Reports

Reports

Analysts’ Viewpoint on Lipids Market Scenario

Several global and regional firms compete in the global lipids market. Manufacturers are investing significantly in R&D to create innovative products that meet the rising demand for lipids. Moreover, domestic manufacturers dominate their respective regional markets. Thus, global manufacturers are collaborating with regional players in order to increase their business reach in their respective regions. Manufacturers have been compelled to create customized lipid products as a result of changing trends in the food & beverages sector as well as ongoing research & advancements in the pharmaceutical industry. The lipids market continues to remain fragmented, with many global and regional companies contending for market share. Leading players are investing substantially in research and development of green lipids products to maintain a competitive edge.

Lipids are organic compounds in the form of fats, oils, and hormones that are insoluble in water, and are being extensively used in the pharmaceutical, food, and cosmetics & personal care industries. However, growth in chronic and lifestyle-related diseases is triggering the demand for lipid-based drug delivery systems. Companies in the lipids market are establishing stable revenue streams by expanding output capacities for pharmaceutical lipids.

Manufacturers are diversifying the production of functional lipids such as omega-3, phytosterols, and conjugated linoleic acids that help in the management of bone health, blood pressure, and cardiovascular health. Functional lipids such as carotenoids and numerous other compounds are widely used as bioactive ingredients in various food products.

Manufacturers in the lipids market are maintaining optimum inventory levels to ensure a robust supply of lipid products amid coronavirus crisis. They are increasing their local production capabilities to reduce dependence on other countries for raw materials. Companies are entering into mergers and acquisitions (M&As) in order to increase their business reach before making in-roads in new regions.

Chemical companies are focusing on mission-critical applications in the pharmaceutical and food industries to keep the economies running. Domestic and global companies are in the midst of rapid shift in supply chain planning, operations, and inventory management to address the impact of the pandemic.

Innovations in nutritional lipids are being achieved with the help of collaborative efforts of international experts at the forefront of lipid science and technology. However, usage of lipids in nutraceuticals is being met with challenges due to research gaps and lack of a single international regulatory framework.

Solid lipid nanoparticles and nanostructured lipid carriers hold promising potentials to transform the nutraceuticals landscape. However, lipid nutrition is under scrutiny due to lack of research for separation techniques of complex matrix such as food. Hence, continuous investment in R&D and collaboration with regulatory authorities is emerging as a promising strategy to commercialize lipid nutrition. Nevertheless, functional medium chain lipids are being used as transporters, bioavailability enhancers, solubilizers, emulsifiers, and energy sources in nutraceutical products.

Manufacturers in the lipids market are boosting the production for glycerophospholipids, also known as lecithins. These lecithins are being used as food emulsifiers and surface active agents for altering viscosity and crystallization properties. Furthermore, species of nannochloropsis have become very popular for studies of lipid production for the manufacture of long-chain polyunsaturated fatty acids and biofuels. Attempts are underway to commercialize nannochloropsis-derived lipids. As such, these lipids are being used for the production of terrestrial and aquatic animal feed. Such trends are contributing to the expansion of the global lipids market.

In addition, there is a high demand for lipids in the personal care industry. The growing demand for cosmeceuticals is triggering innovations in lipid formulations. In recent years, complex lipids used in cosmetic formulations are often obtained from plant or biotechnology origin, making it possible to develop new extraction techniques and methods to promote oilseed crops.

Manufacturers in the lipids market are diversifying the production of mannosylerythritol lipids (MEL) that are being utilized in the production of topical moisturizers that can repair damaged hair. Furthermore, these compounds exhibit both healing and protective properties to activate fibroblasts & papilla cells that act as natural antioxidants.

The ever-expanding pharmaceutical industry in India is benefitting participants in the global lipids market. Customized lipid products are being preferred in the pharmaceutical and food & beverages (F&B) sectors. In order to gain a competitive edge, manufacturers in the lipids market are increasing innovations and R&D in green lipids. This is evident since Asia Pacific is estimated to account for more than 40% volume share among all regions. Moreover, China is expected to dictate a high revenue share of the market of lipids, owing to a surge in demand for personal care & cosmetics products and rise in per capita income.

Rise in awareness about healthy lifestyle and personal hygiene has positively impacted the demand for lipid products in North America and Europe.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 19.4 Bn |

|

Market Forecast Value in 2031 |

US$ 29.9 Bn |

|

Growth Rate (CAGR) |

4.3% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

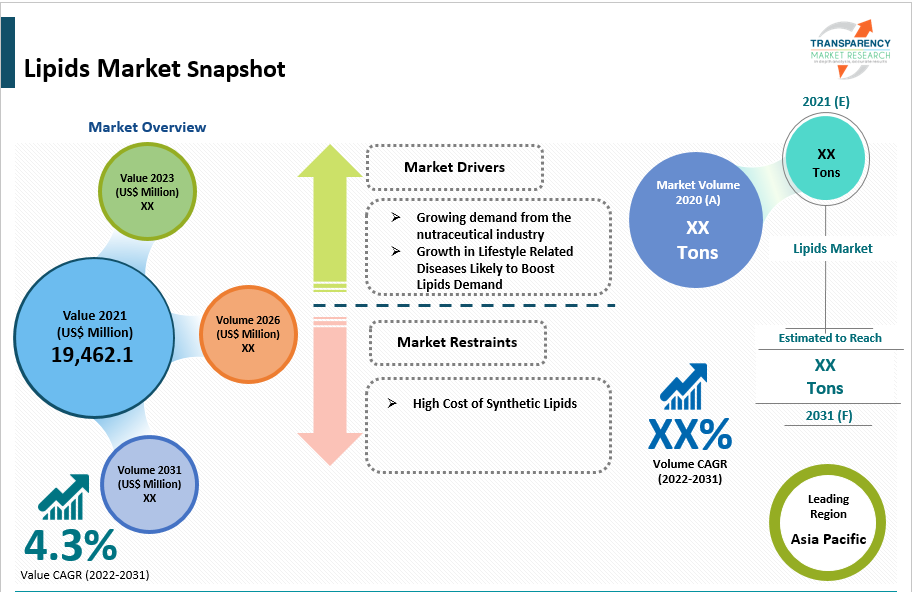

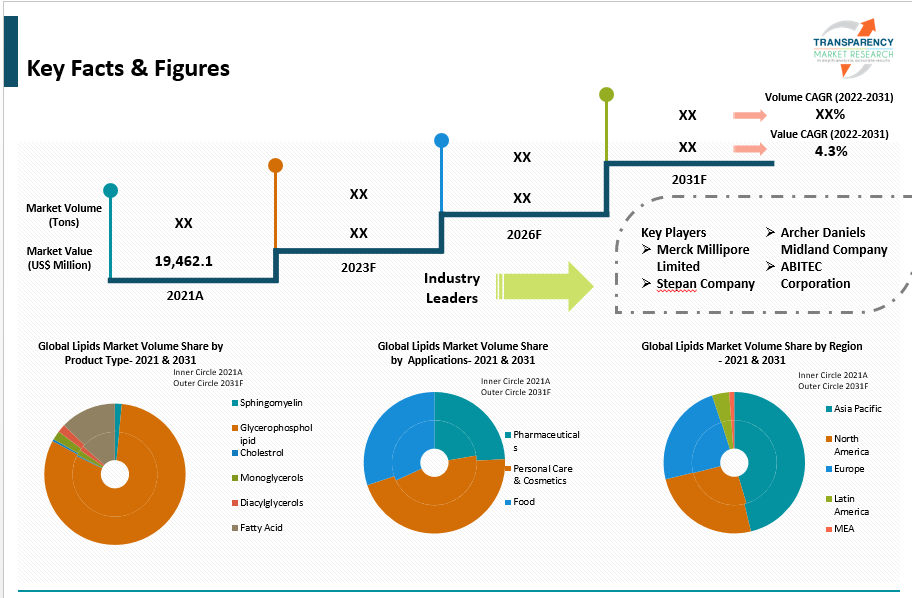

The market size of lipids stood at US$ 19,462.1 Mn in 2021.

The lipids market is expected to expand at a CAGR of 4.3% from 2022 to 2031.

High demand for lipids in the personal care & cosmetics industry and rise in adoption of healthy lifestyle are key factors that are driving the lipids market.

The personal care & cosmetics segment accounted for major share of 46% of the lipids market in 2021.

Asia Pacific is a most attractive region for vendors in the lipids market.

Key players operating in the lipids market include Archer Daniels Midland Company, Merck Millipore Limited, Stepan Company, NOF Corporation, Abitec Corporation, Avanti Polar Lipids Inc., Cayman Chemical Company, Cordenpharma International, Chemi S.P.A., Matreya Llc, Tokyo Chemical Industry Co., Ltd, and Lipoid GmbH.

1. Executive Summary

1.1. Lipids Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Raw Material Providers

2.6.2. List of Key Manufacturers

2.6.3. List of Suppliers/ Distributors

2.6.4. List of Potential Customers

3. COVID-19 Impact Analysis

4. Production Output Analysis, 2021

5. Price Trend Analysis

6. Global Lipids Market Analysis and Forecast, by Product Type, 2022–2031

6.1. Introduction and Definitions

6.2. Global Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

6.2.1. Sphingomyelin

6.2.2. Glycerophospholipid

6.2.3. Cholesterol

6.2.4. Monoglycerols

6.2.5. Diacylglycerols

6.2.6. Fatty Acid

6.3. Global Lipids Market Attractiveness, by Product Type

7. Global Lipids Market Analysis and Forecast, by Application, 2022–2031

7.1. Introduction and Definitions

7.2. Global Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.2.1. Pharmaceuticals

7.2.2. Personal Care & Cosmetics

7.2.3. Food

7.3. Global Lipids Market Attractiveness, by Application

8. Global Lipids Market Analysis and Forecast, by Region, 2022–2031

8.1. Key Findings

8.2. Global Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. Latin America

8.3. Global Lipids Market Attractiveness, by Region

9. North America Lipids Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. North America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

9.3. North America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.4. North America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

9.4.1. U.S. Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

9.4.2. U.S. Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.4.3. Canada Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

9.4.4. Canada Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.5. North America Lipids Market Attractiveness Analysis

10. Europe Lipids Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Europe Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

10.3. Europe Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. Europe Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

10.4.1. Germany Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2022–2031

10.4.2. Germany Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.3. France Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

10.4.4. France Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.5. U.K. Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

10.4.6. U.K. Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.7. Italy Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

10.4.8. Italy Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.9. Russia & CIS Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

10.4.10. Russia & CIS Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4.11. Rest of Europe Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

10.4.12. Rest of Europe Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.5. Europe Lipids Market Attractiveness Analysis

11. Asia Pacific Lipids Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Asia Pacific Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type

11.3. Asia Pacific Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.4. Asia Pacific Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.4.1. China Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

11.4.2. China Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.4.3. Japan Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

11.4.4. Japan Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.4.5. India Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

11.4.6. India Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.4.7. ASEAN Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

11.4.8. ASEAN Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.4.9. Rest of Asia Pacific Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

11.4.10. Rest of Asia Pacific Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.5. Asia Pacific Lipids Market Attractiveness Analysis

12. Latin America Lipids Market Analysis and Forecast, 2022–2031

12.1. Key Findings

12.2. Latin America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

12.3. Latin America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.4. Latin America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.4.1. Brazil Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

12.4.2. Brazil Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.4.3. Mexico Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

12.4.4. Mexico Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.4.5. Rest of Latin America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

12.4.6. Rest of Latin America Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

12.5. Latin America Lipids Market Attractiveness Analysis

13. Middle East & Africa Lipids Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Middle East & Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

13.3. Middle East & Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.4. Middle East & Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.4.1. GCC Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

13.4.2. GCC Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.4.3. South Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

13.4.4. South Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.4.5. Rest of Middle East & Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2022–2031

13.4.6. Rest of Middle East & Africa Lipids Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

13.5. Middle East & Africa Lipids Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Lipids Company Market Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Archer Daniels Midland Company

14.2.1.1. Company Description

14.2.1.2. Business Overview

14.2.1.3. Financial Overview

14.2.1.4. Strategic Overview

14.2.2. Stepan Company

14.2.2.1. Company Description

14.2.2.2. Business Overview

14.2.2.3. Financial Overview

14.2.2.4. Strategic Overview

14.2.3. NOF CORPORATION

14.2.3.1. Company Description

14.2.3.2. Business Overview

14.2.3.3. Financial Overview

14.2.3.4. Strategic Overview

14.2.4. Merck Millipore Limited

14.2.4.1. Company Description

14.2.4.2. Business Overview

14.2.4.3. Financial Overview

14.2.4.4. Strategic Overview

14.2.5. Avanti Polar Lipids Inc.

14.2.5.1. Company Description

14.2.5.2. Business Overview

14.2.5.3. Financial Overview

14.2.5.4. Strategic Overview

14.2.6. Cayman Chemical Company.

14.2.6.1. Company Description

14.2.6.2. Business Overview

14.2.6.3. Financial Overview

14.2.6.4. Strategic Overview

14.2.7. ABITEC Corporation

14.2.7.1. Company Description

14.2.7.2. Business Overview

14.2.7.3. Financial Overview

14.2.7.4. Strategic Overview

14.2.8. ABITEC Corporation.

14.2.8.1. Company Description

14.2.8.2. Business Overview

14.2.8.3. Financial Overview

14.2.8.4. Strategic Overview

14.2.9. CHEMI S.P.A.

14.2.9.1. Company Description

14.2.9.2. Business Overview

14.2.9.3. Financial Overview

14.2.9.4. Strategic Overview

14.2.10. Lipoid GmbH

14.2.10.1. Company Description

14.2.10.2. Business Overview

14.2.10.3. Financial Overview

14.2.10.4. Strategic Overview

14.2.11. Matreya, LLC

14.2.11.1. Company Description

14.2.11.2. Business Overview

14.2.11.3. Financial Overview

14.2.11.4. Strategic Overview

14.2.12. Tokyo Chemical Industry Co., Ltd

14.2.12.1. Company Description

14.2.12.2. Business Overview

14.2.12.3. Financial Overview

14.2.12.4. Strategic Overview

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 2: Global Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 3: Global Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 4: Global Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 5: Global Lipids Market Volume (Tons) Forecast, by Region, 2022–2031

Table 6: Global Lipids Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 7: North America Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 8: North America Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 9: North America Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 10: North America Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: North America Lipids Market Volume (Tons) Forecast, by Country, 2022–2031

Table 12: North America Lipids Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 13: U.S. Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 14: U.S. Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 15: U.S. Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 16: U.S. Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 17: Canada Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 18: Canada Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 19: Canada Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 20: Canada Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 21: Europe Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 22: Europe Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 23: Europe Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 24: Europe Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 25: Europe Lipids Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Lipids Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 28: Germany Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 29: Germany Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 30: Germany Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 31: France Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 32: France Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 33: France Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 34: France Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 35: U.K. Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 36: U.K. Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 37: U.K. Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 38: U.K. Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 39: Italy Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 40: Italy Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 41: Italy Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 42: Italy Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 43: Spain Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 44: Spain Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 45: Spain Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 46: Spain Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 47: Russia & CIS Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 48: Russia & CIS Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 49: Russia & CIS Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 50: Russia & CIS Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 51: Rest of Europe Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 52: Rest of Europe Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 53: Rest of Europe Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Europe Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 55: Asia Pacific Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 56: Asia Pacific Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 57: Asia Pacific Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 58: Asia Pacific Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 59: Asia Pacific Lipids Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Lipids Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 62: China Lipids Market Value (US$ Mn) Forecast, by Product Type 2022–2031

Table 63: China Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 64: China Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 65: Japan Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 66: Japan Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 67: Japan Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 68: Japan Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 69: India Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 70: India Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 71: India Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 72: India Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 73: India Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 74: India Lipids Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 75: ASEAN Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 76: ASEAN Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 77: ASEAN Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 78: ASEAN Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 79: Rest of Asia Pacific Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 80: Rest of Asia Pacific Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 81: Rest of Asia Pacific Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 82: Rest of Asia Pacific Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 83: Latin America Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 84: Latin America Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 85: Latin America Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 86: Latin America Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 87: Latin America Lipids Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 88: Latin America Lipids Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 89: Brazil Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 90: Brazil Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 91: Brazil Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 92: Brazil Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 93: Mexico Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 94: Mexico Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 95: Mexico Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 96: Mexico Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 97: Rest of Latin America Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 98: Rest of Latin America Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 99: Rest of Latin America Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 100: Rest of Latin America Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 101: Middle East & Africa Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 102: Middle East & Africa Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 103: Middle East & Africa Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 104: Middle East & Africa Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 105: Middle East & Africa Lipids Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 106: Middle East & Africa Lipids Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 107: GCC Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 108: GCC Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 109: GCC Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 110: GCC Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 111: South Africa Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 112: South Africa Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 113: South Africa Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 114: South Africa Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 115: Rest of Middle East & Africa Lipids Market Volume (Tons) Forecast, by Product Type, 2022–2031

Table 116: Rest of Middle East & Africa Lipids Market Value (US$ Mn) Forecast, by Product Type, 2022–2031

Table 117: Rest of Middle East & Africa Lipids Market Volume (Tons) Forecast, by Application, 2022–2031

Table 118: Rest of Middle East & Africa Lipids Market Value (US$ Mn) Forecast, by Application, 2022–2031

List of Figures

Figure 1: Global Lipids Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 2: Global Lipids Market Attractiveness, by Product Type

Figure 3: Global Lipids Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 4: Global Lipids Market Attractiveness, by Application

Figure 5: Global Lipids Market Volume Share Analysis, by Region, 2022, 2025, and 2031

Figure 6: Global Lipids Market Attractiveness, by Region

Figure 7: North America Lipids Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 8: North America Lipids Market Attractiveness, by Product Type

Figure 9: North America Lipids Market Attractiveness, by Product Type

Figure 10: North America Lipids Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 11: North America Lipids Market Attractiveness, by Application

Figure 12: North America Lipids Market Attractiveness, by Country

Figure 13: Europe Lipids Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 14: Europe Lipids Market Attractiveness, by Product Type

Figure 15: Europe Lipids Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 16: Europe Lipids Market Attractiveness, by Application

Figure 17: Europe Lipids Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 18: Europe Lipids Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Lipids Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 20: Asia Pacific Lipids Market Attractiveness, by Product Type

Figure 21: Asia Pacific Lipids Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 22: Asia Pacific Lipids Market Attractiveness, by Application

Figure 23: Asia Pacific Lipids Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 24: Asia Pacific Lipids Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Lipids Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 26: Latin America Lipids Market Attractiveness, by Product Type

Figure 27: Latin America Lipids Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 28: Latin America Lipids Market Attractiveness, by Application

Figure 29: Latin America Lipids Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 30: Latin America Lipids Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Lipids Market Volume Share Analysis, by Product Type, 2022, 2025, and 2031

Figure 32: Middle East & Africa Lipids Market Attractiveness, by Product Type

Figure 33: Middle East & Africa Lipids Market Volume Share Analysis, by Application, 2022, 2025, and 2031

Figure 34: Middle East & Africa Lipids Market Attractiveness, by Application

Figure 35: Middle East & Africa Lipids Market Volume Share Analysis, by Country and Sub-region, 2022, 2025, and 2031

Figure 36: Middle East & Africa Lipids Market Attractiveness, by Country and Sub-region