Reports

Reports

Global Bioadhesive Market: Snapshot

The global market for bioadhesive has been gaining significantly over the recent past. Thanks to the increasing implementation of stringent rules and regulations, compelling industries to limit the application of petroleum-based products, the focus on eco-friendly, bio-based adhesives has increased, which is reflecting greatly on this market. The technological advancements in research and development activities and the resultant advancements in adhesives is also supporting the adoption of a variety of bioadhesives across the world. Going forward, the increasing entry of new vendors in this market is likely to back up its growth over the next few years.

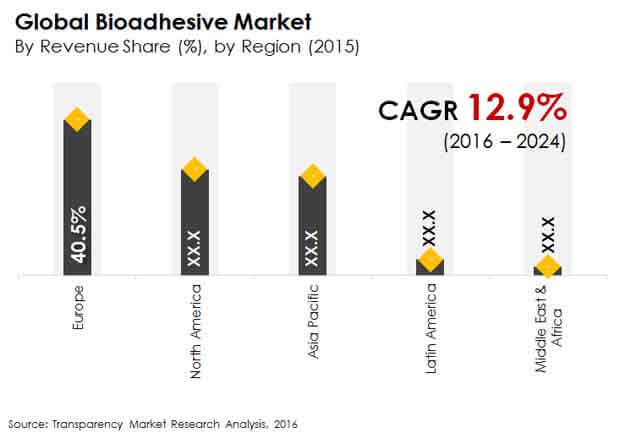

As per Transparency Market Research (TMR), the global market for bioadhesive, which stood at US$251.6 mn in 2015, is anticipated to rise at a healthy CAGR of 12.90% during the period from 2016 to 2024a and is projected to increase to US$736.0 mn by the end of 2024.

Demand for Animal-based Bioadhesives to Remain High

The global market for bioadhesives is broadly analyzed on the basis of the source and the end user. Based on the source, the market has been classified into plant-based bioadhesives and animal-based bioadhesives. Among the two, the animal-based bioadhesive segment led the global market in 2015 with a share of nearly 80%. Researchers expect it to continue like this over the forecast period as well on the ground of the rising utilization of these adhesives in the medical and healthcare industry for specialty applications, such as open surgeries and wound closures.

By the application, the market has been categorized into the paper and packaging, medical, personal care, wood works and furniture, and the construction industries. With a share of more than 30%, the paper and packaging industry surfaced as the leading consumer of a varied range of bioadhesives in 2015. Over the coming years, the industry is expected to continue as the key end user of bioadhesives, thanks to the steady rise in the global packaging industry.

Europe to Retain its Top Position

Geographically, the worldwide market for bioadhesives is led by Europe. In 2015, the European market accounted for more than 35% of the overall market, thanks to the increase in the construction activities. Over the forthcoming years, the regional market is likely to remain dominant on the grounds of the high demand for bioadhesives in several industries, such as construction, packaging, and wood works and furniture in this region. Germany is anticipated to emerge as the leading consumers of bioadhesives in Europe in the near future.

Apart from Europe, North America is also expected to display lucrative growth opportunities for the market for bioadhesives. The rising implementation of stringent norms and policies concerning the usage of petroleum-derived products in this region is likely to boost the North America market for bioadhesives in the years to come. The development of novel products with efficient adhesive properties is also projected to provide momentum to the North American market over the next few years.

Adhesives Research Inc., 3M Co., SCION, Adhbio, Bioadhesive Alliance Inc., Meredian Holdings Group Inc., Ecosynthetix Inc., Ashland, Cryolife Inc., and Henkel Corp. are some of the key players operating in the global bioadhesive market.

Healthcare Sector to Invite Numerous Growth Opportunities for the Bioadhesive Market

The bioadhesive market expects to gain promising growth across the assessment period of 2016-2024 on the back of the rising demand for eco-friendly products among a large chunk of the global populace. The rising restrictions imposed by the government bodies of numerous countries on petrochemical adhesives will bring good growth prospects from the bioadhesive market.

1. Preface

1.1. Report Scope and Market Segmentation

1.2. Research Highlights

2. Assumptions and Research Methodology

2.1. Assumptions and Acronyms Used

2.2. Research Methodology

3. Executive Summary

3.1. Market Size, Indicative (US$ Mn)

3.2. 3Top 3 Trends

4. Market Overview

4.1. Adhesives Overview

4.2. Key Industry Developments

4.3. Market Indicators

4.4. Drivers and Restraints Analysis

4.4.1. Drivers

4.4.2. Restraints

4.4.3. Opportunity Analysis

4.4.4. Opportunities

4.5. Global Bio-Adhesives Market Analysis and Forecast

4.6. Bio-Adhesives Market: Global Demand-Supply Scenario

4.7. Porter’s Analysis

4.7.1. Threat of Substitutes

4.7.2. Bargaining Power of Buyers

4.7.3. Bargaining Power of Suppliers

4.7.4. Threat of New Entrants

4.7.5. Degree of Competition

4.8. Value Chain Analysis

5. Bio-Adhesives Market Analysis, by Source

5.1. Key Findings

5.2. Introduction

5.3. Market Value Share Analysis

5.4. Bio-Adhesives Market Forecast, by Source

5.4.1. Animal based, 2015 – 2024

5.4.2. Plant based, 2015 – 2024

5.5. Comparison Matrix

5.6. Market Attractiveness Analysis

6. Bio-Adhesives Market Analysis, by End-User Industry

6.1. Key Findings

6.2. Introduction

6.3. Market Value Share Analysis

6.4. Bio-Adhesives Market Forecast, by End-User Industry

6.4.1. Packaging & Paper, 2015 – 2024

6.4.2. Construction, 2015 – 2024

6.4.3. Wood & Furniture, 2015 – 2024

6.4.4. Medical, 2015 – 2024

6.4.5. Personal Care, 2015 – 2024

6.4.6. Others, 2015 – 2024

6.5. Comparison Matrix

6.6. Market Attractiveness Analysis

7. Bio-Adhesives Market Analysis, by Region

7.1. Global Regulatory Scenario

7.2. Bio-Adhesives Market Value Share Analysis

7.3. Bio-Adhesives Market Forecast, by Region

7.3.1. North America

7.3.2. Europe

7.3.3. Asia Pacific

7.3.4. Latin America

7.3.5. Middle East & Africa

7.4. Market Attractiveness Analysis

7.5. Market Pricing Analysis, by Source

8. North America Bio-Adhesives Market Analysis

8.1. Key Findings

8.2. North America Bio-Adhesives Market Size and Volume Forecast, by Source

8.2.1. Animal based

8.2.2. Plant based

8.3. North America Bio-Adhesives Market Size and Volume Forecast, by End-User Industry

8.3.1. Packaging & Paper

8.3.2. Construction

8.3.3. Wood & Furniture

8.3.4. Medical

8.3.5. Personal Care

8.3.6. Others

8.4. North America Market Value Share Analysis, by Country

8.4.1. U.S.

8.4.2. Canada

8.5. North America Bio-Adhesives Market Forecast, by Country

8.6. North America Bio-Adhesives Market Attractiveness Analysis, by End-User Industry

9. Europe Bio-Adhesives Market Analysis

9.1. Key Findings

9.2. Europe Bio-Adhesives Market Size and Volume Forecast, by Source

9.2.1. Animal based

9.2.2. Plant based

9.3. Europe Bio-Adhesives Market Size and Volume Forecast, by End-User Industry

9.3.1. Packaging & Paper

9.3.2. Construction

9.3.3. Wood & Furniture

9.3.4. Medical

9.3.5. Personal Care

9.3.6. Others

9.4. Europe Market Value Share Analysis, by Country

9.4.1. France

9.4.2. U.K.

9.4.3. Spain

9.4.4. Germany

9.4.5. Italy

9.4.6. Rest of Europe

9.5. Europe Bio-Adhesives Market Forecast, by Country

9.6. Europe Bio-Adhesives Market Attractiveness Analysis, by End-User Industry

10. Asia Pacific Bio-Adhesives Market Analysis

10.1. Key Findings

10.2. Asia Pacific Bio-Adhesives Market Size and Volume Forecast, by Source

10.2.1. Animal based

10.2.2. Plant based

10.3. Asia Pacific Bio-Adhesives Market Size and Volume Forecast, by End-User Industry

10.3.1. Packaging & Paper

10.3.2. Construction

10.3.3. Wood & Furniture

10.3.4. Medical

10.3.5. Personal Care

10.3.6. Others

10.4. Asia Pacific Market Value Share Analysis, by Country

10.4.1. China

10.4.2. New Zealand

10.4.3. ASEAN

10.4.4. India

10.4.5. Rest of Asia Pacific

10.5. Asia Pacific Bio-Adhesives Market Forecast, by Country

10.6. Asia Pacific Bio-Adhesives Market Attractiveness Analysis, by End-User Industry

11. Latin America Bio-Adhesives Market Analysis

11.1. Key Findings

11.2. Latin America Bio-Adhesives Market Size and Volume Forecast, by Source

11.2.1. Animal based

11.2.2. Plant based

11.3. Latin America Bio-Adhesives Market Size and Volume Forecast, by End-User Industry

11.3.1. Packaging & Paper

11.3.2. Construction

11.3.3. Wood & Furniture

11.3.4. Medical

11.3.5. Personal Care

11.3.6. Others

11.4. Latin America Market Value Share Analysis, by Country

11.4.1. Brazil

11.4.2. Mexico

11.4.3. Rest of Latin America

11.5. Latin America Bio-Adhesives Market Forecast, by Country

11.6. Latin America Bio-Adhesives Market Attractiveness Analysis, by End-User Industry

12. Middle East & Africa Bio-Adhesives Market Analysis

12.1. Key Findings

12.2. Middle East & Africa Bio-Adhesives Market Size and Volume Forecast, by Source

12.2.1. Animal based

12.2.2. Plant based

12.3. Middle East & Africa Bio-Adhesives Market Size and Volume Forecast, by End-User Industry

12.3.1. Packaging & Paper

12.3.2. Construction

12.3.3. Wood & Furniture

12.3.4. Medical

12.3.5. Personal Care

12.3.6. Others

12.4. Middle East & Africa Market Value Share Analysis, by Country

12.4.1. GCC Countries

12.4.2. Egypt

12.4.3. South Africa

12.4.4. Rest of Middle East & Africa

12.5. Middle East & Africa Bio-Adhesives Market Forecast, by Country

12.6. Middle East & Africa Bio-Adhesives Market Attractiveness Analysis, by End-User Industry

13. Competition Landscape

13.1. Bio-Adhesives Market Share Analysis by Company (2015)

13.2. Competition Matrix

13.3. Company Profiles

13.3.1. Henkel Corporation

13.3.1.1. Company Description

13.3.1.2. Business Overview

13.3.1.3. SWOT Analysis

13.3.1.4. Financial Details

13.3.1.5. Strategic Overview

13.3.2. Cryolife Inc.

13.3.2.1. Company Description

13.3.2.2. Business Overview

13.3.2.3. SWOT Analysis

13.3.2.4. Financial Details

13.3.2.5. Strategic Overview

13.3.3. Ashland

13.3.3.1. Company Description

13.3.3.2. Business Overview

13.3.3.3. SWOT Analysis

13.3.3.4. Financial Details

13.3.3.5. Strategic Overview

13.3.4. Ecosynthetix Inc.

13.3.4.1. Company Description

13.3.4.2. Business Overview

13.3.4.3. SWOT Analysis

13.3.4.4. Financial Details

13.3.4.5. Strategic Overview

13.3.5. Meredian Holdings Group Inc.

13.3.5.1. Company Description

13.3.5.2. Business Overview

13.3.5.3. Strategic Overview

13.3.6. Bioadhesive Alliance Inc.

13.3.6.1. Company Description

13.3.6.2. Strategic Overview

13.3.7. Adhbio

13.3.7.1. Company Description

13.3.7.2. Business Overview

13.3.7.3. Strategic Overview

13.3.8. SCION

13.3.8.1. Company Description

13.3.8.2. Business Overview

13.3.8.3. Strategic Overview

13.3.9. 3M Company

13.3.9.1. Company Description

13.3.9.2. Business Overview

13.3.9.3. Strategic Overview

13.3.10. Adhesives Research Inc.

13.3.10.1. Company Description

13.3.10.2. Business Overview

13.3.10.3. Strategic Overview

14. Key Takeaways

List of Tables

Table 1: Global Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Source, 2015–2024

Table 2: Global Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-user Industry, 2015–2024

Table 3: Global Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Region, 2015–2024

Table 4: North America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Source, 2015–2024

Table 5: North America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-User Industry, 2015–2024

Table 6: North America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 7: Europe Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Source, 2015–2024

Table 8: Europe Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-User Industry, 2015–2024

Table 9: Europe Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 10: Asia Pacific Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Source, 2015–2024

Table 11: Asia Pacific Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-User Industry, 2015–2024

Table 12: Asia Pacific Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 13: Latin America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Source, 2015–2024

Table 14: Latin America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-User Industry, 2015–2024

Table 15: Latin America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

Table 16: Middle East & Africa Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Source, 2015–2024

Table 17: Middle East & Africa Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by End-User Industry,

Table 18: Middle East & Africa Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, by Country, 2015–2024

List of Figures

Figure 1: Global Bioadhesive market

Figure 2: Global Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 3: Global Bioadhesive Average Prices (US$/ton), 2015–2024

Figure 4: Global Bioadhesive market Value Share Analysis, by Source, 2015 and 2024

Figure 5: Bioadhesive market for Plant based Bioadhesive

Figure 6: Bioadhesive market for Animal based Bioadhesive

Figure 7: Global Bioadhesive market Attractiveness Analysis, by Source

Figure 8: Global Bioadhesive market Value Share Analysis, by End-user Industry, 2015 and 2024

Figure 9: Bioadhesive market for paper & packaging

Figure 10: Bioadhesive market for Construction

Figure 11: Bioadhesive market for wood works & furniture Works

Figure 12: Bioadhesive market for Medical

Figure 13: Bioadhesive market for Personal Care

Figure 14: Bioadhesive market for Others

Figure 15: Bioadhesive market Attractiveness Analysis, by End-user Industry

Figure 16: Global Bioadhesive market Value Share Analysis, by Region, 2015 and 2024

Figure 17: Global Bioadhesive market Attractiveness Analysis, by Region

Figure 18: Prices of Bioadhesive, by Source, US$/Ton, 2015–2024

Figure 19: North America Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast,

Figure 20: North America Bioadhesive market Size and Volume Y-o-Y Growth Projection,

Figure 21: North America Market Attractiveness Analysis, by Country

Figure 22: North America Market Value Share Analysis, by Source, 2015 and 2024

Figure 23: North America Market Value Share Analysis, by End-User Industry, 2015 and 2024

Figure 24: North America Market Value Share Analysis, by Country, 2015 and 2024

Figure 25: North America Market Attractiveness Analysis, by end-user, 2015

Figure 26: Europe Bioadhesive market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 27: Europe Bioadhesive market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 28: Europe Market Attractiveness Analysis, by Country

Figure 29: Europe Market Value Share Analysis, by Source, 2015 and 2024

Figure 30: Europe Market Value Share Analysis, by End-User Industry, 2015 and 2024

Figure 31: Europe Market Value Share Analysis, by Country, 2015 and 2024

Figure 32: Europe Bioadhesive market Attractiveness Analysis, by end-user, 2015

Figure 33: Asia Pacific Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 34: Asia Pacific Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 35: Asia Pacific Market Attractiveness Analysis, by Country

Figure 36: Asia Pacific Market Value Share Analysis, by Source, 2015 and 2024

Figure 37: Asia Pacific Market Value Share Analysis, by End-User Industry, 2015 and 2024

Figure 38: Asia Pacific Market Value Share Analysis, by Country, 2015 and 2024

Figure 39: Asia Pacific Market Attractiveness Analysis, by End User, 2015

Figure 40: Latin America Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 41: Latin America Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 42: Latin America Market Attractiveness Analysis, by Country

Figure 43: Latin America Market Value Share Analysis, by Source, 2015 and 2024

Figure 44: Latin America Market Value Share Analysis, by End-User Industry, 2015 and 2024

Figure 45: Latin America Market Value Share Analysis, by Country, 2015 and 2024

Figure 46: Latin America Market Attractiveness Analysis, by Application, 2015

Figure 47: Middle East & Africa Market Size (US$ Mn) and Volume (Kilo Tons) Forecast, 2015–2024

Figure 48: Middle East & Africa Market Size and Volume Y-o-Y Growth Projection, 2015–2024

Figure 49: Middle East & Africa Market Attractiveness Analysis, by Country

Figure 50: Middle East & Africa Market Value Share Analysis, by Source, 2015 and 2024

Figure 51: Middle East & Africa Market Value Share Analysis, by End-User Industry, 2015 and 2024

Figure 52: Middle East & Africa Market Value Share Analysis, by Country, 2015 and 2024

Figure 53: Middle East & Africa Market Attractiveness Analysis, by end-user, 2015

Figure 54: Global Paraxylene Market Share Analysis By Company (2015)