Reports

Reports

It is no surprise that the coronavirus pandemic has affected almost all industries, including welding. As manufacturing activities are surging in a staggered manner, companies in the U.S. welding consumables market are focusing on key industries such as construction, agriculture, and power to establish stable revenue streams. The inability for many workers to appear onsite has resulted in hurdles for welding manufacturers.

Stakeholders in the U.S. welding consumables market are improvising on their business activities to avoid shutdowns and maintain productivity. They are emphasizing on the urgency to formulate and mobilize teams to cope with the COVID-19 pandemic. Companies are assembling separate teams for crisis management, growth, and digital transformation developments. As such, the U.S. manufacturing industry is predicted to experience a boom in Q3 and Q4 of 2021 and upcoming years, which would offset losses incurred in 2020.

Sailing enthusiasts, several water sports, and cruises are accelerating construction of different types of ships. However, welding imposes various challenges in shipbuilding such as rigorous inspection of steel plates and need for investment in the shipbuilding infrastructure. Welding manufacturers are adopting digital process control for inspection of welding components and automation to increase productivity that caters to improvement in bottom lines.

The U.S. welding consumables market is expected to exceed the volume of 1,925 kilo tons by 2031. Flexible range of digital process control functions and automation are helping to minimize laborious reworking activities.

Double filler wires are being used to improve productivity and raise welding speeds in various operations. On the other hand, the tandem welding method is being highly publicized in modern mechanized welding. However, this method can sometimes interfere through magnetic arc blow effect. Hence, welding manufacturers in the U.S. welding consumables market are using the twin arc method with pulsed welding, with pulses on each wire displaced out of phase with each other.

There is a growing need for awareness that double wire welding is the process where both wires share the same electrical potential, whereas tandem welding involves wires being applied with independent potentials. High performance tandem welding is being employed by manufacturers in the U.S. welding consumables market to achieve high welding speeds and large seam volumes.

There is a growing demand for solid wires that cut down on post-weld cleanup so that workers spend less time cleaning and more time welding. Manufacturers in the U.S. welding consumables market are developing revolutionary solid wires that deploy process stability, weld integrity, bead cleanliness, and maximize uptime. These wires are gaining prominence in robotic welding applications.

Microelement control, robust geometrical properties, and smooth feedability of solid wires are being preferred in robotic welding applications. Such trends are translating into incremental opportunities for companies in the U.S. welding consumables market.

Machine learning (ML) is acting as a key driver of the U.S. welding consumables market, as it is helping to achieve significant improvement in the performance of hard-facing welding consumables. Welding Alloys Group is mainly focusing on ML to develop hard-facing materials that deliver drastic cost advantages even from the environmental point of view.

Wear is one of the most complex challenges faced by the heavy duty industry. This has created opportunities for companies in the U.S. welding consumables market to use ML and develop high-chromium cast iron-based welding consumables that comply with abrasion-resistant standards.

Analysts’ Viewpoint

The expansion of the welding industry is highly dependent on steel consumption. Due to the slowdown of the automotive industry during the COVID-19 pandemic, stakeholders are estimating a positive outlook in construction, marine, and power generation sectors. The U.S. welding consumables market is projected to grow at a modest CAGR of ~4% during the forecast period. This is evident since metal core wires are demanding investment in automated and robotic setups to achieve high efficiencies in operations. Since the U.S. welding manufacturing industry has been slow in adoption of next-gen technologies, awareness about technological advantages are anticipated to drive investments in automation software and robotics.

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

2. Market Overview

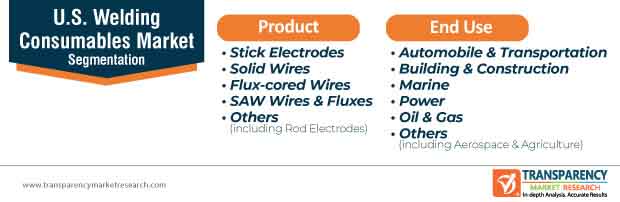

2.1. Market Segmentation

2.2. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1.1. Drivers

3.1.1.2. Restraints

3.1.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

4. COVID-19 Impact Analysis

5. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Product

5.1. Key Findings and Introduction

5.2. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

5.2.1. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Stick Electrodes, 2020–2031

5.2.2. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Solid Wires, 2020–2031

5.2.3. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Flux-cored Wires, 2020–2031

5.2.4. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by SAW Wires & Fluxes, 2020–2031

5.2.5. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2020–2031

5.3. U.S. Welding Consumables Market Attractive Analysis, by Product

6. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by End-use

6.1. Key Findings and Introduction

6.2. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

6.2.1. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Automobile & Transportation, 2020-2031

6.2.2. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Building & Construction, 2020-2031

6.2.3. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Marine, 2020-2031

6.2.4. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Power, 2020-2031

6.2.5. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Oil & Gas, 2020-2031

6.2.6. U.S. Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Others, 2020-2031

6.3. U.S. Welding Consumables Market Attractive Analysis, by End-use

7. Competition Landscape

7.1. Competition Matrix

7.2. U.S. Welding Consumables Market Share Analysis, by Company (2020)

7.3. Market Footprint Analysis

7.4. Company Profiles

7.4.1. Welding Alloys Group

7.4.1.1. Company Details

7.4.1.2. Company Description

7.4.1.3. Business Overview

7.4.1.4. Financial Details

7.4.1.5. Strategic Overview

7.4.2. Mitco Weld Products Pvt. Ltd.

7.4.2.1. Company Details

7.4.2.2. Company Description

7.4.2.3. Business Overview

7.4.3. Air Liquide

7.4.3.1. Company Details

7.4.3.2. Company Description

7.4.3.3. Business Overview

7.4.3.4. Financial Details

7.4.3.5. Strategic Overview

7.4.4. ESAB

7.4.4.1. Company Details

7.4.4.2. Company Description

7.4.4.3. Business Overview

7.4.4.4. Financial Details

7.4.4.5. Strategic Overview

7.4.5. KOBE STEEL, LTD.

7.4.5.1. Company Details

7.4.5.2. Company Description

7.4.5.3. Business Overview

7.4.6. Illinois Tool Works Inc.

7.4.6.1. Company Details

7.4.6.2. Company Description

7.4.6.3. Business Overview

7.4.6.4. Financial Details

7.4.6.5. Strategic Overview

7.4.7. The Lincoln Electric Company

7.4.7.1. Company Details

7.4.7.2. Company Description

7.4.7.3. Business Overview

7.4.7.4. Financial Details

7.4.8. voestalpine Böhler Welding GmbH

7.4.8.1. Company Details

7.4.8.2. Company Description

7.4.8.3. Business Overview

7.4.8.4. Financial Details

8. Primary Research – Key Insights

9. Appendix

9.1. Research Methodology and Assumptions

List of Tables

Table 01: Global Welding Consumables Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

Table 02: U.S. Welding Consumables Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 03: U.S. Welding Consumables Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 04: U.S. Welding Consumables Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 05: U.S. Welding Consumables Market Value (US$ Mn) Forecast, by End-use, 2020–2031

List of Figures

Figure 01: U.S. Welding Consumables Market Share Analysis, by Product

Figure 02: U.S. Welding Consumables Market Attractiveness Analysis, by Product

Figure 03: U.S. Welding Consumables Market Share Analysis, by End-user

Figure 04: U.S. Welding Consumables Market Attractiveness Analysis, by End-user