Reports

Reports

Analysts’ Viewpoint on Market Scenario

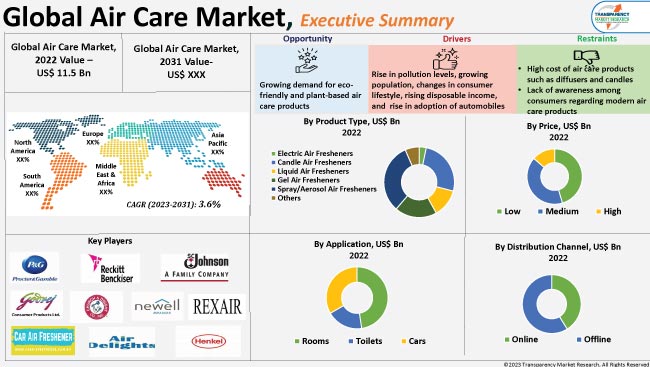

Population growth, changes in lifestyle, switch from traditional to modern practices, and rise in disposable income are key factors contributing to air care market growth. Different types of air freshener sprays are available in the market, each with its own unique scent and formulation.

Rise in pollution levels due to industrialization is one of the main factors influencing the need for air care products globally. Eco-friendly, anti-allergenic, and easy to use products are being launched by manufacturers due to advancements and new innovations in products, consequently driving the air care market share.

Furthermore, rapid urbanization has led to increase in the sales of automobiles such as cars, which further propels the adoption air care products.

Air care products are used to improve the quality and scent of the air in indoor spaces. The products are designed to freshen, purify, or deodorize the air by eliminating unpleasant odors and provide a fresh and pleasant aroma.

Air care products purify the air by removing harmful particles or allergens. They serve a variety of purposes such as masking unpleasant odors and humidifying or dehumidifying the air, depending on the needs of the user.

The different types of air care products include air fresheners, odor eliminators, candles, diffusers, air purifiers, sprays, and plug-ins. These products are often used in homes, offices, cars, and other enclosed spaces to create a more comfortable and inviting environment.

The air care products industry is expanding as a result of rapid industrialization & urbanization, and rise in pollution levels. Some of the most dangerous and frequent indoor pollutants such as volatile organic compounds which are emitted by fragrances, smoke from cigarettes and flames, moth repellents, and hair sprays, have increased air pollution.

As people become more aware of the health hazards associated with indoor and outdoor air pollution, demand for these products is increasing due to the advantages of air care products, as they eliminate unpleasant and harmful odors from the air.

The adoption of air care products in vehicles such as cars has become increasingly popular in recent years, as more people recognize the importance of maintaining good air quality and reducing unpleasant odor inside their cars. Cars can become rather musty or stale-smelling over time, especially if they are used frequently or if the windows are kept closed for long periods of time. Car air fresheners help to freshen the air inside the car and mask any unpleasant odor. The global market for air care products is expanding due to a rapid increase in automobile sales and the growing popularity of using air fresheners in vehicles.

Hanging air fresheners, clip-on air fresheners, spray air fresheners, and air freshener gels are the most common types of air care products used in vehicles

The global air care market segmentation by product type includes electric air fresheners, candle air fresheners, liquid air fresheners, gel air fresheners, spray/aerosol air fresheners, and others (incense sticks, etc.).

According to the air care market analysis, the spray/aerosol air fresheners segment is estimated to lead the global market in the next few years due to the high adoption of air freshener sprays in residential and commercial sectors. They are convenient and easy to use, and provide a quick solution to unpleasant odors or stale air.

According to the air care market forecast, the rooms segment is likely to lead the global market in terms of application, during the forecast period, primarily ascribed to the growth in residential sectors across various regions. Demand for air care products is increasing as they are used to keep indoor spaces clean with a pleasant scent. Rooms are the most common target for air fresheners because they are the primary living spaces where people spend most of their time.

Moreover, rise in new homes, commercial buildings, growth in population, increase in income, and shifting buying patterns are creating demand for air care products.

According to the market size, Europe is likely to dominate the global industry during the forecast period. High living standards of people in the region, technological advancements, easy availability of multiple product types, and product innovations are boosting the air care market value across this region.

Moreover, the air care market demand across Europe is on the rise due to demand for products that are considered natural such as liquid air fresheners or candles that use essential oils.

The global market is fragmented due to the presence of many local and global players. According to future analysis of the air care market, competition is expected to intensify in the next few years due to the entry of local players.

Observing the air care market trends and future of air care products, suppliers and manufacturers are focusing on product developments and introducing more efficient products at reasonable prices.

Procter & Gamble Co., Reckitt Benckiser Group., S.C. Johnson & Son Inc, Godrej Consumer Products Ltd, Church & Dwight Co.Inc., Newell Brands, Car-Freshener Corporation, Air Delights Inc., Rexair LLC, and Henkel AG & Company KGaA are the prominent air care market players.

Key players have been profiled in the air care market research report based on parameters such as company overview, business strategies, product portfolio, financial overview, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 11.5 Bn |

|

Market Forecast Value in 2031 |

US$ 16.4 Bn |

|

Growth Rate (CAGR) |

3.6% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and brand analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 11.5 Bn in 2022

It is expected to reach US$ 16.4 Bn by 2031

It is estimated to grow at a CAGR of 3.6% from 2023 to 2031

Rise in pollution levels, growth in disposable income of consumers, and increase in adoption of air care products in vehicles

The spray/aerosol air fresheners segment is expected to hold major share in terms of product type

Europe is a more attractive region for vendors

Procter & Gamble Co., Reckitt Benckiser Group., S.C. Johnson & Son Inc, Godrej Consumer Products Ltd, Church & Dwight Co.Inc., Newell Brands, Car-Freshener Corporation, Air Delights Inc., Rexair LLC, and Henkel AG & Company KGaA

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Air Care Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Million Units)

6. Global Air Care Market Analysis and Forecast, By Product Type

6.1. Air Care Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017 - 2031

6.1.1. Electric Air Fresheners

6.1.2. Candle Air Fresheners

6.1.3. Liquid Air Fresheners

6.1.4. Gel Air Fresheners

6.1.5. Spray/Aerosol Air Fresheners

6.1.6. Others

6.2. Incremental Opportunity, By Product Type

7. Global Air Care Market Analysis and Forecast, By Application

7.1. Air Care Market Size (US$ Bn and Million Units) Forecast, By Application, 2017 - 2031

7.1.1. Rooms

7.1.2. Toilets

7.1.3. Cars

7.2. Incremental Opportunity, By Application

8. Global Air Care Market Analysis and Forecast, By Price

8.1. Air Care Market Size (US$ Bn and Million Units) Forecast, By Price, 2017 - 2031

8.1.1. Low

8.1.2. Medium

8.1.3. High

8.2. Incremental Opportunity, By Price

9. Global Air Care Market Analysis and Forecast, By Distribution Channel

9.1. Air Care Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

9.1.1. Online

9.1.1.1. E-Commerce Websites

9.1.1.2. Company Owned Websites

9.1.2. Offline

9.1.2.1. Specialty Stores

9.1.2.2. Supermarkets & Hypermarkets

9.1.2.3. Other Retail Stores

9.2. Incremental Opportunity, By Distribution Channel

10. Global Air Care Market Analysis and Forecast, By Region

10.1. Air Care Market Size (US$ Bn and Million Units) Forecast, By Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, By Region

11. North America Air Care Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Price

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Brand Analysis

11.5. Consumer Buying Behavior Analysis

11.6. Air Care Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017 - 2031

11.6.1. Electric Air Fresheners

11.6.2. Candle Air Fresheners

11.6.3. Liquid Air Fresheners

11.6.4. Gel Air Fresheners

11.6.5. Spray/Aerosol Air Fresheners

11.6.6. Others

11.7. Air Care Market Size (US$ Bn and Million Units) Forecast, By Application, 2017 - 2031

11.7.1. Rooms

11.7.2. Toilets

11.7.3. Cars

11.8. Air Care Market Size (US$ Bn and Million Units) Forecast, By Price, 2017 - 2031

11.8.1. Low

11.8.2. Medium

11.8.3. High

11.9. Air Care Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

11.9.1. Online

11.9.1.1. E-Commerce Websites

11.9.1.2. Company Owned Websites

11.9.2. Offline

11.9.2.1. Specialty Stores

11.9.2.2. Supermarkets & Hypermarkets

11.9.2.3. Other Retail Stores

11.10. Air Care Market Size (US$ Bn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2027

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Air Care Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Air Care Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017 - 2031

12.6.1. Electric Air Fresheners

12.6.2. Candle Air Fresheners

12.6.3. Liquid Air Fresheners

12.6.4. Gel Air Fresheners

12.6.5. Spray/Aerosol Air Fresheners

12.6.6. Others.)

12.7. Air Care Market Size (US$ Bn and Million Units) Forecast, By Application, 2017 - 2031

12.7.1. Rooms

12.7.2. Toilets

12.7.3. Cars

12.8. Air Care Market Size (US$ Bn and Million Units) Forecast, By Price, 2017 - 2031

12.8.1. Low

12.8.2. Medium

12.8.3. High

12.9. Air Care Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

12.9.1. Online

12.9.1.1. E-Commerce Websites

12.9.1.2. Company Owned Websites

12.9.2. Offline

12.9.2.1. Specialty Stores

12.9.2.2. Supermarkets & Hypermarkets

12.9.2.3. Other Retail Stores

12.10. Air Care Market Size (US$ Bn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Air Care Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Air Care Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017 - 2031

13.6.1. Electric Air Fresheners

13.6.2. Candle Air Fresheners

13.6.3. Liquid Air Fresheners

13.6.4. Gel Air Fresheners

13.6.5. Spray/Aerosol Air Fresheners

13.6.6. Others

13.7. Air Care Market Size (US$ Bn and Million Units) Forecast, By Application, 2017 - 2031

13.7.1. Rooms

13.7.2. Toilets

13.7.3. Cars

13.8. Air Care Market Size (US$ Bn and Million Units) Forecast, By Price, 2017 - 2031

13.8.1. Low

13.8.2. Medium

13.8.3. High

13.9. Air Care Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

13.9.1. Online

13.9.1.1. E-Commerce Websites

13.9.1.2. Company Owned Websites

13.9.2. Offline

13.9.2.1. Specialty Stores

13.9.2.2. Supermarkets & Hypermarkets

13.9.2.3. Other Retail Stores

13.10. Air Care Market Size (US$ Bn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Air Care Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Air Care Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017 - 2031

14.6.1. Electric Air Fresheners

14.6.2. Candle Air Fresheners

14.6.3. Liquid Air Fresheners

14.6.4. Gel Air Fresheners

14.6.5. Spray/Aerosol Air Fresheners

14.6.6. Others

14.7. Air Care Market Size (US$ Bn and Million Units) Forecast, By Application, 2017 - 2031

14.7.1. Rooms

14.7.2. Toilets

14.7.3. Cars

14.8. Air Care Market Size (US$ Bn and Million Units) Forecast, By Price, 2017 - 2031

14.8.1. Low

14.8.2. Medium

14.8.3. High

14.9. Air Care Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

14.9.1. Online

14.9.1.1. E-Commerce Websites

14.9.1.2. Company Owned Websites

14.9.2. Offline

14.9.2.1. Specialty Stores

14.9.2.2. Supermarkets & Hypermarkets

14.9.2.3. Other Retail Stores

14.10. Air Care Market Size (US$ Bn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Air Care Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Air Care Market Size (US$ Bn and Million Units) Forecast, By Product Type, 2017 - 2031

15.6.1. Electric Air Fresheners

15.6.2. Candle Air Fresheners

15.6.3. Liquid Air Fresheners

15.6.4. Gel Air Fresheners

15.6.5. Spray/Aerosol Air Fresheners

15.6.6. Others

15.7. Air Care Market Size (US$ Bn and Million Units) Forecast, By Application, 2017 - 2031

15.7.1. Rooms

15.7.2. Toilets

15.7.3. Cars

15.8. Air Care Market Size (US$ Bn and Million Units) Forecast, By Price, 2017 - 2031

15.8.1. Low

15.8.2. Medium

15.8.3. High

15.9. Air Care Market Size (US$ Bn and Million Units) Forecast, By Distribution Channel, 2017 - 2031

15.9.1. Online

15.9.1.1. E-Commerce Websites

15.9.1.2. Company Owned Websites

15.9.2. Offline

15.9.2.1. Specialty Stores

15.9.2.2. Supermarkets & Hypermarkets

15.9.2.3. Other Retail Stores

15.10. Air Care Market Size (US$ Bn) (Million Units) Forecast, by Country/Sub-region, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player - Competition Dashboard

16.2. Market Share Analysis - 2022 (%)

16.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

16.3.1. Procter & Gamble Co.

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.2. Reckitt Benckiser Group.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.3. S.C. Johnson & Son, Inc

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.4. Godrej Consumer Products Ltd

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.5. Church & Dwight Co.Inc.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.6. Newell Brands

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.7. Car-Freshener Corporation

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.8. Air Delights Inc.

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.9. Rexair LLC

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.10. Henkel AG & Company KGaA

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Product Type

17.1.2. Application

17.1.3. Price

17.1.4. Distribution channel

17.1.5. Region

17.2. Understanding the Procurement Process of End-users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Air Care Market by Product Type, Million Units 2017-2031

Table 2: Global Air Care Market by Product Type, US$ Bn 2017-2031

Table 3: Global Air Care Market by Application, Million Units 2017-2031

Table 4: Global Air Care Market by Application, US$ Bn 2017-2031

Table 5: Global Air Care Market by Price, Million Units 2017-2031

Table 6: Global Air Care Market by Price, US$ Bn 2017-2031

Table 7: Global Air Care Market by Distribution Channel, Million Units, 2017-2031

Table 8: Global Air Care Market by Distribution Channel, US$ Bn 2017-2031

Table 9: Global Air Care Market by Region, Million Units, 2017-2031

Table 10: Global Air Care Market by Region, US$ Bn 2017-2031

Table 11: North America Air Care Market by Product Type, Million Units 2017-2031

Table 12: North America Air Care Market by Product Type, US$ Bn 2017-2031

Table 13: North America Air Care Market by Application, Million Units 2017-2031

Table 14: North America Air Care Market by Application, US$ Bn 2017-2031

Table 15: North America Air Care Market by Price, Million Units 2017-2031

Table 16: North America Air Care Market by Price, US$ Bn 2017-2031

Table 17: North America Air Care Market by Distribution Channel, Million Units, 2017-2031

Table 18: North America Air Care Market by Distribution Channel, US$ Bn 2017-2031

Table 19: Europe Air Care Market by Product Type, Million Units 2017-2031

Table 20: Europe Air Care Market by Product Type, US$ Bn 2017-2031

Table 21: Europe Air Care Market by Application, Million Units 2017-2031

Table 22: Europe Air Care Market by Application, US$ Bn 2017-2031

Table 23: Europe Air Care Market by Price, Million Units 2017-2031

Table 24: Europe Air Care Market by Price, US$ Bn 2017-2031

Table 25: Europe Air Care Market by Distribution Channel, Million Units, 2017-2031

Table 26: Europe Air Care Market by Distribution Channel, US$ Bn 2017-2031

Table 27: Asia Pacific Air Care Market by Product Type, Million Units 2017-2031

Table 28: Asia Pacific Air Care Market by Product Type, US$ Bn 2017-2031

Table 29: Asia Pacific Air Care Market by Application, Million Units 2017-2031

Table 30: Asia Pacific Air Care Market by Application, US$ Bn 2017-2031

Table 31: Asia Pacific Air Care Market by Price, Million Units 2017-2031

Table 32: Asia Pacific Air Care Market by Price, US$ Bn 2017-2031

Table 33: Asia Pacific Air Care Market by Distribution Channel, Million Units, 2017-2031

Table 34: Asia Pacific Air Care Market by Distribution Channel, US$ Bn 2017-2031

Table 35: Middle East & Africa Air Care Market by Product Type, Million Units 2017-2031

Table 36: Middle East & Africa Air Care Market by Product Type, US$ Bn 2017-2031

Table 37: Middle East & Africa Air Care Market by Application, Million Units 2017-2031

Table 38: Middle East & Africa Air Care Market by Application, US$ Bn 2017-2031

Table 39: Middle East & Africa Air Care Market by Price, Million Units 2017-2031

Table 40: Middle East & Africa Air Care Market by Price, US$ Bn 2017-2031

Table 41: Middle East & Africa Air Care Market by Distribution Channel, Million Units, 2017-2031

Table 42: Middle East & Africa Air Care Market by Distribution Channel, US$ Bn 2017-2031

Table 43: South America Air Care Market by Product Type, Million Units 2017-2031

Table 44: South America Air Care Market by Product Type, US$ Bn 2017-2031

Table 45: South America Air Care Market by Application, Million Units 2017-2031

Table 46: South America Air Care Market by Application, US$ Bn 2017-2031

Table 47: South America Air Care Market by Price, Million Units 2017-2031

Table 48: South America Air Care Market by Price, US$ Bn 2017-2031

Table 49: South America Air Care Market by Distribution Channel, Million Units, 2017-2031

Table 50: South America Air Care Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Air Care Market Projections, by Product Type, Million Units, 2017-2031

Figure 2: Global Air Care Market Projections, by Product Type, US$ Bn 2017-2031

Figure 3: Global Air Care Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 4: Global Air Care Market Projections, by Application, Million Units, 2017-2031

Figure 5: Global Air Care Market Projections, by Application, US$ Bn 2017-2031

Figure 6: Global Air Care Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 7: Global Air Care Market Projections, by Price, Million Units, 2017-2031

Figure 8: Global Air Care Market Projections, by Price, US$ Bn 2017-2031

Figure 9: Global Air Care Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 10: Global Air Care Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 11: Global Air Care Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 12: Global Air Care Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 13: Global Air Care Market Projections, by Region, Million Units, 2017-2031

Figure 14: Global Air Care Market Projections, by Region, US$ Bn 2017-2031

Figure 15: Global Air Care Market, Incremental Opportunity, by Region, US$ Bn 2023-2031

Figure 16: North America Air Care Market Projections, by Product Type, Million Units, 2017-2031

Figure 17: North America Air Care Market Projections, by Product Type, US$ Bn 2017-2031

Figure 18: North America Air Care Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 19: North America Air Care Market Projections, by Application, Million Units, 2017-2031

Figure 20: North America Air Care Market Projections, by Application, US$ Bn 2017-2031

Figure 21: North America Air Care Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 22: North America Air Care Market Projections, by Price, Million Units, 2017-2031

Figure 23: North America Air Care Market Projections, by Price, US$ Bn 2017-2031

Figure 24: North America Air Care Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 25: North America Air Care Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 26: North America Air Care Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 27: North America Air Care Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 28: Europe Air Care Market Projections, by Product Type, Million Units, 2017-2031

Figure 29: Europe Air Care Market Projections, by Product Type, US$ Bn 2017-2031

Figure 30: Europe Air Care Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 31: Europe Air Care Market Projections, by Application, Million Units, 2017-2031

Figure 32: Europe Air Care Market Projections, by Application, US$ Bn 2017-2031

Figure 33: Europe Air Care Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 34: Europe Air Care Market Projections, by Price, Million Units, 2017-2031

Figure 35: Europe Air Care Market Projections, by Price, US$ Bn 2017-2031

Figure 36: Europe Air Care Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 37: Europe Air Care Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 38: Europe Air Care Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 39: Europe Air Care Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 40: Asia Pacific Air Care Market Projections, by Product Type, Million Units, 2017-2031

Figure 41: Asia Pacific Air Care Market Projections, by Product Type, US$ Bn 2017-2031

Figure 42: Asia Pacific Air Care Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 43: Asia Pacific Air Care Market Projections, by Application, Million Units, 2017-2031

Figure 44: Asia Pacific Air Care Market Projections, by Application, US$ Bn 2017-2031

Figure 45: Asia Pacific Air Care Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 46: Asia Pacific Air Care Market Projections, by Price, Million Units, 2017-2031

Figure 47: Asia Pacific Air Care Market Projections, by Price, US$ Bn 2017-2031

Figure 48: Asia Pacific Air Care Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 49: Asia Pacific Air Care Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 50: Asia Pacific Air Care Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 51: Asia Pacific Air Care Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 52: Middle East & Africa Air Care Market Projections, by Product Type, Million Units, 2017-2031

Figure 53: Middle East & Africa Air Care Market Projections, by Product Type, US$ Bn 2017-2031

Figure 54: Middle East & Africa Air Care Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 55: Middle East & Africa Air Care Market Projections, by Application, Million Units, 2017-2031

Figure 56: Middle East & Africa Air Care Market Projections, by Application, US$ Bn 2017-2031

Figure 57: Middle East & Africa Air Care Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 58: Middle East & Africa Air Care Market Projections, by Price, Million Units, 2017-2031

Figure 59: Middle East & Africa Air Care Market Projections, by Price, US$ Bn 2017-2031

Figure 60: Middle East & Africa Air Care Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 61: Middle East & Africa Air Care Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 62: Middle East & Africa Air Care Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 63: Middle East & Africa Air Care Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031

Figure 64: South America Air Care Market Projections, by Product Type, Million Units, 2017-2031

Figure 65: South America Air Care Market Projections, by Product Type, US$ Bn 2017-2031

Figure 66: South America Air Care Market, Incremental Opportunity, by Product Type, US$ Bn 2023-2031

Figure 67: South America Air Care Market Projections, by Application, Million Units, 2017-2031

Figure 68: South America Air Care Market Projections, by Application, US$ Bn 2017-2031

Figure 69: South America Air Care Market, Incremental Opportunity, by Application, US$ Bn 2023-2031

Figure 70: South America Air Care Market Projections, by Price, Million Units, 2017-2031

Figure 71: South America Air Care Market Projections, by Price, US$ Bn 2017-2031

Figure 72: South America Air Care Market, Incremental Opportunity, by Price, US$ Bn 2023-2031

Figure 73: South America Air Care Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 74: South America Air Care Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 75: South America Air Care Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023-2031