Considering industrialization witnessed in Asia Pacific over the last few decades, the demand for industrial gloves has soared higher than ever. The region has emerged as a lucrative market for a majority of the leading manufacturers, as they target capitalizing on untapped opportunities across developing nations. Besides this, the fact that the leading players in the rubber industry are domiciled in Asia Pacific has catapulted the region at the fore of the overall industrial gloves market. As workers operating in the rubber industry are often exposed to hazardous environment, wearing industrial protective gears is imperative for them. Growth witnessed in the region’s rubber industry will therefore give significant impetus to its industrial gloves market. This also entails volatility witnessed in the demand for rubber will subsequently have a negative impact on the Asia Pacific industrial gloves market.

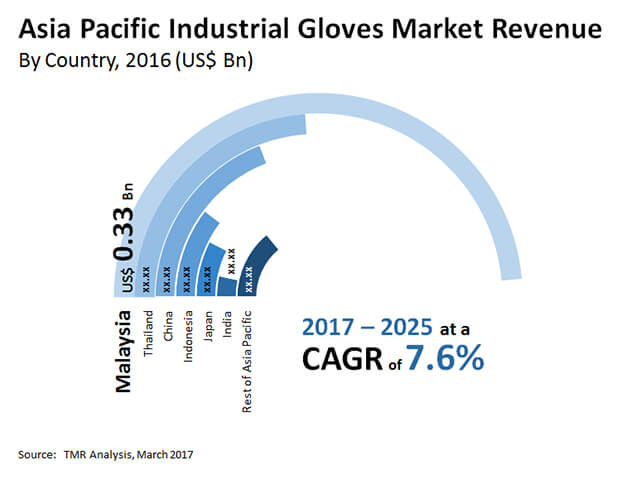

Moreover, stringent regulations have compelled industries to invest in industrial protective gears, thus creating opportunities for the Asia Pacific industrial gloves market. Exhibiting a CAGR of 7.6%, the Asia Pacific industrial gloves market is forecast to reach US$1.25 bn by the end of 2025. The market’s valuation was US$0.66 bn in 2016.

Based on product, the dominance is expected to be with the disposable gloves segment through the course of the forecast period. It held nearly 75.4% of the Asia Pacific industrial gloves market in 2016. Manufacturing cost for the same is low compared to its re-usable counterparts. This is a key factor contributing towards the segment’s growth, as it allows producers to maintain a lower price point thus attracting a large number of consumers.

Based on materials, rubber dominated the industrial gloves market in 2016 and is expected to remain the lead through the forecast period. Rubber gloves, also known as latex gloves are natural material which is made from rubber. Some of the key attributes of rubber gloves include its proper fitting, high level of touch sensitivity, good for wearing for a long period of time, durable against high-risk situations that involves infectious materials, cost effective, bio-degradable, and has a high level of elasticity among others. However, rubber has several adverse effects on human health such as irritant dermatitis, which is not considered extremely dangerous if neglected. It can cause cracks in the skin through which latex particles infiltrate, thus creating latex allergies on the individual. Delayed cutaneous hyper sensitivity is another effect caused due to extensive use of rubber/latex gloves which is manifested within 6 to 48 hours post exposure to latex particles. Due to these factors, this particular material is expected to lose demand in the future.

Based on application, chemicals and pharmaceuticals accounted for the dominant share in 2016. Both industries are expected to maintain their respective positions throughout the forecast period. Workers in chemicals as well as pharmaceutical industries are exposed to hazardous chemicals and thus require high quality industrial protective gears. Also governments keep a strict vigil on these industries to ensure workers’ health and safety. Spurred by this, the market is expected to witness high demand for industrial gloves from chemicals and pharmaceutical industries.

By country, Malaysia has emerged as the most lucrative market for industrial gloves in Asia Pacific. It held over 49.9% of the market in 2016. The country is expected to remain dominant through the forecast period. The flourishing rubber industry will support growth of the industrial gloves market in Malaysia in the coming years. Besides this, China and Thailand are expected to hold considerable share in the market. Industrialization witnessed in these nations will drive the industrial gloves market.

Some of the leading players operating in the Asia Pacific industrial gloves market are Top Glove Corporation Bhd, Hartalega Sdn Bhd, and Kossan Rubber Industries among others

Booming Industrialization and New Workplace Safety Norms will invite Considerable Growth Opportunities for the Asia Pacific Industrial Gloves Market

The industrialization prospects have progressed at a rapid pace across the Asia Pacific region. The growing availability of cheap labor and a treasure of natural resources have made the region a profit haven for industrialists and companies around the world. Massive foreign direct investment infusions and the rising number of government initiatives of various countries in the region regarding industrialization have led to an escalation in industrialization prospects. All these factors will serve as growth boosters for the Asia Pacific industrial gloves market during the assessment period of 2017-2025.

Chapter 1 Preface

1.1 Report Scope and Market Segmentation

1.2 Research Highlights

Chapter 2 Assumptions and Research Methodology

2.1 Assumptions and Acronyms Used

2.2 Research Methodology

Chapter 3 Executive Summary

3.1 Market Snapshot

Chapter 4 Market Overview

4.1 Market Introduction and Key Trends Analysis

4.2 Market Drivers and Restraints Snapshot Analysis

4.2.1 Market Drivers

4.2.2 Market Restraints

4.2.3 Market Opportunities

4.3 Asia Pacific Industrial Gloves Market, Market Attractiveness Analysis, by Material, 2017

4.4 Asia Pacific Industrial Gloves Market, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Chapter 5 Asia Pacific Industrial Gloves Market Analysis, 2017-2025, by Product

5.1 Type Overview

5.2 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Product, 2016 & 2025

5.3 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Product, 2016 & 2025

5.4 Asia Pacific Industrial Gloves Market, Revenue and Volume Forecast, by Product, 2016-2025

Chapter 6 Asia Pacific Industrial Gloves Market Analysis, 2017-2025, by Material

6.1 Type Overview

6.2 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Material, 2016 & 2025

6.3 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Material, 2016 & 2025

6.4 Asia Pacific Industrial Gloves Market, Revenue and Volume Forecast, by Material, 2016-2025

Chapter 7 Asia Pacific Industrial Gloves Market Analysis, 2017-2025, by Application

7.1 Type Overview

7.2 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Application, 2016 & 2025

7.3 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Application, 2016 & 2025

7.4 Asia Pacific Industrial Gloves Market, Revenue and Volume Forecast, by Application, 2016-2025

Chapter 8 Asia Pacific Industrial Gloves Market Analysis, 2017-2025, by Country

8.1 Country Overview

8.2 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Country, 2016 & 2025

8.3 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Country, 2016 & 2025

8.4 Asia Pacific Industrial Gloves Market, Revenue and Volume Forecast, by Country, 2016-2025

Chapter 9 Competition Landscape

9.1 Asia Pacific Industrial Gloves Market: Market Position of Leading Players, 2016 (%)

9.2 Top Glove Corporation Bhd.

9.2.1. Company Details (HQ, Foundation Year, Employee Strength)

9.2.2. Overview

9.2.3. Financial Information (Revenue and Y-o-Y Growth (%))

9.2.4. SWOT analysis

9.2.5. Business Strategy

9.3 Hartalega Sdn Bhd

9.3.1. Company Details (HQ, Foundation Year, Employee Strength)

9.3.2. Overview

9.3.3. Financial Information (Revenue and Y-o-Y Growth (%))

9.3.4. SWOT analysis

9.3.5. Business Strategy

9.4 Kossan Rubber Industries Sdn Bhd

9.4.1. Company Details (HQ, Foundation Year, Employee Strength)

9.4.2. Overview

9.4.3. Financial Information (Revenue and Y-o-Y Growth (%))

9.4.4. SWOT analysis

9.4.5. Business Strategy

9.5 Supermax Corporation Bhd

9.5.1. Company Details (HQ, Foundation Year, Employee Strength)

9.5.2. Overview

9.5.3. Financial Information (Revenue and Y-o-Y Growth (%))

9.5.4. SWOT analysis

9.5.5. Business Strategy

9.6 3M Company

9.6.1. Company Details (HQ, Foundation Year, Employee Strength)

9.6.2. Overview

9.6.3. Financial Information (Revenue and Y-o-Y Growth (%))

9.6.4. SWOT analysis

9.6.5. Business Strategy

List of Figures

Figure 1 Asia Pacific Industrial Gloves Market, Market Attractiveness Analysis, by Material, 2017

Figure 2 Asia Pacific Industrial Gloves Market, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 3 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Product, 2016 & 2025

Figure 4 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Product, 2016 & 2025

Figure 5 Asia Pacific Industrial Gloves Market for Disposable Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 6 Asia Pacific Industrial Gloves Market for Re-Usable Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 7 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Material, 2016 & 2025 (%)

Figure 8 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Material, 2016 & 2025 (%)

Figure 9 Asia Pacific Industrial Gloves Market for Rubber/Latex Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 10 Asia Pacific Industrial Gloves Market for Nitrile Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 11 Asia Pacific Industrial Gloves Market for Vinyl Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 12 Asia Pacific Industrial Gloves Market for Neoprene Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 13 Asia Pacific Industrial Gloves Market for Polyethylene Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 14 Asia Pacific Industrial Gloves Market for Other Gloves, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 15 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Application, 2016 & 2025 (%)

Figure 16 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Application, 2016 & 2025 (%)

Figure 17 Asia Pacific Industrial Gloves Market in Pharmaceutical Sector, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 18 Asia Pacific Industrial Gloves Market in Food Sector, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 19 Asia Pacific Industrial Gloves Market in Healthcare Sector, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 20 Asia Pacific Industrial Gloves Market in Chemicals Sector, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 21 Asia Pacific Industrial Gloves Market in Manufacturing Sector, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 22 Asia Pacific Industrial Gloves Market in Others Sector, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 23 Asia Pacific Industrial Gloves Market, Revenue Share Analysis, by Country, 2016 & 2025(%)

Figure 24 Asia Pacific Industrial Gloves Market, Volume Share Analysis, by Country, 2016 & 2025(%)

Figure 25 Asia Pacific Industrial Gloves Market in India, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 26 Asia Pacific Industrial Gloves Market in Japan, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 27 Asia Pacific Industrial Gloves Market in China, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 28 Asia Pacific Industrial Gloves Market in Malaysia, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 29 Asia Pacific Industrial Gloves Market in Thailand, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 30 Asia Pacific Industrial Gloves Market in Indonesia, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 31 Asia Pacific Industrial Gloves Market in Rest of Asia Pacific, Revenue and Volume Forecast, 2016-2025 (USD Billion and Billion Pairs)

Figure 32 Market Share Analysis of the Leading Players Operating in the Industrial Gloves Market in Asia Pacific, 2016 (%)