Catheters Market: Snapshot

A catheter refers to a thin tube inserted in the human body for performing a surgical procedure or during the treatment of several diseases. In healthcare sector, catheters are used for a wide range of purposes. These devices are used in numerous medical procedures including cardiac electrophysiology, neurosurgery, and angioplasty. Thus, these are considered integral part of healthcare industry worldwide.

Catheters are manufactured using various medical materials such as silicon rubber, plastic, nylon, and polyvinyl chloride (PVC). Based on the end-use, the companies working in the catheters market make essential changes to the material used while manufacturing their products.

Depending on the purpose of use, catheters are named as urological, cardiovascular, neurovascular, ophthalmic, and gastrointestinal catheters. Among all product types, the vendors working in the global catheters market experience extensive demand for cardiovascular catheters. Key factors for this scenario are the increased number of patients living with cardiovascular health issues and increased heart surgeries in all worldwide locations. Apart from this, the global catheters market witnesses remarkable demand for urological catheters.

The enterprises working in the global catheters market are growing focus toward the development of high quality products. Many enterprises in the market for catheters are strengthening their product portfolio. At the same time, several enterprises in the global catheters market are concentrating on expanding their regional presence.

Due to recent COVID-19 pandemic, the healthcare industry is experiencing remarkable drop in number of surgeries carried out in all worldwide locations. The hospitals from all across the globe were focused on performing emergency surgical procedures. As a result, there was sudden plunge in demand for catheters. However, with the considerable improvement in the pandemic situation, the healthcare sector is now getting back to regular activities. As a result, the global catheters market is expected to experience upward graph of sales in the forthcoming years.

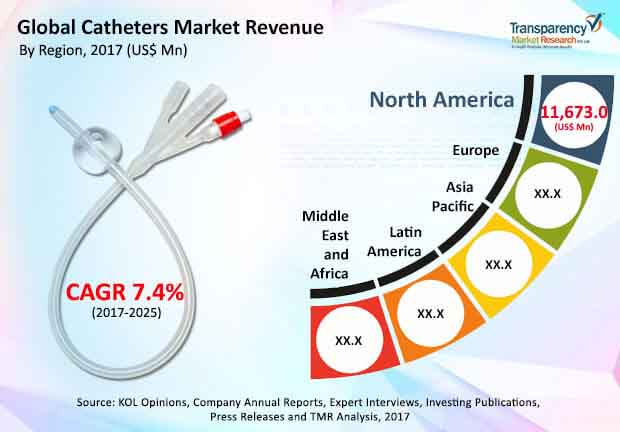

The demand for catheters is expected to remain high in the coming years observes Transparency Market Research. Development and commercialization of various types of catheters for a wide range of applications has significantly propelled the global market in recent years. Catheterization is an important procedure before performing major surgeries. Thus, growing incidences of cardiovascular diseases, kidney disorders, urinary tract procedures, and increasing demand for minimally invasive surgeries has drastically spiked the demand for catheters in the recent years. Growing geriatric population is also projected to be an integral factor in driving the demand for catheters in the near future. According to the research report, the global catheters market is projected to be worth US$55,985.1 mn by the end of 2025. During the forecast years of 2017 and 2025, the global catheters market is expected to exhibit a CAGR of 7.4%.

On the basis of end users, the global catheters market is segmented into ambulatory surgical center, hospitals, and dialysis centers amongst others. Out of these, the hospitals segment dominates the global market as they are obvious key users of catheters. The ambulatory services segment follows this one closely. The report points out that hospitals segment will continue to dominate throughout the forecast period due to growing number of private and government-run hospitals that are expected to come up in the near future. Furthermore, efforts taken by government initiatives to reduce the hospital-related expenditure are also projected to work in the favor of catheters market in the near future.

The various types of catheters available in the global market are cardiovascular catheters, urology catheters, intravenous catheters, specialty catheters, and neurovascular catheters. Out of these, the demand for cardiovascular catheters is projected to remain the highest. The high prevalence of cardiovascular diseases and the rising number of surgeries pertaining to treating the same are stoking the demand for cardiovascular catheters. The World Health Organization states that the cardiovascular diseases are the main cause of deaths across the world. Statistics revealed by WHO states that 17.7 million met a fatal end due to cardiovascular diseases in 2015. These alarming figures are projected to be the primary growth driver for the cardiovascular catheters segment. Furthermore, the increasing demand for minimally-invasive procedures has also supplemented the growth of the market.

Geographically, the global catheters market is segmented into Europe, North America, Asia Pacific, Latin America, and the Middle East and Africa. Out of this, the North America catheters market is expected to lead the way. This regional segment will be driven by the well-established healthcare infrastructure in the region. This has definitely augmented the number of catheterization procedures, thereby boost the regional market’s revenue earnings. Europe is projected to follow North America’s lead in the coming years. The growing pool of geriatrics, high incidences of lifestyle disorders, and tremendous technological advancements and acceptance of the same are expected to keep these two regional markets motivated throughout the forecast period.

On the other hand, the Asia Pacific catheters market too is expected to show rapid growth rate in the coming years. Rise of medical tourism, increasing efforts by the governments of the developing countries to better the healthcare infrastructure, and technological advancements are expected to offer many lucrative opportunities to this regional market.

Some of the leading players operating in the global catheters market are Abbott Laboratories, Dickinson and Company, Becton, C. R. Bard, Inc., B. Braun Melsungen AG, Medtronic plc., Teleflex Incorporated, JOHNSON & JOHNSON, Cook Group Incorporated, and Boston Scientific Corporation.

The global catheters market has been segmented as follows:

|

Product Type |

|

|

End Users |

|

|

Geography |

|

List of Tables

Table 01: Global Catheters Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 02: Global Catheters Market Size (US$ Mn) Forecast, by Cardiovascular Catheters, 2015–2025

Table 03: Global Catheters Market Size (US$ Mn) Forecast, by Urology Catheters, 2015–2025

Table 04: Global Catheters Market Size (US$ Mn) Forecast, by Intravenous Catheters, 2015–2025

Table 05: Global Catheters Market Size (US$ Mn) Forecast, by End Users, 2015–2025

Table 06: Global Catheters Market Size (US$ Mn) Forecast, by Region, 2015–2025

Table 07: North America Catheters Market Size (US$ Mn) Forecast, by Product Type , 2015–2025

Table 08: North America Cardiovascular Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 09: North America Urology Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 10: North America Intravenous Catheters Market Size (US$ Mn) Forecast, by Product Type , 2015–2025

Table 11: North America Catheters Market Size (US$ Mn) Forecast, by End Users, 2015–2025

Table 12: North America Catheters Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 13: Europe Catheters Market Size (US$ Mn) Forecast, by Product Type , 2015–2025

Table 14: Europe Cardiovascular Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 15: Europe Urology Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 16: Europe Intravenous Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 17: Europe Catheters Market Size (US$ Mn) Forecast, by End Users, 2015–2025

Table 18: Europe Catheters Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 19: Asia Pacific Catheters Market Size (US$ Mn) Forecast, by Product Type , 2015–2025

Table 20: Asia Pacific Cardiovascular Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 21: Asia Pacific Urology Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 22: Asia Pacific Intravenous Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 23: Asia Pacific Catheters Market Size (US$ Mn) Forecast, by End Users, 2015–2025

Table 24: Asia Pacific Catheters Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 25: Latin America Catheters Market Size (US$ Mn) Forecast, by Product Type, 2015–2025

Table 26: Latin America Cardiovascular Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 27: Latin America Urology Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 28: Latin America Intravenous Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 29: Latin America Catheters Market Size (US$ Mn) Forecast, by End Users, 2015–2025

Table 30: Latin America Catheters Market Size (US$ Mn) Forecast, by Country, 2015–2025

Table 31: Middle East and Africa Catheters Market Size (US$ Mn) Forecast, by Product Type , 2015–2025

Table 32: Middle East and Africa Cardiovascular Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 33: Middle East and Africa Urology Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 34: Middle East and Africa Intravenous Catheters Market Size (US$ Mn) Forecast, 2015–2025

Table 35: Middle East and Africa Catheters Market Size (US$ Mn) Forecast, by End Users, 2015–2025

Table 36: Middle East and Africa Catheters Market Size (US$ Mn) Forecast, by Country, 2015–2025

List of Figures

Figure 01: Global Catheter Market Snapshot

Figure 02: Global Key Trends Analysis, 2016

Figure 03: Market Share Analysis by Region, 2016

Figure 04: Market Opportunity Map, by Product Type , 2017-2025

Figure 05: Global Catheter Market Size (US$ Mn) Forecast and Y-o-Y Growth (%), 2015–2025

Figure 06: Market Value Share By Product Type (2016)

Figure 07: Market Value Share By End Users (2016)

Figure 08: Market Value Share By Region (2016)

Figure 09: Global Catheters Market Value Share Analysis, by Product Type , 2016 and 2025

Figure 10: Global Cardiovascular Catheters Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 11: Global Urology Catheters Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 12: Global Intravenous Catheters Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 13: Global Neurovascular Catheters Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 14: Global Specialty Catheters Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 15: Global Catheters Market Attractiveness Analysis, by Product Type , 2016

Figure 16: Global Catheters Market Value Share Analysis, by End User, 2016 and 2025

Figure 17: Global Hospital Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 18: Global Ambulatory Surgical Centers Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 19: Global Dialysis Centers Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 20: Global Others Market Revenue (US$ Mn) and Y-o-Y Growth (%), 2015–2025

Figure 21: Global Catheters Market Attractiveness Analysis, by End Users, 2016

Figure 22: Global Catheters Market Value Share Analysis, by Region, 2016 and 2025

Figure 23: Global Catheters Market Attractiveness Analysis, by Region, 2016

Figure 24: North America Catheters Market Size (US$ Mn) Forecast, 2015–2025

Figure 25: North America Catheters Market Y-o-Y Growth Projections, 2016–2025

Figure 26: North America Catheters Market Attractiveness, by Country, 2016

Figure 27: North America Catheters Market Value Share Analysis, by Product Type , 2016 and 2025

Figure 28: North America Catheters Market Attractiveness Analysis, by Product Type , 2016

Figure 29: North America Catheters Market Value Share Analysis, by End Users, 2016 and 2025

Figure 30: North America Catheters Market Attractiveness Analysis, by End Users, 2016

Figure 31: North America Catheters Market, by Country, 2016 and 2025

Figure 32: Europe Catheters Market Size (US$ Mn) Forecast, 2015–2025

Figure 33: Europe Medical Catheters Market Y-o-Y Growth Projections, 2016–2025

Figure 34: Europe Catheters Market Attractiveness, by Country, 2016

Figure 35: Europe Catheters Market Value Share Analysis, by Product Type, 2016 and 2025

Figure 36: Europe Catheters Market Attractiveness Analysis, by Product Type, 2016

Figure 37: Europe Catheters Market Value Share Analysis, by End Users, 2016 and 2025

Figure 38: Europe Catheters Market Attractiveness Analysis, by End Users, 2016

Figure 39: Europe Catheters Market, by Country, 2016 and 2025

Figure 40: Asia Pacific Catheters Market Size (US$ Mn) Forecast, 2015–2025

Figure 41: Asia Pacific Catheters Market Y-o-Y Growth Projections, 2016–2025

Figure 42: Asia Pacific Catheters Market Attractiveness, by Country, 2016

Figure 43: Asia Pacific Catheters Market Value Share Analysis, by Product Type , 2016 and 2025

Figure 44: Asia Pacific Catheters Market Attractiveness Analysis, by Product Type , 2016

Figure 45: Asia Pacific Catheters Market Value Share Analysis, by End Users, 2016 and 2025

Figure 46: Asia Pacific Catheters Market Attractiveness Analysis, by End Users, 2016

Figure 47: Asia Pacific Catheters Market, by Country, 2016 and 2025

Figure 48: Latin America Catheters Market Size (US$ Mn) Forecast, 2015–2025

Figure 49: Latin America Catheters Market Y-o-Y Growth Projections, 2016–2025

Figure 50: Latin America Catheters Market Attractiveness, by Country, 2016

Figure 51: Latin America Catheters Market Value Share Analysis, by Product Type , 2016 and 2025

Figure 52: Latin America Catheters Market Attractiveness Analysis, by Product Type , 2016

Figure 53: Latin America Catheters Market Value Share Analysis, by End Users, 2016 and 2025

Figure 54: Latin America Catheters Market Attractiveness Analysis, by End Users, 2016

Figure 55: Latin America Catheters Market, by Country, 2016 and 2025

Figure 56: Middle East and Africa Catheters Market Size (US$ Mn) Forecast, 2015–2025

Figure 57: Middle East and Africa Catheters Market Y-o-Y Growth Projections, 2016–2025

Figure 58: Middle East and Africa Catheters Market Attractiveness, by Country, 2016

Figure 59: Middle East and Africa Catheters Market Value Share Analysis, by Product Type , 2016 and 2025

Figure 60: Middle East and Africa Catheters Market Attractiveness Analysis, by Product Type , 2016

Figure 61: Middle East and Africa Catheters Market Value Share Analysis, by End Users, 2016 and 2025

Figure 62: Middle East and Africa Catheters Market Attractiveness Analysis, by End Users, 2016

Figure 63: Middle East and Africa Catheters Market, by Country, 2016 and 2025

Figure 64: Global Catheters Market Share Analysis, by Company (2016)