Analysts’ Viewpoint

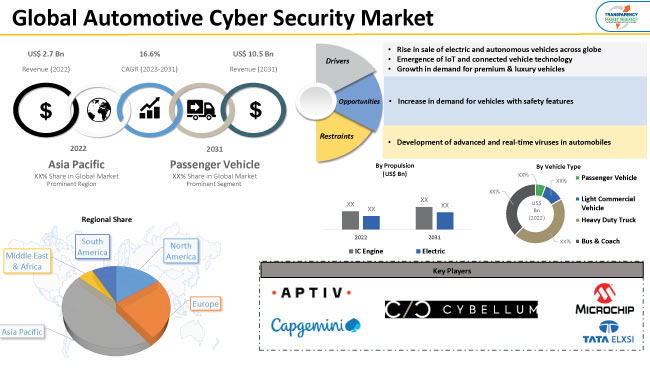

Rise in sale of electric and autonomous vehicles across the globe and emergence of IoT and connected vehicle technology are major factors fueling the automotive cyber security market value. Increase in demand for vehicles enabled with safety features is creating lucrative automotive cyber security business opportunities. Furthermore, rise in adoption of adaptive security is likely to fuel market development in the near future.

Manufacturers are becoming more conscious of the need for automotive cybersecurity on a global scale due to an increase in automobile-related breaches and significant OEM car recalls. This is positively impacting the future of automotive cyber security market. Government bodies around the globe are implementing stringent regulations on the installation of safety features, including lane departure warning systems, automated emergency braking, rearview cameras, and electronic stability control, which is also contributing to the market growth.

The chances of cyber-attacks on vehicles have increased significantly due to increase in use of connected vehicles across the globe. Automobiles, currently, are featured with advanced technologies including 5G, artificial intelligence, edge computing, and high-performance processing units. Edge computing helps autonomous electric vehicles (EVs) manage a vast quantity of data at the edge in order to reduce latency and allow for real-time databased decision-making by vehicles. Advancements in autonomous vehicles are creating growth opportunities for market players. Rise in adoption of autonomous and connected vehicles fuels the demand for products or services that can offer security to these vehicles from cyber threats.

Increase in adaptive security in the automotive sector is likely to fuel market statistics during the forecast period. Adaptive security is a cybersecurity method that monitors behaviors and events to foresee potential threats and prepare for them in advance. Several organizations use an adaptive security architecture to offer proportional enforcement that can be modified while continuously monitoring risk.

The automobile business is changing as vehicles become increasingly connected to everything, including traffic lights and other gadgets. Use of new technology is widespread, and examples include self-driving cars, shared mobility, electrified vehicles, and advanced driver assistance systems (ADAS).

In addition to enhancing comfort and safety on roadways, these technologies also make this intricate and dynamic environment more open to invasions. Attack points grow as the ecosystem gets more integrated, revealing fresh openings for hackers to compromise user privacy, vehicle safety, and the integrity of automotive data. Rise in number of connected car breaches is predicted to fuel the market dynamics in the near future.

ADAS & safety, body control & comfort, communication systems, electronic control units, infotainment, on-board diagnostics, powertrain systems, and telematics, are some of the applications that make up the automotive cyber security market. The infotainment application segment dominated the global market and held 41.3% share in 2022.

The automotive industry is focusing on the development of ground-breaking technology to extend connectivity possibilities, increase vehicle safety, and improve the driving experience. In-vehicle infotainment system is one of the crucial technologies that serves as the focal point of all modern automobile systems. It can be controlled from a single central unit. The infotainment application segment is likely to lead the global market during the forecast period.

The ADAS & safety application segment is also expected to witness rapid growth in the near future. Automatic clutch control, driver monitoring, front penetration detection, and collision avoidance are a few examples of ADAS features.

As per the latest automotive cyber security market sales analysis, in terms of vehicle type, the passenger vehicle segment dominated the global market and held 64.5% share in 2022. As per the latest automotive cyber security industry trends, this segment is likely to maintain its dominance during the forecast period.

Demand for mid-sized premium vehicles is rising due to the popularity of connected car technology. The electric architecture of passenger cars is more complex and significant than that of heavy-duty vehicles including trucks, buses, and coaches. Passenger cars contain more electronic control units (ECUs) than other kinds of vehicles, making them more susceptible to cyber-attacks. A key factor driving the demand for automotive cyber security applications in passenger vehicles is that V2X technologies are being adopted more frequently due to growing concerns about traffic, safety, and pollution levels.

Asia Pacific accounted for major share of the global market in 2022. It is anticipated to dominate the global market during the forecast period. The automotive cyber security market demand is likely to increase in the near future due to the significant production of passenger cars in the region. Increase in use of connected cars and innovative technologies is fueling automotive cyber security industry growth in Asia Pacific.

Rise in production of automobiles in India and China is contributing to the demand for automotive electronics. This factor is driving the automotive cyber security business growth in the region.

According to the automotive cyber security market trends, several firms are creating supply chain networks to increase their revenue share. Higher profit margins are anticipated for the market's newest competitors. Market players are focusing on innovative strategies to gain lucrative automotive cyber security market share. Collaborations, mergers, acquisitions, and expansion of product lines are some of the profitable automotive cyber security marketing strategies implemented by key players.

Some of the leading manufacturers identified in the global market across the globe are Aptiv, Bosch Mobility Solutions, Capgemini, Continental AG (Argus Cyber Security), Cybellum Ltd., ETAS, Infineon Technologies AG, Karamba Security, Lattice Semiconductor, Microchip Technology, NXP Semiconductors, SBD Automotive Ltd., Sectigo Limited., SECURETHINGS, STMicroelectronics, Samsung Electronics Co., Ltd., Synopsys, Tata ELXSI, Upstream Security Ltd., and Vector Informatik GmbH.

Key players have been profiled in the automotive cyber security market analysis report based on parameters such as company overview, business strategies, recent developments, product portfolio, business segments, and financial overview.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 2.7 Bn |

|

Market Forecast Value in 2031 |

US$ 10.5 Bn |

|

Growth Rate (CAGR) |

16.6% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profile |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.7 Bn in 2022

It is expected to advance at a CAGR of 16.6% by 2031

It would be worth US$ 10.5 Bn in 2031

Emergence of IoT and connected vehicle technology

The infotainment application segment accounted for largest share in 2022

Asia Pacific is a highly lucrative region for vendors

Aptiv, Bosch Mobility Solutions, Capgemini, Continental AG (Argus Cyber Security), Cybellum Ltd., ETAS, Infineon Technologies AG, Karamba Security, Lattice Semiconductor, Microchip Technology, NXP Semiconductors, SBD Automotive Ltd., Sectigo Limited., and SECURETHINGS

1. Executive Summary

1.1. Global Market Outlook

1.1.1. Market Value US$ Bn, 2017-2031

1.2. Competitive Dashboard Analysis

2. Market Overview

2.1. TMR Analysis and Recommendations

2.2. Market Coverage / Taxonomy

2.3. Market Definition / Scope / Limitations

2.4. Macro-Economic Factors

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunity

2.6. Market Factor Analysis

2.6.1. Porter’s Five Force Analysis

2.6.2. SWOT Analysis

2.7. Regulatory Scenario

2.8. Key Trend Analysis

3. Industry Ecosystem Analysis

3.1. Value Chain Analysis

3.2. Gross Margin Analysis

4. Impact Factors

4.1. Urbanization and Smart City Cluster

4.2. Autonomous Vehicle Technology

4.3. Edge Computing Trends

4.4. Connected Vehicle Technology

5. Automotive Cyber Security Market: Electric Vehicle Impact Analysis

5.1. Government Initiative & Regulations

5.2. Electric Vehicle Policy Pan India – by State

5.3. Emission Impact

6. Business Case Study

7. COVID-19 Impact Analysis – Automotive Cyber Security Market

8. Pricing Analysis

8.1. Cost Structure Analysis

8.2. Profit Margin Analysis

9. Global Automotive Cyber Security Market, by Offering

9.1. Market Snapshot

9.1.1. Introduction, Definition, and Key Findings

9.1.2. Market Growth & Y-o-Y Projections

9.1.3. Base Point Share Analysis

9.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Offering

9.2.1. Software

9.2.2. Hardware

10. Global Automotive Cyber Security Market, by Form

10.1. Market Snapshot

10.1.1. Introduction, Definition, and Key Findings

10.1.2. Market Growth & Y-o-Y Projections

10.1.3. Base Point Share Analysis

10.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Form

10.2.1. In-vehicle

10.2.2. External Cloud Services

11. Global Automotive Cyber Security Market, by Security Type

11.1. Market Snapshot

11.1.1. Introduction, Definition, and Key Findings

11.1.2. Market Growth & Y-o-Y Projections

11.1.3. Base Point Share Analysis

11.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Security Type

11.2.1. Application

11.2.2. Cloud Security

11.2.3. Endpoint

11.2.4. Wireless Network

11.2.5. Others

12. Global Automotive Cyber Security Market, by Vehicle Type

12.1. Market Snapshot

12.1.1. Introduction, Definition, and Key Findings

12.1.2. Market Growth & Y-o-Y Projections

12.1.3. Base Point Share Analysis

12.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

12.2.1. Passenger Vehicle

12.2.1.1. Hatchback

12.2.1.2. Sedan

12.2.1.3. Utility Vehicle

12.2.2. Light Commercial Vehicle

12.2.3. Heavy Duty Truck

12.2.4. Bus & Coach

13. Global Automotive Cyber Security Market, by Propulsion

13.1. Market Snapshot

13.1.1. Introduction, Definition, and Key Findings

13.1.2. Market Growth & Y-o-Y Projections

13.1.3. Base Point Share Analysis

13.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Propulsion

13.2.1. IC Engine

13.2.1.1. Gasoline

13.2.1.2. Diesel

13.2.2. Electric

13.2.2.1. Battery Electric

13.2.2.2. Plug-in Hybrid Electric

13.2.2.3. Fuel-cell Electric

14. Global Automotive Cyber Security Market, by Application

14.1. Market Snapshot

14.1.1. Introduction, Definition, and Key Findings

14.1.2. Market Growth & Y-o-Y Projections

14.1.3. Base Point Share Analysis

14.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Application

14.2.1. ADAS & Safety

14.2.2. Body Control & Comfort

14.2.3. Communication Systems

14.2.4. Electronic Control Units

14.2.5. Infotainment

14.2.6. On-board Diagnostics

14.2.7. Powertrain Systems

14.2.8. Telematics

14.2.9. Others

15. Global Automotive Cyber Security Market, by Region

15.1. Market Snapshot

15.1.1. Introduction, Definition, and Key Findings

15.1.2. Market Growth & Y-o-Y Projections

15.1.3. Base Point Share Analysis

15.2. Global Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Region

15.2.1. North America

15.2.2. Europe

15.2.3. Asia Pacific

15.2.4. Middle East & Africa

15.2.5. South America

16. North America Automotive Cyber Security Market

16.1. Market Snapshot

16.2. North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Offering

16.2.1. Software

16.2.2. Hardware

16.3. North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Form

16.3.1. In-vehicle

16.3.2. External Cloud Services

16.4. North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Security Type

16.4.1. Application

16.4.2. Cloud Security

16.4.3. Endpoint

16.4.4. Wireless Network

16.4.5. Others

16.5. North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

16.5.1. Passenger Vehicle

16.5.1.1. Hatchback

16.5.1.2. Sedan

16.5.1.3. Utility Vehicle

16.5.2. Light Commercial Vehicle

16.5.3. Heavy Duty Truck

16.5.4. Bus & Coach

16.6. North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Propulsion

16.6.1. IC Engine

16.6.1.1. Gasoline

16.6.1.2. Diesel

16.6.2. Electric

16.6.2.1. Battery Electric

16.6.2.2. Plug-in Hybrid Electric

16.6.2.3. Fuel-cell Electric

16.7. North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Application

16.7.1. ADAS & Safety

16.7.2. Body Control & Comfort

16.7.3. Communication Systems

16.7.4. Electronic Control Units

16.7.5. Infotainment

16.7.6. On-board Diagnostics

16.7.7. Powertrain Systems

16.7.8. Telematics

16.7.9. Others

16.8. Key Country Analysis – North America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031

16.8.1. U.S.

16.8.2. Canada

16.8.3. Mexico

17. Europe Automotive Cyber Security Market

17.1. Market Snapshot

17.2. Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Offering

17.2.1. Software

17.2.2. Hardware

17.3. Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Form

17.3.1. In-vehicle

17.3.2. External Cloud Services

17.4. Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Security Type

17.4.1. Application

17.4.2. Cloud Security

17.4.3. Endpoint

17.4.4. Wireless Network

17.4.5. Others

17.5. Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

17.5.1. Passenger Vehicle

17.5.1.1. Hatchback

17.5.1.2. Sedan

17.5.1.3. Utility Vehicle

17.5.2. Light Commercial Vehicle

17.5.3. Heavy Duty Truck

17.5.4. Bus & Coach

17.6. Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Propulsion

17.6.1. IC Engine

17.6.1.1. Gasoline

17.6.1.2. Diesel

17.6.2. Electric

17.6.2.1. Battery Electric

17.6.2.2. Plug-in Hybrid Electric

17.6.2.3. Fuel-cell Electric

17.7. Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Application

17.7.1. ADAS & Safety

17.7.2. Body Control & Comfort

17.7.3. Communication Systems

17.7.4. Electronic Control Units

17.7.5. Infotainment

17.7.6. On-board Diagnostics

17.7.7. Powertrain Systems

17.7.8. Telematics

17.7.9. Others

17.8. Key Country Analysis – Europe Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031

17.8.1. Germany

17.8.2. U. K.

17.8.3. France

17.8.4. Italy

17.8.5. Spain

17.8.6. Nordic Countries

17.8.7. Russia & CIS

17.8.8. Rest of Europe

18. Asia Pacific Automotive Cyber Security Market

18.1. Market Snapshot

18.2. Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Offering

18.2.1. Software

18.2.2. Hardware

18.3. Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Form

18.3.1. In-vehicle

18.3.2. External Cloud Services

18.4. Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Security Type

18.4.1. Application

18.4.2. Cloud Security

18.4.3. Endpoint

18.4.4. Wireless Network

18.4.5. Others

18.5. Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

18.5.1. Passenger Vehicle

18.5.1.1. Hatchback

18.5.1.2. Sedan

18.5.1.3. Utility Vehicle

18.5.2. Light Commercial Vehicle

18.5.3. Heavy Duty Truck

18.5.4. Bus & Coach

18.6. Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Propulsion

18.6.1. IC Engine

18.6.1.1. Gasoline

18.6.1.2. Diesel

18.6.2. Electric

18.6.2.1. Battery Electric

18.6.2.2. Plug-in Hybrid Electric

18.6.2.3. Fuel-cell Electric

18.7. Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Application

18.7.1. ADAS & Safety

18.7.2. Body Control & Comfort

18.7.3. Communication Systems

18.7.4. Electronic Control Units

18.7.5. Infotainment

18.7.6. On-board Diagnostics

18.7.7. Powertrain Systems

18.7.8. Telematics

18.7.9. Others

18.8. Key Country Analysis – Asia Pacific Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031

18.8.1. China

18.8.2. India

18.8.3. Japan

18.8.4. ASEAN Countries

18.8.5. South Korea

18.8.6. ANZ

18.8.7. Rest of Asia Pacific

19. Middle East & Africa Automotive Cyber Security Market

19.1. Market Snapshot

19.2. Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Offering

19.2.1. Software

19.2.2. Hardware

19.3. Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Form

19.3.1. In-vehicle

19.3.2. External Cloud Services

19.4. Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Security Type

19.4.1. Application

19.4.2. Cloud Security

19.4.3. Endpoint

19.4.4. Wireless Network

19.4.5. Others

19.5. Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

19.5.1. Passenger Vehicle

19.5.1.1. Hatchback

19.5.1.2. Sedan

19.5.1.3. Utility Vehicle

19.5.2. Light Commercial Vehicle

19.5.3. Heavy Duty Truck

19.5.4. Bus & Coach

19.6. Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Propulsion

19.6.1. IC Engine

19.6.1.1. Gasoline

19.6.1.2. Diesel

19.6.2. Electric

19.6.2.1. Battery Electric

19.6.2.2. Plug-in Hybrid Electric

19.6.2.3. Fuel-cell Electric

19.7. Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Application

19.7.1. ADAS & Safety

19.7.2. Body Control & Comfort

19.7.3. Communication Systems

19.7.4. Electronic Control Units

19.7.5. Infotainment

19.7.6. On-board Diagnostics

19.7.7. Powertrain Systems

19.7.8. Telematics

19.7.9. Others

19.8. Key Country Analysis – Middle East & Africa Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031

19.8.1. GCC

19.8.2. South Africa

19.8.3. Turkey

19.8.4. Rest of Middle East & Africa

20. South America Automotive Cyber Security Market

20.1. Market Snapshot

20.2. South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Offering

20.2.1. Software

20.2.2. Hardware

20.3. South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Form

20.3.1. In-vehicle

20.3.2. External Cloud Services

20.4. South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Security Type

20.4.1. Application

20.4.2. Cloud Security

20.4.3. Endpoint

20.4.4. Wireless Network

20.4.5. Others

20.5. South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Vehicle Type

20.5.1. Passenger Vehicle

20.5.1.1. Hatchback

20.5.1.2. Sedan

20.5.1.3. Utility Vehicle

20.5.2. Light Commercial Vehicle

20.5.3. Heavy Duty Truck

20.5.4. Bus & Coach

20.6. South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Propulsion

20.6.1. IC Engine

20.6.1.1. Gasoline

20.6.1.2. Diesel

20.6.2. Electric

20.6.2.1. Battery Electric

20.6.2.2. Plug-in Hybrid Electric

20.6.2.3. Fuel-cell Electric

20.7. South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031, by Application

20.7.1. ADAS & Safety

20.7.2. Body Control & Comfort

20.7.3. Communication Systems

20.7.4. Electronic Control Units

20.7.5. Infotainment

20.7.6. On-board Diagnostics

20.7.7. Powertrain Systems

20.7.8. Telematics

20.7.9. Others

20.8. Key Country Analysis – South America Automotive Cyber Security Market Size Analysis & Forecast, 2017-2031

20.8.1. Brazil

20.8.2. Argentina

20.8.3. Rest of South America

21. Competitive Landscape

21.1. Company Share Analysis/ Brand Share Analysis, 2022

21.2. Pricing comparison among key players

21.3. Company Analysis for each player (Company Overview, Company Footprints, Production Locations, Product Portfolio, Competitors & Customers, Subsidiaries & Parent Organization, Recent Developments, Financial Analysis, Profitability, Revenue Share)

22. Company Profile/ Key Players

22.1. Aptiv

22.1.1. Company Overview

22.1.2. Company Footprints

22.1.3. Production Locations

22.1.4. Product Portfolio

22.1.5. Competitors & Customers

22.1.6. Subsidiaries & Parent Organization

22.1.7. Recent Developments

22.1.8. Financial Analysis

22.1.9. Profitability

22.1.10. Revenue Share

22.2. Bosch Mobility Solutions

22.2.1. Company Overview

22.2.2. Company Footprints

22.2.3. Production Locations

22.2.4. Product Portfolio

22.2.5. Competitors & Customers

22.2.6. Subsidiaries & Parent Organization

22.2.7. Recent Developments

22.2.8. Financial Analysis

22.2.9. Profitability

22.2.10. Revenue Share

22.3. Capgemini

22.3.1. Company Overview

22.3.2. Company Footprints

22.3.3. Production Locations

22.3.4. Product Portfolio

22.3.5. Competitors & Customers

22.3.6. Subsidiaries & Parent Organization

22.3.7. Recent Developments

22.3.8. Financial Analysis

22.3.9. Profitability

22.3.10. Revenue Share

22.4. Continental AG (Argus Cyber Security)

22.4.1. Company Overview

22.4.2. Company Footprints

22.4.3. Production Locations

22.4.4. Product Portfolio

22.4.5. Competitors & Customers

22.4.6. Subsidiaries & Parent Organization

22.4.7. Recent Developments

22.4.8. Financial Analysis

22.4.9. Profitability

22.4.10. Revenue Share

22.5. Cybellum Ltd.

22.5.1. Company Overview

22.5.2. Company Footprints

22.5.3. Production Locations

22.5.4. Product Portfolio

22.5.5. Competitors & Customers

22.5.6. Subsidiaries & Parent Organization

22.5.7. Recent Developments

22.5.8. Financial Analysis

22.5.9. Profitability

22.5.10. Revenue Share

22.6. ETAS

22.6.1. Company Overview

22.6.2. Company Footprints

22.6.3. Production Locations

22.6.4. Product Portfolio

22.6.5. Competitors & Customers

22.6.6. Subsidiaries & Parent Organization

22.6.7. Recent Developments

22.6.8. Financial Analysis

22.6.9. Profitability

22.6.10. Revenue Share

22.7. Infineon Technologies AG

22.7.1. Company Overview

22.7.2. Company Footprints

22.7.3. Production Locations

22.7.4. Product Portfolio

22.7.5. Competitors & Customers

22.7.6. Subsidiaries & Parent Organization

22.7.7. Recent Developments

22.7.8. Financial Analysis

22.7.9. Profitability

22.7.10. Revenue Share

22.8. Karamba Security

22.8.1. Company Overview

22.8.2. Company Footprints

22.8.3. Production Locations

22.8.4. Product Portfolio

22.8.5. Competitors & Customers

22.8.6. Subsidiaries & Parent Organization

22.8.7. Recent Developments

22.8.8. Financial Analysis

22.8.9. Profitability

22.8.10. Revenue Share

22.9. Lattice Semiconductor

22.9.1. Company Overview

22.9.2. Company Footprints

22.9.3. Production Locations

22.9.4. Product Portfolio

22.9.5. Competitors & Customers

22.9.6. Subsidiaries & Parent Organization

22.9.7. Recent Developments

22.9.8. Financial Analysis

22.9.9. Profitability

22.9.10. Revenue Share

22.10. Microchip Technology

22.10.1. Company Overview

22.10.2. Company Footprints

22.10.3. Production Locations

22.10.4. Product Portfolio

22.10.5. Competitors & Customers

22.10.6. Subsidiaries & Parent Organization

22.10.7. Recent Developments

22.10.8. Financial Analysis

22.10.9. Profitability

22.10.10. Revenue Share

22.11. NXP Semiconductors

22.11.1. Company Overview

22.11.2. Company Footprints

22.11.3. Production Locations

22.11.4. Product Portfolio

22.11.5. Competitors & Customers

22.11.6. Subsidiaries & Parent Organization

22.11.7. Recent Developments

22.11.8. Financial Analysis

22.11.9. Profitability

22.11.10. Revenue Share

22.12. SBD Automotive Ltd

22.12.1. Company Overview

22.12.2. Company Footprints

22.12.3. Production Locations

22.12.4. Product Portfolio

22.12.5. Competitors & Customers

22.12.6. Subsidiaries & Parent Organization

22.12.7. Recent Developments

22.12.8. Financial Analysis

22.12.9. Profitability

22.12.10. Revenue Share

22.13. Sectigo Limited

22.13.1. Company Overview

22.13.2. Company Footprints

22.13.3. Production Locations

22.13.4. Product Portfolio

22.13.5. Competitors & Customers

22.13.6. Subsidiaries & Parent Organization

22.13.7. Recent Developments

22.13.8. Financial Analysis

22.13.9. Profitability

22.13.10. Revenue Share

22.14. SECURETHINGS

22.14.1. Company Overview

22.14.2. Company Footprints

22.14.3. Production Locations

22.14.4. Product Portfolio

22.14.5. Competitors & Customers

22.14.6. Subsidiaries & Parent Organization

22.14.7. Recent Developments

22.14.8. Financial Analysis

22.14.9. Profitability

22.14.10. Revenue Share

22.15. STMicroelectronics

22.15.1. Company Overview

22.15.2. Company Footprints

22.15.3. Production Locations

22.15.4. Product Portfolio

22.15.5. Competitors & Customers

22.15.6. Subsidiaries & Parent Organization

22.15.7. Recent Developments

22.15.8. Financial Analysis

22.15.9. Profitability

22.15.10. Revenue Share

22.16. Samsung Electronics Co., Ltd

22.16.1. Company Overview

22.16.2. Company Footprints

22.16.3. Production Locations

22.16.4. Product Portfolio

22.16.5. Competitors & Customers

22.16.6. Subsidiaries & Parent Organization

22.16.7. Recent Developments

22.16.8. Financial Analysis

22.16.9. Profitability

22.16.10. Revenue Share

22.17. Synopsys

22.17.1. Company Overview

22.17.2. Company Footprints

22.17.3. Production Locations

22.17.4. Product Portfolio

22.17.5. Competitors & Customers

22.17.6. Subsidiaries & Parent Organization

22.17.7. Recent Developments

22.17.8. Financial Analysis

22.17.9. Profitability

22.17.10. Revenue Share

22.18. Tata ELXSI

22.18.1. Company Overview

22.18.2. Company Footprints

22.18.3. Production Locations

22.18.4. Product Portfolio

22.18.5. Competitors & Customers

22.18.6. Subsidiaries & Parent Organization

22.18.7. Recent Developments

22.18.8. Financial Analysis

22.18.9. Profitability

22.18.10. Revenue Share

22.19. Upstream Security Ltd

22.19.1. Company Overview

22.19.2. Company Footprints

22.19.3. Production Locations

22.19.4. Product Portfolio

22.19.5. Competitors & Customers

22.19.6. Subsidiaries & Parent Organization

22.19.7. Recent Developments

22.19.8. Financial Analysis

22.19.9. Profitability

22.19.10. Revenue Share

22.20. Vector Informatik GmbH

22.20.1. Company Overview

22.20.2. Company Footprints

22.20.3. Production Locations

22.20.4. Product Portfolio

22.20.5. Competitors & Customers

22.20.6. Subsidiaries & Parent Organization

22.20.7. Recent Developments

22.20.8. Financial Analysis

22.20.9. Profitability

22.20.10. Revenue Share

22.21. Other Key Players

22.21.1. Company Overview

22.21.2. Company Footprints

22.21.3. Production Locations

22.21.4. Product Portfolio

22.21.5. Competitors & Customers

22.21.6. Subsidiaries & Parent Organization

22.21.7. Recent Developments

22.21.8. Financial Analysis

22.21.9. Profitability

22.21.10. Revenue Share

List of Tables

Table 1: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017‒2031

Table 2: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017‒2031

Table 3: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017‒2031

Table 4: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 5: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 6: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 7: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Region, 2017‒2031

Table 8: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017‒2031

Table 9: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017‒2031

Table 10: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017‒2031

Table 11: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 12: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 13: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 14: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 15: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017‒2031

Table 16: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017‒2031

Table 17: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017‒2031

Table 18: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 19: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 20: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 21: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 22: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017‒2031

Table 23: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017‒2031

Table 24: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017‒2031

Table 25: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 26: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 27: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 28: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 29: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017‒2031

Table 30: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017‒2031

Table 31: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017‒2031

Table 32: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 33: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 34: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 35: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017‒2031

Table 36: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017‒2031

Table 37: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017‒2031

Table 38: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017‒2031

Table 39: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017‒2031

Table 40: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017‒2031

Table 41: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017‒2031

Table 42: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017‒2031

List of Figures

Figure 1: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017-2031

Figure 2: Global Automotive Cyber Security Market, Incremental Opportunity, by Offering, Value (US$ Bn), 2023-2031

Figure 3: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017-2031

Figure 4: Global Automotive Cyber Security Market, Incremental Opportunity, by Form, Value (US$ Bn), 2023-2031

Figure 5: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017-2031

Figure 6: Global Automotive Cyber Security Market, Incremental Opportunity, by Security Type, Value (US$ Bn), 2023-2031

Figure 7: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 8: Global Automotive Cyber Security Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 9: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 10: Global Automotive Cyber Security Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 11: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 12: Global Automotive Cyber Security Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 13: Global Automotive Cyber Security Market Value (US$ Bn) Forecast, by Region, 2017-2031

Figure 14: Global Automotive Cyber Security Market, Incremental Opportunity, by Region, Value (US$ Bn), 2023-2031

Figure 15: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017-2031

Figure 16: North America Automotive Cyber Security Market, Incremental Opportunity, by Offering, Value (US$ Bn), 2023-2031

Figure 17: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017-2031

Figure 18: North America Automotive Cyber Security Market, Incremental Opportunity, by Form, Value (US$ Bn), 2023-2031

Figure 19: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017-2031

Figure 20: North America Automotive Cyber Security Market, Incremental Opportunity, by Security Type, Value (US$ Bn), 2023-2031

Figure 21: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 22: North America Automotive Cyber Security Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 23: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 24: North America Automotive Cyber Security Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 25: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 26: North America Automotive Cyber Security Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 27: North America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 28: North America Automotive Cyber Security Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 29: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017-2031

Figure 30: Europe Automotive Cyber Security Market, Incremental Opportunity, by Offering, Value (US$ Bn), 2023-2031

Figure 31: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017-2031

Figure 32: Europe Automotive Cyber Security Market, Incremental Opportunity, by Form, Value (US$ Bn), 2023-2031

Figure 33: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017-2031

Figure 34: Europe Automotive Cyber Security Market, Incremental Opportunity, by Security Type, Value (US$ Bn), 2023-2031

Figure 35: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 36: Europe Automotive Cyber Security Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 37: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 38: Europe Automotive Cyber Security Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 39: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 40: Europe Automotive Cyber Security Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 41: Europe Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 42: Europe Automotive Cyber Security Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 43: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017-2031

Figure 44: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Offering, Value (US$ Bn), 2023-2031

Figure 45: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017-2031

Figure 46: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Form, Value (US$ Bn), 2023-2031

Figure 47: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017-2031

Figure 48: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Security Type, Value (US$ Bn), 2023-2031

Figure 49: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 50: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 51: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 52: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 53: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 54: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 55: Asia Pacific Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 56: Asia Pacific Automotive Cyber Security Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 57: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017-2031

Figure 58: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Offering, Value (US$ Bn), 2023-2031

Figure 59: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017-2031

Figure 60: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Form, Value (US$ Bn), 2023-2031

Figure 61: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017-2031

Figure 62: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Security Type, Value (US$ Bn), 2023-2031

Figure 63: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 64: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 65: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 66: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 67: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 68: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 69: Middle East & Africa Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 70: Middle East & Africa Automotive Cyber Security Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031

Figure 71: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Offering, 2017-2031

Figure 72: South America Automotive Cyber Security Market, Incremental Opportunity, by Offering, Value (US$ Bn), 2023-2031

Figure 73: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Form, 2017-2031

Figure 74: South America Automotive Cyber Security Market, Incremental Opportunity, by Form, Value (US$ Bn), 2023-2031

Figure 75: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Security Type, 2017-2031

Figure 76: South America Automotive Cyber Security Market, Incremental Opportunity, by Security Type, Value (US$ Bn), 2023-2031

Figure 77: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Vehicle Type, 2017-2031

Figure 78: South America Automotive Cyber Security Market, Incremental Opportunity, by Vehicle Type, Value (US$ Bn), 2023-2031

Figure 79: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Propulsion, 2017-2031

Figure 80: South America Automotive Cyber Security Market, Incremental Opportunity, by Propulsion, Value (US$ Bn), 2023-2031

Figure 81: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Application, 2017-2031

Figure 82: South America Automotive Cyber Security Market, Incremental Opportunity, by Application, Value (US$ Bn), 2023-2031

Figure 83: South America Automotive Cyber Security Market Value (US$ Bn) Forecast, by Country, 2017-2031

Figure 84: South America Automotive Cyber Security Market, Incremental Opportunity, by Country, Value (US$ Bn), 2023-2031