Reports

Reports

In order to meet the growing demand for safe, sterile, and secure packaging & delivery of ophthalmic products during the COVID-19 outbreak, manufacturers are adopting innovative packaging formats. Companies in the North America ophthalmic packaging market are making use of highly sophisticated and adaptable aseptic filling lines to address packaging challenges. The diversity in sterile ophthalmic medications is urging packaging companies to make use of aseptic filling lines, since eyes are unquestionably one of the most sensitive and vital organs that can be exposed to coronavirus pathogens.

Sterile packaging of ophthalmic products has become a top priority for manufacturers in the North America ophthalmic packaging market. Stakeholders are aiming for errorless packaging since even the slightest eye irritation increases the risk for coronavirus infection.

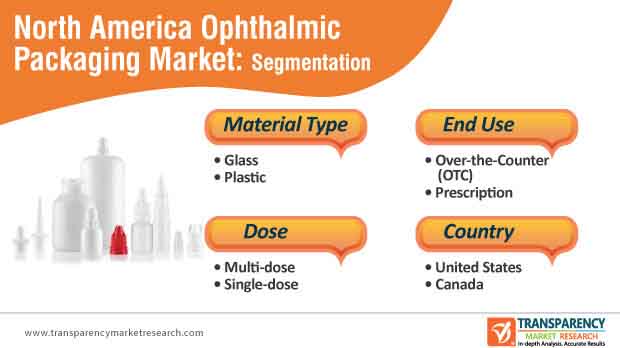

The North America ophthalmic packaging market is expected to advance at a modest CAGR of 5.6% during the assessment period. However, manufacturers need to comply with stringent regulations as suggested by the FDA’s Centre for Drug Evaluation and Research (CDER) for ophthalmic drug packaging components. These components demand the protection of the product’s quality, aid in administration, and maintenance of product sterility following initial seal breakage by the patient or consumer.

Manufacturers in the North America ophthalmic packaging market are following guidelines given by the WHO (World Health Organization) for good manufacturing practices (GMP). GMP is required for the appropriate system of quality assurance for the manufacturing of ophthalmic pharmaceutical products.

Apart from regulatory measures, stakeholders in the North America ophthalmic packaging market need to maintain the quality of product components. The quality of ophthalmic pharmaceutical product packaging is highly dependent on correct information and identification, protection against physical damage, and prevent any biological contamination. This is being achieved with the help of increasing their production for multi-dose plastic container closure systems (CCS). CCS is gaining prominence for liquid ophthalmic drug products.

Over seals and other tamper-evident features are being incorporated in ophthalmic pharmaceutical product packaging. LF of America - a provider of turnkey filling and packing solutions is gaining recognition for making advancements in the injection molding technology that increases the safety and flexibility of ophthalmic products.

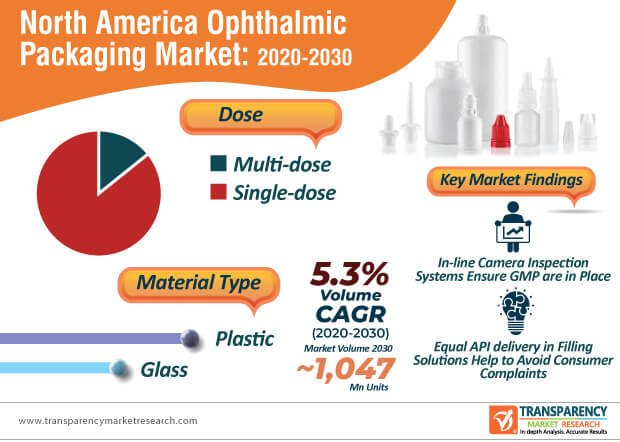

The North America ophthalmic packaging market is expected to reach ~1,047 million units by 2030. Innovations in contract ophthalmic filling are translating into value-grab opportunities for manufacturers. These innovations include R&D for equal API (active pharmaceutical ingredient) delivery in packing and filling solutions and 100% preservative free formula, which help to avoid consumer or patient complaints about burning sensation after use.

Since single-dose sterile single-dose containers are questionable for an environmental point of view, manufacturers in the North America ophthalmic packaging market are developing multi-dose preservative-free eye droppers. These solutions are gaining popularity in complex primary packaging applications with the addition of filters, clip closures, and foams in order to protect the residual solution in vials.

Customization of standard containers, dropper, and closures is helping companies in the North America ophthalmic packaging market gain a competitive edge over other market players. Impressive designs and sizes in plastic packaging are generating business opportunities for manufacturers. Manufacturers are boosting their output capacities in HDPE (High-density Polyethylene) materials and tamper-evident systems.

Increased flow control, drug compatibility, and barrier properties are being borne in mind before innovating in ophthalmic packaging solutions. Companies in the North America ophthalmic packaging market are adhering to ISO (International Organization for Standardization) guidelines for developing packaging that is manufactured in cleanrooms.

Analysts’ Viewpoint

Sterilization process qualifications in compliance with ISO standards have become necessary for manufacturers in the North America ophthalmic packaging market during the coronavirus outbreak. In-line camera vision inspection systems are being fitted in cleanrooms to ensure GMP is in place. However, manufacturers need to address filling challenges such as in small plastic containers that are light with a relatively high center of gravity and may lead to an easy fall during the filling process. Hence, companies should incorporate key filling system components including unscrambler and vacuum belts that keep an upright position of small containers during filling operations. Detailed product documentation has become necessary in ophthalmic pharmaceutical product packaging.

1. Executive Summary

1.1. Market Outlook

1.2. Market Analysis

1.3. Analysis and Recommendations

2. Market Overview

2.1. Market Coverage

2.2. Market Definition

3. Key Market Trends

3.1. Key Trends Impacting the Market

3.2. Product Innovation Trends

4. Key Success Factors

4.1. Product Adoption Analysis

4.2. Product USPs / Features

5. Ophthalmic Packaging Market Demand Analysis 2015–2019 and Forecast, 2020–2030

5.1. Historical Market Volume (Units) Analysis, 2015–2019

5.2. Current and Future Market Volume (Units) Projections, 2020–2030

5.3. Y-o-Y Growth Trend Analysis

6. Ophthalmic Packaging Market - Pricing Analysis

6.1. Regional Pricing Analysis

6.2. Pricing Break-up

6.3. Average Pricing Analysis Benchmark

7. Ophthalmic Packaging Market Demand (Value in US$ Mn) Analysis 2015–2019 and Forecast, 2020–2030

7.1. Historical Market Value (US$ Mn) Analysis, 2015–2019

7.2. Current and Future Market Value (US$ Mn) Projections, 2020–2030

7.2.1. Y-o-Y Growth Trend Analysis

7.2.2. Absolute $ Opportunity Analysis

8. Market Background

8.1. America Packaging Market Outlook

8.2. America Rigid Packaging Market Outlook

8.3. America Healthcare Industry Growth Outlook

8.4. America Pharmaceuticals Industry Growth Outlook

8.5. Key Industry Perspective: What Industry Leaders are saying?

8.6. Macro-Economic Factors

8.6.1. America GDP Growth Outlook

8.6.2. GDP Per Capita

8.6.3. Manufacturing Value Added

8.6.4. Industrial Production

8.7. Forecast Factors - Relevance & Impact

8.7.1. Global Industrial Sector Growth

8.7.2. Healthcare Industry Growth

8.7.3. Pharmaceuticals Industry Growth

8.7.4. Regional Manufacturing Value Added Growth

8.7.5. Segmental Revenue Growth of Key Players

8.7.6. Top Companies Historical Revenue Growth

8.8. Value Chain Analysis

8.8.1. Key Participants

8.8.1.1. Raw Material Suppliers

8.8.1.2. Ophthalmic Packaging Manufacturers

8.8.1.3. Distributors

8.8.2. Profitability Margin

8.9. Impact of COVID-19

8.9.1. Current Statistics and Probable Future Impact

8.9.2. Current Economic Projection – GDP/GVA and Probable Impact

8.9.3. Impact of COVID-19 on Ophthalmic Packaging Market

8.10. Market Dynamics

8.10.1. Drivers

8.10.2. Restraints

8.10.3. Opportunity Analysis

8.10.4. Trends

9. North America Ophthalmic Packaging Market Analysis 2015–2019 and Forecast 2020–2030

9.1. Introduction

9.2. Pricing Analysis

9.3. Historical Market Size (US$ Mn) and Volume (Units) Analysis, by Market Taxonomy, 2015–2019

9.4. Market Size (US$ Mn) and Volume (Units) Forecast, by Market Taxonomy, 2020–2030

9.4.1. By Dose

9.4.1.1. Multi-dose

9.4.1.2. Single-dose

9.4.2. By Material Type

9.4.2.1. Glass

9.4.2.2. Plastic

9.4.2.3. Others

9.4.3. By End Use

9.4.3.1. Over-the-counter (OTC)

9.4.3.2. Prescription

9.5. Market Attractiveness Analysis

9.5.1. By Dose

9.5.2. By Material Type

9.5.3. By End Use

10. Ophthalmic Packaging Market Country wise Analysis 2020 & 2030

10.1. USA Ophthalmic Packaging Market Analysis

10.1.1. Market Volume (Units) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

10.1.1.1. By Dose

10.1.1.2. By Material Type

10.1.1.3. By End Use

10.2. Canada Ophthalmic Packaging Market Analysis

10.2.1. Market Volume (Units) and Value (US$ Mn) Analysis and Forecast, by Market Taxonomy

10.2.1.1. By Dose

10.2.1.2. By Material Type

10.2.1.3. By End Use

11. Market Structure Analysis

11.1. Market Analysis, by Tier of Ophthalmic Packaging Companies

11.2. Market Share Analysis of Top Players

11.3. Market Presence Analysis

11.3.1. By Regional footprint of Players

11.3.2. Product foot print by Players

12. Competition Analysis

12.1. Competition Dashboard

12.2. Competition Benchmarking

12.3. Competition Deep Dive

(North America specific Manufacturers)

12.3.1. Berry Global Inc.

12.3.1.1. Overview

12.3.1.2. Financials

12.3.1.3. Strategy

12.3.1.4. Recent Developments

12.3.1.5. SWOT Analysis

12.3.2. Gerresheimer AG

12.3.2.1. Overview

12.3.2.2. Financials

12.3.2.3. Strategy

12.3.2.4. Recent Developments

12.3.2.5. SWOT Analysis

12.3.3. Nolato AB (publ)

12.3.3.1. Overview

12.3.3.2. Financials

12.3.3.3. Strategy

12.3.3.4. Recent Developments

12.3.3.5. SWOT Analysis

12.3.4. Aptar Pharma

12.3.4.1. Overview

12.3.4.2. Financials

12.3.4.3. Strategy

12.3.4.4. Recent Developments

12.3.4.5. SWOT Analysis

12.3.5. Amcor PLC

12.3.5.1. Overview

12.3.5.2. Financials

12.3.5.3. Strategy

12.3.5.4. Recent Developments

12.3.5.5. SWOT Analysis

12.3.6. West Pharmaceutical Service Inc.

12.3.6.1. Overview

12.3.6.2. Financials

12.3.6.3. Strategy

12.3.6.4. Recent Developments

12.3.6.5. SWOT Analysis

12.3.7. SCHOTT North America, Inc.

12.3.7.1. Overview

12.3.7.2. Financials

12.3.7.3. Strategy

12.3.7.4. Recent Developments

12.3.7.5. SWOT Analysis

12.3.8. LF of America Corp.

12.3.8.1. Overview

12.3.8.2. Financials

12.3.8.3. Strategy

12.3.8.4. Recent Developments

12.3.8.5. SWOT Analysis

12.3.9. Bormioli Pharma S.p.A.

12.3.9.1. Overview

12.3.9.2. Financials

12.3.9.3. Strategy

12.3.9.4. Recent Developments

12.3.9.5. SWOT Analysis

12.3.10. WG Pro-Manufacturing Inc.

12.3.10.1. Overview

12.3.10.2. Financials

12.3.10.3. Strategy

12.3.10.4. Recent Developments

12.3.10.5. SWOT Analysis

*The above list is indicative in nature and is subject to change during the course of research

13. Assumptions and Acronyms Used

14. Research Methodology

List of Tables

Table 01: North America Ophthalmic Packaging Market Value (US$ Mn) Analysis by Dose, 2015H-2030F

Table 02: North America Ophthalmic Packaging Market Volume (Mn Units) Analysis by Dose, 2015H-2030F

Table 03: North America Ophthalmic Packaging Market Value (US$ Mn) Analysis by Material Type, 2015H-2030F

Table 04: North America Ophthalmic Packaging Market Volume (Mn Units) Analysis by Material Type, 2015H-2030F

Table 05: North America Ophthalmic Packaging Market Value (US$ Mn) Analysis by End Use, 2015H-2030F

Table 06: North America Ophthalmic Packaging Market Volume (Mn Units) Analysis by End Use, 2015H-2030F

Table 07: U.S. Ophthalmic Packaging Market Value (US$ Mn) and Volume (Mn Units) Analysis, By Dose, Material Type, and End Use, 2015H-2030F

Table 08: Canada Ophthalmic Packaging Market Value (US$ Mn) and Volume (Mn Units) Analysis, By Dose, Material Type, and End Use, 2015H-2030F

List of Figures

Figure 01: North America Ophthalmic Packaging Market Value (US$ Mn) Analysis and Volume (Mn Units) Projection (2015H-2019A)

Figure 02: North America Ophthalmic Packaging Market Value (US$ Mn) Analysis and Volume (Mn Units) Projection (2020E-2030F)

Figure 03: North America Ophthalmic Packaging Market incremental $ opportunity (US$ Mn) (2020E-2030F)

Figure 04: North America Ophthalmic Packaging Market Share Analysis by Dose, 2020E & 2030F

Figure 05: North America Ophthalmic Packaging Market Y-o-Y Analysis by Dose, 2019A-2030F

Figure 06: North America Ophthalmic Packaging Market Attractiveness Analysis by Dose, 2020E-2030F

Figure 07: North America Ophthalmic Packaging Market Share Analysis by Material Type, 2020E & 2030F

Figure 08: North America Ophthalmic Packaging Market Y-o-Y Analysis by Material Type, 2019A-2030F

Figure 09: North America Ophthalmic Packaging Market Attractiveness Analysis by Material Type, 2020E-2030F

Figure 10: North America Ophthalmic Packaging Market Share Analysis by End Use, 2020E & 2030F

Figure 11: North America Ophthalmic Packaging Market Y-o-Y Analysis by End Use, 2019A-2030F

Figure 12: North America Ophthalmic Packaging Market Attractiveness Analysis by End Use, 2020E-2030F