Reports

Reports

Analysts’ Viewpoint

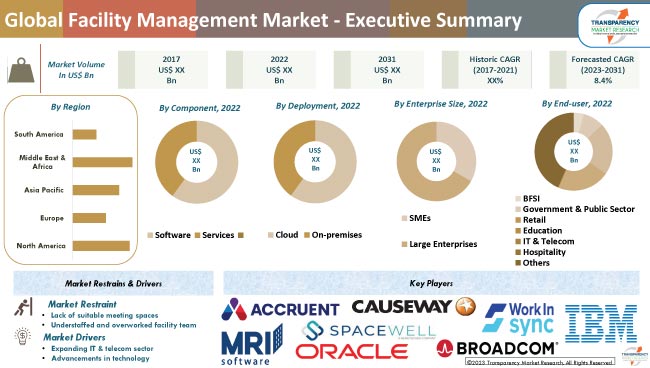

Implementation of new technologies such as facility management tools and services in organizations, and residential & educational sectors is projected to propel global facility management market growth during the forecast period. It is a professional management discipline focused on the efficient and effective delivery of logistics and other support services related to property and buildings. Adoption of facility management in information technology and telecom sectors for service performance and achievement of productivity and workplace-specific standards is driving market expansion.

Rise in popularity of Software-as-a-Service (SaaS) and cloud-based facility management solutions offers lucrative opportunities for market players. Companies are focusing on innovation, expertise, strategic planning management, and continuous improvement in order to increase market share.

Facility management is a set of tools and services that support the functionality, safety, and sustainability of buildings, grounds, infrastructure, and real estate. Facility management tools and services includes, facility property management, asset management, lease management including lease administration & accounting, capital project planning & management, maintenance & operations, energy management, occupancy & space management, employee & occupant experience, emergency management & business continuity, and real estate management. People need to be in buildings that are safe, welcoming, and efficient to do their best work and feel engaged in their environments.

Facility management includes both software and systems. Vast amount of data is generated by environments through Internet of Things (IoT) sensors, Wi-Fi, meters, gauges, and smart devices. Productivity, safety, and comfort must be created efficiently. Facility management is often the largest expense due to its far-reaching impact across the organization; hence, any efforts to minimize unnecessary operating costs are important for a business’ bottom line. Facility managers have a range of important day-to-day responsibilities across numerous industries and company sizes.

Expansion of the IT & telecom sector across the globe is likely to propel global facility management market growth during the forecast period. Information technology has been one of the prominent sectors with the most attention and rapid development. The IT sector is witnessing constant development due to increase in interest among governmental bodies, firms, and individuals. This interest has prompted significant investment in terms of skills & personnel development and machineries. Facility management, which is aimed at ensuring service performance and improving productivity, has been considered integrated into organizations today due to its vast role.

According to the Bureau of Economic Analysis (BEA) of the U.S. Department of Commerce, overall GDP grew by 18% between Q1 of 2020 and Q1 of 2022. Currently, India is the world’s second-largest telecommunications market, with a subscriber base of 1.16 billion, and has registered strong growth in the last decade. India's mobile economy is growing rapidly and is likely to contribute substantially to its Gross Domestic Product (GDP), according to a report prepared by GSM Association (GSMA) in collaboration with Boston Consulting Group (BCG).

Information technology firms operate with gadgets, software, storage devices, machines, and equipment. The need to secure every device, both small and big, has led to demand for facility management incorporated into the organogram of any IT firm. The IT sector requires the professionalism of integrated facility management services to not only keep them going and producing outstanding results, but also to save costs, which could have been incurred on device replacement due to frequent damage through mismanagement.

The global facility management market is evolving. It not only improves operations and reduces costs, but also creates a better overall work environment. Dozens of facility management technology solutions have emerged in the past few years, including more advanced software and mobile applications. The COVID-19 pandemic also changed the way people work, as new concerns about employee health and safety arose and large number of companies shifted to hybrid workplaces.

Strategic space planning tools such as Space-Right could help organizations instantly adjust office spaces for safety or plan for specific scenarios. Workplaces are adopting touchless, sensor-enabled solutions, such as smart lighting, HVAC systems that adjust based on occupancy, and touchless visitor management systems that allow guests to pre-register and simply scan a QR code when they arrive instead of waiting in a crowded lobby.

These modern facility management technologies offer several potential applications such as making virtual meetings more lifelike by creating holograms of participants and showing 3D images of floor plans. AR technology has the potential to make facility management faster, more efficient, and more precise. Smart building technologies use IoT sensors to collect data about the workplace and workforce, which could help facility management make adjustments faster.

Implementation of new technology, such as facility management tools and services, within an organization could make an organization more effective and productive.

North America is expected to account for the largest global facility management market share during the forecast period. This is ascribed to presence of major facility management industry players, rise in adoption of advanced technologies, and increase in demand for professional & managed services. Demand for facility management solutions is high in infrastructure development in countries such as the U.S. and Canada. Increase in demand for facility management services in BFSI, IT & telecom, retail, and other industries is likely to propel the market in North America.

The facility management market in Asia Pacific is anticipated to grow at a rapid pace during the forecast period. This is ascribed to rise in number of companies offering these services in developing countries such as India and China. The facility management industry in India is in the midst of rapid development, which has led to considerable growth of commercial activities in metropolitan cities.

Prominent manufacturers in the industry are focusing on investment in R&D, product expansion, and merger & acquisition. Product development is a major marketing strategy for top players in the global facility management business. The market is stagnant and competitive, with the presence of large number of global and regional players. Accruent, Broadcom, Inc., Causeway Technologies, IBM Corporation, MRI Software, LLC, Office Space Software, Inc., Oracle Corporation, Smarten Spaces, Spacewell International, and WorkInSync are the prominent players in the global market.

Each of these players has been profiled in the facility management industry research report based on parameters such as company overview, financial overview, strategies, product portfolio, segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 48.7 Bn |

|

Forecast (Value) in 2031 |

US$ 100.3 Bn |

|

Growth Rate (CAGR) |

8.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 48.7 Bn in 2022.

The CAGR is projected to be 8.4% from 2023 to 2031.

Expanding IT & telecom sector and advancements in technology are driving the global facility management industry.

The software segment accounted for significant share in 2022.

Asia Pacific is likely to be one of the lucrative markets in the next few years.

Accruent, Broadcom, Inc., Causeway Technologies, IBM Corporation, MRI Software, LLC, Office Space Software, Inc., Oracle Corporation, Smarten Spaces, Spacewell International, and WorkInSync are the prominent players in the global facility management business.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technological Overview Analysis

5.5. Key Market Indicators

5.6. Raw Material Analysis

5.7. Porter’s Five Forces Analysis

5.8. Industry SWOT Analysis

5.9. Value Chain Analysis

5.10. Regulatory Framework

5.11. Global Facility Management Market Analysis and Forecast, 2017–2031

5.11.1. Market Value Projections (US$ Bn)

5.11.2. Market Volume Projections (Thousand Units)

6. Global Facility Management Market Analysis and Forecast, by Component

6.1. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Component, 2017–2031

6.1.1. Software

6.1.2. Services

6.1.2.1. Professional

6.1.2.2. Managed

6.2. Incremental Opportunity, by Component

7. Global Facility Management Market Analysis and Forecast, by Deployment

7.1. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, Deployment, 2017–2031

7.1.1. Cloud

7.1.2. On-premises

7.2. Incremental Opportunity, Deployment

8. Global Facility Management Market Analysis and Forecast, by Enterprise Size

8.1. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Enterprise Size, 2017–2031

8.1.1. SMEs

8.1.2. Large Enterprises

8.2. Incremental Opportunity, by Enterprise Size Capacity

9. Global Facility Management Market Analysis and Forecast, by End-user

9.1. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by End-user, 2017–2031

9.1.1. BFSI

9.1.2. Government & Public Sector

9.1.3. Healthcare

9.1.4. Manufacturing

9.1.5. Retail

9.1.6. Education

9.1.7. IT & Telecom

9.1.8. Hospitality

9.1.9. Others

9.2. Incremental Opportunity, by End-user

10. Global Facility Management Market Analysis and Forecast, by Region

10.1. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Facility Management Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Consumer Buying Behavior

11.3. Brand Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Key Trends Analysis

11.5.1. Demand Side

11.5.2. Supplier Side

11.6. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Component, 2017–2031

11.6.1. Software

11.6.2. Services

11.6.2.1. Professional

11.6.2.2. Managed

11.7. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, Deployment, 2017–2031

11.7.1. Cloud

11.7.2. On-premises

11.8. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Enterprise Size, 2017–2031

11.8.1. SMEs

11.8.2. Large Enterprises

11.9. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by End-user, 2017–2031

11.9.1. BFSI

11.9.2. Government & Public Sector

11.9.3. Healthcare

11.9.4. Manufacturing

11.9.5. Retail

11.9.6. Education

11.9.7. IT & Telecom

11.9.8. Hospitality

11.9.9. Others

11.10. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

11.10.1. U.S

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Facility Management Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Consumer Buying Behavior

12.3. Brand Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side

12.5.2. Supplier Side

12.6. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Component, 2017–2031

12.6.1. Software

12.6.2. Services

12.6.2.1. Professional

12.6.2.2. Managed

12.7. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, Deployment, 2017–2031

12.7.1. Cloud

12.7.2. On-premises

12.8. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Enterprise Size, 2017–2031

12.8.1. SMEs

12.8.2. Large Enterprises

12.9. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by End-user, 2017–2031

12.9.1. BFSI

12.9.2. Government & Public Sector

12.9.3. Healthcare

12.9.4. Manufacturing

12.9.5. Retail

12.9.6. Education

12.9.7. IT & Telecom

12.9.8. Hospitality

12.9.9. Others

12.10. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

12.10.1. U.K

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Facility Management Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Consumer Buying Behavior

13.3. Brand Analysis

13.4. Key Trends Analysis

13.4.1. Demand Side

13.4.2. Supplier Side

13.5. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Component, 2017–2031

13.5.1. Software

13.5.2. Services

13.5.2.1. Professional

13.5.2.2. Managed

13.6. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, Deployment, 2017–2031

13.6.1. Cloud

13.6.2. On-premises

13.7. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Enterprise Size, 2017–2031

13.7.1. SMEs

13.7.2. Large Enterprises

13.8. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by End-user, 2017–2031

13.8.1. BFSI

13.8.2. Government & Public Sector

13.8.3. Healthcare

13.8.4. Manufacturing

13.8.5. Retail

13.8.6. Education

13.8.7. IT & Telecom

13.8.8. Hospitality

13.8.9. Others

13.9. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

13.9.1. India

13.9.2. China

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & South Africa Facility Management Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Consumer Buying Behavior

14.3. Brand Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Key Trends Analysis

14.5.1. Demand Side

14.5.2. Supplier Side

14.6. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Component, 2017–2031

14.6.1. Software

14.6.2. Services

14.6.2.1. Professional

14.6.2.2. Managed

14.7. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, Deployment, 2017–2031

14.7.1. Cloud

14.7.2. On-premises

14.8. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Enterprise Size, 2017–2031

14.8.1. SMEs

14.8.2. Large Enterprises

14.9. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by End-user, 2017–2031

14.9.1. BFSI

14.9.2. Government & Public Sector

14.9.3. Healthcare

14.9.4. Manufacturing

14.9.5. Retail

14.9.6. Education

14.9.7. IT & Telecom

14.9.8. Hospitality

14.9.9. Others

14.10. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

14.10.1. GCC

14.10.2. Rest of MEA

14.11. Incremental Opportunity Analysis

15. South America Facility Management Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Consumer Buying Behavior

15.3. Brand Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Price

15.5. Key Trends Analysis

15.5.1. Demand Side

15.5.2. Supplier Side

15.6. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Component, 2017–2031

15.6.1. Software

15.6.2. Services

15.6.2.1. Professional

15.6.2.2. Managed

15.7. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, Deployment, 2017–2031

15.7.1. Cloud

15.7.2. On-premises

15.8. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Enterprise Size, 2017–2031

15.8.1. SMEs

15.8.2. Large Enterprises

15.9. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by End-user, 2017–2031

15.9.1. BFSI

15.9.2. Government & Public Sector

15.9.3. Healthcare

15.9.4. Manufacturing

15.9.5. Retail

15.9.6. Education

15.9.7. IT & Telecom

15.9.8. Hospitality

15.9.9. Others

15.10. Facility Management Market Size (US$ Bn and Thousand Units) Forecast, by Country, 2017–2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player–Competition Dashboard

16.2. Market Share Analysis (%), by Company, (2022)

16.3. Company Profiles (Details–Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Accruent

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Broadcom, Inc.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. Causeway Technologies

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. IBM Corporation

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. MRI Software, LLC

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Office Space Software, Inc.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Oracle Corporation

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Smarten Spaces

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Spacewell International

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. WorkInSync

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. By Component

17.1.2. By Deployment

17.1.3. By Enterprise Size

17.1.4. By End-user

17.1.5. By Region

17.2. Prevailing Market Risks

17.3. Understanding the Buying Process of the Customers

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Facility Management Market Value (US$ Bn), by Component, 2017-2031

Table 2: Global Facility Management Market Volume (Thousand Units), by Component 2017-2031

Table 3: Global Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Table 4: Global Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Table 5: Global Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Table 6: Global Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Table 7: Global Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Table 8: Global Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Table 9: Global Facility Management Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Table 11: North America Facility Management Market Value (US$ Bn), by Component, 2017-2031

Table 12: North America Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Table 13: North America Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Table 14: North America Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Table 15: North America Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Table 16: North America Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Table 17: North America Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Table 18: North America Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Table 19: North America Facility Management Market Value (US$ Bn), by Country, 2017-2031

Table 20: North America Facility Management Market Volume (Thousand Units), by Country, 2017-2031

Table 21: Europe Facility Management Market Value (US$ Bn), by Component, 2017-2031

Table 22: Europe Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Table 23: Europe Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Table 24: Europe Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Table 25: Europe Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Table 26: Europe Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Table 27: Europe Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Table 28: Europe Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Table 29: Europe Facility Management Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Table 31: Asia Pacific Facility Management Market Value (US$ Bn), by Component, 2017-2031

Table 32: Asia Pacific Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Table 33: Asia Pacific Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Table 34: Asia Pacific Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Table 35: Asia Pacific Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Table 36: Asia Pacific Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Table 37: Asia Pacific Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Table 38: Asia Pacific Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Table 39: Asia Pacific Facility Management Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Table 41: Middle East & Africa Facility Management Market Value (US$ Bn), by Component, 2017-2031

Table 42: Middle East & Africa Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Table 43: Middle East & Africa Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Table 44: Middle East & Africa Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Table 45: Middle East & Africa Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Table 46: Middle East & Africa Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Table 47: Middle East & Africa Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Table 48: Middle East & Africa Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Table 49: Middle East & Africa Facility Management Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Table 51: South America Facility Management Market Value (US$ Bn), by Component, 2017-2031

Table 52: South America Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Table 53: South America Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Table 54: South America Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Table 55: South America Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Table 56: South America Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Table 57: South America Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Table 58: South America Facility Management Market Volume (Thousand Units), by End-user 2017-2031

Table 59: South America Facility Management Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America Facility Management Market Volume (Thousand Units), by Region, 2017-2031

List of Figures

Figure 1: Global Facility Management Market Value (US$ Bn), by Component, 2017-2031

Figure 2: Global Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Figure 3: Global Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Component, 2023-2031

Figure 4: Global Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Figure 5: Global Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Figure 6: Global Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Deployment, 2023-2031

Figure 7: Global Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Figure 8: Global Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Figure 9: Global Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Enterprise Size, 2023-2031

Figure 10: Global Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Figure 11: Global Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Figure 12: Global Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 13: Global Facility Management Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Figure 15: Global Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America Facility Management Market Value (US$ Bn), by Component, 2017-2031

Figure 17: North America Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Figure 18: North America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Component, 2023-2031

Figure 19: North America Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Figure 20: North America Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Figure 21: North America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Deployment, 2023-2031

Figure 22: North America Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Figure 23: North America Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Figure 24: North America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Enterprise Size, 2023-2031

Figure 25: North America Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Figure 26: North America Facility Management Market Volume (Thousand Units), by End-user 2017-2031

Figure 27: North America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 28: North America Facility Management Market Value (US$ Bn), by Country, 2017-2031

Figure 29: North America Facility Management Market Volume (Thousand Units), by Country, 2017-2031

Figure 30: North America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Country, 2023-2031

Figure 31: Europe Facility Management Market Value (US$ Bn), by Component, 2017-2031

Figure 32: Europe Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Figure 33: Europe Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Component, 2023-2031

Figure 34: Europe Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Figure 35: Europe Facility Management Market Volume (Thousand Units), by Deployment ,2017-2031

Figure 36: Europe Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Deployment, 2023-2031

Figure 37: Europe Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Figure 38: Europe Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Figure 39: Europe Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Enterprise Size, 2023-2031

Figure 40: Europe Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Figure 41: Europe Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Figure 42: Europe Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 43: Europe Facility Management Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Figure 45: Europe Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific Facility Management Market Value (US$ Bn), by Component, 2017-2031

Figure 47: Asia Pacific Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Figure 48: Asia Pacific Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Component, 2023-2031

Figure 49: Asia Pacific Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Figure 50: Asia Pacific Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Figure 51: Asia Pacific Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Deployment, 2023-2031

Figure 52: Asia Pacific Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Figure 53: Asia Pacific Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Figure 54: Asia Pacific Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Enterprise Size, 2023-2031

Figure 55: Asia Pacific Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Figure 56: Asia Pacific Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Figure 57: Asia Pacific Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 58: Asia Pacific Facility Management Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Figure 60: Asia Pacific Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa Facility Management Market Value (US$ Bn), by Component, 2017-2031

Figure 62: Middle East & Africa Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Figure 63: Middle East & Africa Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Component, 2023-2031

Figure 64: Middle East & Africa Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Figure 65: Middle East & Africa Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Figure 66: Middle East & Africa Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Deployment, 2023-2031

Figure 67: Middle East & Africa Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Figure 68: Middle East & Africa Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Figure 69: Middle East & Africa Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Enterprise Size, 2017-2031

Figure 70: Middle East & Africa Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Figure 71: Middle East & Africa Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Figure 72: Middle East & Africa Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 73: Middle East & Africa Facility Management Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Figure 75: Middle East & Africa Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America Facility Management Market Value (US$ Bn), by Component, 2017-2031

Figure 77: South America Facility Management Market Volume (Thousand Units), by Component, 2017-2031

Figure 78: South America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Component, 2023-2031

Figure 79: South America Facility Management Market Value (US$ Bn), by Deployment, 2017-2031

Figure 80: South America Facility Management Market Volume (Thousand Units), by Deployment, 2017-2031

Figure 81: South America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Deployment, 2023-2031

Figure 82: South America Facility Management Market Value (US$ Bn), by Enterprise Size, 2017-2031

Figure 83: South America Facility Management Market Volume (Thousand Units), by Enterprise Size, 2017-2031

Figure 84: South America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Enterprise Size, 2023-2031

Figure 85: South America Facility Management Market Value (US$ Bn), by End-user, 2017-2031

Figure 86: South America Facility Management Market Volume (Thousand Units), by End-user, 2017-2031

Figure 87: South America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by End-user, 2023-2031

Figure 88: South America Facility Management Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America Facility Management Market Volume (Thousand Units), by Region, 2017-2031

Figure 90: South America Facility Management Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031