Reports

Reports

Analysts’ Viewpoint on Global Cervical Cancer Diagnostic Tests Market Scenario

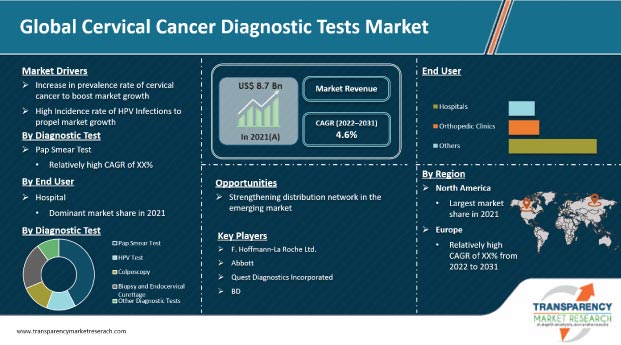

Cervical cancer is the fourth most common cancer and leading cause of deaths among women worldwide. The fast growth of human papillomavirus (HPV) contamination in women population and long-term use of oral contraceptive drugs are key elements boosting rapid growth of cervical cancer diagnostic tests market. Cervical cancer, if diagnosed in its early stages, can be treated effectively. Moreover, big pharmaceutical companies are working tirelessly toward discovering best treatments for the same. There are numerous promising drugs/biologics in the later phases of clinical trials. The introduction of technologically advanced computer-guided cervical cancer screening tests to reduce false-negative test results and improve accuracy would contribute to the growth of the cervical cancer diagnostic tests market during the forecast period.

Cervical cancer is a medical condition in which cells present in the lining of the cervix gradually develop into pre-cancerous mass of cells that ultimately turn into cancerous tumors. Two key types of cervical cancers that are typically screened and diagnosed in women are adenocarcinoma and squamous cell carcinoma. According to the World Health Organization (WHO), cervical cancer is the second most commonly prevalent cancer and the third-largest cause of death in women, with 530,000 new cases discovered each year.

Human papillomavirus (HPV) infection is responsible for 99% of the cervical cancer cases. Increase in incidence of weakened immune system, rapid spread of human papillomavirus (HPV) infection among the female population, and long-term use of oral contraceptive pills are the primary factors boosting the growth of the global cervical cancer diagnostic tests market. Moreover, other lifestyle-related factors such as smoking, multiple sex partners, and certain family history of cervical cancer are anticipated to fuel the growth of the global cervical cancer diagnostic tests market in the near future.

However, lack of education regarding the prevalence of cervical cancer and reluctance of the female population to undergo cervical cancer prognosis are projected to hamper the growth of the global cervical cancer diagnostic tests market. Moreover, unfavorable taxation and dearth of favorable reimbursement policies in countries of Europe and Asia Pacific are anticipated to restrain the global cervical cancer diagnostic tests market.

The increase in prevalence of cervical cancer among women propels the global cervical cancer diagnostics market. In 2018, an estimated 570,000 women were diagnosed with cervical cancer globally and about 311,000 women succumbed to the disease. According to the World Health Organization (WHO), over 270,000 women die every year due to cervical cancer.

Increase in awareness about cancer diagnosis in the early stages and rise in demand for diagnostic & advanced screening techniques drive the global market. Moreover, high adoption rate of preventive diagnostic techniques among the population, technological advancements, and patient safety are expected to propel the cervical cancer diagnostic tests market in Asia Pacific, Latin America, and Middle East & Africa during the forecast period.

In terms of diagnostic test, the global cervical cancer diagnostic tests market has been classified into pap smear test, HPV test, colposcopy, biopsy and endocervical curettage, and other diagnostic tests. The pap smear test segment accounted for the largest market share in 2021, and the trend is likely to continue during the forecast period. This can be attributed to increase in the number of patients with high-risk HPV infection & cervical cancer across the globe and surge in incidence of teenage sex, along with low pricing of the test.

Based on end-user, the global cervical cancer diagnostic tests market has been divided into hospitals, specialty clinics, and others. The hospitals segment held key share of the global cervical cancer diagnostic tests market in 2021. The growth of the segment can be ascribed to the availability of multiple service options & devices and tie-ups with healthcare companies in order to enhance medical products and service offerings. Moreover, hospitals are the preferred choice of patients due to the availability of advanced equipment and better health care services.

The specialty clinics segment is projected to grow at a high CAGR, especially in developed countries, due to rise in cervical cancer cases and improvements in health care infrastructure & support.

In terms of region, the global cervical cancer diagnostic tests market has been segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America held the largest share of the global cervical cancer diagnostic tests market in 2021, followed by Europe. North America dominated the market due to the presence of a large number of diagnostic kits and device providers, which helped cervical cancer patients in the region with easy access to screening solutions, rapid technological advancements, and assisted the baby boomer population that can afford high cost of diagnostic procedures. The high prevalence and incidence rate of cervical cancer among the population and increase in government initiatives on cancer awareness are likely to fuel the growth of the market in the next few years.

The global cervical cancer diagnostic tests market is highly fragmented as a number of players are providing different and advanced products to gain edge over competitors. Key players operating in the global cervical cancer diagnostic tests market include F. Hoffmann-La Roche Ltd., Abbott, Quest Diagnostics Incorporated, QIAGEN, Hologic, Inc., DYSIS Medical, Inc., Femasys, Inc., Guided Therapeutics, Inc., Cooper Companies, Inc., and BD.

Each of these players has been profiled in the cervical cancer diagnostic tests market report based on parameters such as company overview, financial overview, business strategies, application portfolio, business segments, and recent developments.

Key players in the global cervical cancer diagnostic tests market are focused on diversification of product portfolio through mergers and acquisitions. Some of the recent developments in the market have been provided below:

|

Attribute |

Detail |

|

Market Size Value in 2021 (Base Year) |

US$ 8.7 Bn |

|

Market Forecast Value in 2031 |

US$ 13.6 Bn |

|

Growth Rate (CAGR) |

4.6% |

|

Forecast Period |

2022–2031 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, pricing analysis, and parent industry overview. |

|

Format |

Electronic (PDF) |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global cervical cancer diagnostic tests market was valued at US$ 8.7 Bn in 2021.

The global cervical cancer diagnostic tests market is expected to surpass US$ 13.6 Bn by 2031.

The global cervical cancer diagnostic tests market recorded the CAGR of 4.3% from 2017 to 2021.

The global cervical cancer diagnostic tests market is anticipated to record a CAGR of 4.6% from 2022 to 2031.

The pap smear test, diagnostic test type segment, held key share of the global cervical cancer diagnostic tests market in 2021.

North America is expected to be a potential revenue generator during the forecast period.

Prominent players in the global cervical cancer diagnostic tests market include F. Hoffmann-La Roche Ltd., Abbott, Quest Diagnostics Incorporated, QIAGEN, Hologic, Inc., DYSIS Medical, Inc., Femasys, Inc., Guided Therapeutics, Inc., Cooper Companies, Inc., and BD.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Cervical Cancer Diagnostic Tests Market

4. Market Overview

4.1. Introduction

4.1.1. Diagnostic Test Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Cervical Cancer Diagnostic Tests Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Disease Prevalence & Incidence Rate globally with key countries

5.3. Key Industry Events (mergers, acquisitions, partnerships, etc.)

5.4. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Cervical Cancer Diagnostic Tests Market Analysis and Forecast, by Diagnostic Test

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Diagnostic Test, 2017–2031

6.3.1. Pap Smear Test

6.3.2. HPV Test

6.3.3. Colposcopy

6.3.4. Biopsy & Endocervical Curettage

6.3.5. Other diagnostic tests

6.4. Market Attractiveness Analysis, by Diagnostic Test

7. Global Cervical Cancer Diagnostic Tests Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals

7.3.2. Specialty Clinics

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Cervical Cancer Diagnostic Tests Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Cervical Cancer Diagnostic Tests Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Diagnostic Test, 2017–2031

9.2.1. Pap Smear Test

9.2.2. HPV Test

9.2.3. Colposcopy

9.2.4. Biopsy & Endocervical Curettage

9.2.5. Other diagnostic tests

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals

9.3.2. Specialty Clinics

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Diagnostic Test

9.5.2. By End-user

9.5.3. By Country

10. Europe Cervical Cancer Diagnostic Tests Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Diagnostic Test, 2017–2031

10.2.1. Pap Smear Test

10.2.2. HPV Test

10.2.3. Colposcopy

10.2.4. Biopsy & Endocervical Curettage

10.2.5. Other diagnostic tests

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals

10.3.2. Specialty Clinics

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Spain

10.4.5. Italy

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Diagnostic Test

10.5.2. By End-user

10.5.3. By Country Country/Sub-region

11. Asia Pacific Cervical Cancer Diagnostic Tests Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Diagnostic Test, 2017–2031

11.2.1. Pap Smear Test

11.2.2. HPV Test

11.2.3. Colposcopy

11.2.4. Biopsy & Endocervical Curettage

11.2.5. Other diagnostic tests

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals

11.3.2. Specialty Clinics

11.3.3. Others

11.4. Market Value Forecast, by Country Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Diagnostic Test

11.5.2. By End-user

11.5.3. By Country Country/Sub-region

12. Latin America Cervical Cancer Diagnostic Tests Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Diagnostic Test, 2017–2031

12.2.1. Pap Smear Test

12.2.2. HPV Test

12.2.3. Colposcopy

12.2.4. Biopsy & Endocervical Curettage

12.2.5. Other diagnostic tests

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals

12.3.2. Specialty Clinics

12.3.3. Others

12.4. Market Value Forecast, by Country Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Diagnostic Test

12.5.2. By End-user

12.5.3. By Country Country/Sub-region

13. Middle East & Africa Cervical Cancer Diagnostic Tests Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Diagnostic Test, 2017–2031

13.2.1. Pap Smear Test

13.2.2. HPV Test

13.2.3. Colposcopy

13.2.4. Biopsy & Endocervical Curettage

13.2.5. Other diagnostic tests

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals

13.3.2. Specialty Clinics

13.3.3. Others

13.4. Market Value Forecast, by Country Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Diagnostic Test

13.5.2. By End-user

13.5.3. By Country Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix

14.2. Market Share Analysis, by Company, 2021

14.3. Company Profiles

14.3.1. Abbott

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. SWOT Analysis

14.3.1.4. Strategic Overview

14.3.2. BD

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. SWOT Analysis

14.3.2.4. Strategic Overview

14.3.3. Cooper Companies, Inc.

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. SWOT Analysis

14.3.3.4. Strategic Overview

14.3.4. DYSIS Medical, Inc.

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. SWOT Analysis

14.3.4.4. Strategic Overview

14.3.5. F. Hoffmann-La Roche Ltd.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. SWOT Analysis

14.3.5.4. Strategic Overview

14.3.6. Femasys, Inc.

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. SWOT Analysis

14.3.6.4. Strategic Overview

14.3.7. Guided Therapeutics, Inc.

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. SWOT Analysis

14.3.7.4. Strategic Overview

14.3.8. Hologic, Inc.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. SWOT Analysis

14.3.8.4. Strategic Overview

14.3.9. QIAGEN

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. SWOT Analysis

14.3.9.4. Strategic Overview

14.3.10. Quest Diagnostics Incorporated

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. SWOT Analysis

14.3.10.4. Strategic Overview

List of Table

Table 01: Global Cervical Cancer Diagnostic Tests Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 02: Global Cervical Cancer Diagnostic Tests Market Value (US$ Mn) Forecast, by End-user, 2022–2031

Table 03: Global Cervical Cancer Diagnostic Tests Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 04: North America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Country, 2022–2031

Table 05: North America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Product, 2022–2031

Table 06: North America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by End-user, 2022–2031

Table 07: Europe Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2022–2031

Table 08: Europe Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Product, 2022–2031

Table 09: Europe Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by End-user, 2022–2031

Table 10: Asia Pacific Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2022–2031

Table 11: Asia Pacific Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Product, 2022–2031

Table 12: Asia Pacific Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by End-user, 2022–2031

Table 13: Latin America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2022–2031

Table 14: Latin America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Product, 2022–2031

Table 15: Latin America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by End-user, 2022–2031

Table 16: Middle East & Africa Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Country/Sub-region, 2022–2031

Table 17: Middle East & Africa Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by Product, 2022–2031

Table 18: Middle East & Africa Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast, by End-user, 2022–2031

List of Figures

Figure 01: Global Cervical Cancer Diagnostic Tests Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Diagnostic Test, 2021 and 2031

Figure 03: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Pap Smear Test, 2017–2031

Figure 04 Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by HPV Test, 2017–2031

Figure 05: Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Colposcopy, 2017–2031

Figure 06: Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Biopsy & Endocervical Curettage, 2017–2031

Figure 07: Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 08: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Product, 2022–2031

Figure 09: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by End-user, 2021 and 2031

Figure 10: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Hospitals, 2017–2031

Figure 11: Global Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Specialty Clinics, 2017–2031

Figure 12: Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) and Y-o-Y Growth (%), by Others, 2017–2031

Figure 13: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2022-2031

Figure 14: Global Cervical Cancer Diagnostic Tests Market Scenario, 2022-2031

Figure 15: Global Cervical Cancer Diagnostic Tests Market Value Share Analysis, by Region, 2022 and 2031

Figure 16: Global Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Region, 2022-2031

Figure 17: North America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 18: North America Cervical Cancer Diagnostic Tests Market Value Share (%), by Country, 2021 and 2031

Figure 19: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country, 2022–2031

Figure 20: North America Cervical Cancer Diagnostic Tests Market Value Share (%), by Product, 2021 and 2031

Figure 21: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Product, 2022–2031

Figure 22: North America Cervical Cancer Diagnostic Tests Market Value Share (%), by End-user, 2021 and 2031

Figure 23: North America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2022–2031

Figure 24: Europe Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 25: Europe Cervical Cancer Diagnostic Tests Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 26: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 27: Europe Cervical Cancer Diagnostic Tests Market Value Share (%), by Product, 2021 and 2031

Figure 28: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Product, 2022–2031

Figure 29: Europe Cervical Cancer Diagnostic Tests Market Value Share (%), by End-user, 2021 and 2031

Figure 30: Europe Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2021–2031

Figure 31: Asia Pacific Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2022–2031

Figure 32: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share (%), by Country/Sub-region, 2017 and 2031

Figure 33: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 34: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share (%), by Product, 2021 and 2031

Figure 35: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Product, 2021–2031

Figure 36: Asia Pacific Cervical Cancer Diagnostic Tests Market Value Share (%), by End-user, 2021 and 2031

Figure 37: Asia Pacific Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2022–2031

Figure 38: Latin America Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2022–2031

Figure 39: Latin America Cervical Cancer Diagnostic Tests Market Value Share (%), by Country/Sub-region, 2021 and 2031

Figure 40: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 41: Latin America Cervical Cancer Diagnostic Tests Market Value Share (%), by Product, 2021 and 2031

Figure 42: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Product, 2022–2031

Figure 43: Latin America Cervical Cancer Diagnostic Tests Market Value Share (%), by End-user, 2022 and 2031

Figure 44: Latin America Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2022–2031

Figure 45: Middle East & Africa Cervical Cancer Diagnostic Tests Market Revenue (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2022–2031

Figure 46: Middle East & Africa Cervical Cancer Diagnostic Tests Market Value Share (%), by Country/Sub-region, 2022 and 2031

Figure 47: Middle East & Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Country/Sub-region

Figure 48: Middle East & Africa Cervical Cancer Diagnostic Tests Market Value Share (%), by Product, 2021 and 2031

Figure 49: Middle East & Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by Product, 2022–2031

Figure 50: Middle East & Africa Cervical Cancer Diagnostic Tests Market Value Share (%), by End-user, 2021 and 2031

Figure 51: Middle East & Africa Cervical Cancer Diagnostic Tests Market Attractiveness Analysis, by End-user, 2022–2031

Figure 52: Global Cervical Cancer Diagnostic Tests Market Share Analysis by Company (2021) region, 2022–2031