Reports

Reports

Analysts’ Viewpoint on IoT Connected Machine Market Scenario

Connected IoT devices are increasingly being adopted in various industries to mitigate tedious manual processes and meet the rising customer demand for digitized experiences. Increase in machine–to–machine (M2M) applications in the automotive sector for vehicle tracking, vehicle-to-vehicle (V2V) and vehicle-to-infrastructure applications, traffic control, and fleet management is driving the IoT connected machines market. Growth in the healthcare industry is estimated to augment the demand for IoT, as data collected from IoT can help physicians identify the best treatment process for better patient outcomes. Additionally, several large IoT-focused acquisitions, including that of companies concentrating on IoT software and semiconductor chips, AI, and analytics, are anticipated to fuel the market. Introduction of smart city projects in economies such as India, Berlin, and the Netherlands is likely to provide lucrative opportunities for players offering connected IoT products.

Internet of Things (IoT) connected machines and appliances rely on a computing concept, which turns devices into connected devices by a connection through the internet. IoT connected machines include machine-to-machine (M2M) and industrial communication technologies with automated applications. IoT connected machines are used to monitor and analyze real-time data. IoT connected machines are also considered a fundamental requirement for digital manufacturing and for connecting all the industrial assets with machines and control systems. Sensors and connected devices gather a large amount of data, which is fed to analytics solutions in order to analyze the process and increase operational efficiency. Additionally, the rapidly changing demand from consumers has fueled the need for smart manufacturing. Application of IoT connected machines enhances production efficiency and offers the solution and services required for smart manufacturing.

Digital innovations are fundamentally transforming manufacturing operations, medical device monitoring, and vehicle connectivity. The connected system enables the machine to exchange information and execute processes autonomously. This results in time-effective and agile decision-making. IoT helps manufacturers streamline, collapse, and create system architecture in a more responsive, effective, and affordable manner. Additionally, IoT assists in communication and interaction of several industrial devices, aided by sensors and actuators, to provide manufacturers with flexibility in production and optimal performance. Thus, rise in usage of IoT connected machines in various industrial sectors is expected to drive the market.

Businesses are increasingly leveraging cloud platforms to make their operations agile, scalable, and flexible. The cloud computing infrastructure enables IoT to give meaning to the expandable volume of data generated. The range of services offered by cloud computing platforms includes data storage, processing, and analyzing. IoT can benefit M2M infrastructure with unlimited storage capabilities and resources of the cloud to compensate for its technological constraints such as processing, storage, and low energy transmission. For instance, Azure IoT edge for Linux on Windows (EFLOW) helps run cloud-native workloads on Windows IoT in production deployment. The cloud technology also offers solutions to implement IoT connected machines service management and applications that can process the data produced. Thus, increase in usage of cloud computing is expected to augment the Internet of Things (IoT) connected machines market.

Deployment of 5G technology has led to a wave of IoT applications, thereby increasing the IoT market share. The 5G IoT reaches new dimensions, connecting a large number of IoT devices at a higher speed. It has introduced a lower latency that has benefited industrial plants by increasing the use of sensors. Smart traffic mobility, smart grid automation, and smart parking technologies are a some of the other solutions that are evident to quantify and predict the material impact of 5G and IoT. For instance, Ericsson AB’s Mobility Report predicts that there will be 550 million 5G subscriptions in 2022. This, in turn, is helping 5G to spur innovation across various industries, thus enabling the deployment of emergent technologies (IoT). Furthermore, growth of AI, development of big data technology, and innovative implication of machine learning language (ML) and machine-to-person (M2P) are other factors expected to drive the market. Rise in investment in development of technologies is likely to positively impact the market during the forecast period. For instance, Samsung Electronics invested around US$ 22 Bn for the development of AI and 5G technology in 2018.

IoT connected machines in the healthcare sector are projected to offer an opportunity to tailor their cognitive data analysis platform by placing major emphasis on health-related services and products. This data analysis is expected to optimize organizational performance, have better customer engagement, and gain cost efficiencies by effectively managing patients through enhanced decision-making. Using IoT connected machines is likely to provide an opportunity to offer quality and contactless patient care. For instance, in China, the 5G-powered police patrol robot by Guangzhou Gosuncn Robot Co., Ltd uses Advantech’s MIC-770 Edge Computer to monitor body temperature and mask-wearing. Additionally, IoT connected devices forecast a rise in popularity of IoT wearable devices.

Embedded and wearable medical devices help trial administrators to better understand the risks of specific drugs and their efficacy while performing clinical trials. Along with gaining a better understanding of the subject’s response, they also enable them to take proactive action when a negative outcome is predicted or identified. Additionally, IoT connected devices are tagged with sensors in order to track the real-time location of the medical equipment such as wheelchairs, oxygen pumps, and defibrillators in a hospital. IoT devices are also used in environment monitoring and asset management such as pharmacy inventory control.

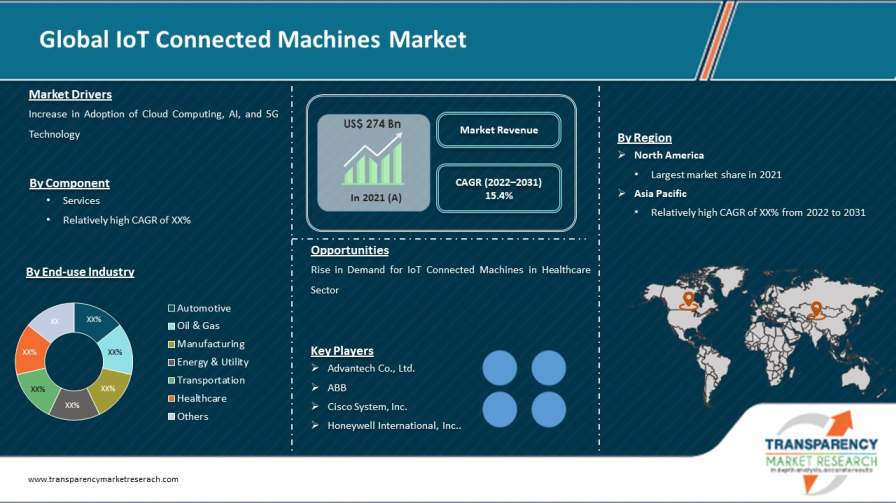

North America is anticipated to account for dominant share of the global IoT connected machines market during the forecast period. Rise in demand for improved diagnostic facilities, owing to the proliferation of big data analytics, is expected to drive the market in the region. Rise in mobile application of IoT in health monitoring devices is another factor augmenting the market in North America.

The IoT connected machines market in Asia Pacific is expected to grow at the highest CAGR during the forecast period owing to the increase in adoption rate of IoT connected machines in the region. For instance, in 2017, the Government of China reported the installation of around 278 million IoT devices in the country and increased the focus on building a strong IoT network site.

Detailed profiles of companies offering IoT connected machines have been provided in the market report to evaluate their financials, key product offerings, recent developments, and strategies. Top IoT device companies are expanding their product portfolio to increase their market share. Key players operating in the global IoT connected machine market are Advantech Co., Ltd., AT&T, ABB, Beckhoff Automation, Cisco Systems, Inc., Dell Inc., General Electric, Honeywell International, Inc., IBM, Robert Bosch GmbH, Rockwell Automation, Inc., Schneider Electric, and Siemens.

Each of these players has been profiled in the IoT connected machines market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 274 Bn |

|

Market Forecast Value in 2031 |

US$ 1.10 Trn |

|

Growth Rate (CAGR) |

15.4% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2016–2020 |

|

Quantitative Units |

US$ Bn/Trn for Value |

|

Market Analysis |

Includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The IoT-connected machines market is expected to reach US$ 1.10 Trn by 2031.

The IoT-connected market is estimated to grow at a CAGR of 15.4% during the forecast period.

Increase in adoption of cloud computing, AI, and 5G technology.

Hardware was the largest segment of the IoT-connected connected machines market in 2021.

North America is the dominant region for vendors in the IoT connected machines market.

Advantech Co., Ltd., AT&T, ABB, Beckhoff Automation, Cisco Systems, Inc., Dell Inc., General Electric, Honeywell International, Inc., IBM, Robert Bosch GmbH, Rockwell Automation, Inc., Schneider Electric, and Siemens.

1. Preface

1.1. Market Introduction

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions and Research Methodology

2.1. Research Methodology

2.1.1. List of Primary and Secondary Sources

2.2. Key Assumptions for Data Modeling

3. Executive Summary: Global IoT Connected Machines Market

4. Market Overview

4.1. Market Definition

4.2. Technology/ Product Roadmap

4.3. Market Factor Analysis

4.3.1. Forecast Factors

4.3.2. Ecosystem/Value Chain Analysis

4.3.3. Market Dynamics (Growth Influencers)

4.3.3.1. Drivers

4.3.3.2. Restraints

4.3.3.3. Opportunities

4.3.3.4. Impact Analysis of Drivers and Restraints

4.4. COVID-19 Impact Analysis

4.4.1. Impact of COVID-19 on IoT Connected Machines Market

4.4.2. End-user Sentiment Analysis: Comparative Analysis on Spending

4.4.2.1. Increase in Spending

4.4.2.2. Decrease in Spending

4.4.3. Short Term and Long Term Impact on the Market

4.5. Market Opportunity Assessment – by Region (North America/Europe/Asia Pacific/Middle East & Africa/South America)

4.5.1. By Component

4.5.2. By End-use Industry

5. Global IoT Connected Machines Market Analysis and Forecast

5.1. Market Revenue Analysis (US$ Bn), 2016-2031

5.1.1. Historic Growth Trends, 2016-2021

5.1.2. Forecast Trends, 2022-2031

6. Global IoT Connected Machines Market Analysis, by Component

6.1. Overview and Definitions

6.2. Key Segment Analysis

6.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by Component, 2018 - 2031

6.3.1. Hardware

6.3.1.1. IoT Kit

6.3.1.2. Gateways

6.3.2. Software

6.3.3. Services

6.3.3.1. Consulting

6.3.3.2. Installation & Integration

6.3.3.3. Support & Maintenance

7. Global IoT Connected Machines Market Analysis, by End-use Industry

7.1. Overview and Definitions

7.2. Key Segment Analysis

7.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by End-use Industry, 2018 - 2031

7.3.1. Automotive

7.3.2. Oil & Gas

7.3.3. Manufacturing

7.3.4. Energy & Utility

7.3.5. Transportation

7.3.6. Healthcare

7.3.7. Others (Building Automation, Mining, and Agriculture)

8. Global IoT Connected Machines Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Size (US$ Bn) Forecast by Region, 2018-2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Middle East & Africa

8.2.5. South America

9. North America IoT Connected Machines Market Analysis and Forecast

9.1. Regional Outlook

9.2. IoT Connected Machines Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

9.2.1. By Component

9.2.2. By End-use Industry

9.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

9.3.1. U.S.

9.3.2. Canada

9.3.3. Mexico

10. Europe IoT Connected Machines Market Analysis and Forecast

10.1. Regional Outlook

10.2. IoT Connected Machines Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

10.2.1. By Component

10.2.2. By End-use Industry

10.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

10.3.1. Germany

10.3.2. UK

10.3.3. France

10.3.4. Italy

10.3.5. Spain

10.3.6. Rest of Europe

11. Asia Pacific IoT Connected Machines Market Analysis and Forecast

11.1. Regional Outlook

11.2. IoT Connected Machines Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

11.2.1. By Component

11.2.2. By End-use Industry

11.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

11.3.1. China

11.3.2. India

11.3.3. Japan

11.3.4. ASEAN

11.3.5. Rest of Asia Pacific

12. Middle East & Africa IoT Connected Machines Market Analysis and Forecast

12.1. Regional Outlook

12.2. IoT Connected Machines Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

12.2.1. By Component

12.2.2. By End-use Industry

12.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

12.3.1. Saudi Arabia

12.3.2. The United Arab Emirates

12.3.3. South Africa

12.3.4. Rest of Middle East & Africa

13. South America IoT Connected Machines Market Analysis and Forecast

13.1. Regional Outlook

13.2. IoT Connected Machines Market Size (US$ Bn) Analysis and Forecast, 2018 - 2031

13.2.1. By Component

13.2.2. By End-use Industry

13.3. IoT Connected Machines Market Size (US$ Bn) Forecast, by Country, 2018 - 2031

13.3.1. Brazil

13.3.2. Argentina

13.3.3. Rest of South America

14. Competition Landscape

14.1. Market Competition Matrix, by Leading Players

14.2. Market Revenue Share Analysis (%), by Leading Players (2021)

14.3. Competitive Scenario

14.3.1. List of Emerging, Prominent and Leading Players

14.3.2. Major Mergers & Acquisitions, Expansions, Partnership, Contacts, Deals, etc.

15. Company Profiles

15.1. Advantech Co., Ltd.

15.1.1. Business Overview

15.1.2. Company Revenue

15.1.3. Product Portfolio

15.1.4. Geographic Footprint

15.1.5. Strategic Partnership

15.1.6. Merger & Acquisition

15.1.7. Business Expansion

15.1.8. New Product Launch

15.1.9. Innovation, etc.

15.2. AT&T

15.2.1. Business Overview

15.2.2. Company Revenue

15.2.3. Product Portfolio

15.2.4. Geographic Footprint

15.2.5. Strategic Partnership

15.2.6. Merger & Acquisition

15.2.7. Business Expansion

15.2.8. New Product Launch

15.2.9. Innovation, etc.

15.3. ABB

15.3.1. Business Overview

15.3.2. Company Revenue

15.3.3. Product Portfolio

15.3.4. Geographic Footprint

15.3.5. Strategic Partnership

15.3.6. Merger & Acquisition

15.3.7. Business Expansion

15.3.8. New Product Launch

15.3.9. Innovation, etc.

15.4. Beckhoff Automation

15.4.1. Business Overview

15.4.2. Company Revenue

15.4.3. Product Portfolio

15.4.4. Geographic Footprint

15.4.5. Strategic Partnership

15.4.6. Merger & Acquisition

15.4.7. Business Expansion

15.4.8. New Product Launch

15.4.9. Innovation, etc.

15.5. Cisco Systems, Inc.

15.5.1. Business Overview

15.5.2. Company Revenue

15.5.3. Product Portfolio

15.5.4. Geographic Footprint

15.5.5. Strategic Partnership

15.5.6. Merger & Acquisition

15.5.7. Business Expansion

15.5.8. New Product Launch

15.5.9. Innovation, etc.

15.6. Dell Inc.

15.6.1. Business Overview

15.6.2. Company Revenue

15.6.3. Product Portfolio

15.6.4. Geographic Footprint

15.6.5. Strategic Partnership

15.6.6. Merger & Acquisition

15.6.7. Business Expansion

15.6.8. New Product Launch

15.6.9. Innovation, etc.

15.7. General Electric

15.7.1. Business Overview

15.7.2. Company Revenue

15.7.3. Product Portfolio

15.7.4. Geographic Footprint

15.7.5. Strategic Partnership

15.7.6. Merger & Acquisition

15.7.7. Business Expansion

15.7.8. New Product Launch

15.7.9. Innovation, etc.

15.8. Honeywell International, Inc.

15.8.1. Business Overview

15.8.2. Company Revenue

15.8.3. Product Portfolio

15.8.4. Geographic Footprint

15.8.5. Strategic Partnership

15.8.6. Merger & Acquisition

15.8.7. Business Expansion

15.8.8. New Product Launch

15.8.9. Innovation, etc.

15.9. IBM

15.9.1. Business Overview

15.9.2. Company Revenue

15.9.3. Product Portfolio

15.9.4. Geographic Footprint

15.9.5. Strategic Partnership

15.9.6. Merger & Acquisition

15.9.7. Business Expansion

15.9.8. New Product Launch

15.9.9. Innovation, etc.

15.10. Robert Bosch GmbH

15.10.1. Business Overview

15.10.2. Company Revenue

15.10.3. Product Portfolio

15.10.4. Geographic Footprint

15.10.5. Strategic Partnership

15.10.6. Merger & Acquisition

15.10.7. Business Expansion

15.10.8. New Product Launch

15.10.9. Innovation, etc.

15.11. Rockwell Automation, Inc.

15.11.1. Business Overview

15.11.2. Company Revenue

15.11.3. Product Portfolio

15.11.4. Geographic Footprint

15.11.5. Strategic Partnership

15.11.6. Merger & Acquisition

15.11.7. Business Expansion

15.11.8. New Product Launch

15.11.9. Innovation, etc.

15.12. Schneider Electric

15.12.1. Business Overview

15.12.2. Company Revenue

15.12.3. Product Portfolio

15.12.4. Geographic Footprint

15.12.5. Strategic Partnership

15.12.6. Merger & Acquisition

15.12.7. Business Expansion

15.12.8. New Product Launch

15.12.9. Innovation, etc.

15.13. Siemens

15.13.1. Business Overview

15.13.2. Company Revenue

15.13.3. Product Portfolio

15.13.4. Geographic Footprint

15.13.5. Strategic Partnership

15.13.6. Merger & Acquisition

15.13.7. Business Expansion

15.13.8. New Product Launch

15.13.9. Innovation, etc.

15.14. Others

15.14.1. Business Overview

15.14.2. Company Revenue

15.14.3. Product Portfolio

15.14.4. Geographic Footprint

15.14.5. Strategic Partnership

15.14.6. Merger & Acquisition

15.14.7. Business Expansion

15.14.8. New Product Launch

15.14.9. Innovation, etc.

16. Key Takeaways

List of Tables

Table 1: Acronyms Used in the IoT Connected Machines Market

Table 2: North America IoT Connected Machines Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 3: Europe IoT Connected Machines Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 4: Asia Pacific IoT Connected Machines Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 5: Middle East & Africa IoT Connected Machines Market Revenue Analysis, by Country, 2021 and 2031 (US$ Bn)

Table 6: South America IoT Connected Machines Market Revenue Analysis, by Country, 2022 - 2031 (US$ Bn)

Table 7: Forecast Factors: Relevance and Impact (1/2)

Table 8: Forecast Factors: Relevance and Impact (2/2)

Table 9: Impact Analysis of Drivers & Restraints

Table 10: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 11: List of Companies, Visits Per Minute (VPM), Features, and Pricing

Table 12: Global IoT Connected Machines Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 13: Global IoT Connected Machines Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 14: Global IoT Connected Machines Market Volume (US$ Bn) Forecast, by Region, 2018 - 2031

Table 15: North America IoT Connected Machines Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 16: North America IoT Connected Machines Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 17: North America IoT Connected Machines Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 18: U.S. IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 19: Canada IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 20: Mexico IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 21: Europe IoT Connected Machines Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 22: Europe IoT Connected Machines Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 23: Europe IoT Connected Machines Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 24: Germany IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 25: UK IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 26: France IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 27: Italy IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 28: Spain IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 29: Asia Pacific IoT Connected Machines Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 30: Asia Pacific IoT Connected Machines Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 31: Asia Pacific IoT Connected Machines Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 32: China IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 33: India IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 34: Japan IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 35: ASEAN IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 36: Middle East & Africa IoT Connected Machines Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 37: Middle East & Africa IoT Connected Machines Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 38: Middle East & Africa IoT Connected Machines Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 39: Saudi Arabia IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 40: The United Arab Emirates IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 41: South Africa IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 42: South America IoT Connected Machines Market Value (US$ Bn) Forecast, by Component, 2018 – 2031

Table 43: South America IoT Connected Machines Market Value (US$ Bn) Forecast, by End-use Industry, 2018 – 2031

Table 44: South America IoT Connected Machines Market Value (US$ Bn) Forecast, by Country, 2018 - 2031

Table 45: Brazil IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 46: Argentina IoT Connected Machines Market Revenue CAGR Breakdown (%), by Growth Term

Table 47: Mergers & Acquisitions, Partnerships (1/2)

Table 48: Mergers & Acquisitions, Partnership (2/2)

List of Figure:

Figure 1: Global IoT Connected Machines Market Size (US$ Bn) Forecast, 2018–2031

Figure 2: Global IoT Connected Machines Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2022E

Figure 3: Top Segment Analysis of IoT Connected Machines Market

Figure 4: Global IoT Connected Machines Market Revenue (US$ Bn) Opportunity Assessment, by Region, 2031F

Figure 5: Global IoT Connected Machines Market Attractiveness Assessment, by Component

Figure 6: Global IoT Connected Machines Market Attractiveness Assessment, by End-use Industry

Figure 7: Global IoT Connected Machines Market Attractiveness Assessment, by Region

Figure 8: Global IoT Connected Machines Market Revenue (US$ Bn) Historic Trends, 2016 – 2021

Figure 9: Global IoT Connected Machines Market Revenue Opportunity (US$ Bn) Historic Trends, 2016 – 2021

Figure 10: Global IoT Connected Machines Market Value Share Analysis, by Component, 2022

Figure 11: Global IoT Connected Machines Market Value Share Analysis, by Component, 2031

Figure 12: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 13: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 14: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 15: Global IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2022

Figure 16: Global IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2031

Figure 17: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Automotive, 2022 – 2031

Figure 18: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Oil & Gas, 2022 – 2031

Figure 19: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 20: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Energy & Utility, 2022 – 2031

Figure 21: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 22: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 23: Global IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 24: Global IoT Connected Machines Market Opportunity (US$ Bn), by Region

Figure 25: Global IoT Connected Machines Market Opportunity Share (%), by Region, 2022–2031

Figure 26: Global IoT Connected Machines Market Size (US$ Bn), by Region, 2022 & 2031

Figure 27: Global IoT Connected Machines Market Value Share Analysis, by Region, 2022

Figure 28: Global IoT Connected Machines Market Value Share Analysis, by Region, 2031

Figure 29: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 30: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 31: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 32: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 33: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), 2022 – 2031

Figure 34: North America IoT Connected Machines Market Revenue Opportunity Share, by Component

Figure 35: North America IoT Connected Machines Market Revenue Opportunity Share, by End-use Industry

Figure 36: North America IoT Connected Machines Market Revenue Opportunity Share, by End-user

Figure 37: North America IoT Connected Machines Market Revenue Opportunity Share, by Country

Figure 38: North America IoT Connected Machines Market Value Share Analysis, by Component, 2022

Figure 39: North America IoT Connected Machines Market Value Share Analysis, by Component, 2031

Figure 40: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 41: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 42: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 43: North America IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2022

Figure 44: North America IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2031

Figure 45: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Automotive, 2022 – 2031

Figure 46: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Oil & Gas, 2022 – 2031

Figure 47: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 48: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Energy & Utility, 2022 – 2031

Figure 49: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 50: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 51: North America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 52: North America IoT Connected Machines Market Value Share Analysis, by Country, 2022

Figure 53: North America IoT Connected Machines Market Value Share Analysis, by Country, 2031

Figure 54: U.S. IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 55: Canada IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 56: Mexico IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 57: Europe IoT Connected Machines Market Revenue Opportunity Share, by Component

Figure 58: Europe IoT Connected Machines Market Revenue Opportunity Share, by End-use Industry

Figure 59: Europe IoT Connected Machines Market Revenue Opportunity Share, by Country

Figure 60: Europe IoT Connected Machines Market Value Share Analysis, by Component, 2022

Figure 61: Europe IoT Connected Machines Market Value Share Analysis, by Component, 2031

Figure 62: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 63: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 64: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 65: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Automotive, 2022 – 2031

Figure 66: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Oil & Gas, 2022 – 2031

Figure 67: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 68: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Energy & Utility, 2022 – 2031

Figure 69: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 70: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 71: Europe IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 72: Europe IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2022

Figure 73: Europe IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2031

Figure 74: Europe IoT Connected Machines Market Value Share Analysis, by Country, 2022

Figure 75: Europe IoT Connected Machines Market Value Share Analysis, by Country, 2031

Figure 76: Germany IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 77: U.K. IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 78: France IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 79: Italy IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 80: Spain IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 81: Asia Pacific IoT Connected Machines Market Revenue Opportunity Share, by Component

Figure 82: Asia Pacific IoT Connected Machines Market Revenue Opportunity Share, by End-use Industry

Figure 83: Asia Pacific IoT Connected Machines Market Revenue Opportunity Share, by Country

Figure 84: Asia Pacific IoT Connected Machines Market Value Share Analysis, by Component, 2022

Figure 85: Asia Pacific IoT Connected Machines Market Value Share Analysis, by Component, 2031

Figure 86: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 87: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 88: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 89: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Automotive, 2022 – 2031

Figure 90: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Oil & Gas, 2022 – 2031

Figure 91: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 92: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Energy & Utility, 2022 – 2031

Figure 93: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 94: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 95: Asia Pacific IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 96: Asia Pacific IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2022

Figure 97: Asia Pacific IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2031

Figure 98: Asia Pacific IoT Connected Machines Market Value Share Analysis, by Country, 2022

Figure 99: Asia Pacific IoT Connected Machines Market Value Share Analysis, by Country, 2031

Figure 100: China IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 101: India IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 102: Japan IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 103: ASEAN IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 104: Middle East & Africa IoT Connected Machines Market Revenue Opportunity Share, by Component

Figure 105: Middle East & Africa IoT Connected Machines Market Revenue Opportunity Share, by End-use Industry

Figure 106: Middle East & Africa IoT Connected Machines Market Revenue Opportunity Share, by Country

Figure 107: Middle East & Africa IoT Connected Machines Market Value Share Analysis, by Component, 2022

Figure 108: Middle East & Africa IoT Connected Machines Market Value Share Analysis, by Component, 2031

Figure 109: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 110: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 111: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 112: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Automotive, 2022 – 2031

Figure 113: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Oil & Gas, 2022 – 2031

Figure 114: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 115: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Energy & Utility, 2022 – 2031

Figure 116: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 117: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 118: Middle East & Africa IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 119: Middle East & Africa IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2022

Figure 120: Middle East & Africa IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2031

Figure 121: Middle East & Africa IoT Connected Machines Market Value Share Analysis, by Country, 2022

Figure 122: Middle East & Africa IoT Connected Machines Market Value Share Analysis, by Country, 2031

Figure 123: Saudi Arabia IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 124: United Arab Emirates IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 125: South Africa IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 126: South America IoT Connected Machines Market Revenue Opportunity Share, by Component

Figure 127: South America IoT Connected Machines Market Revenue Opportunity Share, by End-use Industry

Figure 128: South America IoT Connected Machines Market Revenue Opportunity Share, by Country

Figure 129: South America IoT Connected Machines Market Value Share Analysis, by Component, 2022

Figure 130: South America IoT Connected Machines Market Value Share Analysis, by Component, 2031

Figure 131: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Hardware, 2022 – 2031

Figure 132: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Software, 2022 – 2031

Figure 133: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Services, 2022 – 2031

Figure 134: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Automotive, 2022 – 2031

Figure 135: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Oil & Gas, 2022 – 2031

Figure 136: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Manufacturing, 2022 – 2031

Figure 137: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Energy & Utility, 2022 – 2031

Figure 138: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Transportation, 2022 – 2031

Figure 139: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Healthcare, 2022 – 2031

Figure 140: South America IoT Connected Machines Market Absolute Opportunity (US$ Bn), by Others, 2022 – 2031

Figure 141: South America IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2022

Figure 142: South America IoT Connected Machines Market Value Share Analysis, by End-use Industry, 2031

Figure 143: South America IoT Connected Machines Market Value Share Analysis, by Country, 2022

Figure 144: South America IoT Connected Machines Market Value Share Analysis, by Country, 2031

Figure 145: Brazil IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031

Figure 146: Argentina IoT Connected Machines Market Opportunity Growth Analysis (US$ Bn) Forecast, 2022 – 2031