Reports

Reports

Global Animal Feed Additives Market for Ruminants: Snapshot

The key driver for all producers of animal feed additives for ruminants is the globally increasing demand for meat and dairy. This applies especially to developing countries, where the growing population densities and increasing disposable incomes are generating a vast consumer base for animal products.

A substantial portion of the animal feed additives for ruminants are intended for dairy animals over meat, due to the rapidly increasing demand for dairy and dairy products.

A lot of players – both top tier and regional – are looking into developments in coating technologies for animal feed. These coatings are increasing in importance as they help improve the effectiveness of the animal feed.

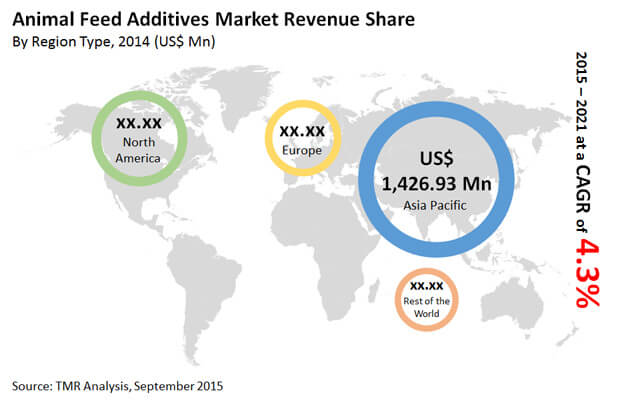

The resulting effect of all the above factors is a CAGR of 4.3% from 2015 to 2021 in revenue for the global animal feed additives for ruminants market. This market is expected to reach US$4.7 bn by the end of 2016 and US$5.9 bn by the end of 2021.

Asia Pacific to Exhibit Leading Demand for Animal Feed Additives for Ruminants

By the end of 2021, Asia Pacific is expected to hold 32.6% of the revenue in the animal feed additives for ruminants market. This will account for the largest share in revenue, close to the percentage that the region held in 2014. A large part of this leading share is attributed to the high cattle population in the region. China and India are the two biggest regions in terms of demand for animal products demand owing to growing population densities. There is an especially high demand for dairy products from these countries. Additionally, the Asia Pacific region is ramping up its exports of meat to other regions, further increasing the demand for quality animal feed.

North America is also showing an increase in the demand for cattle-based meat and dairy. A large part of the increase in demand comes from the expanding cattle population of Canada. Furthermore, the animal husbandry industry in North America is guided by strict regulations that only allow meat and dairy above a specific grade to be sold. This has added to the demand for high-quality animal feed additives for ruminants.

Most of Animal Feed Additives for Ruminants Continues to be Taken up by Cattle

Cattle were the leading animal type in terms of demand for animal feed additives for ruminants in 2014. By 2021, cattle are expected to take up 80.80% of the total animal feed additives revenue generation. Owing to the high demand for cattle meat and dairy across the world, the improvements in cattle feed additives is expected to generate large amounts of demand as well. This is drawing a greater number of players towards this sector and allowing them multiple opportunities of expansion.

Another key reason for the growing demand for animal feed additives for cattle is the growing concern over the health of the cattle and consequently, the quality of the meat and the health of the consumer.

The key players in the global animal feed additives market for ruminants include DSM, BASF SE, Danisco A/S, Elanco Animal Health, Evonik Industries, Novozymes, Alltech, Inc., Archer Daniels Midland Co., and Chr. Hansen Holding A/S.

Increasing Use of Quality Food Items for Domestic Animals will Bolster Growth of Animal Feed Additives Market

Developing meat utilization combined with a new episode of sicknesses has created the requirement for additives in poultry, water, and other animal-based items which thusly, is relied upon to drive the item interest. Additives are the segments basic for the improvement of execution just as the wellbeing of the animals. Consequently, these items are indirectly impacting human food item qualities. Utilization of food containing an appropriate amount of additives applies constructive outcomes on domesticated animals, like improvement in absorption and multiplication.

Steers is the essential wellspring of dairy items across the world. A huge ascent in dairy cattle cultivating is probably going to drive the interest for animal feed additives over the estimate time frame. Also, expanding awareness about the advantages of additives and the new flare-up of different illnesses has emphatically affected the interest. On the contrary, guidelines confining the utilization of anti-infection agents in animal feed are projected to limit the development in the approaching years. Europe has acquainted guidelines with limit the utilization of anti-microbial, which is expected for food-creating animals inferable from diminished protection from microscopic organisms. Such a factor is expected to additionally limit the development of the market over the estimate time frame.

Then, no less energizing advancements in the worldwide animal feed additives market are from the desire of producers to acquire upgrades definitions for different kinds. Offensively, the factor that has applied most telling effect is refreshes in refreshes in administrative rules. A valid example is new guideline by United States Department of Agriculture for feed additives named as 'natural'. Advances in maturation and extraction innovation are assisting players with revealing better details in the animal feed additives market. Feed administrative organizations all throughout the planet have additionally gotten progressively mindful of the impact of animal feed additives and the human populace that burns-through animal meat and poultry items.

Chapter 1 Global Animal Feed Additives Market for Ruminants: Preface

1.1. Report Description

1.2. Market Segmentation

1.3. Research Scope

1.4. Research Methodology

Chapter 2 Global Animal Feed Additives Market for Ruminants:Executive Summary

Chapter 3 Global Animal Feed Additives Market for Ruminants: Market Overview:

3.1. Introduction

3.2. Overview about coating technologies

3.2.1. Types of coating technologies used for Animal Feed Additives

3.2.2. Types of feed additives imperative for coating technologies

3.2.3. Major players in coating technology for feed additives

3.3. Major players operating in the global animal feed additives market for ruminants

Chapter 4: Global Animal Feed Additives Market for Ruminants; by Type, 2014-2021

4.1. Overview

4.2. Global Vitamins Market, Revenue Forecast, 2014-2021 (USD Million)

4.3. Global Probiotics and Prebiotics Market, Revenue Forecast, 2014-2021 (USD Million)

4.4. Global Choline Chloride Market, Revenue Forecast, 2014-2021 (USD Million)

4.5. Global Phytobiotics Market, Revenue Forecast, 2014-2021 (USD Million)

4.6. Global Organic Acid Market, Revenue Forecast, 2014-2021 (USD Million)

4.7. Global Polyunsaturated Fatty Acid Market, Revenue Forecast, 2014-2021 (USD Million)

4.8. Global Amino Acids Market, Revenue Forecast, 2014-2021 (USD Million)

4.9. Global Feed Enzymes Market, Revenue Forecast, 2014-2021 (USD Million)

4.10. Global Non-Protein Nitrogen (NPN) Market, Revenue Forecast, 2014-2021 (USD Million)

4.11. Global Immunomodulators Market, Revenue Forecast, 2014-2021 (USD Million)

4.12. Global Others Market, Revenue Forecast, 2014-2021 (USD Million)

Chapter 5:Global Animal Feed Additives Market for Ruminants: By Ruminants Type, 2014-2021

5.1. Overview

5.2. Animal Feed Additives Market for Cattle, Revenue Forecast, 2014-2021 (USD Million)

5.3. Animal Feed Additives Market for Buffalo, Revenue Forecast, 2014-2021 (USD Million)

5.4. Animal Feed Additives Market for Other, Revenue Forecast, 2014-2021 (USD Million)

Chapter 6:Global Animal Feed Additives Market for Ruminants: By Region

6.1. North America Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

6.2. Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

6.3. Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

6.4. Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

Chapter 6:Company Profiles

7.1. DSM

7.2. BASF S.E.

7.3. Evonik Industries

7.4. Elanco

7.5. Danisco

7.6. Cargill Inc.

7.7. Archer Daniels Midlands Co.

7.8. Novozymes

7.9. Alltech Inc

7.10 CHR Holdings A/S

List of Tables

TABLE 1: Global Animal Feed Additives Market for Ruminants, Revenue Forecast, by Vitamin Type, 2014-2021 (USD Million)

TABLE 2: Global Animal Feed Additives Market for Ruminants, Revenue Forecast, by Amino Acid Type, 2014-2021 (USD Million)

TABLE 3: Global Animal Feed Additives Market for Ruminants, Revenue Forecast,by Feed Enzyme Type, 2014-2021 (USD Million)

TABLE 4: Global Animal Feed Additives Market for Ruminants, Revenue Forecast, by Cattle Type, 2014-2021 (USD Million)

TABLE 5: Global Animal Feed Additives Market for Ruminants, Revenue Forecast, by Buffalo Type, 2014-2021 (USD Million)

TABLE 6: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Product Type, 2014-2021 (USD Million)

TABLE 7: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Vitamins Type, 2014-2021 (USD Million)

TABLE 8: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Amino Acids Type, 2014-2021 (USD Million)

TABLE 9: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Feed Enzymes Type, 2014-2021 (USD Million)

TABLE 10: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Ruminants Type, 2014-2021 (USD Million)

TABLE 11: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Cattle Usage Type, 2014-2021 (USD Million)

TABLE 12: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Buffalo Usage Type, 2014-2021 (USD Million)

TABLE 13: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, by Country, 2014-2021 (USD Million)

TABLE 14: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Product Type, 2014-2021 (USD Million)

TABLE 15: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Vitamins Type, 2014-2021 (USD Million)

TABLE 16: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Amino Acids Type, 2014-2021 (USD Million)

TABLE 17: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Feed Enzyme Type, 2014-2021 (USD Million)

TABLE 18: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Ruminants Type, 2014-2021 (USD Million)

TABLE 19: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Cattle Usage Type, 2014-2021 (USD Million)

TABLE 20: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Buffalo Usage Type, 2014-2021 (USD Million)

TABLE 21: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, by Country, 2014-2021 (USD Million)

TABLE 22: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Product Type, 2014-2021 (USD Million)

TABLE 23: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Vitamins Type, 2014-2021 (USD Million)

TABLE 24: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Amino Acid Type, 2014-2021 (USD Million)

TABLE 25: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Feed Enzyme Type, 2014-2021 (USD Million)

TABLE 26: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Ruminants Type, 2014-2021 (USD Million)

TABLE 27: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Cattle Usage Type, 2014-2021 (USD Million)

TABLE 28: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Buffalo Usage Type, 2014-2021 (USD Million)

TABLE 29: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, by Country, 2014-2021 (USD Million)

TABLE 30: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Product Type, 2014-2021 (USD Million)

TABLE 31: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Vitamins Type, 2014-2021 (USD Million)

TABLE 32: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Amino Acids Type, 2014-2021 (USD Million)

TABLE 33: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Feed Enzyme Type, 2014-2021 (USD Million)

TABLE 34: Rest of the World (RoW) Animal Feed Additives Market for Ruminants,Revenue Forecast, by Ruminants Type, 2014-2021 (USD Million)

TABLE 35: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Cattle Usage Type, 2014-2021 (USD Million)

TABLE 36: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Buffalo Usage Type, 2014-2021 (USD Million)

TABLE 37: Rest of the World (RoW) Animal Feed Additives Market for Ruminants, Revenue Forecast, by Country, 2014-2021 (USD Million)

List of Figures

FIG 1: Global Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014 2021 (USD Million)

FIG 2: Global Animal Feed Additives Market for Ruminants, by Product Type, 2014-2021 (%)

FIG 3: Global Vitamins Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 4:Global Probiotics and Prebiotics Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 5: Global Choline Chloride Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 6: Global Phytobiotics Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 7: Global Organic Acids Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 8: Global Polyunsaturated Fatty Acids Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 9: Global Amino Acids Market, Revenue Forecast, 2014-2021 (USD Million)

FIG10: Global Feed Enzymes Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 11: Global Non-Protein Nitrogen Market (NPN), Revenue Forecast, 2014-2021 (USD Million)

FIG 12: Global Immunomodulators Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 13: Global Others (Feed Acidifiers, Antioxidants, Trace Minerals, Antibiotics, etc) Market, Revenue Forecast, 2014-2021 (USD Million)

FIG 14: Global Animal Feed Additives Market for Ruminants, by Ruminants Type, 2014- 2021 (%)

FIG 15: Global Animal Feed Additives Market for Cattle, Revenue Forecast, 2014-2021 (USD Million)

FIG 16: Global Animal Feed Additives Market for Buffalo, Revenue Forecast, 2014-2021 (USD Million)

FIG 17; Global Animal Feed Additives Market for Others (Sheep, Goat, Deer, Etc), Revenue Forecast, 2014-2021 (USD Million)

FIG 18: Global Animal Feed Additives Market for Ruminants, Revenue Share, by Region, 2014-2021 (%)

FIG 19: North America Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

FIG 20: Europe Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

FIG 21: Asia Pacific Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)

FIG 22: Rest of the World Animal Feed Additives Market for Ruminants, Revenue Forecast, 2014-2021 (USD Million)