Reports

Reports

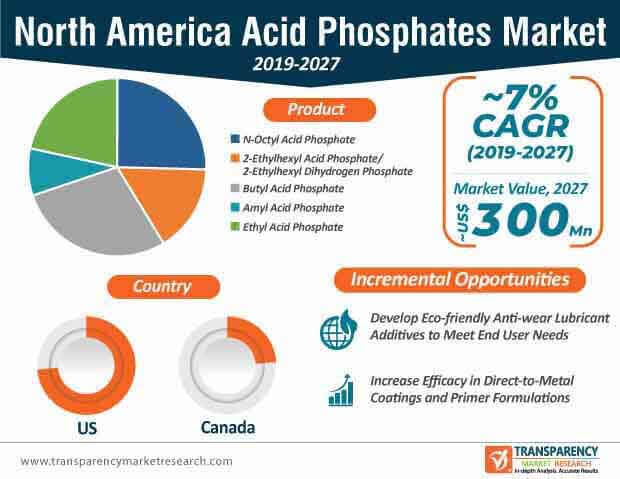

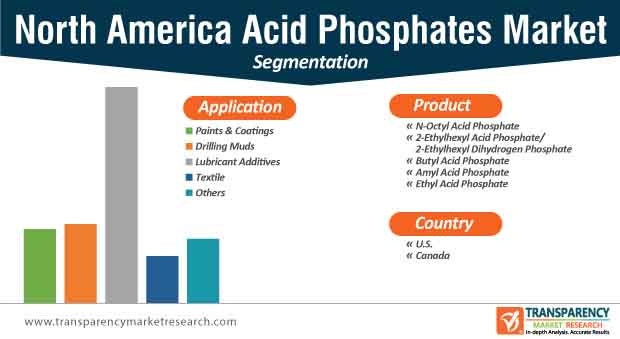

Eco-friendly anti-wear lubricant additives are gaining the attention of manufacturers in the North America acid phosphates market. Hence, manufacturers are increasing their production capacities to develop sustainable phosphate-esters with excellent de-foaming attributes. For instance, global leader in advanced materials and specialty chemicals Solvay, has a rich product portfolio in acid phosphates such as their product Lubrhophos® LF800 that offers anti-wear performance and staining inhibition in metalworking formulations. As such, the revenue of lubricant additive application segment is projected to experience an uptick and the North America acid phosphates market is expected to be valued at ~US$ 256 Mn by the end of 2027.

In order to bolster their credibility in the global landscape, manufacturers are developing non eco-toxic and readily biodegradable phosphate-esters with anti-corrosion attributes. These novel esters are pervasively replacing cetyl oleyl phosphate esters, owing to their outstanding emulsion stability and limited soap formation in hard water. Thus, good anti-wear and de-foaming performance have become the key focus points for companies in the market landscape.

Since the revenue of lubricant additives is anticipated for exponential growth, companies in the North America acid phosphates market are increasing their R&D capabilities to introduce new ways of sustainable chemistry. For instance, the specialist in performance additives for lubricants, Italmatch Chemicals, is increasing its research activities in specialty chemicals to develop sustainable lubricants. Manufacturers are prioritizing their investment in R&D capabilities that cover all aspects of organic and inorganic synthesis. They are focusing on performance testing of new as well as existing lubricant products that are suitable for final applications.

A global and flexible manufacturing footprint has become one of the key success factors for companies in the North America acid phosphates market. Apart from Europe and Asia Pacific, companies are increasing efforts to produce diversified batch chemistries at different plants in the U.S. This explains why the revenue in terms of application is higher in the U.S. as compared to Canada in the market landscape.

The North America acid phosphates market is expected to witness a robust growth of ~7% during the forecast period. Moreover, the paints & coatings application segment is expected to grow aggressively in the coming years. Hence, companies are tapping into value-grab opportunities in automotive applications.

The ever-evolving automotive industry has raised a demand for high-performance coatings for the surface protection of magnesium (Mg) alloys in automotive components. However, corrosion-related issues pose a challenge for manufacturers and the market. Hence, manufacturers in the North America acid phosphates market are innovating in non-chromate chemical conversion coatings such as phosphate and stannate coatings to achieve high levels of corrosion protection.

One of the widely used methods for pretreatment in automotive industries is zinc (Zn) phosphating, as this solution is acidic in nature, which helps to dissolve Mg parts on entering pretreatment baths. This novel solution is increasingly replacing chromium-based conversion coatings.

Apart from lubricant additives and coatings, manufacturers in the North America acid phosphates market are exploring incrementing opportunities with drilling muds, since their revenue is anticipated to exponentially during the forecast period. As such, the market is estimated to reach an output of ~33,200 tons by the end of 2027. On the other hand, manufacturers in the North America acid phosphates market are increasing their production capacities to develop phosphate esters, as novel esters are also being used as adhesion promoters. For instance, Lubrizol— a key supplier of specialty chemicals for industrial and consumer markets, is involved with the development of phosphate esters used as adhesion promoters for water-borne and solvent-borne coatings to ferrous metal, zinc alloys, and aluminum substrates.

Companies in the North America acid phosphates market are directing their investments toward corrosion inhibitor technologies that deploy corrosion protection to metal and zinc alloys. This has led to increased availability of direct-to-metal coatings and high-performance primer formulations.

Analysts’ Viewpoint

The North America acid phosphates market is competitive and largely consolidated with tier 1 companies comprising major players dictating ~30%-45% of the market share. Prioritizing investment in R&D activities is one of the key takeaways, which will be an important deciding factor of a company’s success in the next decade.

The demand for acid phosphates is increasing due to the rising demand for high-performance coatings for Mg alloys. However, corrosion-related issues pose a restraint for market growth. Hence, manufacturers should increase the availability of zinc phosphating formulations that are useful in pretreatment baths in order to achieve corrosion protection for automotive components.

North America Acid Phosphates Market: Overview

North America Acid Phosphates Market: Key Drivers and Restraints

North America Acid Phosphates Market: Key Product Segments

North America Acid Phosphates Market: Key Applications

U.S. to be a Highly Lucrative Region of North America Acid Phosphates Market

North America Acid Phosphates Market: Competition Landscape

1. Executive Summary

1.1. North America Acid Phosphates Market Snapshot

1.2. Key Market Trends

1.3. Current Market & Future Potential

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Indicators

2.3. Market Definitions

2.4. Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Market Outlook

2.7. Porter’s Five Forces Analysis

2.8. Value Chain Analysis

2.8.1. List of Potential Customers

3. Acid Phosphates Price Trend Analysis, 2018–2027

3.1. By Product

3.2. By Country

4. North America Acid Phosphates Market Analysis and Forecast, by Product

4.1. Key Findings, by Product

4.2. North America Acid Phosphates Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2018–2027

4.2.1. N-Octyl Acid Phosphate

4.2.2. 2-Ethylhexyl Acid Phosphate/2-Ethylhexyl Dihydrogen Phosphate

4.2.3. Butyl Acid Phosphate

4.2.4. Amyl Acid Phosphate

4.2.5. Ethyl Acid Phosphate

4.3. North America Acid Phosphates Market Attractiveness Analysis, by Product

5. North America Acid Phosphates Market Analysis and Forecast, by Application

5.1. Key Findings, by Application

5.2. North America Acid Phosphates Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2018–2027

5.2.1. Paints & Coatings

5.2.2. Drilling Muds

5.2.3. Lubricant Additives

5.2.4. Textile

5.2.5. Others

5.3. North America Acid Phosphates Market Attractiveness Analysis, by Application

6. North America Acid Phosphates Market Analysis and Forecast, by Country

6.1. North America Acid Phosphates Market Volume (Tons) and Value (US$ Mn), by Country, 2018–2027

6.1.1. U.S.

6.1.2. Canada

6.2. North America Acid Phosphates Market Attractiveness Analysis, by Country

7. Competition Landscape

7.1. North America Acid Phosphates Market Share Analysis, by Company (2018)

7.2. North America Acid Phosphates Market Footprint Analysis

7.3. Company Profiles

7.3.1. Solvay

7.3.1.1. Company Description

7.3.1.2. Business Overview

7.3.1.3. Financial Overview

7.3.1.4. Strategic Overview

7.3.2. Kao Corporation

7.3.2.1. Company Description

7.3.2.2. Business Overview

7.3.2.3. Financial Overview

7.3.2.4. Strategic Overview

7.3.3. Lanxess

7.3.3.1. Company Description

7.3.3.2. Business Overview

7.3.3.3. Financial Overview

7.3.3.4. Strategic Overview

7.3.4. Lubrizol Corporation

7.3.4.1. Company Description

7.3.4.2. Business Overview

7.3.4.3. Financial Overview

7.3.4.4. Strategic Overview

7.3.5. Toronto Research Chemicals

7.3.5.1. Company Description

7.3.5.2. Business Overview

7.3.6. Alfa Aesar

7.3.6.1. Company Description

7.3.6.2. Business Overview

7.3.7. Santacruz Biotechnology

7.3.7.1. Company Description

7.3.7.2. Business Overview

7.3.8. IsleChem

7.3.8.1. Company Description

7.3.8.2. Business Overview

7.3.9. Kurt Obermeier GmbH & Co. KG

7.3.9.1. Company Description

7.3.9.2. Business Overview

8. Key Primary Insights

List of Tables

Table 01: North America Acid Phosphates Market Volume (Tons) Forecast, by Product, 2018–2027

Table 02: North America Acid Phosphates Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 03: North America Acid Phosphates Market Volume (Tons) Forecast, by Application, 2018–2027

Table 04: North America Acid Phosphates Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 05: North America Acid Phosphates Market Volume (Tons) Forecast, by Country, 2018–2027

Table 06: North America Acid Phosphates Market Value (US$ Mn) Forecast, by Country, 2018–2027

Table 07: U.S. Acid Phosphates Market Volume (Tons) Forecast, by Product, 2018–2027

Table 08: U.S. Acid Phosphates Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 09: U.S. Acid Phosphates Market Volume (Tons) Forecast, by Application, 2018–2027

Table 10: U.S. Acid Phosphates Market Value (US$ Mn) Forecast, by Application, 2018–2027

Table 11: Canada Acid Phosphates Market Volume (Tons) Forecast, by Product, 2018–2027

Table 12: Canada Acid Phosphates Market Value (US$ Mn) Forecast, by Product, 2018–2027

Table 13: Canada Acid Phosphates Market Volume (Tons) Forecast, by Application, 2018–2027

Table 14: Canada Acid Phosphates Market Value (US$ Mn) Forecast, by Application, 2018–2027

List of Figures

Figure 01: North America Acid Phosphates Market Volume (Tons) and Value (US$ Mn), 2018–2027

Figure 02: North America Acid Phosphates Market, Absolute $ Opportunity (US$ Mn), 2018–2027

Figure 03: Price Trend Analysis (US$/Kilogram), by Product, 2018–2027

Figure 04: North America Acid Phosphates Market Volume Share Analysis, by Product

Figure 05: North America Acid Phosphates Market Attractiveness Analysis, by Product

Figure 06: North America Acid Phosphates Market Volume Share Analysis, by Application

Figure 07: North America Acid Phosphates Market Attractiveness Analysis, by Application

Figure 08: North America Acid Phosphates Market Volume Share Analysis, by Country

Figure 09: North America Acid Phosphates Market Attractiveness Analysis, by Country

Figure 10: North America Acid Phosphates Market Share Analysis, by Company, 2018