Reports

Reports

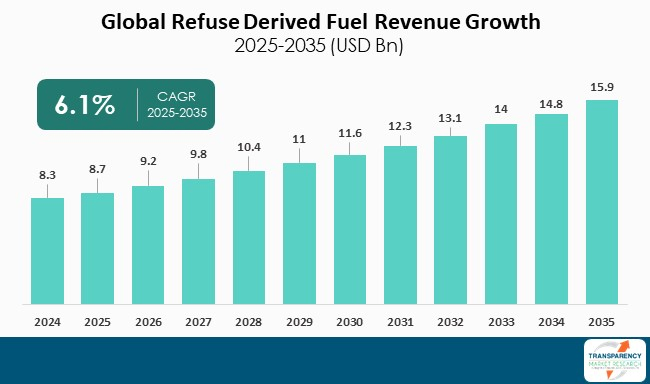

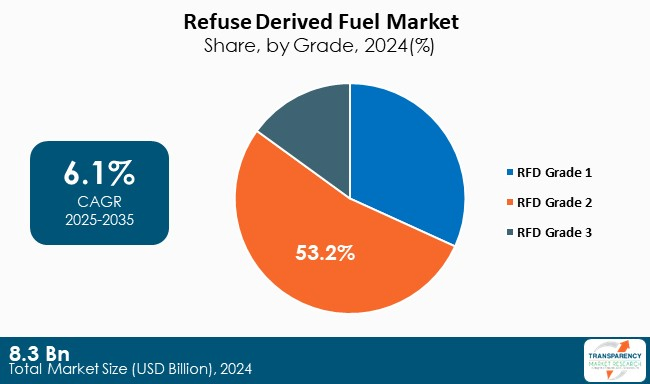

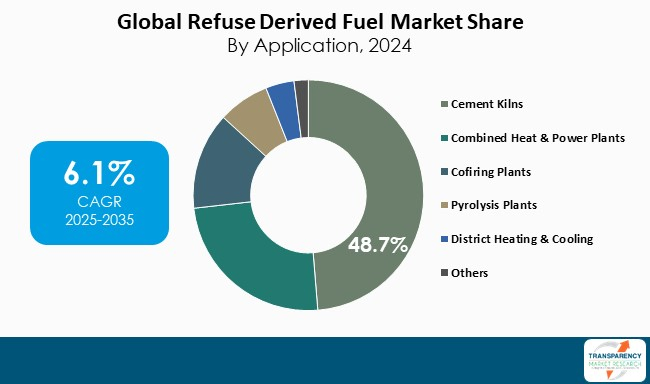

The Refuse Derived Fuel (RDF) market is anticipated to grow at a CAGR of 6.1% during the forecast period owing to the increasing demand from the cement kilns, combined heat & power plants, and cofiring plants, among others. Refuse derived fuel has higher calorific value and can provide stable combustion. In cement kilns, RDF is used as an alternative fuel to coal and wood. It is helping the cement industry to reduce their carbon footprint.

Stringent environmental regulations related to landfill and waste management are providing a good platform for waste management companies to produce refuse derived fuel. The major source of waste for producing is municipal solid waste. RDF helps in diverting unrecyclable materials from landfills.

Refused derived fuel can play a significant role in the circular economy strategy of countries such as The Netherlands, France, Portugal, China, Japan, and India. Stringent regulations related to pollution and higher landfill prices in Europe drive the generation of significant amount of refuse derived fuel.

Refuse derived fuel is a fuel produced from commercial waste, municipal solid waste, and industrial waste. Waste is crushed, dried, classified by removing foreign materials, crushed again, and pelletized to create refuse derived fuel. Refuse derived fuel helps in reducing landfill waste, and offering a renewable energy resource. By converting non-recyclable waste into fuel, RDF diverts such waste from reaching landfills, and minimizes environmental impact of landfill sites.

Refuse derived fuel generates a calorific fuel feed for thermos-chemical processes such as pyrolysis, incineration, and gasification. RDF has higher calorific value and offer features such as stable combustion, and easy to store and transport - lower secondary pollution. RDF processing facilitates recovery of materials, salvaging of metals, and various recyclable items within the waste stream.

RDF can be utilized as a substitute for wood and coal in industries such as cement plants, industrial boilers, and power plants. Refuse derived fuel helps in reducing the carbon footprint of the cement industry. Governments offers subsidies and incentives for supporting RDF projects to make them more economically feasible. RDF is available at lower prices when compared to fossil fuels. RDF can be used in sectors such as chemicals, ceramics, and pulp and paper.

| Attribute | Detail |

|---|---|

| Refuse Derived Fuel Market Drivers |

|

The need for renewable energy has exploded over the past couple of years, as society looks to address climate change and reduce reliance on fossil fuels. This demand has been assured by the realization of the environmental costs and economical burdens faced with traditional power sources such as coal, oil, and natural gas. The use of Refuse Derived Fuel (RDF) as renewable energy resource from non-recyclable waste is becoming a viable renewable energy resource to satisfy growing demand.

RDF is made using a process to convert municipal solid waste (MSW) and non-recyclable visual material into a fuel that can then be turned into electricity, heat, and industrial energy. As governments and industry strive to find cleaner substitutes to fossil fuel, RDF is becoming more commonly implemented in waste-to-energy (WtE) facilities, cement kilns, and power generation plants. Political and industry leader corroboration to use low carbon future fuels, and push for less greenhouse gas emissions, supports RDF. The RDF substitution supports all industries moving away from fossil fuels to reduce their carbon footprint and meet their commitment to simple, affordable, non-fossil fuel use.

RDF also has a unique dual function in that it is both - a renewable energy source and a first step to addressing the world's waste problem. As urbanization and industrialization continue to expand, so does the amount of waste being produced, which is forcing waste management systems to oversimplify the waste management process and taxes their capacity. Landfilling is no longer sustainable due to methane emissions and the other environmental implications. Converting waste into RDF, meanwhile, doesn't eliminate the waste but rather creates energy from it, reducing reliance on landfilling and energy generation

The increasing need for renewable energy is also part of the growing global energy crisis. Conventional energy production has become an issue of access in the developing world. The infrastructure to transport energy was often lacking before the world energy crisis created such demand for it.

RDF has the great advantage of producing energy locally where waste is readily available.

In addition, with technological improvements in RDF production, the technology used to convert waste into energy has also improved. Processing technologies such as mechanical biological treatment (MBT) and gasification have noticeably increased the yield of RDF produced and made it an even more viable and efficient energy source.

Government regulations and policies are the major components of the development and growth of the Refuse Derived Fuel (RDF) sector in the context of waste-to-energy (WtE) technologies. As all countries are pressed to adhere to environmental targets while reducing dependency on landfills, RDF is an integral part of waste management. Government and regulatory authorities are integral to developing the market for RDF alongside WtE by implementing supportive regulations.

One of the most salient regulations driving the proliferation of RDF has been the number of landfill diversion laws. These regulations compel the reduction of waste being diverted to landfills to minimize the harm to the environment by reducing the environmentally harmful physical consequences, such as methane emissions and groundwater contamination.

Waste diversion regulations now exist commonly in many jurisdictions that impose large fines against industries that fail to satisfy a waste diversion target. Regulations that promote landfill diversion will provide inducements to municipalities and industries to consider alternative to landfilling waste, which can be developed into RDF and hence the other energy resources, rather than destroyed in a landfill.

Aside from landfill diversion, government policies also help push for the recycling of waste and the use of waste that cannot be recycled to produce energy. RDF works within these frameworks, allowing for the recycling of waste that cannot be used in any other way, preventing it from entering the landfill, thereby contributing toward renewable energy production.

RDF provides a two-pronged service by reducing waste going to the landfill, whilst also providing a fuel source to produce electricity, which is aligned with the principles of a circular economy that uses the principles of reduce, reuse, and recycle of materials to maintain the materials life cycle and reduce waste.

Governments provide financial incentives and subsidies for the private sector to invest in waste-to-energy projects and get more players in the waste-to-energy market. This can be in the form of tax credits, feed-in-tariffs, or guaranteed prices for the energy produced from RDF-derived facilities.

These incentives relieve the financial burden of the waste-to-energy technology by lowering the capital cost of entry for the business that may be unwilling to invest in the high upfront costs of RDF production facilities. Providing incentives helps governments to enhance the refuse derived fuel market and incentivize private sector innovation and capital expenditure into more effective and environmentally-friendly waste-to-energy technologies.

The cement kilns dominate the refuse derived fuel (RDF) market, with indoor cement kilns consuming approximately 48.4% of all its use, due to their large hidden thermal demand, and operational flexibility. Kilns are also able to operate at extreme temperatures (often well over 1400 degrees Celsius), which allows for the complete combustion of RDF, which is a blend of combustible waste materials (plastics, paper, textiles, etc.).

Environmental regulations further encourage the use of RDF, as it reduces carbon emissions while extending support to circular economy targets by drawing waste from landfills.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Europe has 55.6 percent of the worldwide refuse derived fuel (RDF) market ground into the territory due to its strong regulatory environment, as well as its waste management infrastructure, and focus on sustainability. The European Union's Waste Framework Directive and Landfill Directive promotes the use of waste-to-energy feeds like RDF to eliminate landfill mechanisms and reduce GHG emissions.

Many European countries, especially Germany, The Netherlands, and Sweden have publicly and privately funded RDF-compatible plants, especially in cement and power generation industries. Additionally, the prevalence of landfill taxes has stigmatized landfilling, further promoting RDF to secure a cheap and environmentally-friendly replacement for fossil fuels, thus increasing the demand regionally.

Asia Pacific has a considerable share of the refuse derived fuel (RDF) market, due to swift urbanization, increased waste production, and rising energy demands. Countries such as Japan, China, and India are implementing RDF in their waste management strategies to alleviate landfill concerns, and help them reach sustainable waste management goals.

Government initiatives around the region to promote waste-to-energy technologies are also impacting the market, while infrastructure and regulatory developments vary. North America's share of the refuse derived fuel market has come largely from gradual uptake, based on reduced landfill costs, less regulatory pressure versus Europe, and slow development of facilities. However, there is an increased interest in sustainable waste-to-energy solutions, which will continue to encourage uptake across the region.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 8.3 Bn |

| Market Forecast Value in 2035 | US$ 15.9 Mn |

| Growth Rate (CAGR) | 6.1% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Refuse Derived Fuel market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Grade

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The refuse derived fuel market was valued at US$ 8.3 Bn in 2024

The refuse derived fuel industry is expected to grow at a CAGR of 6.1% from 2025 to 2035

Increasing demand for renewable energy and government regulations and policies supporting waste to energy technologies

Cement kiln was the largest application segment and its value is anticipated to grow at a CAGR of 7.1% during the forecast period

Europe was the most lucrative region in 2024

Renewi, Veolia, Estre Ambiental, Countrystyle Recycling, FCC Environment CEE, Broad Group, Reworld, N+P Group, Verdis Environment Ltd, and Nathabumi are the major players in the refuse derived fuel market

Table 1 Global Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 2 Global Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 3 Global Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 4 Global Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 5 Global Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 6 Global Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 7 Global Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Region, 2025 to 2035

Table 8 Global Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 10 North America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 11 North America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 12 North America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 13 North America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 14 North America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 15 North America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Country, 2025 to 2035

Table 16 North America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 18 U.S. Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 19 U.S. Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 20 U.S. Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 21 U.S. Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 22 U.S. Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 23 Canada Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 24 Canada Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 25 Canada Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 26 Canada Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 27 Canada Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 28 Canada Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 29 Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 30 Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 31 Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 32 Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 33 Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 34 Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 35 Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 38 Germany Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 39 Germany Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 40 Germany Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 41 Germany Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 42 Germany Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 43 France Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 44 France Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 45 France Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 46 France Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 47 France Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 48 France Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 49 U.K. Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 50 U.K. Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 51 U.K. Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 52 U.K. Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 53 U.K. Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 54 U.K. Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 55 Italy Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 56 Italy Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 57 Italy Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 58 Italy Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 59 Italy Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 60 Italy Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 61 Spain Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 62 Spain Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 63 Spain Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 64 Spain Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 65 Spain Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 66 Spain Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 67 Russia & CIS Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 68 Russia & CIS Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 69 Russia & CIS Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 70 Russia & CIS Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 71 Russia & CIS Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 72 Russia & CIS Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 73 Rest of Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 74 Rest of Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 75 Rest of Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 76 Rest of Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 77 Rest of Europe Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 78 Rest of Europe Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 79 Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 80 Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 81 Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 82 Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 83 Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 84 Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 85 Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 88 China Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade 2025 to 2035

Table 89 China Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 90 China Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 91 China Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 92 China Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 93 Japan Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 94 Japan Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 95 Japan Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 96 Japan Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 97 Japan Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 98 Japan Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 99 India Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 100 India Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 101 India Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 102 India Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 103 India Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 104 India Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 105 India Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 106 India Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 107 ASEAN Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 108 ASEAN Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 109 ASEAN Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 110 ASEAN Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 111 ASEAN Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 112 ASEAN Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 113 Rest of Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 114 Rest of Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 115 Rest of Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 116 Rest of Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 117 Rest of Asia Pacific Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 118 Rest of Asia Pacific Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 119 Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 120 Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 121 Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 122 Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 123 Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 124 Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 125 Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 128 Brazil Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 129 Brazil Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 130 Brazil Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 131 Brazil Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 132 Brazil Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 133 Mexico Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 134 Mexico Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 135 Mexico Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 136 Mexico Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 137 Mexico Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 138 Mexico Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 139 Rest of Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 140 Rest of Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 141 Rest of Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 142 Rest of Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 143 Rest of Latin America Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 144 Rest of Latin America Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 145 Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 146 Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 147 Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 148 Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 149 Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 150 Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 151 Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 154 GCC Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 155 GCC Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 156 GCC Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 157 GCC Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 158 GCC Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 159 South Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 160 South Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 161 South Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 162 South Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 163 South Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 164 South Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 165 Rest of Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Grade, 2025 to 2035

Table 166 Rest of Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Grade, 2025 to 2035

Table 167 Rest of Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Source, 2025 to 2035

Table 168 Rest of Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 169 Rest of Middle East & Africa Refuse Derived Fuel Market Volume (Kilo Tons) Forecast, by Application, 2025 to 2035

Table 170 Rest of Middle East & Africa Refuse Derived Fuel Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Figure 1 Global Refuse Derived Fuel Market Volume Share Analysis, by Grade, 2024. 2028, and 2035

Figure 2 Global Refuse Derived Fuel Market Attractiveness, by Grade

Figure 3 Global Refuse Derived Fuel Market Volume Share Analysis, by Source, 2024. 2028, and 2035

Figure 4 Global Refuse Derived Fuel Market Attractiveness, by Source

Figure 5 Global Refuse Derived Fuel Market Volume Share Analysis, by Application, 2024. 2028, and 2035

Figure 6 Global Refuse Derived Fuel Market Attractiveness, by Application

Figure 7 Global Refuse Derived Fuel Market Volume Share Analysis, by Region, 2024. 2028, and 2035

Figure 8 Global Refuse Derived Fuel Market Attractiveness, by Region

Figure 9 North America Refuse Derived Fuel Market Volume Share Analysis, by Grade, 2024. 2028, and 2035

Figure 10 North America Refuse Derived Fuel Market Attractiveness, by Grade

Figure 11 North America Refuse Derived Fuel Market Volume Share Analysis, by Source, 2024. 2028, and 2035

Figure 12 North America Refuse Derived Fuel Market Attractiveness, by Source

Figure 13 North America Refuse Derived Fuel Market Volume Share Analysis, by Application, 2024. 2028, and 2035

Figure 14 North America Refuse Derived Fuel Market Attractiveness, by Application

Figure 15 North America Refuse Derived Fuel Market Attractiveness, by Country and Sub-region

Figure 16 Europe Refuse Derived Fuel Market Volume Share Analysis, by Grade, 2024. 2028, and 2035

Figure 17 Europe Refuse Derived Fuel Market Attractiveness, by Grade

Figure 18 Europe Refuse Derived Fuel Market Volume Share Analysis, by Source, 2024. 2028, and 2035

Figure 19 Europe Refuse Derived Fuel Market Attractiveness, by Source

Figure 20 Europe Refuse Derived Fuel Market Volume Share Analysis, by Application, 2024. 2028, and 2035

Figure 21 Europe Refuse Derived Fuel Market Attractiveness, by Application

Figure 22 Europe Refuse Derived Fuel Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 23 Europe Refuse Derived Fuel Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Refuse Derived Fuel Market Volume Share Analysis, by Grade, 2024. 2028, and 2035

Figure 25 Asia Pacific Refuse Derived Fuel Market Attractiveness, by Grade

Figure 26 Asia Pacific Refuse Derived Fuel Market Volume Share Analysis, by Source, 2024. 2028, and 2035

Figure 27 Asia Pacific Refuse Derived Fuel Market Attractiveness, by Source

Figure 28 Asia Pacific Refuse Derived Fuel Market Volume Share Analysis, by Application, 2024. 2028, and 2035

Figure 29 Asia Pacific Refuse Derived Fuel Market Attractiveness, by Application

Figure 30 Asia Pacific Refuse Derived Fuel Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 31 Asia Pacific Refuse Derived Fuel Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Refuse Derived Fuel Market Volume Share Analysis, by Grade, 2024. 2028, and 2035

Figure 33 Latin America Refuse Derived Fuel Market Attractiveness, by Grade

Figure 34 Latin America Refuse Derived Fuel Market Volume Share Analysis, by Source, 2024. 2028, and 2035

Figure 35 Latin America Refuse Derived Fuel Market Attractiveness, by Source

Figure 36 Latin America Refuse Derived Fuel Market Volume Share Analysis, by Application, 2024. 2028, and 2035

Figure 37 Latin America Refuse Derived Fuel Market Attractiveness, by Application

Figure 38 Latin America Refuse Derived Fuel Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 39 Latin America Refuse Derived Fuel Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Refuse Derived Fuel Market Volume Share Analysis, by Grade, 2024. 2028, and 2035

Figure 41 Middle East & Africa Refuse Derived Fuel Market Attractiveness, by Grade

Figure 42 Middle East & Africa Refuse Derived Fuel Market Volume Share Analysis, by Source, 2024. 2028, and 2035

Figure 43 Middle East & Africa Refuse Derived Fuel Market Attractiveness, by Source

Figure 44 Middle East & Africa Refuse Derived Fuel Market Volume Share Analysis, by Application, 2024. 2028, and 2035

Figure 45 Middle East & Africa Refuse Derived Fuel Market Attractiveness, by Application

Figure 46 Middle East & Africa Refuse Derived Fuel Market Volume Share Analysis, by Country and Sub-region, 2024. 2028, and 2035

Figure 47 Middle East & Africa Refuse Derived Fuel Market Attractiveness, by Country and Sub-region