WealthTech Solutions Market - Introduction

- WealthTech solutions are solutions used for wealth planning management and they support ultra-high net equity and high net worth consumers. WealthTech solutions help clients achieve their financial goals successfully. WealthTech solutions provide various advantages such as more efficient portfolio management, improved liquidity of assets, cost transparency, and enhanced customer service. These advantages drive the WealthTech solutions market.

- WealthTech solutions are used for digitizing process/outsourcing automation, retirement savings, digitized management of customer relationships, and comprehensive analysis of financial data. WealthTech solutions are used for strategic planning for integrated employer stock modeling, cash flows, complicated tax planning, strategic estate planning, and legacy planning. All these benefits tend to fuel the growth of the market.

Key Drivers of the WealthTech Solutions Market

- Rising implementation of automation solutions in various verticals is a factor that drives the growth of the market. WealthTech solutions allow businesses to identify new generation customer needs for small consulting firms and large banks, such as tech-enabled financial solutions, automated rebalancing, and portfolio creation. Key players in WealthTech concentrate on transforming the industry by identifying inefficiencies in the entire value chain of financial services.

- WealthTech solutions are more expensive, and lack of process, resources, methodology, and capital negatively impacts the growth of the market. In addition, lack of knowledge of financial investment are some factors that hamper the growth of the WealthTech solutions market.

Impact of COVID-19 on the Global WealthTech Solutions Market

The pandemic situation brings hardship for businesses, consumers, and communities across the globe. WealthTech solutions help in meeting rising demand for accountability during the COVID-19 crisis. WealthTech solutions helps to meet growing demands for fairness and transparency that, post COVID-19 crisis, will certainly increase as people requires a better advisor that help them to manage their commercial and financial affairs. In order to meet the challenge of remote working and the stress of fast-declining margins will provide growth opportunity to the market.

North America Accounts for Dominant Share of the WealthTech Solutions Market

- North America holds a prominent share of the wealthtech solutions due to the growing expansion of industries in the region, which is expected to drive the demand during the forecasted period. Moreover, implementation of technologies in banks is another factor likely to increase demand for wealthtech solutions. These solutions are capable of providing real time data that help businesses make better investment decisions, which further helps improve the efficiency of management along with operational agility.

- The Asia Pacific wealthtech solutions is expected to expand at the highest CAGR during the forecast period. Rising internet penetration in developing economies increases digitalization in the financial sector. WealthTech solutions provide relevant information along with regulatory requirements. Investors and investment managers are looking for digital communication platforms that can ensure quick access to the investment portfolio.

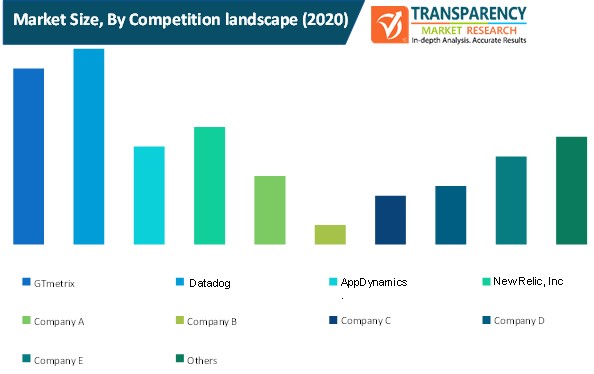

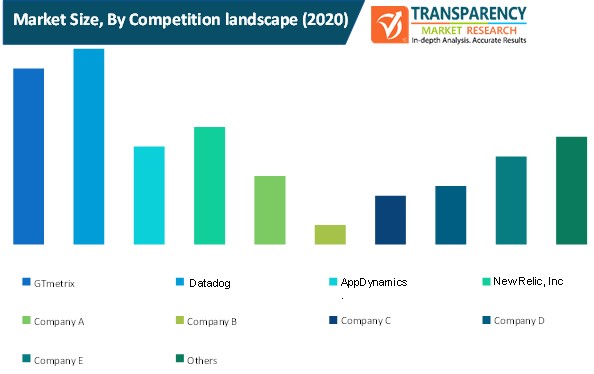

Key Players Operating in the Global WealthTech Solutions Market

Companies operating in the wealthtech solutions market are increasingly investing in research and development to develop new and innovative techniques to provide social CRM solutions. The wealthtech solutions market is highly fragmented with the presence of numerous manufacturers in both developed and developing regions. Key players operating in the global wealthtech solutions market include:

- Finmason

- Aixigo AG

- InvestCloud

- Wealthfront

- Valuefy

- Fintech

- BlackRock, Inc.

- Synechron

- Wealthfront Corporation

Global WealthTech Solutions Market: Research Scope

Global WealthTech Solutions Market, by Component

- Solutions

- Services

- Managed Services

- Consulting Services

- Implementation Services

Global WealthTech Solutions Market, by Deployment Mode

Global WealthTech Solutions Market, by Organization Size

- Large Enterprises

- Small & Medium-sized Enterprises

Global WealthTech Solutions Market, by End-user

- Banks

- Investment Firms

- Wealth Management Firms

- Others

Global WealthTech Solutions Market Segmentation, by Region

- North America

- Europe

- Germany

- U.K.

- France

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- ASEAN

- Rest of Asia Pacific

- Middle East & Africa (MEA)

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- South America

- Brazil

- Argentina

- Rest of South America

Alternative Keywords

- Accounting Management

- Financial Management Software