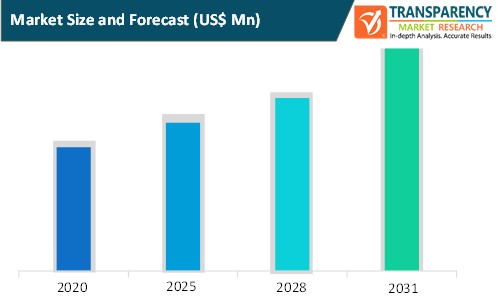

Working Capital Management: Introduction

- Working capital management is a type of business strategy, essentially designed to monitor a company’s current liabilities or assets to maintain sufficient cash flows, in order to meet short-term debt obligations and short-term operating costs. Working capital management mainly involves tracking three main ratios that include the collection ratio, the working capital ratio, and the inventory turnover ratio.

- Furthermore, working capital management can improve a company’s profitability and earnings by making efficient use of its resources.

Global Working Capital Management Market: Dynamics

Global Working Capital Management Market: Key Drivers

- Surge in demand for working capital management among organizations to maintain sufficient cash flow is a key factor likely to accelerate the market in the next few years.

- Growing need for working capital management to maximize business operational efficiency, due to rising adoption of temporary working capital is projected to boost the growth of the working capital management market across the globe.

- Businesses or industries that deal in the manufacturing of products that have seasonal demand and need to maintain seasonal working capital is expected to fuel the working capital management market.

- Increase in adoption of working capital management for granting credit to customers, managing short-term investments, managing inventory, and managing payables to avoid over-borrowing, is expected to create new opportunities for the working capital management market during the forecast period.

Global Working Capital Management Market: Restraints

- Inadequate working capital is one of the major factors which can have a negative impact on the growth of the working capital management market. Besides, growing security and privacy concerns are likely to obstruct the growth of the global working capital management market during the forecast period.

Impact of COVID-19 on the Global Working Capital Management Market

The COVID-19 outbreak has been a major challenge for the post-pandemic business environment. Governments of different countries across the world have imposed lockdowns to curb the spread of the disease. Hence, increase in credit risk with more reported insolvencies, defaults, and bankruptcies during the pandemic outbreak (due to disrupting financial markets) is expected to enhance the growth of the working capital management market. In addition, the pandemic outbreak has increased the short-term, medium, and long-term cash needs of people for reducing financial disruptions in these challenging times and has raised the demand for working capital management extensively across both developed and developing countries during the pandemic outbreak to enhance trade receivables. This in turn is expected to drive the growth of the working capital management market during the COVID-19 outbreak.

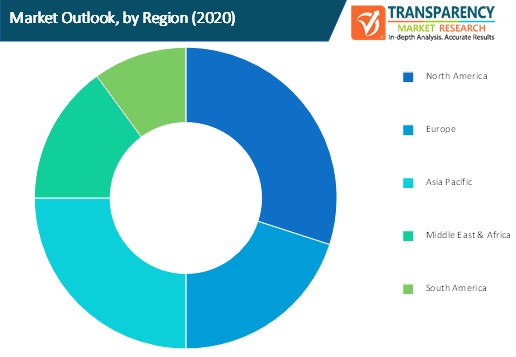

North America to Hold Major Share of the Global Working Capital Management Market

- In terms of region, the global working capital management market can be divided into North America, Europe, Asia Pacific, Middle East & Africa, and South America

- North America dominated the global working capital management market in 2020. The U.S. is the key market in the region, to maintain sufficient cash flow to meet short term goals and obligations in multinational enterprises across the country. Additionally, presence of well-established players who offer working capital management is expected to boost the market in the North American region.

- The working capital management market in Asia Pacific is projected to expand at a rapid pace during the forecast period. This can be attributed to increasing adoption of working capital management among enterprises across China, Japan, Singapore, Australia, and India, to enhance return on assets and return on equity.

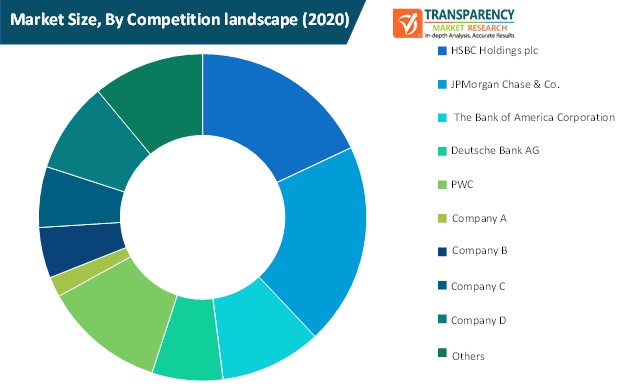

Global Working Capital Management Market: Competition Landscape

Several local, regional, and global players are active in the working capital management market with a strong presence. Rapid technological advancements have created significant opportunities in the global working capital management market. Providers are increasingly focusing on collaborations, mergers, and acquisition activities with technology partners to develop innovative and advanced solutions in order to improve their offerings and market reach.

Key Players Operating in the Global Working Capital Management Market Include:

- Citigroup Inc.

- Deutsche Bank AG

- HSBC Holdings plc

- JPMorgan Chase & Co.

- KPMG

- PWC

- Raiffeisen Bank

- SEBI

- Standard Chartered

- The Bank of America Corporation

- The Bank Of New York Mellon Corporation

- UniCredit S.p.A

Global Working Capital Management Market: Research Scope

Global Working Capital Management Market, by Product Type

- Gross Working Capital (GWC)

- Net Working Capital (NWC)

- Temporary Working Capital

- Permanent Working Capital

- Others

Global Working Capital Management Market, by Application

- Inventory Management

- Accounts Receivable

- Accounts Payable

- Cash Management

Global Working Capital Management Market, by Region

- North America

- U.S.

- Canada

- Rest of North America

- Europe

- Germany

- France

- U.K.

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Rest of South America