Reports

Reports

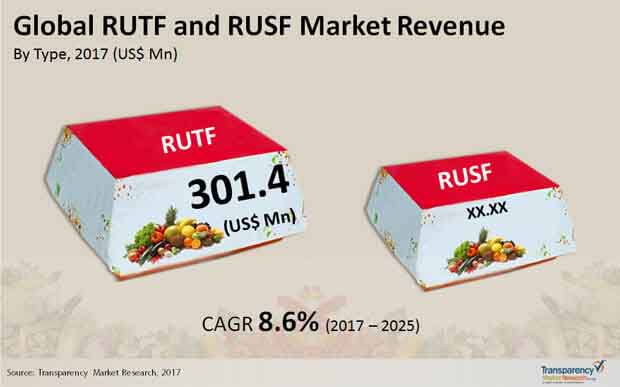

The demand in the global market for ready-to-use therapeutic food (RUTF) and ready-to-use supplementary food (RUFF) market projected to increment at a healthy CAGR of 8.6% during the forecast period of 2017 to 2025. The prosperity of RUTF and RUSF market is a reflection of a number of factors, such as increased government and NGO concerns regarding malnutrition treatment, growing malnutrition as a result of escalating population across the globe, rising demand for drinkable RUTF products, and increased number of emergencies and disasters in various parts of the world. On the other hand, increasing consumer or local government shift toward local ingredients and risk of contamination as a result of inconsistency in RUTF milk products are some of the hindrances faced by the market.

The global ready-to-use therapeutic food and supplementary food market is estimated to be worth US$829.3 mn by the end of 2025, remarkably up from its evaluated valuation of US$429.9 mn in 2017. The stockholders of RUTF and RUSF market are expected to gain new opportunities from UNICEF encouragements for domestic production of RUTF, escalated research on substitute of raw material, and the development of new drinkable powdered and bar form of RUTF.

Based on product, the market for ready-to-use therapeutic food has been segmented into solid products including powder or blends and biscuit or bar, semi-solid products or paste, and drinkable therapeutic food, whereas the ready-to-use supplementary food segment has been classified into solid or powder and semi-solid or paste. Collectively, the RUTF segment served more than 70% of the demand in 2017, and is expected to further eat into RUSF segment’s share towards the end of the forecast period. While solid power sub-segment is gaining traction from its usage in infant food, semi-solid or paste sub-segment is frequently used as they do not require any preparation.

On the basis of end-users, the report detects that UNICEF contributed 66.1% of the demand in 2017, chalk and cheese ahead of other end-use categorizes of WFP and NGOs. A number of companies are focused on making RUTF and RUSF products that comply with UNICEF requirements.

In 2017, Europe accounted for more than half, 54.3% of the demand, daylight ahead of second most profitable region of the Middle East and Africa, which didn’t even contribute a quarter of the global demand in the ready-to-use therapeutic food and supplementary food market. A number of regional players in Europe are concentrating on supplying RUTF and RUSF to UNICEF and other NGOs, as well as increase their production capacity. In North America, regional manufacturers are engaged in the production of high-quality ready-to-use therapeutic food and supplementary food products, supplying them to infants in a number of African nations such as Kenya, Sudan, Ethiopia, Burkina Faso, and Nigeria. In Asia Pacific, the implementation of CAMAM in various countries such as India, Pakistan, Bangladesh, Bhutan, and Afghanistan has helped the market.

Some of the key companies currently operating in the global ready-to-use therapeutic food and supplementary food market are: Mana Nutritive Aid Products, Nutriset SAS, Valid Nutrition, InnoFaso, GC Rieber Compact AS, Tabatchnik Fine Foods, Edesia USA, Diva Nutritional Products, Hilina, Insta Products, NutriVita Foods, Kaira District Cooperative, 13.3.15. Meds & Food For Kids, Nuflower Foods and Nutrition Pvt., Samil Industrial Co., and Power Foods Tanzania.

Ready-to-use Therapeutic Food and Supplementary Food (RUTF & RUSF) Market: Snapshot

The flourishing of RUTF and RUSF market is an impression of various variables, for example, expanded government and NGO concerns in regards to unhealthiness treatment, developing ailing health because of heightening populace across the globe, rising demand for RUTF items for drinking, and expanded number of crises and debacles in different pieces of the world. Then again, expanding buyer or neighborhood government move toward nearby fixings and hazard of defilement because of irregularity in RUTF milk items are a portion of the deterrents looked by the market.

One of the significant factors driving the RUTF and RUSF market is expanding instances of ailing health kids and grown-ups all over the world. Outrageous destitution and admission of modest nature of food items are probably going to support the development of the market. Different government activities embraced to manage steady developing hunger cases around the globe will help especially the market in the creating district develop. Expanding number of plans by government to assist with taking care of individuals beneath neediness line is boosting the market to develop. It has been noticed that agricultural nations are greatest casualties with regards to hunger cases. Government in these nations is attempting to build mindfulness with respect to the unfavorable impact one can have because of unhealthiness.

Another factor that is going about as a column in supporting the development of the worldwide market is the ascent in number of NGOs on the whole corners of the world. NGOs across the world are ceaselessly attempting to loosen the pace of lack of healthy sustenance by giving the RUSF and RUTF to the one out of luck. This is relied upon to expand the demand. Notwithstanding, it has been noted that rising demand for neighborhood fixings by shopper and government combined with increasing pollution rates is forecasted to ruin market development.

1. Executive Summary

2. Market Introduction

2.1. Market Definition

2.2. Market Taxonomy

3. Ready-to-use Therapeutic Food & Supplementary Food Market Analysis Scenario

3.1. Market Volume Analysis

3.1.1. Production Outlook

3.2. Pricing Analysis

3.2.1. Pricing Assumptions

3.2.2. Price Projections Per Region

3.3. Market Size (US$) and Volume (Units) Forecast

3.3.1. Market Size and Y-o-Y Growth

3.3.2. Absolute $ Opportunity

3.4. Industry Value and Supply Chain Analysis

4. Market Dynamics

4.1. Macro-economic Factors

4.2. Drivers

4.3. Restraints

4.4. Opportunity

4.5. Forecast Factors – Relevance and Impact

5. Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast, By Product Type

5.1. Introduction

5.1.1. Basis Point Share (BPS) Analysis By Product Type

5.1.2. Y-o-Y Growth Projections By Product Type

5.2. Market Size (US$) and Volume (Units) Forecast By Product Type

5.2.1. RUTF

5.2.1.1. Solid

5.2.1.1.1. Powder/Blends

5.2.1.1.2. Biscuit/Bar

5.2.1.2. Semi solid Paste

5.2.1.3. Drinkable Therapeutic Food

5.2.2. RUSF

5.2.2.1. Solid (Powder)

5.2.2.2. Semi solid Paste

5.3. Market Attractiveness Analysis By Product Type

5.4. Prominent Trends

6. Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast, By End-use

6.1. Introduction

6.1.1. Basis Point Share (BPS) Analysis By End-use

6.1.2. Y-o-Y Growth Projections By End-use

6.2. Market Size (US$) and Volume (Units) Forecast By End-use

6.2.1. UNICEF

6.2.2. WFP

6.2.3. NGOs

6.2.4. Others

6.3. Market Attractiveness Analysis By End-use

6.4. Prominent Trends

7. Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast, By Region

7.1. Introduction

7.1.1. Basis Point Share (BPS) Analysis By Region

7.1.2. Y-o-Y Growth Projections By Region

7.2. Market Size (US$) and Volume (Units) Forecast By Region

7.2.1. North America

7.2.2. Europe

7.2.3. APAC

7.2.4. Latin America

7.2.5. Middle East and Africa

7.3. Market Attractiveness Analysis By Region

8. North America Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast

8.1. Introduction

8.1.1. Basis Point Share (BPS) Analysis By Country

8.1.2. Y-o-Y Growth Projections By Country

8.1.3. Key Trends

8.2. Market Size (US$) and Volume (Units) Forecast By Country

8.2.1. U.S.

8.2.2. Canada

8.3. Market Size (US$) and Volume (Units) Forecast By Product Type

8.3.1. RUTF

8.3.1.1. Solid

8.3.1.1.1. Powder/Blends

8.3.1.1.2. Biscuit/Bar

8.3.1.2. Semi solid Paste

8.3.1.3. Drinkable Therapeutic Food

8.3.2. RUSF

8.3.2.1. Solid (Powder)

8.3.2.2. Semi solid Paste

8.4. Market Size (US$) and Volume (Units) Forecast By End-use

8.4.1. UNICEF

8.4.2. WFP

8.4.3. NGOs

8.4.4. Others

8.5. Market Attractiveness Analysis

8.5.1. By Country

8.5.2. By Product Type

8.5.3. By End-use

8.6. Drivers and Restraints: Impact Analysis

9. Latin America Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast

9.1. Introduction

9.1.1. Basis Point Share (BPS) Analysis By Country

9.1.2. Y-o-Y Growth Projections By Country

9.1.3. Key Trends

9.2. Market Size (US$) and Volume (Units) Forecast By Country

9.2.1. Brazil

9.2.2. Mexico

9.2.3. Rest of Latin America

9.3. Market Size (US$) and Volume (Units) Forecast By Product Type

9.3.1. RUTF

9.3.1.1. Solid

9.3.1.1.1. Powder/Blends

9.3.1.1.2. Biscuit/Bar

9.3.1.2. Semi solid Paste

9.3.1.3. Drinkable Therapeutic Food

9.3.2. RUSF

9.3.2.1. Solid (Powder)

9.3.2.2. Semi solid Paste

9.4. Market Size (US$) and Volume (Units) Forecast By End-use

9.4.1. UNICEF

9.4.2. WFP

9.4.3. NGOs

9.4.4. Others

9.5. Market Attractiveness Analysis

9.5.1. By Country

9.5.2. By Product Type

9.5.3. By End-use

9.6. Drivers and Restraints: Impact Analysis

10. Europe Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast

10.1. Introduction

10.1.1. Basis Point Share (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.1.3. Key Trends

10.2. Market Size (US$) and Volume (Units) Forecast By Country

10.2.1. Germany

10.2.2. France

10.2.3. Italy

10.2.4. Spain

10.2.5. U.K.

10.2.6. Nordic

10.2.7. Russia

10.2.8. Poland

10.2.9. BENELUX

10.2.10. Rest of Europe

10.3. Market Size (US$) and Volume (Units) Forecast By Product Type

10.3.1. RUTF

10.3.1.1. Solid

10.3.1.1.1. Powder/Blends

10.3.1.1.2. Biscuit/Bar

10.3.1.2. Semi solid Paste

10.3.1.3. Drinkable Therapeutic Food

10.3.2. RUSF

10.3.2.1. Solid (Powder)

10.3.2.2. Semi solid Paste

10.4. Market Size (US$) and Volume (Units) Forecast By End-use

10.4.1. UNICEF

10.4.2. WFP

10.4.3. NGOs

10.4.4. Others

10.5. Market Attractiveness Analysis

10.5.1. By Country

10.5.2. By Product Type

10.5.3. By End-use

10.6. Drivers and Restraints: Impact Analysis

11. APAC Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast

11.1. Introduction

11.1.1. Basis Point Share (BPS) Analysis By Country

11.1.2. Y-o-Y Growth Projections By Country

11.1.3. Key Trends

11.2. Market Size (US$) and Volume (Units) Forecast By Country

11.2.1. China

11.2.2. India

11.2.3. Japan

11.2.4. ASEAN

11.2.5. Australia and New Zealand

11.2.6. Rest of APAC

11.3. Market Size (US$) and Volume (Units) Forecast By Product Type

11.3.1. RUTF

11.3.1.1. Solid

11.3.1.1.1. Powder/Blends

11.3.1.1.2. Biscuit/Bar

11.3.1.2. Semi solid Paste

11.3.1.3. Drinkable Therapeutic Food

11.3.2. RUSF

11.3.2.1. Solid (Powder)

11.3.2.2. Semi solid Paste

11.4. Market Size (US$) and Volume (Units) Forecast By End-use

11.4.1. UNICEF

11.4.2. WFP

11.4.3. NGOs

11.4.4. Others

11.5. Market Attractiveness Analysis

11.5.1. By Country

11.5.2. By Product Type

11.5.3. By End-use

11.6. Drivers and Restraints: Impact Analysis

12. Middle East and Africa Ready-to-use Therapeutic Food & Supplementary Food Market Analysis and Forecast

12.1. Introduction

12.1.1. Basis Point Share (BPS) Analysis By Country

12.1.2. Y-o-Y Growth Projections By Country

12.1.3. Key Trends

12.2. Market Size (US$) and Volume (Units) Forecast By Country

12.2.1. GCC

12.2.2. North Africa

12.2.3. Tanzania

12.2.4. Ethiopia

12.2.5. Nigeria

12.2.6. Malawi

12.2.7. Kenya

12.2.8. South Africa

12.2.9. Rest of MEA

12.3. Market Size (US$) and Volume (Units) Forecast By Product Type

12.3.1. RUTF

12.3.1.1. Solid

12.3.1.1.1. Powder/Blends

12.3.1.1.2. Biscuit/Bar

12.3.1.2. Semi solid Paste

12.3.1.3. Drinkable Therapeutic Food

12.3.2. RUSF

12.3.2.1. Solid (Powder)

12.3.2.2. Semi solid Paste

12.4. Market Size (US$) and Volume (Units) Forecast By End-use

12.4.1. UNICEF

12.4.2. WFP

12.4.3. NGOs

12.4.4. Others

12.5. Market Attractiveness Analysis

12.5.1. By Country

12.5.2. By Product Type

12.5.3. By End-use

12.6. Drivers and Restraints: Impact Analysis

13. Competition Landscape

13.1. Competition Dashboard

13.2. Market Structure

13.3. Company Profiles (Details–Overview, Product Offerings, Financials, Strategy, Recent Developments)

13.3.1. GC Rieber Compact AS

13.3.2. Diva Nutritional Products

13.3.3. Edesia USA

13.3.4. Hilina

13.3.5. InnoFaso

13.3.6. Insta Products

13.3.7. Mana Nutritive Aid Products

13.3.8. Nutriset SAS

13.3.9. NutriVita Foods

13.3.10. Power Foods Tanzania

13.3.11. Tabatchnik Fine Foods

13.3.12. Kaira District Cooperative, India

13.3.13. Meds & Food For Kids.

13.3.14. Valid Nutrition

13.3.15. Samil Industry Co.

13.3.16. Nuflower Foods and Nutrition Pvt.

14. Assumptions and Acronyms Used

15. Research Methodology

List of Tables

Table 01: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Product Type, 2017–2025

Table 02: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUTF Segment, 2017–2025

Table 03: Global Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Solid Category, 2017–2025

Table 04: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUSF Segment, 2017–2025

Table 05: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by End-user, 2017—2025

Table 06: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), By Region, 2017 –2025

Table 07: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 08: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Product Type, 2017–2025

Table 09: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by RUTF Segment, 2017–2025

Table 10: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Solid Category, 2017–2025

Table 11: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUSF Segment, 2017–2025

Table 12: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) End-user, 2017–2025

Table 13: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 14: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Product Type, 2017–2025

Table 15: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by RUTF Segment, 2017–2025

Table 16: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Solid Category, 2017–2025

Table 17: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUSF Segment, 2017–2025

Table 18: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) End-user, 2017–2025

Table 19: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 20: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 21: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Product Type, 2017–2025

Table 22: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by RUTF Segment, 2017–2025

Table 23: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Solid Category, 2017–2025

Table 24: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUSF Segment, 2017–2025

Table 25: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) End-user, 2017–2025

Table 26: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 27: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Product Type, 2017–2025

Table 28: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by RUTF Segment, 2017–2025

Table 29: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Solid Category, 2017–2025

Table 30: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUSF Segment, 2017–2025

Table 31: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) End-user, 2017–2025

Table 32: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 33: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by Country, 2017–2025

Table 34: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Product Type, 2017–2025

Table 35: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by RUTF Segment, 2017–2025

Table 36: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) by Solid Category, 2017–2025

Table 37: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), by RUSF Segment, 2017–2025

Table 38: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT) End-user, 2017–2025

List of Figures

Figure 01: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value (US$ Mn) & Volume (MT) Forecast, 2016–2025

Figure 02: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2016–2025

Figure 03: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis, by Product Type, 2017 & 2025

Figure 04: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Y-o-Y Growth, by Product Type, 2017–2025

Figure 05: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), by RUTF Segment, 2017?2025

Figure 06: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), by RUSF Segment, 2017?2025

Figure 07: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Attractiveness Index, by Product Type, 2017–2025

Figure 08: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis, by End-user, 2017 & 2025

Figure 09: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Y-o-Y Growth, by End-user, 2017–2025

Figure 10: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by UNICEF Segment, 2017?2025

Figure 11: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by WFP Segment, 2017?2025

Figure 12: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by NGOs Segment, 2017?2025

Figure 13: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2017?2025

Figure 14: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Attractiveness Index, by End-user, 2017–2025

Figure 15: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis, by Region, 2017 & 2025

Figure 16: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Y-o-Y Growth, by Region, 2017–2025

Figure 17: Global Ready-To-Use Therapeutic Food and Supplementary Food Market Attractiveness Index, by Region, 2017–2025

Figure 18: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), 2016?2025

Figure 19: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2016–2025

Figure 20: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Country, 2017 & 2025

Figure 21: North America Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Region, 2017–2025

Figure 22: U.S. Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 23: Canada Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 24: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Product Type, 2017 & 2025

Figure 25: North America Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Product Type , 2017–2025

Figure 26: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUTF Segment, 2017?2025

Figure 27: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUSF Segment, 2017?2025

Figure 28: North America Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by End-user, 2017 & 2025

Figure 29: North America Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by End-user, 2017–2025

Figure 30: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by UNICEF Segment, 2017?2025

Figure 31: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by WFP Segment, 2017?2025

Figure 32: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by NGOs Segment, 2017?2025

Figure 33: North America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2017?2025

Figure :34 North America Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Country, 2017–2025

Figure 35: North America Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Product Type, 2017–2025

Figure 36: North America Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by End-user, 2017–2025

Figure 37: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), 2016?2025

Figure 38: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2016–2025

Figure 39: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Country, 2017 & 2025

Figure 40: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Region, 2017–2025

Figure 41: Brazil Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 42: Mexico Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 43: Rest of Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn)l, 2017?2025

Figure 44: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Product Type, 2017 & 2025

Figure 45: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Product Type , 2017–2025

Figure 46: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUTF Segment, 2017?2025

Figure 47: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUSF Segment, 2017?2025

Figure 48: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by End-user, 2017 & 2025

Figure 49: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by End-user, 2017–2025

Figure 50: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by UNICEF Segment, 2017?2025

Figure 51: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by WFP Segment, 2017?2025

Figure 52: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by NGOs Segment, 2017?2025

Figure 53: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2017?2025

Figure 54: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Country, 2017–2025

Figure 55: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Product Type, 2017–2025

Figure 56: Latin America Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by End-user, 2017–2025

Figure 57: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), 2016?2025

Figure 58: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2016–2025

Figure 59: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Country, 2017 & 2025

Figure 60: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Region, 2017–2025

Figure 61: Germany Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 62: France Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 63: Italy Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 64: Spain Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 65: U.K. Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 66: Nordic Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 67: Russia Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 68: Poland Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 69: BENELUX Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 70: Poland Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 71: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Product Type, 2017 & 2025

Figure 72: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Product Type , 2017–2025

Figure 73: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUTF Segment, 2017?2025

Figure 74: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUSF Segment, 2017?2025

Figure 75: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by End-user, 2017 & 2025

Figure 76: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by End-user, 2017–2025

Figure 77: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by UNICEF Segment, 2017?2025

Figure 78: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by WFP Segment, 2017?2025

Figure 79: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by NGOs Segment, 2017?2025

Figure 80: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2017?2025

Figure 81: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Country, 2017–2025

Figure 82: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Product Type, 2017–2025

Figure 83: Europe Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by End-user, 2017–2025

Figure 84: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), 2016?2025

Figure 85: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2016–2025

Figure 86: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Country, 2017 & 2025

Figure 87: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Region, 2017–2025

Figure 88: China Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 89: India Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 90: Japan Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 91: ASEAN Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 92: Australia and New Zealand Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 93: Rest of APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 94: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Product Type, 2017 & 2025

Figure 95: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Product Type , 2017–2025

Figure 96: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUTF Segment, 2017?2025

Figure 97: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUSF Segment, 2017?2025

Figure 98: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by End-user, 2017 & 2025

Figure 99: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by End-user, 2017–2025

Figure 100: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by UNICEF Segment, 2017?2025

Figure 101: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by WFP Segment, 2017?2025

Figure 102: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by NGOs Segment, 2017?2025

Figure 103: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2017?2025

Figure 104: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Country, 2017–2025

Figure 105: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Product Type, 2017–2025

Figure 106: APAC Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by End-user, 2017–2025

Figure 107: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value (US$ Mn) and Volume (MT), 2016?2025

Figure 108: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2016–2025

Figure 109: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Country, 2017 & 2025

Figure 110: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Region, 2017–2025

Figure 111: GCC Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 112: North Africa Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 113: Tanzania Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 114: Ethiopia Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 115: Nigeria Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 116: Malwai Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 117: Kenya Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 118: South Africa Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 119: South Africa Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn), 2017?2025

Figure 120: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by Product Type, 2017 & 2025

Figure 121: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by Product Type , 2017–2025

Figure 122: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUTF Segment, 2017?2025

Figure 123: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by RUSF Segment, 2017?2025

Figure 124: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Value Share (%) and BPS Analysis by End-user, 2017 & 2025

Figure 125: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Y-o-Y Growth by End-user, 2017–2025

Figure 126: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by UNICEF Segment, 2017?2025

Figure 127: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by WFP Segment, 2017?2025

Figure 128: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by NGOs Segment, 2017?2025

Figure 129: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Absolute $ Opportunity (US$ Mn) by Others Segment, 2017?2025

Figure 130: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Country, 2017–2025

Figure 131: MEA Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by Product Type, 2017–2025

Figure 132 MEA Ready-to-use Therapeutic Food and Supplementary Food Market Attractiveness Index by End-user, 2017–2025