Analysts’ Viewpoint on Market Scenario

The automotive industry is being driven consistently by developments in emerging markets, rapid pace of innovation in technology, digitization, automation, and introduction of new business models that have disrupted the automotive sector.

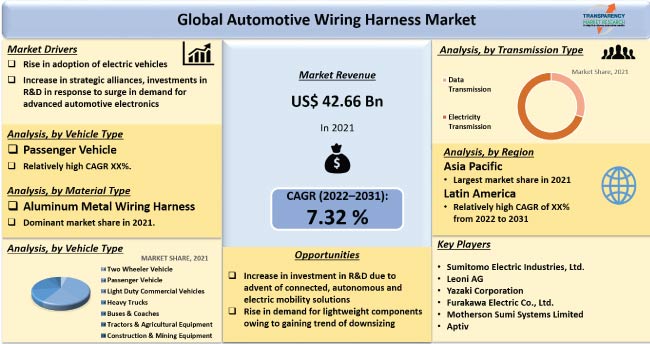

Robust development in automotive electronics owing to increasing data processing requirement in vehicles and adoption of cutting-edge safety technologies are propelling the automotive wiring harness market. Advancements in electric vehicles are increasing the complexity in the automotive wiring harness.

Increase in adoption of EVs and rise in demand for safer in-vehicle power transmission are significant factors driving the wiring harness market. High number of accidents related to failure of high-power electric equipment in electric vehicles are being observed, which in turn is prompting automotive wiring harness manufacturers to develop heat resistant and light-weight material applications for wiring harness in order to boost revenues and expand their customer base globally.

Wiring harnesses are compactly bundled wires and data circuits that function as the central nervous system of a vehicle. Automobiles are equipped with several electronic systems that operate using control signals running on electrical power supplied from the battery to ensure safety and basic functions (moving, turning and stopping) as well as provide comfort and convenience.

Vehicle wire harness acts as the conduit for the transmission of these signals and electrical power. The automotive cable harness is designed as per the dimensional requirement of automobiles, and it is integrated to connect different parts of vehicle such as engine, body, dashboard, chassis and the others.

Car wiring loom kits comprise connectors, Ethernet cables, and wires that transmit power to all electronic components and devices such as wipers, ignition, and lights. The entire electrical system depends on the wiring harness, as wires drive all the electrical operations of the automobile.

Increase in the global automotive wiring harness market size can be attributed to the rapid growth and development of electrification trend in the global automobile industry and heavy investments in advanced vehicle safety features.

Increasing demand for in-vehicle infotainment and advancement in vehicle technology is further driving the market. Stringent government regulations associated with the electric vehicle battery cells, onboard chargers, designs of the battery pack, and thermal propagation are anticipated to offer the significant growth opportunity for the market.

Request a sample to get extensive insights into the Market

Governments across the globe are promoting the adoption of electric vehicles by offering subsidies and tax relaxations. Rising tailpipe emissions and awareness about the environment is fueling the demand for electric vehicles. Use of automotive electric harness improves fuel efficiency and enhances performance. Application of internet and digitization has been increasing in automobiles, which has fueled the demand for automotive wire harness connectors and terminals.

Furthermore, the demand for SUVs and MPVs has drastically increased across the globe. Increasing millennial population and increased demand for sporty and advanced featured cars, thereby driving the market.

The novel trend of electrification has several benefits and challenges as well. The important challenge, such as rise in accidents caused by automation faults has gained an attention of automakers and governments, which in turn has increased focus on manufacturers to introduce robust and advanced safety features in the various types of connectors used in automotive wiring harness.

The elimination of risk of shorting is anticipated to bolster the demand for high temperature resistant automotive wire harness tapes. Key players are entering into strategic collaborations to tackle the challenges and capture the market by grasping earlier opportunities.

For instance, DriveElectric has signed a transformative deal with Sumitomo Corporation, and the alliance is intended to cater its products and services to cater the increasing demand for electric vehicles in the U.K. In July 2021, Yazaki India Private Limited, a subsidiary of Yazaki Corporation Japan confirmed the news of setting up a wire harnessing manufacturing plant in Manipur, India.

In terms of vehicle type, the passenger cars segment is estimated to hold majority share of the global automotive wiring harness market. Increased demand for SUVs and MPVs is estimated to boost the demand for car wiring kits significantly.

Increase in disposable income of people around the world, development in road infrastructure and connectivity are important factors dominating the growth of passenger vehicle sales across the globe. High competition among automakers has prompted them to introduce well featured cars and automotive custom wiring harnesses at affordable prices.

Rise in number of youth consumers and availability of infotainment, navigation and cutting-edge safety features in the modern cars have attracted the attention of consumers. Advancements in in-vehicle technologies are expected to foster the development of automotive secondary wiring harness and robust car battery harnesses in the near future.

Downsizing of components is a recent trend witnessed in the automobile industry. Demand for weight reduction of parts has been significantly strong owing to increased environmental awareness in the last few years. At the same time, there have been constant concerns about resource depletion and the spontaneous rise in the price of copper.

Aluminum is a highly suitable alternative material to copper. Manufacturers have focused their attention on aluminum because of its light weight, its moderate price, and abundant availability. Several OEMs are using aluminum alloy as a conductor material in the wiring harness, which leads to weight reduction of wiring harness by almost 15% to 20% (depending on the application or the extent of the implementation).

Asia Pacific is projected to hold a dominant share of the global market. The region is home to prominent automobile industries in China, India, Japan, and South Korea. China is all set to dominate the global automotive wiring harness market during the forecast period. China has been the world’s largest automotive manufacturing country since 2009. It accounts for around 30% of total global vehicle production.

China has surpassed the production capacity of European Union, the United States and Japan combined. China is also the leading nation in the production and sales of electric vehicles. Surge in electrification in conventional vehicles and rate of adoption of electrical vehicles is anticipated to significantly propel the market in China during the forecast period.

Europe is likely to follow Asia Pacific in terms of revenue share of the global automotive wiring harness market. Europe is witnessing a rise in adoption of electric vehicles. The European Union has a target of sale electric cars only by 2035 to reduce emissions.

North America holds a significant share of the global market owing to high demand for passenger and commercial vehicles in the region. The U.S government has major plans regarding net zero carbon emissions and supporting electrification and hybridization of EVs, which in turn is estimated to fuel the automotive wiring harness market in the region.

The global automotive wiring harness market is fragmented with a higher number of players controlling major market share and key companies possessing the potential to increase the pace of growth by the way of adoption of newer technologies. Expansion of product portfolios and mergers and acquisitions are major strategies adopted by prominent players.

Some of the key players identified in the automotive wiring harness market across the globe are Motherson Sumi Systems Limited, Aptiv, Borg Warner Inc., Continental AG, CTS Corporation, DENSO Corporation, Dhoot Transmission, Furakawa Electric Co., Ltd., Hella GmbH & Co., KGaA, Hitachi Ltd., Johnson Electric, Lear Corporation, Leoni AG, MAHLE GmbH, Mitusbishi Corporation, Nidec Motors & Actuators, Robert Bosch GmbH, Robertshaw Controls Pvt. Ltd., Spark Minda, Sumitomo Electric Industries Ltd., THB Group, Valeo, WABCO, and Yazaki Corporation.

Request a custom report on Automotive Wiring Harness Market

Each of these players has been profile in the automotive wiring harness market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 42.66 Bn |

|

Market Forecast Value in 2031 |

US$ 86.46 Bn |

|

Growth Rate (CAGR) |

7.32% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market is valued at US$ 42.66 billion in 2021

The market has expected to expand at a CAGR of 7.32% by 2031.

The industry would be worth US$ 86.46 billion in 2031.

Increasing trend of electrification and vehicle autonomy is driving the market

The passenger vehicle segment accounts for nearly 80% share of the market.

Asia Pacific is anticipated to be the highly lucrative region of the global automotive wiring harness market.

Motherson Sumi Systems Limited, Aptiv, Borg Warner Inc., Continental AG, CTS Corporation, DENSO Corporation, Dhoot Transmission, Furakawa Electric Co., Ltd., Hella GmbH & Co., KGaA, Hitachi Ltd., Johnson Electric, Lear Corporation, Leoni AG, MAHLE GmbH, Mitusbishi Corporation, Nidec Motors & Actuators, Robert Bosch GmbH, Robertshaw Controls Pvt. Ltd., Spark Minda, Sumitomo Electric Industries Ltd., THB Group, Valeo, WABCO, Yazaki Corporation.

1. Preface

1.1. Market Segmentation

1.2. Key Research Objectives

1.3. Report Assumptions

1.4. Research Methodology

1.4.1. Primary Research and List of Primary Sources

1.4.1.1. Sampling Techniques & Data Collection Methods

1.4.1.2. Primary Participants

1.4.2. Desk Research

1.4.2.1. Key Secondary Sources

1.4.2.2. Data from Secondary Sources

2. Global Automotive Wiring Harness Market - Executive Summary

2.1. Market Size, US$ Bn, 2017-2031

2.2. Market Analysis and Key Segment Analysis

2.3. TMR Analysis and Recommendations

3. Premium Insights

3.1. Market Attractiveness Opportunity

3.2. Key Trend Analysis

3.2.1. Product Trend

3.2.2. Industry Trend

3.3. Supply-Demand Scenario

3.3.1. Supply Side Analysis

3.3.2. Demand Trend Analysis

3.4. OEM Vs Aftermarket – Automotive Wiring Harness Analysis

3.5. Competitive Scenario & Trends

3.5.1. Market Concentration Rate

3.5.2. List of Emerging, Leading Players

3.5.3. Merger & Acquisition, Expansion

3.6. Automotive Wiring Harness Market: COVID-19 Impact

4. Market Overview

4.1. Macro-economic Factors

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunity

4.3. Market Factor Analysis

4.3.1. Porter’s Five Force Analysis

4.3.2. PESTEL Analysis

4.3.3. Value Chain Analysis

4.3.3.1. List of Key Manufacturers

4.3.3.2. List of Customers

4.3.3.3. Level of Integration

4.3.4. SWOT Analysis

4.4. Key Regulations by Regions

4.5. Technology Roadmap

4.6. Impact Analysis of Automotive Wiring Harness Market due to:

4.6.1. 48 V Architecture

4.6.2. Electrification in vehicles

4.6.3. Introduction of Electric

4.6.4. Introduction of Semiautonomous and Autonomous Vehicle

4.7. Automotive Wiring Harness Market - Technological Impact

4.7.1. Impact of technology on Automotive Wiring Harness

4.8. Automotive Wiring Harness Market – Advancement in Materials

4.8.1. Changes in Material

4.8.2. Pricing analysis of materials

4.8.2.1. Metal

4.8.2.2. Optical Fiber

5. Global Automotive Wiring Harness Market, Vehicle Type

5.1. Market Snapshot

5.1.1. Introduction & Definition

5.1.2. Market Growth & Y-o-Y Projections

5.1.3. Base Point Share Analysis

5.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Vehicle Type

5.2.1. Two Wheeler Vehicle

5.2.2. Passenger Vehicle

5.2.2.1. Hatchback

5.2.2.2. Sedan

5.2.2.3. Utility Vehicles

5.2.3. Light Duty Commercial Vehicles

5.2.4. Heavy Trucks

5.2.5. Buses & Coaches

5.2.6. Tractors & Agricultural Equipment

5.2.7. Construction & Mining Equipment

6. Global Automotive Wiring Harness Market, Application

6.1. Market Snapshot

6.1.1. Introduction & Definition

6.1.2. Market Growth & Y-o-Y Projections

6.1.3. Base Point Share Analysis

6.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Application

6.2.1. Engine Harness

6.2.2. Chassis Automotive Wiring Harness

6.2.3. Body & Lighting Harness

6.2.4. HVAC Automotive Wiring Harness

6.2.5. Dashboard/ Cabin Harness

6.2.6. Battery Automotive Wiring Harness

6.2.7. Seat Automotive Wiring Harness

6.2.8. Sunroof Automotive Wiring Harness

6.2.9. Door Automotive Wiring Harness

7. Global Automotive Wiring Harness Market, Material Type

7.1. Market Snapshot

7.1.1. Introduction & Definition

7.1.2. Market Growth & Y-o-Y Projections

7.1.3. Base Point Share Analysis

7.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Material Type

7.2.1. Metallic

7.2.1.1. Copper

7.2.1.2. Aluminum

7.2.1.3. Other Metals

7.2.2. Optical Fiber

7.2.2.1. Plastic Optical Fiber

7.2.2.2. Glass Optical Fiber

8. Global Automotive Wiring Harness Market, Sales Channel

8.1. Market Snapshot

8.1.1. Introduction & Definition

8.1.2. Market Growth & Y-o-Y Projections

8.1.3. Base Point Share Analysis

8.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Sales Channel

8.2.1. OEM

8.2.2. Aftermarket

9. Global Automotive Wiring Harness Market, Category

9.1. Market Snapshot

9.1.1. Introduction & Definition

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Category

9.2.1. General Wires

9.2.2. Heat Resistant Wires

9.2.3. Shielded Wires

9.2.4. Tubed Wires

10. Global Automotive Wiring Harness Market, Electric Vehicle Type

10.1. Market Snapshot

10.1.1. Introduction & Definition

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Electric Vehicle Type

10.2.1. Battery Electric Vehicle

10.2.2. Plug-in Hybrid Electric Vehicle

10.2.3. Hybrid Electric Vehicle

11. Global Automotive Wiring Harness Market, by Transmission

11.1. Market Snapshot

11.1.1. Introduction & Definition

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

11.2.1. Data Transmission

11.2.2. Electricity Transmission

12. Global Automotive Wiring Harness Market, by Region

12.1. Market Snapshot

12.1.1. Market Growth & Y-o-Y Projections

12.1.2. Base Point Share Analysis

12.2. Global Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Region

12.2.1. North America

12.2.2. Latin America

12.2.3. Europe

12.2.4. Asia Pacific

12.2.5. Middle East & Africa

13. North America Automotive Wiring Harness Market Analysis & Forecast, 2017-2031

13.1. North America Market Snapshot

13.1.1. Market Growth & Y-o-Y Projections

13.1.2. Base Point Share Analysis

13.2. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Vehicle Type

13.2.1. Two Wheeler Vehicle

13.2.2. Passenger Vehicle

13.2.2.1. Hatchback

13.2.2.2. Sedan

13.2.2.3. Utility Vehicles

13.2.3. Light Duty Commercial Vehicles

13.2.4. Heavy Trucks

13.2.5. Buses & Coaches

13.2.6. Tractors & Agricultural Equipment

13.2.7. Construction & Mining Equipment

13.3. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Application

13.3.1. Engine Harness

13.3.2. Chassis Automotive Wiring Harness

13.3.3. Body & Lighting Harness

13.3.4. HVAC Automotive Wiring Harness

13.3.5. Dashboard/ Cabin Harness

13.3.6. Battery Automotive Wiring Harness

13.3.7. Seat Automotive Wiring Harness

13.3.8. Sunroof Automotive Wiring Harness

13.3.9. Door Automotive Wiring Harness

13.4. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Material Type

13.4.1. Metallic

13.4.1.1. Copper

13.4.1.2. Aluminum

13.4.1.3. Other Metals

13.4.2. Optical Fiber

13.4.2.1. Plastic Optical Fiber

13.4.2.2. Glass Optical Fiber

13.5. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Sales Channel

13.5.1. OEM

13.5.2. Aftermarket

13.6. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Category

13.6.1. General Wires

13.6.2. Heat Resistant Wires

13.6.3. Shielded Wires

13.6.4. Tubed Wires

13.7. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Electric Vehicle Type

13.7.1. Battery Electric Vehicle

13.7.2. Plug-in Hybrid Electric Vehicle

13.7.3. Hybrid Electric Vehicle

13.8. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

13.8.1. Data Transmission

13.8.2. Electricity Transmission

13.9. North America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

13.9.1. U. S.

13.9.2. Canada

14. Latin America Automotive Wiring Harness Market Analysis & Forecast, 2017-2031

14.1. Latin America Market Snapshot

14.1.1. Market Growth & Y-o-Y Projections

14.1.2. Base Point Share Analysis

14.2. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Vehicle Type

14.2.1. Two Wheeler Vehicle

14.2.2. Passenger Vehicle

14.2.2.1. Hatchback

14.2.2.2. Sedan

14.2.2.3. Utility Vehicles

14.2.3. Light Duty Commercial Vehicles

14.2.4. Heavy Trucks

14.2.5. Buses & Coaches

14.2.6. Tractors & Agricultural Equipment

14.2.7. Construction & Mining Equipment

14.3. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Application

14.3.1. Engine Harness

14.3.2. Chassis Automotive Wiring Harness

14.3.3. Body & Lighting Harness

14.3.4. HVAC Automotive Wiring Harness

14.3.5. Dashboard/ Cabin Harness

14.3.6. Battery Automotive Wiring Harness

14.3.7. Seat Automotive Wiring Harness

14.3.8. Sunroof Automotive Wiring Harness

14.3.9. Door Automotive Wiring Harness

14.4. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Material Type

14.4.1. Metallic

14.4.1.1. Copper

14.4.1.2. Aluminum

14.4.1.3. Other Metals

14.4.2. Optical Fiber

14.4.2.1. Plastic Optical Fiber

14.4.2.2. Glass Optical Fiber

14.5. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Sales Channel

14.5.1. OEM

14.5.2. Aftermarket

14.6. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Category

14.6.1. General Wires

14.6.2. Heat Resistant Wires

14.6.3. Shielded Wires

14.6.4. Tubed Wires

14.7. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Electric Vehicle Type

14.7.1. Battery Electric Vehicle

14.7.2. Plug-in Hybrid Electric Vehicle

14.7.3. Hybrid Electric Vehicle

14.8. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

14.8.1. Data Transmission

14.8.2. Electricity Transmission

14.9. Latin America Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

14.9.1. Brazil

14.9.2. Mexico

14.9.3. Rest of Latin America

15. Europe Automotive Wiring Harness Market Analysis & Forecast, 2017-2031

15.1. Europe Market Snapshot

15.1.1. Market Growth & Y-o-Y Projections

15.1.2. Base Point Share Analysis

15.2. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Vehicle Type

15.2.1. Two Wheeler Vehicle

15.2.2. Passenger Vehicle

15.2.2.1. Hatchback

15.2.2.2. Sedan

15.2.2.3. Utility Vehicles

15.2.3. Light Duty Commercial Vehicles

15.2.4. Heavy Trucks

15.2.5. Buses & Coaches

15.2.6. Tractors & Agricultural Equipment

15.2.7. Construction & Mining Equipment

15.3. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Application

15.3.1. Engine Harness

15.3.2. Chassis Automotive Wiring Harness

15.3.3. Body & Lighting Harness

15.3.4. HVAC Automotive Wiring Harness

15.3.5. Dashboard/ Cabin Harness

15.3.6. Battery Automotive Wiring Harness

15.3.7. Seat Automotive Wiring Harness

15.3.8. Sunroof Automotive Wiring Harness

15.3.9. Door Automotive Wiring Harness

15.4. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Material Type

15.4.1. Metallic

15.4.1.1. Copper

15.4.1.2. Aluminum

15.4.1.3. Other Metals

15.4.2. Optical Fiber

15.4.2.1. Plastic Optical Fiber

15.4.2.2. Glass Optical Fiber

15.5. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Sales Channel

15.5.1. OEM

15.5.2. Aftermarket

15.6. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Category

15.6.1. General Wires

15.6.2. Heat Resistant Wires

15.6.3. Shielded Wires

15.6.4. Tubed Wires

15.7. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Electric Vehicle Type

15.7.1. Battery Electric Vehicle

15.7.2. Plug-in Hybrid Electric Vehicle

15.7.3. Hybrid Electric Vehicle

15.8. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

15.8.1. Data Transmission

15.8.2. Electricity Transmission

15.9. Europe Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

15.9.1. Germany

15.9.2. U. K.

15.9.3. France

15.9.4. Italy

15.9.5. Spain

15.9.6. Rest of Europe

16. Asia Pacific Automotive Wiring Harness Market Analysis & Forecast, 2017-2031

16.1. Asia Pacific Market Snapshot

16.1.1. Market Growth & Y-o-Y Projections

16.1.2. Base Point Share Analysis

16.2. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Vehicle Type

16.2.1. Two Wheeler Vehicle

16.2.2. Passenger Vehicle

16.2.2.1. Hatchback

16.2.2.2. Sedan

16.2.2.3. Utility Vehicles

16.2.3. Light Duty Commercial Vehicles

16.2.4. Heavy Trucks

16.2.5. Buses & Coaches

16.2.6. Tractors & Agricultural Equipment

16.2.7. Construction & Mining Equipment

16.3. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Application

16.3.1. Engine Harness

16.3.2. Chassis Automotive Wiring Harness

16.3.3. Body & Lighting Harness

16.3.4. HVAC Automotive Wiring Harness

16.3.5. Dashboard/ Cabin Harness

16.3.6. Battery Automotive Wiring Harness

16.3.7. Seat Automotive Wiring Harness

16.3.8. Sunroof Automotive Wiring Harness

16.3.9. Door Automotive Wiring Harness

16.4. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Material Type

16.4.1. Metallic

16.4.1.1. Copper

16.4.1.2. Aluminum

16.4.1.3. Other Metals

16.4.2. Optical Fiber

16.4.2.1. Plastic Optical Fiber

16.4.2.2. Glass Optical Fiber

16.5. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Sales Channel

16.5.1. OEM

16.5.2. Aftermarket

16.6. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Category

16.6.1. General Wires

16.6.2. Heat Resistant Wires

16.6.3. Shielded Wires

16.6.4. Tubed Wires

16.7. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Electric Vehicle Type

16.7.1. Battery Electric Vehicle

16.7.2. Plug-in Hybrid Electric Vehicle

16.7.3. Hybrid Electric Vehicle

16.8. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

16.8.1. Data Transmission

16.8.2. Electricity Transmission

16.9. Asia Pacific Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

16.9.1. China

16.9.2. India

16.9.3. Japan

16.9.4. South Korea

16.9.5. ASEAN

16.9.6. Rest of Asia Pacific

17. Middle East & Africa Automotive Wiring Harness Market Analysis & Forecast, 2017-2031

17.1. Middle East & Africa Market Snapshot

17.1.1. Market Growth & Y-o-Y Projections

17.1.2. Base Point Share Analysis

17.2. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Vehicle Type

17.2.1. Two Wheeler Vehicle

17.2.2. Passenger Vehicle

17.2.2.1. Hatchback

17.2.2.2. Sedan

17.2.2.3. Utility Vehicles

17.2.3. Light Duty Commercial Vehicles

17.2.4. Heavy Trucks

17.2.5. Buses & Coaches

17.2.6. Tractors & Agricultural Equipment

17.2.7. Construction & Mining Equipment

17.3. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Application

17.3.1. Engine Harness

17.3.2. Chassis Automotive Wiring Harness

17.3.3. Body & Lighting Harness

17.3.4. HVAC Automotive Wiring Harness

17.3.5. Dashboard/ Cabin Harness

17.3.6. Battery Automotive Wiring Harness

17.3.7. Seat Automotive Wiring Harness

17.3.8. Sunroof Automotive Wiring Harness

17.3.9. Door Automotive Wiring Harness

17.4. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Material Type

17.4.1. Metallic

17.4.1.1. Copper

17.4.1.2. Aluminum

17.4.1.3. Other Metals

17.4.2. Optical Fiber

17.4.2.1. Plastic Optical Fiber

17.4.2.2. Glass Optical Fiber

17.5. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Sales Channel

17.5.1. OEM

17.5.2. Aftermarket

17.6. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Category

17.6.1. General Wires

17.6.2. Heat Resistant Wires

17.6.3. Shielded Wires

17.6.4. Tubed Wires

17.7. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, Electric Vehicle Type

17.7.1. Battery Electric Vehicle

17.7.2. Plug-in Hybrid Electric Vehicle

17.7.3. Hybrid Electric Vehicle

17.8. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Transmission

17.8.1. Data Transmission

17.8.2. Electricity Transmission

17.9. Middle East & Africa Market Value (US$ Bn) Analysis & Forecast, 2017-2031, by Country

17.9.1. GCC

17.9.2. South Africa

17.9.3. Rest of Middle East & Africa

18. Competition Assessment

18.1. Global Target Market Competition - a Dashboard View

18.2. Global Target Market Structure Analysis

18.3. Global Target Market Company Share Analysis

18.3.1. For Tier 1 Market Players, 2021

19. Company Profile

19.1. Motherson Sumi Systems Limited

19.1.1. Company Overview

19.1.2. Product Portfolio

19.1.3. Strategy Overview

19.1.4. Recent Developments

19.1.5. Financial Analysis

19.1.6. Revenue Share

19.1.7. Executive Bios

19.2. Aptiv

19.2.1. Company Overview

19.2.2. Product Portfolio

19.2.3. Strategy Overview

19.2.4. Recent Developments

19.2.5. Financial Analysis

19.2.6. Revenue Share

19.2.7. Executive Bios

19.3. Borg Warner Inc.

19.3.1. Company Overview

19.3.2. Product Portfolio

19.3.3. Strategy Overview

19.3.4. Recent Developments

19.3.5. Financial Analysis

19.3.6. Revenue Share

19.3.7. Executive Bios

19.4. Continental AG

19.4.1. Company Overview

19.4.2. Product Portfolio

19.4.3. Strategy Overview

19.4.4. Recent Developments

19.4.5. Financial Analysis

19.4.6. Revenue Share

19.4.7. Executive Bios

19.5. CTS Corporation

19.5.1. Company Overview

19.5.2. Product Portfolio

19.5.3. Strategy Overview

19.5.4. Recent Developments

19.5.5. Financial Analysis

19.5.6. Revenue Share

19.5.7. Executive Bios

19.6. DENSO Corporation

19.6.1. Company Overview

19.6.2. Product Portfolio

19.6.3. Strategy Overview

19.6.4. Recent Developments

19.6.5. Financial Analysis

19.6.6. Revenue Share

19.6.7. Executive Bios

19.7. Dhoot Transmission

19.7.1. Company Overview

19.7.2. Product Portfolio

19.7.3. Strategy Overview

19.7.4. Recent Developments

19.7.5. Financial Analysis

19.7.6. Revenue Share

19.7.7. Executive Bios

19.8. Furakawa Electric Co., Ltd.

19.8.1. Company Overview

19.8.2. Product Portfolio

19.8.3. Strategy Overview

19.8.4. Recent Developments

19.8.5. Financial Analysis

19.8.6. Revenue Share

19.8.7. Executive Bios

19.9. Hella GmbH & Co., KGaA

19.9.1. Company Overview

19.9.2. Product Portfolio

19.9.3. Strategy Overview

19.9.4. Recent Developments

19.9.5. Financial Analysis

19.9.6. Revenue Share

19.9.7. Executive Bios

19.10. Hitachi Ltd.

19.10.1. Company Overview

19.10.2. Product Portfolio

19.10.3. Strategy Overview

19.10.4. Recent Developments

19.10.5. Financial Analysis

19.10.6. Revenue Share

19.10.7. Executive Bios

19.11. Johnson Electric

19.11.1. Company Overview

19.11.2. Product Portfolio

19.11.3. Strategy Overview

19.11.4. Recent Developments

19.11.5. Financial Analysis

19.11.6. Revenue Share

19.11.7. Executive Bios

19.12. Lear Corporation

19.12.1. Company Overview

19.12.2. Product Portfolio

19.12.3. Strategy Overview

19.12.4. Recent Developments

19.12.5. Financial Analysis

19.12.6. Revenue Share

19.12.7. Executive Bios

19.13. Leoni AG

19.13.1. Company Overview

19.13.2. Product Portfolio

19.13.3. Strategy Overview

19.13.4. Recent Developments

19.13.5. Financial Analysis

19.13.6. Revenue Share

19.13.7. Executive Bios

19.14. MAHLE GmbH

19.14.1. Company Overview

19.14.2. Product Portfolio

19.14.3. Strategy Overview

19.14.4. Recent Developments

19.14.5. Financial Analysis

19.14.6. Revenue Share

19.14.7. Executive Bios

19.15. Mitusbishi Corporation

19.15.1. Company Overview

19.15.2. Product Portfolio

19.15.3. Strategy Overview

19.15.4. Recent Developments

19.15.5. Financial Analysis

19.15.6. Revenue Share

19.15.7. Executive Bios

19.16. Nidec Motors & Actuators

19.16.1. Company Overview

19.16.2. Product Portfolio

19.16.3. Strategy Overview

19.16.4. Recent Developments

19.16.5. Financial Analysis

19.16.6. Revenue Share

19.16.7. Executive Bios

19.17. Robert Bosch GmbH

19.17.1. Company Overview

19.17.2. Product Portfolio

19.17.3. Strategy Overview

19.17.4. Recent Developments

19.17.5. Financial Analysis

19.17.6. Revenue Share

19.17.7. Executive Bios

19.18. Robertshaw Controls Pvt. Ltd.

19.18.1. Company Overview

19.18.2. Product Portfolio

19.18.3. Strategy Overview

19.18.4. Recent Developments

19.18.5. Financial Analysis

19.18.6. Revenue Share

19.18.7. Executive Bios

19.19. Spark Minda

19.19.1. Company Overview

19.19.2. Product Portfolio

19.19.3. Strategy Overview

19.19.4. Recent Developments

19.19.5. Financial Analysis

19.19.6. Revenue Share

19.19.7. Executive Bios

19.20. Sumitomo Electric Industries, Ltd.

19.20.1. Company Overview

19.20.2. Product Portfolio

19.20.3. Strategy Overview

19.20.4. Recent Developments

19.20.5. Financial Analysis

19.20.6. Revenue Share

19.20.7. Executive Bios

19.21. THB Group

19.21.1. Company Overview

19.21.2. Product Portfolio

19.21.3. Strategy Overview

19.21.4. Recent Developments

19.21.5. Financial Analysis

19.21.6. Revenue Share

19.21.7. Executive Bios

19.22. Valeo

19.22.1. Company Overview

19.22.2. Product Portfolio

19.22.3. Strategy Overview

19.22.4. Recent Developments

19.22.5. Financial Analysis

19.22.6. Revenue Share

19.22.7. Executive Bios

19.23. WABCO

19.23.1. Company Overview

19.23.2. Product Portfolio

19.23.3. Strategy Overview

19.23.4. Recent Developments

19.23.5. Financial Analysis

19.23.6. Revenue Share

19.23.7. Executive Bios

19.24. Yazaki Corporation

19.24.1. Company Overview

19.24.2. Product Portfolio

19.24.3. Strategy Overview

19.24.4. Recent Developments

19.24.5. Financial Analysis

19.24.6. Revenue Share

19.24.7. Executive Bios

List of Tables

Table 1: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 2: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 3: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Material Type, 2017-2031

Table 4: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 5: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Category, 2017-2031

Table 6: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 7: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Transmission 2017-2031

Table 8: Global Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Region, 2017-2031

Table 9: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 10: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 11: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Material Type, 2017-2031

Table 12: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 13: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Category, 2017-2031

Table 14: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 15: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Transmission 2017-2031

Table 16: North America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 17: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 18: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 19: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Material Type, 2017-2031

Table 20: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 21: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Category, 2017-2031

Table 22: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 23: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Transmission 2017-2031

Table 24: Europe Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 25: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 26: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 27: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Material Type, 2017-2031

Table 28: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 29: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Category, 2017-2031

Table 30: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 31: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Transmission 2017-2031

Table 32: Asia Pacific Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 34: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 35: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Material Type, 2017-2031

Table 36: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 37: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Category, 2017-2031

Table 38: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 39: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Transmission 2017-2031

Table 40: Middle East & Africa Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

Table 41: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Vehicle Type, 2017-2031

Table 42: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Application, 2017-2031

Table 43: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Material Type, 2017-2031

Table 44: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Sales Channel, 2017-2031

Table 45: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Category, 2017-2031

Table 46: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Electric Vehicle Type, 2017-2031

Table 47: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Transmission 2017-2031

Table 48: Latin America Automotive Wiring Harness Market Revenue (US$ Mn) Forecast, by Country, 2017-2031

List of Figures

Figure 1: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 2: Global Automotive Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 3: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 4: Global Automotive Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 5: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 6: Global Automotive Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 7: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 8: Global Automotive Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 9: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 10: Global Automotive Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2022-2031

Figure 11: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 12: Global Automotive Wiring Harness Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 13: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Transmission 2017-2031

Figure 14: Global Automotive Wiring Harness Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2022-2031

Figure 15: Global Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 16: Global Automotive Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 17: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 18: North America Automotive Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 19: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 20: North America Automotive Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 21: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 22: North America Automotive Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 23: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 24: North America Automotive Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 25: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 26: North America Automotive Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2022-2031

Figure 27: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 28: North America Automotive Wiring Harness Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 29: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Transmission 2017-2031

Figure 30: North America Automotive Wiring Harness Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2022-2031

Figure 31: North America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 32: North America Automotive Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 33: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 34: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 35: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 36: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 37: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 38: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 39: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 40: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 41: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 42: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2022-2031

Figure 43: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 44: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 45: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Transmission 2017-2031

Figure 46: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2022-2031

Figure 47: Europe Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 48: Europe Automotive Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 49: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 50: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 51: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 52: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 53: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 54: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 55: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 56: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 57: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 58: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2022-2031

Figure 59: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 60: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Transmission 2017-2031

Figure 62: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2022-2031

Figure 63: Asia Pacific Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 64: Asia Pacific Automotive Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 65: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 66: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 67: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 68: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 69: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 70: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 71: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 72: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 73: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 74: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2022-2031

Figure 75: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 76: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 77: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Transmission 2017-2031

Figure 78: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 80: Middle East & Africa Automotive Wiring Harness Market, Incremental Opportunity, by Region, Value (US$ Bn), 2022-2031

Figure 81: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 82: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2022-2031

Figure 83: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 84: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Application, Value (US$ Bn), 2022-2031

Figure 85: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Material Type, 2017-2031

Figure 86: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Material Type, Value (US$ Bn), 2022-2031

Figure 87: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Sales Channel, 2017-2031

Figure 88: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Sales Channel, Value (US$ Bn), 2022-2031

Figure 89: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Category, 2017-2031

Figure 90: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Category, Value (US$ Bn), 2022-2031

Figure 91: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Electric Vehicle Type, 2017-2031

Figure 92: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Electric Vehicle Type, Value (US$ Bn), 2022-2031

Figure 93: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Transmission 2017-2031

Figure 94: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Transmission, Value (US$ Bn), 2022-2031

Figure 95: Latin America Automotive Wiring Harness Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 96: Latin America Automotive Wiring Harness Market, Incremental Opportunity, by Country, Value (US$ Bn), 2022-2031