Reports

Reports

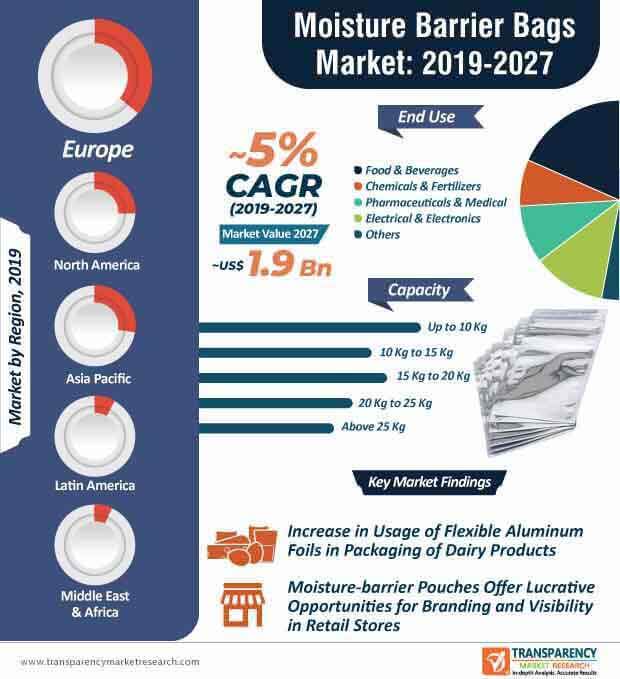

Flexible packaging is one of the fastest-growing sectors in the FMCG manufacturing industry. Hence, companies in the moisture barrier bags market are innovating in flexible packaging solutions for the food industry. The versatility of bags is increasingly gaining the attention of packaging manufacturers. Hence, manufacturers in the moisture barrier bags market are introducing novel moisture-resistant bags that cater to the convenience of consumers.

Since users are always challenged with space-constrained storage in household environment, manufacturers in the moisture barrier bags market are developing multi-layer pouches that provide resistance to moisture, puncture, pests, and air, among others. Thus, bags are generating incremental opportunities, due to their high demand in commercial and domestic settings. Aluminum foils are gaining popularity in the market for moisture barrier bags. Though aluminum foils do not hold a significant share in terms of value and volume as compared to plastic, they are gaining prominence in confectionary packaging for dairy items.

Growing environmental concerns associated with plastic has led to the introduction of recyclable coextruded polyethylene (PE) pouches. As such, plastic material segment dominates the moisture barrier bags market, in terms of value and volume, which is expected to reach an output of ~373,300 tons by the end of 2027.

In order to provide resistance toward vapor, odor, and light, manufacturers in the market for moisture barrier bags are undertaking extensive R&D activities to develop five and nine layer PE pouches. On the other hand, they are increasing production capacities to develop PE laminates of up to two to three layers to provide efficacious resistance against quality-degrading elements.

Companies in the moisture barrier bags market are increasing the availability of PE pouches that can be surface-printed and manufactured with coextruded films. As such, PE pouches are witnessing rise in demand from manufacturers in various end markets, since they can be designed with barrier properties on the basis of specific shelf-life requirements. Thus, recyclable PE bags are becoming increasingly mainstream in food packaging applications for dry and frozen foods.

Growing consumer dissatisfaction toward damaged and mangled electronic products has driven the demand for moisture barrier bags. As such, moisture is one of the main causes of degradation of PCB (Printed Circuit Board). Hence, manufacturers in the moisture barrier bags market are increasing their efficacy in moisture-proof packaging solutions to prevent degradation of PCB.

Outdoor and shipment applications of PCB are creating growth opportunities for manufacturers. As such, electrical & electronics end use segment of the moisture barrier bags market is estimated to reach an output of ~133,400 tons by 2027. Hence, manufacturers are tapping opportunities in shipment applications such as sea freight.

Companies in the market for moisture barrier bags are exploring opportunities to cater end user needs when PCB is being transported via long-distance travel through regions with humid climate. Moreover, growing awareness about moisture-proof packaging among consumers is boosting the uptake of moisture barrier bags. Thus, there is a growth in demand for heat-sealable and puncture-resistant bags for electricals and electronics.

Growing environmental footprint, owing to plastic packaging solutions has compelled market players to innovate in compostable packaging. Though compostable packaging constitute only a fraction of the global packaging market, companies in the moisture barrier bags market are increasingly focusing on food packaging. As such, food & beverages end use segment of the moisture barrier bags market is estimated to reach an output of ~145,700 tons by 2021. Hence, manufacturers are increasing their efficacy in compostable food packaging to reduce environmental impact.

Innovations in compostable food packaging are bolstering the credibility credentials of companies in the market for moisture barrier bags. However, manufacturers face limitations to comply with existing food industry requirements depending on the type of food. Hence, manufacturers are increasing research to fine-tune compostable packaging that matches oxygen and water vapor transmission rates.

Analysts’ Viewpoint

The moisture barrier bags market is largely fragmented with regional and local players accounting to more than 90% of the global market share. This creates opportunities for manufacturers to innovate in packaging solutions for pharmaceutical and medical products. Bags are gaining popularity in the F&B industry and are bolstering credibility credentials of manufacturers, since these bags offer lucrative opportunities for branding and visibility in retail stores.

However, limitations in compostable food packaging pose as a challenge for manufacturers. Hence, companies should develop new material blends to align with existing food industry requirements. For instance, BASF - a leading European chemicals company, blended ‘ecoflex’ with polylactic acid to develop multiple grades of BASF’s ‘ecovio’ for use in thermoforming and injection molding applications.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. Analysis and Recommendations

1.4. Wheel of Opportunity

2. Market Introduction

2.1. Market Taxonomy

2.2. Market Definition

3. Market Viewpoint

3.1. Global Economic Outlook

3.2. Global Packaging Industry Outlook

3.3. Product USPs & Strategic Promotional Strategies

3.4. Macro-economic Factors & Correlation Analysis

3.5. Forecast Factors: Relevance & Impact

3.6. Value Chain Analysis

3.6.1. Key Market Participants

3.6.1.1. Raw Material Suppliers

3.6.1.2. Moisture Barrier Bags Manufacturers

3.6.1.3. Distributors

3.6.2. Profitability Margin

3.7. Market Dynamics

3.7.1. Drivers

3.7.2. Restraints

3.7.3. Trends

3.7.4. Opportunities

4. Global Moisture Barrier Bags Market Analysis

4.1. Market Value (US$ Mn) and Volume (Tons) Analysis & Forecast

4.2. Y-o-Y Growth Projections

4.3. Absolute $ Opportunity Analysis

5. Global Moisture Barrier Bags Market Analysis, by Material Type

5.1. Section Summary

5.2. Introduction

5.2.1. Market Value Share Analysis, by Material Type

5.2.2. Y-o-Y Growth Analysis, by Material Type

5.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Material Type

5.3.1. Aluminum Foil

5.3.2. Paper

5.3.3. Plastic

5.3.3.1. Polyethylene (PE)

5.3.3.2. Polyester

5.3.3.3. Nylon

5.3.3.4. Others

5.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Material Type

5.4.1. Aluminum Foil

5.4.2. Paper

5.4.3. Plastic

5.4.3.1. Polyethylene (PE)

5.4.3.2. Polyester

5.4.3.3. Nylon

5.4.3.4. Others

5.5. Market Attractiveness Analysis, by Material Type

6. Global Moisture Barrier Bags Market Analysis, by Product Type

6.1. Section Summary

6.2. Introduction

6.2.1. Market Value Share Analysis, by Material Type

6.2.2. Y-o-Y Growth Analysis, by Material Type

6.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Product Type

6.3.1. Static Shielding

6.3.2. Poly Moisture Barrier Bags

6.3.3. Volatile Inhibitor

6.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Product Type

6.4.1. Static Shielding

6.4.2. Poly Moisture Barrier Bags

6.4.3. Volatile Inhibitor

6.5. Market Attractiveness Analysis, by Product Type

7. Global Moisture Barrier Bags Market Analysis, by Package Type

7.1. Section Summary

7.2. Introduction

7.2.1. Market Value Share Analysis, by Package Type

7.2.2. Y-o-Y Growth Analysis, by Package Type

7.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Package Type

7.3.1. Flat Bags

7.3.2. Gusseted Bags

7.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Package Type

7.4.1. Flat Bags

7.4.2. Gusseted Bags

7.5. Market Attractiveness Analysis, by Package Type

8. Global Moisture Barrier Bags Market Analysis, by Capacity

8.1. Section Summary

8.2. Introduction

8.2.1. Market Value Share Analysis, by Capacity

8.2.2. Y-o-Y Growth Analysis, by Capacity

8.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Capacity

8.3.1. Up to 10 Kg

8.3.2. 10 Kg to 15 Kg

8.3.3. 15 Kg to 20 Kg

8.3.4. 20 Kg to 25 Kg

8.3.5. Above 25 Kg

8.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

8.4.1. Up to 10 Kg

8.4.2. 10 Kg to 15 Kg

8.4.3. 15 Kg to 20 Kg

8.4.4. 20 Kg to 25 Kg

8.4.5. Above 25 Kg

8.5. Market Attractiveness Analysis, by Capacity

9. Global Moisture Barrier Bags Market Analysis, by End Use

9.1. Section Summary

9.2. Introduction

9.2.1. Market Value Share Analysis, by End Use

9.2.2. Y-o-Y Growth Analysis, by End Use

9.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by End Use

9.3.1. Food & Beverages

9.3.2. Chemicals & Fertilizers

9.3.3. Pharmaceuticals & Medical

9.3.4. Electrical & Electronics

9.3.5. Others

9.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by End Use

9.4.1. Food & Beverages

9.4.2. Chemicals & Fertilizers

9.4.3. Pharmaceuticals & Medical

9.4.4. Electrical & Electronics

9.4.5. Others

9.5. Market Attractiveness Analysis, by End Use

10. Global Moisture Barrier Bags Market Analysis, by Region

10.1. Section Summary

10.2. Introduction

10.2.1. Market Value Share Analysis, by Region

10.2.2. Y-o-Y Growth Analysis, by Region

10.3. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Region

10.3.1. North America

10.3.2. Latin America

10.3.3. Europe

10.3.4. Asia Pacific

10.3.5. Middle East & Africa (MEA)

10.4. Market Attractiveness Analysis, by Region

11. North America Moisture Barrier Bags Market Analysis

11.1. Introduction

11.2. Pricing Analysis

11.3. Historical Market Value(US$ Mn) and Volume (Tons) Analysis, 2014-2018, by Country

11.3.1. U.S.

11.3.2. Canada

11.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Country

11.4.1. U.S.

11.4.2. Canada

11.5. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Material Type

11.5.1. Aluminum Foil

11.5.2. Paper

11.5.3. Plastic

11.5.3.1. Polyethylene (PE)

11.5.3.2. Polyester

11.5.3.3. Nylon

11.6. Others Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Material Type

11.6.1. Aluminum Foil

11.6.2. Paper

11.6.3. Plastic

11.6.3.1. Polyethylene (PE)

11.6.3.2. Polyester

11.6.3.3. Nylon

11.7. Others Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Product Type

11.7.1. Static Shielding

11.7.2. Poly Moisture Barrier Bags

11.8. Volatile Inhibitor Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Product Type

11.8.1. Static Shielding

11.8.2. Poly Moisture Barrier Bags

11.9. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Package Type

11.9.1. Flat Bags

11.9.2. Gusseted Bags

11.10. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Package Type

11.10.1. Flat Bags

11.10.2. Gusseted Bags

11.11. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Capacity

11.11.1. Up to 10 Kg

11.11.2. 10 Kg to 15 Kg

11.11.3. 15 Kg to 20 Kg

11.11.4. 20 Kg to 25 Kg

11.11.5. Above 25 Kg

11.12. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

11.12.1. Up to 10 Kg

11.12.2. 10 Kg to 15 Kg

11.12.3. 15 Kg to 20 Kg

11.12.4. 20 Kg to 25 Kg

11.12.5. Above 25 Kg

11.13. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by End Use

11.13.1. Food & Beverages

11.13.2. Chemicals & Fertilizers

11.13.3. Pharmaceuticals & Medical

11.13.4. Electrical & Electronics

11.13.5. Others

11.14. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by End Use

11.14.1. Food & Beverages

11.14.2. Chemicals & Fertilizers

11.14.3. Pharmaceuticals & Medical

11.14.4. Electrical & Electronics

11.14.5. Others

12. Latin America Moisture Barrier Bags Market Analysis

12.1. Introduction

12.2. Pricing Analysis

12.3. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Country

12.3.1. Brazil

12.3.2. Mexico

12.3.3. Argentina

12.3.4. Rest of Latin America

12.4. Market Value (US$ Mn) and Volume (Tons) Analysis, by Country, 2019-2027

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Argentina

12.4.4. Rest of Latin America

12.5. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Material Type

12.5.1. Aluminum Foil

12.5.2. Paper

12.5.3. Plastic

12.5.3.1. Polyethylene (PE)

12.5.3.2. Polyester

12.5.3.3. Nylon

12.6. Others Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Material Type

12.6.1. Aluminum Foil

12.6.2. Paper

12.6.3. Plastic

12.6.3.1. Polyethylene (PE)

12.6.3.2. Polyester

12.6.3.3. Nylon

12.7. Others Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Product Type

12.7.1. Static Shielding

12.7.2. Poly Moisture Barrier Bags

12.8. Volatile Inhibitor Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Product Type

12.8.1. Static Shielding

12.8.2. Poly Moisture Barrier Bags

12.9. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Package Type

12.9.1. Flat Bags

12.9.2. Gusseted Bags

12.10. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Package Type

12.10.1. Flat Bags

12.10.2. Gusseted Bags

12.11. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Capacity

12.11.1. Up to 10 Kg

12.11.2. 10 Kg to 15 Kg

12.11.3. 15 Kg to 20 Kg

12.11.4. 20 Kg to 25 Kg

12.11.5. Above 25 Kg

12.12. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

12.12.1. Up to 10 Kg

12.12.2. 10 Kg to 15 Kg

12.12.3. 15 Kg to 20 Kg

12.12.4. 20 Kg to 25 Kg

12.12.5. Above 25 Kg

12.13. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by End Use

12.13.1. Food & Beverages

12.13.2. Chemicals & Fertilizers

12.13.3. Pharmaceuticals & Medical

12.13.4. Electrical & Electronics

12.13.5. Others

12.14. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by End Use

12.14.1. Food & Beverages

12.14.2. Chemicals & Fertilizers

12.14.3. Pharmaceuticals & Medical

12.14.4. Electrical & Electronics

12.14.5. Others

13. Europe Moisture Barrier Bags Market Analysis

13.1. Introduction

13.2. Pricing Analysis

13.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Country

13.3.1. Germany

13.3.2. Italy

13.3.3. France

13.3.4. U.K.

13.3.5. Spain

13.3.6. Benelux

13.3.7. Russia

13.3.8. Rest of Europe

13.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Country

13.4.1. Germany

13.4.2. Italy

13.4.3. France

13.4.4. U.K.

13.4.5. Spain

13.4.6. Benelux

13.4.7. Russia

13.4.8. Rest of Europe

13.5. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Material Type

13.5.1. Aluminum Foil

13.5.2. Paper

13.5.3. Plastic

13.5.3.1. Polyethylene (PE)

13.5.3.2. Polyester

13.5.3.3. Nylon

13.6. Others Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Material Type

13.6.1. Aluminum Foil

13.6.2. Paper

13.6.3. Plastic

13.6.3.1. Polyethylene (PE)

13.6.3.2. Polyester

13.6.3.3. Nylon

13.7. Others Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Product Type

13.7.1. Static Shielding

13.7.2. Poly Moisture Barrier Bags

13.8. Volatile Inhibitor Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Product Type

13.8.1. Static Shielding

13.8.2. Poly Moisture Barrier Bags

13.9. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Package Type

13.9.1. Flat Bags

13.9.2. Gusseted Bags

13.10. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Package Type

13.10.1. Flat Bags

13.10.2. Gusseted Bags

13.11. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Capacity

13.11.1. Up to 10 Kg

13.11.2. 10 Kg to 15 Kg

13.11.3. 15 Kg to 20 Kg

13.11.4. 20 Kg to 25 Kg

13.11.5. Above 25 Kg

13.12. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

13.12.1. Up to 10 Kg

13.12.2. 10 Kg to 15 Kg

13.12.3. 15 Kg to 20 Kg

13.12.4. 20 Kg to 25 Kg

13.12.5. Above 25 Kg

13.13. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by End Use

13.13.1. Food & Beverages

13.13.2. Chemicals & Fertilizers

13.13.3. Pharmaceuticals & Medical

13.13.4. Electrical & Electronics

13.13.5. Others

13.14. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by End Use

13.14.1. Food & Beverages

13.14.2. Chemicals & Fertilizers

13.14.3. Pharmaceuticals & Medical

13.14.4. Electrical & Electronics

13.14.5. Others

14. Asia Pacific Moisture Barrier Bags Market Analysis

14.1. Introduction

14.2. Pricing Analysis

14.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Country

14.3.1. China

14.3.2. India

14.3.3. ASEAN

14.3.4. Australia and New Zealand

14.3.5. Japan

14.3.6. Rest of Asia Pacific

14.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Country

14.4.1. China

14.4.2. India

14.4.3. ASEAN

14.4.4. Australia and New Zealand

14.4.5. Japan

14.4.6. Rest of Asia Pacific

14.5. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Material Type

14.5.1. Aluminum Foil

14.5.2. Paper

14.5.3. Plastic

14.5.3.1. Polyethylene (PE)

14.5.3.2. Polyester

14.5.3.3. Nylon

14.6. Others Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Material Type

14.6.1. Aluminum Foil

14.6.2. Paper

14.6.3. Plastic

14.6.3.1. Polyethylene (PE)

14.6.3.2. Polyester

14.6.3.3. Nylon

14.7. Others Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Product Type

14.7.1. Static Shielding

14.7.2. Poly Moisture Barrier Bags

14.8. Volatile Inhibitor Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Product Type

14.8.1. Static Shielding

14.8.2. Poly Moisture Barrier Bags

14.9. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Package Type

14.9.1. Flat Bags

14.9.2. Gusseted Bags

14.10. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Package Type

14.10.1. Flat Bags

14.10.2. Gusseted Bags

14.11. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Capacity

14.11.1. Up to 10 Kg

14.11.2. 10 Kg to 15 Kg

14.11.3. 15 Kg to 20 Kg

14.11.4. 20 Kg to 25 Kg

14.11.5. Above 25 Kg

14.12. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

14.12.1. Up to 10 Kg

14.12.2. 10 Kg to 15 Kg

14.12.3. 15 Kg to 20 Kg

14.12.4. 20 Kg to 25 Kg

14.12.5. Above 25 Kg

14.13. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by End Use

14.13.1. Food & Beverages

14.13.2. Chemicals & Fertilizers

14.13.3. Pharmaceuticals & Medical

14.13.4. Electrical & Electronics

14.13.5. Others

14.14. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by End Use

14.14.1. Food & Beverages

14.14.2. Chemicals & Fertilizers

14.14.3. Pharmaceuticals & Medical

14.14.4. Electrical & Electronics

14.14.5. Others

15. Middle East & Africa Moisture Barrier Bags Market Analysis

15.1. Introduction

15.2. Pricing Analysis

15.3. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Country

15.3.1. GCC Countries

15.3.2. Northern Africa

15.3.3. South Africa

15.3.4. Rest of MEA

15.4. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Country

15.4.1. GCC Countries

15.4.2. Northern Africa

15.4.3. South Africa

15.4.4. Rest of MEA

15.5. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Material Type

15.5.1. Aluminum Foil

15.5.2. Paper

15.5.3. Plastic

15.5.3.1. Polyethylene (PE)

15.5.3.2. Polyester

15.5.3.3. Nylon

15.5.3.4. Others

15.6. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Material Type

15.6.1. Aluminum Foil

15.6.2. Paper

15.6.3. Plastic

15.6.3.1. Polyethylene (PE)

15.6.3.2. Polyester

15.6.3.3. Nylon

15.7. Others Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Product Type

15.7.1. Static Shielding

15.7.2. Poly Moisture Barrier Bags

15.8. Volatile Inhibitor Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Product Type

15.8.1. Static Shielding

15.8.2. Poly Moisture Barrier Bags

15.9. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Package Type

15.9.1. Flat Bags

15.9.2. Gusseted Bags

15.10. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Package Type

15.10.1. Flat Bags

15.10.2. Gusseted Bags

15.11. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by Capacity

15.11.1. Up to 10 Kg

15.11.2. 10 Kg to 15 Kg

15.11.3. 15 Kg to 20 Kg

15.11.4. 20 Kg to 25 Kg

15.11.5. Above 25 Kg

15.12. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by Capacity

15.12.1. Up to 10 Kg

15.12.2. 10 Kg to 15 Kg

15.12.3. 15 Kg to 20 Kg

15.12.4. 20 Kg to 25 Kg

15.12.5. Above 25 Kg

15.13. Historical Market Value(US$ Mn) and Volume (Tons), 2014-2018, by End Use

15.13.1. Food & Beverages

15.13.2. Chemicals & Fertilizers

15.13.3. Pharmaceuticals & Medical

15.13.4. Electrical & Electronics

15.13.5. Others

15.14. Market Value (US$ Mn) and Volume (Tons) Forecast, 2019-2027, by End Use

15.14.1. Food & Beverages

15.14.2. Chemicals & Fertilizers

15.14.3. Pharmaceuticals & Medical

15.14.4. Electrical & Electronics

15.14.5. Others

16. Market Structure Analysis

16.1. Market Analysis by Tier of Companies

16.1.1. By Large, Medium, and Small

16.2. Market Concentration

16.2.1. By Top 5 and by Top 10

16.3. Production Capacity Share Analysis

16.3.1. By Large, Medium, and Small

16.3.2. By Top 5 and Top 10

16.4. Market Share Analysis of Top 10 Players

16.4.1. The Americas Market Share Analysis, by Top Players

16.4.2. MEA Market Share Analysis, by Top Players

16.4.3. Asia Pacific Market Share Analysis, by Top Players

16.5. Market Presence Analysis

17. Competition Analysis

17.1. Competition Dashboard

17.2. Profitability and Gross Margin Analysis

17.3. Competition Developments

17.4. Competition Deep Dive

17.4.1. Mondi Plc

17.4.1.1. Overview

17.4.1.2. Product Portfolio

17.4.1.3. Profitability

17.4.1.4. Production Footprint

17.4.1.5. Sales Footprint

17.4.1.6. Channel Footprint

17.4.1.7. Competition Benchmarking

17.4.1.8. Strategy

17.4.1.8.1. Marketing Strategy

17.4.1.8.2. Product Strategy

17.4.1.8.3. Channel Strategy

17.4.2. Sonoco Products Company.

17.4.2.1. Overview

17.4.2.2. Product Portfolio

17.4.2.3. Profitability

17.4.2.4. Production Footprint

17.4.2.5. Sales Footprint

17.4.2.6. Channel Footprint

17.4.2.7. Competition Benchmarking

17.4.2.8. Strategy

17.4.2.8.1. Marketing Strategy

17.4.2.8.2. Product Strategy

17.4.2.8.3. Channel Strategy

17.4.3. Amcor Plc.

17.4.3.1. Overview

17.4.3.2. Product Portfolio

17.4.3.3. Profitability

17.4.3.4. Production Footprint

17.4.3.5. Sales Footprint

17.4.3.6. Channel Footprint

17.4.3.7. Competition Benchmarking

17.4.3.8. Strategy

17.4.3.8.1. Marketing Strategy

17.4.3.8.2. Product Strategy

17.4.3.8.3. Channel Strategy

17.4.4. Flexopack SA

17.4.4.1. Overview

17.4.4.2. Product Portfolio

17.4.4.3. Profitability

17.4.4.4. Production Footprint

17.4.4.5. Sales Footprint

17.4.4.6. Channel Footprint

17.4.4.7. Competition Benchmarking

17.4.4.8. Strategy

17.4.4.8.1. Marketing Strategy

17.4.4.8.2. Product Strategy

17.4.4.8.3. Channel Strategy

17.4.5. 3M.

17.4.5.1. Overview

17.4.5.2. Product Portfolio

17.4.5.3. Profitability

17.4.5.4. Production Footprint

17.4.5.5. Sales Footprint

17.4.5.6. Channel Footprint

17.4.5.7. Competition Benchmarking

17.4.5.8. Strategy

17.4.5.8.1. Marketing Strategy

17.4.5.8.2. Product Strategy

17.4.5.8.3. Channel Strategy

17.4.6. SCG Packaging Public Company Limited

17.4.6.1. Overview

17.4.6.2. Product Portfolio

17.4.6.3. Profitability

17.4.6.4. Production Footprint

17.4.6.5. Sales Footprint

17.4.6.6. Channel Footprint

17.4.6.7. Competition Benchmarking

17.4.6.8. Strategy

17.4.6.8.1. Marketing Strategy

17.4.6.8.2. Product Strategy

17.4.6.8.3. Channel Strategy

17.4.7. Protective Packaging Corporation Inc.

17.4.7.1. Overview

17.4.7.2. Product Portfolio

17.4.7.3. Profitability

17.4.7.4. Production Footprint

17.4.7.5. Sales Footprint

17.4.7.6. Channel Footprint

17.4.7.7. Competition Benchmarking

17.4.7.8. Strategy

17.4.7.8.1. Marketing Strategy

17.4.7.8.2. Product Strategy

17.4.7.8.3. Channel Strategy

17.4.8. ProAmpac LLC.

17.4.8.1. Overview

17.4.8.2. Product Portfolio

17.4.8.3. Profitability

17.4.8.4. Production Footprint

17.4.8.5. Sales Footprint

17.4.8.6. Channel Footprint

17.4.8.7. Competition Benchmarking

17.4.8.8. Strategy

17.4.8.8.1. Marketing Strategy

17.4.8.8.2. Product Strategy

17.4.8.8.3. Channel Strategy

17.4.9. Ahlstrom-Munksjo Oyj

17.4.9.1. Overview

17.4.9.2. Product Portfolio

17.4.9.3. Profitability

17.4.9.4. Production Footprint

17.4.9.5. Sales Footprint

17.4.9.6. Channel Footprint

17.4.9.7. Competition Benchmarking

17.4.9.8. Strategy

17.4.9.8.1. Marketing Strategy

17.4.9.8.2. Product Strategy

17.4.9.8.3. Channel Strategy

17.4.10. Nordic Paper Holdings AB.

17.4.10.1. Overview

17.4.10.2. Product Portfolio

17.4.10.3. Profitability

17.4.10.4. Production Footprint

17.4.10.5. Sales Footprint

17.4.10.6. Channel Footprint

17.4.10.7. Competition Benchmarking

17.4.10.8. Strategy

17.4.10.8.1. Marketing Strategy

17.4.10.8.2. Product Strategy

17.4.10.8.3. Channel Strategy

17.4.11. Twin Rivers Paper Company LLC.

17.4.11.1. Overview

17.4.11.2. Product Portfolio

17.4.11.3. Profitability

17.4.11.4. Production Footprint

17.4.11.5. Sales Footprint

17.4.11.6. Channel Footprint

17.4.11.7. Competition Benchmarking

17.4.11.8. Strategy

17.4.11.8.1. Marketing Strategy

17.4.11.8.2. Product Strategy

17.4.11.8.3. Channel Strategy

17.4.12. Billerudkorsnäs Ab.

17.4.12.1. Overview

17.4.12.2. Product Portfolio

17.4.12.3. Profitability

17.4.12.4. Production Footprint

17.4.12.5. Sales Footprint

17.4.12.6. Channel Footprint

17.4.12.7. Competition Benchmarking

17.4.12.8. Strategy

17.4.12.8.1. Marketing Strategy

17.4.12.8.2. Product Strategy

17.4.12.8.3. Channel Strategy

18. Assumptions and Acronyms Used

19. Research Methodology

List of Tables

Table 01: Global Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F, by Service Type

Table 02: Global Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F, by Technology

Table 03: Global Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F, by Application

Table 04: Global Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F, by Region

Table 05: North America Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F

Table 06: Latin America Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F

Table 07: Europe Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F

Table 08: Asia Pacific Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F

Table 09: MEA Pre-press for Packaging Market Value (US$ Mn) 2014H-2027F

List of Figures

Figure 01: Global Pre-press for Packaging Market Share Analysis by Service (2014H, 2019E & 2027F)

Figure 02: Global Pre-press for Packaging Market Attractiveness Index, by Service Type (2019 – 2027)

Figure 03: Global Pre-press for Packaging Market Share Analysis by Technology (2014H, 2019E & 2027F)

Figure 04: Global Pre-press for Packaging Market Attractiveness Index, by Technology (2019 – 2027)

Figure 05: Global Pre-press for Packaging Market Share Analysis by Application (2019E)

Figure 06: Global Pre-press for Packaging Market Attractiveness Index, by Rigid Packaging (2019 – 2027)

Figure 08: North America Pre-press for Packaging Market Attractiveness Index, Service Type (2019 – 2027)

Figure 09: North America Pre-press for Packaging Market Attractiveness Index, Country (2019 – 2027)

Figure 10: Latin America Pre-press for Packaging Market Attractiveness Index, Service Type (2019 – 2027)

Figure 11: Global Pre-press for Packaging Market Attractiveness Index, Country (2019 – 2027)

Figure 12: Europe Pre-press for Packaging Market Attractiveness Index, Service Type (2019 – 2027)

Figure 13: Europe Pre-press for Packaging Market Attractiveness Index, Country (2019 – 2027)

Figure 14: Asia Pacific Pre-press for Packaging Market Attractiveness Index, Service Type (2019 – 2027)

Figure 15: Asia Pacific Pre-press for Packaging Market Attractiveness Index, Country (2019 – 2027)

Figure 16: MEA Pre-press for Packaging Market Attractiveness Index, Service Type (2019 – 2027)

Figure 17: MEA Pre-press for Packaging Market Attractiveness Index, Country (2019 – 2027)