Reports

Reports

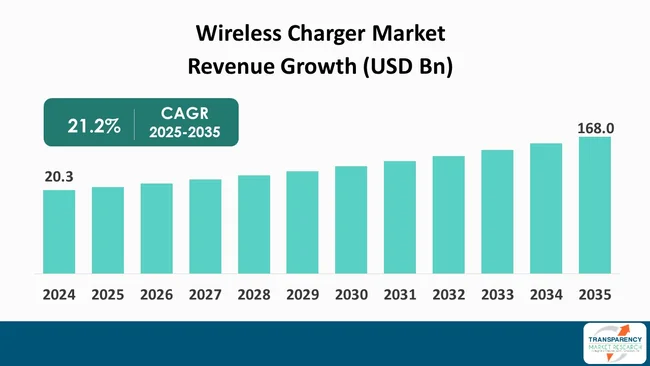

The global Wireless Charger market size was valued at US$ 20.3 Bn in 2024 and is projected to reach US$ 168.0 Bn by 2035, expanding at a CAGR of 21.2% from 2025 to 2035. The market growth is driven by the rising adoption of smartphones and wearable devices and growing preference for convenience and cable-free charging.

The wireless charger market is becoming a major part of the entire consumer electronics and power solutions fields. Wireless charging has transitioned from being a convenience feature to an essential expectation due to improvements in charging speed, interoperability standards, and compactness.

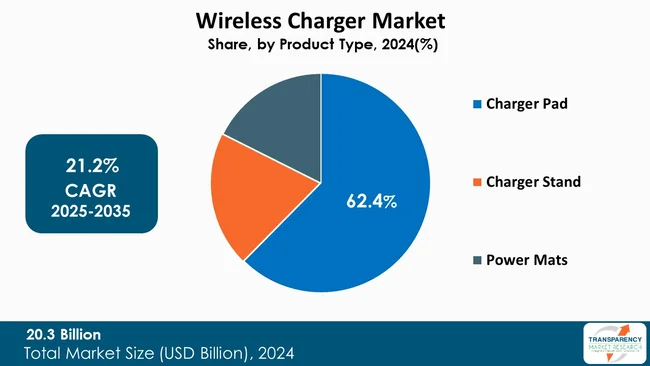

Charger pads, among the different product types, dominate the market, as they are easy to use, cost-effective, and appropriate for large-scale deployment in residential, commercial, and public areas. Their flat structure and easy integration into the furniture and infrastructure allow them to be scaled commercially.

Asia-Pacific is the biggest market for wireless chargers globally, backed by the fact that it has a strong electronics manufacturing ecosystem, high consumer device penetration, and short distances between component suppliers and OEMs. The region's market leadership indicates that it is both - a production hotspot and a major user of wireless-charging-compatible devices. In general, the market is marked by continuous acceptance, standardization, and growing consumer and industrial applications’ usage.

The wireless charger market involves the worldwide industry that facilitates the design, production, and distribution of units that allow the transfer of electric power to electronic devices without the need for any wires or connectors. The main technology used by the wireless chargers is electromagnetic induction, magnetic resonance, or RF, which enables the charging of compatible devices just by putting them on a charging spot or near a charging spot.

The market comprises a wide variety of products including charging pads, stands, mounts, multi-device charging stations, and embedded wireless charging modules, and also includes transmitters, receivers, and power management systems as supporting components. Wireless chargers are regarded as their main advantages, namely convenience, no cable wear, higher safety, and better user experience, particularly in places where frequent plugging and unplugging of devices is not practical.

The wireless charger market is mainly influenced by the continuous improvements in fast-charging capacities, energy consumption, heat management, and freedom of space. As well as the increasing use of smart devices and the growing focus on the use of cables that are not visible and technology that is minimalistic in all three areas, namely residential, commercial, and mobility.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The growing utilization of smartphones and wearable gadgets is the factor that predominantly propels the wireless charger market, with rapid growth of global digital connectivity. The International Telecommunication Union (ITU) states that in 2025, about 6 billion people are using the internet, thus pointing to the deep penetration of digital technologies into the daily life of people.

Internet availability has a strong correlation with smartphone ownership as in many areas smartphones are still the only access point for the digital services like communication, digital payments, streaming, navigation and remote work.

On the other hand, the mobile broadband coverage has become almost fully available, with the 5G networks reaching now about 55% of the world’s population offering faster data speeds, low latency, and high device usage intensity.

Apart from the smartphones, a variety of wearables like smartwatches, fitness trackers, and health monitoring devices are becoming more popular as accessories of mobile ecosystems. The rise in the number of interconnected users together with the expansion of the next-gen mobile networks makes it easier for consumers to acquire multiple smart devices at the same time, hence the per-user charging demand increases.

With the increase in the use of smartphones, wearables, and the other portable devices, the demand for solutions that lessen the effort and streamline the workflow is getting higher.

Wired charging generally requires locating the appropriate cable, joining the two ends, and experiencing the wear and tear of the device due to its uninterrupted connection and disconnection. Conversely, wireless charging offers the same comfort by letting the users put the device on the charging surface with minimal interaction and getting more fluid and natural to experience.

The contemporary way of living is getting increasingly portable and quicker each day, and gadgets are being utilized in the house, workplace, vehicle, and even in public areas. Wireless charging in such places allows users to be more flexible and find it easier to charge the devices during the day especially when several devices are charged every day. Wireless chargers also eliminate the problem of cable clutter, thereby resulting in cleaner workspaces and living areas.

In case of users who heavily depend on the devices, the outcome is longer device life and less downtime. Convenience is gradually becoming the main deciding factor in the purchase of consumer electronics and the need for wireless, hassle-free charging continues to boom.

Charger Pads dominates the wireless charger market, accounting for 62.4% of the whole market share. The demand for Charger Pads is increasing due to the consumers' acceptance of the product and its attributes of simple design, easy to use, and compatibility with various devices. The flat, small, and compact form factor of charger pads allows placing of the devices directly on the surface without having to align them precisely.

The charger pads are less expensive in terms of the production process and design compared to charger stands and power mats so the cost-efficient pricing is very much applicable to not only the manufacturers but also the end users. Manufacturers of charger pads are generally using the same wireless charging standards which are accepted by all thus allowing the use of the products across brands without the need for any special configurations being set up.

The fact of charger pads being scalable has even more fortified their position in the market. The continuous investments in charging efficiency, thermal management, and multi-coil designs have not only kept but also increased the performance level while keeping the small size thus making the charger pads the most commercially viable wireless charging option.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific region is leading the wireless charger market, with share of 45.1%. The primary reasons for the region's top position are the manufacturing base of the electronics industry, proliferation of smartphones, and the rapid acceptance of wireless charging technology across various non-consumer and consumer applications.

The major device makers, component providers, and OEMs are positioned in Asia Pacific’s economies such as China, South Korea, Japan, and Taiwan, which is why they are able to accelerate commercialization and produce wireless charging solutions at a lower cost.

The presence of leading mobile phone makers also pushes the incorporation of wireless charging features into the first stage of the new product cycle thereby increasing the demand of the market. Not only the consumer electronics sector but also the electric vehicle charging infrastructure and automation are among the factors that the region is drawing benefits from.

The wireless charging technology is increasingly being adopted in electric vehicles, automated guided vehicles, and smart manufacturing areas where the investment in infrastructure is being widely backed. Moreover, rapid urbanization and the formation of smart cities have made it a necessity to install the wireless charging stations in public places, offices, and commercial buildings. The advantages in the manufacturing process in terms of skilled workers providing labor and developing supply chains has helped the Asia-Pacific region's position as being competitive.

Key players in the wireless charger market include Apple Inc., Avenir Telecom, Delta Electronics Inc., etatronix GmbH, Huawei Technologies, InductEV Inc., LG Electronics, Meredot SIA, Plugless Power, Inc., Powermat Technologies Ltd., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Sony Corporation, Xiaomi Corporation, and the other key players.

Each of these companies has been profiled in the wireless charger market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 20.3 Bn |

| Market Forecast Value in 2035 | US$ 168.0 Bn |

| Growth Rate (CAGR 2025 to 2035) | 21.2% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Thousand Units for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global wireless charger market was valued at US$ 20.3 Bn in 2024

The global wireless charger industry is projected to reach US$ 168.0 Bn by the end of 2035

The rising adoption of smartphones and wearable devices and growing preference for convenience and cable-free charging are some of the factors driving the expansion of wireless charger market.

The CAGR is anticipated to be 21.2% from 2025 to 2035

Apple Inc., Avenir Telecom, Delta Electronics Inc., etatronix GmbH, Huawei Technologies, InductEV Inc., LG Electronics, Meredot SIA, Plugless Power, Inc., Powermat Technologies Ltd., Renesas Electronics Corporation, Samsung Electronics Co., Ltd., Sony Corporation, and Xiaomi Corporation, and the other key players.

Table 01: Global Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 02: Global Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 03: Global Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 04: Global Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 05: Global Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 06: Global Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 07: Global Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 08: Global Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 09: Global Wireless Charger Market Value (US$ Bn) Projection, By Region 2020 to 2035

Table 10: Global Wireless Charger Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Table 11: North America Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 12: North America Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 13: North America Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 14: North America Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 15: North America Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 16: North America Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 17: North America Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 18: North America Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 19: North America Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 20: North America Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 21: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 22: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 23: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 24: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 25: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 26: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 27: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 28: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 29: Canada Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 30: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 31: Canada Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 32: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 33: Canada Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 34: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 35: Canada Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 36: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 37: Europe Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 38: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 39: Europe Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 40: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 41: Europe Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 42: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 43: Europe Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 44: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 45: Europe Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 46: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 47: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 48: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 49: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 50: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 51: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 52: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 53: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 54: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 55: Germany Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 56: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 57: Germany Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 58: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 59: Germany Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 60: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 61: Germany Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 62: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 63: France Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 64: France Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 65: France Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 66: France Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 67: France Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 68: France Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 69: France Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 70: France Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 71: Italy Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 72: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 73: Italy Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 74: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 75: Italy Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 76: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 77: Italy Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 78: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 79: Spain Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 80: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 81: Spain Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 82: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 83: Spain Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 84: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 85: Spain Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 86: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 87: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 88: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 89: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 90: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 91: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 92: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 93: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 94: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 95: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 96: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 97: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 98: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 99: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 100: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 101: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 102: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 103: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 105: China Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 106: China Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 107: China Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 108: China Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 109: China Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 110: China Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 111: China Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 112: China Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 113: India Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 114: India Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 115: India Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 116: India Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 117: India Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 118: India Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 119: India Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 120: India Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 121: Japan Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 122: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 123: Japan Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 124: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 125: Japan Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 126: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 127: Japan Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 128: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 129: Australia Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 130: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 131: Australia Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 132: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 133: Australia Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 134: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 135: Australia Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 136: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 137: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 138: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 139: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 140: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 141: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 142: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 143: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 144: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 145: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 146: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 147: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 148: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 149: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 150: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 151: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 152: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 153: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 154: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 155: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 156: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 157: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 158: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 159: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 160: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 161: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 163: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 164: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 165: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 166: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 167: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 168: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 169: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 170: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 171: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 172: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 173: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 174: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 175: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 176: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 177: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 178: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 179: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 180: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 181: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 182: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 183: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 184: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 185: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 186: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 187: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Table 188: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Table 189: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 190: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 191: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 192: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 193: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 194: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 195: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 196: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 197: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 198: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 199: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 200: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 201: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 202: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 203: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 204: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Table 205: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Table 206: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Table 207: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Table 208: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Table 209: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Table 210: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Table 211: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Table 212: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 01: Global Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 02: Global Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 03: Global Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 04: Global Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 05: Global Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 06: Global Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 07: Global Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 08: Global Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 09: Global Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 10: Global Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 11: Global Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 12: Global Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 13: Global Wireless Charger Market Value (US$ Bn) Projection, By Region 2020 to 2035

Figure 14: Global Wireless Charger Market Volume (Thousand Units) Projection, By Region 2020 to 2035

Figure 15: Global Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Region 2025 to 2035

Figure 16: North America Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 17: North America Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 18: North America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 19: North America Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 20: North America Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 21: North America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 22: North America Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 23: North America Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 24: North America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 25: North America Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 26: North America Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 27: North America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 28: North America Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 29: North America Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 30: North America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 32: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 33: U.S. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 34: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 35: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 36: U.S. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 37: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 38: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 39: U.S. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 40: U.S. Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 41: U.S. Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 42: U.S. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 43: Canada Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 44: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 45: Canada Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 46: Canada Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 47: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 48: Canada Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 49: Canada Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 50: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 51: Canada Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 52: Canada Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 53: Canada Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 54: Canada Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 55: Europe Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 56: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 57: Europe Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 58: Europe Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 59: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 60: Europe Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 61: Europe Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 62: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 63: Europe Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 64: Europe Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 65: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 66: Europe Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 67: Europe Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 68: Europe Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 69: Europe Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 71: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 72: U.K. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 73: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 74: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 75: U.K. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 76: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 77: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 78: U.K. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 79: U.K. Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 80: U.K. Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 81: U.K. Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 82: Germany Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 83: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 84: Germany Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 85: Germany Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 86: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 87: Germany Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 88: Germany Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 89: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 90: Germany Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 91: Germany Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 92: Germany Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 93: Germany Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 94: France Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 95: France Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 96: France Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 97: France Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 98: France Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 99: France Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 100: France Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 101: France Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 102: France Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 103: France Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 104: France Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 105: France Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 106: Italy Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 107: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 108: Italy Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 109: Italy Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 110: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 111: Italy Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 112: Italy Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 113: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 114: Italy Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 115: Italy Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 116: Italy Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 117: Italy Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 118: Spain Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 119: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 120: Spain Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 121: Spain Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 122: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 123: Spain Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 124: Spain Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 125: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 126: Spain Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 127: Spain Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 128: Spain Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 129: Spain Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 130: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 131: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 132: The Netherlands Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 133: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 134: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 135: The Netherlands Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 136: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 137: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 138: The Netherlands Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 139: The Netherlands Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 140: The Netherlands Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 141: The Netherlands Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 142: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 143: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 144: Asia Pacific Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 145: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 146: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 147: Asia Pacific Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 148: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 149: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 150: Asia Pacific Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 151: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 152: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 153: Asia Pacific Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 154: Asia Pacific Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 157: China Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 158: China Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 159: China Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 160: China Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 161: China Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 162: China Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 163: China Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 164: China Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 165: China Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 166: China Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 167: China Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 168: China Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 169: India Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 170: India Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 171: India Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 172: India Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 173: India Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 174: India Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 175: India Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 176: India Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 177: India Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 178: India Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 179: India Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 180: India Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 181: Japan Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 182: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 183: Japan Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 184: Japan Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 185: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 186: Japan Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 187: Japan Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 188: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 189: Japan Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 190: Japan Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 191: Japan Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 192: Japan Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 193: Australia Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 194: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 195: Australia Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 196: Australia Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 197: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 198: Australia Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 199: Australia Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 200: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 201: Australia Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 202: Australia Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 203: Australia Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 204: Australia Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 205: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 206: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 207: South Korea Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 208: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 209: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 210: South Korea Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 211: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 212: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 213: South Korea Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 214: South Korea Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 215: South Korea Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 216: South Korea Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 217: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 218: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 219: ASEAN Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 220: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 221: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 222: ASEAN Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 223: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 224: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 225: ASEAN Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 226: ASEAN Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 227: ASEAN Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 228: ASEAN Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 229: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 230: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 231: Middle East & Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 232: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 233: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 234: Middle East & Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 235: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 236: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 237: Middle East & Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 238: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 239: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 240: Middle East & Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 241: Middle East & Africa Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 245: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 246: GCC Countries Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 247: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 248: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 249: GCC Countries Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 250: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 251: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 252: GCC Countries Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 253: GCC Countries Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 254: GCC Countries Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 255: GCC Countries Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 256: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 257: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 258: South Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 259: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 260: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 261: South Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 262: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 263: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 264: South Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 265: South Africa Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 266: South Africa Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 267: South Africa Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 268: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 269: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 270: Latin America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 271: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 272: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 273: Latin America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 274: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 275: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 276: Latin America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 277: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 278: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 279: Latin America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 280: Latin America Wireless Charger Market Value (US$ Bn) Projection, By Country 2020 to 2035

Figure 281: Latin America Wireless Charger Market Volume (Thousand Units) Projection, By Country 2020 to 2035

Figure 282: Latin America Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 284: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 285: Brazil Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 286: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 287: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 288: Brazil Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 289: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 290: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 291: Brazil Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 292: Brazil Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 293: Brazil Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 294: Brazil Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 295: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 296: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 297: Mexico Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 298: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 299: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 300: Mexico Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 301: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 302: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 303: Mexico Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 304: Mexico Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 305: Mexico Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 306: Mexico Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035

Figure 307: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Product Type 2020 to 2035

Figure 308: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Product Type 2020 to 2035

Figure 309: Argentina Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Product Type 2025 to 2035

Figure 310: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Technology 2020 to 2035

Figure 311: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Technology 2020 to 2035

Figure 312: Argentina Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Technology 2025 to 2035

Figure 313: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Rated Power 2020 to 2035

Figure 314: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Rated Power 2020 to 2035

Figure 315: Argentina Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Rated Power 2025 to 2035

Figure 316: Argentina Wireless Charger Market Value (US$ Bn) Projection, By Application 2020 to 2035

Figure 317: Argentina Wireless Charger Market Volume (Thousand Units) Projection, By Application 2020 to 2035

Figure 318: Argentina Wireless Charger Market Incremental Opportunities (US$ Bn) Forecast, By Application 2025 to 2035