Reports

Reports

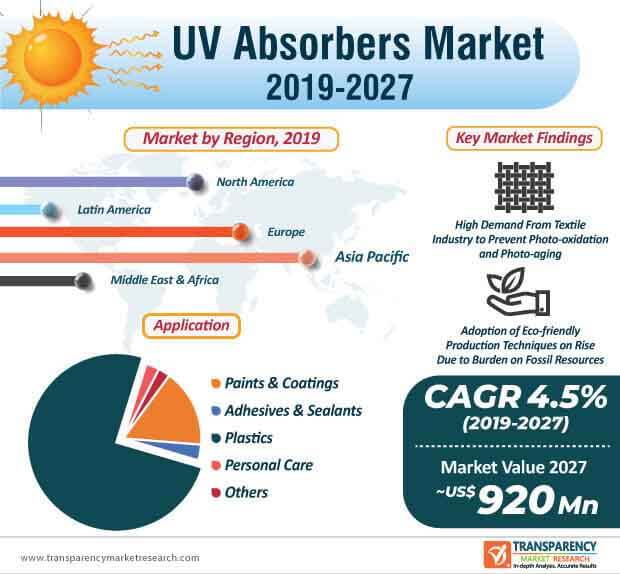

The demand for ultraviolet (UV) absorbers is growing at a rapid pace due to significant developments at the research front. Research and development activities continue to play a key role in exploring new potential applications of UV absorbers in a range of industrial sectors. Over the past few decades, UV absorbers market has witnessed significant expansion, as UV absorbers are essential in absorbing and converting UV energy into heat or kinetic energy. Moreover, UV absorbers are increasingly being used to prevent photo-oxidation and photo-aging process in the textile industry. While the adoption of UV absorbers in the textile industry continues to gain momentum, as per the current trends, the demand from automotive, construction, and cosmetics sectors is also growing at a considerable pace.

UV stabilizers are widely used to prevent degradation in polymeric applications, as the physical and chemical structure of the polymer is affected upon exposure to sunlight. In addition, UV degradation could also affect impact resistance, molecular weight, gloss, color, and other properties of fibers-a factor that is expected to generate significant demand for UV absorbers in the textile industry. As a result of these factors, the global UV absorbers market is expected to reach a value of ~US$ 669 Mn in 2020 and ~US$ 920 Mn by 2027.

Industrial and manufacturing sectors across the world are under continual pressure to comply with stringent environmental norms and regulations. Over the past decade, due to mounting environmental concerns, stakeholders in the UV absorbers market are leaning toward eco-friendly manufacturing processes with materials and compounds that have a low environmental footprint. Amidst the mounting environmental concerns, research and development activities have gained significant momentum in the UV absorbers market.

For instance, in August 2019, a research team from the University of Witwatersrand, along with their peers from other universities in Tanzania, Malawi, and Germany, claimed to have found an eco-friendly way to produce potential UVB and UVA absorbers by utilizing cashew nutshells. Additionally, the team is also exploring other alternatives to manufacture vital compounds from edible waste and wood by deploying a chemical process known as Xylo chemistry i.e. wood chemistry. The rapid utilization of fossil resources for chemical synthesis in the UV absorber market was a major factor that triggered the research in this field. The newly developed aromatic compounds could find applications in coating, polymers, etc.

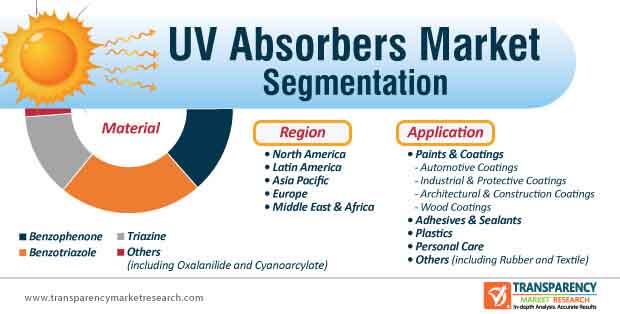

Automotive companies are consistently seeking new techniques to protect the exterior coatings of their automobiles. Similar to how sunscreen is used to protect the skin from the sun, UV absorbers play an integral role in protecting automotive coatings from sun exposure. Light stabilizer solutions, which contain hindered amine light stabilizers and UV absorbers are increasingly being used to improve the performance of refinish paints and automotive OEM clear coat. UV absorbers also play a key role in mitigating the effects of oxidation and heat in the long run. Due to these factors, the demand for UV absorbers to make automotive coatings is expected to witness steady growth during the forecast period (2019-2027). While the paints & coatings application segment is expected to reach a value of ~US$ 108 Mn in 2020, the automotive coatings application segment is projected to for ~US$ 27 Mn in the same year.

Stakeholders Focus on Expanding Production Capacity

Participants operating in the UV absorbers market are expected to focus on product innovation, eco-friendly manufacturing, and expanding their production capacity to gain competitive edge in the current market landscape. As per current trends, multiple stakeholders are expanding their production capacity to solidify their position in the global UV absorbers market. For instance, in December 2018, SONGWON announced that the company would expand its in-house production of UV absorbers by adding a new production line at Suwon’s manufacturing unit.

Analysts’ Viewpoint

The UV absorbers market is estimated to grow at a steady CAGR of 4.5% during the forecast period. The market growth can be primarily attributed to the soaring demand for UV absorbers used in the production of paints and coatings that are employed in the automobile sector. The growth in the number of construction and infrastructure development projects, particularly in the Asia Pacific region, will provide an impetus for growth of the UV absorbers market during the forecast period. Research and development activities will largely focus on the eco-friendly production of UV absorbers using natural wastes such as cashew shells. Stakeholders should focus on developing new products that comply with regulations and industrial guidelines.

UV Absorbers Market: Overview

Key Drivers of UV Absorbers Market

Major Challenges for UV Absorbers Market

Lucrative Opportunities for UV Absorbers Market

Asia Pacific to Dominate UV Absorbers Market

High Demand for Benzotriazole UV Absorbers

Leading Players Actively Engage in Joint Ventures and R&D Activities

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global UV Absorbers Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators/Definitions

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Porter’s Five Forces Analysis

4.5. Value Chain Analysis

5. Production Outlook, 2018

5.1. Production Outlook, by Region

6. Pricing Analysis, 2018 (Benchmarking)

6.1. Price Comparison Analysis, by Material

6.2. Price Comparison Analysis, by Region

7. Global UV Absorbers Market Analysis and Forecast, by Material

7.1. Introduction

7.2. Global UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

7.2.1. Benzophenone

7.2.2. Benzotriazole

7.2.3. Triazine

7.2.4. Others

7.3. Global UV Absorbers Market Attractiveness, by Material

8. Global UV Absorbers Market Analysis and Forecast, by Application

8.1. Introduction

8.2. Global UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

8.2.1. Paints & Coatings

8.2.1.1. Automotive Coatings

8.2.1.2. Industrial & Protective Coatings

8.2.1.3. Architectural & Construction Coatings

8.2.1.4. Wood Coatings

8.2.2. Adhesives & Sealants

8.2.3. Plastics

8.2.4. Personal Care

8.2.5. Others

8.3. Global UV Absorbers Market Attractiveness, by Application

9. Global UV Absorbers Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Global UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2019–2027

9.3. Global UV Absorbers Market Attractiveness, by Region

10. North America UV Absorbers Market Analysis and Forecast

10.1. Key Findings

10.2. North America UV Absorbers Forecast, by Material, 2019–2027

10.3. North America UV Absorbers Forecast, by Application, 2019–2027

10.4. North America UV Absorbers Market Forecast, by Country, 2019–2027

10.4.1. U.S. UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

10.4.2. U.S. UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.4.3. Canada UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

10.4.4. Canada UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

10.5. North America UV Absorbers Market Attractiveness Analysis

11. Europe UV Absorbers Market Analysis and Forecast

11.1. Key Findings

11.2. Europe UV Absorbers Forecast, by Material, 2019–2027

11.3. Europe UV Absorbers Forecast, by Application, 2019–2027

11.4. Europe UV Absorbers Market Forecast, by Country and Sub-region, 2019–2027

11.4.1. Germany UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.2. Germany UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4.3. U.K. UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.4. U.K. UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4.5. France UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.6. France UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4.7. Italy UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.8. Italy UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4.9. Spain UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.10. Spain UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4.11. Russia & CIS UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.12. Russia & CIS UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.4.13. Rest of Europe UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

11.4.14. Rest of Europe UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

11.5. Europe UV Absorbers Market Attractiveness Analysis

12. Asia Pacific UV Absorbers Market Analysis and Forecast

12.1. Key Findings

12.2. Asia Pacific UV Absorbers Forecast, by Material, 2019–2027

12.3. Asia Pacific UV Absorbers Forecast, by Application, 2019–2027

12.4. Asia Pacific UV Absorbers Market Forecast, by Country and Sub-region, 2019–2027

12.4.1. China UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

12.4.2. China UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.4.3. Japan UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

12.4.4. Japan UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.4.5. India UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

12.4.6. India UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.4.7. ASEAN UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

12.4.8. ASEAN UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.4.9. Rest of Asia Pacific UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

12.4.10. Rest of Asia Pacific UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

12.5. Asia Pacific UV Absorbers Market Attractiveness Analysis

13. Latin America UV Absorbers Market Analysis and Forecast

13.1. Key Findings

13.2. Latin America UV Absorbers Forecast, by Material, 2019–2027

13.3. Latin America UV Absorbers Forecast, by Application, 2019–2027

13.4. Latin America UV Absorbers Market Forecast, by Country and Sub-region, 2019–2027

13.4.1. Brazil UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

13.4.2. Brazil UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

13.4.3. Mexico UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

13.4.4. Mexico UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

13.4.5. Rest of Latin America UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

13.4.6. Rest of Latin America UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

13.5. Latin America UV Absorbers Market Attractiveness Analysis

14. Middle East & Africa UV Absorbers Market Analysis and Forecast

14.1. Key Findings

14.2. Middle East & Africa UV Absorbers Forecast, by Material, 2019–2027

14.3. Middle East & Africa UV Absorbers Forecast, by Application, 2019–2027

14.4. Middle East & Africa UV Absorbers Market Forecast, by Country and Sub-region, 2019–2027

14.4.1. South Africa UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

14.4.2. South Africa UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

14.4.3. GCC UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

14.4.4. GCC UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

14.4.5. Rest of Middle East & Africa UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Material, 2019–2027

14.4.6. Rest of Middle East & Africa UV Absorbers Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2019–2027

14.5. Middle East & Africa UV Absorbers Market Attractiveness Analysis

15. Competition Landscape

15.1. Global UV Absorbers Market Share Analysis, by Company, 2018

15.2. Company Profiles

15.2.1. ADEKA Corporation

15.2.1.1. Company Description

15.2.1.2. Business Overview

15.2.1.3. Financial Details

15.2.1.4. Key Developments

15.2.2. SONGWON Industrial Group

15.2.2.1. Company Description

15.2.2.2. Business Overview

15.2.2.3. Financial Details

15.2.2.4. Key Developments

15.2.3. BASF SE

15.2.3.1. Company Description

15.2.3.2. Business Overview

15.2.3.3. Financial Details

15.2.3.4. Key Developments

15.2.4. Solvay S.A.

15.2.4.1. Company Description

15.2.4.2. Business Overview

15.2.4.3. Financial Details

15.2.4.4. Key Developments

15.2.5. Bioray Chemical Co., Ltd.

15.2.5.1. Company Description

15.2.5.2. Business Overview

15.2.6. SI Group, Inc.

15.2.6.1. Company Description

15.2.6.2. Business Overview

15.2.7. Clariant AG

15.2.7.1. Company Description

15.2.7.2. Business Overview

15.2.7.3. Financial Details

15.2.7.4. Key Developments

15.2.8. Rianlon Corporation

15.2.8.1. Company Description

15.2.8.2. Business Overview

15.2.9. Everspring Chemical Co., Ltd.

15.2.9.1. Company Description

15.2.9.2. Business Overview

15.2.10. BLS Polymers Ltd

15.2.10.1. Company Description

15.2.10.2. Business Overview

15.2.11. Beijing Tiangang Auxiliary Co., Ltd

15.2.11.1. Company Description

15.2.11.2. Business Overview

15.2.12. Dalian Richfortune Chemicals Co., Ltd.

15.2.12.1. Company Description

15.2.12.2. Business Overview

15.2.13. Chitec Technology Co., Ltd.

15.2.13.1. Company Description

15.2.13.2. Business Overview

15.2.14. TAIWAN DYESTUFFS & PIGMENTS CORP.

15.2.14.1. Company Description

15.2.14.2. Business Overview

15.2.15. Everlight Chemical Industrial Corp.

15.2.15.1. Company Description

15.2.15.2. Business Overview

15.2.15.3. Financial Details

15.2.15.4. Key Developments

15.2.16. Shanghai New Shanghua Polymer Material Co., Ltd.

15.2.16.1. Company Description

15.2.16.2. Business Overview

15.2.17. Greenchemicals SpA

15.2.17.1. Company Description

15.2.17.2. Business Overview

15.2.18. Mayzo, Inc.

15.2.18.1. Company Description

15.2.18.2. Business Overview

List of Tables

Table 1: Global UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 2: Global UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 3: Global UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2018–2027

Table 4: North America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 5: North America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 6: U.S. UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 7: U.S. UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 8: Canada UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 9: Canada UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 10: North America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2018–2027

Table 11: Europe UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 12: Europe UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 13: Germany UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 14: Germany UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 15: France UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 16: France UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 17: U.K. UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 18: U.K. UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 19: Italy UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 20: Italy UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 21: Spain UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 22: Spain UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 23: Russia & CIS UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 24: Russia & CIS UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 25: Rest of Europe UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 26: Rest of Europe UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 27: Europe UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 28: Asia Pacific UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 29: Asia Pacific UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 30: China UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 31: China UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 32: India UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 33: India UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 34: Japan UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 35: Japan UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 36: ASEAN UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 37: ASEAN UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 38: Rest of Asia Pacific UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 39: Rest of Asia Pacific UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 40: Asia Pacific UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 41: Latin America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 42: Latin America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 43: Brazil UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 44: Brazil UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 45: Mexico UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 46: Mexico UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 47: Rest of Latin America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 48: Rest of Latin America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 49: Latin America UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

Table 50: Middle East & Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 51: Middle East & Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 52: GCC UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 53: GCC UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 54: South Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 55: South Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 56: Rest of Middle East & Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2018–2027

Table 57: Rest of Middle East & Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

Table 58: Middle East & Africa UV Absorbers Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2018–2027

List of Figures

Figure 01: Production Output of UV Absorbers, by Region, 2018

Figure 02: Global UV Absorbers Pricing Analysis (US$/Ton), by Material, 2018–2027

Figure 03: Global UV Absorbers Pricing Analysis (US$/Ton), by Region, 2018–2027

Figure 04: Global UV Absorbers Market Volume Share Analysis, by Material

Figure 05: Global UV Absorbers Market Attractiveness Analysis, by Material

Figure 06: Global UV Absorbers Market Volume Share Analysis, by Application

Figure 07: Global UV Absorbers Market Attractiveness Analysis, by Application

Figure 08: Global UV Absorbers Market Volume Share Analysis, by Region

Figure 09: Global UV Absorbers Market Attractiveness Analysis, by Region

Figure 08: North America UV Absorbers Market Volume Share Analysis, by Material

Figure 09: North America UV Absorbers Market Attractiveness Analysis, by Material

Figure 10: North America UV Absorbers Market Volume Share Analysis, by Application

Figure 11: North America UV Absorbers Market Attractiveness Analysis, by Application

Figure 12: North America UV Absorbers Market Volume Share Analysis, by Country

Figure 13: North America UV Absorbers Market Attractiveness Analysis, by Country

Figure 14: Europe UV Absorbers Market Volume Share Analysis, by Material

Figure 15: Europe UV Absorbers Market Attractiveness Analysis, by Material

Figure 16: Europe UV Absorbers Market Volume Share Analysis, by Application

Figure 17: Europe UV Absorbers Market Attractiveness Analysis, by Application

Figure 18: Europe UV Absorbers Market Volume Share Analysis, by Country and Sub-region

Figure 19: Europe UV Absorbers Market Attractiveness Analysis, by Country and Sub-region

Figure 20: Asia Pacific UV Absorbers Market Volume Share Analysis, by Material

Figure 21: Asia Pacific UV Absorbers Market Attractiveness Analysis, by Material

Figure 22: Asia Pacific UV Absorbers Market Volume Share Analysis, by Application

Figure 23: Asia Pacific UV Absorbers Market Attractiveness Analysis, by Application

Figure 24: Asia Pacific UV Absorbers Market Volume Share Analysis, by Country and Sub-region

Figure 25: Asia Pacific UV Absorbers Market Attractiveness Analysis, by Country and Sub-region

Figure 26: Latin America UV Absorbers Volume Market Share Analysis, by Material

Figure 27: Latin America UV Absorbers Market Attractiveness Analysis, by Material

Figure 28: Latin America UV Absorbers Volume Market Share Analysis, by Application

Figure 29: Latin America UV Absorbers Market Attractiveness Analysis, by Application

Figure 30: Latin America UV Absorbers Market Share Analysis, by Country and Sub-region

Figure 31: Latin America UV Absorbers Market Attractiveness Analysis, by Country and Sub-region

Figure 32: Middle East & Africa UV Absorbers Market Volume Share Analysis, by Material

Figure 33: Middle East & Africa UV Absorbers Market Attractiveness Analysis, by Material

Figure 34: Middle East & Africa UV Absorbers Market Volume Share Analysis, by Application

Figure 35: Middle East & Africa UV Absorbers Market Attractiveness Analysis, by Application

Figure 36: Middle East & Africa UV Absorbers Market Volume Share Analysis, by Country and Sub-region

Figure 37: Middle East & Africa UV Absorbers Market Attractiveness Analysis, by Country and Sub-region

Figure 38: Global UV Absorbers Market Share Analysis, by Company, 2018