Reports

Reports

Canada home healthcare market represents a wide range of home medical devices and services to support patients with chronic disease conditions. The risk and prevalence of chronic and lifestyle related diseases are constantly increasing in Canada which would drive the acceptance of home medical devices and services, consequently leading to the growth of the market. Moreover, changing demographics in Canada further supports the growth of Canada home healthcare market. Statistics Canada projected that around 5 million people in Canada were aged over 60– 65 years in 2011 and the number is expected to double in the next 25 years (10.4 million). Such change in demographics will shift a substantial portion of population to the higher risk level for illnesses that demand continuous medical intervention. Thus, this factor would in turn increase the utilization of home healthcare devices and services hence driving the market growth. Moreover, advancement in technologies, increasing sedentary lifestyle and growing preference for alternatives to hospital based long-term care also supports the Canada home healthcare market growth. However, high costs coupled with strict regulatory environment restraints the market growth. The Canada home healthcare market is estimated to be USD 10,449.1 million in 2013 and is expected to reach USD 18,939.9 million by 2020, growing at a CAGR of 8.9% from 2014 to 2020.

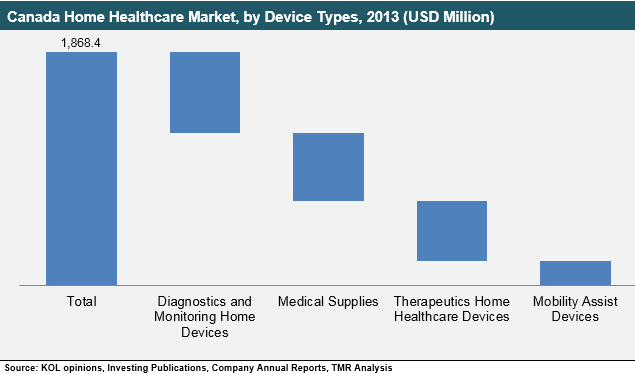

The Canada home healthcare market has been studied from three perspectives: by device types, by services and by provinces. Based on device types, the market has been segmented into four categories: diagnostic and monitoring devices, therapeutic home healthcare devices, home mobility assist devices and medical supplies. Among these, diagnostics and monitoring devices are accounted for the largest market, capturing over 30% of the total Canada home medical devices market in 2013. Efforts of the Canadian government to increase awareness about hypertension, diabetes and sleep apnea management through home monitoring drives the growth of diagnostics and monitoring devices segment. Moreover, home mobility assist devices market segment recorded the lowest revenue in 2013 owing to the low cost of market constituents such as cranes and crutches, walkers and rollators and others.

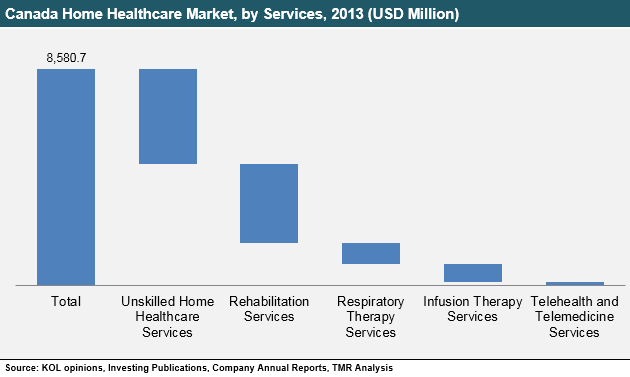

Based on services, the Canada home healthcare market is categorized into rehabilitation, telehealth and telemedicine, respiratory therapy, infusion therapy and unskilled home healthcare services. In 2013, unskilled home healthcare services market accounted for the largest market and is expected to dominate the market in future. Growing geriatric population coupled with increasing uptake of nonprofessional home care services in Canada helps this segment to grow consistently during the forecast period. Moreover, telehealth and telemedicine services only accounted for 2% revenue of the total home healthcare services market in 2013 but is expected to grow with the highest CAGR of around 11% during the forecast period from 2014 to 2020. Fundamental benefits availed from these services such as high cost-effectiveness, quality health care and access to health care services throughout rural and urban areas supports the growth of the market in Canada.

In terms of geographic distribution, the Canada home healthcare market has been segmented into four provinces i.e. Ontario, Quebec, Alberta and Rest of Canada. The Ontario home healthcare market in 2013 accounted for the largest market share due to high demand for home healthcare devices and services. Moreover, consistent rise in geriatric population and favorable government policies propels the growth of home healthcare market in Ontario. Followed by Ontario, Rest of Canada turned out to be the second largest market due to increasing number of obese population over the last few years. The Canada home healthcare market in Quebec is expected to grow at the highest CAGR of 9.2% from 2014 to 2020. The growth of this province is mainly attributed to the large population base and increasing incidence rate of chronic diseases.

The Canada home healthcare market is fragmented in nature, having presence of large number of small scale and large scale home medical device and services providers. Some of the prominent home healthcare devices and service providers in the Canada home healthcare market are Johnson & Johnson, Omron Healthcare, 3M Healthcare, GM Healthcare, We Care Health Services, The Canadian Home Care Association, Home Care Ontario and others.

List of Figures

FIG. 1 Canada Home Healthcare Market: Market Segmentation

FIG. 2 Canada Home Health Care Market, by Device Type, 2013 (USD Million)

FIG. 3 Canada Home Health Care Market, by Services, 2013 (USD Million)

FIG. 4 Comparative Analysis: Canada Home Health Care Market, by Province, 2013 and 2020 (Value %)

FIG. 5 Percentage change in the population of 65 years and over in Canada: 2001 – 2061

FIG. 6 Porter’s Five Forces Analysis: Canada Home Health Care Market

FIG. 7 Market Attractiveness Analysis: Canada Home Healthcare Market, by Provinces

FIG. 8 Canada Home Healthcare Devices Market Segmentation, by Device Types

FIG. 9 Canada Blood Glucose Monitors Market Revenue, 2012 – 2020 (USD Million)

FIG. 10 Canada Blood Pressure Monitors Market Revenue, 2012 – 2020 (USD Million)

FIG. 11 Canada Heart Rate Monitors Market Revenue, 2012 – 2020 (USD Million)

FIG. 12 Canada Temperature Monitors Market Revenue, 2012 – 2020 (USD Million)

FIG. 13 Canada Sleep Apnea Monitors Market Revenue, 2012 – 2020 (USD Million)

FIG. 14 Canada Coagulation Monitors Market Revenue, 2012 – 2020 (USD Million)

FIG. 15 Canada Pregnancy Test Kits Market Revenue, 2012 – 2020 (USD Million)

FIG. 16 Canada Pulse Oximeters Market Revenue, 2012 – 2020 (USD Million)

FIG. 17 Canada Pedometers Market Revenue, 2012 – 2020 (USD Million)

FIG. 18 Canada Insulin Delivery Devices Market Revenue, 2012 – 2020 (USD Million)

FIG. 19 Canada Nebulizers Market Revenue, 2012 – 2020 (USD Million)

FIG. 20 Canada Ventilators and CPAP Devices Market Revenue, 2012 – 2020 (USD Million)

FIG. 21 Canada IV Equipment Market Revenue, 2012 – 2020 (USD Million)

FIG. 22 Canada Dialysis Equipment Market Revenue, 2012 – 2020 (USD Million)

FIG. 23 Canada Wheelchairs Market Revenue, 2012 – 2020 (USD Million)

FIG. 24 Canada Cranes and Crutches Market Revenue, 2012 – 2020 (USD Million)

FIG. 25 Canada Other Home Mobility Assist Devices Market Revenue, 2012 – 2020 (USD Million)

FIG. 26 Canada Medical Supplies Market Revenue, 2012 – 2020 (USD Million)

FIG. 27 Canada Rehabilitation Services Market Revenue, 2012 – 2020 (USD Million)

FIG. 28 Canada Telehealth and Telemedicine Services Market Revenue, 2012 – 2020 (USD Million)

FIG. 29 Canada Infusion Therapy Services Market Revenue, 2012 – 2020 (USD Million)

FIG. 30 Canada Respiratory Therapy Services Market Revenue, 2012 – 2020 (USD Million)

FIG. 31 Canada Unskilled Home Healthcare Services Market Revenue, 2012 – 2020 (USD Million)

FIG. 32 Ontario Home Healthcare Market Revenue, 2012 – 2020 (USD Million)

FIG. 33 Quebec Home Healthcare Market Revenue, 2012 – 2020 (USD Million)

FIG. 34 Alberta Home Healthcare Market Revenue, 2012 – 2020 (USD Million)

FIG. 35 Rest of Canada Home Healthcare Market Revenue, 2012 – 2020 (USD Million)

FIG. 36 3M: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 37 Abbott Laboratories: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 38 Cardinal Health: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 39 General Electric Company: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 40 Invacare Corporation: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 41 Johnson & Johnson: Annual Revenue, 2012 – 2014 (USD Million)

FIG. 42 Medtronic plc: Annual Revenue, 2012 – 2014 (USD Million)