Reports

Reports

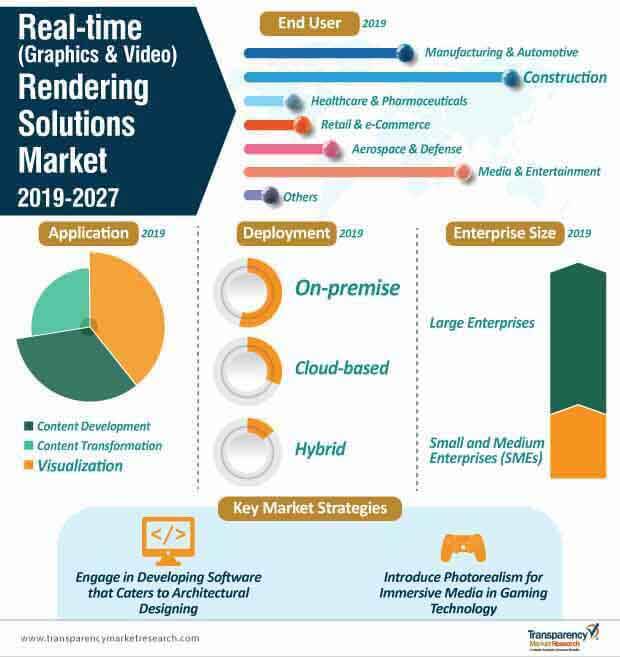

Architectural renderings have established a stable business in the real-time (graphics and video) rendering solutions market. Hence, software providers are aiming for higher objectives such as 3D visualization. The construction sector accounted for the highest revenue in 2018, with a value of ~US$ 326 million in the real-time (graphics and video) rendering solutions market. Due to high incremental opportunities in Europe and Asia Pacific, stakeholders are offering software with CAD (Computer-aided Design) and BIM (Building Information Modelling) tools.

Vendors are increasing their focus on catering to the needs of stakeholders in the AEC (Architecture, Engineering, and Construction) value chain. Due to high competition in the AEC industry, software providers in the real-time (graphics and video) rendering solutions market are developing platforms that render images and videos at impeccable speed. They are adapting their software for easy usability in computers, tablets and even smartphones, to develop and present visuals in real time. With the influx of digital media, stakeholders are taking efforts to build robust software that meet the increasing demand for viral content.

Although the construction sector accounted for the highest revenue in 2018, analysts at Transparency Market Research (TMR) project an exponential increase in value share for the media and entertainment industry. The media and entertainment industry is currently estimated to have a value share of ~26%, which is projected to reach ~32% by 2027, in the real-time (graphics and video) rendering solutions market.

Stakeholders in the real-time (graphics and video) rendering solutions landscape are capitalizing on the increasing trend of digital marketing. Since more and more individuals demand immersive and interactive content via smartphones and tablets, software professionals are incorporating artificial intelligence (AI) and virtual reality (VR) into rendering platforms.

Since stakeholders in the media and entertainment industry are pressed for deadlines and project demands, real-time rendering solutions act as a boon for meeting their timelines. With the growing media and entertainment space, stakeholders in the real-time graphics rendering solutions market are increasingly offering software programs that are cost-competitive and simplify complex graphic rendering.

The real-time (graphics and video) rendering solutions market is fragmented. As a result, emerging market players pose tough competition to leading market players. However, certain challenges in the real-time (graphics and video) rendering solutions market are likely to hamper market growth.

For instance, in the AEC industry, users have a common misconception that, real-time rendering solutions require expensive tools for integration. Another concern that inhibits market growth is the investment of time and capital to train individuals, in order to make them well-versed with the software. Hence, stakeholders in the real-time (graphics and video) rendering solutions market are running marketing campaigns that convey the message of easy integration of real-time technology with existing BIM architectural design software. By clearing this misconception, users are convinced that adopting real-time rendering doesn’t require overhead expenses of training their employees. Faster design iterations of real-time technology and its ability to create an engaging experience for individuals have positively opened up new artistic possibilities amongst employees.

In 2018, biased renders accounted to ~65% of the renderer adoption rate in the global real-time (graphics and video) rendering solutions market. Hence vendors should focus on developing biased renders, as they are more intelligent and efficient as compared to unbiased renders.

With a high renderer adoption rate, it can be said in the right means that users need real-time rendering now more than ever. However, in many cases, users also have a misunderstanding about the high-cost integration of real-time technology. As such, stakeholders are increasing awareness about the easy integration of software with existing tools, by extending their customer services. Stakeholders should increase capabilities in virtual reality experience, since analysts anticipate that, real-time design collaborations will become the norm in the global market.

Real-Time (Graphics and Video) Rendering Solutions Market: Overview

Real-time (Graphics and Video) Rendering Solutions Market - Definition

North America Real-time (Graphics and Video) Rendering Solutions Market – Snapshot

Less Time Required for 3D Rendering with Reduced Cost – A Key Driver

Real-Time (Graphics and Video) Rendering Solutions Market – Competition Landscape

Real-Time (Graphics and Video) Rendering Solutions Market - Company Profiles Snapshot

1. Preface

1.1. Market Scope

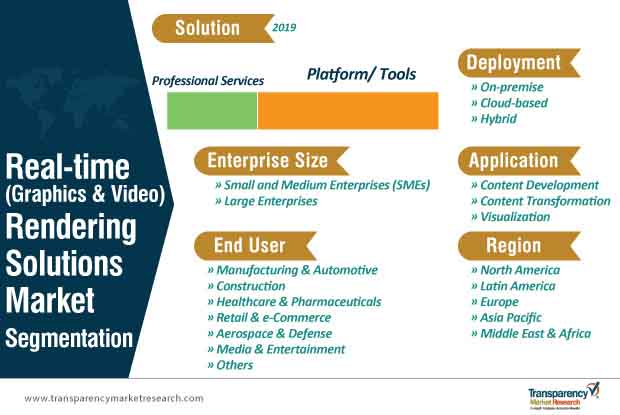

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Real-time (Graphics and Video) Rendering Solutions Market

4. Market Overview

4.1. Introduction

4.2. Key Market Indicators

4.2.1. List of Top Rendering Software Tools

4.3. Technology/Product Roadmap

4.4. Market Factor Analysis

4.4.1. Porter’s Five Forces Analysis

4.4.2. PESTEL Analysis

4.4.3. Value Chain Analysis

4.4.4. Market Dynamics (Growth Influencers)

4.4.4.1. Drivers

4.4.4.2. Restraints

4.4.4.3. Opportunities

4.4.4.4. Impact Analysis of Drivers & Restraints

4.5. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, 2017?2027

4.5.1. Market Revenue Analysis (US$ Mn)

4.5.1.1. Historic Growth Trends, 2013-2018

4.5.1.2. Forecast Trends, 2019-2027

4.5.2. Renderer Adoption Rate (%)

4.5.2.1. Biased

4.5.2.2. Unbiased

4.6. Market Opportunity Analysis – By Region (Global/ North America/ Europe/ Asia Pacific/ Middle East & Africa/ South America)

4.6.1. By Region

4.6.2. By Solution

4.6.3. By Deployment

4.6.4. By Application

4.6.5. By Enterprise Size

4.6.6. By End-use

4.7. Market Outlook

4.8. Competitive Scenario and Trends

4.8.1. Market Concentration Rate

4.8.1.1. List of New Entrants

4.8.2. Mergers & Acquisitions, Expansions

5. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, by Solution

5.1. Overview and Definitions

5.2. Key Findings

5.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Solution, 2017?2027

5.3.1. Platform/ Tools (Engines)

5.3.1.1. Unity

5.3.1.2. Unreal

5.3.1.3. CryEngine

5.3.1.4. Revit

5.3.1.5. Others (Mizuchi, Cinema 4D, etc.)

5.3.2. Professional Services

6. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, by Deployment

6.1. Overview and Definitions

6.2. Key Findings

6.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Deployment, 2017?2027

6.3.1. On-premise

6.3.2. Cloud-based

6.3.3. Hybrid

7. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, by Application

7.1. Overview and Definitions

7.2. Key Findings

7.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Application, 2017?2027

7.3.1. Content Development

7.3.1.1. 3D Gaming

7.3.1.2. Real-time VR Content

7.3.1.3. Rendered & Interactive Video Production

7.3.2. Content Transformation

7.3.3. Visualization

8. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, by Enterprise Size

8.1. Overview and Definitions

8.2. Key Findings

8.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017?2027

8.3.1. Small and Medium Enterprises (SMEs)

8.3.2. Large enterprises

9. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, by End-use

9.1. Key Findings

9.2. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by End-use, 2017?2027

9.2.1. Manufacturing & Automotive

9.2.2. Construction

9.2.3. Healthcare & Pharmaceutical

9.2.4. Retail and E-commerce

9.2.5. Aerospace & Defense

9.2.6. Media & Entertainment

9.2.6.1. Digital Avatar Production

9.2.6.2. Gaming

9.2.7. Others (Education, Travel & Tourism)

10. Global Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Region, 2017?2027

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

11. North America Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast

11.1. Key Findings

11.2. Impact Analysis of Drivers and Restraints

11.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Solution, 2017?2027

11.3.1. Platform/ Tools (Engines)

11.3.1.1. Unity

11.3.1.2. Unreal

11.3.1.3. CryEngine

11.3.1.4. Revit

11.3.1.5. Others (Mizuchi, Cinema 4D, etc.)

11.3.2. Professional Services

11.4. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Deployment, 2017?2027

11.4.1. On-premise

11.4.2. Cloud-based

11.4.3. Hybrid

11.5. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Application, 2017?2027

11.5.1. Content Development

11.5.1.1. 3D Gaming

11.5.1.2. Real-time VR Content

11.5.1.3. Rendered & Interactive Video Production

11.5.2. Content Transformation

11.5.3. Visualization

11.6. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017?2027

11.6.1. Small and Medium Enterprises (SMEs)

11.6.2. Large enterprises

11.7. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by End-use, 2017?2027

11.7.1. Manufacturing & Automotive

11.7.2. Construction

11.7.3. Healthcare & Pharmaceutical

11.7.4. Retail and E-commerce

11.7.5. Aerospace & Defense

11.7.6. Media & Entertainment

11.7.6.1. Digital Avatar Production

11.7.6.2. Gaming

11.7.7. Others (Education, Travel & Tourism)

11.8. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017?2027

11.8.1. The U.S.

11.8.2. Canada

11.8.3. Rest of North America

12. Europe Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers and Restraints

12.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Solution, 2017?2027

12.3.1. Platform/ Tools (Engines)

12.3.1.1. Unity

12.3.1.2. Unreal

12.3.1.3. CryEngine

12.3.1.4. Revit

12.3.1.5. Others (Mizuchi, Cinema 4D, etc.)

12.3.2. Professional Services

12.4. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Deployment, 2017?2027

12.4.1. On-premise

12.4.2. Cloud-based

12.4.3. Hybrid

12.5. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Application, 2017?2027

12.5.1.1. Content Development

12.5.1.1.1. 3D Gaming

12.5.1.1.2. Real-time VR Content

12.5.1.1.3. Rendered & Interactive Video Production

12.5.1.2. Content Transformation

12.5.1.3. Visualization

12.6. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017?2027

12.6.1. Small and Medium Enterprises (SMEs)

12.6.2. Large enterprises

12.7. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by End-use, 2017?2027

12.7.1. Manufacturing & Automotive

12.7.2. Construction

12.7.3. Healthcare & Pharmaceutical

12.7.4. Retail and E-commerce

12.7.5. Aerospace & Defense

12.7.6. Media & Entertainment

12.7.6.1. Digital Avatar Production

12.7.6.2. Gaming

12.7.7. Others (Education, Travel & Tourism)

12.8. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017?2027

12.8.1. Germany

12.8.2. France

12.8.3. UK

12.8.4. Rest of Europe

13. Asia Pacific Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast

13.1. Key Findings

13.2. Impact Analysis of Drivers and Restraints

13.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Solution, 2017?2027

13.3.1. Platform/ Tools (Engines)

13.3.1.1. Unity

13.3.1.2. Unreal

13.3.1.3. CryEngine

13.3.1.4. Revit

13.3.1.5. Others (Mizuchi, Cinema 4D, etc.)

13.3.2. Professional Services

13.4. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Deployment, 2017?2027

13.4.1. On-premise

13.4.2. Cloud-based

13.4.3. Hybrid

13.5. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Application, 2017?2027

13.5.1.1. Content Development

13.5.1.1.1. 3D Gaming

13.5.1.1.2. Real-time VR Content

13.5.1.1.3. Rendered & Interactive Video Production

13.5.1.2. Content Transformation

13.5.1.3. Visualization

13.6. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017?2027

13.6.1. Small and Medium Enterprises (SMEs)

13.6.2. Large enterprises

13.7. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by End-use, 2017?2027

13.7.1. Manufacturing & Automotive

13.7.2. Construction

13.7.3. Healthcare & Pharmaceutical

13.7.4. Retail and E-commerce

13.7.5. Aerospace & Defense

13.7.6. Media & Entertainment

13.7.6.1. Digital Avatar Production

13.7.6.2. Gaming

13.7.7. Others (Education, Travel & Tourism)

13.8. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017?2027

13.8.1. China

13.8.2. Japan

13.8.3. India

13.8.4. Australia

13.8.5. Korea

13.8.6. Rest of Asia Pacific

14. Middle East & Africa Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast

14.1. Key Findings

14.2. Impact Analysis of Drivers and Restraints

14.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Solution, 2017?2027

14.3.1. Platform/ Tools (Engines)

14.3.1.1. Unity

14.3.1.2. Unreal

14.3.1.3. CryEngine

14.3.1.4. Revit

14.3.1.5. Others (Mizuchi, Cinema 4D, etc.)

14.3.2. Professional Services

14.4. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Deployment, 2017?2027

14.4.1. On-premise

14.4.2. Cloud-based

14.4.3. Hybrid

14.5. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Application, 2017?2027

14.5.1.1. Content Development

14.5.1.1.1. 3D Gaming

14.5.1.1.2. Real-time VR Content

14.5.1.1.3. Rendered & Interactive Video Production

14.5.1.2. Content Transformation

14.5.1.3. Visualization

14.6. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017?2027

14.6.1. Small and Medium Enterprises (SMEs)

14.6.2. Large enterprises

14.7. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by End-use, 2017?2027

14.7.1. Manufacturing & Automotive

14.7.2. Construction

14.7.3. Healthcare & Pharmaceutical

14.7.4. Retail and E-commerce

14.7.5. Aerospace & Defense

14.7.6. Media & Entertainment

14.7.6.1. Digital Avatar Production

14.7.6.2. Gaming

14.7.7. Others (Education, Travel & Tourism)

14.8. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017?2027

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

15. South America Real-time (Graphics and Video) Rendering Solutions Market Analysis and Forecast

15.1. Key Findings

15.2. Impact Analysis of Drivers and Restraints

15.3. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Solution, 2017?2027

15.3.1. Platform/ Tools (Engines)

15.3.1.1. Unity

15.3.1.2. Unreal

15.3.1.3. CryEngine

15.3.1.4. Revit

15.3.1.5. Others (Mizuchi, Cinema 4D, etc.)

15.3.2. Professional Services

15.4. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Deployment, 2017?2027

15.4.1. On-premise

15.4.2. Cloud-based

15.4.3. Hybrid

15.5. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Application, 2017?2027

15.5.1.1. Content Development

15.5.1.1.1. 3D Gaming

15.5.1.1.2. Real-time VR Content

15.5.1.1.3. Rendered & Interactive Video Production

15.5.1.2. Content Transformation

15.5.1.3. Visualization

15.6. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Enterprise Size, 2017?2027

15.6.1. Small and Medium Enterprises (SMEs)

15.6.2. Large enterprises

15.7. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by End-use, 2017?2027

15.7.1. Manufacturing & Automotive

15.7.2. Construction

15.7.3. Healthcare & Pharmaceutical

15.7.4. Retail and E-commerce

15.7.5. Aerospace & Defense

15.7.6. Media & Entertainment

15.7.6.1. Digital Avatar Production

15.7.6.2. Gaming

15.7.7. Others (Education, Travel & Tourism)

15.8. Real-time (Graphics and Video) Rendering Solutions Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017?2027

15.8.1. Brazil

15.8.2. Rest of South America

16. Competition Landscape

16.1. Market Player – Competition Matrix

16.2. Market Revenue Share Analysis (%), by Company (2018)

16.3. Regional Presence (Intensity Map)

17. Company Profiles

17.1. Avid Technology, Inc.

17.1.1. Company Description

17.1.2. Geographical Presence

17.1.3. Product Portfolio

17.1.4. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

17.1.5. Strategic Overview

17.2. Autodesk, Inc.

17.2.1. Company Description

17.2.2. Geographical Presence

17.2.3. Product Portfolio

17.2.4. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

17.3. ACCA software

17.3.1. Company Description

17.3.2. Strategic Overview

17.4. Easy Render

17.4.1. Company Description

17.4.2. Strategic Overview

17.5. Epic Games, Inc.

17.5.1. Company Description

17.5.2. Strategic Overview

17.6. Idex Solutions Inc.

17.6.1. Company Description

17.6.2. Strategic Overview

17.7. Lumiscaphe

17.7.1. Company Description

17.7.2. Strategic Overview

17.8. Nanopixel

17.8.1. Company Description

17.8.2. Strategic Overview

17.9. Promotheus

17.9.1. Company Description

17.9.2. Strategic Overview

17.10. Silicon Studio Corp

17.10.1. Company Description

17.10.2. Strategic Overview

17.11. Umbra

17.11.1. Company Description

17.11.2. Strategic Overview

17.12. Urender

17.12.1. Company Description

17.12.2. Strategic Overview

18. Key Takeaway

List of Table

Table 1: List of Top Rendering Software Tools

Table 2: Company Name

Table 3: Mergers & Acquisitions, Expansions

Table 4: Product Launch, Development, Innovations

Table 5: Global Real-time (Graphics & Video) Rendering Solution Market Revenue (US$ Mn) Forecast, by Solutions, 2017?2027

Table 6: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Platform, 2017–2027

Table 7: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Deployment , 2017–2027

Table 8: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Enterprise Size, 2017–2027

Table 9: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 10: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Content Development, 2017–2027

Table 11: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Table 12: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Media & Entertainment, 2017–2027

Table 13: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Region, 2017?2027

Table 14: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Solution, 2017–2027

Table 15: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Platform, 2017–2027

Table 16: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Deployment , 2017–2027

Table 17: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Enterprise Size, 2017–2027

Table 18: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 19: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Content Development, 2017–2027

Table 20: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Table 21: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Media & Entertainment, 2017–2027

Table 22: North America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 23: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Solution, 2017–2027

Table 24: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Platform, 2017–2027

Table 25: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Deployment , 2017–2027

Table 26: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Enterprise Size, 2017–2027

Table 27: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 28: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Content Development, 2017–2027

Table 29: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Table 30: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Media & Entertainment, 2017–2027

Table 31: Europe Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 32: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Solution, 2017–2027

Table 33: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Platform, 2017–2027

Table 34: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Deployment , 2017–2027

Table 35: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Enterprise Size, 2017–2027

Table 36: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 37: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Content Development, 2017–2027

Table 38: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Table 39: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Media & Entertainment, 2017–2027

Table 40: Asia Pacific Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 41: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Solution, 2017–2027

Table 42: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Platform, 2017–2027

Table 43: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Deployment , 2017–2027

Table 44: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Enterprise Size, 2017–2027

Table 45: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 46: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Content Development, 2017–2027

Table 47: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Table 48: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Media & Entertainment, 2017–2027

Table 49: Middle East & Africa Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 50: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Solution, 2017–2027

Table 51: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Platform, 2017–2027

Table 53: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Enterprise Size, 2017–2027

Table 54: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Application, 2017–2027

Table 55: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Content Development, 2017–2027

Table 56: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by End-use, 2017–2027

Table 57: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Media & Entertainment, 2017–2027

Table 58: South America Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017–2027

Table 59: Product Portfolio

List of Figure

Figure 1: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, 2017–2027

Figure 2: Global Real-time (Graphics & Video) Rendering Solution Market CAGR Breakdown, 2019 – 2027

Figure 3: Real-time (Graphics & Video) Rendering Solutions Market: Points of Estimates

Figure 4: Technology/Product Roadmap

Figure 5: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, 2013 – 2018

Figure 6: Global Real-time (Graphics & Video) Rendering Solution Market Size (US$ Mn) Forecast, 2019 – 2027

Figure 7: Renderer Adoption Rate (%)

Figure 8: Global real-time rendering solutions Market Attractiveness Analysis, by Region

Figure 9: Global real-time rendering solutions Market Attractiveness Analysis, by Solution

Figure 10: Global real-time rendering solutions Market Attractiveness Analysis, by Deployment

Figure 11: Global real-time rendering solutions Market Attractiveness Analysis, by Enterprise Size

Figure 12: Global real-time rendering solutions Market Attractiveness Analysis, by Application

Figure 13: Global real-time rendering solutions Market Attractiveness Analysis, by End-use

Figure 14: Market Outlook

Figure 15: Global Real-time (Graphics & Video) Rendering Solution Market Share Analysis, by Solutions (2018)

Figure 16: Global Real-time (Graphics & Video) Rendering Solution Market Share Analysis, by Solutions (2027)

Figure 17: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2018

Figure 18: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2027

Figure 19: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2018

Figure 20: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2027

Figure 21: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2018

Figure 22: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2027

Figure 23: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2018

Figure 24: Global Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2027

Figure 25: Global Real-time (Graphics & Video) Rendering Solution Market Share Analysis, by Region (2018)

Figure 26: Global Real-time (Graphics & Video) Rendering Solution Market Share Analysis, by Region (2027)

Figure 27: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Solutions, 2018

Figure 28: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Component, 2027

Figure 29: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2018

Figure 30: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2027

Figure 31: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2018

Figure 32: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2027

Figure 33: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2018

Figure 34: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2027

Figure 35: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2018

Figure 36: North America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2027

Figure 37: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Solutions, 2018

Figure 38: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Component, 2027

Figure 39: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2018

Figure 40: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2027

Figure 41: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2018

Figure 42: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2027

Figure 43: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2018

Figure 44: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2027

Figure 45: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2018

Figure 46: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2027

Figure 47: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2018

Figure 48: Europe Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2027

Figure 49: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Solutions, 2018

Figure 50: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Component, 2027

Figure 51: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2018

Figure 52: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2027

Figure 53: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2018

Figure 54: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2027

Figure 55: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2018

Figure 56: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2027

Figure 57: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2018

Figure 58: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2027

Figure 59: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2018

Figure 60: Asia Pacific Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2027

Figure 61: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Solutions, 2018

Figure 62: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Component, 2027

Figure 63: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2018

Figure 64: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2027

Figure 65: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2018

Figure 66: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2027

Figure 67: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2018

Figure 68: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2027

Figure 69: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2018

Figure 70: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2027

Figure 71: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2018

Figure 72: Middle East & Africa Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2027

Figure 73: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2018

Figure 74: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Deployment, 2027

Figure 75: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2018

Figure 76: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Enterprise Size, 2027

Figure 77: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2018

Figure 78: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Application, 2027

Figure 79: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2018

Figure 80: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by End-use, 2027

Figure 81: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2018

Figure 82: South America Real-time (Graphics & Video) Rendering Solutions Value Share Analysis, by Country/Sub-region, 2027

Figure 83: Global real-time (graphics & video) rendering solutions Market Share Analysis, by Company (2018)

Figure 84: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure 85: Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018