Analysts’ Viewpoint on Biopesticides Market Scenario

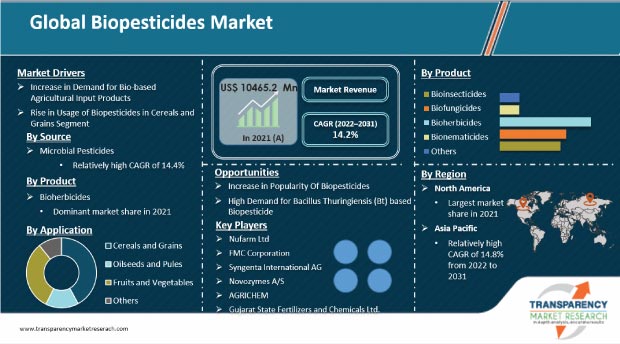

Companies in the biopesticides market are focusing on high-growth applications such as cereals & grains and fruits & vegetables to keep their business growing after the COVID-19. Increase in investments made toward the development of a robust agriculture sector has created opportunities for the market. The need to increase productivity of cash crops and food crops is expected to boost the global biopesticides market. In addition, the non-toxic nature of biopesticides, combined with their natural stint for improving soil fertility is anticipated to generate additional revenue in the global market. Furthermore, agricultural research and development courses available at several universities and research institutions are creating significant awareness about biopesticides. Manufacturers should tap into incremental opportunities in bioherbicides to diversify their revenue streams.

Biopesticides, also known as biological pesticides, are pesticides derived from natural materials such as animals, plants, bacteria, and certain minerals. Typically, biopesticides have unique modes of action and are considered reduced-risk pesticides. Most are selective, leave little or no toxic residue, and have significantly lower development costs than traditional synthetic chemical pesticides. Biopesticides possess various appealing properties that make them valuable components of integrated pest management (IPM). Many biopesticides are suitable for small-scale production and can be applied using farmers' existing spray equipment. The use of biopesticides in integrated pest management (IPM) systems can significantly reduce the usage of chemical pesticides. It allows the use of multiple management approaches and technologies. This is driving research on biopesticides in many institutions and companies.

In terms of revenue, the cereals and grains segment accounted for a 40.6% share of the global biopesticides market in 2021. The segment is expected to grow at a rapid pace during the forecast period. The rise in the cultivation of cereals, which are consumed as staples across the globe, and the high profit associated with the cultivation of organic cereals are projected to boost the demand for biopesticides among cereal growers. Chemical-based pesticides are harmful to the environment. Therefore, the usage of biopesticides for cereals and grains has been rising. In addition, biopesticides produce better results than chemical-based pesticides. This is expected to propel the cereals and grains segment during the forecast period.

Biopesticides contain natural materials, which are less toxic and harmless to the environment. They are pivotal for the development of sustainable agricultural products. Biopesticides offer excellent performance efficiency in terms of pest prevention against a wide range of pests and pathogens. Additionally, they can be easily adopted in integrated pest management (IPM) programs. Hence, biopesticides are effective alternatives to chemical-based pesticides. Population growth is driving the demand for food, while the yield and production of crops are declining. Producers are depending more on chemical pesticides, which in the long run can have negative effects on the environment, humans, and animals. Infrastructure for storage and distribution of food grains and edible agricultural produce is lacking in developing and underdeveloped countries. Advanced agrochemicals such as biopesticides need to be used to maintain the balance between the environment and the rising demand for food. However, excessive use of conventional agrochemicals can harm the environment. Agro-product innovations, such as plant extract-based solutions, help combat diseases. They can improve the efficacy of biopesticides for integrated pest management (IPM) programs for a diverse range of crops across the globe.

In terms of source, biopesticides are classified into microbial pesticides (bt products and non bt products), biochemical pesticides, and plant-incorporated protectants. The microbial pesticides segment dominated the global biopesticides market in 2021 with a market share of 55.4%. The segment is also expected to register the highest CAGR of 14.4% during the forecast period.

Increasing adoption of biopesticides in agriculture industry offers significant revenue opportunities for market players. Microbial pesticides are less expensive alternatives that perform well. Bacteria, viruses, fungi, or protozoans are active elements in microbial pesticides. Unlike chemical pesticides, these natural materials have no negative impact on the environment. Microbial pesticides typically target a specific pest on the crop. This keeps other beneficial insects from being harmed by chemical pesticides. The microbial pesticides segment is expected to remain attractive during the forecast period, owing to the increase in popularity of these pesticides due to their cost-effectiveness and lower environmental impact than chemical-based pesticides.

In terms of product, the biopesticides market has been divided into bioinsecticides, biofungicides, bioherbicides, bionematicides, and others. The bioherbicides segment dominated the global biopesticides market in 2021 with a market share of 35.4%. The segment is expected to account for a CAGR of 14.5% during the forecast period. Crop protection technology innovation and the shift in consumer preference toward a more nutritional and environment-friendly diet are driving the demand for bioherbicides. Bioherbicides are used to increase the organic yield of fruits and vegetables as well as grains. The non-agricultural applications of bioherbicides such as turf maintenance, railway track clearing, and gardening are increasing. This is expected to boost the demand for bioherbicides during the forecast period.

Biopesticides market in North America is expected to account for largest share in the global market during the forecast period. The North America held the largest value share of 38.2% of the global market in 2021. The rise in awareness about the harmful effects of chemical-based agro products and an increase in demand for organic food are major factors that are expected to drive market revenue growth during the forecast period.

Europe and the Asia Pacific are also major consumers of biopesticides. These regions accounted for 33.0% and 13.2% value share, respectively, of the global market in 2021. The rise in demand for high-quality crops to maintain export quality, regulatory bans on key active ingredients and the emergence of pests and diseases as a result of climate change are all paving the way for the use of biopesticides in Europe.

The global biopesticides market is consolidated, with a small number of large-scale vendors controlling the majority of the share. Several companies are investing significantly in comprehensive research & development, primarily to develop environment-friendly products. Expansion of product portfolios and mergers and acquisitions are the key strategies adopted by key players. Some of the prominent entities operating in the market are Nufarm Ltd, FMC Corporation, Syngenta International AG, Novozymes A/S, AGRICHEM, and Gujarat State Fertilizers and Chemicals Ltd.

Each of these players has been profiled in the biopesticides market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Details |

|---|---|

|

Market Size Value in 2021 |

US$ 10.4 Bn |

|

Market Forecast Value in 2031 |

US$ 34.5 Bn |

|

Growth Rate (CAGR) |

14.2% |

|

Forecast Period |

2022-2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Mn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as region level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market size of biopesticides stood over US$ 10.4 Bn in 2021

The biopesticides market is expected to grow at a CAGR of 14.2% from 2022 to 2031.

Rise in demand for biopesticides in cereals and grains; and increase in demand for bio-based products are the key factors driving the biopesticides market.

The cereals and grains segment accounted for major value share of 40.6% of the biopesticides market in 2021.

North America is a more attractive region for vendors in the biopesticides market.

Key players of the biopesticides market include Nufarm Ltd, FMC Corporation, Syngenta International AG, Novozymes A/S, AGRICHEM, and Gujarat State Fertilizers and Chemicals Ltd.

1. Executive Summary

1.1. Biopesticides Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Providers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/Distributors

2.6.4. List of Potential Customers

2.6.5. Production Overview/Route of Synthesis

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2021

5. Price Trend Analysis

6. Global Biopesticides Market Analysis and Forecast, by Source, 2022-2031

6.1. Introduction and Definitions

6.2. Global Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

6.2.1. Microbial Pesticides

6.2.1.1. Bt Products

6.2.1.2. Non Bt Products

6.2.2. Biochemical Pesticides

6.3. Plant-incorporated Protectants Global Biopesticides Market Attractiveness, by Source

7. Global Biopesticides Market Analysis and Forecast, by Product, 2022-2031

7.1. Introduction and Definitions

7.2. Global Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

7.2.1. Bioinsecticides

7.2.2. Biofungicides

7.2.3. Bioherbicides

7.2.4. Bionematicides

7.2.5. Others (including Plant Growth Regulators)

7.3. Global Biopesticides Market Attractiveness, by Product

8. Global Biopesticides Market Analysis and Forecast, by Application, 2022-2031

8.1. Introduction and Definitions

8.2. Global Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

8.2.1. Cereals & Grains

8.2.2. Oilseeds & Pules

8.2.3. Fruits & Vegetables

8.2.4. Others (including Nursery and Turf)

8.3. Global Biopesticides Market Attractiveness, by Application

9. Global Biopesticides Market Analysis and Forecast, by Region, 2022-2031

9.1. Key Findings

9.2. Global Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2022-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Middle East & Africa

9.2.5. Latin America

9.3. Global Biopesticides Market Attractiveness, by Region

10. North America Biopesticides Market Analysis and Forecast, 2022-2031

10.1. Key Findings

10.2. North America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

10.3. North America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

10.4. North America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

10.5. North America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2022-2031

10.5.1. U.S. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

10.5.2. U.S. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

10.5.3. U.S. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

10.5.4. Canada Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

10.5.5. Canada Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

10.5.6. Canada Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

10.6. North America Biopesticides Market Attractiveness Analysis

11. Europe Biopesticides Market Analysis and Forecast, 2022-2031

11.1. Key Findings

11.2. Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.3. Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.4. Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.5. Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.5.1. Germany Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.5.2. Germany Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.5.3. Germany Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.5.4. France Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.5.5. France Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.5.6. France Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.5.7. U.K. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.5.8. U.K. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.5.9. U.K. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.5.10. Italy Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.5.11. Italy. Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.5.12. Italy Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.5.13. Russia & CIS Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.5.14. Russia & CIS Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.5.15. Russia & CIS Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.5.16. Rest of Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

11.5.17. Rest of Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

11.5.18. Rest of Europe Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

11.6. Europe Biopesticides Market Attractiveness Analysis

12. Asia Pacific Biopesticides Market Analysis and Forecast, 2022-2031

12.1. Key Findings

12.2. Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source 2022-2031

12.3. Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

12.4. Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

12.5. Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.5.1. China Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

12.5.2. China Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

12.5.3. China Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

12.5.4. Japan Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

12.5.5. Japan Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

12.5.6. Japan Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

12.5.7. India Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

12.5.8. India Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

12.5.9. India Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

12.5.10. ASEAN Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

12.5.11. ASEAN Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

12.5.12. ASEAN Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

12.5.13. Rest of Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

12.5.14. Rest of Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

12.5.15. Rest of Asia Pacific Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

12.6. Asia Pacific Biopesticides Market Attractiveness Analysis

13. Latin America Biopesticides Market Analysis and Forecast, 2022-2031

13.1. Key Findings

13.2. Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

13.3. Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

13.4. Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

13.5. Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.5.1. Brazil Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

13.5.2. Brazil Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

13.5.3. Brazil Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

13.5.4. Mexico Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

13.5.5. Mexico Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

13.5.6. Mexico Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

13.5.7. Rest of Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

13.5.8. Rest of Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

13.5.9. Rest of Latin America Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

13.6. Latin America Biopesticides Market Attractiveness Analysis

14. Middle East & Africa Biopesticides Market Analysis and Forecast, 2022-2031

14.1. Key Findings

14.2. Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

14.3. Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

14.4. Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

14.5. Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.5.1. GCC Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

14.5.2. GCC Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

14.5.3. GCC Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

14.5.4. South Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

14.5.5. South Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

14.5.6. South Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

14.5.7. Rest of Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Source, 2022-2031

14.5.8. Rest of Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2022-2031

14.5.9. Rest of Middle East & Africa Biopesticides Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2022-2031

14.6. Middle East & Africa Biopesticides Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Biopesticides Company Market Share Analysis, 2021

15.2. Company Profiles (Details - Overview, Financials, Recent Developments, and Strategy)

15.2.1. Certis USA LLC

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Overview

15.2.1.4. Strategic Overview

15.2.2. Syngenta International AG

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Overview

15.2.2.4. Strategic Overview

15.2.3. Nufarm Ltd

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Overview

15.2.3.4. Strategic Overview

15.2.4. Bayer AG

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Overview

15.2.4.4. Strategic Overview

15.2.5. Novozymes A/S

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.5.3. Financial Overview

15.2.5.4. Strategic Overview

15.2.6. Gujarat State Fertilizers and Chemicals Ltd.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.6.3. Financial Overview

15.2.6.4. Strategic Overview

15.2.7. FMC Corporation

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Overview

15.2.7.4. Strategic Overview

15.2.8. Agri Life

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.8.3. Financial Overview

15.2.8.4. Strategic Overview

15.2.9. Symborg S.L.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.9.3. Financial Overview

15.2.9.4. Strategic Overview

15.2.10. Biotech International Limited

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.10.3. Financial Overview

15.2.10.4. Strategic Overview

15.2.11. T. Stanes & Company Limited

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.11.3. Financial Overview

15.2.11.4. Strategic Overview

15.2.12. Summit Chemical, Inc.

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.12.3. Financial Overview

15.2.12.4. Strategic Overview

15.2.13. BioSafe Systems, LLC

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.13.3. Financial Overview

15.2.13.4. Strategic Overview

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 1: Global Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 2: Global Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 3: Global Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 4: Global Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 5: Global Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 6: Global Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 7: Global Biopesticides Market Volume (Kilo Tons) Forecast, by Region, 2022-2031

Table 8: Global Biopesticides Market Value (US$ Mn) Forecast, by Region, 2022-2031

Table 9: North America Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 10: North America Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 11: North America Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 12: North America Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 13: North America Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 14: North America Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 15: North America Biopesticides Market Volume (Kilo Tons) Forecast, by Country, 2022-2031

Table 16: North America Biopesticides Market Value (US$ Mn) Forecast, by Country, 2022-2031

Table 17: U.S. Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 18: U.S. Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 19: U.S. Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 20: U.S. Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 21: U.S. Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 22: U.S. Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 23: Canada Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 24: Canada Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 25: Canada Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 26: Canada Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 27: Canada Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 28: Canada Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 29: Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 30: Europe Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 31: Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 32: Europe Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 33: Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 34: Europe Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 35: Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 36: Europe Biopesticides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 37: Germany Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 38: Germany Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 39: Germany Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 40: Germany Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 41: Germany Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 42: Germany Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 43: France Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 44: France Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 45: France Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 46: France Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 47: France Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 48: France Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 49: U.K. Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 50: U.K. Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 51: U.K. Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 52: U.K. Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 53: U.K. Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 54: U.K. Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 55: Italy Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 56: Italy Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 57: Italy Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 58: Italy Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 59: Italy Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 60: Italy Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 61: Spain Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 62: Spain Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 63: Spain Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 64: Spain Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 65: Spain Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 66: Spain Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 67: Russia & CIS Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 68: Russia & CIS Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 69: Russia & CIS Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 70: Russia & CIS Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 71: Russia & CIS Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 72: Russia & CIS Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 73: Rest of Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 74: Rest of Europe Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 75: Rest of Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 76: Rest of Europe Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 77: Rest of Europe Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 78: Rest of Europe Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 79: Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 80: Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 81: Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 82: Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 83: Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 84: Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 85: Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 86: Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 87: China Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 88: China Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 89: China Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 90: China Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 91: China Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 92: China Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 93: Japan Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 94: Japan Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 95: Japan Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 96: Japan Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 97: Japan Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 98: Japan Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 99: India Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 100: India Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 101: India Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 102: India Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 103: India Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 104: India Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 105: ASEAN Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 106: ASEAN Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 107: ASEAN Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 108: ASEAN Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 109: ASEAN Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 110: ASEAN Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 111: Rest of Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 112: Rest of Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 113: Rest of Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 114: Rest of Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 115: Rest of Asia Pacific Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 116: Rest of Asia Pacific Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 117: Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 118: Latin America Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 119: Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 120: Latin America Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 121: Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 122: Latin America Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 123: Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 124: Latin America Biopesticides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 125: Brazil Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 126: Brazil Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 127: Brazil Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 128: Brazil Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 129: Brazil Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 130: Brazil Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 131: Mexico Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 132: Mexico Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 133: Mexico Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 134: Mexico Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 135: Mexico Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 136: Mexico Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 137: Rest of Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 138: Rest of Latin America Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 139: Rest of Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 140: Rest of Latin America Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 141: Rest of Latin America Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 142: Rest of Latin America Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 143: Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 144: Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 145: Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 146: Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 147: Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 148: Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 149: Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2022-2031

Table 150: Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

Table 151: GCC Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 152: GCC Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 153: GCC Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 154: GCC Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 155: GCC Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 156: GCC Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 157: South Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 158: South Africa Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 159: South Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 160: South Africa Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 161: South Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 162: South Africa Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

Table 163: Rest of Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Source, 2022-2031

Table 164: Rest of Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Source, 2022-2031

Table 165: Rest of Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Product, 2022-2031

Table 166: Rest of Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Product, 2022-2031

Table 167: Rest of Middle East & Africa Biopesticides Market Volume (Kilo Tons) Forecast, by Application, 2022-2031

Table 168: Rest of Middle East & Africa Biopesticides Market Value (US$ Mn) Forecast, by Application, 2022-2031

List of Figures

Figure 1: Global Biopesticides Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 2: Global Biopesticides Market Attractiveness, by Source

Figure 3: Global Biopesticides Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 4: Global Biopesticides Market Attractiveness, by Product

Figure 5: Global Biopesticides Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 6: Global Biopesticides Market Attractiveness, by Application

Figure 7: Global Biopesticides Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 8: Global Biopesticides Market Attractiveness, by Region

Figure 9: North America Biopesticides Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 10: North America Biopesticides Market Attractiveness, by Source

Figure 11: North America Biopesticides Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 12: North America Biopesticides Market Attractiveness, by Product

Figure 13: North America Biopesticides Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 14: North America Biopesticides Market Attractiveness, by Application

Figure 15: North America Biopesticides Market Attractiveness, by Country

Figure 16: Europe Biopesticides Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 17: Europe Biopesticides Market Attractiveness, by Source

Figure 18: Europe Biopesticides Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 19: Europe Biopesticides Market Attractiveness, by Product

Figure 20: Europe Biopesticides Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 21: Europe Biopesticides Market Attractiveness, by Application

Figure 22: Europe Biopesticides Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 23: Europe Biopesticides Market Attractiveness, by Country and Sub-region

Figure 24: Asia Pacific Biopesticides Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 25: Asia Pacific Biopesticides Market Attractiveness, by Source

Figure 26: Asia Pacific Biopesticides Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 27: Asia Pacific Biopesticides Market Attractiveness, by Product

Figure 28: Asia Pacific Biopesticides Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 29: Asia Pacific Biopesticides Market Attractiveness, by Application

Figure 30: Asia Pacific Biopesticides Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 31: Asia Pacific Biopesticides Market Attractiveness, by Country and Sub-region

Figure 32: Latin America Biopesticides Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 33: Latin America Biopesticides Market Attractiveness, by Source

Figure 34: Latin America Biopesticides Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 35: Latin America Biopesticides Market Attractiveness, by Product

Figure 36: Latin America Biopesticides Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 37: Latin America Biopesticides Market Attractiveness, by Application

Figure 38: Latin America Biopesticides Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 39: Latin America Biopesticides Market Attractiveness, by Country and Sub-region

Figure 40: Middle East & Africa Biopesticides Market Volume Share Analysis, by Source, 2022, 2025, and 2031

Figure 41: Middle East & Africa Biopesticides Market Attractiveness, by Source

Figure 42: Middle East & Africa Biopesticides Market Volume Share Analysis, by Product, 2022, 2025, and 2031

Figure 43: Middle East & Africa Biopesticides Market Attractiveness, by Product

Figure 44: Middle East & Africa Biopesticides Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 45: Middle East & Africa Biopesticides Market Attractiveness, by Application

Figure 46: Middle East & Africa Biopesticides Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 47: Middle East & Africa Biopesticides Market Attractiveness, by Country and Sub-region