Reports

Reports

The COVID-19 pandemic has disrupted daily lives of people and affected manufacturers’ supply chains to a great extent. Companies in the Middle East & Africa type C-bulk bags market are witnessing plant closures and labor unavailability. New potential outbreaks of coronavirus in India, Pakistan, Canada, and other countries are emerging as challenges for stakeholders. Hence, manufacturers are increasing the availability of on-demand type C-bulk bags and FIBCs (flexible intermediate bulk containers) to meet end user requirements.

Companies in the Middle East & Africa type C-bulk bags market are gaining awareness about vendor managed inventory programs that are inviting and encouraging customers to take advantage of large-scale warehouse facilities to store their packaging materials. These programs are allowing flexibility to clients to enjoy the benefits of obtaining their packaging products as per their needs.

The Middle East & Africa type C-bulk bags market is expected to reach US$ 1 Bn by 2029. However, human error, while using type C-bulk bags can lead to industrial accidents, owing to a broken or missing ground connection. Stakeholders are creating awareness about ground connection and risks associated with potentially damaged bags that help to prevent industrial accidents.

Manufacturers are offering competitive type C-bulk bags and FIBCs to their clients in order to gain an edge over other market players. They are increasing efforts for in-house production processes such as granulating, wire drawing, testing, and packaging, among others.

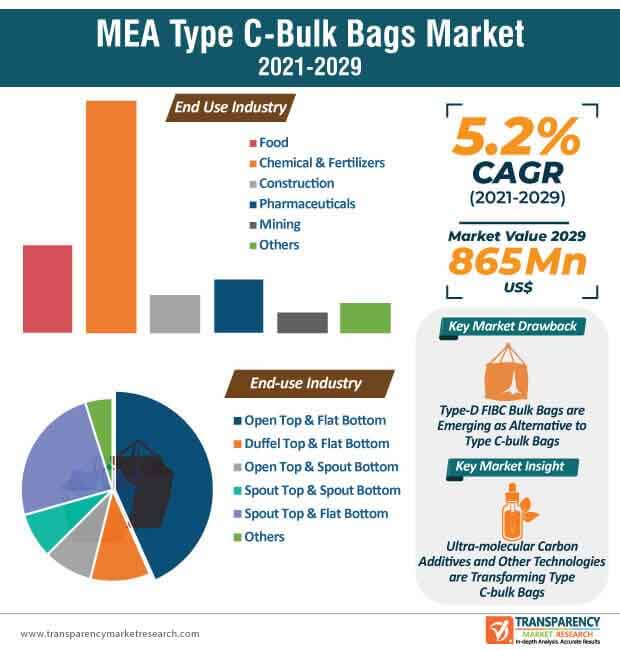

The Middle East & Africa type C-bulk bags market is slated to register a modest CAGR of 5.2% during the forecast period. Manufacturers are increasing focus in FIBC bags and polypropylene (PP) fabrics manufacturing and marketing. They are investing in modernized plants and increasing training for skilled workers. In order to gain a competitive edge over other market players in the potentially fragmented market landscape, companies are teaming up with professionals excellent in designing and selling.

The in-house control of production processes are being associated with cost savings in the Middle East type C-bulk bags market. Manufacturers are boosting their production capabilities in products complying with ISO (International Organization for Standardization) norms. The customizable type C-bulk bags are being preferred by end users.

Continuous product innovation and utilization of advanced manufacturing technologies are contributing to the recognition of Gulf Plastic Industries, which has a comprehensive portfolio in FIBCs and type C-bulk bags. Companies in the Middle East & Africa type C-bulk bags market are leveraging incremental opportunities in the minerals & ores, chemicals, and construction industries, among others. In order to stay competent, manufacturers are conforming to stringent international standards, especially to expand their revenue streams in agriculture and pharmaceuticals industry.

The sustainability aspect is gaining prominence in the Middle East & Africa type C-bulk bags market. They are increasing output capacities in bags that eliminate the need for pallets or secondary packaging. This helps to save on transportation and storage costs.

There is a growing demand for FIBCs that protect against dangerous static discharges through grounding of the bag itself during the filling & discharging processes. The manufacturers in the Middle East & Africa type C-bulk bags market are constructing bags with conductive carbon, silver core, or steal threads woven into fabrics. Such bags are considered to be potentially safe when grounded, as any electrostatic potential that builds up as a result of rapid filling or discharging quickly & safely exits the bag to the ground. This is being achieved via the network of conductive fibers woven into the fabric of the bag.

The manufacturers in the Middle East & Africa type C-bulk bags market are aiming for UV resistance in bags to protect materials from harmful sunrays.

Analysts’ Viewpoint

Besides vendor-managed inventory programs, companies in the Middle East & Africa type C-bulk bags market are focusing on customer demands in food, agriculture, and essential industries such as pharmaceuticals to stay afloat during the coronavirus pandemic. However, type-D FIBC bulk bags are emerging as an alternative to type C-bulk bags. Hence, companies should adopt advanced manufacturing technologies and invest in continuous product innovation to improve the quality & safety of type C-bulk bags. The carbon graphite thread conductor technology is being used by manufacturers to aid in grounding of any static charge produced due to the fast filling of the bag. The ultra-molecular carbon additives are being inserted into the material of bags.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Type C-Bulk Bags Market Overview

3.1. Introduction

3.2. Global Packaging Market Outlook

3.3. Macro-economic Factors – Correlation Analysis

3.4. Forecast Factors – Relevance & Impact

3.5. Type C-Bulk Bags Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Raw Material Type Suppliers

3.5.1.2. Manufacturers / Converters

3.5.1.3. Distributors/Retailers

3.5.1.4. End users

3.5.2. Profitability Margins

3.6. Impact of COVID-19

3.6.1. Current Statistics and Probable Future Impact

3.6.2. Impact of COVID-19 on Type-C Bulk Bags Market

4. Type C-Bulk Bags Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Region

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Type C-Bulk Bags Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunity Analysis

5.4. Trends

6. MEA Type C-Bulk Bags Market Analysis and Forecast, By Capacity

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

6.1.2. Y-o-Y Growth Projections, By Capacity

6.2. Historical Market Value(US$ Mn) and Volume (Th Units), 2013-2020, By Capacity

6.2.1. Small (Upto 0.75 cu. m)

6.2.2. Medium (0.75 to 1,.5 cu. m)

6.2.3. Large (Above 1,.5 cu. m)

6.3. Market Size (US$ Mn) and Volume (Th Units) Forecast Analysis 2021-2029, By Capacity

6.3.1. Small (Upto 0.75 cu. m)

6.3.2. Medium (0.75 to 1,.5 cu. m)

6.3.3. Large (Above 1,.5 cu. m)

6.4. Market Attractiveness Analysis, By Capacity

7. MEA Type C-Bulk Bags Market Analysis and Forecast, By Design

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Design

7.1.2. Y-o-Y Growth Projections, By Design

7.2. Historical Market Value (US$ Mn) and Volume (Th Units), 2013-2020, By Design

7.2.1. U-Panel

7.2.2. Four Side Panel

7.2.3. Baffle

7.2.4. Circular/Tabular

7.2.5. Cross Corner

7.2.6. Others

7.3. Market Size (US$ Mn) and Volume (Th Units) Forecast Analysis 2021-2029, By Design

7.3.1. U-Panel

7.3.2. Four Side Panel

7.3.3. Baffle

7.3.4. Circular/Tabular

7.3.5. Cross Corner

7.3.6. Others

7.4. Market Attractiveness Analysis, By Design

8. MEA Type C-Bulk Bags Market Analysis and Forecast, By Filling and Discharge

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Filling and Discharge

8.1.2. Y-o-Y Growth Projections, By Filling and Discharge

8.2. Historical Market Value(US$ Mn) and Volume (Th Units), 2013-2020, By Filling and Discharge

8.2.1. Open Top & Flat Bottom

8.2.2. Duffel Top & Flat Bottom

8.2.3. Open Top & Spout Bottom

8.2.4. Spout Top & Spout Bottom

8.2.5. Spout Top & Flat Bottom

8.2.6. Others

8.3. Market Size (US$ Mn) and Volume (Th Units) Forecast Analysis 2021-2029, By Filling and Discharge

8.3.1. Open Top & Flat Bottom

8.3.2. Duffel Top & Flat Bottom

8.3.3. Open Top & Spout Bottom

8.3.4. Spout Top & Spout Bottom

8.3.5. Spout Top & Flat Bottom

8.3.6. Others

8.4. Market Attractiveness Analysis, By Filling and Discharge

9. MEA Type C-Bulk Bags Market Analysis and Forecast, By End Use Industry

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By End Use Industry

9.1.2. Y-o-Y Growth Projections, By End Use Industry

9.2. Historical Market Value(US$ Mn) and Volume (Th Units), 2013-2020, By End Use Industry

9.2.1. Food

9.2.2. Chemicals & Fertilizers

9.2.3. Construction

9.2.4. Pharmaceuticals

9.2.5. Mining

9.2.6. Others

9.3. Market Size (US$ Mn) and Volume (Th Units) Forecast Analysis 2021-2029, By End Use Industry

9.3.1. Food

9.3.2. Chemicals & Fertilizers

9.3.3. Construction

9.3.4. Pharmaceuticals

9.3.5. Mining

9.3.6. Others

9.4. Market Attractiveness Analysis, By End Use Industry

10. MEA Type C-Bulk Bags Market Analysis and Forecast, By Country

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis, By Country

10.1.2. Y-o-Y Growth Projections, By Country

10.2. Historical Market Value(US$ Mn) and Volume (Th Units), 2013-2020, By Country

10.2.1. GCC Countries

10.2.2. Turkey

10.2.3. Northern Africa

10.2.4. South Africa

10.2.5. Rest of MEA

10.3. Market Size (US$ Mn) and Volume (Th Units) Forecast Analysis 2021-2029, By Country

10.3.1. GCC Countries

10.3.2. Turkey

10.3.3. Northern Africa

10.3.4. South Africa

10.3.5. Rest of MEA

10.4. Market Attractiveness Analysis, By Country

11. Competitive Landscape

11.1. Market Structure

11.2. Competition Dashboard

11.3. Company Market Share Analysis

11.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

11.5. Competition Deep Dive

11.5.1. Olympic Bulk Bags Pty Ltd

11.5.1.1. Overview

11.5.1.2. Financials

11.5.1.3. Strategy

11.5.1.4. Recent Developments

11.5.1.5. SWOT Analysis

11.5.2. LC Packaging International BV

11.5.2.1. Overview

11.5.2.2. Financials

11.5.2.3. Strategy

11.5.2.4. Recent Developments

11.5.2.5. SWOT Analysis

11.5.3. Gulf Plastic Industries

11.5.3.1. Overview

11.5.3.2. Financials

11.5.3.3. Strategy

11.5.3.4. Recent Developments

11.5.3.5. SWOT Analysis

11.5.4. Jumbo Plastics Industry LLC

11.5.4.1. Overview

11.5.4.2. Financials

11.5.4.3. Strategy

11.5.4.4. Recent Developments

11.5.4.5. SWOT Analysis

11.5.5. Nice Smell Trading L.L.C

11.5.5.1. Overview

11.5.5.2. Financials

11.5.5.3. Strategy

11.5.5.4. Recent Developments

11.5.5.5. SWOT Analysis

11.5.6. Plastochem F.Z.C.

11.5.6.1. Overview

11.5.6.2. Financials

11.5.6.3. Strategy

11.5.6.4. Recent Developments

11.5.6.5. SWOT Analysis

11.5.7. Akma Packaging Industries LLC

11.5.7.1. Overview

11.5.7.2. Financials

11.5.7.3. Strategy

11.5.7.4. Recent Developments

11.5.7.5. SWOT Analysis

11.5.8. Anwar Makkah General Trading LLC

11.5.8.1. Overview

11.5.8.2. Financials

11.5.8.3. Strategy

11.5.8.4. Recent Developments

11.5.8.5. SWOT Analysis

11.5.9. STARLINK Dubai LLC- NOVA Starlink

11.5.9.1. Overview

11.5.9.2. Financials

11.5.9.3. Strategy

11.5.9.4. Recent Developments

11.5.9.5. SWOT Analysis

11.5.10. Bramani FIBC S.A.

11.5.10.1. Overview

11.5.10.2. Financials

11.5.10.3. Strategy

11.5.10.4. Recent Developments

11.5.10.5. SWOT Analysis

11.5.11. Tufbag

11.5.11.1. Overview

11.5.11.2. Financials

11.5.11.3. Strategy

11.5.11.4. Recent Developments

11.5.11.5. SWOT Analysis

11.5.12. Cape Bulk Bags

11.5.12.1. Overview

11.5.12.2. Financials

11.5.12.3. Strategy

11.5.12.4. Recent Developments

11.5.12.5. SWOT Analysis

11.5.13. Custom Bulk Bags

11.5.13.1. Overview

11.5.13.2. Financials

11.5.13.3. Strategy

11.5.13.4. Recent Developments

11.5.13.5. SWOT Analysis

11.5.14. M.G Bag CC

11.5.14.1. Overview

11.5.14.2. Financials

11.5.14.3. Strategy

11.5.14.4. Recent Developments

11.5.14.5. SWOT Analysis

11.5.15. Sunny Bag (Pty) Ltd.

11.5.15.1. Overview

11.5.15.2. Financials

11.5.15.3. Strategy

11.5.15.4. Recent Developments

11.5.15.5. SWOT Analysis

*The above list is indicative and is subject to change during the course of research

12. Assumptions and Acronyms Used

13. Research Methodology

List of Tables

Table 01: MEA Type-C Bulk Bags Market Volume (Th Units) Analysis by Capacity, 2013H-2029F

Table 02: MEA Type-C Bulk Bags Market Value (US$ Mn) Analysis by Capacity, 2013H-2029F

Table 03: MEA Type-C Bulk Bags Market Volume (Th Units) Analysis by Design, 2013H-2029F

Table 04: MEA Type-C Bulk Bags Market Value (US$ Mn) Analysis by Design, 2013H-2029F

Table 05: MEA Type-C Bulk Bags Market Volume (Th Units) Analysis by Filling and Discharge, 2013H-2029F

Table 06: MEA Type-C Bulk Bags Market Value (US$ Mn) Analysis by Filling and Discharge, 2013H-2029F

Table 07: MEA Type-C Bulk Bags Market Volume (Th Units) Analysis by End Use Industry, 2013H-2029F

Table 08: MEA Type-C Bulk Bags Market Value (US$ Mn) Analysis by End Use Industry, 2013H-2029F

Table 09: MEA Type-C Bulk Bags Market Volume (Th Units) Analysis by Country, 2013H-2029F

Table 10: MEA Type-C Bulk Bags Market Value (US$ Mn) Analysis by Country, 2013H-2029F

List of Figures

Figure 01: GDP (Nominal) in US$ Bn Country-wise Outlook (2020)

Figure 02: GDP Growth Rate (Y-o-Y), 2012–2020

Figure 03: Packaging Industry Growth Projection Before and After the Outbreak of Covid-19

Figure 04: MEA Type-C Bulk Bags Market Scenario Forecast, 2021 (E)

Figure 05: Type-C Bulk Bags Market Value (US$ Mn) Analysis and Volume (Th Units) Projection (2013H-2020A)

Figure 06: Type-C Bulk Bags Market Value (US$ Mn) Analysis and Volume (Th Units) Projection (2021E-2031F)

Figure 07: Type-C Bulk Bags Market Absolute Opportunity Analysis (US$ Mn) (2021E-2029F)

Figure 08: MEA Type-C Bulk Bags Market ASP (US$/ Th Units) by Capacity, 2020A

Figure 09: MEA Type-C Bulk Bags Market Share Analysis by Capacity, 2021E & 2029F

Figure 10: MEA Type-C Bulk Bags Market Y-o-Y Analysis by Capacity, 2019H-2029F

Figure 11: MEA Type-C Bulk Bags Market Attractiveness Analysis by Capacity, 2021E-2029F

Figure 12: MEA Type-C Bulk Bags Market Share Analysis by Design, 2021E & 2029F

Figure 13: MEA Type-C Bulk Bags Market Y-o-Y Analysis by Design, 2019H-2029F

Figure 14: MEA Type-C Bulk Bags Market Attractiveness Analysis by Design, 2021E-2029F

Figure 15: MEA Type-C Bulk Bags Market Share Analysis by Filling and Discharge, 2021E & 2029F

Figure 16: MEA Type-C Bulk Bags Market Y-o-Y Analysis by Filling and Discharge, 2019H-2029F

Figure 17: MEA Type-C Bulk Bags Market Attractiveness Analysis by Filling and Discharge, 2021E-2029F

Figure 18: MEA Type-C Bulk Bags Market Share Analysis by End Use Industry, 2021E & 2029F

Figure 19: MEA Type-C Bulk Bags Market Y-o-Y Analysis by End Use Industry, 2019H-2029F

Figure 20: MEA Type-C Bulk Bags Market Attractiveness Analysis by End Use Industry, 2021E-2029F

Figure 21: MEA Type-C Bulk Bags Market Share Analysis by Country, 2021E & 2029F

Figure 22: MEA Type-C Bulk Bags Market Y-o-Y Analysis by Country, 2019H-2029F

Figure 23: MEA Type-C Bulk Bags Market Attractiveness Analysis by Country, 2021E-2029F