Reports

Reports

Global Smart Gas Market – Key Trends

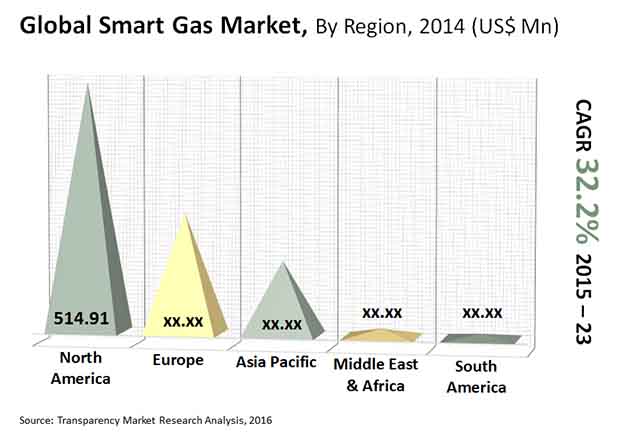

Governments around the world are exploring various ways of improving energy efficiency and security during prolonged power-cuts. This has created lucrative prospects for the smart gas meter manufacturers. As per Transparency Market Research (TMR), the market is also likely to gain impetus from the favorable policies drafted in various nations to curb the carbon footprint. Furthermore, smart gas meters offer end users greater control over their electricity consumption and bills. Spurred by these factors, the global smart gas market is expected to report a CAGR of 32.2% between 2015 and 2023.

Despite witnessing promising growth opportunities, the high initial investment required for installing smart gas meters limits the market’s trajectory to an extent. Nevertheless, the rising energy demand in Asia Pacific is likely to boost opportunities for the market in the near future.

As per TMR, the global smart gas market stood at US$944.67 mn in 2014. The market is expected to reach US$10.5 bn by the end of 2023.

High Demand from Residential Segment Emerges as Primary Driver

The global smart gas market is segmented into residential, commercial, and industrial sectors. Of these, the market is currently dominated by the residential segment, which held approximately 73.85% of the market in 2014. As compared to commercial users, the consumers in the residential segment pay lesser for installation of smart gas meters. This is one of the key factors leading to the widespread deployment of smart gas meter across the residential sector.

However, during the course of the forecast period, several regulations are likely to be implemented, obligating the installation of smart gas meters across the commercial and industrial segment. Installing smart gas meters enable energy savings by providing the ability to control gas usage. This is a primary factor that will boost the deployment of smart gas in the industrial and commercial segment.

New Opportunities across Europe and Asia Pacific to Augur Well for the Market

Regionally, North America leads the global smart gas market. Based on revenue, it held over 54.41% of the global smart gas market in 2014. However, as per TMR, the deployment of smart gas meters is slowing down in the region as compared to considerable roll outs of smart gas meters in countries such as China. Given the speed at which the developing economies are upgrading their transmission and distribution systems, and generating capabilities, they will very soon match the growth exhibited by the smart gas market across developed regions.

In North America, Canada, Mexico, and the U.S. are currently exhibiting the highest demand for smart gas meters. In Europe smart metering initiatives are propelled by the increasing investments by the governments of Italy, France, and the U.K. The member nations of the European Union, as per a recent mandate, are required to deliver smart gas meters to almost 80% of their gas consumers by the end of 2020. Such regulations are expected to augur well for the future of the smart gas market.

However, during the forecast period, Asia Pacific is expected to emerge as one of the most dynamic markets for smart gas meters. The commencement of various large-scale smart gas metering projects in countries such as China and Japan will fuel demand from the region. With utilities and governments in Asia Pacific encouraging aggressive smart gas meter deployments, the smart gas market in the region is expected to expand at a robust pace.

Some of the leading players operating in the smart gas market include Itron, Inc., Elster Group GmbH, General Electric, EnerNOC Inc., and Sensus Metering Systems, Inc.

Increasing Adoption of Smart Gas Pipeline to Bolster Growth of Smart Gas Market

The drive for expanding operational productivity and security and accommodation for shoppers has mixed the sending of different smart gas gadgets and innovations. Service organizations all throughout the planet have progressively profited by the steps in the smart gas market by using the adaptability and dependability of the innovations to guarantee a better yield on their ventures. The suggestion of utilizing smart gas frameworks for constant perceivability into the trustworthiness of the framework has permitted utility suppliers to design opportune support.

Moreover, the energy and utilities industry is encountering the development of these smart advancements intently. For instance, the appropriation of smart matrix innovation is developing rapidly in the energy area, because of various advantages related with the smart lattice innovation, for example, self-recuperating of the organization, continuous help to energy the board frameworks, cost reserve funds, energy protections, and others. Similarly, the reception of smart gas is additionally on the ascent among utilities around the world because of its huge advantages, for example, ongoing checking of gas pipelines and framework, gas utilization, spillages, and cost investment funds on bills.

Current and future worldwide smart gas market patterns are laid out to decide the general engaging quality of the market. Top affecting components feature the chance during the smart gas market estimate period. Expansion deprived to upgrade metropolitan wellbeing is the key factor driving the market development for the smart gas industry. Likewise, ascend in interest in smart gas pipeline and smart framework network is additionally powering the market development. In addition, expansion in urbanization all around the world is additionally impelling the interest for smart gas arrangements across business and private clients. Nonetheless, absence of attention to smart gas frameworks among individuals is required to hinder the market development during the figure time frame. Moreover, expanding speculation and drives for smart energy the board by the public authority is expected to give significant development freedoms to the smart gas market in forthcoming years.

Section 1 Preface

Section 2 Executive Summary

Section 3 Industry Analysis

Section 4 Global Smart Gas Market – Device Segment, by Revenue, 2014 – 2023 (USD Million) and by Volume (Units)

Section 5 Global Smart Gas Market – Technology Segment, by Revenue, 2014 – 2023 (USD Million)

Section 6 Global Smart Gas Market – End Use Segment, by Revenue, 2014 – 2023 (USD million) and by Volume (Units)

Section 7 Global Smart Gas Market – Regional Analysis by revenue, 2014 – 2023 (USD million) and by volume (Units)

Section 8 Company Profiles

List of Tables

Global Smart Gas Market: Snapshot

U.U.S. Smart Gas Market Volume and Forecast, by Device, 2013−2023 (Million Units)

U.S. Smart Gas Market Revenue and Forecast, by Device, 2013−2023 (USD Million)

U.S. Smart Gas Market Revenue and Forecast, by Technology, 2013−2023 (USD Million)

U.S. Smart Gas Market Volume and Forecast, by End Use, 2013−2023 (Million Units)

U.S. Smart Gas Market Revenue and Forecast, by End Use, 2013−2023 (USD Million)

Canada Smart Gas Market Volume and Forecast, by Device, 2013−2023 (Million Units)

Canada Smart Gas Market Revenue and Forecast, by Device, 2013−2023 (USD Million)

Canada Smart Gas Market Revenue and Forecast, by Technology, 2013−2023 (USD Million)

Canada Smart Gas Market Volume and Forecast, by End Use, 2013−2023 (Million Units)

Canada Smart Gas Market Revenue and Forecast, by End Use, 2013−2023 (USD Million)

Mexico Smart Gas Market Volume and Forecast, by Device, 2013−2023 (Million Units)

Mexico Smart Gas Market Revenue and Forecast, by Device, 2013−2023 (USD Million)

Mexico Smart Gas Market Revenue and Forecast, by Technology, 2013−2023 (USD Million)

Mexico Smart Gas Market Volume and Forecast, by End Use, 2013−2023 (Million Units)

Mexico Smart Gas Market Volume and Forecast, by End Use, 2013−2023 (USD Million)

France Smart Gas Market Volume and Forecast, by Device, 2013−2023 (Million Units)

France Smart Gas Market Revenue and Forecast, by Device, 2013−2023 (USD Million)

France Smart Gas Market Revenue and Forecast, by Technology, 2013−2023 (USD Million)

France Smart Gas Market Volume and Forecast, by End Use, 2014−2023 (Million Units)

France Smart Gas Market Revenue and Forecast, by End Use, 2014−2023 (USD Million)

Italy Smart Gas Market Volume and Forecast, by Device, 2014−2023 (Million Units)

Italy Smart Gas Market Revenue and Forecast, by Device, 2014−2023 (USD Million)

Italy Smart Gas Market Revenue and Forecast, by Technology, 2014−2023 (USD Million)

Italy Smart Gas Market Volume and Forecast, by End Use, 2014−2023 (Million Units)

Italy Smart Gas Market Revenue and Forecast, by End Use, 2014−2023 (USD Million)

U.K. Smart Gas Market Volume and Forecast, by Device, 2014−2023 (Million Units)

U.K. Smart Gas Market Revenue and Forecast, by Device, 2014−2023 (USD Million)

U.K. Smart Gas Market Revenue and Forecast, by Technology, 2014−2023 (USD Million)

U.K. Smart Gas Market Volume and Forecast, by End Use, 2014−2023 (Million Units)

U.K. Smart Gas Market Revenue and Forecast, by End Use, 2014−2023 (USD Million)

Rest of Europe Smart Gas Market Volume and Forecast, by Device, 2014−2023 (Million Units)

Rest of Europe Smart Gas Market Revenue and Forecast, by Device, 2014−2023 (USD Million)

Rest of Europe Smart Gas Market Revenue and Forecast, by Technology, 2014−2023 (USD Million)

Rest of Europe Smart Gas Market Volume and Forecast, by End Use, 2014−2023 (Million Units)

Rest of Europe Smart Gas Market Revenue and Forecast, by End Use, 2014−2023 (USD Million)

China Smart Gas Market Volume and Forecast, by Device, 2013 - 2023 (Million Units)

China Smart Gas Market Revenue and Forecast, by Device, 2013 - 2023 (USD Million)

China Smart Gas Market Revenue and Forecast, by Technology, 2013 - 2023 (USD Million)

China Smart Gas Market Volume and Forecast, by End Use, 2013 - 2023 (Million Units)

China Smart Gas Market Revenue and Forecast, by End Use, 2013 - 2023 (USD Million)

Japan Smart Gas Market Volume and Forecast, by Device, 2013 - 2023 (Million Units)

Japan Smart Gas Market Revenue and Forecast, by Device, 2013 - 2023 (USD Million)

Japan Smart Gas Market Revenue and Forecast, by Technology, 2013 - 2023 (USD Million)

Japan Smart Gas Market Volume and Forecast, by End Use, 2013 - 2023 (Million Units)

Japan Smart Gas Market Revenue and Forecast, by End Use, 2013 - 2023 (USD Million)

South Korea Smart Gas Market Volume and Forecast, by Device, 2013 - 2023 (Million Units)

South Korea Smart Gas Market Revenue and Forecast, by Device, 2013 - 2023 (USD Million)

South Korea Smart Gas Market Revenue and Forecast, by Technology, 2013 - 2023 (USD Million)

South Korea Smart Gas Market Volume and Forecast, by End Use, 2013 - 2023 (Million Units)

South Korea Smart Gas Market Revenue and Forecast, by End Use, 2013 - 2023 (USD Million)

Rest of Asia Pacific Smart Gas Market Volume and Forecast, by Device, 2013 - 2023 (Million Units)

Rest of Asia Pacific Smart Gas Market Revenue and Forecast, by Device, 2013 - 2023 (USD Million)

Rest of Asia Pacific Smart Gas Market Revenue and Forecast, by Technology, 2013 - 2023 (USD Million)

Rest of Asia Pacific Smart Gas Market Volume and Forecast, by End Use, 2013 - 2023 (Million Units)

Rest of Asia Pacific Smart Gas Market Revenue and Forecast, by End Use, 2013 - 2023 (USD Million)

South Africa Smart Gas Market Volume and Forecast, by Device, 2013 - 2023 (Million Units)

South Africa Smart Gas Market Revenue and Forecast, by Device, 2013 - 2023 (USD Million)

South Africa Smart Gas Market Revenue and Forecast, by Technology, 2013 - 2023 (USD Million)

South Africa Smart Gas Market Volume and Forecast, by End Use, 2013 - 2023 (Million Units)

South Africa Smart Gas Market Revenue and Forecast, by End Use, 2013 - 2023 (USD Million)

Rest of MEA Smart Gas Market Volume and Forecast, by Device, 2013 - 2023 (Million Units)

Rest of MEA Smart Gas Market Revenue and Forecast, by Device, 2013 - 2023 (USD Million)

Rest of MEA Smart Gas Market Revenue and Forecast, by Technology, 2013 - 2023 (USD Million)

Rest of MEA Smart Gas Market Volume and Forecast, by End Use, 2013 - 2023 (Million Units)

Rest of MEA Smart Gas Market Revenue and Forecast, by End Use, 2013 - 2023 (USD Million)

Brazil Smart Gas Market Volume and Forecast, by Device, 2013−2023 (Million Units)

Brazil Smart Gas Market Revenue and Forecast, by Device, 2013−2023 (USD Million)

Brazil Smart Gas Market Revenue and Forecast, by Technology, 2013−2023 (USD Million)

Brazil Smart Gas Market Volume and Forecast, by End Use, 2013−2023 (Million Units)

Brazil Smart Gas Market Revenue and Forecast, by End Use, 2013−2023 (USD Million)

Rest of SCA Smart Gas Market Volume and Forecast, by Device, 2013−2023 (Million Units)

Rest of SCA Smart Gas Market Revenue and Forecast, by Device, 2013−2023 (USD Million)

Rest of SCA Smart Gas Market Revenue and Forecast, by Technology, 2013−2023 (USD Million)

List of Figures

Global Smart Gas Market, Estimates and Forecast, by Volume, 2014–2023 (Million Units)

Global Smart Gas Market, Estimates and Forecast, by Revenue, 2014–2023 (USD Million)

Global Carbon Dioxide (CO2) Reduction by Smart Gas Meters

Cost Structure of Smart Gas Meters

Smart gas meter installation % roll out for 2014

Global Smart Gas Market, Company Market Share (%) (2014)

Market Attractiveness, Smart Gas Market

Global Smart Gas, Market Share by Device Segment, 2014

Global Smart Gas, Market Share by Device Segment, 2023

Global Smart Gas Market, Device Segment, By Volume, 2014–2023 (Million Units)

Global Smart Gas Market, Device Segment, By Revenue, 2014–2023 (USD Million)

Global Smart Gas Market, Traditional Gas Meter, By Volume, 2014–2023 (Million Units)

Global Smart Gas Market, Traditional Gas Meter, By Revenue, 2014–2023 (USD Million)

Global Smart Gas Market, Gas Warning Device, By Volume, 2014–2023 (Million Units)

Global Smart Gas Market, Gas Warning Device, By Revenue, 2014–2023 (USD Million)

Global Smart Gas Market, AMI Communication Gas Module, By Volume, 2014–2023 (Million Units)

Global Smart Gas Market, AMI Communication Gas Module, By Revenue, 2014–2023 (USD Million)

Global Smart Gas, Market Share by Technology Segment, 2014

Global Smart Gas, Market Share by Technology Segment, 2023

Global Smart Gas Market, Technology Segment, By Revenue, 2014 – 2023 (USD Million)

Global Smart Gas Market, Meter Data Management (MDM), By Revenue, 2014 – 2023 (USD Million)

Global Smart Gas Market, Supervisory Control and Data Acquisition (SCADA), By Revenue, 2014 – 2023 (USD Million)

Global Smart Gas Market, Geographic Information System (GIS), By Revenue, 2014 – 2023 (USD Million)

Global Smart Gas Market, Others, By Revenue, 2014 – 2023 (USD Million)

Global Smart Gas, Market Share by End-use Segment, 2014

Global Smart Gas, Market Share by End-use Segment, 2023

Global Smart Gas Market, End-use Segment, by Volume, 2014–2023 (Million Units)

Global Smart Gas Market, End-use Segment, by Revenue, 2014–2023 (USD Million)

Global Smart Gas Market, Residential, By Volume, 2014–2023 (Million

Global Smart Gas Market, Residential, By Revenue, 2014–2023 (USD Million)

Global Smart Gas Market, Commercial and Industrial, by Volume, 2014–2023 (Million Units)

Global Smart Gas Market, Commercial and Industrial, by Revenue, 2014–2023 (USD Million)

Global Smart Gas Market Share, by Region, 2014 and 2023

North America Smart Gas Market Share, by Country, 2014 and 2023

North America Smart Gas Market, by Volume, 2014–2023 (Million Units)

North America Smart Gas Market, by Revenue, 2014–2023 (USD Million)

S. Smart Gas Market, by Volume, 2014–2023 (Million Units)

S. Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Canada Smart Gas Market, by Volume, 2014–2023 (Million Units)

Canada Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Mexico Smart Gas Market, by Volume, 2014–2023 (Million Units)

Mexico Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Europe Smart Gas Market Share, by Country, 2014 and 2023

Europe Smart Gas Market, by Volume, 2014–2023 (Million Units)

Europe Smart Gas Market, by Revenue, 2014–2023 (USD Million)

France Smart Gas Market, by Volume, 2014–2023 (Million Units)

France Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Italy Smart Gas Market, by Volume, 2013–2023 (Million Units)

Italy Smart Gas Market, by Revenue, 2013–2023 (USD Million)

K. Smart Gas Market, by Volume, 2013–2023 (Million Units)

K. Smart Gas Market, by Revenue, 2013–2023 (USD Million)

Rest of Europe Smart Gas Market, by Volume, 2013–2023 (Million Units)

Rest of Europe Smart Gas Market, by Revenue, 2013–2023 (USD Million)

Asia Pacific Smart Gas Market Share, by Country, 2014 and 2023

Asia Pacific Smart Gas Market, by Volume, 2014–2023 (Million Units)

Asia Pacific Smart Gas Market, by Revenue, 2014–2023 (USD Million)

China Smart Gas Market, by Volume, 2014–2023 (Million Units)

China Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Japan Smart Gas Market, by Volume, 2014–2023 (Million Units)

Japan Smart Gas Market, by Revenue, 2014–2023 (USD Million)

South Korea Smart Gas Market, by Volume, 2014–2023 (Million Units)

South Korea Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Rest of Asia Pacific Smart Gas Market, by Volume, 2014–2023 (Million Units)

Rest of Asia Pacific Smart Gas Market, by Revenue, 2014–2023 (USD Million)

MEA Smart Gas Market Volume Share, by Country, 2014 and 2023

MEA Smart Gas Market, by Volume, 2014–2023 (Million Units)

MEA Smart Gas Market, by Revenue, 2014–2023 (USD Million)

South Africa Smart Gas Market, by Volume, 2014–2023 (Million Units)

South Africa Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Rest of MEA Smart Gas Market, by Volume, 2014–2023 (Million Units)

Rest of MEA Smart Gas Market, by Revenue, 2014–2023 (USD Million)

SCA Smart Gas Market Share, by Country, 2014 and 2023

SCA Smart Gas Market, by Volume, 2014–2023 (Million Units)

SCA Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Brazil Smart Gas Market, by Volume, 2014–2023 (Million Units)

Brazil Smart Gas Market, by Revenue, 2014–2023 (USD Million)

Rest of SCA Smart Gas Market, by Volume, 2014–2023 (Million Units)

Rest of SCA Smart Gas Market, by Revenue, 2014–2023 (USD Million)

ABB, % Revenue By Business Segment, 2014

ABB, % Revenue By Region, 2014

Capgemini S.A, % Revenue By Business Segment, 2014

Capgemini S.A, Revenue By Region, 2014

Elster Group GmbH, % Revenue By Business Segment, 2014

Elster Group GmbH, Revenue By Region, 2014

General Electric, % Revenue By Business Segment, 2014

General Electric, %Revenue By Region, 2014

Itron, Inc., % Revenue By Business Segment, 2014

Itron, Inc., %Revenue By Region, 2014

Schneider Electric SE, % Revenue By Business Segment, 2014

Schneider Electric SE, %Revenue By Region, 2014