Reports

Reports

In thermoelectric energy generation environments, the advent of a newer thermoelectric material for thermal products is a breakthrough to capture residual energy. This energy is usually lost during the regular process of the conversion of waste heat into electricity. Based on common semiconductor telluride, the new material is environmentally-stable, and is expected to capture 15 to 20 percent of waste heat into electricity. This strengthens the correlation between thermoelectric materials and the thermoelectric effect. Based on the merits exhibited, the new material is gauged to have a 2.2 thermoelectric figure of merit (ZT), the highest among thermoelectric materials available so far. Meanwhile, under laws of thermoelectricity, the higher ZT of a material connotes higher efficiency for converting heat into electricity.

Such developments point at a positive outlook for the uptake of thermoelectric-based HVAC cooling systems in industrial and commercial environments. For instance, HVAC cooling systems based on the Seebeck effect that create voltage from temperature difference are increasingly being installed. Such moves are aimed to comply with governmental guidelines for energy-efficient processes and to reduce wastage of energy.

Exponential growth of the IT & telecommunications sector has indirectly led to a spurt in the demand for thermal products. HVAC cooling systems that use thermal products find wide use for cooling servers and computers. This serves to boost the thermal market, indirectly. Expansion of the food and beverage sector in developing economies such as India has indirectly led to a spurt in demand within the thermal market. Strong macro-economic indicators, reforms, and liberalized foreign direct investment have massively expanded the scope of individual operations for the production of food and beverages. Food production, packaging, shipping, and distribution are some energy-hungry operations in the food and beverage sector. Such operations heavily depend upon HVAC systems to maintain optimum indoor temperatures on shop floors.

While thermoelectric systems are mostly used in cooling devices, these systems find use in the heating devices of HVAC systems. This further expands the scope of demand for thermal products, translating into growth for the thermal market.

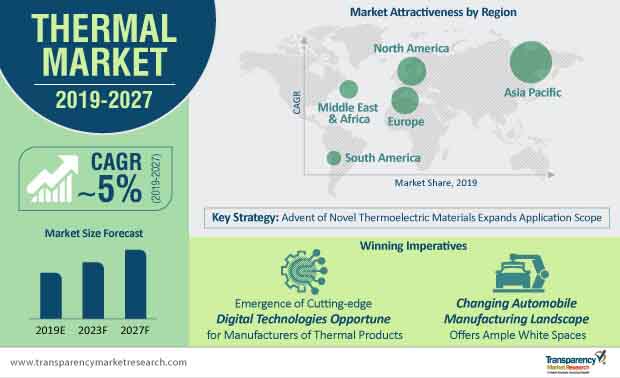

Finding applications in high economic value end-use industries, thermal products and the associated thermal market are poised for significant growth. This aroused interest of Transparency Market Research to release a market intelligence publication of the thermal market. Following extensive research and employing standard analytical tools, TMR forecasts the global thermal market to rise at a ~5% CAGR during the forecast period of 2019 to 2027.

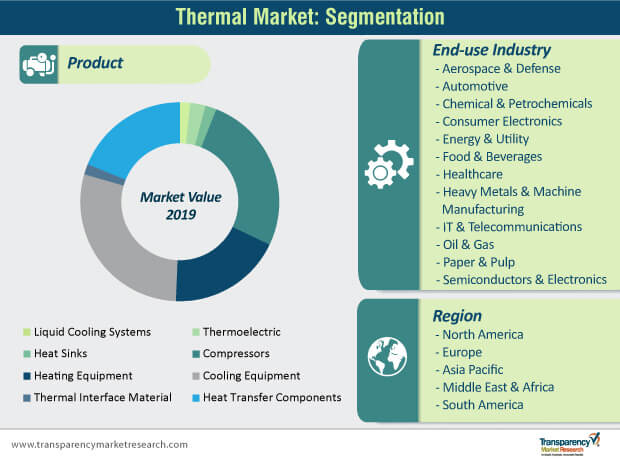

Among the key product types, the liquid cooling system segment is poised to display significant growth in the thermal market over the forecast period. The growth of this segment mainly stems to serve the demand of the IT & telecommunication sector, which is booming with digitalization in almost every walk of life. Serving this, liquid cooling systems are predicted to register a leading CAGR among other products in the thermal market during the forecast period.

On the other hand, the cooling equipment product segment holds a leading share in the thermal market, which is predicted to continue over the forecast period. This is because of the vast demand for cooling equipment from several end-use industries of high economic significance, including oil & gas, food & beverages, and chemicals & petroleum.

By end-use industry, the heavy metals and manufacturing industry holds a lion’s share in the thermal market, and is predicted to maintain its share over the forecast period.

Nonetheless, the IT & telecommunications sector is predicted to emerge as a significant end-use industry in the thermal market. Vast expansion of the IT sector to support mammoth volumes of data generated from commercial, industrial, and domestic sectors has led to a stir in the demand for core and support equipment. IT systems of large organizations with multiple servers require 24x7 uptime to serve employees working from multiple locations. This requires reliable cooling equipment to minimize the downtime of these IT systems. Cooling equipment plays a key role here, which, in turn, stimulates the growth of the thermal market.

In a moving vehicles, a large amount of heat is generated in the engine every time the spark plug ignites fuel in each cylinder to propel the vehicle. A cooling system plays a crucial role here to control these high temperatures so as to maintain a comfortable interior temperature for the passengers.

Changing consumer expectations from automobiles has led to a sea of change in the processes in the entire automotive ecosystem. Autonomous vehicles, biometric access for vehicles, and parameters of increased safety have led to requirements of several other energy-driven equipment and processes. This includes an array of thermal products such as heat sinks and heating equipment for the two-way transfer of heat. Such assemblies are examples of the Seebeck-Peltier effect for the transfer of heat and potential difference, and vice-versa.

The ceaseless adoption of consumer electronics is also creating demand for thermal products and equipment. Vast technological innovations and advancements in the manufacture of consumer electronics have led to newer assembly and manufacturing environments for these products.

The reshaping of the telecom sector over the past few years and adoption of cutting-edge technologies such as cloud computing and 5G technology have influenced the demand for thermal products to a great extent, in turn, fueling the growth of the market. The scope of development of new thermal technologies serves to provide lucrative opportunities for players in the thermal market. To leverage this, extensive R&D to develop equipment for various ambient temperatures is what savvy players are banking on for growth.

From a competitive standpoint, the thermal market features a fragmented vendor landscape, including established and emerging players. Nonetheless, leading players having a long presence in the market hold ~one-third share of the overall thermal market. Keen players vying to consolidate their position are focused on R&D. These companies are striving to develop next-generation thermal products to be compatible with the manufacturing assembly lines of advanced automobile companies.

The development of novel thermal products to cut energy costs is also the focus of keen players in the thermal market. For example, DCX The Liquid Cooling Company is focused on saving the energy consumption of industrial systems by almost 50%, and cutting the CAPEX and OPEX costs of running IT and telecom infrastructures.

Acquisitions and collaborations are also some growth strategies that players in the thermal market have resorted to. In a recent industry development, SPX Corporation – an Illinois-based company, completed the acquisition of Sabik Marine and Obstruction lighting business.

Increasing Use of Thermal Products in Food and Beverages a Key Market Driver

Development of Energy-efficient Systems Latest Trend Being Adopted by Key Market Players

Sluggish Growth of Markets in Europe and North America a Major Challenge

Global Thermal Market: Competition Landscape

Global Thermal Market: Key Developments

Manufacturers operating in the global thermal market, such as Blue Star Limited, Advanced Cooling Technologies, Inc., and ASSMANN WSW Components GmbH, are strengthening their market position by improving product quality and expanding their businesses. Certain key developments in the global thermal market are as follows:

The ‘Competition Landscape’ section has been included in the report to provide readers with a dashboard view and company market share analysis of key players operating in the global thermal market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Thermal Market

4. Market Overview

4.1. Introduction

4.2. Market Dynamics

4.2.1. Drivers

4.2.2. Restraints

4.2.3. Opportunities

4.3. Key Trends Analysis

4.4. Global Thermal Market Analysis and Forecast, 2017–2027

4.4.1. Market Revenue Projection (US$ Mn)

4.4.2. Market Volume Projection (Million Units)

4.5. Porter’s Five Forces Analysis - Global Thermal Market

4.6. Market Outlook

5. Thermal Market Analysis and Forecast, By Product

5.1. Overview & Definitions

5.2. Global Thermal Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

5.2.1. Liquid Cooling Systems

5.2.1.1. Liquid Heat Exchanger Systems

5.2.1.2. Compressor-based Systems (Recirculating Chillers)

5.2.2. Thermoelectric

5.2.3. Heat Sinks

5.2.4. Compressors

5.2.5. Heating Equipment

5.2.5.1. Furnaces

5.2.5.2. Heaters

5.2.5.3. Boilers

5.2.6. Cooling Equipment

5.2.6.1. VRF

5.2.6.2. Ducted Split/Packaged Units

5.2.6.3. Split Units

5.2.6.4. Others

5.2.7. Thermal Interface Materials (TIMs)

5.2.8. Heat Transfer Component

5.2.8.1. Heat Pumps

5.2.8.2. Fans

5.2.8.3. Heat Pipes & Plates

5.3. Product Comparison Matrix

5.4. Global Thermal Market Attractiveness, by Product

6. Global Thermal Market Analysis and Forecast, by End-use Industry

6.1. Overview & Definitions

6.2. Global Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

6.2.1. Aerospace & Defense

6.2.2. Automotive

6.2.3. Chemicals & Petrochemicals

6.2.4. Consumer Electronics

6.2.5. Energy & Utilities

6.2.6. Food & Beverages

6.2.7. Healthcare

6.2.8. Heavy Metals & Machine Manufacturing

6.2.9. IT & Telecommunications

6.2.10. Oil & Gas

6.2.11. Paper & Pulp

6.2.12. Semiconductors & Electronics

6.2.13. Others

6.3. End-use Industry Comparison Matrix

6.4. Global Thermal Market Attractiveness, by End-use Industry

7. Global Thermal Market Analysis and Forecast, by Region

7.1. Key Findings

7.2. Global Thermal Market Size (US$ Mn and Million Units) Forecast, by Region, 2017–2027

7.2.1. North America

7.2.2. Europe

7.2.3. Asia Pacific

7.2.4. Middle East & Africa

7.2.5. South America

7.3. Global Thermal Market Attractiveness, by Region

8. North America Thermal Market Analysis and Forecast

8.1. Key Findings

8.2. North America Thermal Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

8.2.1. Liquid Cooling Systems

8.2.1.1. Liquid Heat Exchanger Systems

8.2.1.2. Compressors-based Systems (Recirculating Chillers)

8.2.2. Thermoelectric

8.2.3. Heat Sinks

8.2.4. Compressors

8.2.5. Heating Equipment

8.2.5.1. Furnaces

8.2.5.2. Heaters

8.2.5.3. Boilers

8.2.6. Cooling Equipment

8.2.6.1. VRF

8.2.6.2. Ducted Split/Packaged Units

8.2.6.3. Split Units

8.2.6.4. Others

8.2.7. Thermal Interface Materials (TIMs)

8.2.8. Heat Transfer Component

8.2.8.1. Heat Pumps

8.2.8.2. Fans

8.2.8.3. Heat Pipes & Plates

8.3. North America Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

8.3.1. Aerospace & Defense

8.3.2. Automotive

8.3.3. Chemicals & Petrochemicals

8.3.4. Consumer Electronics

8.3.5. Energy & Utilities

8.3.6. Food & Beverages

8.3.7. Healthcare

8.3.8. Heavy Metals & Machine Manufacturing

8.3.9. IT & Telecommunications

8.3.10. Oil & Gas

8.3.11. Paper & Pulp

8.3.12. Semiconductors & Electronics

8.3.13. Others

8.4. North America Thermal Market Size (US$ Mn and Million Units) Forecast, by Country, 2017–2027

8.4.1. U.S.

8.4.2. Canada

8.4.3. Rest of North America

8.5. North America Thermal Market Attractiveness Analysis

8.5.1. By Product

8.5.2. By End-use Industry

8.5.3. By Country/Sub-region

9. Europe Thermal Market Analysis and Forecast

9.1. Key Findings

9.2. Europe Thermal Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

9.2.1. Liquid Cooling Systems

9.2.1.1. Liquid Heat Exchanger Systems

9.2.1.2. Compressors-based Systems (Recirculating Chillers)

9.2.2. Thermoelectric

9.2.3. Heat Sinks

9.2.4. Compressors

9.2.5. Heating Equipment

9.2.5.1. Furnaces

9.2.5.2. Heaters

9.2.5.3. Boilers

9.2.6. Cooling Equipment

9.2.6.1. VRF

9.2.6.2. Ducted Split/Packaged Units

9.2.6.3. Split Units

9.2.6.4. Others

9.2.7. Thermal Interface Materials (TIMs)

9.2.8. Heat Transfer Component

9.2.8.1. Heat Pumps

9.2.8.2. Fans

9.2.8.3. Heat Pipes & Plates

9.3. Europe Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

9.3.1. Aerospace & Defense

9.3.2. Automotive

9.3.3. Chemicals & Petrochemicals

9.3.4. Consumer Electronics

9.3.5. Energy & Utilities

9.3.6. Food & Beverages

9.3.7. Healthcare

9.3.8. Heavy Metals & Machine Manufacturing

9.3.9. IT & Telecommunications

9.3.10. Oil & Gas

9.3.11. Paper & Pulp

9.3.12. Semiconductors & Electronics

9.3.13. Others

9.4. Europe Thermal Market Size (US$ Mn and Million Units) Forecast, by Country, 2017–2027

9.4.1. Germany

9.4.2. U.K.

9.4.3. France

9.4.4. Rest of Europe

9.5. Europe Thermal Market Attractiveness Analysis

9.5.1. By Product

9.5.2. By End-use Industry

9.5.3. By Country/Sub-region

10. Asia Pacific Thermal Market Analysis and Forecast

10.1. Key Findings

10.2. Asia Pacific Thermal Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

10.2.1. Liquid Cooling Systems

10.2.1.1. Liquid Heat Exchanger Systems

10.2.1.2. Compressors-based Systems (Recirculating Chillers)

10.2.2. Thermoelectric

10.2.3. Heat Sinks

10.2.4. Compressors

10.2.5. Heating Equipment

10.2.5.1. Furnaces

10.2.5.2. Heaters

10.2.5.3. Boilers

10.2.6. Cooling Equipment

10.2.6.1. VRF

10.2.6.2. Ducted Split/Packaged Units

10.2.6.3. Split Units

10.2.6.4. Others

10.2.7. Thermal Interface Materials (TIMs)

10.2.8. Heat Transfer Component

10.2.8.1. Heat Pumps

10.2.8.2. Fans

10.2.8.3. Heat Pipes & Plates

10.3. Asia Pacific Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

10.3.1. Aerospace & Defense

10.3.2. Automotive

10.3.3. Chemicals & Petrochemicals

10.3.4. Consumer Electronics

10.3.5. Energy & Utilities

10.3.6. Food & Beverages

10.3.7. Healthcare

10.3.8. Heavy Metals & Machine Manufacturing

10.3.9. IT & Telecommunications

10.3.10. Oil & Gas

10.3.11. Paper & Pulp

10.3.12. Semiconductors & Electronics

10.3.13. Others

10.4. Asia Pacific Thermal Market Size (US$ Mn and Million Units) Forecast, by Country, 2017–2027

10.4.1. China

10.4.2. India

10.4.3. Japan

10.4.4. Australia

10.4.5. Rest of Asia Pacific

10.5. Asia Pacific Thermal Market Attractiveness Analysis

10.5.1. By Product

10.5.2. By End-use Industry

10.5.3. By Country/Sub-region

11. Middle East & Africa Thermal Market Analysis and Forecast

11.1. Key Findings

11.2. Middle East & Africa Thermal Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

11.2.1. Liquid Cooling Systems

11.2.1.1. Liquid Heat Exchanger Systems

11.2.1.2. Compressors-based Systems (Recirculating Chillers)

11.2.2. Thermoelectric

11.2.3. Heat Sinks

11.2.4. Compressors

11.2.5. Heating Equipment

11.2.5.1. Furnaces

11.2.5.2. Heaters

11.2.5.3. Boilers

11.2.6. Cooling Equipment

11.2.6.1. VRF

11.2.6.2. Ducted Split/Packaged Units

11.2.6.3. Split Units

11.2.6.4. Others

11.2.7. Thermal Interface Materials (TIMs)

11.2.8. Heat Transfer Component

11.2.8.1. Heat Pumps

11.2.8.2. Fans

11.2.8.3. Heat Pipes & Plates

11.3. Middle East & Africa Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

11.3.1. Aerospace & Defense

11.3.2. Automotive

11.3.3. Chemicals & Petrochemicals

11.3.4. Consumer Electronics

11.3.5. Energy & Utilities

11.3.6. Food & Beverages

11.3.7. Healthcare

11.3.8. Heavy Metals & Machine Manufacturing

11.3.9. IT & Telecommunications

11.3.10. Oil & Gas

11.3.11. Paper & Pulp

11.3.12. Semiconductors & Electronics

11.3.13. Others

11.4. Middle East & Africa Thermal Market Size (US$ Mn and Million Units) Forecast, by Country, 2017–2027

11.4.1. GCC

11.4.2. South Africa

11.4.3. Rest of Middle East & Africa

11.5. Middle East & Africa Thermal Market Attractiveness Analysis

11.5.1. By Product

11.5.2. By End-use Industry

11.5.3. By Country/Sub-region

12. South America Thermal Market Analysis and Forecast

12.1. Key Findings

12.2. South America Thermal Market Size (US$ Mn and Million Units) Forecast, by Product, 2017–2027

12.2.1. Liquid Cooling Systems

12.2.1.1. Liquid Heat Exchanger Systems

12.2.1.2. Compressors-based Systems (Recirculating Chillers)

12.2.2. Thermoelectric

12.2.3. Heat Sinks

12.2.4. Compressors

12.2.5. Heating Equipment

12.2.5.1. Furnaces

12.2.5.2. Heaters

12.2.5.3. Boilers

12.2.6. Cooling Equipment

12.2.6.1. VRF

12.2.6.2. Ducted Split/Packaged Units

12.2.6.3. Split Units

12.2.6.4. Others

12.2.7. Thermal Interface Materials (TIMs)

12.2.8. Heat Transfer Component

12.2.8.1. Heat Pumps

12.2.8.2. Fans

12.2.8.3. Heat Pipes & Plates

12.3. South America Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

12.3.1. Aerospace & Defense

12.3.2. Automotive

12.3.3. Chemicals & Petrochemicals

12.3.4. Consumer Electronics

12.3.5. Energy & Utilities

12.3.6. Food & Beverages

12.3.7. Healthcare

12.3.8. Heavy Metals & Machine Manufacturing

12.3.9. IT & Telecommunications

12.3.10. Oil & Gas

12.3.11. Paper & Pulp

12.3.12. Semiconductors & Electronics

12.3.13. Others

12.4. South America Thermal Market Size (US$ Mn and Million Units) Forecast, by Country, 2017–2027

12.4.1. Brazil

12.4.2. Rest of South America

12.5. South America Thermal Market Attractiveness Analysis

12.5.1. By Product

12.5.2. By End-use Industry

12.5.3. By Country/Sub-region

13. Competition Landscape

13.1. Global Thermal Market Share Analysis, by Company (2018)

13.2. Company Profiles (Details – Basic Overview, Recent Developments, Geographical Presence, Revenue, SWOT Analysis, and Strategy)

13.2.1. Advanced Cooling Technologies

13.2.1.1. Basic Overview

13.2.1.2. Recent Developments

13.2.1.3. Geographical Presence

13.2.1.4. Revenue

13.2.1.5. SWOT Analysis

13.2.1.6. Strategy

13.2.2. AHI Carrier

13.2.2.1. Basic Overview

13.2.2.2. Recent Developments

13.2.2.3. Geographical Presence

13.2.2.4. Revenue

13.2.2.5. SWOT Analysis

13.2.2.6. Strategy

13.2.3. AranerLytron

13.2.3.1. Basic Overview

13.2.3.2. Recent Developments

13.2.3.3. Geographical Presence

13.2.3.4. Revenue

13.2.3.5. SWOT Analysis

13.2.3.6. Strategy

13.2.4. Asetek

13.2.4.1. Basic Overview

13.2.4.2. Recent Developments

13.2.4.3. Geographical Presence

13.2.4.4. Revenue

13.2.4.5. SWOT Analysis

13.2.4.6. Strategy

13.2.5. ASSMANN WSW Components GmbH

13.2.5.1. Basic Overview

13.2.5.2. Recent Developments

13.2.5.3. Geographical Presence

13.2.5.4. Revenue

13.2.5.5. SWOT Analysis

13.2.5.6. Strategy

13.2.6. Bluestar Limited

13.2.6.1. Basic Overview

13.2.6.2. Recent Developments

13.2.6.3. Geographical Presence

13.2.6.4. Revenue

13.2.6.5. SWOT Analysis

13.2.6.6. Strategy

13.2.7. CTS CORPORATION

13.2.7.1. Basic Overview

13.2.7.2. Recent Developments

13.2.7.3. Geographical Presence

13.2.7.4. Revenue

13.2.7.5. SWOT Analysis

13.2.7.6. Strategy

13.2.8. DCX Sp. z.o.o.

13.2.8.1. Basic Overview

13.2.8.2. Recent Developments

13.2.8.3. Geographical Presence

13.2.8.4. Revenue

13.2.8.5. SWOT Analysis

13.2.8.6. Strategy

13.2.9. DK THERMAL METAL CIRCUIT TECHNOLOGY

13.2.9.1. Basic Overview

13.2.9.2. Recent Developments

13.2.9.3. Geographical Presence

13.2.9.4. Revenue

13.2.9.5. SWOT Analysis

13.2.9.6. Strategy

13.2.10. Ferrotec Corporation

13.2.10.1. Basic Overview

13.2.10.2. Recent Developments

13.2.10.3. Geographical Presence

13.2.10.4. Revenue

13.2.10.5. SWOT Analysis

13.2.10.6. Strategy

13.2.11. Henkel AG & Co. KGaA

13.2.11.1. Basic Overview

13.2.11.2. Recent Developments

13.2.11.3. Geographical Presence

13.2.11.4. Revenue

13.2.11.5. SWOT Analysis

13.2.11.6. Strategy

13.2.12. II-VI Incorporated

13.2.12.1. Basic Overview

13.2.12.2. Recent Developments

13.2.12.3. Geographical Presence

13.2.12.4. Revenue

13.2.12.5. SWOT Analysis

13.2.12.6. Strategy

13.2.13. International Thermal Systems

13.2.13.1. Basic Overview

13.2.13.2. Recent Developments

13.2.13.3. Geographical Presence

13.2.13.4. Revenue

13.2.13.5. SWOT Analysis

13.2.13.6. Strategy

13.2.14. JULABO GmbH

13.2.14.1. Basic Overview

13.2.14.2. Recent Developments

13.2.14.3. Geographical Presence

13.2.14.4. Revenue

13.2.14.5. SWOT Analysis

13.2.14.6. Strategy

13.2.15. Keith Company

13.2.15.1. Basic Overview

13.2.15.2. Recent Developments

13.2.15.3. Geographical Presence

13.2.15.4. Revenue

13.2.15.5. SWOT Analysis

13.2.15.6. Strategy

13.2.16. Kelk

13.2.16.1. Basic Overview

13.2.16.2. Recent Developments

13.2.16.3. Geographical Presence

13.2.16.4. Revenue

13.2.16.5. SWOT Analysis

13.2.16.6. Strategy

13.2.17. Komatsu Ltd.

13.2.17.1. Basic Overview

13.2.17.2. Recent Developments

13.2.17.3. Geographical Presence

13.2.17.4. Revenue

13.2.17.5. SWOT Analysis

13.2.17.6. Strategy

13.2.18. Laird Thermal

13.2.18.1. Basic Overview

13.2.18.2. Recent Developments

13.2.18.3. Geographical Presence

13.2.18.4. Revenue

13.2.18.5. SWOT Analysis

13.2.18.6. Strategy

13.2.19. Lytron

13.2.19.1. Basic Overview

13.2.19.2. Recent Developments

13.2.19.3. Geographical Presence

13.2.19.4. Revenue

13.2.19.5. SWOT Analysis

13.2.19.6. Strategy

13.2.20. Opticool Technologies

13.2.20.1. Basic Overview

13.2.20.2. Recent Developments

13.2.20.3. Geographical Presence

13.2.20.4. Revenue

13.2.20.5. SWOT Analysis

13.2.20.6. Strategy

13.2.21. Polyscience

13.2.21.1. Basic Overview

13.2.21.2. Recent Developments

13.2.21.3. Geographical Presence

13.2.21.4. Revenue

13.2.21.5. SWOT Analysis

13.2.21.6. Strategy

13.2.22. Radian Thermal Products

13.2.22.1. Basic Overview

13.2.22.2. Recent Developments

13.2.22.3. Geographical Presence

13.2.22.4. Revenue

13.2.22.5. SWOT Analysis

13.2.22.6. Strategy

13.2.23. SMC Corporation

13.2.23.1. Basic Overview

13.2.23.2. Recent Developments

13.2.23.3. Geographical Presence

13.2.23.4. Revenue

13.2.23.5. SWOT Analysis

13.2.23.6. Strategy

13.2.24. Subros Limited

13.2.24.1. Basic Overview

13.2.24.2. Recent Developments

13.2.24.3. Geographical Presence

13.2.24.4. Revenue

13.2.24.5. SWOT Analysis

13.2.24.6. Strategy

13.2.25. Thermal Care, Inc.

13.2.25.1. Basic Overview

13.2.25.2. Recent Developments

13.2.25.3. Geographical Presence

13.2.25.4. Revenue

13.2.25.5. SWOT Analysis

13.2.25.6. Strategy

13.2.26. THERMAL ENGINEERING SYSTEMS

13.2.26.1. Basic Overview

13.2.26.2. Recent Developments

13.2.26.3. Geographical Presence

13.2.26.4. Revenue

13.2.26.5. SWOT Analysis

13.2.26.6. Strategy

13.2.27. Thermo Fisher Scientific

13.2.27.1. Basic Overview

13.2.27.2. Recent Developments

13.2.27.3. Geographical Presence

13.2.27.4. Revenue

13.2.27.5. SWOT Analysis

13.2.27.6. Strategy

13.2.28. Weil-McLain

13.2.28.1. Basic Overview

13.2.28.2. Recent Developments

13.2.28.3. Geographical Presence

13.2.28.4. Revenue

13.2.28.5. SWOT Analysis

13.2.28.6. Strategy

14. Key Takeaway0073

List of Tables

Table 01: Global Thermal Market Revenue (US$ Mn) Forecast, by Product, 2017–2027

Table 02: Global Thermal Market Volume (Thousand Units) Forecast, by Product, 2017–2027

Table 03: Global Thermal Market Revenue (US$ Mn) Forecast, by Product, by Liquid Cooling Systems, 2017–2027

Table 04: Global Thermal Market Volume (Thousand Units) Forecast, by Product, by Liquid Cooling Systems, 2017–2027

Table 05: Global Thermal Market Revenue (US$ Mn) Forecast, by Product, by Heating Equipment, 2017–2027

Table 06: Global Thermal Market Volume (Thousand units) Forecast, by Product, by Heating Equipment, 2017–2027

Table 07: Global Thermal Market Revenue (US$ Mn) Forecast, by Product, by Cooling Equipment, 2017–2027

Table 08: Global Thermal Market Size (Thousand Units) Forecast, by Product, by Cooling Equipment, 2017–2027

Table 09: Global Thermal Market Revenue (US$ Mn) Forecast, by Product, by Heat Transfer Component, 2017–2027

Table 10: Global Thermal Market Volume (Thousand Units) Forecast, by Product, by Heat Transfer Component, 2017–2027

Table 11: Global Thermal Market Revenue (US$ Mn) Forecast, by End-use Industry, 2017–2027

Table 12: Global Thermal Market Revenue Forecast, by Region, 2017–2027 (US$ Mn)

Table 13: Global Thermal Market Volume Forecast, by Region, 2017–2027 (Thousand Units)

Table 14: North America Thermal Market Revenue Forecast, by Product, 2017–2027 (US$ Mn)

Table 15: North America Thermal Market Volume Forecast, by Product, 2017–2027 (Thousand Units)

Table 16: North America Thermal Market Size Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (US$ Mn)

Table 17: North America Thermal Market Volume Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (Thousand Units)

Table 18: North America Thermal Market Size Forecast, by Product, by Heating Equipment, 2017–2027 (US$ Mn)

Table 19: North America Thermal Market Volume Forecast, by Product, by Heating Equipment, 2017–2027 (Thousand Units)

Table 20: North America Thermal Market Size Forecast, by Product, by Cooling Equipment, 2017–2027 (US$ Mn)

Table 21: North America Thermal Market Volume Forecast, by Product, by Cooling Equipment, 2017–2027 (Thousand Units)

Table 22: North America Thermal Market Size Forecast, by Product, by Heat Transfer Component, 2017–2027 (US$ Mn)

Table 23: North America Thermal Market Volume Forecast, by Product, by Heat Transfer Component, 2017–2027 (Thousand Units)

Table 24: North America Thermal Market Revenue Forecast, by End-use Industry, 2017–2027 (US$ Mn)

Table 25: North America Thermal Market Revenue Forecast, by Country/Sub-region, 2017–2027 (US$ Mn)

Table 26: North America Thermal Market Volume Forecast, by Country/Sub-region, 2017–2027 (Thousand Units)

Table 27: Europe Thermal Market Revenue Forecast, by Product, 2017–2027 (US$ Mn)

Table 28: Europe Thermal Market Volume Forecast, by Product, 2017–2027 (Thousand Units)

Table 29: Europe Thermal Market Size Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (US$ Mn)

Table 30: Europe Thermal Market Volume Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (Thousand Units)

Table 31: Europe Thermal Market Size Forecast, by Product, by Heating Equipment, 2017–2027 (US$ Mn)

Table 32: Europe Thermal Market Volume Forecast, by Product, by Heating Equipment, 2017–2027 (Thousand Units)

Table 33: Europe Thermal Market Size Forecast, by Product, by Cooling Equipment, 2017–2027 (US$ Mn)

Table 34: Europe Thermal Market Volume Forecast, by Product, by Cooling Equipment, 2017–2027 (Thousand Units)

Table 35: Europe Thermal Market Size Forecast, by Product, by Heat Transfer Component, 2017–2027 (US$ Mn)

Table 36: Europe Thermal Market Volume Forecast, by Product, by Heat Transfer Component, 2017–2027 (Thousand Units)

Table 37: Europe Thermal Market Revenue Forecast, by End-use Industry, 2017–2027 (US$ Mn)

Table 38: Europe Thermal Market Revenue Forecast, by Country/Sub-region, 2017–2027 (US$ Mn)

Table 39: Europe Thermal Market Volume Forecast, by Country/Sub-region, 2017–2027 (Thousand Units)

Table 40: Asia Pacific Thermal Market Revenue Forecast, by Product, 2017–2027 (US$ Mn)

Table 41: Asia Pacific Thermal Market Volume Forecast, by Product, 2017–2027 (Thousand Units)

Table 42: Asia Pacific Thermal Market Size Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (US$ Mn)

Table 43: Asia Pacific Thermal Market Volume Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (Thousand Units)

Table 44: Asia Pacific Thermal Market Size Forecast, by Product, by Heating Equipment, 2017–2027 (US$ Mn)

Table 45: Asia Pacific Thermal Market Volume Forecast, by Product, by Heating Equipment, 2017–2027 (Thousand Units)

Table 46: Asia Pacific Thermal Market Size Forecast, by Product, by Cooling Equipment, 2017–2027 (US$ Mn)

Table 47: Asia Pacific Thermal Market Volume Forecast, by Product, by Cooling Equipment, 2017–2027 (Thousand Units)

Table 48: Asia Pacific Thermal Market Size Forecast, by Product, by Heat Transfer Component, 2017–2027 (US$ Mn)

Table 49: Asia Pacific Thermal Market Volume Forecast, by Product, by Heat Transfer Component, 2017–2027 (Thousand Units)

Table 50: Asia Pacific Thermal Market Revenue Forecast, by End-use Industry, 2017–2027 (US$ Mn)

Table 51: Asia Pacific Thermal Market Revenue Forecast, by Country/Sub-region, 2017–2027 (US$ Mn)

Table 52: Asia Pacific Thermal Market Volume Forecast, by Country/Sub-region, 2017–2027 (Thousand Units)

Table 53: Middle East & Africa Thermal Market Revenue Forecast, by Product, 2017–2027 (US$ Mn)

Table 54: Middle East & Africa Thermal Market Volume Forecast, by Product, 2017–2027 (Thousand Units)

Table 55: Middle East & Africa Thermal Market Size Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (US$ Mn)

Table 56: Middle East & Africa Thermal Market Volume Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (Thousand Units)

Table 57: Middle East & Africa Thermal Market Size Forecast, by Product, by Heating Equipment, 2017–2027 (US$ Mn)

Table 58: Middle East & Africa Thermal Market Volume Forecast, by Product, by Heating Equipment, 2017–2027 (Thousand Units)

Table 59: Middle East & Africa Thermal Market Size Forecast, by Product, by Cooling Equipment, 2017–2027 (US$ Mn)

Table 60: Middle East & Africa Thermal Market Volume Forecast, by Product, by Cooling Equipment, 2017–2027 (Thousand Units)

Table 61: Middle East & Africa Thermal Market Size Forecast, by Product, by Heat Transfer Component, 2017–2027 (US$ Mn)

Table 62: Middle East & Africa Thermal Market Volume Forecast, by Product, by Heat Transfer Component, 2017–2027 (Thousand Units)

Table 63: Middle East & Africa Thermal Market Revenue Forecast, by End-use Industry, 2017–2027 (US$ Mn)

Table 64: Middle East & Africa Thermal Market Revenue Forecast, by Country/Sub-region, 2017–2027 (US$ Mn)

Table 65: Middle East & Africa Thermal Market Volume Forecast, by Country/Sub-region, 2017–2027 (Thousand Units)

Table 66: South America Thermal Market Revenue Forecast, by Product, 2017–2027 (US$ Mn)

Table 67: South America Thermal Market Volume Forecast, by Product, 2017–2027 (Thousand Units)

Table 68: South America Thermal Market Size Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (US$ Mn)

Table 69: South America Thermal Market Volume Forecast, by Product, by Liquid Cooling Systems, 2017–2027 (Thousand Units)

Table 70: South America Thermal Market Size Forecast, by Product, by Heating Equipment, 2017–2027 (US$ Mn)

Table 71: South America Thermal Market Volume Forecast, by Product, by Heating Equipment, 2017–2027 (Thousand Units)

Table 72: South America Thermal Market Size Forecast, by Product, by Cooling Equipment, 2017–2027 (US$ Mn)

Table 73: South America Thermal Market Volume Forecast, by Product, by Cooling Equipment, 2017–2027 (Thousand Units)

Table 74: South America Thermal Market Size Forecast, by Product, by Heat Transfer Component, 2017–2027 (US$ Mn)

Table 75: South America Thermal Market Volume Forecast, by Product, by Heat Transfer Component, 2017–2027 (Thousand Units)

Table 76: South America Thermal Market Revenue Forecast, by End-use Industry, 2017–2027 (US$ Mn)

Table 77: South America Thermal Market Revenue Forecast, by Country/Sub-region, 2017–2027 (US$ Mn)

Table 78: South America Thermal Market Volume Forecast, by Country/Sub-region, 2017–2027 (Thousand Units)

List of Figures

Figure 01: North America Thermal Market CAGR

Figure 02: Europe Thermal Market CAGR

Figure 03: Asia Pacific Thermal Market CAGR

Figure 04: Middle East & Africa Thermal Market CAGR

Figure 05: South America Thermal Market CAGR

Figure 06: Global Thermal Market Revenue Projection, 2017–2027 (US$ Mn)

Figure 07: Global Thermal Market Volume Projection, 2017–2027 (Thousand Units)

Figure 08: Global Thermal Market, by Product (2019)

Figure 09: Global Thermal Market, by Region (2019)

Figure 10: Global Thermal Market, by End-use Industry (2019)

Figure 11: Global Thermal Market Value Share Analysis, by Product, 2019 and 2027

Figure 12: Global Thermal Market, by Product, Liquid Cooling Systems

Figure 13: Global Thermal Market, by Product, Thermoelectric

Figure 14: Global Thermal Market, by Product, Heat Sinks

Figure 15: Global Thermal Market, by Product, Compressors

Figure 16: Global Thermal Market, by Product, Heating Equipment

Figure 17: Global Thermal Market, by Product, Cooling Equipment

Figure 18: Global Thermal Market, by Product, Thermal Interface Materials

Figure 19: Global Thermal Market, by Product, Heat Transfer Component

Figure 20: Segment Growth Matrix, 2019–27 (%)

Figure 21: Segment Revenue Contribution, 2019–27 (%)

Figure 22: Segment Compounded Growth Matrix (CAGR %)

Figure 23: Global Thermal Market Attractiveness Analysis, by Product

Figure 24: Global Thermal Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 25: Global Thermal Market, by End-use Industry, Aerospace & Defense

Figure 26: Global Thermal Market, by End-use Industry, Automotive

Figure 27: Global Thermal Market, by End-use Industry, Chemicals & Petrochemicals

Figure 28: Global Thermal Market, by End-use Industry, Consumer Electronics

Figure 29: Global Thermal Market, by End-use Industry, Energy & Utilities

Figure 30: Global Thermal Market, by End-use Industry, Food & Beverages

Figure 31: Global Thermal Market, by End-use Industry, Healthcare

Figure 32: Global Thermal Market, by End-use Industry, Heavy Metals & Machine Manufacturing

Figure 33: Global Thermal Market, by End-use Industry, IT & Telecommunications

Figure 34: Global Thermal Market, by End-use Industry, Oil & Gas

Figure 35: Global Thermal Market, by End-use Industry, Paper & Pulp

Figure 36: Global Thermal Market, by End-use Industry, Semiconductor & Electronics

Figure 37: Global Thermal Market, by End-use Industry, Others

Figure 38: Segment Growth Matrix, 2019–27 (%)

Figure 39: Segment Revenue Contribution, 2019–27 (%)

Figure 40: Segment Compounded Growth Matrix (CAGR %)

Figure 41: Global Thermal Market Attractiveness Analysis, by End-use Industry

Figure 42: Global Thermal Market, by Region, North America

Figure 43: Global Thermal Market, by Region, Europe

Figure 44: Global Thermal Market, by Region, Asia Pacific

Figure 45: Global Thermal Market, by Region, Middle East & Africa

Figure 46: Global Thermal Market, by Region, South America

Figure 47: Global Thermal Market Attractiveness Analysis, by Region

Figure 48: North America Thermal Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 49: North America Thermal Market Volume (Thousand Units) Forecast, 2017–2027

Figure 50: North America Thermal Market Value Share Analysis, by Product, 2019 and 2027

Figure 51: North America Thermal Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 52: North America Thermal Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 53: North America Thermal Market Attractiveness Analysis, by Product

Figure 54: North America Thermal Market Attractiveness Analysis, by End-use Industry

Figure 55: North America Thermal Market Attractiveness Analysis, by Country/Sub-region

Figure 56: Europe Thermal Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 57: Europe Thermal Market Volume (Thousand Units) Forecast, 2017–2027

Figure 58: Europe Thermal Market Value Share Analysis, by Product, 2019 and 2027

Figure 59: Europe Thermal Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 60: Europe Thermal Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 61: Europe Thermal Market Attractiveness Analysis, by Product

Figure 62: Europe Thermal Market Attractiveness Analysis, by End-use Industry

Figure 63: Europe Thermal Market Attractiveness Analysis, by Country/Sub-region

Figure 64: Asia Pacific Thermal Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 65: Asia Pacific Thermal Market Volume (Thousand Units) Forecast, 2017–2027

Figure 66: Asia Pacific Thermal Market Value Share Analysis, by Product, 2019 and 2027

Figure 67: Asia Pacific Thermal Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 68: Asia Pacific Thermal Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 69: Asia Pacific Thermal Market Attractiveness Analysis, by Product

Figure 70: Asia Pacific Thermal Market Attractiveness Analysis, by End-use Industry

Figure 71: Asia Pacific Thermal Market Attractiveness Analysis, by Country/Sub-region

Figure 72: Middle East & Africa Thermal Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 73: Middle East & Africa Thermal Market Volume (Thousand Units) Forecast, 2017–2027

Figure 74: Middle East & Africa Thermal Market Value Share Analysis, by Product, 2019 and 2027

Figure 75: Middle East & Africa Thermal Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 76: Middle East & Africa Thermal Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 77: Middle East & Africa Thermal Market Attractiveness Analysis, by Product

Figure 78: Middle East & Africa Thermal Market Attractiveness Analysis, by End-use Industry

Figure 79: Middle East & Africa Thermal Market Attractiveness Analysis, by Country/Sub-region

Figure 80: South America Thermal Market Revenue (US$ Mn) Forecast, 2017–2027

Figure 81: South America Thermal Market Volume (Thousand Units) Forecast, 2017–2027

Figure 82: South America Thermal Market Value Share Analysis, by Product, 2019 and 2027

Figure 83: South America Thermal Market Value Share Analysis, by End-use Industry, 2019 and 2027

Figure 84: South America Thermal Market Value Share Analysis, by Country/Sub-region, 2019 and 2027

Figure 85: South America Thermal Market Attractiveness Analysis, by Product

Figure 86: South America Thermal Market Attractiveness Analysis, by End-use Industry

Figure 87: South America Thermal Market Attractiveness Analysis, by Country/Sub-region

Figure 88: Global Thermal Market Share Analysis, by Company (2018)