Analysts’ Viewpoint on Electric Vehicle Market Scenario

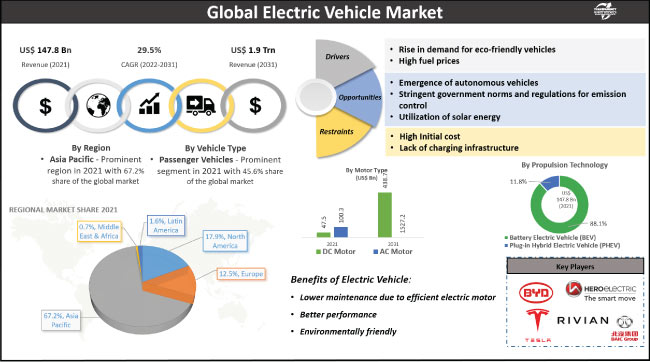

Rise in demand for safe, eco-friendly, and fuel-efficient vehicles is projected to drive the global electric vehicle industry during the forecast period. Electric vehicles or hybrid electric vehicles are built to minimize the dependency on fossil fuels and reduce carbon footprint. Market players are focusing on developing highly precise electric vehicles that do not get affected by different kinds of road/terrain and climate fluctuations.

Leading electric vehicle companies, such as BYD, Baic Motor, Ford Motor Company, and General Motors, are focusing on improving the performance of electric-powered vehicles. Manufacturers are also tapping into incremental opportunities in the market to empower the future of electrified vehicles.

Electric vehicle (EV) is a vehicle/mode of transportation that uses one or more electric motors for propulsion. It can be empowered by a collector system, with electricity from extravehicular sources, or it can be powered autonomously by a battery (sometimes charged by solar panels or conversion of fuel into electricity by using fuel cells or a generator). Industrial electric vehicles such as electric trucks are being increasingly used across the globe.

The global market share of electric vehicles is projected to increase significantly during the forecast period, owing to the rise in adoption of environment-friendly vehicles. Growth in purchasing power of the people and rise in demand for zero carbon emission vehicles are also augmenting the global market.

Request a sample to get extensive insights into the Electric Vehicle Market

Pollution levels are rising in several countries across the globe. Carbon dioxide, nitrogen oxide, hydrocarbon, carbon monoxide, and sulfur dioxide are examples of tailpipe emissions that cause respiratory disorders, cardiac issues, and mental illnesses, thus adding to the strain on healthcare systems.

According to a report by the European Environment Agency published in 2018, automobile emissions have degraded air quality across Europe, costing the continent's healthcare systems more than US$ 80 Bn. Increasing number of individuals are choosing EVs, as these vehicles offer higher performance, lower operating costs, and improved vehicle safety.

According to the International Energy Agency, global sales of electrified vehicles surpassed 6.9 million units in 2021. Rise in oil prices and growth in environmental awareness are propelling the worldwide market for EV. Furthermore, introduction of autonomous vehicles has significantly improved the quality of road infrastructure. EVs provide a number of benefits over ICE vehicles, including zero carbon emission, low operating cost, and ease of operation.

Significant demand for budget-friendly autonomous vehicles and the need for zero carbon emissions are driving the global market. National and international organizations are striving to promote design, development, production, and adoption of electrified vehicles.

Regulatory bodies in the transportation industry have implemented stringent emission standards for automobiles. This is encouraging OEMs to expand their selection of EVs. The European Union, for instance, declared a relaxation in the CO2 emission target for an automaker business if its share of zero- or low-emitting cars, such as electric cars, rises.

A number of countries provide financial incentives such as tax credits and rebates and waiving of registration fees to encourage the adoption of EVs. Many countries also provide non-cash incentives for EVs such as free municipal parking and access to carpool lanes.

In terms of vehicle type, the passenger vehicles segment held major share of the global market in 2021, owing to the benefits of passenger vehicles such as safety, comfort, and reliability. It is the fastest-growing vehicle type in the automobile industry. Emergence of advanced technologies such as IoT and ADAS makes passenger vehicles a safer option. Hence, demand for these vehicles is increasing consistently across the globe.

Two wheeler is a highly convenient mode of transportation, owing to its easy operation and accessibility in narrow or uneven roads. Increase in sale of two wheelers across the globe can be ascribed to their affordability and convenience.

Based on motor type, the AC motor segment is expected to dominate the market in the near future. AC motor (electric vehicle motor) provides higher torque and more acceleration than the DC motor, allowing the vehicle to negotiate rougher terrain more easily. Hence, AC motors are largely used in electric vehicles. Growth in demand for energy-efficient electric vehicles across the globe is likely to boost the demand for AC motors during the forecast period.

Asia Pacific dominated the global market in 2021, owing to the presence of two highly populated countries: China and India. These countries are also the second and fifth largest economies in the world, respectively. China is one of the prominent producers of electric vehicles in Asia Pacific. Most of the automakers in Asia Pacific have changed their product lines to focus on electric cars.

Asia Pacific is followed by North America and Europe in terms of revenue and volume, respectively. Presence of various automotive giants makes Europe a lucrative market for electric vehicles. The electric vehicle industry in North America is projected to grow during the forecast period due to the increase in number of electric vehicle charging stations, government subsidies, and R&D activities in electric vehicle battery technology in the region.

The global market is fairly consolidated, with the largest players controlling a majority of the share. Most of the firms are investing significantly in comprehensive research and development activities, primarily to develop advanced electric drive systems. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by leading vehicle manufacturers.

Some of the leading electric vehicle manufacturers are BYD, BAIC Motor, Ford Motor Company, General Motors, Hyundai Motors, Tesla Motors, Toyota Motor Corporation, REE Auto, Okinawa, Rivian, and Ola Electric.

Request a custom report on Electric Vehicle Market

Key players have been profiled in the market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 147.8 Bn |

|

Market Forecast Value in 2031 |

US$ 1.9 Trn |

|

Growth Rate (CAGR) |

29.5% |

|

Forecast Period |

2022-2031 |

|

Quantitative Units |

US$ Bn/Trn for Value and Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The market was valued at US$ 147.8 Bn in 2021

It is expected to grow at a CAGR of 29.53% during 2022-2031

The market would be worth US$ 1.9 Trn in 2031

China is more lucrative country that held 66.25% share in 2021

The passenger vehicles segment held the largest share of 45.63% in 2021

Increase in demand for advanced driving assistance features and autonomous technology in electric vehicles

Asia Pacific is the most lucrative region that held dominant share of 67.22% in 2021

BYD, Baic Motor, Ford Motor Company, General Motors, Honda Motor Co., Ltd., JAC, Kia Motors, Hyundai Motors, Tesla Motors, Toyota Motor Corporation, REE Auto, Okinawa, Rivian, and Ola Electric

1. Report Summary

1.1. Market Segmentation

1.2. Research Methodology

1.2.1. Primary Research and List of Primary Sources

1.2.2. Desk Research

2. Global Electric Vehicle Market - Executive Summary

2.1. Market Size, Units, US$ Mn, 2017-2031

2.2. Market Analysis and Key Segment Analysis

2.3. TMR Analysis, Recommendations, and Conclusion

3. Market Overview and Insights

3.1. Scope of the Report & Report Assumptions

3.2. Analyst Insight & Current Market Trends

3.3. Key Research Objectives

3.4. Key Findings

3.5. Rules & Regulations

4. Market Determinants

4.1. Motivators/ Drivers

4.2. Restraints

4.3. Opportunities

5. Key Players by region, by Vehicle Type

5.1. Current Status of the Players

5.2. Future Strategy by the Players

5.2.1. Two Wheelers

5.2.2. Passenger Vehicles

5.2.2.1. Hatchbacks

5.2.2.2. Sedans

5.2.2.3. Utility Vehicles

5.2.3. Light Commercial Vehicles

5.2.4. Commercial Vehicles

5.2.4.1. Class 6 Trucks

5.2.4.2. Class 7 Trucks

5.2.4.3. Class 8 Trucks

5.2.5. Buses

6. Key Players by region, by Application

6.1. Step Side Vehicles

6.1.1. Last-mile Delivery Vehicles

6.2. Powersports Applications

6.2.1. ATVs (All-Terrain Vehicles) and Quads

6.2.2. Golf Carts

6.2.3. Boats/Watersports

6.2.4. Snowmobiles

6.2.5. UTVs (Utility Terrain Vehicles)

6.3. Aerospace

6.4. AGVs

7. Existing ICE companies respond to the EV market

7.1. Strategic Overview

7.2. Adoption of EVs by key ICE players

8. Vehicle Production Trends, for each country mentioned in TOC, 2017-2031

8.1. (EV+ICE) Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031

8.1.1. Electric Vehicle Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

8.1.1.1. Two Wheelers

8.1.1.2. Passenger Vehicles

8.1.1.2.1. Hatchbacks

8.1.1.2.2. Sedans

8.1.1.2.3. Utility Vehicles

8.1.1.3. Light Commercial Vehicles

8.1.1.4. Commercial Vehicles

8.1.1.4.1. Class 6 Trucks

8.1.1.4.2. Class 7 Trucks

8.1.1.4.3. Class 8 Trucks

8.1.1.5. Buses

8.1.2. ICE Vehicle Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, by Vehicle Type

8.1.2.1. Two Wheelers

8.1.2.2. Passenger Vehicles

8.1.2.2.1. Hatchbacks

8.1.2.2.2. Sedans

8.1.2.2.3. Utility Vehicles

8.1.2.3. Light Commercial Vehicles

8.1.2.4. Commercial Vehicles

8.1.2.4.1. Class 6 Trucks

8.1.2.4.2. Class 7 Trucks

8.1.2.4.3. Class 8 Trucks

8.1.2.5. Buses

9. Key System or Component Suppliers for EV for each region -

9.1. Battery packs

9.1.1. Battery Suppliers for planned EVs

9.1.2. Production Capacity of Battery Supplier

9.1.3. Supply-Demand Gap for Batteries

9.1.3.1. EV Battery Market Size and forecast, 2017-2031

9.1.3.2. EV Market Size and Forecast, 2017-2031

9.1.4. Cost Analysis of EV Battery, 2017-2031

9.1.5. Cost Analysis of Electric Vehicle, 2017-2031, by Vehicle Type

9.2. Fuel Cell

9.3. Motors

9.4. Reducers

9.5. Monitors

9.6. Gages

9.7. On-board Charger

9.8. Electric Power Control Unit

9.8.1. Inverter

9.8.2. DC-DC Converter

9.8.3. Vehicle Control Unit

9.9. Regenerative Braking

9.10. Battery Management System

10. Global Electric Vehicle Market, Motor Type

10.1. Market Snapshot

10.1.1. Introduction & Definition

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

10.2.1. DC Motor

10.2.2. AC Motor

11. Global Electric Vehicle Market, Vehicle Type

11.1. Market Snapshot

11.1.1. Introduction & Definition

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

11.2.1. Two Wheelers

11.2.2. Passenger Vehicles

11.2.2.1. Hatchbacks

11.2.2.2. Sedans

11.2.2.3. Utility Vehicles

11.2.3. Light Commercial Vehicles

11.2.4. Commercial Vehicles

11.2.4.1. Class 6 Trucks

11.2.4.2. Class 7 Trucks

11.2.4.3. Class 8 Trucks

11.2.5. Buses

12. Global Electric Vehicle Market, Propulsion Technology

12.1. Market Snapshot

12.1.1. Introduction & Definition

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

12.2.1. Battery Electric Vehicle (BEV)

12.2.2. Plug-in Hybrid Electric Vehicle (PHEV)

13. Global Electric Vehicle Market, Application

13.1. Market Snapshot

13.1.1. Introduction & Definition

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

13.2.1. Last-mile Delivery Vehicles

13.2.2. Powersports Applications

13.2.2.1. ATVs (All-Terrain Vehicles) and Quads

13.2.2.2. Golf Carts

13.2.2.3. Boats/Watersports

13.2.2.4. Snowmobiles

13.2.2.5. UTVs (Utility Terrain Vehicles)

13.2.3. Aerospace

13.2.4. AGVs

14. Global Electric Vehicle Market, Region

14.1. Market Snapshot

14.1.1. Introduction & Definition

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Region

14.2.1. North America

14.2.2. Europe

14.2.3. Asia Pacific

14.2.4. Middle East & Africa

14.2.5. Latin America

15. North America Electric Vehicle Market

15.1. Market Snapshot

15.2. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

15.2.1. DC Motor

15.2.2. AC Motor

15.3. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

15.3.1. Two Wheelers

15.3.2. Passenger Vehicles

15.3.2.1. Hatchbacks

15.3.2.2. Sedans

15.3.2.3. Utility Vehicles

15.3.3. Light Commercial Vehicles

15.3.4. Commercial Vehicles

15.3.4.1. Class 6 Trucks

15.3.4.2. Class 7 Trucks

15.3.4.3. Class 8 Trucks

15.3.5. Buses

15.4. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

15.4.1. Battery Electric Vehicle (BEV)

15.4.2. Plug-in Hybrid Electric Vehicle (PHEV)

15.5. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

15.5.1. Last-mile Delivery Vehicles

15.5.2. Powersports Applications

15.5.2.1. ATVs (All-Terrain Vehicles) and Quads

15.5.2.2. Golf Carts

15.5.2.3. Boats/Watersports

15.5.2.4. Snowmobiles

15.5.2.5. UTVs (Utility Terrain Vehicles)

15.5.3. Aerospace

15.5.4. AGVs

15.6. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Country

15.6.1. The U. S.

15.6.2. Canada

15.7. The U. S. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

15.7.1. DC Motor

15.7.2. AC Motor

15.8. The U. S. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

15.8.1. Two Wheelers

15.8.2. Passenger Vehicles

15.8.2.1. Hatchbacks

15.8.2.2. Sedans

15.8.2.3. Utility Vehicles

15.8.3. Light Commercial Vehicles

15.8.4. Commercial Vehicles

15.8.4.1. Class 6 Trucks

15.8.4.2. Class 7 Trucks

15.8.4.3. Class 8 Trucks

15.8.5. Buses

15.9. The U. S. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

15.9.1. Battery Electric Vehicle (BEV)

15.9.2. Plug-in Hybrid Electric Vehicle (PHEV)

15.10. The U. S. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

15.10.1. Last-mile Delivery Vehicles

15.10.2. Powersports Applications

15.10.2.1. ATVs (All-Terrain Vehicles) and Quads

15.10.2.2. Golf Carts

15.10.2.3. Boats/Watersports

15.10.2.4. Snowmobiles

15.10.2.5. UTVs (Utility Terrain Vehicles)

15.10.3. Aerospace

15.10.4. AGVs

16. Europe Electric Vehicle Market

16.1. Market Snapshot

16.2. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

16.2.1. DC Motor

16.2.2. AC Motor

16.3. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

16.3.1. Two Wheelers

16.3.2. Passenger Vehicles

16.3.2.1. Hatchbacks

16.3.2.2. Sedans

16.3.2.3. Utility Vehicles

16.3.3. Light Commercial Vehicles

16.3.4. Commercial Vehicles

16.3.4.1. Class 6 Trucks

16.3.4.2. Class 7 Trucks

16.3.4.3. Class 8 Trucks

16.3.5. Buses

16.4. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

16.4.1. Battery Electric Vehicle (BEV)

16.4.2. Plug-in Hybrid Electric Vehicle (PHEV)

16.5. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

16.5.1. Last-mile Delivery Vehicles

16.5.2. Powersports Applications

16.5.2.1. ATVs (All-Terrain Vehicles) and Quads

16.5.2.2. Golf Carts

16.5.2.3. Boats/Watersports

16.5.2.4. Snowmobiles

16.5.2.5. UTVs (Utility Terrain Vehicles)

16.5.3. Aerospace

16.5.4. AGVs

16.6. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Country

16.6.1. Germany

16.6.2. U. K.

16.6.3. France

16.6.4. Italy

16.6.5. Spain

16.6.6. Nordic Countries

16.6.7. Rest of Europe

17. Asia Pacific Electric Vehicle Market

17.1. Market Snapshot

17.2. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

17.2.1. DC Motor

17.2.2. AC Motor

17.3. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

17.3.1. Two Wheelers

17.3.2. Passenger Vehicles

17.3.2.1. Hatchbacks

17.3.2.2. Sedans

17.3.2.3. Utility Vehicles

17.3.3. Light Commercial Vehicles

17.3.4. Commercial Vehicles

17.3.4.1. Class 6 Trucks

17.3.4.2. Class 7 Trucks

17.3.4.3. Class 8 Trucks

17.3.5. Buses

17.4. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

17.4.1. Battery Electric Vehicle (BEV)

17.4.2. Plug-in Hybrid Electric Vehicle (PHEV)

17.5. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

17.5.1. Last-mile Delivery Vehicles

17.5.2. Powersports Applications

17.5.2.1. ATVs (All-Terrain Vehicles) and Quads

17.5.2.2. Golf Carts

17.5.2.3. Boats/Watersports

17.5.2.4. Snowmobiles

17.5.2.5. UTVs (Utility Terrain Vehicles)

17.5.3. Aerospace

17.5.4. AGVs

17.6. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Country

17.6.1. China

17.6.2. India

17.6.3. Japan

17.6.4. South Korea

17.6.5. ANZ

17.6.6. ASEAN

17.6.7. Rest of Asia Pacific

18. Middle East & Africa Electric Vehicle Market

18.1. Market Snapshot

18.2. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

18.2.1. DC Motor

18.2.2. AC Motor

18.3. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

18.3.1. Two Wheelers

18.3.2. Passenger Vehicles

18.3.2.1. Hatchbacks

18.3.2.2. Sedans

18.3.2.3. Utility Vehicles

18.3.3. Light Commercial Vehicles

18.3.4. Commercial Vehicles

18.3.4.1. Class 6 Trucks

18.3.4.2. Class 7 Trucks

18.3.4.3. Class 8 Trucks

18.3.5. Buses

18.4. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

18.4.1. Battery Electric Vehicle (BEV)

18.4.2. Plug-in Hybrid Electric Vehicle (PHEV)

18.5. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

18.5.1. Last-mile Delivery Vehicles

18.5.2. Powersports Applications

18.5.2.1. ATVs (All-Terrain Vehicles) and Quads

18.5.2.2. Golf Carts

18.5.2.3. Boats/Watersports

18.5.2.4. Snowmobiles

18.5.2.5. UTVs (Utility Terrain Vehicles)

18.5.3. Aerospace

18.5.4. AGVs

18.6. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Country

18.6.1. GCC

18.6.2. South Africa

18.6.3. Rest of Middle East & Africa

19. Latin America Electric Vehicle Market

19.1. Market Snapshot

19.2. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Motor Type

19.2.1. DC Motor

19.2.2. AC Motor

19.3. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Vehicle Type

19.3.1. Two Wheelers

19.3.2. Passenger Vehicles

19.3.2.1. Hatchbacks

19.3.2.2. Sedans

19.3.2.3. Utility Vehicles

19.3.3. Light Commercial Vehicles

19.3.4. Commercial Vehicles

19.3.4.1. Class 6 Trucks

19.3.4.2. Class 7 Trucks

19.3.4.3. Class 8 Trucks

19.3.5. Buses

19.4. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Propulsion Technology

19.4.1. Battery Electric Vehicle (BEV)

19.4.2. Plug-in Hybrid Electric Vehicle (PHEV)

19.5. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Application

19.5.1. Last-mile Delivery Vehicles

19.5.2. Powersports Applications

19.5.2.1. ATVs (All-Terrain Vehicles) and Quads

19.5.2.2. Golf Carts

19.5.2.3. Boats/Watersports

19.5.2.4. Snowmobiles

19.5.2.5. UTVs (Utility Terrain Vehicles)

19.5.3. Aerospace

19.5.4. AGVs

19.6. Market Size (Units) & Revenue (US$ Mn) Analysis & Forecast, 2017-2031, Country

19.6.1. Brazil

19.6.2. Mexico

19.6.3. Rest of Latin America

20. Competitive Landscape /Company Profile

20.1. Company Share Analysis/ Brand Share Analysis, 2021

20.2. Company Analysis for each player

Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share

20.3. Company Profile/Key Players

20.3.1. ABB Ltd.

20.3.1.1. Company Overview

20.3.1.2. Company Footprints

20.3.1.3. Production Locations

20.3.1.4. Product Portfolio

20.3.1.5. Competitors & Customers

20.3.1.6. Subsidiaries & Parent Organization

20.3.1.7. Recent Developments

20.3.1.8. Financial Analysis

20.3.1.9. Profitability

20.3.1.10. Revenue Share

20.3.2. Alcraft Motor Company

20.3.2.1. Company Overview

20.3.2.2. Company Footprints

20.3.2.3. Production Locations

20.3.2.4. Product Portfolio

20.3.2.5. Competitors & Customers

20.3.2.6. Subsidiaries & Parent Organization

20.3.2.7. Recent Developments

20.3.2.8. Financial Analysis

20.3.2.9. Profitability

20.3.2.10. Revenue Share

20.3.3. Baic Motor

20.3.3.1. Company Overview

20.3.3.2. Company Footprints

20.3.3.3. Production Locations

20.3.3.4. Product Portfolio

20.3.3.5. Competitors & Customers

20.3.3.6. Subsidiaries & Parent Organization

20.3.3.7. Recent Developments

20.3.3.8. Financial Analysis

20.3.3.9. Profitability

20.3.3.10. Revenue Share

20.3.4. BMW

20.3.4.1. Company Overview

20.3.4.2. Company Footprints

20.3.4.3. Production Locations

20.3.4.4. Product Portfolio

20.3.4.5. Competitors & Customers

20.3.4.6. Subsidiaries & Parent Organization

20.3.4.7. Recent Developments

20.3.4.8. Financial Analysis

20.3.4.9. Profitability

20.3.4.10. Revenue Share

20.3.5. BYD

20.3.5.1. Company Overview

20.3.5.2. Company Footprints

20.3.5.3. Production Locations

20.3.5.4. Product Portfolio

20.3.5.5. Competitors & Customers

20.3.5.6. Subsidiaries & Parent Organization

20.3.5.7. Recent Developments

20.3.5.8. Financial Analysis

20.3.5.9. Profitability

20.3.5.10. Revenue Share

20.3.6. Canoo

20.3.6.1. Company Overview

20.3.6.2. Company Footprints

20.3.6.3. Production Locations

20.3.6.4. Product Portfolio

20.3.6.5. Competitors & Customers

20.3.6.6. Subsidiaries & Parent Organization

20.3.6.7. Recent Developments

20.3.6.8. Financial Analysis

20.3.6.9. Profitability

20.3.6.10. Revenue Share

20.3.7. Chery

20.3.7.1. Company Overview

20.3.7.2. Company Footprints

20.3.7.3. Production Locations

20.3.7.4. Product Portfolio

20.3.7.5. Competitors & Customers

20.3.7.6. Subsidiaries & Parent Organization

20.3.7.7. Recent Developments

20.3.7.8. Financial Analysis

20.3.7.9. Profitability

20.3.7.10. Revenue Share

20.3.8. Continental AG

20.3.8.1. Company Overview

20.3.8.2. Company Footprints

20.3.8.3. Production Locations

20.3.8.4. Product Portfolio

20.3.8.5. Competitors & Customers

20.3.8.6. Subsidiaries & Parent Organization

20.3.8.7. Recent Developments

20.3.8.8. Financial Analysis

20.3.8.9. Profitability

20.3.8.10. Revenue Share

20.3.9. Daimler

20.3.9.1. Company Overview

20.3.9.2. Company Footprints

20.3.9.3. Production Locations

20.3.9.4. Product Portfolio

20.3.9.5. Competitors & Customers

20.3.9.6. Subsidiaries & Parent Organization

20.3.9.7. Recent Developments

20.3.9.8. Financial Analysis

20.3.9.9. Profitability

20.3.9.10. Revenue Share

20.3.10. Ford Motor Company

20.3.10.1. Company Overview

20.3.10.2. Company Footprints

20.3.10.3. Production Locations

20.3.10.4. Product Portfolio

20.3.10.5. Competitors & Customers

20.3.10.6. Subsidiaries & Parent Organization

20.3.10.7. Recent Developments

20.3.10.8. Financial Analysis

20.3.10.9. Profitability

20.3.10.10. Revenue Share

20.3.11. Geely

20.3.11.1. Company Overview

20.3.11.2. Company Footprints

20.3.11.3. Production Locations

20.3.11.4. Product Portfolio

20.3.11.5. Competitors & Customers

20.3.11.6. Subsidiaries & Parent Organization

20.3.11.7. Recent Developments

20.3.11.8. Financial Analysis

20.3.11.9. Profitability

20.3.11.10. Revenue Share

20.3.12. General Motors

20.3.12.1. Company Overview

20.3.12.2. Company Footprints

20.3.12.3. Production Locations

20.3.12.4. Product Portfolio

20.3.12.5. Competitors & Customers

20.3.12.6. Subsidiaries & Parent Organization

20.3.12.7. Recent Developments

20.3.12.8. Financial Analysis

20.3.12.9. Profitability

20.3.12.10. Revenue Share

20.3.13. GWM

20.3.13.1. Company Overview

20.3.13.2. Company Footprints

20.3.13.3. Production Locations

20.3.13.4. Product Portfolio

20.3.13.5. Competitors & Customers

20.3.13.6. Subsidiaries & Parent Organization

20.3.13.7. Recent Developments

20.3.13.8. Financial Analysis

20.3.13.9. Profitability

20.3.13.10. Revenue Share

20.3.14. Changan

20.3.14.1. Company Overview

20.3.14.2. Company Footprints

20.3.14.3. Production Locations

20.3.14.4. Product Portfolio

20.3.14.5. Competitors & Customers

20.3.14.6. Subsidiaries & Parent Organization

20.3.14.7. Recent Developments

20.3.14.8. Financial Analysis

20.3.14.9. Profitability

20.3.14.10. Revenue Share

20.3.15. Leap Motor

20.3.15.1. Company Overview

20.3.15.2. Company Footprints

20.3.15.3. Production Locations

20.3.15.4. Product Portfolio

20.3.15.5. Competitors & Customers

20.3.15.6. Subsidiaries & Parent Organization

20.3.15.7. Recent Developments

20.3.15.8. Financial Analysis

20.3.15.9. Profitability

20.3.15.10. Revenue Share

20.3.16. BAIC

20.3.16.1. Company Overview

20.3.16.2. Company Footprints

20.3.16.3. Production Locations

20.3.16.4. Product Portfolio

20.3.16.5. Competitors & Customers

20.3.16.6. Subsidiaries & Parent Organization

20.3.16.7. Recent Developments

20.3.16.8. Financial Analysis

20.3.16.9. Profitability

20.3.16.10. Revenue Share

20.3.17. Hozon

20.3.17.1. Company Overview

20.3.17.2. Company Footprints

20.3.17.3. Production Locations

20.3.17.4. Product Portfolio

20.3.17.5. Competitors & Customers

20.3.17.6. Subsidiaries & Parent Organization

20.3.17.7. Recent Developments

20.3.17.8. Financial Analysis

20.3.17.9. Profitability

20.3.17.10. Revenue Share

20.3.18. Hitachi Automotive Systems, Ltd.

20.3.18.1. Company Overview

20.3.18.2. Company Footprints

20.3.18.3. Production Locations

20.3.18.4. Product Portfolio

20.3.18.5. Competitors & Customers

20.3.18.6. Subsidiaries & Parent Organization

20.3.18.7. Recent Developments

20.3.18.8. Financial Analysis

20.3.18.9. Profitability

20.3.18.10. Revenue Share

20.3.19. Honda Motor Co., Ltd.

20.3.19.1. Company Overview

20.3.19.2. Company Footprints

20.3.19.3. Production Locations

20.3.19.4. Product Portfolio

20.3.19.5. Competitors & Customers

20.3.19.6. Subsidiaries & Parent Organization

20.3.19.7. Recent Developments

20.3.19.8. Financial Analysis

20.3.19.9. Profitability

20.3.19.10. Revenue Share

20.3.20. Hyundai

20.3.20.1. Company Overview

20.3.20.2. Company Footprints

20.3.20.3. Production Locations

20.3.20.4. Product Portfolio

20.3.20.5. Competitors & Customers

20.3.20.6. Subsidiaries & Parent Organization

20.3.20.7. Recent Developments

20.3.20.8. Financial Analysis

20.3.20.9. Profitability

20.3.20.10. Revenue Share

20.3.21. JAC

20.3.21.1. Company Overview

20.3.21.2. Company Footprints

20.3.21.3. Production Locations

20.3.21.4. Product Portfolio

20.3.21.5. Competitors & Customers

20.3.21.6. Subsidiaries & Parent Organization

20.3.21.7. Recent Developments

20.3.21.8. Financial Analysis

20.3.21.9. Profitability

20.3.21.10. Revenue Share

20.3.22. Kia Motors

20.3.22.1. Company Overview

20.3.22.2. Company Footprints

20.3.22.3. Production Locations

20.3.22.4. Product Portfolio

20.3.22.5. Competitors & Customers

20.3.22.6. Subsidiaries & Parent Organization

20.3.22.7. Recent Developments

20.3.22.8. Financial Analysis

20.3.22.9. Profitability

20.3.22.10. Revenue Share

20.3.23. Lucid Motors

20.3.23.1. Company Overview

20.3.23.2. Company Footprints

20.3.23.3. Production Locations

20.3.23.4. Product Portfolio

20.3.23.5. Competitors & Customers

20.3.23.6. Subsidiaries & Parent Organization

20.3.23.7. Recent Developments

20.3.23.8. Financial Analysis

20.3.23.9. Profitability

20.3.23.10. Revenue Share

20.3.24. Nidec Corp.

20.3.24.1. Company Overview

20.3.24.2. Company Footprints

20.3.24.3. Production Locations

20.3.24.4. Product Portfolio

20.3.24.5. Competitors & Customers

20.3.24.6. Subsidiaries & Parent Organization

20.3.24.7. Recent Developments

20.3.24.8. Financial Analysis

20.3.24.9. Profitability

20.3.24.10. Revenue Share

20.3.25. Nissan Motor Corporation Ltd.

20.3.25.1. Company Overview

20.3.25.2. Company Footprints

20.3.25.3. Production Locations

20.3.25.4. Product Portfolio

20.3.25.5. Competitors & Customers

20.3.25.6. Subsidiaries & Parent Organization

20.3.25.7. Recent Developments

20.3.25.8. Financial Analysis

20.3.25.9. Profitability

20.3.25.10. Revenue Share

20.3.26. Protean Electric

20.3.26.1. Company Overview

20.3.26.2. Company Footprints

20.3.26.3. Production Locations

20.3.26.4. Product Portfolio

20.3.26.5. Competitors & Customers

20.3.26.6. Subsidiaries & Parent Organization

20.3.26.7. Recent Developments

20.3.26.8. Financial Analysis

20.3.26.9. Profitability

20.3.26.10. Revenue Share

20.3.27. REE Auto

20.3.27.1. Company Overview

20.3.27.2. Company Footprints

20.3.27.3. Production Locations

20.3.27.4. Product Portfolio

20.3.27.5. Competitors & Customers

20.3.27.6. Subsidiaries & Parent Organization

20.3.27.7. Recent Developments

20.3.27.8. Financial Analysis

20.3.27.9. Profitability

20.3.27.10. Revenue Share

20.3.28. Rivian

20.3.28.1. Company Overview

20.3.28.2. Company Footprints

20.3.28.3. Production Locations

20.3.28.4. Product Portfolio

20.3.28.5. Competitors & Customers

20.3.28.6. Subsidiaries & Parent Organization

20.3.28.7. Recent Developments

20.3.28.8. Financial Analysis

20.3.28.9. Profitability

20.3.28.10. Revenue Share

20.3.29. SAIC Motor

20.3.29.1. Company Overview

20.3.29.2. Company Footprints

20.3.29.3. Production Locations

20.3.29.4. Product Portfolio

20.3.29.5. Competitors & Customers

20.3.29.6. Subsidiaries & Parent Organization

20.3.29.7. Recent Developments

20.3.29.8. Financial Analysis

20.3.29.9. Profitability

20.3.29.10. Revenue Share

20.3.30. SGMW

20.3.30.1. Company Overview

20.3.30.2. Company Footprints

20.3.30.3. Production Locations

20.3.30.4. Product Portfolio

20.3.30.5. Competitors & Customers

20.3.30.6. Subsidiaries & Parent Organization

20.3.30.7. Recent Developments

20.3.30.8. Financial Analysis

20.3.30.9. Profitability

20.3.30.10. Revenue Share

20.3.31. Tesla Motors

20.3.31.1. Company Overview

20.3.31.2. Company Footprints

20.3.31.3. Production Locations

20.3.31.4. Product Portfolio

20.3.31.5. Competitors & Customers

20.3.31.6. Subsidiaries & Parent Organization

20.3.31.7. Recent Developments

20.3.31.8. Financial Analysis

20.3.31.9. Profitability

20.3.31.10. Revenue Share

20.3.32. Toyota Motor Corporation

20.3.32.1. Company Overview

20.3.32.2. Company Footprints

20.3.32.3. Production Locations

20.3.32.4. Product Portfolio

20.3.32.5. Competitors & Customers

20.3.32.6. Subsidiaries & Parent Organization

20.3.32.7. Recent Developments

20.3.32.8. Financial Analysis

20.3.32.9. Profitability

20.3.32.10. Revenue Share

20.3.33. Volkswagen

20.3.33.1. Company Overview

20.3.33.2. Company Footprints

20.3.33.3. Production Locations

20.3.33.4. Product Portfolio

20.3.33.5. Competitors & Customers

20.3.33.6. Subsidiaries & Parent Organization

20.3.33.7. Recent Developments

20.3.33.8. Financial Analysis

20.3.33.9. Profitability

20.3.33.10. Revenue Share

20.3.34. Volvo

20.3.34.1. Company Overview

20.3.34.2. Company Footprints

20.3.34.3. Production Locations

20.3.34.4. Product Portfolio

20.3.34.5. Competitors & Customers

20.3.34.6. Subsidiaries & Parent Organization

20.3.34.7. Recent Developments

20.3.34.8. Financial Analysis

20.3.34.9. Profitability

20.3.34.10. Revenue Share

20.3.35. Zotye

20.3.35.1. Company Overview

20.3.35.2. Company Footprints

20.3.35.3. Production Locations

20.3.35.4. Product Portfolio

20.3.35.5. Competitors & Customers

20.3.35.6. Subsidiaries & Parent Organization

20.3.35.7. Recent Developments

20.3.35.8. Financial Analysis

20.3.35.9. Profitability

20.3.35.10. Revenue Share

20.3.36. Li Auto

20.3.36.1. Company Overview

20.3.36.2. Company Footprints

20.3.36.3. Production Locations

20.3.36.4. Product Portfolio

20.3.36.5. Competitors & Customers

20.3.36.6. Subsidiaries & Parent Organization

20.3.36.7. Recent Developments

20.3.36.8. Financial Analysis

20.3.36.9. Profitability

20.3.36.10. Revenue Share

20.3.37. NIO

20.3.37.1. Company Overview

20.3.37.2. Company Footprints

20.3.37.3. Production Locations

20.3.37.4. Product Portfolio

20.3.37.5. Competitors & Customers

20.3.37.6. Subsidiaries & Parent Organization

20.3.37.7. Recent Developments

20.3.37.8. Financial Analysis

20.3.37.9. Profitability

20.3.37.10. Revenue Share

20.3.38. XPeng

20.3.38.1. Company Overview

20.3.38.2. Company Footprints

20.3.38.3. Production Locations

20.3.38.4. Product Portfolio

20.3.38.5. Competitors & Customers

20.3.38.6. Subsidiaries & Parent Organization

20.3.38.7. Recent Developments

20.3.38.8. Financial Analysis

20.3.38.9. Profitability

20.3.38.10. Revenue Share

20.3.39. Polestar

20.3.39.1. Company Overview

20.3.39.2. Company Footprints

20.3.39.3. Production Locations

20.3.39.4. Product Portfolio

20.3.39.5. Competitors & Customers

20.3.39.6. Subsidiaries & Parent Organization

20.3.39.7. Recent Developments

20.3.39.8. Financial Analysis

20.3.39.9. Profitability

20.3.39.10. Revenue Share

20.3.40. Yadea

20.3.40.1. Company Overview

20.3.40.2. Company Footprints

20.3.40.3. Production Locations

20.3.40.4. Product Portfolio

20.3.40.5. Competitors & Customers

20.3.40.6. Subsidiaries & Parent Organization

20.3.40.7. Recent Developments

20.3.40.8. Financial Analysis

20.3.40.9. Profitability

20.3.40.10. Revenue Share

20.3.41. Aima

20.3.41.1. Company Overview

20.3.41.2. Company Footprints

20.3.41.3. Production Locations

20.3.41.4. Product Portfolio

20.3.41.5. Competitors & Customers

20.3.41.6. Subsidiaries & Parent Organization

20.3.41.7. Recent Developments

20.3.41.8. Financial Analysis

20.3.41.9. Profitability

20.3.41.10. Revenue Share

20.3.42. Tailg

20.3.42.1. Company Overview

20.3.42.2. Company Footprints

20.3.42.3. Production Locations

20.3.42.4. Product Portfolio

20.3.42.5. Competitors & Customers

20.3.42.6. Subsidiaries & Parent Organization

20.3.42.7. Recent Developments

20.3.42.8. Financial Analysis

20.3.42.9. Profitability

20.3.42.10. Revenue Share

20.3.43. Luyuan

20.3.43.1. Company Overview

20.3.43.2. Company Footprints

20.3.43.3. Production Locations

20.3.43.4. Product Portfolio

20.3.43.5. Competitors & Customers

20.3.43.6. Subsidiaries & Parent Organization

20.3.43.7. Recent Developments

20.3.43.8. Financial Analysis

20.3.43.9. Profitability

20.3.43.10. Revenue Share

20.3.44. Xinri

20.3.44.1. Company Overview

20.3.44.2. Company Footprints

20.3.44.3. Production Locations

20.3.44.4. Product Portfolio

20.3.44.5. Competitors & Customers

20.3.44.6. Subsidiaries & Parent Organization

20.3.44.7. Recent Developments

20.3.44.8. Financial Analysis

20.3.44.9. Profitability

20.3.44.10. Revenue Share

20.3.45. Bajaj Auto

20.3.45.1. Company Overview

20.3.45.2. Company Footprints

20.3.45.3. Production Locations

20.3.45.4. Product Portfolio

20.3.45.5. Competitors & Customers

20.3.45.6. Subsidiaries & Parent Organization

20.3.45.7. Recent Developments

20.3.45.8. Financial Analysis

20.3.45.9. Profitability

20.3.45.10. Revenue Share

20.3.46. Ola

20.3.46.1. Company Overview

20.3.46.2. Company Footprints

20.3.46.3. Production Locations

20.3.46.4. Product Portfolio

20.3.46.5. Competitors & Customers

20.3.46.6. Subsidiaries & Parent Organization

20.3.46.7. Recent Developments

20.3.46.8. Financial Analysis

20.3.46.9. Profitability

20.3.46.10. Revenue Share

20.3.47. Hero Electric

20.3.47.1. Company Overview

20.3.47.2. Company Footprints

20.3.47.3. Production Locations

20.3.47.4. Product Portfolio

20.3.47.5. Competitors & Customers

20.3.47.6. Subsidiaries & Parent Organization

20.3.47.7. Recent Developments

20.3.47.8. Financial Analysis

20.3.47.9. Profitability

20.3.47.10. Revenue Share

20.3.48. TVS Motors

20.3.48.1. Company Overview

20.3.48.2. Company Footprints

20.3.48.3. Production Locations

20.3.48.4. Product Portfolio

20.3.48.5. Competitors & Customers

20.3.48.6. Subsidiaries & Parent Organization

20.3.48.7. Recent Developments

20.3.48.8. Financial Analysis

20.3.48.9. Profitability

20.3.48.10. Revenue Share

20.3.49. Okinawa

20.3.49.1. Company Overview

20.3.49.2. Company Footprints

20.3.49.3. Production Locations

20.3.49.4. Product Portfolio

20.3.49.5. Competitors & Customers

20.3.49.6. Subsidiaries & Parent Organization

20.3.49.7. Recent Developments

20.3.49.8. Financial Analysis

20.3.49.9. Profitability

20.3.49.10. Revenue Share

20.3.50. Corvus UTV

20.3.50.1. Company Overview

20.3.50.2. Company Footprints

20.3.50.3. Production Locations

20.3.50.4. Product Portfolio

20.3.50.5. Competitors & Customers

20.3.50.6. Subsidiaries & Parent Organization

20.3.50.7. Recent Developments

20.3.50.8. Financial Analysis

20.3.50.9. Profitability

20.3.50.10. Revenue Share

List of Tables

Table 1: Global Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 2: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 3: Global Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Table 4: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 5: Global Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Table 6: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Table 7: Global Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Table 8: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Table 9: Global Electric Vehicle Market Volume (Units) Forecast, by Region, 2017‒2031

Table 10: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Table 11: North America Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 12: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 13: North America Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Table 14: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 15: North America Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Table 16: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Table 17: North America Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Table 18: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Table 19: North America Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Table 20: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 21: Europe Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 22: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 23: Europe Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Table 24: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 25: Europe Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Table 26: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Table 27: Europe Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Table 28: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Table 29: Europe Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Table 30: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 31: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 32: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Table 34: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 35: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Table 36: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Table 37: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Table 38: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Table 39: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Table 40: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 41: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 42: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 43: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Table 44: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 45: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Table 46: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Table 47: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Table 48: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Table 49: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Table 50: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Table 51: Latin America Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Table 52: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Table 53: Latin America Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Table 54: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Table 55: Latin America Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Table 56: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Table 57: Latin America Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Table 58: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Table 59: Latin America Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Table 60: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 2: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 3: Global Electric Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022‒2031

Figure 4: Global Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 5: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 6: Global Electric Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 7: Global Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Figure 8: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Figure 9: Global Electric Vehicle Market, Incremental Opportunity, by Motor Type, Value (US$ Mn), 2022‒2031

Figure 10: Global Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 11: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Figure 12: Global Electric Vehicle Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Mn), 2022‒2031

Figure 13: Global Electric Vehicle Market Volume (Units) Forecast, by Region, 2017‒2031

Figure 14: Global Electric Vehicle Market Value (US$ Mn) Forecast, by Region, 2017‒2031

Figure 15: Global Electric Vehicle Market, Incremental Opportunity, by Region, Value (US$ Mn), 2022‒2031

Figure 16: North America Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 17: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 18: North America Electric Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022‒2031

Figure 19: North America Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 20: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 21: North America Electric Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 22: North America Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Figure 23: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Figure 24: North America Electric Vehicle Market, Incremental Opportunity, by Motor Type, Value (US$ Mn), 2022‒2031

Figure 25: North America Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 26: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Figure 27: North America Electric Vehicle Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Mn), 2022‒2031

Figure 28: North America Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 29: North America Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 30: North America Electric Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 31: Europe Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 32: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 33: Europe Electric Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022‒2031

Figure 34: Europe Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 35: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 36: Europe Electric Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 37: Europe Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Figure 38: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Figure 39: Europe Electric Vehicle Market, Incremental Opportunity, by Motor Type, Value (US$ Mn), 2022‒2031

Figure 40: Europe Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 41: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Figure 42: Europe Electric Vehicle Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Mn), 2022‒2031

Figure 43: Europe Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 44: Europe Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 45: Europe Electric Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 46: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 47: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 48: Asia Pacific Electric Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022‒2031

Figure 49: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 50: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 51: Asia Pacific Electric Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 52: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Figure 53: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Figure 54: Asia Pacific Electric Vehicle Market, Incremental Opportunity, by Motor Type, Value (US$ Mn), 2022‒2031

Figure 55: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 56: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Figure 57: Asia Pacific Electric Vehicle Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Mn), 2022‒2031

Figure 58: Asia Pacific Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 59: Asia Pacific Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 60: Asia Pacific Electric Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 61: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 62: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 63: Middle East & Africa Electric Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022‒2031

Figure 64: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 65: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 66: Middle East & Africa Electric Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 67: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Figure 68: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Figure 69: Middle East & Africa Electric Vehicle Market, Incremental Opportunity, by Motor Type, Value (US$ Mn), 2022‒2031

Figure 70: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 71: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Figure 72: Middle East & Africa Electric Vehicle Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Mn), 2022‒2031

Figure 73: Middle East & Africa Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 74: Middle East & Africa Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 75: Middle East & Africa Electric Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031

Figure 76: Latin America Electric Vehicle Market Volume (Units) Forecast, by Vehicle Type, 2017‒2031

Figure 77: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Vehicle Type, 2017‒2031

Figure 78: Latin America Electric Vehicle Market, Incremental Opportunity, by Vehicle Type, Value (US$ Mn), 2022‒2031

Figure 79: Latin America Electric Vehicle Market Volume (Units) Forecast, by Application, 2017‒2031

Figure 80: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Application, 2017‒2031

Figure 81: Latin America Electric Vehicle Market, Incremental Opportunity, by Application, Value (US$ Mn), 2022‒2031

Figure 82: Latin America Electric Vehicle Market Volume (Units) Forecast, by Motor Type, 2017‒2031

Figure 83: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Motor Type, 2017‒2031

Figure 84: Latin America Electric Vehicle Market, Incremental Opportunity, by Motor Type, Value (US$ Mn), 2022‒2031

Figure 85: Latin America Electric Vehicle Market Volume (Units) Forecast, by Propulsion Technology, 2017‒2031

Figure 86: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Propulsion Technology, 2017‒2031

Figure 87: Latin America Electric Vehicle Market, Incremental Opportunity, by Propulsion Technology, Value (US$ Mn), 2022‒2031

Figure 88: Latin America Electric Vehicle Market Volume (Units) Forecast, by Country, 2017‒2031

Figure 89: Latin America Electric Vehicle Market Value (US$ Mn) Forecast, by Country, 2017‒2031

Figure 90: Latin America Electric Vehicle Market, Incremental Opportunity, by Country, Value (US$ Mn), 2022‒2031