Reports

Reports

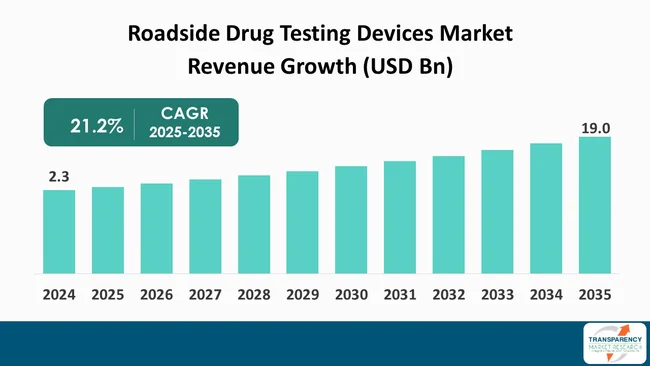

The global roadside drug testing devices market size was valued at US $ 2.3 billion in 2024 and is projected to reach US $ 19.0 billion by 2035, expanding at a CAGR of 21.2% from 2025 to 2035. The market growth is driven by increasing incidence of drug-impaired driving and advancements in drug detection technologies.

The roadside drug testing devices market is witnessing steadiness as the global community becomes more concerned about drug-impaired driving. The need for accurate, fast, and non-invasive tools for detecting drug use in drivers is recognized by the governments and law enforcement agencies.

The technological breakthroughs are addressing this increased demand by significantly upgrading the user-friendly, portable, and reliable features of such devices, especially the ones employing oral fluid testing. These advancements in the field of immediate testing make it less invasive and faster, thus allowing for more efficient roadside checks.

The market is mainly driven by the tightening of road safety regulations that lead to the use of drug-testing devices apart from the traditional alcohol breathalyzers. There is a growing interest in handheld and integrated multi-panel testing systems due to their capability of detecting several substances at the same time. These systems are particularly effective in exposing the extensive drug range such as cannabis, amphetamines, cocaine, and opioids.

Moreover, the industry is facing some obstacles despite its positive trends. Variability in regulatory standards across different regions for device certification and deployment can hinder the establishment of local markets. Limited accuracy, false positives, and the necessity of confirmatory laboratory testing hinder the adoption of these devices on a large scale. Nevertheless, as a result of the rising enforcement infrastructure expenditure and ongoing innovations, roadside drug testing will probably be a standard global safety measure on roads in the near future.

Roadside drug testing devices are the primary instruments that law enforcement officials can use on the spot to identify drug-impaired drivers quickly. This method of testing undoubtedly contributes to public safety and accident prevention. Those tools have the feature of being portable and are equipped with the simplest of the procedures to be performed in the field. In such situations, officers can collect samples - oral fluid or saliva, in most cases - without the necessity of the blood or urine method, which is not only inconvenient but also hard to handle logistically.

The oral fluid method of sampling a subject's drug consumption status raises the test operation to a level that is much faster and more efficient, especially in a roadside or mobile scenario. The substance compositions of the persons in question can be acquired from marijuana, amphetamines, cocaine, opioids, and benzodiazepines.

Most of these devices include the capability of achieving the intended goal within a short period of time, usually under a few minutes or so. Therefore, the period from the commission of the crime until an officer is in the position to take necessary legal action is shortened significantly by the promptness of results. Thus, the law enforcement agencies involved get the opportunity to make on-the-spot decisions quickly, and basically immediate actions, such as detaining the person, driving under the influence, can be done.

On the other hand, they cannot be considered as single-point solutions due to the disadvantages of the devices used for roadside drug testing. Firstly, in-depth tests at a lab are still considered the only way to give definite and legally binding proof. Differences in drug metabolism, possibilities for false positives and negatives in results, and distinctions in local rules are some of the unresolved issues for these gadgets.

Moreover, the question of how much money is to be spent on the project, alongside considerations for the necessary training and skill level of the device users, contributes to that problem in particular geographic locations with fewer resources.

| Attribute | Detail |

|---|---|

| Roadside Drug Testing Devices Market Drivers |

|

The rise in drug-impaired driving incidents in both - developed and developing regions has been one of the main factors that have contributed to the growth of the roadside drug testing devices market. In a world where both - the misuse of prescription drugs and the use of illicit drugs are common, the risk of drug-impaired individuals driving is also increasing. Alcohol does differ from drugs in that it has well-established roadside detection methods with legal limits, whereas drug impairment is much more complicated as it involves a large number of substances affecting people in different ways. The increase of this menace has forced law enforcement agencies and governments to take more direct measures such as the usage of rapid roadside drug testing tools.

The legalization of recreational cannabis in certain economies is one of the reasons for the rise of drug-related traffic incidents, thereby making drug detection a public safety issue. Drivers under the influence of substances like cannabis, amphetamines, opioids, and benzodiazepines significantly increase the risk of accidents, which ultimately leads to more fatalities. More number of individuals have become aware of the problem as the data on accidents that emphasize the severity of the issue are published. Thus the pressure on the authorities to put effective roadside screening programs into practice is increasing. This trend is creating a steady demand for portable, accurate, and rapid drug testing devices that can be used in the field, thereby promoting market growth as part of a wider strategy to enhance road safety.

The market for roadside drug testing equipment is being largely influenced by the alterations in drug detection technologies. The technological innovations have made these devices more accurate, efficient, and user-friendly, thereby enabling law enforcement agencies to detect drug impairment in real-time with minimal training.

In the past, drug testing methods were heavily depending on the use of blood or urine samples, which were time-consuming, invasive, and not suitable for use at the roadside. At present, portable devices that use oral fluid samples have gained popularity as they are non-invasive and capable of providing results quickly.

In addition, the technology has improved the devices' specificity and sensitivity, thus helping them to detect a broader range of substances like cannabis, opioids, cocaine, amphetamines, and benzodiazepines at lower levels. Majority of these devices are now integrated with multi-panel testing, digital displays, and automated result interpretation, thus the human error factor has been reduced to a minimum.

Moreover, advancements in sensor technology and miniaturization have resulted in lightweight, small systems that are conducive to mobile or field settings. Additionally, certain devices are equipped with GPS features and data connectivity, thus facilitating secure evidence storage and easy reporting.

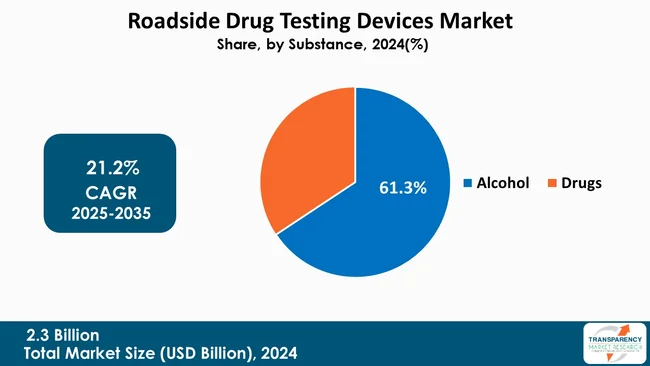

One of the key segments contributing to the growth of the roadside drug testing devices market has been ”alcohol”, which has historically been the main point of attention in the context of the public safety issues caused by the consumption of the driving.

For a long time, alcohol has been the main cause of traffic accidents and deaths, thus the governments and law enforcement agencies have been forced to spend a lot on the implementation of effective detection and deterrence measures. In this sense, breathalyzer devices, which are the most common tools for frontline alcohol testing, can be found almost everywhere, and they are simple to operate, thus they can be very efficient for field enforcement since they grant fast results.

Moreover, the legal structures and regulations laid out for the different blood alcohol concentration (BAC) levels are quite clear in the majority of the states, which is a sizable contribution to coherence and the possibility of issuance of the legal roadside testing. In this sense, public communication on the risks of drunk driving has raised the demand for alcohol detection equipment, thus these devices have been increasingly used in routine traffic stops and sobriety checkpoints.

On the other hand, drug-impaired driving is only gaining acknowledgement as a problem; however, alcohol is still the most critical issue as it is the most prevalent one and the technology and the legal systems for testing are mature.

Therefore, the alcohol segment is still at the forefront of market growth as it is instrumental in generating demand for trustworthy, easy-to-use, and inexpensive regulatory roadside testing devices that are able to provide safety to a greatly vulnerable public.

| Attribute | Detail |

|---|---|

| Leading Region |

|

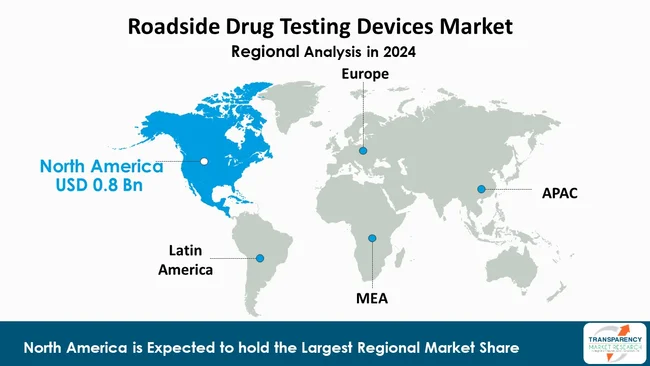

North America is at the forefront of the roadside drug testing devices market, holding the largest revenue share of 35.2%. This position is due to the region combining strict regulatory enforcement, advanced infrastructure, and a high level of awareness of drug-impaired driving. The region has encountered a significant increase in drug-related road traffic incidents following the legalization of recreational cannabis in several U.S. states and some parts of Canada. Such a transition has necessitated policemen's adopting more direct approaches to testing on the roadside to guarantee safety on the roads.

Thanks to strong governmental support and financing, it has become possible to spread the use of portable drug testing devices in both - metropolitan and countryside areas. Besides, North America is getting benefited by a well-established legal framework that is supportive of such devices' utilization. It also includes regulations for confirmatory testing and the device's results' being presented in court.

The local presence of top device manufacturers is an additional factor that propels quick upgrading of technology and innovation in testing methods greatly, such as multi-panel and saliva-based detection systems. Besides, Law enforcement officers are also a growing emphasis on their training and equipping them with the right tools and knowledge to handle roadside drug detection effectively.

All these factors facilitate the penetration and growth of drug testing devices in the community. Therefore, North America is still leading the way in the execution of comprehensive drug-impaired driving prevention programs, which strengthens its dominant position in the market.

Abbott, Drägerwerk AG & Co. KGaA, Securetec Detektions‑Systeme AG, Lifeloc Technologies,Inc., Oranoxis Inc., MAVAND Solutions GmbH, UCP Biosciences, BACtrack, Alere, Varian OraLab, HYSEN are the key players governing the global Roadside Drug Testing Devices Market.

Each of these players has been profiled in the Roadside Drug Testing Devices Market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 2.3 Bn |

| Forecast Value in 2035 | More than US$ 19.0 Bn |

| CAGR | 21.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Modality

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 2.3 Bn in 2024

It is projected to cross US$ 19.0 Bn by the end of 2035

Increasing incidence of drug-impaired driving and advancements in drug detection technologies

It is anticipated to grow at a CAGR of 21.2% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Abbott, Drägerwerk AG & Co. KGaA, Securetec Detektions‑Systeme AG, Lifeloc Technologies,Inc., Oranoxis Inc., MAVAND Solutions GmbH, UCP Biosciences, BACtrack, Alere, Varian OraLab, HYSEN, and others

Table 01: Global Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 02: Global Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Substance, 2020 to 2035

Table 03: Global Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 04: Global Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 05: Global Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 08: North America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Substance, 2020 to 2035

Table 09: North America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 10: North America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 11: Europe Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 13: Europe Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Substance, 2020 to 2035

Table 14: Europe Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 15: Europe Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 16: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 18: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Substance, 2020 to 2035

Table 19: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 20: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 21: Latin America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 23: Latin America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Substance, 2020 to 2035

Table 24: Latin America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 25: Latin America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 26: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Modality, 2020 to 2035

Table 28: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Substance, 2020 to 2035

Table 29: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Drugs, 2020 to 2035

Table 30: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Figure 01: Global Roadside Drug Testing Devices Market Value Share Analysis, By Modality, 2024 and 2035

Figure 02: Global Roadside Drug Testing Devices Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 03: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Standalone, 2020 to 2035

Figure 04: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Handheld, 2020 to 2035

Figure 05: Global Roadside Drug Testing Devices Market Value Share Analysis, By Substance, 2024 and 2035

Figure 06: Global Roadside Drug Testing Devices Market Attractiveness Analysis, By Substance, 2025 to 2035

Figure 07: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Alcohol, 2020 to 2035

Figure 08: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Drugs, 2020 to 2035

Figure 09: Global Roadside Drug Testing Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 10: Global Roadside Drug Testing Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 11: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Urine, 2020 to 2035

Figure 12: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Oral Fluid, 2020 to 2035

Figure 13: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Hair, 2020 to 2035

Figure 14: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Sweat, 2020 to 2035

Figure 15: Global Roadside Drug Testing Devices Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 16: Global Roadside Drug Testing Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 17: Global Roadside Drug Testing Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 18: North America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 19: North America Roadside Drug Testing Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 20: North America Roadside Drug Testing Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 21: North America Roadside Drug Testing Devices Market Value Share Analysis, By Modality, 2024 and 2035

Figure 22: North America Roadside Drug Testing Devices Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 23: North America Roadside Drug Testing Devices Market Value Share Analysis, By Substance, 2024 and 2035

Figure 24: North America Roadside Drug Testing Devices Market Attractiveness Analysis, By Substance, 2025 to 2035

Figure 25: North America Roadside Drug Testing Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 26: North America Roadside Drug Testing Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 27: Europe Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 28: Europe Roadside Drug Testing Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 29: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 30: Europe Roadside Drug Testing Devices Market Value Share Analysis, By Modality, 2024 and 2035

Figure 31: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 32: Europe Roadside Drug Testing Devices Market Value Share Analysis, By Substance, 2024 and 2035

Figure 33: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, By Substance, 2025 to 2035

Figure 34: Europe Roadside Drug Testing Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 35: Europe Roadside Drug Testing Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 36: Asia Pacific Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 37: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 38: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 39: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, By Modality, 2024 and 2035

Figure 40: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 41: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, By Substance, 2024 and 2035

Figure 42: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, By Substance, 2025 to 2035

Figure 43: Asia Pacific Roadside Drug Testing Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 44: Asia Pacific Roadside Drug Testing Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 45: Latin America Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: Latin America Roadside Drug Testing Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 47: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 48: Latin America Roadside Drug Testing Devices Market Value Share Analysis, By Modality, 2024 and 2035

Figure 49: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 50: Latin America Roadside Drug Testing Devices Market Value Share Analysis, By Substance, 2024 and 2035

Figure 51: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, By Substance, 2025 to 2035

Figure 52: Latin America Roadside Drug Testing Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 53: Latin America Roadside Drug Testing Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 54: Middle East & Africa Roadside Drug Testing Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 55: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 56: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 57: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, By Modality, 2024 and 2035

Figure 58: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, By Modality, 2025 to 2035

Figure 59: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, By Substance, 2024 and 2035

Figure 60: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, By Substance, 2025 to 2035

Figure 61: Middle East & Africa Roadside Drug Testing Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 62: Middle East & Africa Roadside Drug Testing Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035