Reports

Reports

Smart lights, sensors and detectors in the embedded infrastructure are no longer futuristic ideas. Companies in the smart camera system market are exploring opportunities in traffic surveillance to solve issues related to traffic management. As such, traffic surveillance comes under the government domain, which is anticipated to account for the second-highest revenue in the smart camera system market. Hence, manufacturers are experimenting with Big Data and IoT to make traffic management smarter.

One of the key areas to start with for smarter traffic management is to develop smart traffic lights. With increased government initiatives toward the development of smart cities, greater focus of governments toward leveraging big data and IoT is acting as an advantage for manufacturers in the market of smart camera system. Growing prevalence of connected devices like sensors and vehicle-mounted information systems are generating increased revenue for companies in the market of smart camera system.

Computer vision, signal processing, and machine leaning algorithms are steering innovations in intelligent video surveillance (IVS) applications. As such, the surveillance application segment of the smart camera system market is anticipated for exponential growth during the forecast period. Hence, companies are increasing research in hardware and algorithmic processes to introduce IVS in turnkey smart camera systems.

Companies in the smart camera system market are increasing research on multi-camera IVS. Due to advancements made in electronics, companies are able to offer smart camera systems at affordable prices to end users. These end users are increasingly benefitting, due to the advantages of multi-camera IVS to carry out data processing, storage, and integrate communication modules in the systems. Due to the availability of advanced software in multi camera IVS, companies are able to comply with stringent privacy laws laid down by government organizations.

The smart camera system market is largely fragmented since leading players account to only 35-45% of the total market share. This indicates that leading players are facing a tough competition from emerging and prominent players in the global market. On the other hand, companies in the market for smart camera systems are tapping opportunities to make smart homes truly intelligent.

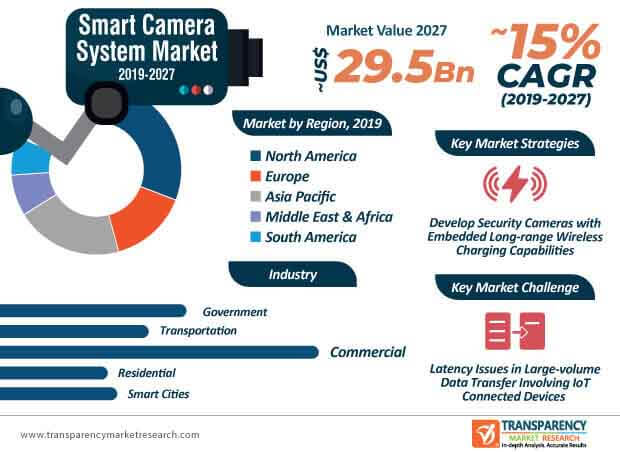

Moreover, proliferation of IoT in smart homes is one of the key drivers contributing to market growth. The application of IoT is expanding at a rapid pace, giving rise to the concept of connected devices such as smart appliances, smart camera systems, and home entertainment systems. However, latency issues and delays caused during the transfer of heavy data from connected devices to remote servers poses as a barrier for companies in the smart camera system market. Hence, companies are increasing R&D in edge analytics and fog computing to make smart systems more intelligent. Edge intelligence is helping users to bring data processing from cloud to the field of smart homes where sensors and devices are being deployed.

Apart from innovation in the hardware, advancements in software are transforming the smart camera system market. There is a growing need for real-time adaptation in smart camera systems that overcome limitations of traditional camera systems. Companies are innovating in full-feature solutions that offer precision in data and image capture. For instance, in March 2019, leading telecommunications equipment company Huawei won the Frost & Sullivan 2019 Global Video Surveillance Camera New Product Innovation Award for its innovation in software-defined camera system.

The software component segment is expected to grow aggressively in the smart camera system market. Thus, technology in smart camera systems is evolving from single-feature to full-feature solutions that reduce inaccuracies and offer precision in image capturing and data processing. Companies are increasing efforts to carry out joint data analysis between multiple cameras and the cloud to support practical applications. They are developing systems that are more self-aware, and can easily adapt to changing environmental conditions and gestures.

Analysts of Transparency Market Research opine that the smart camera system market is projected to expand at a CAGR of 14.9% during the forecast period. Companies are developing systems with embedded long-range wireless charging capabilities to overcome limitations of battery-powered devices.

IoT is playing a crucial role in powering smart homes. However, privacy concerns of information getting stored in distant servers of external users pose as a limitation in IoT-based applications. Hence, companies should innovate in edge intelligence for errorless storage of data. Moreover, they should increase availability of AI-driven software in smart traffic systems to help end users analyze footages better in order to manage traffic-related congestion.

Smart Camera System Market: Overview

Smart Camera System Market: Definition

North America Smart Camera System Market: Snapshot

Key Growth Drivers of the Smart Camera System Market

Key Challenges Faced by Smart Camera System Market Players

Smart Camera System Market

Smart Camera System Market - Company Snapshot

1. Preface

1.1. Market Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

2.1. Market Taxonomy - Segment Definitions

2.2. Research Methodology

2.2.1. List of Primary and Secondary Sources

2.3. Key Assumptions for Data Modelling

3. Executive Summary: Global Smart Camera System Market

4. Market Overview

4.1. Introduction

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Porter’s Five Forces Analysis

4.3.2. Ecosystem Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. Regulations and Policies

4.5. Overview on Software Defined Camera (SDC)

4.5.1. Architecture

4.5.2. Technology

4.5.3. Type

4.5.4. Application

4.6. Global Smart Camera System Market Analysis and Forecast, 2017 - 2027

4.6.1. Market Revenue Analysis (US$ Mn)

4.6.1.1. Historic Growth Trends, 2013 and 2018

4.6.1.2. Forecast Trends, 2019-2027

4.6.2. Market Volume/ Shipment Analysis (Million Units), 2017-2027

4.6.3. Price Trend Analysis

4.7. Market Opportunity Assessment – by Region (North America/ Europe/ Asia Pacific/ Middle East and Africa/ South America)

4.7.1. By Region/Country

4.7.2. By Component

4.7.3. By Application

4.7.4. By Industry

4.8. Market Outlook

5. Global Smart Camera System Market Analysis and Forecast, by Component

5.1. Overview and Definitions

5.2. Smart Camera System Market Size (US$ Mn and Million Units) Forecast, by Component, 2017 - 2027

5.2.1. Hardware

5.2.1.1. Camera

5.2.1.1.1. Box Camera

5.2.1.1.2. Dome Camera

5.2.1.1.3. Bullet Camera

5.2.1.2. Video Management System

5.2.2. Software

5.2.3. Services

5.2.3.1. Professional

5.2.3.2. Managed

6. Global Smart Camera System Market Analysis and Forecast, by Application

6.1. Overview

6.2. Smart Camera System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

6.2.1. License Plate Recognition

6.2.2. Surveillance

6.2.3. Advanced Driver Assistance Systems (ADAS)

6.2.4. Facial Recognition (Identity Access Management)

7. Global Smart Camera System Market Analysis and Forecast, by Industry

7.1. Overview

7.2. Smart Camera System Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

7.2.1. Government

7.2.1.1. Traffic Surveillance

7.2.1.2. Toll Road Cameras

7.2.2. Transportation

7.2.2.1. Railway stations

7.2.2.2. Airports

7.2.2.3. Marine

7.2.3. Commercial

7.2.3.1. Retail

7.2.3.2. BFSI

7.2.3.3. Education

7.2.3.4. OEM

7.2.3.5. Others (Healthcare and Hospitality)

7.2.4. Residential

7.2.5. Smart Cities

8. Global Smart Camera System Market Analysis and Forecast, by Region

8.1. Overview

8.2. Smart Camera System Market Size (US$ Mn) Forecast, by Region, 2016 -2026

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America Smart Camera System Market Analysis and Forecast

9.1. Key Findings

9.2. Impact Analysis of Drivers and Restraints

9.3. Smart Camera System Market Size (US$ Mn and Million Units) Forecast, by Component, 2017 - 2027

9.3.1. Hardware

9.3.1.1. Camera

9.3.1.1.1. Box Camera

9.3.1.1.2. Dome Camera

9.3.1.1.3. Bullet Camera

9.3.1.2. Video Management System

9.3.2. Software

9.3.3. Services

9.3.3.1. Professional

9.3.3.2. Managed

9.4. Smart Camera System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

9.4.1. License Plate Recognition

9.4.2. Surveillance

9.4.3. Advanced Driver Assistance Systems (ADAS)

9.4.4. Facial Recognition (Identity Access Management)

9.5. Smart Camera System Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

9.5.1. Government

9.5.1.1. Traffic Surveillance

9.5.1.2. Toll Road Cameras

9.5.2. Transportation

9.5.2.1. Railway stations

9.5.2.2. Airports

9.5.2.3. Marine

9.5.3. Commercial

9.5.3.1. Retail

9.5.3.2. BFSI

9.5.3.3. Education

9.5.3.4. OEM

9.5.3.5. Others (Healthcare and Hospitality)

9.5.4. Residential

9.5.5. Smart Cities

9.6. Smart Camera System Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

10. Europe Smart Camera System Market Analysis and Forecast

10.1. Key Findings

10.2. Impact Analysis of Drivers and Restraints

10.3. Smart Camera System Market Size (US$ Mn and Million Units) Forecast, by Component, 2017 - 2027

10.3.1. Hardware

10.3.1.1. Camera

10.3.1.1.1. Box Camera

10.3.1.1.2. Dome Camera

10.3.1.1.3. Bullet Camera

10.3.1.2. Video Management System

10.3.2. Software

10.3.3. Services

10.3.3.1. Professional

10.3.3.2. Managed

10.4. Smart Camera System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

10.4.1. License Plate Recognition

10.4.2. Surveillance

10.4.3. Advanced Driver Assistance Systems (ADAS)

10.4.4. Facial Recognition (Identity Access Management)

10.5. Smart Camera System Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

10.5.1. Government

10.5.1.1. Traffic Surveillance

10.5.1.2. Toll Road Cameras

10.5.2. Transportation

10.5.2.1. Railway stations

10.5.2.2. Airports

10.5.2.3. Marine

10.5.3. Commercial

10.5.3.1. Retail

10.5.3.2. BFSI

10.5.3.3. Education

10.5.3.4. OEM

10.5.3.5. Others (Healthcare and Hospitality)

10.5.4. Residential

10.5.5. Smart Cities

10.6. Smart Camera System Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

10.6.1. Germany

10.6.2. U.K.

10.6.3. France

10.6.4. Rest of Europe

11. Asia Pacific Smart Camera System Market Analysis and Forecast

11.1. Key Findings

11.2. Impact Analysis of Drivers and Restraints

11.3. Smart Camera System Market Size (US$ Mn and Million Units) Forecast, by Component, 2017 - 2027

11.3.1. Hardware

11.3.1.1. Camera

11.3.1.1.1. Box Camera

11.3.1.1.2. Dome Camera

11.3.1.1.3. Bullet Camera

11.3.1.2. Video Management System

11.3.2. Software

11.3.3. Services

11.3.3.1. Professional

11.3.3.2. Managed

11.4. Smart Camera System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

11.4.1. License Plate Recognition

11.4.2. Surveillance

11.4.3. Advanced Driver Assistance Systems (ADAS)

11.4.4. Facial Recognition (Identity Access Management)

11.5. Smart Camera System Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

11.5.1. Government

11.5.1.1. Traffic Surveillance

11.5.1.2. Toll Road Cameras

11.5.2. Transportation

11.5.2.1. Railway stations

11.5.2.2. Airports

11.5.2.3. Marine

11.5.3. Commercial

11.5.3.1. Retail

11.5.3.2. BFSI

11.5.3.3. Education

11.5.3.4. OEM

11.5.3.5. Others (Healthcare and Hospitality)

11.5.4. Residential

11.5.5. Smart Cities

11.6. Smart Camera System Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. Rest of Asia Pacific

12. Middle East & Africa (MEA) Smart Camera System Market Analysis and Forecast

12.1. Key Findings

12.2. Impact Analysis of Drivers and Restraints

12.3. Smart Camera System Market Size (US$ Mn and Million Units) Forecast, by Component, 2017 - 2027

12.3.1. Hardware

12.3.1.1. Camera

12.3.1.1.1. Box Camera

12.3.1.1.2. Dome Camera

12.3.1.1.3. Bullet Camera

12.3.1.2. Video Management System

12.3.2. Software

12.3.3. Services

12.3.3.1. Professional

12.3.3.2. Managed

12.4. Smart Camera System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

12.4.1. License Plate Recognition

12.4.2. Surveillance

12.4.3. Advanced Driver Assistance Systems (ADAS)

12.4.4. Facial Recognition (Identity Access Management)

12.5. Smart Camera System Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

12.5.1. Government

12.5.1.1. Traffic Surveillance

12.5.1.2. Toll Road Cameras

12.5.2. Transportation

12.5.2.1. Railway stations

12.5.2.2. Airports

12.5.2.3. Marine

12.5.3. Commercial

12.5.3.1. Retail

12.5.3.2. BFSI

12.5.3.3. Education

12.5.3.4. OEM

12.5.3.5. Others (Healthcare and Hospitality)

12.5.4. Residential

12.5.5. Smart Cities

12.6. Smart Camera System Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

12.6.1. GCC Countries

12.6.2. South Africa

12.6.3. Rest of MEA

13. South America Smart Camera System Market Analysis and Forecast

13.1. Key Findings

13.2. Impact Analysis of Drivers and Restraints

13.3. Smart Camera System Market Size (US$ Mn and Million Units) Forecast, by Component, 2017 - 2027

13.3.1. Hardware

13.3.1.1. Camera

13.3.1.1.1. Box Camera

13.3.1.1.2. Dome Camera

13.3.1.1.3. Bullet Camera

13.3.1.2. Video Management System

13.3.2. Software

13.3.3. Services

13.3.3.1. Professional

13.3.3.2. Managed

13.4. Smart Camera System Market Size (US$ Mn) Forecast, by Application, 2017 - 2027

13.4.1. License Plate Recognition

13.4.2. Surveillance

13.4.3. Advanced Driver Assistance Systems (ADAS)

13.4.4. Facial Recognition (Identity Access Management)

13.5. Smart Camera System Market Size (US$ Mn) Forecast, by Industry, 2017 - 2027

13.5.1. Government

13.5.1.1. Traffic Surveillance

13.5.1.2. Toll Road Cameras

13.5.2. Transportation

13.5.2.1. Railway stations

13.5.2.2. Airports

13.5.2.3. Marine

13.5.3. Commercial

13.5.3.1. Retail

13.5.3.2. BFSI

13.5.3.3. Education

13.5.3.4. OEM

13.5.3.5. Others (Healthcare and Hospitality)

13.5.4. Residential

13.5.5. Smart Cities

13.6. Smart Camera System Market Size (US$ Mn) Forecast, by Country/Sub-region, 2017 - 2027

13.6.1. Brazil

13.6.2. Rest of South America

14. Competition Landscape

14.1. Market Revenue Share Analysis (%), by Company (2018)

15. Company Profiles (Details – Business Overview, Geographical Presence, Revenue and Strategy)

15.1. ADT, Inc.

15.1.1. Business Overview

15.1.2. Geographical Presence

15.1.3. Revenue and Strategy

15.2. Axis Communications

15.2.1. Business Overview

15.2.2. Geographical Presence

15.2.3. Revenue and Strategy

15.3. Bosch Smart Systems, Inc.

15.3.1. Business Overview

15.3.2. Geographical Presence

15.3.3. Revenue and Strategy

15.4. Canon, Inc.

15.4.1. Business Overview

15.4.2. Geographical Presence

15.4.3. Revenue and Strategy

15.5. Dahua Technology Co., Ltd

15.5.1. Business Overview

15.5.2. Geographical Presence

15.5.3. Revenue and Strategy

15.6. Flir Systems, Inc.

15.6.1. Business Overview

15.6.2. Geographical Presence

15.6.3. Revenue and Strategy

15.7. Hikvision

15.7.1. Business Overview

15.7.2. Geographical Presence

15.7.3. Revenue and Strategy

15.8. Huawei Technologies Co. Ltd

15.8.1. Business Overview

15.8.2. Geographical Presence

15.8.3. Revenue and Strategy

15.9. Panasonic Corporation

15.9.1. Business Overview

15.9.2. Geographical Presence

15.9.3. Revenue and Strategy

15.10. Raptor Photonics Ltd.

15.10.1. Business Overview

15.10.2. Geographical Presence

15.10.3. Revenue and Strategy

15.11. Samsung Techwin Co., Ltd

15.11.1. Business Overview

15.11.2. Geographical Presence

15.11.3. Revenue and Strategy

15.12. SimpliSafe, Inc.

15.12.1. Business Overview

15.12.2. Geographical Presence

15.12.3. Revenue and Strategy

15.13. Sony Corporation

15.13.1. Business Overview

15.13.2. Geographical Presence

15.13.3. Revenue and Strategy

15.14. Vivint, Inc.

15.14.1. Business Overview

15.14.2. Geographical Presence

15.14.3. Revenue and Strategy

15.15. Watec Co., Ltd.

15.15.1. Business Overview

15.15.2. Geographical Presence

15.15.3. Revenue and Strategy

16. Key Takeaways

List of Tables

Table No.1 Global Smart Camera System Market Value (US$ Mn) and Forecast, by Component 2017 – 2027

Table No.2 Global Smart Camera System Market Value (Million Units) and Forecast, by Hardware 2017 – 2027

Table No.3 Global Smart Camera System Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table No.4 Global Smart Camera System Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table No.5 Global Smart Camera System Market Value (US$ Mn) and Forecast, by Region, 2017 – 2027

Table No.6 North America Smart Camera System Market Value (US$ Mn) and Forecast, by Component 2017 – 2027

Table No.7 North America Smart Camera System Market Value (Million Units) and Forecast, by Hardware 2017 – 2027

Table No.8 North America Smart Camera System Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table No.9 North America Smart Camera System Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table No.10 North America Smart Camera System Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table No.11 Europe Smart Camera System Market Value (US$ Mn) and Forecast, by Component 2017 – 2027

Table No.12 Europe Smart Camera System Market Value (Million Units) and Forecast, by Hardware 2017 – 2027

Table No.13 Europe Smart Camera System Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table No.14 Europe Smart Camera System Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table No.15 Europe Smart Camera System Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table No.16 Asia Pacific Smart Camera System Market Value (US$ Mn) and Forecast, by Component 2017 – 2027

Table No.17 Asia Pacific Smart Camera System Market Value (Million Units) and Forecast, by Hardware 2017 – 2027

Table No.18 Asia Pacific Smart Camera System Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table No.19 Asia Pacific Smart Camera System Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table No.20 Asia Pacific Smart Camera System Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table No.21 Middle East & Africa Smart Camera System Market Value (US$ Mn) and Forecast, by Component 2017 – 2027

Table No.22 Middle East & Africa Smart Camera System Market Value (Million Units) and Forecast, by Hardware 2017 – 2027

Table No.23 Middle East & Africa Smart Camera System Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table No.24 Middle East & Africa Smart Camera System Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table No.25 Middle East & Africa Smart Camera System Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table No.26 South America Smart Camera System Market Value (US$ Mn) and Forecast, by Component 2017 – 2027

Table No.27 South America Smart Camera System Market Value (Million Units) and Forecast, by Hardware 2017 – 2027

Table No.28 South America Smart Camera System Market Value (US$ Mn) and Forecast, by Application, 2017 – 2027

Table No.29 South America Smart Camera System Market Value (US$ Mn) and Forecast, by Industry, 2017 – 2027

Table No.30 South America Smart Camera System Market Value (US$ Mn) and Forecast, by Country, 2017 – 2027

Table No.31 SimpliSafe, Inc. Business Overview/Portfolio

Table No.32 Raptor Photonics Ltd Business Overview/Portfolio

Table No.33 Vivint, Inc. Business Overview/Portfolio

Table No.34 Watec Co., Ltd. Business Overview/Portfolio

List of Figure

Figure No.1 Global Smart Camera System Market Size (US$ Mn) Forecast, 2017 – 2027

Figure No.2 Global Smart Camera System Market Size (US$ Mn) and Forecast, 2013 - 2027

Figure No.3 Global Smart Camera System Market Opportunity Analysis, 2013 – 2027

Figure No.4 Global Smart Camera System Market Volume (Million Units) and Forecast, 2017 - 2027

Figure No.6 Global Smart Camera Market Opportunity Analysis, by Application (2019-2027)

Figure No.8 Global Smart Camera System Market Opportunity Analysis, by Region (2019-2027)

Figure No.5 Global Smart Camera System Market Opportunity Analysis, by Component (2019-2027)

Figure No.7 Global Smart Camera System Market Opportunity Analysis, by Industry (2019-2027)

Figure No.9 Global Smart Camera System Market Analysis and Forecast, by Component (2019)

Figure No.10 Global Smart Camera System Market Analysis and Forecast, by Component (2027)

Figure No.11 Global Smart Camera System Market Analysis and Forecast, by Application (2019)

Figure No.12 Global Smart Camera System Market Analysis and Forecast, by Application (2027)

Figure No.13 Global Smart Camera System Market Analysis and Forecast, by Industry (2019)

Figure No.14 Global Smart Camera System Market Analysis and Forecast, by Industry (2027)

Figure No.15 Global Smart Camera System Market Analysis and Forecast, by Region (2019)

Figure No.16 Global Smart Camera System Market Analysis and Forecast, by Region (2027)

Figure No.17 North America Smart Camera System Market Analysis and Forecast, by Component (2019)

Figure No.18 North America Smart Camera System Market Analysis and Forecast, by Component (2027)

Figure No.19 North America Smart Camera System Market Analysis and Forecast, by Application (2019)

Figure No.20 North America Smart Camera System Market Analysis and Forecast, by Application (2027)

Figure No.21 North America Smart Camera System Market Analysis and Forecast, by Industry (2019)

Figure No.22 North America Smart Camera System Market Analysis and Forecast, by Industry (2027)

Figure No.23 North America Smart Camera System Market Analysis and Forecast, by Country (2019)

Figure No.24 North America Smart Camera System Market Analysis and Forecast, by Country (2027)

Figure No.25 Europe Smart Camera System Market Analysis and Forecast, by Component (2019)

Figure No.26 Europe Smart Camera System Market Analysis and Forecast, by Component (2027)

Figure No.27 Europe Smart Camera System Market Analysis and Forecast, by Application (2019)

Figure No.28 Europe Smart Camera System Market Analysis and Forecast, by Application (2027)

Figure No.29 Europe Smart Camera System Market Analysis and Forecast, by Industry (2019)

Figure No. 30 Europe Smart Camera System Market Analysis and Forecast, by Industry (2027)

Figure No.31 Europe Smart Camera System Market Analysis and Forecast, by Country (2019)

Figure No.32 Europe Smart Camera System Market Analysis and Forecast, by Country (2027)

Figure No.33 Asia Pacific Smart Camera System Market Analysis and Forecast, by Component (2019)

Figure No.34 Asia Pacific Smart Camera System Market Analysis and Forecast, by Component (2027)

Figure No.35 Asia Pacific Smart Camera System Market Analysis and Forecast, by Application (2019)

Figure No.36 Asia Pacific Smart Camera System Market Analysis and Forecast, by Application (2027)

Figure No.37 Asia Pacific Smart Camera System Market Analysis and Forecast, by Industry (2019)

Figure No.38 Asia Pacific Smart Camera System Market Analysis and Forecast, by Industry (2027)

Figure No.39 Asia Pacific Smart Camera System Market Analysis and Forecast, by Country (2019)

Figure No.40 Asia Pacific Smart Camera System Market Analysis and Forecast, by Country (2027)

Figure No.41 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Component (2019)

Figure No.42 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Component (2027)

Figure No.43 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Application (2019)

Figure No.44 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Application (2027)

Figure No.45 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Industry (2019)

Figure No.46 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Industry (2027)

Figure No.47 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Country (2019)

Figure No.48 Middle East & Africa Smart Camera System Market Analysis and Forecast, by Country (2027)

Figure No.49 South America Smart Camera System Market Analysis and Forecast, by Component (2019)

Figure No.50 South America Smart Camera System Market Analysis and Forecast, by Component (2027)

Figure No.51 South America Smart Camera System Market Analysis and Forecast, by Application (2019)

Figure No.52 South America Smart Camera System Market Analysis and Forecast, by Application (2027)

Figure No.53 South America Smart Camera System Market Analysis and Forecast, by Industry (2019)

Figure No.54 South America Smart Camera System Market Analysis and Forecast, by Industry (2027)

Figure No.55 South America Smart Camera System Market Analysis and Forecast, by Country (2019)

Figure No.56 South America Smart Camera System Market Analysis and Forecast, by Country (2027)

Figure No. 57 Samsung Electronics Co., Ltd. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 58 Huawei Technologies Co., Ltd. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 59 FLIR Systems, Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 60 Hangzhou Hikvision Digital Technology Co., Ltd. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 61 Bosch Security Systems Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 62 Axis Communications AB Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 63 Zhejiang Dahua Technology Co.,Ltd. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 64 Canon Inc. Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018

Figure No. 65 Sony Corporation Revenue (US$ Mn) & Y-o-Y Growth (%), 2016–2018