Reports

Reports

Reinsurance Market - Snapshot

Reinsurance is an arrangement under which the reinsurer company (reinsurer) agrees to protect the insurance company (also known as ceding company) from calamities written under the agreement. Reinsurance is designed to enhance the ceding company’s surplus position and financial strength, and reduce the net amount at risk on specific risks. Reinsurance allows the ceding company to maximize the risk it can underwrite on a single risk and expand the volume of business it can underwrite. The reinsurance includes group and individual critical illness, disability and life & health, and property & casualty (P&C) reinsurance. In terms of end-user, the non-life/property & casualty reinsurance segment accounted for highest market share in 2017 and is estimated to hold the position over the forecast period. To protect their investments, oil and gas, mining, agriculture, and transportation are some of the leading sectors opting for property & casualty reinsurance services.The global reinsurance market is currently driven by a favorable regulatory environment.

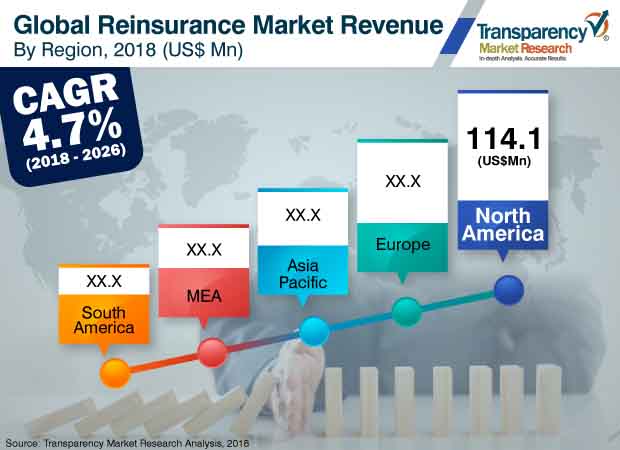

The global reinsurance marketwas valued at US$ 241.14 Bn in 2017 and is expected to expand at a CAGR of 4.7% during the forecast period.

Growth in property catastrophe protection is a major factor expected to drive the reinsurance market. However, lack of disposable income is a major factor restraining the market. Developing countries of Africa have frail economies with resultant low insurance infiltration due to lack of disposable income, and globalization & competition from foreign companies. In South Africa, disposable income per capita is much lower than the OECD average of USD 30,563. Regional economic activities are anticipated to present significant opportunities for the reinsurance market. The United States, China, Germany, Japan, and United Kingdom are some of the countries with the strongest economic growth. Thus, increasing economic activities and public-private collaboration schemes and a movement toward financial stability is offering enormous growth opportunities to the reinsurance market. Local insurers progressively retain premiums. Increased retention is a reflection of insurers’ confidence in their own underwriting. Insurers are starting to retain more risk as it implies that they are concentrating more on the fundamentals, on underwriting, and on their risk selection. However, unrealized investment losses and adverse currency fluctuation have impacted reinsurance capital across all the regions which are however offset by stable operating earnings aided by continued light catastrophe activity.

The global reinsurance market is expected to be further driven by significant growth in Asia Pacific. The region is estimated to constitute a significant market share during the forecast period, with India, Japan, and China contributing most to the region’s revenue. The reinsurance market in Asia Pacific is mainly driven by growth in property catastrophe protection. This is largely because the region has encountered several property losses in the past few years. Moreover, a series of typhoons, floods, earthquakes, and other weather-related losses also impacted the region. For instance, in August 2018, Kerala, a state in India was affected by severe flooding caused by heavy rainfall. The flooding resulted in various property losses and at least a million people were expatriated from their homes. These factors are anticipated to further fuel the demand for reinsurance services around the globe. In the Asia Pacific region, increasing amounts of catastrophe protection are being purchased to secure income instead of essentially ensure capital. As multinational companies have extended their footprintin Asia, they have discovered that country-specific regulatory realities and local practices have occasionally prompted reinsurance decisions that were in conflict with the objectives of the broader multinational group. As a result, reinsurers are advancing to a progressively incorporated or Asia-regionalized reinsurance strategy.

Major players operating in the reinsurance market include Barents Re Reinsurance, Inc., Berkshire Hathaway Inc., BMS Group Ltd., China Reinsurance (Group) Corporation, Everest Re Group, Ltd., Hannover Re, IRB-Brasil Resseguros S.A., Lloyd's, Munich Re, Odyssey Reinsurance, PartnerRe, Reinsurance Group of America, Incorporated, SCOR SE, and Swiss RE Group.

Reinsurance Market to See Consistent Growth from Demand for Property Catastrophe Protection

Reinsurance is a common practice adopted by insurance companies to mitigate their risks by partly transferring their risk portfolios to other parties called reinsurers, while the main entity is known as primary insurance companies. Reinsurance market has witnessed some notable disruptions particularly after the outbreaks of COVID-19 pandemic in 2020. The reinsurers are keen on offering value-added services to primary insurers and have taken numerous measures in smoothening the latter’s earnings. The focus has slightly veered off from just covering property catastrophe risks to covering broader array of risks. To this end, they are leaning on developing new business models. The trend of automated risk placement is a key trend expected to become more cogent in the times to come, opine insurance experts. Market modernization initiatives have begun making waves, and will be crucial in the future growth trajectories in the reinsurance market. A rapidly evolving capital markets structuring is a key trend bolstering the expansion of the reinsurance market. The value chain of the market has also been reshaped by the advent of alternative capital, nudging reinsurers to realign their offering to cover a wide range of risks. New technologies used for risk placement and trading are key trends that may affect the course of the reinsurance market.

The COVID-19 pandemic is not mere a humanitarian crisis but a global health pandemic of severe level. The aftermaths have transformed the business and operating models of businesses from across various industries. The reinsurance market has also been battling the economic and social fallout of the pandemic, which is still emerging in some parts of the world due to emerging virus variants. The socio-economic disruptions have strengthened the forces of consolidation among brokers, primary insurers, and reinsurers. This stridently has echoed the relevance of new business models in excavating new revenue streams. The appetite of the buyers have also changed, and there has been rise in renewable rates. Emerging scenarios in the reinsurance market suggest that technology will play a greater role in meeting the clients’ needs in the post-pandemic world.

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Reinsurance Market

4. Market Overview

4.1. Introduction

4.2. Global Market – Macro Economic Factors Overview

4.2.1. World GDP Indicator – For Top 20 Economies

4.2.2. Global ICT Spending (US$ Bn), 2012, 2018, 2026

4.3. Technology/Product Roadmap

4.4. Key Market Indicators

4.5. Analysis of Reinsurance Market, by Type

4.5.1. Facultative Reinsurance

4.5.2. Treaty Reinsurance

4.6. Analysis of Reinsurance Contracts by, Industry

4.6.1. Aviation

4.6.2. Marine

4.6.3. Automotive

4.6.4. Healthcare

4.6.5. Agriculture

4.6.6. Others (Property and Specialty, Engineering etc.)

4.7. Reinsurance Pricing Model Analysis

4.8. Market Factor Analysis

4.8.1. Porter’s Five Forces Analysis

4.8.2. PESTEL Analysis

4.8.3. Ecosystem Analysis

4.8.3.1. Key End User/Customers Analysis

4.8.3.2. Market Channel Development Trends

4.8.4. Market Dynamics (Growth Influencers)

4.8.4.1. Drivers

4.8.4.2. Restraints

4.8.4.3. Opportunities

4.8.4.4. Impact Analysis of Drivers & Restraints

4.8.5. Key Trends

4.9. Global Reinsurance Market Analysis and Forecast, 2012 - 2026

4.9.1. Market Revenue Analysis (US$ Bn)

4.9.1.1. Historic growth trends, 2012-2017

4.9.1.2. Forecast trends, 2018-2026

4.10. Market Attractiveness Analysis

4.10.1. By Distribution Channel

4.10.2. By End-user

4.10.3. By Country

4.11. Competitive Scenario and Trends

4.11.1. Reinsurance Market Concentration Rate

4.11.1.1. List of Emerging, Prominent and Leading Players

4.11.2. Mergers & Acquisitions, Expansions

4.12. Market Outlook

5. Global Reinsurance Market Analysis and Forecast, by Distribution Channel

5.1. Overview & Definitions

5.2. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

5.2.1. Direct Writing

5.2.2. Broker

6. Global Reinsurance Market Analysis and Forecast, by End-user

6.1. Overview & Definitions

6.2. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

6.2.1. Life & Health Reinsurance

6.2.2. Non-Life/ Property & Casualty Reinsurance

7. Global Reinsurance Market Analysis and Forecast, by Region

7.1. Overview & Definitions

7.2. Reinsurance Market Size (US$ Bn) Forecast, by Region, 2016 – 2026

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

8. North America Reinsurance Market Analysis and Forecast

8.1. Key Findings

8.2. Impact Analysis of Drivers & Restraints

8.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

8.3.1. Direct Writing

8.3.2. Broker

8.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 - 2026

8.4.1. Life & Health Reinsurance

8.4.2. Non-Life/ Property & Casualty Reinsurance

8.5. Reinsurance Market Size (US$ Bn) Forecast, by Country and Sub-region, 2016 - 2026

8.5.1. The U.S.

8.5.2. Mexico

8.5.3. Canada

8.5.4. Rest of North America

9. Europe Reinsurance Market Analysis and Forecast

9.1. Key Findings

9.2. Impact Analysis of Drivers & Restraints

9.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

9.3.1. Direct Writing

9.3.2. Broker

9.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 - 2026

9.4.1. Life & Health Reinsurance

9.4.2. Non-Life/ Property & Casualty Reinsurance

9.5. Reinsurance Market Size (US$ Bn) Forecast, by Country and Sub-region, 2016 - 2026

9.5.1. Germany

9.5.2. France

9.5.3. Italy

9.5.4. UK

9.5.5. Rest of Europe

10. Asia Pacific Reinsurance Market Analysis and Forecast

10.1. Key Findings

10.2. Impact Analysis of Drivers & Restraints

10.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

10.3.1. Direct Writing

10.3.2. Broker

10.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 - 2026

10.4.1. Life & Health Reinsurance

10.4.2. Non-Life/ Property & Casualty Reinsurance

10.5. Reinsurance Market Size (US$ Bn) Forecast, by Country and Sub-region, 2016 - 2026

10.5.1. China

10.5.2. Japan

10.5.3. India

10.5.4. Rest of Asia Pacific

11. Middle East & Africa Reinsurance Market Analysis and Forecast

11.1. Key Findings

11.2. Impact Analysis of Drivers & Restraints

11.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

11.3.1. Direct Writing

11.3.2. Broker

11.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 - 2026

11.4.1. Life & Health Reinsurance

11.4.2. Non-Life/ Property & Casualty Reinsurance

11.5. Reinsurance Market Size (US$ Bn) Forecast, by Country and Sub-region, 2016 - 2026

11.5.1. GCC

11.5.2. South Africa

11.5.3. Rest of MEA

12. South America Reinsurance Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers & Restraints

12.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

12.3.1. Direct Writing

12.3.2. Broker

12.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 - 2026

12.4.1. Life & Health Reinsurance

12.4.2. Non-Life/ Property & Casualty Reinsurance

12.5. Reinsurance Market Size (US$ Bn) Forecast, by Country and Sub-region, 2016 - 2026

12.5.1. Brazil

12.5.2. Argentina

12.5.3. Chile

12.5.4. Colombia

12.5.5. Panama

12.5.6. Rest of South America

13. Brazil Reinsurance Market Analysis and Forecast

13.1. Key Findings

13.2. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

13.2.1. Direct Writing

13.2.2. Broker

13.3. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

13.3.1. Life & Health Reinsurance

13.3.2. Non-Life/ Property & Casualty Reinsurance

14. Mexico Reinsurance Market Analysis and Forecast

14.1. Key Findings

14.2. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

14.2.1. Direct Writing

14.2.2. Broker

14.3. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

14.3.1. Life & Health Reinsurance

14.3.2. Non-Life/ Property & Casualty Reinsurance

15. Argentina Reinsurance Market Analysis and Forecast

15.1. Key Findings

15.2. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

15.2.1. Direct Writing

15.2.2. Broker

15.3. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

15.3.1. Life & Health Reinsurance

15.3.2. Non-Life/ Property & Casualty Reinsurance

16. Chile Reinsurance Market Analysis and Forecast

16.1. Key Findings

16.2. Impact Analysis of Drivers & Restraints

16.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

16.3.1. Direct Writing

16.3.2. Broker

16.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

16.4.1. Life & Health Reinsurance

16.4.2. Non-Life/ Property & Casualty Reinsurance

17. Colombia Reinsurance Market Analysis and Forecast

17.1. Key Findings

17.2. Impact Analysis of Drivers & Restraints

17.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

17.3.1. Direct Writing

17.3.2. Broker

17.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

17.4.1. Life & Health Reinsurance

17.4.2. Non-Life/ Property & Casualty Reinsurance

18. Panama Reinsurance Market Analysis and Forecast

18.1. Key Findings

18.2. Impact Analysis of Drivers & Restraints

18.3. Reinsurance Market Size (US$ Bn) Forecast, by Distribution Channel, 2016 – 2026

18.3.1. Direct Writing

18.3.2. Broker

18.4. Reinsurance Market Size (US$ Bn) Forecast, by End-user, 2016 – 2026

18.4.1. Life & Health Reinsurance

18.4.2. Non-Life/ Property & Casualty Reinsurance

19. Competition Landscape

19.1. Market Player – Competition Matrix

19.2. Market Share Analysis by Company (2017)

20. Company Profiles (Details – Business Overview, Sales Area/Geographical Presence, Revenue and Strategy)

20.1. Barents Re Reinsurance, Inc.

20.1.1. Business Overview

20.1.2. Sales Area/Geographical Revenue/GWP

20.1.3. Business Strategy

20.2. Berkshire Hathaway Inc.

20.2.1. Business Overview

20.2.2. Sales Area/Geographical Revenue/GWP

20.2.3. Business Strategy

20.3. BMS Group Ltd.

20.3.1. Business Overview

20.3.2. Sales Area/Geographical Revenue/GWP

20.3.3. Business Strategy

20.4. China Reinsurance (Group) Corporation

20.4.1. Business Overview

20.4.2. Sales Area/Geographical Revenue/GWP

20.4.3. Business Strategy

20.5. Everest Re Group, Ltd.

20.5.1. Business Overview

20.5.2. Sales Area/Geographical Revenue/GWP

20.5.3. Business Strategy

20.6. Hannover Re

20.6.1. Business Overview

20.6.2. Sales Area/Geographical Revenue/GWP

20.6.3. Business Strategy

20.7. IRB-Brasil Resseguros S.A.

20.7.1. Business Overview

20.7.2. Sales Area/Geographical Revenue/GWP

20.7.3. Business Strategy

20.8. Lloyd's

20.8.1. Business Overview

20.8.2. Sales Area/Geographical Revenue/GWP

20.8.3. Business Strategy

20.9. Munich Re

20.9.1. Business Overview

20.9.2. Sales Area/Geographical Revenue/GWP

20.9.3. Business Strategy

20.10. Odyssey Reinsurance

20.10.1. Business Overview

20.10.2. Sales Area/Geographical Revenue/GWP

20.10.3. Business Strategy

20.11. PartnerRe

20.11.1. Business Overview

20.11.2. Sales Area/Geographical Revenue/GWP

20.11.3. Business Strategy

20.12. Reinsurance Group of America, Incorporated

20.12.1. Business Overview

20.12.2. Sales Area/Geographical Revenue/GWP

20.12.3. Business Strategy

20.13. SCOR SE

20.13.1. Business Overview

20.13.2. Sales Area/Geographical Revenue/GWP

20.13.3. Business Strategy

20.14. Swiss Re Group

20.14.1. Business Overview

20.14.2. Sales Area/Geographical Revenue/GWP

20.14.3. Business Strategy

21. Key Takeaways

List of Tables

Table 1: Global Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 2: Global Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 3: Global Reinsurance Market Revenue (US$ Bn) Forecast, by Country, 2016 - 2026

Table 4: North America Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 5: North America Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 6: North America Reinsurance Market Revenue (US$ Bn) Forecast, by Country, 2016 - 2026

Table 7: Europe Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 8: Europe Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 9: Europe Reinsurance Market Revenue (US$ Bn) Forecast, by Country, 2016 - 2026

Table 10: Asia Pacific Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 11: Asia Pacific Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 12: Asia Pacific Reinsurance Market Revenue (US$ Bn) Forecast, by Country, 2016 - 2026

Table 13: Middle East & Africa Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 14: Middle East & Africa Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 15: Middle East & Africa Reinsurance Market Revenue (US$ Bn) Forecast, by Country, 2016 - 2026

Table 16: South America Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 17: South America Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 18: South America Reinsurance Market Revenue (US$ Bn) Forecast, by Country, 2016 - 2026

Table 19: Brazil Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 20: Brazil Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 21: Mexico Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 22: Mexico Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 23: Argentina Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 24: Argentina Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 25: Chile Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 26: Chile Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 27: Colombia Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 28: Colombia Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

Table 29: Panama Reinsurance Market Revenue (US$ Bn) Forecast, by Distribution Channel, 2016 - 2026

Table 30: Panama Reinsurance Market Revenue (US$ Bn) Forecast, by End-user, 2016 - 2026

List of Figures

Figure 1: Global Reinsurance Market Size (US$ Bn) Forecast, 2016–2026

Figure 2: Reinsurance Market Size (US$ Bn) Forecast, 2012 – 2017

Figure 3: Global Reinsurance Market Y-o-Y Growth (Value %), 2012 – 2017

Figure 4: Reinsurance Market Size (US$ Bn) Forecast, 2018 - 2016

Figure 5: Global Reinsurance Market Y-o-Y Growth (Value %), 2018 - 2016

Figure 6: Global Reinsurance Market Attractiveness Analysis, by Distribution Channel

Figure 7: Global Reinsurance Market Attractiveness Analysis, by End-user

Figure 8: Global Reinsurance Market Attractiveness Analysis, by Region

Figure 9: Global Reinsurance Market Outlook (Value %), by Distribution Channel

Figure 10: Global Reinsurance Market Outlook (Value %), by End-user

Figure 11: Global Reinsurance Market Outlook (Value %), by Region

Figure 12: Global Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 13: Global Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 14: Global Reinsurance Market Share Analysis, by End-user (2018)

Figure 15: Global Reinsurance Market Share Analysis, by End-user (2026)

Figure 16: Global Reinsurance Market Share Analysis, by Region (2018)

Figure 17: Global Reinsurance Market Share Analysis, by Region (2026)

Figure 18: North America Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 19: North America Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 20: North America Reinsurance Market Share Analysis, by End-user (2018)

Figure 21: North America Reinsurance Market Share Analysis, by End-user (2026)

Figure 22: North America Reinsurance Market Share Analysis, by Country (2018)

Figure 23: North America Reinsurance Market Share Analysis, by Country (2026)

Figure 24: Europe Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 25: Europe Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 26: Europe Reinsurance Market Share Analysis, by End-user (2018)

Figure 27: Europe Reinsurance Market Share Analysis, by End-user (2026)

Figure 28: Europe Reinsurance Market Share Analysis, by Country (2018)

Figure 29: Europe Reinsurance Market Share Analysis, by Country (2026)

Figure 30: Asia Pacific Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 31: Asia Pacific Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 32: Asia Pacific Reinsurance Market Share Analysis, by End-user (2018)

Figure 33: Asia Pacific Reinsurance Market Share Analysis, by End-user (2026)

Figure 34: Asia Pacific Reinsurance Market Share Analysis, by Country (2018)

Figure 35: Asia Pacific Reinsurance Market Share Analysis, by Country (2026)

Figure 36: Middle East & Africa Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 37: Middle East & Africa Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 38: Middle East & Africa Reinsurance Market Share Analysis, by End-user (2018)

Figure 39: Middle East & Africa Reinsurance Market Share Analysis, by End-user (2026)

Figure 40: Middle East & Africa Reinsurance Market Share Analysis, by Country (2018)

Figure 41: Middle East & Africa Reinsurance Market Share Analysis, by Country (2026)

Figure 42: South America Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 43: South America Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 44: South America Reinsurance Market Share Analysis, by End-user (2018)

Figure 45: South America Reinsurance Market Share Analysis, by End-user (2026)

Figure 46: South America Reinsurance Market Share Analysis, by Country (2018)

Figure 47: South America Reinsurance Market Share Analysis, by Country (2026)

Figure 48: Brazil Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 49: Brazil Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 50: Brazil Reinsurance Market Share Analysis, by End-user (2018)

Figure 51: Brazil Reinsurance Market Share Analysis, by End-user (2026)

Figure 52: Brazil Reinsurance Market Attractiveness Analysis, by Distribution Channel (2018)

Figure 53: Brazil Reinsurance Market Attractiveness Analysis, by End-user (2018)

Figure 54: Mexico Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 55: Mexico Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 56: Mexico Reinsurance Market Share Analysis, by End-user (2018)

Figure 57: Mexico Reinsurance Market Share Analysis, by End-user (2026)

Figure 58: Mexico Reinsurance Market Attractiveness Analysis, by Distribution Channel (2018)

Figure 59: Mexico Reinsurance Market Attractiveness Analysis, by End-user (2018)

Figure 60: Argentina Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 61: Argentina Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 62: Argentina Reinsurance Market Share Analysis, by End-user (2018)

Figure 63: Argentina Reinsurance Market Share Analysis, by End-user (2026)

Figure 64: Argentina Reinsurance Market Attractiveness Analysis, by Distribution Channel (2018)

Figure 65: Argentina Reinsurance Market Attractiveness Analysis, by End-user (2018)

Figure 66: Chile Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 67: Chile Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 68: Chile Reinsurance Market Share Analysis, by End-user (2018)

Figure 69: Chile Reinsurance Market Share Analysis, by End-user (2026)

Figure 70: Chile Reinsurance Market Attractiveness Analysis, by Distribution Channel (2018)

Figure 71: Chile Reinsurance Market Attractiveness Analysis, by End-user (2018)

Figure 72: Colombia Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 73: Colombia Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 74: Colombia Reinsurance Market Share Analysis, by End-user (2018)

Figure 75: Colombia Reinsurance Market Share Analysis, by End-user (2026)

Figure 76: Colombia Reinsurance Market Attractiveness Analysis, by Distribution Channel (2018)

Figure 77: Colombia Reinsurance Market Attractiveness Analysis, by End-user (2018)

Figure 78: Panama Reinsurance Market Share Analysis, by Distribution Channel (2018)

Figure 79: Panama Reinsurance Market Share Analysis, by Distribution Channel (2026)

Figure 80: Panama Reinsurance Market Share Analysis, by End-user (2018)

Figure 81: Panama Reinsurance Market Share Analysis, by End-user (2026)

Figure 82: Panama Reinsurance Market Attractiveness Analysis, by Distribution Channel (2018)

Figure 83: Panama Reinsurance Market Attractiveness Analysis, by End-user (2018)