Carboxylic acid is under scrutiny for the development of medicines and pharmaceuticals for the treatment of COVID-19 patients. Companies in the carboxylic acid market are increasing efforts to maintain robust supply chains in essential industries such as food & beverages (F&B) and life sciences to keep economies running during the pandemic. As such, staggered growth in the lubricants industry, the animal feed industry and the fragrances industry is emerging as a challenge for manufacturers in the carboxylic acid market.

Manufacturers in the market are increasing efforts to achieve financial flexibility by focusing on debt planning and limiting their investment in new technologies due to poor revenue flow in the market. Companies are ensuring business continuity for mission critical applications in the sciences, agriculture, and F&B industries. They are adopting the plug-and-play mode for the production to align with volatile demand & supply for goods.

To gauge the scope of customization in our reports Ask for a Sample

The fermentation helps to produce a pure isomer of the carboxylic acid, which can be used for better processing and applications purposes. The fermentation process does have an advantage over chemical synthesis of carboxylic acid, since the latter usually produces a mixture of optical isomers that are difficult to separate from each other. Nevertheless, the fermentation has a disadvantage of low productivity and product concentration that tend to limit its industrial applications. Hence, companies in the carboxylic acid market are gaining a strong research base in extractive fermentation technologies that help to alleviate product inhibition.

Extractive fermentation technologies are being highly publicized to improve the fermentation for economical production of many industrially important carboxylic acids that are currently produced by petrochemical routes.

Get an idea about the offerings of our report from Report Brochure

The F&B industry is creating reliable revenue channels for chemical companies in the carboxylic acid market. Acetic acid, which is made by fermenting cider and honey in the presence of oxygen, helps to produce vinegar used in the food service industry for cooking. The apple cider vinegar is being highly publicized in healthcare for the treatment of chronic arthritis. The acetic acid is also known as a weak acid used in educational and industrial chemistry laboratories.

The demand for natural preservatives and additives for sour taste in food and drinks is translating into incremental opportunities for manufacturers in the carboxylic acid market. Citric acid has gained a strong presence in the beverage industry and is being widely used in carbonated beverages, owing to its flavoring and buffering properties. The high solubility properties of citric acid make it a supreme additive for syrup concentrates.

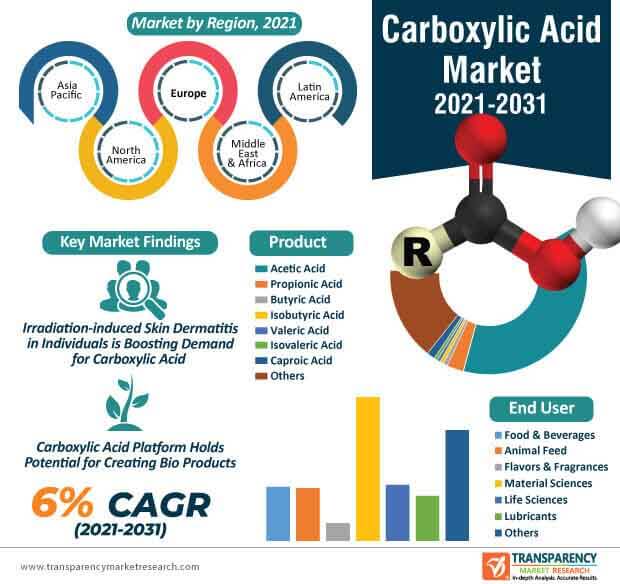

The carboxylic acid market is predicted to expand at a favorable CAGR of 6% during the assessment period. In Europe, the biomass usage for the bioeconomy is mainly focused on raw materials based on sugar or starch, which are associated with high costs for the environment in terms of land use, resource, and energy consumption. However, cities and rural areas in Europe hold great potential for biowaste streams, owing to their heterogeneity. This has led to the recognition of the EU-funded CAFIPLA project, which is helping to unlock the potential of the combination of a Carboxylic Acid Platform (CAP) and Fibre Recovery Platform (FRP).

Currently, biowaste streams are valorized only to a limited extent or used exclusively in low-value applications. Companies in the Europe carboxylic acid market are gaining awareness about the CAFIPLA project, which is helping to valorize biomass into biochemical, feed, biomaterials, and other bio products.

The innovative carboxylic acid-based admixture is under scrutiny for improving concrete watertightness and self-sealing ability of the cement matrix. Companies in the carboxylic acid market are increasing their production capabilities in fumaric acid-based waterproofing admixtures, which improve concrete watertightness.

The concrete has been considered as an eternal material in the construction industry and is contributing toward growth of the carboxylic acid market. However, reinforced concrete structures have shown several vulnerabilities in terms of design, placing, and environmental exposure conditions. This has led to the usage of fumaric acid-based waterproofing admixtures that have helped to significantly reduce maintenance operations over the entire lifespan of buildings.

The high prevalence of radiation dermatitis among individuals is acting as a key driver for the expansion of the global carboxylic acid market. The topical application of Benzene-Poly-Carboxylic Acid and Molybdenum Complex (BP-C2) prophylactically has the potential to protect mice skin from irradiation-induced dermatitis. Such findings hold significance in irradiation-induced skin dermatitis among individuals.

On the other hand, recent advancements in catalytic routes for the production of carboxylic acids from biomass are grabbing the attention of stakeholders. Companies in the carboxylic acid market are aiming to adopt a circular consumption of plastics and produce renewable carbon-neutral monomers. This has led to innovations in the chemocatalytic processes for producing biomass-derived carboxylic acids. Manufacturers are gaining proficiency in developing renewable carboxylic acid that are relevant for use as specialty polyesters and polyamides. Polyesters and polyamides are suitable to be depolymerized to other valuable chemicals or to their constituent monomers that enable the circular reutilization of these monomers.

The formic acid being publicized as an all-rounder for gaining prominence in cleaning & biocide applications, feed & silage, and latex coagulation processes. BASF SE - a Germany-based multinational chemical company is developing its portfolio in carboxylic acid and its types such as formic acid, which is acquiring prominence in households, industrial cleaning, and leather processing applications.

Animal feed additives and preservation mixes are creating revenue opportunities for manufacturers in the carboxylic acid market. Grass silage and fish silage are bolstering the demand for formic acid. This is evident since formic acid prevents bacteria and mold growth to avoid spoilage in open storage structures. The traditional use of formic acid such as in the coagulation of natural rubber, which is further processed into tires and numerous other rubber products is leading to market expansion.

Looking for Regional Analysis or Competitive Landscape in Carboxylic Acid Market for Performance OEM , ask for a customized report

Analysts’ Viewpoint

Due to the unprecedented demand for cleaners and disinfectants, manufacturers are capitalizing on this opportunity to work at break-neck speeds to ensure the availability of products during the COVID-19 outbreak. The carboxylic acid market is expected to reach the valuation of US$ 26.7 Bn by 2031. However, the fermentation of carboxylic acid leads to low productivity and product concentration, thus limiting its industrial applications. Hence, companies should increase their research in extractive fermentation technologies that have the potential to alleviate product inhibition and improve fermentation for economical production of many industrially important carboxylic acids. Manufacturers should focus on developing topical treatments of radiation dermatitis in individuals.

Carboxylic Acid Market: Overview

Growth in Demand for Food and Beverages: Key Driver of Carboxylic Acid Market

Increase in Demand for Nutritional Products in Animal Feed Industry

Acetic Acid Dominates Carboxylic Acid Market

Carboxylic Acid Market: Competition Landscape

Carboxylic Acid Market: Key Developments

Carboxylic Acid Market – Segmentation

TMR’s research study assesses the global carboxylic acid market in terms of product, end user, and region. This report presents extensive market dynamics and trends associated with different segments of the market and how they are influencing growth prospects of the global carboxylic acid market.

| Product |

|

| End User |

|

| Region |

|

Carboxylic Acid Market is expected to reach US$ 26.7 Bn By 2031

Carboxylic Acid Market is estimated to rise at a CAGR of 6% during forecast period

The usage of carboxylic acid in the food & beverages industry is driving the growth of the Carboxylic Acid Market

Asia Pacific is more attractive for vendors in the Carboxylic Acid Market

Key players of Carboxylic Acid Market are BASF SE, Celanese Corporation, The Dow Chemical Company, LyondellBasell Industries N.V., Eastman Chemical Company, Thirumalai Chemicals Ltd., Alfa Aesar, Ashok Alco - chem Limited, Finetech Industry Limited, OXEA, VanDeMark Inc., Shenyang Zhangming Chemical Co., Ltd., VVF LLC, and Perstorp Holding AB (Perstorp)

1. Executive Summary

1.1. Carboxylic Acid Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Definition

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Global Carboxylic Acid Market Analysis and Forecast, 2020-2031

2.5. Porter’s Five Forces Analysis

2.6. Regulatory Landscape

2.7. Value Chain Analysis

2.7.1. List of Suppliers/Manufacturers

2.7.2. List of Potential Customers

3. Production Output Analysis

4. COVID-19 Impact Analysis

5. Import-Export Analysis

6. Price Trend Analysis

7. Global Carboxylic Acid Market Analysis and Forecast, by Product, 2020–2031

7.1. Introduction and Definitions

7.2. Global Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

7.2.1. Acetic Acid

7.2.2. Propionic Acid

7.2.3. Butyric Acid

7.2.4. Isobutyric Acid

7.2.5. Valeric Acid

7.2.6. Isovaleric Acid

7.2.7. Caproic Acid

7.3. Global Carboxylic Acid Market Attractiveness, by Product

8. Global Carboxylic Acid Market Analysis and Forecast, by End-user, 2020–2031

8.1. Introduction and Definitions

8.2. Global Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

8.2.1. Food & Beverages

8.2.2. Animal Feed

8.2.3. Flavors & Fragrances

8.2.4. Material Sciences

8.2.5. Life Sciences

8.2.6. Lubricants

8.3. Global Carboxylic Acid Market Attractiveness, by End-user

9. Global Carboxylic Acid Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Carboxylic Acid Market Attractiveness, by Region

10. North America Carboxylic Acid Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.3. North America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.4. North America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2021–2031

10.4.1. U.S. Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.2. U.S. Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.4.3. Canada Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.4.4. Canada Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

10.5. North America Carboxylic Acid Market Attractiveness Analysis

11. Europe Carboxylic Acid Market Analysis and Forecast, 2020–2031

11.1. Key Findings

11.2. Europe Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.3. Europe Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4. Europe Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

11.4.1. Germany Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.2. Germany Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.3. France Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.4. France Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.5. U.K. Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.6. U.K. Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.7. Italy Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.8. Italy Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.9. Spain Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.10. Spain Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.11. Russia & CIS Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.12. Russia & CIS Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.4.13. Rest of Europe Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

11.4.14. Rest of Europe Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

11.5. Europe Carboxylic Acid Market Attractiveness Analysis

12. Asia Pacific Carboxylic Acid Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.3. Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.4. Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

12.4.1. China Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.2. China Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.4.3. Japan Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.4. Japan Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.4.5. India Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.6. India Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.4.7. ASEAN Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.8. ASEAN Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.4.9. Rest of Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

12.4.10. Rest of Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

12.5. Asia Pacific Carboxylic Acid Market Attractiveness Analysis

13. Latin America Carboxylic Acid Market Analysis and Forecast, 2020–2031

13.1. Key Findings

13.2. Latin America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.3. Latin America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.4. Latin America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

13.4.1. Brazil Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.4.2. Brazil Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.4.3. Mexico Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.4.4. Mexico Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.4.5. Rest of Latin America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

13.4.6. Rest of Latin America Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

13.5. Latin America Carboxylic Acid Market Attractiveness Analysis

14. Middle East & Africa Carboxylic Acid Market Analysis and Forecast, 2020–2031

14.1. Key Findings

14.2. Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.3. Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.4. Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

14.4.1. GCC Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.4.2. GCC Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.4.3. South Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.4.4. South Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.4.5. Rest of Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

14.4.6. Rest of Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-user, 2020–2031

14.5. Middle East & Africa Carboxylic Acid Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Carboxylic Acid Company Market Share Analysis, 2020

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. BASF SE

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.2. Celanese Corporation

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.3. The Dow Chemical Company

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.4. LyondellBasell Industries N.V.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.5. Eastman Chemical Company

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.6. Thirumalai Chemicals Ltd.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.7. Alfa Aesar

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.8. Ashok Alco - chem Limited

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.9. Finetech Industry Limited

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.10. OXEA

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.11. VanDeMark Inc.

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.12. Shenyang Zhangming Chemical Co., Ltd

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.13. VVF LLC

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.14. Perstorp Holding AB (Perstorp)

15.2.14.1. Company Description

15.2.14.2. Business Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 2: Global Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 3: Global Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 4: Global Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 5: Global Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 6: Global Carboxylic Acid Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 7: North America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 8: North America Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 9: North America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 10: North America Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 11: North America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 12: North America Carboxylic Acid Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 14: U.S. Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 15: U.S. Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 16: U.S. Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 17: Canada Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 18: Canada Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 19: Canada Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 20: Canada Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 21: Europe Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 22: Europe Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 23: Europe Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 24: Europe Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 25: Europe Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Carboxylic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 28: Germany Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 29: Germany Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 30: Germany Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 31: U.K. Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 32: U.K. Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 33: U.K. Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 34: U.K. Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 35: France Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 36: France Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 37: France Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 38: France Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 39: Italy Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 40: Italy Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 41: Italy Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 42: Italy Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 43: Spain Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 44: Spain Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 45: Spain Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 46: Spain Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 47: Russia & CIS Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 48: Russia & CIS Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 49: Russia & CIS Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 50: Russia & CIS Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 51: Rest of Europe Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 52: Rest of Europe Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 53: Rest of Europe Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 54: Rest of Europe Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 55: Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 56: Asia Pacific Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 57: Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 58: Asia Pacific Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 59: Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 60: Asia Pacific Carboxylic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 61: China Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 62: China Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 63: China Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 64: China Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 65: Japan Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 66: Japan Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 67: Japan Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 68: Japan Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 69: India Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 70: India Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 71: India Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 72: India Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 73: ASEAN Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 74: ASEAN Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 75: ASEAN Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 76: ASEAN Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 77: Rest of Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 78: Rest of Asia Pacific Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 79: Rest of Asia Pacific Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 80: Rest of Asia Pacific Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 81: Latin America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 82: Latin America Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 83: Latin America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 84: Latin America Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 85: Latin America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Latin America Carboxylic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: Brazil Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 88: Brazil Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 89: Brazil Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 90: Brazil Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 91: Mexico Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 92: Mexico Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 93: Mexico Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 94: Mexico Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 95: Rest of Latin America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 96: Rest of Latin America Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 97: Rest of Latin America Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 98: Rest of Latin America Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 99: Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 100: Middle East & Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 101: Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 102: Middle East & Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 103: Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 104: Middle East & Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 105: GCC Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 106: GCC Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 107: GCC Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 108: GCC Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 109: South Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 110: South Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 111: South Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 112: South Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

Table 113: Rest of Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 114: Rest of Middle East & Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 115: Rest of Middle East & Africa Carboxylic Acid Market Volume (Kilo Tons) Forecast, by End-user, 2020–2031

Table 116: Rest of Middle East & Africa Carboxylic Acid Market Value (US$ Mn) Forecast, by End-user, 2020–2031

List of Figures

Figure 1: Global Carboxylic Acid Market Analysis, by Product, 2020, 2025, and 2031

Figure 2: Global Carboxylic Acid Market Attractiveness, by Product

Figure 3: Global Carboxylic Acid Market Share Analysis, by End-user, 2020, 2025, and 2031

Figure 4: Global Carboxylic Acid Market Attractiveness, by End-user

Figure 5: Global Carboxylic Acid Market Share Analysis, by Region, 2020, 2025, and 2031

Figure 6: Global Carboxylic Acid Market Attractiveness, by Region

Figure 7: North America Carboxylic Acid Market Share Analysis, by Product, 2020, 2025, and 2031

Figure 8: North America Carboxylic Acid Market Attractiveness, by Product

Figure 9: North America Carboxylic Acid Market Share Analysis, by End-user, 2020, 2025, and 2031

Figure 10: North America Carboxylic Acid Market Attractiveness, by End-user

Figure 11: North America Carboxylic Acid Market Share Analysis, by Country, 2020, 2025, and 2031

Figure 12: North America Carboxylic Acid Market Attractiveness, by Country

Figure 13: Europe Carboxylic Acid Market Share Analysis, by Product, 2020, 2025, and 2031

Figure 14: Europe Carboxylic Acid Market Attractiveness, by Product

Figure 15: Europe Carboxylic Acid Market Share Analysis, by End-user, 2020, 2025, and 2031

Figure 16: Europe Carboxylic Acid Market Attractiveness, by End-user

Figure 17: Europe Carboxylic Acid Market Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 18: Europe Carboxylic Acid Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Carboxylic Acid Market Share Analysis, by Product, 2020, 2025, and 2031

Figure 20: Asia Pacific Carboxylic Acid Market Attractiveness, by Product

Figure 21: Asia Pacific Carboxylic Acid Market Share Analysis, by End-user, 2020, 2025, and 2031

Figure 22: Asia Pacific Carboxylic Acid Market Attractiveness, by End-user

Figure 23: Asia Pacific Carboxylic Acid Market Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 24: Asia Pacific Carboxylic Acid Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Carboxylic Acid Market Share Analysis, by Product, 2020, 2025, and 2031

Figure 26: Latin America Carboxylic Acid Market Attractiveness, by Product

Figure 27: Latin America Carboxylic Acid Market Share Analysis, by End-user, 2020, 2025, and 2031

Figure 28: Latin America Carboxylic Acid Market Attractiveness, by End-user

Figure 29: Latin America Carboxylic Acid Market Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 30: Latin America Carboxylic Acid Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Carboxylic Acid Market Share Analysis, by Product, 2020, 2025, and 2031

Figure 32: Middle East & Africa Carboxylic Acid Market Attractiveness, by Product

Figure 33: Middle East & Africa Carboxylic Acid Market Share Analysis, by End-user, 2020, 2025, and 2031

Figure 34: Middle East & Africa Carboxylic Acid Market Attractiveness, by End-user

Figure 35: Middle East & Africa Carboxylic Acid Market Share Analysis, by Country and Sub-region, 2020, 2025, and 2031

Figure 36: Middle East & Africa Carboxylic Acid Market Attractiveness, by Country and Sub-region