55: Europe Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 56: Europe Regulatory Affairs Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 57: Europe Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 58: Europe Regulatory Affairs Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 59: Europe Regulatory Affairs Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 60: Asia Pacific Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 61: Asia Pacific Regulatory Affairs Outsourcing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 62: Asia Pacific Regulatory Affairs Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 63: Asia Pacific Regulatory Affairs Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 64: Asia Pacific Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 65: Asia Pacific Regulatory Affairs Outsourcing Market Value Share Analysis, By Product Development Stage, 2024 and 2035

Figure 66: Asia Pacific Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Product Development Stage, 2025 to 2035

Figure 67: Asia Pacific Regulatory Affairs Outsourcing Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 68: Asia Pacific Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 69: Asia Pacific Regulatory Affairs Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 70: Asia Pacific Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 71: Asia Pacific Regulatory Affairs Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 72: Asia Pacific Regulatory Affairs Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 73: Latin America Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 74: Latin America Regulatory Affairs Outsourcing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 75: Latin America Regulatory Affairs Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 76: Latin America Regulatory Affairs Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 77: Latin America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 78: Latin America Regulatory Affairs Outsourcing Market Value Share Analysis, By Product Development Stage, 2024 and 2035

Figure 79: Latin America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Product Development Stage, 2025 to 2035

Figure 80: Latin America Regulatory Affairs Outsourcing Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 81: Latin America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 82: Latin America Regulatory Affairs Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 83: Latin America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 84: Latin America Regulatory Affairs Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 85: Latin America Regulatory Affairs Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 86: Middle East & Africa Regulatory Affairs Outsourcing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 87: Middle East & Africa Regulatory Affairs Outsourcing Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 88: Middle East & Africa Regulatory Affairs Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 89: Middle East & Africa Regulatory Affairs Outsourcing Market Value Share Analysis, By Service Type, 2024 and 2035

Figure 90: Middle East & Africa Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Service Type, 2025 to 2035

Figure 91: Middle East & Africa Regulatory Affairs Outsourcing Market Value Share Analysis, By Product Development Stage, 2024 and 2035

Figure 92: Middle East & Africa Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Product Development Stage, 2025 to 2035

Figure 93: Middle East & Africa Regulatory Affairs Outsourcing Market Value Share Analysis, By Enterprise Size, 2024 and 2035

Figure 94: Middle East & Africa Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Enterprise Size, 2025 to 2035

Figure 95: Middle East & Africa Regulatory Affairs Outsourcing Market Value Share Analysis, By Therapeutic Area, 2024 and 2035

Figure 96: Middle East & Africa Regulatory Affairs Outsourcing Market Attractiveness Analysis, By Therapeutic Area, 2025 to 2035

Figure 97: Middle East & Africa Regulatory Affairs Outsourcing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 98: Middle East & Africa Regulatory Affairs Outsourcing Market Attractiveness Analysis, By End-user, 2025 to 2035