Reports

Reports

Soap Noodles Market: Snapshot

Aggressive sales promotions by large and small companies and the introduction of functional soaps have had a tremendous impact on the demand for soaps and soap noodles over the past few years. Considering the immense competition among players in a highly fragmented market, companies have been compelled to offering products with a wide range of features such as aromatherapy, moisturizing, anti-bacterial, medicated, and herbal soaps. As the demand for these products surges across the globe, the demand for soap noodles has also grown.

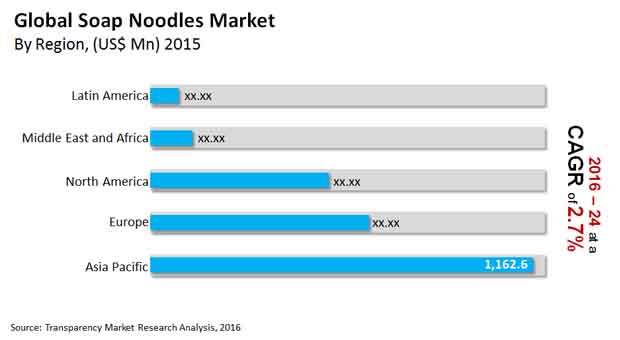

The revenue of the global soap noodles market stood at US$2.5 bn in 2015 and is forecast to reach US$3.2 bn by 2024, expanding at a modest CAGR of 2.7% from 2016 and 2024. The demand in terms of volume for soap noodles is projected to rise at a 2.1% CAGR during the same period.

Growing Consumer Preference for Vegetable Oil-based Soaps

Soap noodles are categorized into various types depending on the raw materials used such as vegetable oil and tallow. In 2015, vegetable oil-based soap noodles led the overall soap noodles market vis-à-vis tallow-based soap noodles. Different specifications of soap noodles are produced by adding various functional additives depending on their end-use application such as toilet soaps, laundry soaps, translucent soaps, high lather soaps, and medicated soaps. The abundant supply of palm oil and the rise in consumer preference regarding the usage of vegetable-based materials are the major factors estimated to drive the vegetable oil segment during the forecast period.

Tallow-based soap noodles also offer lucrative opportunities for players considering that tallow is presently the best alternative material for palm oil in the production of soap noodles.

Easy Availability of Raw Materials in Asia Pacific Attracting Soap Noodle Manufacturers

The global soap noodles market comprises five main regions: North America, Latin America, Europe, Asia Pacific, and the Middle East and Africa.

Asia Pacific emerged as the leading contributor in the global soap noodles market in 2015, followed by Europe and North America. Increasing awareness about hygiene among the population and an improvement in the standard of living in the developing economies of Asia Pacific such as China, India, and Japan are projected to boost the demand for soap bars. This, in turn, is estimated to propel the demand for soap noodles in APAC in the near future. Asia Pacific is also projected to be the fastest growing market over the course of the forecast period with end-user industries such as healthcare and personal care on the path of rapid expansion. China is one of the major consumers and suppliers of soap noodles. The majority of soap noodle manufacturers are based in Malaysia and Indonesia due to the easy availability of raw materials in these countries.

Europe is also a key market for soap noodles owing to the increasing production of soap bars with special functional additives.

Permata Hijau Group, KLK OLEO, 3F INDUSTRIES LTD., Deeno Group, Adimulia Sarimas Indonesia, IOI Oleochemicals, Wilmar International Ltd., John Drury, Musim Mas Holdings, and VVF Limited are some of the prominent names in the soap noodles market.

Soap Noodles Market to Gain Significant Momentum Owing to Increasing Popularity of Natural Soaps

The introduction of functional soaps and their rising popularity is expected to drive the growth of the global soap noodles market. Metropolitan populaces living in the metropolitan zones across arising economies have begun to procure huge piece of discretionary cashflow and are transforming into worthwhile focused on clients for various industry players. That being said, the sheer need of soaps to keep up cleanliness and significantly ease of the items has consistently had the soap market healthy.

With expanded extra cash, guardians and single men are contributing on skin health management consistently and merchants will do well to create 70:30 evaluations of soap noodles for these particular items. Forceful advertising and special exercises by significant organizations, improvement of inventive items like natural soap, saturating soaps, and fragrant healing soap, and expanded interest for hand fluid soaps are a portion of different components prepared to help to the success of the soap noodles market.

The worldwide soap noodles market is likely to attract higher revenues in the coming years and this is attributable to its expanding request in soap industry. The item is utilized in the creation of soaps for toilet and household soaps as a base material with expansion of mark aroma, shades, and different added substances in application businesses. Developing interest of the item in end-use ventures is required to move the interest over the conjecture time frame. The item is marked both Halal and Kosher confirmed because of its natural root, for example, RBD palm part oil, RBD palm oil, and coconut oil. Accordingly, it is required to expand the item interest before very long.

Considering the huge rivalry among major parts in a profoundly divided market, organizations have been constrained to offering items with a wide scope of highlights like fragrant healing, saturating, against bacterial, cured, and home grown soaps. With the rising popularity of these items across the globe, the interest for soap noodles has additionally developed.

1. Preface

1.1. Report Description

1.2. Research Scope

1.3. Assumptions

1.4. Market Segmentation

1.5. Research Methodology

2. Executive Summary

2.1. Global Soap Noodles Market, 2015 - 2024, (Kilo Tons) (US$ Mn)

2.2. Soap Noodles: Market Snapshot

3. Market Overview

3.1. Introduction

3.2. Value Chain Analysis

3.3. Market Drivers

3.3.1. Increase in hygiene and living standard of consumers with growing awareness for cleanliness is expected to driver the soap noodles market

3.3.2. Increase in promotion and marketing activities for bar soap which in turn will drive the soap noodles market

3.4. Opportunity

3.4.1. Development in soap bars such as herbal soap, aromatherapy soap , moisturizing soap, anti-bacterial soap, etc. has provide huge growth opportunity for soap bars which is expected to boost soap noodles market in the near future

3.5. Restraints

3.5.1. Increasing demand for hand liquid soaps, body washes and shower gels is expected to hamper growth of soap noodles in the long term

3.6. Porter’s Five Forces Analysis

3.6.1. Bargaining Power of Suppliers

3.6.2. Bargaining Power of Buyers

3.6.3. Threat of New Entrants

3.6.4. Threat of Substitutes

3.6.5. Degree of Competition

3.7. Soap Noodles: Market Attractiveness Analysis

3.7.1. Attractiveness Analysis: By Source type

3.7.2. Attractiveness Analysis: By Country

3.8. Soap Noodles Market: Company Market Share Analysis, 2015

4. Global Soap Noodles Market: Raw Material and Price Trend Analysis

4.1. Raw Material Analysis

4.2. Soap Noodles Price Trend, 2015-2024 (US$/Ton)

5. Soap Noodles Market – Source Segment Analysis

5.1. Global Soap Noodles Market form Vegetable Oil (Kilo tons) (US$ Mn), 2015–2024

5.2. Global Soap Noodles Market form Tallow (Kilo tons) (US$ Mn), 2015–2024

6. Soap Noodles Market - Regional Analysis

6.1. Global Soap Noodles Market: Regional Overview

6.2. North America Soap Noodles Market, 2015 and 2024

6.2.1. North America Soap Noodles Market Volume, Source Segment Analysis, 2015-2024 (Kilo Tons)

6.2.2. North America Soap Noodles Market Revenue, Source Segment Analysis, 2015-2024 (US$ Mn)

6.2.3. U.S. Soap Noodles Market Volume, Source Segment Analysis, 2015-2024 (Kilo Tons)

6.2.4. U.S. Soap Noodles Market Revenue, Source Segment Analysis, 2015-2024 (US$ Mn)

6.2.5. Rest of North America Soap Noodles Market Volume, Source Segment Analysis, 2015-2024 (Kilo Tons)

6.2.6. Rest of North America Soap Noodles Market Revenue, by Source Segment Analysis, 2015-2024 (US$ Mn)

6.3. Europe Soap Noodles Market, 2015 and 2024

6.3.1. Europe Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.2. Europe Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.3.3. Germany Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.4. Germany Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.3.5. UK Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.6. UK Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.3.7. Spain Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.8. Spain Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.3.9. France Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.10. France Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.3.11. Italy Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.12. Italy Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.3.13. Rest of Europe Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.3.14. Rest of Europe Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.4. Asia Pacific Soap Noodles Market, 2015 and 2024

6.4.1. Asia Pacific Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.4.2. Asia Pacific Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.4.3. China Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.4.4. China Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.4.5. Japan Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.4.6. Japan Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.4.7. ASEAN Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.4.8. ASEAN Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.4.9. Rest of Asia Pacific Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.4.10. Rest of Asia Pacific Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.5. Latin America Soap Noodles Market, 2015 and 2024

6.5.1. Latin America Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.5.2. Latin America Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.5.3. Brazil Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.5.4. Brazil Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.5.5. Rest of Latin America Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.5.6. Rest of Latin America Soap Noodles Market Revenue, by Source Segment, 2015-2024 (US$ Mn)

6.6. Middle East & Africa Soap Noodles Market, 2015 and 2024

6.6.1. Middle East & Africa Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.6.2. Middle East & Africa Soap Noodles Market Revenue, by Sources Segment, 2015-2024 (US$ Mn)

6.6.3. GCC Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.6.4. GCC Soap Noodles Market Revenue, by Sources Segment, 2015-2024 (US$ Mn)

6.6.5. South Africa Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.6.6. South Africa Soap Noodles Market Revenue, by Sources Segment, 2015-2024 (US$ Mn)

6.6.7. Rest of Middle East & Africa Soap Noodles Market Volume, by Source Segment, 2015-2024 (Kilo Tons)

6.6.8. Rest of Middle East & Africa Soap Noodles Market Revenue, by Sources Segment, 2015-2024 (US$ Mn)

7. Company Profiles

7.1. Deeno Group

Company Details

Business Overview

Business Strategy

7.2. IOI Oleochemicals

Company Details

Business Overview

Business Strategy

7.3. John Drury

Company Details

Business Overview

Business Strategy

7.4. KLK OLEO

Company Details

Business Overview

Business Strategy

7.5. Musim Mas Holdings.

Company Details

Business Overview

Business Strategy

7.6. Adimulia Sarimas Indonesia

Company Details

Business Overview

Business Strategy

7.7. Permata Hijau Group

Company Details

Business Overview

Business Strategy

7.8. VVF Limited

Company Details

Business Overview

Business Strategy

7.9. Wilmar International Ltd.

Company Details

Business Overview

Business Strategy

7.10. 3F INDUSTRIES LTD

Company Details

Business Overview

Business Strategy

7.11. Others

8. Primary Research - Key Findings

9. List of Customers

List of Tables

Table 1: Global Soap Noodles Market Snapshot

Table 2: Increase in promotion and marketing activities expected to drive the soap noodles market

Table 3: North America Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 4: North America Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 5: U.S. Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 6: U.S. Soap Noodles Revenue, by Source Segment (US$ Mn), 2015–2024

Table 7: Rest of North America Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 8: Rest of North America Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 9: Europe Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 10: Europe Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 11: Germany Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 12: Germany Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 13: U.K. Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 14: U.K. Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 15: Spain Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 16: Spain Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 17: France Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 18: France Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 19: Italy Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 20: Italy Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 21: Rest of Europe Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 22: Rest of Europe Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 23: Asia Pacific Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 24: Asia Pacific Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 25: China Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 26: China Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 27: Japan Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 28: Japan Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 29: ASEAN Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 30: ASEAN Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 31: Rest of Asia Pacific Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 32: Rest of Asia Pacific Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 33: Latin America Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 34: Latin America Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 35: Brazil Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 36: Brazil Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 37: Rest of Latin America Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 38: Rest of Latin America Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 39: Middle East & Africa Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 40: Middle East & Africa Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 41: GCC Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 42: GCC Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 43: South Africa Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 44: South Africa Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 45: Rest of Middle East & Africa Soap Noodles Market Volume, by Source Segment (Kilo Tons), 2015–2024

Table 46: Rest of Middle East & Africa Soap Noodles Market Revenue, by Source Segment (US$ Mn), 2015–2024

Table 47: List of Customers for Soap Noodles

List of Figures

Figure 1: Soap Noodles Market Segmentation

Figure 2: Global Soap Noodles Market (Kilo Tons) (US$ Mn), 2016–2024

Figure 3: Soap Noodles Market: Value Chain Analysis

Figure 4: Increase in promotion and marketing activities expected to drive the soap noodles market

Figure 5: Development in soap bars such as herbal soap, aromatherapy soap , moisturizing soap, anti-bacterial soap, etc. has provide huge growth opportunity for soap bars which is expected to boost soap noodles market in the near future

Figure 6: Increasing demand for liquid hand wash, body washes, and shower gels expected to hamper growth of soap noodles in the long term

Figure 7: Porter’s Five Forces Analysis

Figure 8: Global Soap Noodles Market Attractiveness, by Source, 2015

Figure 9: Global Soap Noodles Market Attractiveness, by Country, 2015

Figure 10: Global Soap Noodles Market Share, by Company, 2015

Figure 11: Soap Noodles Price Trend, 2015–2024 (US$/Ton)

Figure 12: Soap Noodles Market: Source Overview

Figure 13: Global Soap Noodles Market for Vegetable Oil (Kilo Tons) (US$ Mn), 2015–2024

Figure 14: Global Soap Noodles Market for Tallow (Kilo Tons) (US$ Mn), 2015–2024

Figure 15: Global Soap Noodles Market Regional Overview

Figure 16: North America Soap Noodles Market, by Region, 2015–2024

Figure 17: Europe Soap Noodles Market, by Region, 2015–2024

Figure 18: Asia Pacific Soap Noodles Market, by Region,2015–2024

Figure 19: Latin America Soap Noodles Market, by Region, 2015–2024

Figure 20: Middle East & Africa Soap Noodles Market, by Region, 2015–2024

Figure 21: Wilmar International Ltd Financial Details by Segment (2015)