Reports

Reports

Therapeutics such as corticosteroids are being extensively used as joint injections for horses. Bisphosphonates such as tiludronate disodium (Tildren) and clondronate (Osphos) are labeled for controlling clinical signs associated with navicular syndrome. There is a need for research surrounding bisphosphonate’s use in horses under the age of four.

As such, the equine healthcare market is riding on increasing awareness about the importance of horses’ health.

The global equine healthcare market is expected to grow owing to the rise in equine population due to increasing frequency of horse ownership, sports, and recreational activities. Moreover, growing demand for preventive care including vaccinations, deworming, and regular check-ups is expected to foster the overall market growth in the upcoming future. Furthermore, the equine healthcare industry growth is primarily fueled by the rising population of domesticated and sport horses globally. As equestrian sports continue to gain popularity-ranging from horse racing and dressage to endurance and rodeo-there is growing demand for high-quality veterinary care.

| Attribute | Detail |

|---|---|

| Equine Healthcare Market Drivers |

|

The increased prevalence of equine diseases is a key driving force of the equine healthcare market, affecting many segments of the market and leading to rising demand for various products and services. Rising incidence of equine diseases can increase the rate of awareness among horse owners and veterinarians regarding the need for preventive care. This ranges from routine vaccinations, deworming programs, and check-ups.

For example, equine influenza, equine herpesvirus (EHV), and West Nile virus are a few infectious diseases on the rise. Due to this, there is an increasing demand for vaccines against the infections that are potent enough to provide protection to horses against diseases. Likewise, the pressure of internal and external parasites is propelling the demand for effective parasiticides and deworming.

Regular deworming programs are crucial in maintaining the health and functioning of horses and, consequently, increase the market for parasiticides. Disease detection at early stages is an important consideration in equine health care. There is an increase in frequency of more advanced diagnostic tests, such as blood tests, imaging (X-Ray, ultrasound, MRI, and CT scans), and genetic tests.

Health check-ups are more commonly employed by horse owners and veterinarians to keep track of the general health of horses and pick out potential underlying conditions early. Early diagnosis can result in enhanced and less expensive treatment, maximizing long-term horse health and productivity. This is fueling growth in the diagnostic portion of the equine healthcare market.

The rise in incidence of disease is also increasing demand for therapeutic medicine. This comprises a wide range of drugs like antibiotics, anti-inflammatory, and analgesics. Occurrences if diseases like lameness, respiratory disease, and gastrointestinal disease are on the rise, and there is an increasing need for effective medicine. There is also specialized medicine for diseases like equine metabolic syndrome, laminitis, and equine Cushing's.

R&D activities have developed more effective and efficient parasiticides, anti-infectives, and anti-inflammatory chemical species-specific that are less toxic for long-term administration. Slow-release drug and advanced anthelmintics are a few examples, which are more effectively controlling internal parasites with negligible resistance.

Veterinary R&D activities have introduced high-technology imaging and diagnostic modalities like digital radiography, ultrasound, and endoscopy for early diagnosis of musculoskeletal, respiratory, and reproductive disease of horses. The technology enhances treatment efficacy and reduces competition horse downtime. Regenerative medicine–stem cell therapy, platelet-rich plasma (PRP), and prolotherapy technology are revolutionizing equine medicine, particularly joint trauma, tendon/ligament injury, and osteoarthritis care.

The biologic therapies promote healing of performance animals and become increasingly available through research. Genetic diagnosis, biomarker identification, and individualized health planning are being enabled by research and development activities for horses. Accuracy testing is facilitating early disease diagnosis of genetic disease, enhanced breeding results, and lifetime health.

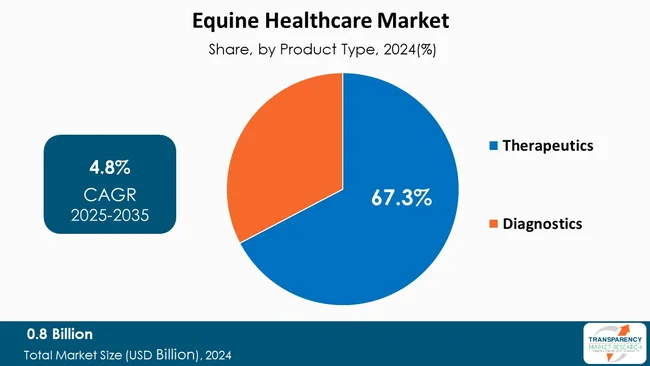

The therapeutics industry in the equine health sector is controlled by the therapeutics segment due to the prevalence of the major equine diseases and the focal role of drugs in general veterinary practice. The equine animals are prone to numerous forms of diseases like respiratory infections, gastrointestinal disease, arthritic inflammation, and parasitic disease that have to be treated and cured by continuous drug therapy. Therefore, gastrointestinal medications, anti-infectives, and anti-inflammatory drugs are never in short supply, and therapeutics become a routine part of normal equine care.

The most significant aspect of this ubiquity is the rampant use of parasiticides. Deworming is a fundamental part of equine husbandry, especially in breeding and agricultural operations where parasites are managed due to their necessity to be maintained under control for herd well-being. With growing resistance to the traditional deworming medicines, demand for good and safe parasiticides is even higher.

Anti-inflammatories and analgesics are also administered regularly to race-oriented horses to cure lameness and arthritis so that they can recover faster and compete on equal terms. Furthermore, developments in veterinary pharmaceuticals and medicines have augmented the arsenal of treatments.

Targeted therapies, long-acting injectables, and regenerative medications such as stem cell treatment and platelet-rich plasma (PRP) are being consumed in huge volumes, most notably on premium horses such as racehorses and showjumpers. The innovations are introducing efficacy and appeal to therapeutics, thus inducing greater uptake among both - the developed nations and emerging countries.

| Attribute | Detail |

|---|---|

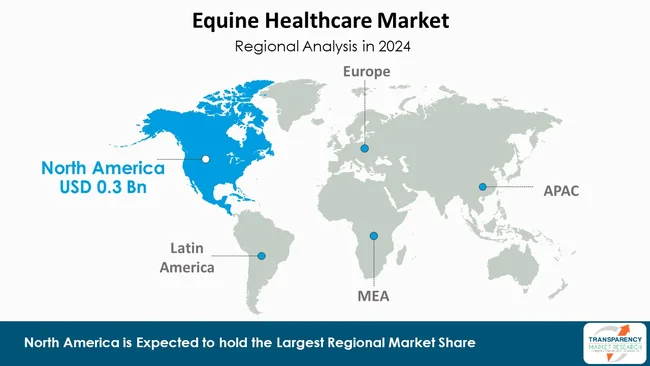

| Leading Region | North America |

North America, and the United States above all, holds the largest equine healthcare market share due to a series of healthy health policy decisions, high level of awareness, buying power, and common availability. Additionally, North American consumers place high importance on convenience, cleanliness, and technology, and hence the market is open to high-end and innovative products.

Leading companies are partnering with hospitals, specialty clinics, and research institutes to expand inorganically. Zoetis, Arthrex, Inc., Dechra Pharmaceuticals, Boehringer Ingelheim, Animal Health USA Inc., Ceva, Heska Corporation, Merck & Co., Inc., Esaote SpA, IDEXX, Covetrus, Elanco, Cargill Incorporated, Santa Cruz Biotechnology Inc. are the prominent equine healthcare market players.

Each of these players has been have been profiled in the equine healthcare industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

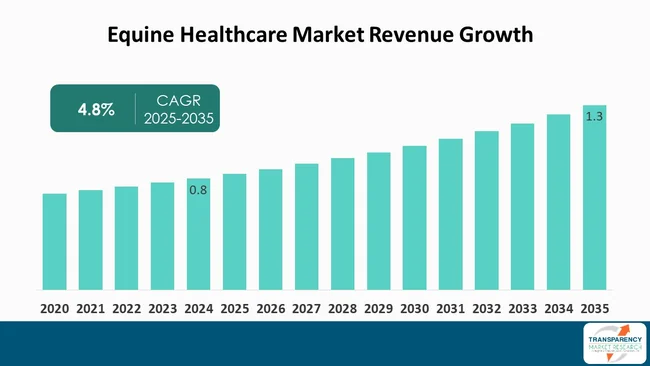

| Size in 2024 | US$ 0.8 Bn |

| Forecast Value in 2035 | US$ 1.3 Bn |

| CAGR | 4.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global equine healthcare market was valued at US$ 0.8 Bn in 2024.

Equine Healthcare business is projected to cross US$ 1.3 Bn by the end of 2035.

Growing incidence of equine diseases and rising research and development across the veterinary field.

The CAGR is anticipated to be 4.8% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Zoetis, Arthrex, Inc., Dechra Pharmaceuticals, Boehringer Ingelheim, Animal Health USA Inc., Ceva, Heska Corporation, Merck & Co., Inc., Esaote SpA, IDEXX, Covetrus, Elanco, Cargill Incorporated, Santa Cruz Biotechnology Inc, and other players are the prominent Equine Healthcare Market players.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Equine Healthcare Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Equine Healthcare Market Analysis and Forecasts, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Equine Healthcare Market Trends

5.2. Regulatory Scenario Across Key Regions/Countries

5.3. PESTEL Analysis

5.4. PORTER's Analysis

5.5. Pipeline Analysis for Equine Drugs and Vaccines

5.6. Pricing Trends of Equine Health Care Products

5.7. Key Industry Events

5.8. Epidemiology Analysis Across Key Regions/Countries

5.9. Go-to-Market Strategy for New Market Entrants

5.10. Key Shortlisting Metrics for End-users

5.11. Benchmarking of the Products Offered by the Leading Competitors

6. Global Equine Healthcare Market Analysis and Forecasts, By Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product Type, 2020 to 2035

6.3.1. Therapeutics

6.3.1.1. Drugs

6.3.1.1.1. Anti-Infective

6.3.1.1.2. Anti-inflammatory

6.3.1.1.3. Parasiticides

6.3.1.1.4. Others

6.3.1.2. Vaccine

6.3.1.2.1. Inactivated

6.3.1.2.2. Live Attenuated

6.3.1.2.3. Recombinant

6.3.1.2.4. Others

6.3.1.3. Supplemental Feed additives

6.3.1.3.1. Proteins and amino acids

6.3.1.3.2. Vitamins

6.3.1.3.3. Enzymes

6.3.1.3.4. Minerals

6.3.1.3.5. Others

6.3.1.4. Regenerative Medicine

6.3.2. Diagnostics

6.3.2.1. Diagnostic Kits & Reagents

6.3.2.2. Instruments

6.4. Market Attractiveness By Product Type

7. Global Equine Healthcare Market Analysis and Forecasts, By Indication

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Indication, 2020 to 2035

7.3.1. Equine Influenza

7.3.2. Equine Herpes virus (EHV)

7.3.3. Equine Encephalomyelitis

7.3.4. West Nile Virus

7.3.5. Equine Rabies

7.3.6. Potomac Horse Fever

7.3.7. Osteoarthritis

7.3.8. Tetanus

7.3.9. Others

7.4. Market Attractiveness By Indication

8. Global Equine Healthcare Market Analysis and Forecasts, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By End-user, 2020 to 2035

8.3.1. Veterinary Hospitals

8.3.2. Equine Clinics

8.3.3. Equestrian Facilities

8.3.4. Others

8.4. Market Attractiveness By End-user

9. Global Equine Healthcare Market Analysis and Forecasts, By Region

9.1. Key Findings

9.2. Market Value Forecast By Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness By Country/Region

10. North America Equine Healthcare Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast By Product Type, 2020 to 2035

10.2.1. Therapeutics

10.2.1.1. Drugs

10.2.1.1.1. Anti-Infective

10.2.1.1.2. Anti-inflammatory

10.2.1.1.3. Parasiticides

10.2.1.1.4. Others

10.2.1.2. Vaccine

10.2.1.2.1. Inactivated

10.2.1.2.2. Live Attenuated

10.2.1.2.3. Recombinant

10.2.1.2.4. Others

10.2.1.3. Supplemental Feed additives

10.2.1.3.1. Proteins and amino acids

10.2.1.3.2. Vitamins

10.2.1.3.3. Enzymes

10.2.1.3.4. Minerals

10.2.1.3.5. Others

10.2.1.4. Regenerative Medicine

10.2.2. Diagnostics

10.2.2.1. Diagnostic Kits & Reagents

10.2.2.2. Instruments

10.3. Market Value Forecast By Indication, 2020 to 2035

10.3.1. Equine Influenza

10.3.2. Equine Herpes virus (EHV)

10.3.3. Equine Encephalomyelitis

10.3.4. West Nile Virus

10.3.5. Equine Rabies

10.3.6. Potomac Horse Fever

10.3.7. Osteoarthritis

10.3.8. Tetanus

10.3.9. Others

10.4. Market Value Forecast By End-user, 2020 to 2035

10.4.1. Veterinary Hospitals

10.4.2. Equine Clinics

10.4.3. Equestrian Facilities

10.4.4. Others

10.5. Market Value Forecast By Country, 2020 to 2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Indication

10.6.3. By End-user

10.6.4. By Country

11. Europe Equine Healthcare Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product Type, 2020 to 2035

11.2.1. Therapeutics

11.2.1.1. Drugs

11.2.1.1.1. Anti-Infective

11.2.1.1.2. Anti-inflammatory

11.2.1.1.3. Parasiticides

11.2.1.1.4. Others

11.2.1.2. Vaccine

11.2.1.2.1. Inactivated

11.2.1.2.2. Live Attenuated

11.2.1.2.3. Recombinant

11.2.1.2.4. Others

11.2.1.3. Supplemental Feed additives

11.2.1.3.1. Proteins and amino acids

11.2.1.3.2. Vitamins

11.2.1.3.3. Enzymes

11.2.1.3.4. Minerals

11.2.1.3.5. Others

11.2.1.4. Regenerative Medicine

11.2.2. Diagnostics

11.2.2.1. Diagnostic Kits & Reagents

11.2.2.2. Instruments

11.3. Market Value Forecast By Indication, 2020 to 2035

11.3.1. Equine Influenza

11.3.2. Equine Herpes virus (EHV)

11.3.3. Equine Encephalomyelitis

11.3.4. West Nile Virus

11.3.5. Equine Rabies

11.3.6. Potomac Horse Fever

11.3.7. Osteoarthritis

11.3.8. Tetanus

11.3.9. Others

11.4. Market Value Forecast By End-user, 2020 to 2035

11.4.1. Veterinary Hospitals

11.4.2. Equine Clinics

11.4.3. Equestrian Facilities

11.4.4. Others

11.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Switzerland

11.5.7. The Netherlands

11.5.8. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Indication

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Equine Healthcare Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product Type, 2020 to 2035

12.2.1. Therapeutics

12.2.1.1. Drugs

12.2.1.1.1. Anti-Infective

12.2.1.1.2. Anti-inflammatory

12.2.1.1.3. Parasiticides

12.2.1.1.4. Others

12.2.1.2. Vaccine

12.2.1.2.1. Inactivated

12.2.1.2.2. Live Attenuated

12.2.1.2.3. Recombinant

12.2.1.2.4. Others

12.2.1.3. Supplemental Feed additives

12.2.1.3.1. Proteins and amino acids

12.2.1.3.2. Vitamins

12.2.1.3.3. Enzymes

12.2.1.3.4. Minerals

12.2.1.3.5. Others

12.2.1.4. Regenerative Medicine

12.2.2. Diagnostics

12.2.2.1. Diagnostic Kits & Reagents

12.2.2.2. Instruments

12.3. Market Value Forecast By Indication, 2020 to 2035

12.3.1. Equine Influenza

12.3.2. Equine Herpes virus (EHV)

12.3.3. Equine Encephalomyelitis

12.3.4. West Nile Virus

12.3.5. Equine Rabies

12.3.6. Potomac Horse Fever

12.3.7. Osteoarthritis

12.3.8. Tetanus

12.3.9. Others

12.4. Market Value Forecast By End-user, 2020 to 2035

12.4.1. Veterinary Hospitals

12.4.2. Equine Clinics

12.4.3. Equestrian Facilities

12.4.4. Others

12.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

12.5.1. China

12.5.2. India

12.5.3. Japan

12.5.4. South Korea

12.5.5. Australia & New Zealand

12.5.6. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Indication

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Equine Healthcare Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product Type, 2020 to 2035

13.2.1. Therapeutics

13.2.1.1. Drugs

13.2.1.1.1. Anti-Infective

13.2.1.1.2. Anti-inflammatory

13.2.1.1.3. Parasiticides

13.2.1.1.4. Others

13.2.1.2. Vaccine

13.2.1.2.1. Inactivated

13.2.1.2.2. Live Attenuated

13.2.1.2.3. Recombinant

13.2.1.2.4. Others

13.2.1.3. Supplemental Feed additives

13.2.1.3.1. Proteins and amino acids

13.2.1.3.2. Vitamins

13.2.1.3.3. Enzymes

13.2.1.3.4. Minerals

13.2.1.3.5. Others

13.2.1.4. Regenerative Medicine

13.2.2. Diagnostics

13.2.2.1. Diagnostic Kits & Reagents

13.2.2.2. Instruments

13.3. Market Value Forecast By Indication, 2020 to 2035

13.3.1. Equine Influenza

13.3.2. Equine Herpes virus (EHV)

13.3.3. Equine Encephalomyelitis

13.3.4. West Nile Virus

13.3.5. Equine Rabies

13.3.6. Potomac Horse Fever

13.3.7. Osteoarthritis

13.3.8. Tetanus

13.3.9. Others

13.4. Market Value Forecast By End-user, 2020 to 2035

13.4.1. Veterinary Hospitals

13.4.2. Equine Clinics

13.4.3. Equestrian Facilities

13.4.4. Others

13.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Argentina

13.5.4. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Indication

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Equine Healthcare Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product Type, 2020 to 2035

14.2.1. Therapeutics

14.2.1.1. Drugs

14.2.1.1.1. Anti-Infective

14.2.1.1.2. Anti-inflammatory

14.2.1.1.3. Parasiticides

14.2.1.1.4. Others

14.2.1.2. Vaccine

14.2.1.2.1. Inactivated

14.2.1.2.2. Live Attenuated

14.2.1.2.3. Recombinant

14.2.1.2.4. Others

14.2.1.3. Supplemental Feed additives

14.2.1.3.1. Proteins and amino acids

14.2.1.3.2. Vitamins

14.2.1.3.3. Enzymes

14.2.1.3.4. Minerals

14.2.1.3.5. Others

14.2.1.4. Regenerative Medicine

14.2.2. Diagnostics

14.2.2.1. Diagnostic Kits & Reagents

14.2.2.2. Instruments

14.3. Market Value Forecast By Indication, 2020 to 2035

14.3.1. Equine Influenza

14.3.2. Equine Herpes virus (EHV)

14.3.3. Equine Encephalomyelitis

14.3.4. West Nile Virus

14.3.5. Equine Rabies

14.3.6. Potomac Horse Fever

14.3.7. Osteoarthritis

14.3.8. Tetanus

14.3.9. Others

14.4. Market Value Forecast By End-user, 2020 to 2035

14.4.1. Veterinary Hospitals

14.4.2. Equine Clinics

14.4.3. Equestrian Facilities

14.4.4. Others

14.5. Market Value Forecast By Country/Sub-region, 2020 to 2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Indication

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (By Tier and Size of companies)

15.2. Market Share Analysis By Company (2024)

15.3. Company Profiles

15.3.1. Zoetis

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Financial Overview

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Arthrex, Inc.

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Financial Overview

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Dechra Pharmaceuticals

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Financial Overview

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Boehringer Ingelheim Animal Health USA Inc.

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Financial Overview

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Ceva

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Financial Overview

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Heska Corporation

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Financial Overview

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Merck & Co., Inc.,

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Financial Overview

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Esaote SpA

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Financial Overview

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. IDEXX

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Financial Overview

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. Covetrus

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Financial Overview

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. Elanco

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Financial Overview

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. Cargill, Incorporated

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Financial Overview

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Santa Cruz Biotechnology Inc.

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Financial Overview

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. Other Prominent Players

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Financial Overview

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

List of Tables

Table 01: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 03: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Drugs, 2020 to 2035

Table 04: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Vaccine, 2020 to 2035

Table 05: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Supplemental Feed Additives, 2020 to 2035

Table 06: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 07: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Indication, 2020 to 2035

Table 08: Global Equine Healthcare Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 09: Global Equine Healthcare Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 10: North America - Equine Healthcare Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 11: North America - Equine Healthcare Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 12: North America - Equine Healthcare Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 13: North America - Equine Healthcare Market Value (US$ Mn) Forecast, By Drugs, 2020 to 2035

Table 14: North America - Equine Healthcare Market Value (US$ Mn) Forecast, By Vaccine, 2020 to 2035

Table 15: North America - Equine Healthcare Market Value (US$ Mn) Forecast, By Supplemental Feed Additives, 2020 to 2035

Table 16: North America - Equine Healthcare Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 17: North America - Equine Healthcare Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 18: North America - Equine Healthcare Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 19: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 20: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 21: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 22: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, By Drugs, 2020 to 2035

Table 23: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, By Vaccine, 2020 to 2035

Table 24: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, By Supplemental Feed Additives, 2020 to 2035

Table 25: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 26: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 27: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 28: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 29: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 30: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 31: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, By Drugs, 2020 to 2035

Table 32: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, By Vaccine, 2020 to 2035

Table 33: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, By Supplemental Feed Additives, 2020 to 2035

Table 34: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 35: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 36: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 37: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 38: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 39: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 40: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, By Drugs, 2020 to 2035

Table 41: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, By Vaccine, 2020 to 2035

Table 42: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, By Supplemental Feed Additives, 2020 to 2035

Table 43: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 44: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 45: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 46: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 47: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, by Product Type, 2020 to 2035

Table 48: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, By Therapeutics, 2020 to 2035

Table 49: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, By Drugs, 2020 to 2035

Table 50: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, By Vaccine, 2020 to 2035

Table 51: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, By Supplemental Feed Additives, 2020 to 2035

Table 52: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, By Diagnostics, 2020 to 2035

Table 53: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, by Indication, 2020 to 2035

Table 54: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Equine Healthcare Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Equine Healthcare Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Equine Healthcare Market Revenue (US$ Mn), by Therapeutics, 2020 to 2035

Figure 04: Global Equine Healthcare Market Revenue (US$ Mn), by Diagnostics, 2020 to 2035

Figure 05: Global Equine Healthcare Market Value Share Analysis, By Indication, 2024 and 2035

Figure 06: Global Equine Healthcare Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 07: Global Equine Healthcare Market Revenue (US$ Mn), by Equine Influenza, 2020 to 2035

Figure 08: Global Equine Healthcare Market Revenue (US$ Mn), by Equine Herpes virus (EHV), 2020 to 2035

Figure 09: Global Equine Healthcare Market Revenue (US$ Mn), by Equine Encephalomyelitis, 2020 to 2035

Figure 10: Global Equine Healthcare Market Revenue (US$ Mn), by West Nile Virus, 2020 to 2035

Figure 11: Global Equine Healthcare Market Revenue (US$ Mn), by Equine Rabies, 2020 to 2035

Figure 12: Global Equine Healthcare Market Revenue (US$ Mn), by Potomac Horse Fever, 2020 to 2035

Figure 13: Global Equine Healthcare Market Revenue (US$ Mn), by Osteoarthritis, 2020 to 2035

Figure 14: Global Equine Healthcare Market Revenue (US$ Mn), by Tetanus, 2020 to 2035

Figure 15: Global Equine Healthcare Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 16: Global Equine Healthcare Market Value Share Analysis, By End-user, 2024 and 2035

Figure 17: Global Equine Healthcare Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 18: Global Equine Healthcare Market Revenue (US$ Mn), by Veterinary Hospitals, 2020 to 2035

Figure 19: Global Equine Healthcare Market Revenue (US$ Mn), by Equine Clinics, 2020 to 2035

Figure 20: Global Equine Healthcare Market Revenue (US$ Mn), by Equestrian Facilities, 2020 to 2035

Figure 21: Global Equine Healthcare Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 22: Global Equine Healthcare Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Equine Healthcare Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America - Equine Healthcare Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 25: North America - Equine Healthcare Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America - Equine Healthcare Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Equine Healthcare Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 28: North America Equine Healthcare Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 29: North America - Equine Healthcare Market Value Share Analysis, By Indication, 2024 and 2035

Figure 30: North America - Equine Healthcare Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 31: North America - Equine Healthcare Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: North America - Equine Healthcare Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Europe - Equine Healthcare Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 34: Europe - Equine Healthcare Market Value Share Analysis, by Country, 2024 and 2035

Figure 35: Europe - Equine Healthcare Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 36: Europe Equine Healthcare Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 37: Europe Equine Healthcare Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 38: Europe - Equine Healthcare Market Value Share Analysis, By Indication, 2024 and 2035

Figure 39: Europe - Equine Healthcare Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 40: Europe - Equine Healthcare Market Value Share Analysis, By End-user, 2024 and 2035

Figure 41: Europe - Equine Healthcare Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 42: Asia Pacific - Equine Healthcare Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 43: Asia Pacific - Equine Healthcare Market Value Share Analysis, by Country, 2024 and 2035

Figure 44: Asia Pacific - Equine Healthcare Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 45: Asia Pacific Equine Healthcare Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 46: Asia Pacific Equine Healthcare Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 47: Asia Pacific - Equine Healthcare Market Value Share Analysis, By Indication, 2024 and 2035

Figure 48: Asia Pacific - Equine Healthcare Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 49: Asia Pacific - Equine Healthcare Market Value Share Analysis, By End-user, 2024 and 2035

Figure 50: Asia Pacific - Equine Healthcare Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 51: Latin America - Equine Healthcare Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 52: Latin America - Equine Healthcare Market Value Share Analysis, by Country, 2024 and 2035

Figure 53: Latin America - Equine Healthcare Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 54: Latin America Equine Healthcare Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 55: Latin America Equine Healthcare Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 56: Latin America - Equine Healthcare Market Value Share Analysis, By Indication, 2024 and 2035

Figure 57: Latin America - Equine Healthcare Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 58: Latin America - Equine Healthcare Market Value Share Analysis, By End-user, 2024 and 2035

Figure 59: Latin America - Equine Healthcare Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 60: Middle East & Africa - Equine Healthcare Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 61: Middle East & Africa - Equine Healthcare Market Value Share Analysis, by Country, 2024 and 2035

Figure 62: Middle East & Africa - Equine Healthcare Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 63: Middle East & Africa Equine Healthcare Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 64: Middle East & Africa Equine Healthcare Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 65: Middle East & Africa - Equine Healthcare Market Value Share Analysis, By Indication, 2024 and 2035

Figure 66: Middle East & Africa - Equine Healthcare Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 67: Middle East & Africa - Equine Healthcare Market Value Share Analysis, By End-user, 2024 and 2035

Figure 68: Middle East & Africa - Equine Healthcare Market Attractiveness Analysis, By End-user, 2025 to 2035