Reports

Reports

Railway traction motors are gaining popularity because of its robust performance, and high durability. Owing to high performance of motors, they are used for propelling locomotives. Demand for railway traction motors is anticipated to surge on the back of progress in railroad technologies. Also, revised regulations pertaining to vehicular emissions in accord with restriction on transportation system is likely to boost the demand rate.

In North America, growth of the railway traction motor market is associated with ongoing electrification of the rail routes and high adoption rate of metros and monorails. On flip side, designing and manufacturing of rails is costly. Also, initial installment cost is very high.

This, in turn, may interfere with the growth of the railway traction market.

On the other hand, introduction of eco-friendly technologies, modernization of railcars, electrification of railways, and modernization of railcars are likely to strike a balance in expansion process of the market.

Further, launch of electric vehicles is anticipated to provide fresh growth avenue to North America railway traction motors market in coming years.

The market for railway traction motors in North America is currently expanding at a steady pace. With the rising population in North America and the growing influx of foreign nationals in the region, the demand for enhanced transportation is escalating. Owing to this factor, the railway industry in North America is undergoing significant transformation. This has had a positive impact on the market for associated equipment. The value of the North America railway traction motors market was pegged at US$10.05 bn in 2015 and, registering a 3.1% CAGR from 2016 to 2024, is estimated to amount to US$13.21 bn by 2024.

North American railroading is majorly privatized and the industry consists of both local and international companies. Considering the rise in initiatives for electrification, the modernization of railcars, and the introduction of environment-friendly technologies, the market provides lucrative opportunities for manufacturers of railway traction motors.

Railway traction motors find application in diesel locomotives, electrical multiple units (EMUs), electric locomotives, and diesel-electric locomotives, among others. The diesel-electric locomotive segment is likely to account for a share of over 45% by 2024, retaining its position as the leading application segment throughout the forecast period. The diesel locomotives segment followed suit, also accounting for a considerable share in the North America railway traction motors market.

Although the electric locomotive segment is anticipated to account for a small share in the overall market, it is projected to register a high CAGR of 5.0% from 2016 to 2024. This has been identified by TMR as one of the most attractive application segments in terms of revenue.

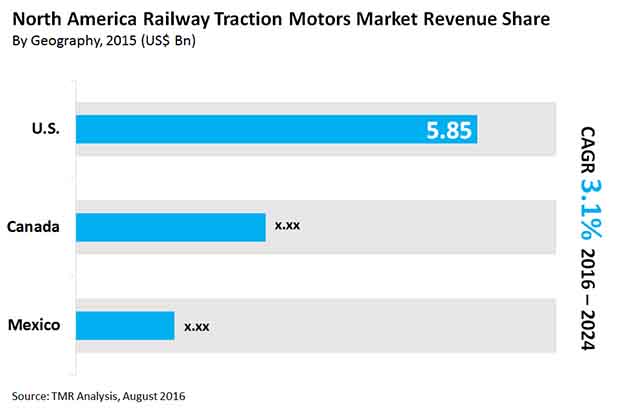

On the basis of country, the North America market railway traction motors market comprises the U.S., Canada, and Mexico. The U.S. accounted for the leading share in the railways traction motors market in North America and is estimated to retain its dominance throughout the forecast period. Registering a 3.5% CAGR during the forecast period, the market is projected to generate just under US$8 bn by 2024. The strong presence of a large number of manufacturers in the country and their consistent efforts in developing improved traction motors have significantly benefited the market here. Large-scale urbanization and rising initiatives to electrify passenger railways have also provided the railway traction motors market in the U.S. significant impetus.

Canada is also a major market for railway traction motors but is presently expanding at a pace slower than that of the U.S. Transparency Market Research attributes this mainly to the limited electrification of rail networks in the country. However, the rising passenger traffic using rail services in Canada has driven railroad companies to adopt improved railway equipment, including railway traction motors. This is anticipated to help the market in Canada maintain a steady pace through 2024.

Mexico accounts for the least share in the North America railway traction motors market. However, new investments are projected to give this market a much-needed boost in the coming years. The railway traction motors market in Mexico also benefits from the North American Free Trade Agreement (NAFTA), which allows the country access to trade and technology from the developed economies of the U.S. and Canada.

Major companies operating in the North America railway traction motors market include ABB Ltd. Alstom S.A., Siemens AG, Bombardier Inc., Hynundai Rotem Company, Mitsubishi Electric Corporation, Skoda Transportation A.S., Hitachi Ltd., Sulzer Ltd., and VEM Sac

Section 1 Preface

1.1 Report Scope & Market Segmentation

1.2 Research Highlights

Section 2 Research Methodology

Section 3 Executive Summary

Section 4 Market Overview

4.1 Product Overview

4.2 Market Introduction

4.3 Market Trends

4.4 Market Challenges

Section 5 Market Dynamics

5.1 Drivers and Restraints: Snapshot Analysis

5.2 Drivers

5.2.1 Growing urbanization coupled with increase in freight rail set to boost market growth

5.2.2 Innovation in railway technologies boosts demand for traction motors

5.2.3 Modernization of passenger railcars

5.2 Restraints

5.2.1 Exceptionally low replacement market

5.3 Opportunities

5.3.1 Urbanization coupled with environmental concerns

5.3.2 Technology driven initiatives to improve railroading

5.4 Value Chain Analysis

5.5 North America Railway Traction Motors Market Outlook

Section 6 North America Railway Traction Motors Market Analysis: By Motor Type

6.1 Direct Current (D.C.) Traction Motors

6.2 Alternating Current (A.C.) Traction Motors

6.3 Synchronous Alternating Current Traction Motors

6.4 North America Railway Traction Motors Market Attractiveness Analysis by Motor Type

Section 7 North America Railway Traction Motors Market Analysis: By Application

7.1 Diesel Locomotives

7.2 Electric Multiple Units (EMUs)

7.3 Electric Locomotives

7.4 Diesel-Electric Locomotives

7.5 North America Railway Traction Motors Market Attractiveness Analysis: By Application

Section 8 North America Railway Traction Motors Market Analysis: By Country

8.1 U.S. Railway Traction Motors Market Analysis

8.2 Canada Railway Traction Motors Market Analysis

8.3 Mexico Railway Traction Motors Market Analysis

Section 9 North America Railway Traction Motors Market Analysis: Competitive Landscape

9.1 North America Railway Traction Motors Market Share Analysis by Company (2015)

Section 10 Company Profiles

10.1 Mitsubishi Electric Corporation

10.1.1 Company Description & Details

10.1.2 Business Overview

10.1.3 SWOT Analysis

10.1.4 Geographical Revenue Share

10.1.5 Financial Overview

10.1.6 Strategic Overview

10.2 Sulzer Ltd.

10.2.1 Company Description & Details

10.2.2 Business Overview

10.2.3 SWOT Analysis

10.2.4 Geographical Revenue Share

10.2.5 Financial Overview

10.2.6 Strategic Overview

10.3 ABB Ltd.

10.3.1 Company Description & Details

10.3.2 Business Overview

10.3.3 SWOT Analysis

10.3.4 Geographical Revenue Share

10.3.5 Financial Overview

10.3.6 Strategic Overview

10.4 Alstom S.A.

10.4.1 Company Description & Details

10.4.2 Business Overview

10.4.3 SWOT Analysis

10.4.4 Geographical Revenue Share

10.4.5 Financial Overview

10.4.6 Strategic Overview

10.5 Bombardier Inc.

10.5.1 Company Description & Details

10.5.2 Business Overview

10.5.3 SWOT Analysis

10.5.4 Geographical Revenue Share

10.5.5 Financial Overview

10.5.6 Strategic Overview

10.6 Hyundai Rotem Company

10.6.1 Company Description & Details

10.6.2 Business Overview

10.6.3 SWOT Analysis

10.6.4 Geographical Revenue Share

10.6.5 Financial Overview

10.6.6 Strategic Overview

10.7 Siemens AG

10.7.1 Company Description & Details

10.7.2 Business Overview

10.7.3 SWOT Analysis

10.7.4 Geographical Revenue Share

10.7.5 Financial Overview

10.7.6 Strategic Overview

10.8 VEM Sachsenwerk GmbH

10.8.1 Company Description & Details

10.8.2 Business Overview

10.8.3 SWOT Analysis

10.8.4 Geographical Revenue Share

10.8.5 Financial Overview

10.8.6 Strategic Overview

10.9 Skoda Transportation a.s.

10.9.1 Company Description & Details

10.9.2 Business Overview

10.9.3 SWOT Analysis

10.9.4 Geographical Revenue Share

10.9.5 Financial Overview

10.9.6 Strategic Overview

10.10 Hitachi Ltd.

10.10.1 Company Description & Details

10.10.2 Business Overview

10.10.3 SWOT Analysis

10.10.4 Geographical Revenue Share

10.10.5 Financial Overview

10.10.6 Strategic Overview

List of Tables

Table 1 North America Market Size (USD Bn) Forecast, By Motor Type, 2015 – 2024

Table 2 North America Market Size (USD Bn) Forecast, By Application, 2015 – 2024

List of Figures

FIG. 1 Report Scope

FIG. 2 Market Size, Indicative (USD Bn)

FIG. 3 Market Size, By Country (USD Bn)

FIG. 4 Growth Trend, By Country, 2015 – 2024

FIG. 5 Market Share, By Country, 2015 & 2024

FIG. 6 U.S. Passenger Miles Travelled by Rail Type, 2009 – 2014

FIG. 7 Canada Passenger Miles Travelled by Rail Type, 2009 – 2014

FIG. 8 North America Value Chain Analysis

FIG. 9 Market Value Share By Motor Type (2015)

FIG. 10 Market Value Share By Application (2015)

FIG. 11 Market Value Share By Country (2015)

FIG. 12 North America Market Value Share Analysis By Motor Type, 2016 and 2024

FIG. 13 D.C. Traction Motors Market, 2015 – 2024, USD Bn

FIG. 14 A.C. Traction Motors Market, 2015 – 2024, USD Bn

FIG. 15 Synchronous A.C. Traction Motors Market, 2015 – 2024 , USD Bn

FIG. 16 Market Attractiveness Analysis (2015) By Motor Type

FIG. 17 North America Market Value Share Analysis By Application, 2016 and 2024

FIG. 18 Diesel Locomotives Market, 2015 – 2024, USD Bn

FIG. 19 Diesel – Electric Locomotives Market, 2015 – 2024, USD Bn

FIG. 20 Electrical Multiple Units (EMUs) Market, 2015 – 2024, USD Bn

FIG. 21 Electric Locomotives Market, 2015 – 2024, USD Bn

FIG. 22 Market Attractiveness Analysis (2015) By Application

FIG. 23 U.S. Railway Traction Motors Market, 2015 – 2024, USD Bn

FIG. 24 Canada Railway Traction Motors Market, 2015 – 2024, USD Bn

FIG. 25 Mexico Railway Traction Motors Market, 2015 – 2024, USD Bn

FIG. 26 North America Railway Traction Motors Market Share Analysis By Company (2015)