Analysts’ Viewpoint on Free Space Optics (FSO) Communication Market Scenario

The free space optics (FSO) communication market is expected to grow significantly during the forecast period, owing to the numerous advantages offered by free space optics (FSO) communication such as license-free spectrum, easy and quick deployability, high bandwidth, high data rate, low power requirement, and low probability of intercept for higher security. Security quality and bandwidth of FSO technology make it an attractive communication network for military applications. Companies operating in the free space optics (FSO) communication market are focusing on high-growth applications such as data transmission and enterprise connectivity to create lucrative opportunities post the peak of the COVID-19 pandemic.

Free space optics (FSO) communication, also known as optical wireless or free space photonics, is used to wirelessly transmit data for computer networking and telecommunication. The global free space optics (FSO) communication market is primarily driven by the rising applications in enterprise connectivity, security and surveillance, etc.

Request a sample to get extensive insights into the Free Space Optics (FSO) Communication Market

Free space optics (FSO) technology can be an excellent alternative to established RF systems for voice and data communication. Demand for high bandwidth in the present communication systems is increasing consistently. High data rates require a considerable spectrum; hence, FSO technology is gaining popularity. Choices are continuously evolving in last mile access, especially for companies looking to balance value, flexibility, and risk. Therefore, demand for last mile connectivity is increasing. FSO is a highly promising new access technology where optical transceivers transmit laser beams directly through the atmosphere to form point-to-point high-speed communications links. This is boosting the free space optics (FSO) communication market.

Demand for bandwidth on the battlefield has been increasing significantly since the last two decades, as communication between subordinates and higher commands has shifted from radio and voice to email and chat messages. Furthermore, data-rich multimedia content such as high-definition pictures, video files, video, chat, and PowerPoint briefings are being sent at every level of the chain of command. Military communications need the highest level of broadband security in an extremely dense RF operating environment. Security qualities and bandwidth of FSO make it an attractive technology for military communications. Military communications also need a secure connection for data transfer. The FSO communication system has the ability to connect at a high data rate. This is estimated to propel the adoption of free space optics (FSO) communication. The advanced free space optics (FSO) technology used in civil and military domain systems offers significant benefits such as high security, better data rates, fast installations, better costs, and simplicity of design. Additionally, it does not require a licensed spectrum.

In terms of industry vertical, the global free space optics (FSO) communication market can be segregated into IT and telecommunication, aerospace and defense, consumer electronics, automotive, and others. The IT and telecommunication segment dominated the global free space optics (FSO) communication market in 2021, as data transmitted through the FSO system is more secure as compared to fiber-based optical networks and the RF communication system. The wireless communication system is currently available at a premium, and optical fiber systems are often expensive and difficult to install, while free‑space optical communication (FSOC) systems are an attractive alternative for point‑to‑point telecommunications. This is driving the IT and telecommunication segment of the free space optics (FSO) communication market.

In terms of application, the free space optics (FSO) communication market has been classified into data transmission, last mile access, security and surveillance, enterprise connectivity, and others. The data transmission segment dominated the global free space optics (FSO) communication market in 2021, as it uses lasers and LED to deliver high bandwidth connection to transfer data that include voice, video, and document over a light beam for telecommunication and computer networking. Furthermore, the technology in FSO communication allows the development of new types of components that are capable of transmitting data such as documents and videos. Currently, FSO is capable of wirelessly transmitting up to 2.5 Gbps of data, voice, and video communications through the air, which enables optical connectivity without requiring fiber optic cable. This is augmenting the free space optics (FSO) communication market.

North America dominated the global free space optics (FSO) communication market in 2021, as FSO communication technology is used by the U.S. military, primarily in naval and ship-to-ship communications. Continuous expansion and upgrade of network facilities is also estimated to propel the free space optics (FSO) communication market in North America. Furthermore, increase in applications of FSO communication technology in the aerospace and defense sector is anticipated to propel the market in the next few years. The market in Asia Pacific is likely to grow significantly due to the rapid expansion of the IT and telecommunication industry in the region.

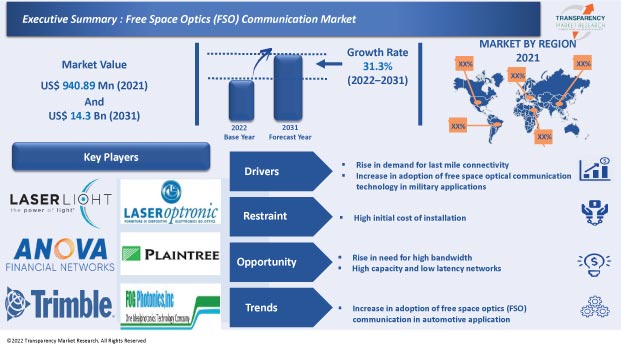

The global free space optics (FSO) communication market is consolidated, with a small number of large-scale vendors controlling majority of the share. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by key players. Anova Technologies Inc. (AOptix), Fog Optics Inc., Laser Light Communications LLC, LaserOptronics, Inc., LightPointe Communications, Inc., MOSTCOM Ltd, Optelix Pty Ltd., Plaintree Systems Inc., Trimble Hungary Ltd., and Wireless Excellence Limited are the prominent entities operating in the market.

Request a custom report on Free Space Optics (FSO) Communication Market

Each of these players has been profiled in the free space optics (FSO) communication market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 940.89 Mn |

|

Market Forecast Value in 2031 |

US$ 14.3 Bn |

|

Growth Rate (CAGR) |

31.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value & Million for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The free space optics (FSO) communication market stood at US$ 940.89 Mn in 2021.

The free space optics (FSO) communication market is expected to grow at a CAGR of 31.3% from 2022 to 2031.

Rise in demand for last mile connectivity and increase in adoption of free space optical communication technology in military applications are key factors that are driving the free space optics (FSO) communication market.

The IT and Telecommunication segment accounted for major share of 43% of the free space optics (FSO) communication market in 2021.

North America is a more attractive region for vendors in the free space optics (FSO) communication market.

Key players operating in the free space optics (FSO) communication market include Anova Technologies Inc. (AOptix), Fog Optics Inc., Laser Light Communications LLC, LaserOptronics, Inc., LightPointe Communications, Inc., MOSTCOM Ltd, Optelix Pty Ltd., Plaintree Systems Inc., Trimble Hungary Ltd., and Wireless Excellence Limited.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Free Space Optics (FSO) Communication Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Optical Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Insulation Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Free Space Optics (FSO) Communication Market Analysis By Component

5.1. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Component, 2017–2031

5.1.1. Transmitter

5.1.2. Transceiver

5.1.3. Receiver

5.1.4. Others

5.2. Market Attractiveness Analysis, By Component

6. Free Space Optics (FSO) Communication Market Analysis By Range Type

6.1. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Range Type, 2017–2031

6.1.1. Short Range

6.1.2. Medium Range

6.1.3. Long Range

6.2. Market Attractiveness Analysis, By Range Type

7. Free Space Optics (FSO) Communication Market Analysis By Application

7.1. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

7.1.1. Mobile Backhaul

7.1.2. Disaster Recovery

7.1.3. Data Transmission

7.1.4. Airborne Application

7.1.5. Last-Mile access

7.1.6. Security and Surveillance

7.1.7. Others (Enterprise Connectivity, Storage Area Network, etc.)

7.2. Market Attractiveness Analysis, By Application

8. Free Space Optics (FSO) Communication Market Analysis By Industry Vertical

8.1. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

8.1.1. IT and Telecommunication

8.1.2. Aerospace and Defense

8.1.3. Consumer Electronics

8.1.4. Automotive

8.1.5. Others (Healthcare, Industrial, etc.)

8.2. Market Attractiveness Analysis, By Industry Vertical

9. Free Space Optics (FSO) Communication Market Analysis and Forecast, by Region

9.1. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Free Space Optics (FSO) Communication Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Component, 2017–2031

10.3.1. Transmitter

10.3.2. Transceiver

10.3.3. Receiver

10.3.4. Others

10.4. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Range Type, 2017–2031

10.4.1. Short Range

10.4.2. Medium Range

10.4.3. Long Range

10.5. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

10.5.1. Mobile Backhaul

10.5.2. Disaster Recovery

10.5.3. Data Transmission

10.5.4. Airborne Application

10.5.5. Last-Mile access

10.5.6. Security and Surveillance

10.5.7. Others

10.6. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

10.6.1. IT and Telecommunication

10.6.2. Aerospace and Defense

10.6.3. Consumer Electronics

10.6.4. Automotive

10.6.5. Others

10.7. Free Space Optics (FSO) Communication Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-region, 2017–2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Component

10.8.2. By Range Type

10.8.3. By Application

10.8.4. By Industry Vertical

10.8.5. By Country & Sub-region

11. Europe Free Space Optics (FSO) Communication Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Component, 2017–2031

11.3.1. Transmitter

11.3.2. Transceiver

11.3.3. Receiver

11.3.4. Others

11.4. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Range Type, 2017–2031

11.4.1. Short Range

11.4.2. Medium Range

11.4.3. Long Range

11.5. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

11.5.1. Mobile Backhaul

11.5.2. Disaster Recovery

11.5.3. Data Transmission

11.5.4. Airborne Application

11.5.5. Last-Mile access

11.5.6. Security and Surveillance

11.5.7. Others

11.6. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

11.6.1. IT and Telecommunication

11.6.2. Aerospace and Defense

11.6.3. Consumer Electronics

11.6.4. Automotive

11.6.5. Others

11.7. Free Space Optics (FSO) Communication Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By Range Type

11.8.3. By Application

11.8.4. By Industry Vertical

11.8.5. By Country & Sub-region

12. Asia Pacific Free Space Optics (FSO) Communication Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Component, 2017–2031

12.3.1. Transmitter

12.3.2. Transceiver

12.3.3. Receiver

12.3.4. Others

12.4. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Range Type, 2017–2031

12.4.1. Short Range

12.4.2. Medium Range

12.4.3. Long Range

12.5. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

12.5.1. Mobile Backhaul

12.5.2. Disaster Recovery

12.5.3. Data Transmission

12.5.4. Airborne Application

12.5.5. Last-Mile access

12.5.6. Security and Surveillance

12.5.7. Others

12.6. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

12.6.1. IT and Telecommunication

12.6.2. Aerospace and Defense

12.6.3. Consumer Electronics

12.6.4. Automotive

12.6.5. Others

12.7. Free Space Optics (FSO) Communication Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By Range Type

12.8.3. By Application

12.8.4. By Industry Vertical

12.8.5. By Country & Sub-region

13. Middle East & Africa Free Space Optics (FSO) Communication Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Component, 2017–2031

13.3.1. Transmitter

13.3.2. Transceiver

13.3.3. Receiver

13.3.4. Others

13.4. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Range Type, 2017–2031

13.4.1. Short Range

13.4.2. Medium Range

13.4.3. Long Range

13.5. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

13.5.1. Mobile Backhaul

13.5.2. Disaster Recovery

13.5.3. Data Transmission

13.5.4. Airborne Application

13.5.5. Last-Mile access

13.5.6. Security and Surveillance

13.5.7. Others

13.6. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

13.6.1. IT and Telecommunication

13.6.2. Aerospace and Defense

13.6.3. Consumer Electronics

13.6.4. Automotive

13.6.5. Others

13.7. Free Space Optics (FSO) Communication Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of the Middle East and Africa

13.8. Market Attractiveness Analysis

13.8.1. By Component

13.8.2. By Range Type

13.8.3. By Application

13.8.4. By Industry Vertical

13.8.5. By Country & Sub-region

14. South America Free Space Optics (FSO) Communication Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Free Space Optics (FSO) Communication Market Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Component, 2017–2031

14.3.1. Transmitter

14.3.2. Transceiver

14.3.3. Receiver

14.3.4. Others

14.4. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Range Type, 2017–2031

14.4.1. Short Range

14.4.2. Medium Range

14.4.3. Long Range

14.5. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Application, 2017–2031

14.5.1. Mobile Backhaul

14.5.2. Disaster Recovery

14.5.3. Data Transmission

14.5.4. Airborne Application

14.5.5. Last-Mile access

14.5.6. Security and Surveillance

14.5.7. Others

14.6. Free Space Optics (FSO) Communication Market Value (US$ Mn) Analysis & Forecast, by Industry Vertical, 2017–2031

14.6.1. IT and Telecommunication

14.6.2. Aerospace and Defense

14.6.3. Consumer Electronics

14.6.4. Automotive

14.6.5. Others

14.7. Free Space Optics (FSO) Communication Value (US$ Mn) and Volume (Units) Analysis & Forecast, By Country & Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Component

14.8.2. By Range Type

14.8.3. By Application

14.8.4. By Industry Vertical

14.8.5. By Country & Sub-region

15. Competition Assessment

15.1. Global Free Space Optics (FSO) Communication Market Competition Matrix - a Dashboard View

15.1.1. Global Free Space Optics (FSO) Communication Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. Anova Technologies Inc. (AOptix)

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Fog Optics Inc.

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Laser Light Communications LLC

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. LaserOptronics, Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. LightPointe Communications, Inc.

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Mostcom Ltd.

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. Optelix Pty Ltd.

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. Plaintree Systems Inc.

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Trimble Hungary Ltd.

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. Wireless Excellence Limited

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component

17.1.2. By Range Type

17.1.3. By Application

17.1.4. By Industry Vertical

17.1.5. By Region

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 01: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 02: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Volume (Units), 2017‒2031

Table 03: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Table 04: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 05: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Table 06: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2017‒2031

Table 07: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Volume (Units), 2017‒2031

Table 08: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 09: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Volume (Units), 2017‒2031

Table 10: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Table 11: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 12: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Table 13: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 14: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Volume (Units), 2017‒2031

Table 15: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 16: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Volume (Units), 2017‒2031

Table 17: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Table 18: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 19: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Table 20: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 21: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Volume (Units), 2017‒2031

Table 22: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 23: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Volume (Units), 2017‒2031

Table 24: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Table 25: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 26: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 27: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Volume (Units), 2017‒2031

Table 28: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 29: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Volume (Units), 2017‒2031

Table 30: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Table 31: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 32: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Table 33: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 34: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Volume (Units), 2017‒2031

Table 35: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Table 36: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Volume (Units), 2017‒2031

Table 37: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Table 38: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Table 39: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Table 40: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Table 41: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Volume (Units), 2017‒2031

List of Figures

Figure 01: Global Free Space Optics (FSO) Communication Price Trend Analysis (Average Price, US$)

Figure 02: Global Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 03: Global Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 04: Global Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 05: Global Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 06: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 07: Global Free Space Optics (FSO) Communication Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 08: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2022‒2031

Figure 09: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Figure 10: Global Free Space Optics (FSO) Communication Market Attractiveness, by Range Type, Value (US$ Mn), 2022‒2031

Figure 11: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2022‒2031

Figure 12: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 13: Global Free Space Optics (FSO) Communication Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 14: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 15: Global Free Space Optics (FSO) Communication Market Attractiveness, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 16: Global Free Space Optics (FSO) Communication Market Attractiveness, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 17: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 18: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 19: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 20: Global Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 21: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 22: North America Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 23: North America Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 24: North America Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 25: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 26: North America Free Space Optics (FSO) Communication Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 27: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2022‒2031

Figure 28: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Figure 29: North America Free Space Optics (FSO) Communication Market Attractiveness, by Range Type, Value (US$ Mn), 2022‒2031

Figure 30: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2022‒2031

Figure 31: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 32: North America Free Space Optics (FSO) Communication Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 33: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 34: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Figure 35: North America Free Space Optics (FSO) Communication Market Attractiveness, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 36: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 37: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 38: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 39: North America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 40: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 41: Europe Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 42: Europe Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 43: Europe Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 44: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 45: Europe Free Space Optics (FSO) Communication Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 46: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2022‒2031

Figure 47: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Figure 48: Europe Free Space Optics (FSO) Communication Market Attractiveness, by Range Type, Value (US$ Mn), 2022‒2031

Figure 49: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2022‒2031

Figure 50: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 51: Europe Free Space Optics (FSO) Communication Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 52: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2022‒2031

Figure 53: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2017‒2031

Figure 54: Europe Free Space Optics (FSO) Communication Market Attractiveness, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 55: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 56: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 57: Europe Free Space Optics (FSO) Communication Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 58: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 59: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 60: Europe Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 61: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 62: Asia Pacific Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 63: Asia Pacific Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 64: Asia Pacific Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 65: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 66: Asia Pacific Free Space Optics (FSO) Communication Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 67: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2022‒2031

Figure 68: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Figure 69: Asia Pacific Free Space Optics (FSO) Communication Market Attractiveness, by Range Type, Value (US$ Mn), 2022‒2031

Figure 70: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2022‒2031

Figure 71: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 72: Asia Pacific Free Space Optics (FSO) Communication Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 73: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2022‒2031

Figure 74: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 75: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 76: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 77: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 78: Asia Pacific Free Space Optics (FSO) Communication Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 79: Asia Pacific Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 80: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 81: Middle East & Africa Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 82: Middle East & Africa Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 83: Middle East & Africa Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 84: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 85: Middle East & Africa Free Space Optics (FSO) Communication Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 86: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2022‒2031

Figure 87: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Figure 88: Middle East & Africa Free Space Optics (FSO) Communication Market Attractiveness, by Range Type, Value (US$ Mn), 2022‒2031

Figure 89: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2022‒2031

Figure 90: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 91: Middle East & Africa Free Space Optics (FSO) Communication Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 92: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2022‒2031

Figure 93: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 94: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 95: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 96: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 97: Middle East & Africa Free Space Optics (FSO) Communication Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 98: Middle East & Africa Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 99: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Region, Value (US$ Mn), 2022‒2031

Figure 100: South America Free Space Optics (FSO) Communication Market, Value (US$ Mn), 2017‒2031

Figure 101: South America Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 102: South America Free Space Optics (FSO) Communication Market, Volume (Units), 2017‒2031

Figure 103: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2017‒2031

Figure 104: South America Free Space Optics (FSO) Communication Market Attractiveness, by Component, Value (US$ Mn), 2022‒2031

Figure 105: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Component, Value (US$ Mn), 2022‒2031

Figure 106: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2017‒2031

Figure 107: South America Free Space Optics (FSO) Communication Market Attractiveness, by Range Type, Value (US$ Mn), 2022‒2031

Figure 108: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Range Type, Value (US$ Mn), 2022‒2031

Figure 109: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2017‒2031

Figure 110: South America Free Space Optics (FSO) Communication Market Attractiveness, by Application, Value (US$ Mn), 2022‒2031

Figure 111: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Application, Value (US$ Mn), 2022‒2031

Figure 112: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 113: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 114: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Industry Vertical, Value (US$ Mn), 2022‒2031

Figure 115: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2017‒2031

Figure 116: South America Free Space Optics (FSO) Communication Market Attractiveness, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 117: South America Free Space Optics (FSO) Communication Market Size & Forecast, by Country & Sub-region, Value (US$ Mn), 2022‒2031

Figure 118: Global Free Space Optics (FSO) Communication Market Share Analysis, by Company