Reports

Reports

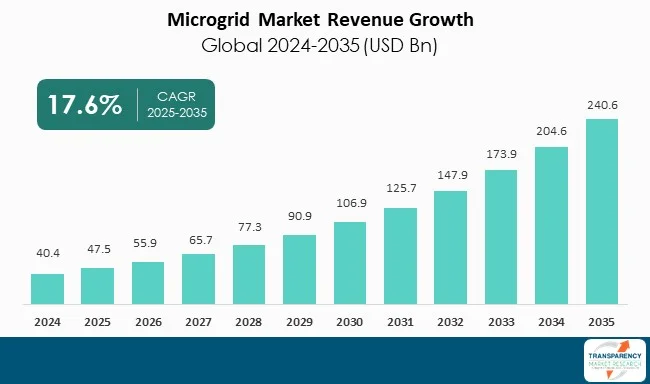

The microgrid market is anticipated to grow at a CAGR of 17.6% during the forecast period owing to the growth in adoption of renewable energy and rise in demand for energy resilience. Microgrid opens up new avenues to electricity for underserved and remote communities in many countries. Microgrids that rely on renewable energy sources, energy storage or backup generators can operate independently. Global market is anticipated to benefit from favorable government policies that help in the expansion of renewable energy projects around the world.

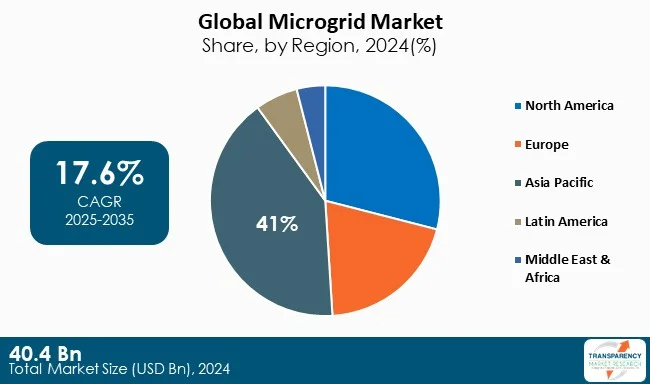

Microgrids provide back-up during disruptions in grid and they make sure of the continuous operations of critical facilities like airports, defense facilities, data centers, and hospitals, among others. Various industries and big companies are installing microgrids as part of their decarbonization goals, sustainability goals, and an attempt to reduce reliance on the main grids for electricity. Asia Pacific is the dominant region in the global microgrid market owing to large number of rural electrification projects and renewable energy integration projects in the populous countries in the region.

A microgrid is a type of energy network within a locality that is capable of operating in tandem with a major power grid or independently. A microgrid basically integrates distributed energy resources such as wind turbines, solar panels, backup generators, and energy storage. As the energy landscape has changed today, microgrids have become a smart way to bolster energy efficiency, security, and sustainability, particularly in areas with grid reliability issues or increased use of renewables.

The main advantage of microgrids is resilience and reliability. Their innate ability of providing back-up power during a grid outage ensures that critical facilities such as hospitals, airports, data centers, and military bases can continue operations without interruption.

Microgrids help with cost optimization through load balancing and onsite offtake of renewable energy, thereby helping organizations save on their energy expense. Microgrids aid organizations achieve their sustainability goals through maximizing renewable energy use and cutting down on carbon emissions, rendering these systems the foundation of corporate ESG efforts and formal decarbonization plans.

Microgrids are utilized across multiple sectors, including industry campuses, remote communities, universities, military bases, and areas susceptible to natural disasters, where reliability is the most important factor when deploying energy resources. The advancements in the form of digitalization and smart-grid development have led microgrids to include more embedded controls and analytical capabilities, which will make microgrids an important facilitator of the global energy systems moving away from centralized, federally regulated generation to decentralized, clean, and resilient systems.

| Attribute | Detail |

|---|---|

| Microgrid Market Drivers |

|

Factors including transition toward renewable energy and declining fossil fuel dependency include growing commitment by government and corporations to meet decarbonization targets, both of which are propelling the global microgrid market.

Microgrids take on a unique role; in that they use renewable resources including solar, wind, and small-scale hydro in a localized power grid to strictly define the scope of a community or business to move away from fossil fuels and decouples energy security. The International Energy Agency (IEA) determined that renewables accounted for nearly 30% share of global electricity generation in 2023, and the IEA is expecting renewables to exceed 42% by 2030, thereby creating a strong rationale for microgrids as fundamental accelerators of distributed clean energy deployment.

Governments across the globe are rolling out ambitious decarbonization strategies, creating catalysts for greater adoption of microgrids. The European Union's "Fit for 55" package is an effort seeking to reduce greenhouse gas emissions by 55% by 2030, and has induced investment in decentralization renewable energy infrastructure. The U.S. Department of Energy has earmarked over US$ 10.5 Bn toward grid modernization and clean energy projects, part of which is being used for microgrids including the ones with solar, wind, and energy storage. In Asia, India is creating an energy revolution regarding rural electrification with more than 1,000 solar microgrids generating reliable electricity to millions of people in off grid villages.

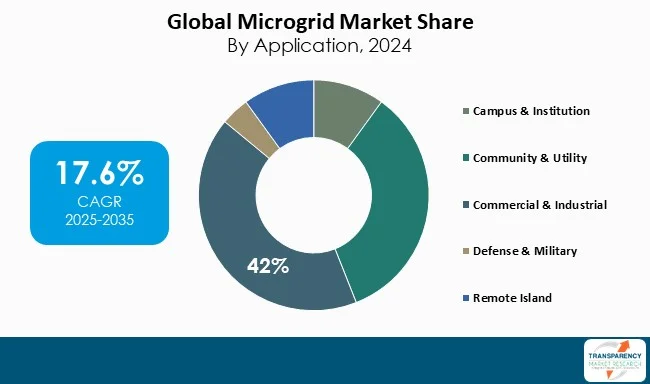

Microgrids have the broadest application in the commercial & industrial (C&I) sector and represent the biggest component of global microgrid installations. This leadership is due, in part, to industries like manufacturing, mining, oil & gas, or data centers having a larger demand for energy, longer operational continuity requirements, and/or sustainability objectives. The few large-scale industrial users that have begun adopting solar-plus-storage microgrids have reported electricity savings of 20–30%, as well as reduced risk during power outages.

International corporations are investing in C&I microgrids to meet decarbonization pledges. Companies like Google, Amazon, and Microsoft have installed renewable powered microgrids at their data centers to meet their goal of 100% renewable energy. Corporations engaged in heavy industries are also using hybrid microgrids to limit their carbon footprint. In regions like North America and Asia Pacific, where some of the highest levels of consumption are witnessed, C&I will remain the leading driver of global microgrid adoption, e.g. energy resilience coupled with long-term cost reductions.

| Attribute | Detail |

|---|---|

| Leading Region | Asia Pacific is the leading region in the Microgrid market |

The global microgrid market is mostly led by Asia-Pacific and North America, especially with deployment and innovation. Asia-Pacific has been the fastest growing and a predominating region. As our current report demonstrates, Asia-Pacific is at least a few years ahead of North America predicated by large-scale rural electrification programs and the incorporation of renewable energy sources. India has deployed more than 1,000 solar microgrids to power isolated villages, and China is handsomely investing in hybrid microgrid as part of its clean energy transition strategy. Japan, focusing on disaster resilience, positioned microgrids into its community infrastructures following Fukushima. In North America (that is not dependent on renewable adoption), the clear demand for resilience and security has created a significant share of the microgrid industry. With over 460 operational microgrids while providing over 3.5 GW of capacity to mainly industrial, commercial and military facilities, and increasing or setting targets for renewables and corporate sustainability, Asia-Pacific and North America will continue to be the engine driving global microgrid growth.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 40.4 Bn |

| Market Forecast Value in 2035 | US$ 240.6 Bn |

| Growth Rate (CAGR) | 17.6% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value & MW for Capacity |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Microgrid market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The microgrid market was valued at US$ 40.4 Bn in 2024

The microgrid industry is expected to grow at a CAGR of 17.6% from 2025 to 2035

Growing demand for energy resilience and reliability, and rising adoption of renewable energy and decarbonization goals

Commercial and Industrial was the largest application segment in the microgrid market.

Asia Pacific was the most lucrative region in 2024

ABB Ltd, Siemens AG, General Electric, Eaton, Schneider Electric, Honeywell International Inc, ENGIE EPS S.A., Ameresco, Bloom Energy, Pareto Energy Limited, Toshiba Corporation, Duke Energy Corporation, and Power Analytics Corporation are the major companies in the global microgrid market.

Table 1 Global Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 2 Global Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 3 Global Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 4 Global Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 5 Global Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 6 Global Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 7 Global Microgrid Market Capacity (MW) Forecast, by Region, 2025 to 2035

Table 8 Global Microgrid Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 10 North America Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 11 North America Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 12 North America Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 13 North America Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 14 North America Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 15 North America Microgrid Market Capacity (MW) Forecast, by Country, 2025 to 2035

Table 16 North America Microgrid Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 18 U.S. Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 19 U.S. Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 20 U.S. Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 21 U.S. Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 22 U.S. Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 23 Canada Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 24 Canada Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 25 Canada Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 26 Canada Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 27 Canada Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 28 Canada Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 29 Europe Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 30 Europe Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 31 Europe Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 32 Europe Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 33 Europe Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 34 Europe Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 35 Europe Microgrid Market Capacity (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 38 Germany Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 39 Germany Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 40 Germany Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 41 Germany Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 42 Germany Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 43 France Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 44 France Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 45 France Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 46 France Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 47 France Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 48 France Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 49 U.K. Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 50 U.K. Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 51 U.K. Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 52 U.K. Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 53 U.K. Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 54 U.K. Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 55 Italy Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 56 Italy Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 57 Italy Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 58 Italy Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 59 Italy Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 60 Italy Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 61 Spain Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 62 Spain Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 63 Spain Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 64 Spain Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 65 Spain Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 66 Spain Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 67 Russia & CIS Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 68 Russia & CIS Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 69 Russia & CIS Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 70 Russia & CIS Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 71 Russia & CIS Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 72 Russia & CIS Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 73 Rest of Europe Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 74 Rest of Europe Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 75 Rest of Europe Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 76 Rest of Europe Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 77 Rest of Europe Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 78 Rest of Europe Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 79 Asia Pacific Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 80 Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 81 Asia Pacific Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 82 Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 83 Asia Pacific Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 84 Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 85 Asia Pacific Microgrid Market Capacity (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 88 China Microgrid Market Value (US$ Bn) Forecast, by Component 2025 to 2035

Table 89 China Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 90 China Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 91 China Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 92 China Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 93 Japan Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 94 Japan Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 95 Japan Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 96 Japan Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 97 Japan Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 98 Japan Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 99 India Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 100 India Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 101 India Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 102 India Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 103 India Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 104 India Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 105 India Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 106 India Microgrid Market Value (US$ Bn) Forecast, by Application 2025 to 2035

Table 107 ASEAN Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 108 ASEAN Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 109 ASEAN Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 110 ASEAN Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 111 ASEAN Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 112 ASEAN Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 113 Rest of Asia Pacific Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 114 Rest of Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 115 Rest of Asia Pacific Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 116 Rest of Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 117 Rest of Asia Pacific Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 118 Rest of Asia Pacific Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 119 Latin America Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 120 Latin America Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 121 Latin America Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 122 Latin America Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 123 Latin America Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 124 Latin America Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 125 Latin America Microgrid Market Capacity (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 128 Brazil Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 129 Brazil Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 130 Brazil Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 131 Brazil Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 132 Brazil Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 133 Mexico Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 134 Mexico Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 135 Mexico Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 136 Mexico Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 137 Mexico Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 138 Mexico Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 139 Rest of Latin America Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 140 Rest of Latin America Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 141 Rest of Latin America Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 142 Rest of Latin America Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 143 Rest of Latin America Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 144 Rest of Latin America Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 145 Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 146 Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 147 Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 148 Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 149 Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 150 Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 151 Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 154 GCC Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 155 GCC Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 156 GCC Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 157 GCC Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 158 GCC Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 159 South Africa Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 160 South Africa Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 161 South Africa Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 162 South Africa Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 163 South Africa Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 164 South Africa Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 165 Rest of Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Component, 2025 to 2035

Table 166 Rest of Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Component, 2025 to 2035

Table 167 Rest of Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Connectivity, 2025 to 2035

Table 168 Rest of Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Connectivity, 2025 to 2035

Table 169 Rest of Middle East & Africa Microgrid Market Capacity (MW) Forecast, by Application, 2025 to 2035

Table 170 Rest of Middle East & Africa Microgrid Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Figure 1 Global Microgrid Market Value Share Analysis, by Component, 2024, 2028, and 2035

Figure 2 Global Microgrid Market Attractiveness, by Component

Figure 3 Global Microgrid Market Value Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 4 Global Microgrid Market Attractiveness, by Connectivity

Figure 5 Global Microgrid Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Microgrid Market Attractiveness, by Application

Figure 7 Global Microgrid Market Value Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Microgrid Market Attractiveness, by Region

Figure 9 North America Microgrid Market Value Share Analysis, by Component, 2024, 2028, and 2035

Figure 10 North America Microgrid Market Attractiveness, by Component

Figure 11 North America Microgrid Market Value Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 12 North America Microgrid Market Attractiveness, by Connectivity

Figure 13 North America Microgrid Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 14 North America Microgrid Market Attractiveness, by Application

Figure 15 North America Microgrid Market Attractiveness, by Country and Sub-region

Figure 16 Europe Microgrid Market Value Share Analysis, by Component, 2024, 2028, and 2035

Figure 17 Europe Microgrid Market Attractiveness, by Component

Figure 18 Europe Microgrid Market Value Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 19 Europe Microgrid Market Attractiveness, by Connectivity

Figure 20 Europe Microgrid Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 21 Europe Microgrid Market Attractiveness, by Application

Figure 22 Europe Microgrid Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 23 Europe Microgrid Market Attractiveness, by Country and Sub-region

Figure 24 Asia Pacific Microgrid Market Value Share Analysis, by Component, 2024, 2028, and 2035

Figure 25 Asia Pacific Microgrid Market Attractiveness, by Component

Figure 26 Asia Pacific Microgrid Market Value Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 27 Asia Pacific Microgrid Market Attractiveness, by Connectivity

Figure 28 Asia Pacific Microgrid Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 29 Asia Pacific Microgrid Market Attractiveness, by Application

Figure 30 Asia Pacific Microgrid Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 31 Asia Pacific Microgrid Market Attractiveness, by Country and Sub-region

Figure 32 Latin America Microgrid Market Value Share Analysis, by Component, 2024, 2028, and 2035

Figure 33 Latin America Microgrid Market Attractiveness, by Component

Figure 34 Latin America Microgrid Market Value Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 35 Latin America Microgrid Market Attractiveness, by Connectivity

Figure 36 Latin America Microgrid Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 37 Latin America Microgrid Market Attractiveness, by Application

Figure 38 Latin America Microgrid Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Latin America Microgrid Market Attractiveness, by Country and Sub-region

Figure 40 Middle East & Africa Microgrid Market Value Share Analysis, by Component, 2024, 2028, and 2035

Figure 41 Middle East & Africa Microgrid Market Attractiveness, by Component

Figure 42 Middle East & Africa Microgrid Market Value Share Analysis, by Connectivity, 2024, 2028, and 2035

Figure 43 Middle East & Africa Microgrid Market Attractiveness, by Connectivity

Figure 44 Middle East & Africa Microgrid Market Value Share Analysis, by Application, 2024, 2028, and 2035

Figure 45 Middle East & Africa Microgrid Market Attractiveness, by Application

Figure 46 Middle East & Africa Microgrid Market Value Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 47 Middle East & Africa Microgrid Market Attractiveness, by Country and Sub-region