Reports

Reports

The rising number of accidents and surgeries is likely to be a major driver for the expansion of the global heparin market. Over the forecast period, the global market is likely to rise due to an increase in the frequency of venous thromboembolism and cardiovascular illnesses. Pulmonary embolism and deep vein thrombosis and impact roughly 900,000 people in the U.S. each year, as per data published by the Centers for Disease Control and Prevention (CDC) in 2018. In the next years, this factor is expected to boost demand in the global heparin market.

Some biopharmaceutical businesses are putting money into new medication research. Organizations like the Centers for Disease Control and Prevention (CDC) and the National Institutes of Health (NIH) are working to raise awareness through programs aimed at avoiding thrombosis-related problems in the early stages. The global heparin market is expected to benefit from increased demand for anticoagulants. In addition to that, rising healthcare expenditures and patient awareness levels are expected to propel the market forward throughout the forecast period.

During the Covid-19 pandemic, there was also an unexpected impact on the global heparin market. The demand for heparin, on the other hand, remained unchanged, resulting in increasing heparin output. Shenzhen Panorama Network, for example, expanded manufacture of novel low molecular weight heparin formulations to grow its market share.

Low molecular weight heparins (LMWHs) refers to a new anticoagulant that is produced from unfractionated heparin (UFH). Venous thromboembolism is treated, blood clots are averted, and myocardial infarction is also being treated using LMWHs. They are also frequently utilized to keep thrombosis at bay.

Companies are continually working on new products, which are predicted to propel the market forward. For instance, Meitheal Pharmaceuticals Inc. got permission from the US Food and Drug Administration in May 2020 for Enoxaparin Sodium Injection (USP), the generic version of Lovenox. This segment's market expansion is projected to be aided by advancements like these.

Because of the rising frequency and incidence of heart-related illnesses, coronary artery disease took the lead in 2018. According to the American Heart Association, around 92.1 million persons in the United States suffered from cardiovascular disease in 2018. Furthermore, cardiovascular disease is responsible for almost one out of every three deaths in the U.S., accounting for approximately 2,300 deaths every day.

Over the forecast period, venous thromboembolism (VTE) is predicted to be the fastest expanding category. PE (pulmonary embolism) and DVT (deep vein thrombosis) are two types of venous thromboembolism (DVT). One of the key elements driving the segment's rise is growing understanding of thrombosis. The launch of an online portal by the International Society on Thrombosis and Haemostasis, Inc., for instance, is anticipated to raise patient knowledge of thrombosis.

Furthermore, rising venous thromboembolism death rates are expected to add to category growth. According to statistics released by the International Society on Thrombosis and Haemostasis, Inc., over 10 million instances of VTE are diagnosed globally each year, with around 544,000 VTE-related fatalities occurring in Europe each year.

Due to the rise in sports injuries and cardiovascular problems, North America topped the global heparin market in terms of revenue. In addition to that, the region’s significant share can be linked to greater healthcare expenditure levels, strong patient awareness, and advanced healthcare infrastructure in this region.

In the future years, the market in Asia Pacific is expected to develop at a rapid growth rate. The region's rapid expansion can be attributed to a number of causes, including constantly increasing healthcare facilities, the availability of unexplored potential, economic development, and rising activities by private and public organizations.

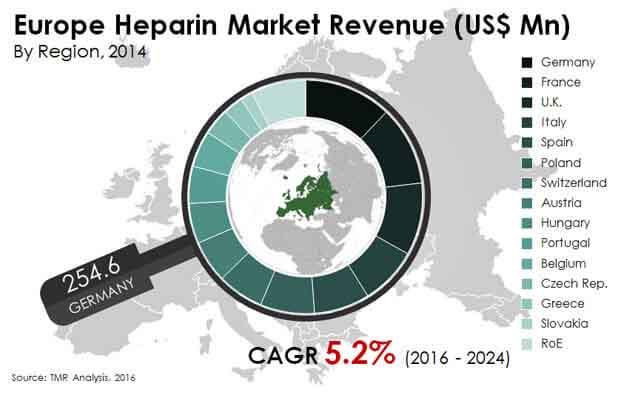

Europe heparin market is projected to gain revenue worth US$3.5 bn by 2024

Europe heparin market is Estimated to expand at a CAGR 5.2% from 2016 to 2024

Heparin market in europe is driven by rising number of coagulation disorders in the form of venous thromboembolism (VTE)

The end-use segments in europe heparin market are hospitals and blood and stem cell banks

Key players in the europe heparin market are Dr. Reddy's Laboratories Ltd., Leo Pharma, Pfizer, Inc., Sanofi SA, and Teva Pharmaceutical Industries Ltd.

1. Preface

1.1. Research Scope

1.2. Market Segmentation

1.3. Research Objectives

1.4. Key Questions Answered

2. Assumptions and Research Methodology

2.1. Report Assumptions

2.2. Acronyms Used

2.3. Research Methodology

3. Executive Summary

3.1. Europe Heparin Market Snapshot

3.2. Key Trends

4. Market Overview

4.1. Product Overview

4.2. Key Industry Events

4.3. Death Rate of CVD in Europe, 2015

4.4. Top Causes of Death in the EU

4.5. Pharmaceutical Expenditure, 2014

4.6. Pharmaceutical Expenditure, 2013

5. Market Dynamics

5.1. Drivers and Restraints Snapshot Analysis

5.2. Drivers

5.2.1. Rise in incidence of coagulation and renal disorders in Europe

5.2.2. Inclination of slaughterhouse owners to enter crude heparin processing business expected to overcome demand-supply gap

5.2.3. Ban on imports from China to boost production in Europe

5.2.4. Commercialization of safe and cost-effective heparin products

5.3. Restraints

5.3.1. Availability of alternative anticoagulants impeding sale of biological heparin products

5.3.2. Enhanced quality control measures and environmental factors elevating the cost of heparin production

5.3.3. Patent loss and increasing use of off-label products

5.3.4. Risk of heparin induced thrombocytopenia

5.4. Opportunities

5.4.1. Biosimilars as an alternative to biological-based products

5.4.2. Research activities on marine-based heparin products

5.5. Opportunity Analysis

5.6. Pricing and Market Projections

6. Europe Heparin Market Analysis, by Product Type

6.1. Key Findings

6.2. Market Value Share Analysis, by Product Type, 2015 and 2024

6.3. Europe Heparin Market Size (US$ Mn) Forecast, by Product, 2014-2024

6.3.1. Low Molecular Weight Heparin

6.3.2. Unfractionated Heparin

6.3.3. Ultra-low Molecular Weight Heparin

6.4. Key Trends

6.5. Market Attractiveness Analysis, by Product, 2015

7. Europe Heparin Market Analysis, by End-user

7.1. Key Findings

7.2. Introduction

7.3. Market Value Share Analysis, by End-user, 2015 and 2024

7.4. Europe Heparin Market Size (US$ Mn) Forecast, by End-user, 2014-2024

7.4.1. Hospitals

7.4.2. Blood and Stem Cell Bank

7.4.3. Others

7.5. Key Trends

8. Europe Heparin Market Analysis, by Country

8.1. Market Value Share Analysis, by Country, 2015 and 2024

8.2. Germany

8.3. France

8.4. U.K.

8.5. Italy

8.6. Spain

8.7. Poland

8.8. Switzerland

8.9. Austria

8.10. Hungary

8.11. Belgium

8.12. Portugal

8.13. Czech Republic

8.14. Greece

8.15. Slovakia

8.16. Rest of Europe

8.17. Market Attractiveness Analysis, by End-user, 2015

9. Competitive Landscape

9.1. Europe Heparin Market Share Analysis, by Company (2015)

9.2. Competition Matrix

9.2.1. Sanofi SA

9.2.2. GlaxoSmithKline plc

9.2.3. Pfizer, Inc.

9.2.4. Leo Pharma

9.2.5. Dr. Reddy’s Laboratories

9.2.6. Fresenius SE & Co. KG

9.2.7. Teva Pharmaceutical Industries Ltd.

10. Company Profiles

10.1. Sanofi SA

10.1.1. Company Details

10.1.2. Company Description

10.1.3. Business Overview

10.1.4. SWOT Analysis

10.1.5. Financial Analysis

10.1.6. Strategic Overview

10.2. GlaxoSmithKline plc

10.2.1. Company Details

10.2.2. Company Description

10.2.3. Business Overview

10.2.4. SWOT Analysis

10.2.5. Financial Analysis

10.2.6. Strategic Overview

10.3. Pfizer, Inc.

10.3.1. Company Details

10.3.2. Company Description

10.3.3. Business Overview

10.3.4. SWOT Analysis

10.3.5. Financial Analysis

10.3.6. Strategic Overview

10.4. Leo Pharma

10.4.1. Company Details

10.4.2. Company Description

10.4.3. Business Overview

10.4.4. SWOT Analysis

10.4.5. Financial Analysis

10.4.6. Strategic Overview

10.5. Dr. Reddy’s Laboratories

10.5.1. Company Details

10.5.2. Company Description

10.5.3. Business Overview

10.5.4. SWOT Analysis

10.5.5. Financial Analysis

10.5.6. Strategic Overview

10.6. Fresenius SE & Co. KG

10.6.1. Company Details

10.6.2. Company Description

10.6.3. Business Overview

10.6.4. SWOT Analysis

10.6.5. Financial Analysis

10.6.6. Strategic Overview

10.7. Teva Pharmaceutical Industries Ltd.

10.7.1. Company Details

10.7.2. Company Description

10.7.3. Business Overview

10.7.4. SWOT Analysis

10.7.5. Financial Analysis

10.7.6. Strategic Overview

List of Tables

TABLE 1 Europe Heparin Market Size (US$ Mn) Forecast, By Product, 2016–2024

TABLE 2 Europe Heparin Market Size (US$ Mn) Forecast, By End-user, 2016–2024

TABLE 3 Europe Heparin Market Size (US$ Mn) Forecast, by Country, 2014–2024

List of Figures

FIG. 1 Europe Heparin Market Revenue (US$ Mn), 2015

FIG. 2 Europe Heparin Market Size (US$ Mn) Forecast, 2014–2024

FIG. 3 Europe Heparin Average Pricing Analysis (US$) 2015–2024

FIG. 4 Europe Heparin Market Value Share Analysis By Product, 2016 and 2024

FIG. 5 Europe LMWH Market Revenue, (US$ Mn), 2014-2024

FIG. 6 Europe Unfractionated Heparin Market Revenue (US$ Mn), 2014-2024

FIG. 7 Europe ULMWH Market Revenue, (US$ Mn), 2014-2024

FIG. 8 Europe Heparin Market Value Share Analysis By End-user, 2016 and 2024

FIG. 9 Europe Hospitals Heparin Market Revenue, (US$ Mn), 2014–2024

FIG. 10 Europe Blood and Stem Cell Bank Heparin Market Revenue, (US$ Mn), 2014-2024

FIG. 11 Europe Others (End-user) Heparin Market Revenue, (US$ Mn), 2014–2024

FIG. 12 Europe Heparin Market Value Share Analysis, by Country, 2015 and 2024

FIG. 13 Germany Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 14 France Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 15 UK Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 16 Italy Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 17 Spain Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 18 Poland Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 19 Switzerland Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 20 Austria Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 21 Hungary Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 22 Belgium Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 23 Portugal Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 24 Czech Republic Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 25 Greece Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 26 Slovakia Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 27 Rest of Europe Heparin Market Revenue (US$ Mn), 2014–2024

FIG. 28 Heparin Market Attractiveness Analysis, by Product, 2015

FIG. 29 Heparin Market Attractiveness Analysis, by End-user, 2015

FIG. 30 Europe Heparin Market Share Analysis By Company (2015)