Reports

Reports

Analysts’ Viewpoint

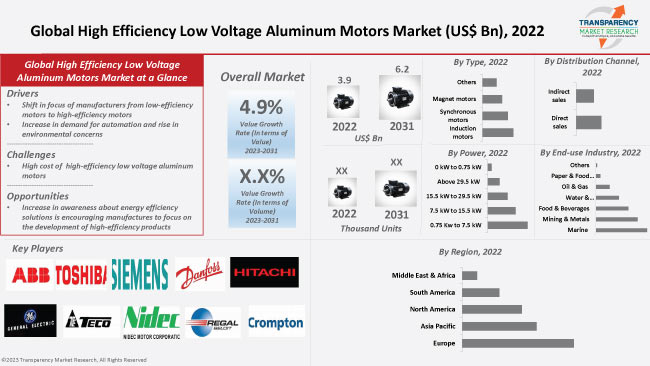

Rapid growth of various industries is projected to drive the global high efficiency low voltage aluminum motors market during the forecast period. Increase in awareness about smart motors and technological developments, such as Industrial Internet of Things (IIoT), are fueling global high efficiency low voltage aluminum motors market growth. Furthermore, surge in adoption of these motors owing to energy saving performance, low operating expenses, reduced greenhouse emissions, and improved efficiency is bolstering global high efficiency low voltage aluminum motors market size.

Growing industrialization and increase in infrastructure & construction activities offer lucrative opportunities for market players. Manufacturers are collaborating with distributors to set up manufacturing units for high efficiency low voltage aluminum motors that can be used in other applications such as fans, pumps, and refrigeration.

Low voltage aluminum motors are equipment made up of aluminum. These are standard, high performance and high-power efficient motors. These consume less energy and offer improved productivity with high safety standards. Low voltage motors have several applications such as food & beverages, oil & gas, and paper & food processing. Moreover, demand for high efficiency low voltage aluminum motors is increasing due to benefits such as durability and reliability in performance. Furthermore, these motors are used in special applications such as fans, pumps, and refrigeration systems due to high efficiency and low voltage.

The three basic types of high efficiency low voltage aluminum motor are induction motors, permanent magnet motors, and synchronous motors. Rise in number of industries with significant infrastructure is propelling demand for equipment such as high efficiency low voltage aluminum motors.

The global high efficiency low voltage aluminum motors market is driven by rise in demand for high-efficiency equipment. Increase in awareness about energy efficient solutions is encouraging manufacturers to focus on the development of high efficiency products. Rise in energy costs is increasing demand for high efficiency low voltage aluminum motors. Utilization of high efficiency motors saves energy and operating costs. Surge in demand for energy and rising pressure on reducing carbon emissions are encouraging industries to adopt energy-efficient equipment. Rise in awareness about Industrial Internet of Things (Eliot) is a major driver of global high efficiency low voltage aluminum motors market share. Moreover, awareness about the importance of lower greenhouse emissions is driving the global high efficiency low voltage aluminum motors industry.

Rise in adoption of automation technologies by companies has increased the need for efficient and reliable motors. High efficiency low voltage aluminum motors are well suited for use in automated systems, as these can provide the necessary power while minimizing energy consumption. Furthermore, rise in concerns about climate change has induced several companies to reduce carbon footprint. High efficiency low voltage aluminum motors can help companies achieve this goal by reducing energy consumption and greenhouse gas emissions.

In terms of type, the induction motors segment is projected to lead the global market during the forecast period. This is ascribed to cost effectiveness and other benefits of induction motors compared to other motors. This motor is commonly used in alternating current (AC) electric motor. An induction motor is a high-efficient machine with full load efficiency. Moreover, it does not contain any type of brushes and slip rings as in other motors. Hence, induction motors cost less and can operate in hazardous conditions. Stick electrodes can be easily modified depending upon its nature of applications. Furthermore, demand for induction motors is rising across the globe due to increase in oil & gas, mining, automotive, and other industries in emerging economies.

Based on end-use industry, the global market has been classified into marine, mining & metals, food & beverages, water & wastewater treatment, oil & gas, paper & food processing, chemicals & fertilizers, and others. The food & beverages segment accounted for the largest global high efficiency low voltage aluminum motors market share in 2022. This is ascribed to increase in shift from low-efficiency motors to energy saving high efficiency motors.

As per high efficiency low voltage aluminum motors market trends, Europe is projected to dominate the global market during the forecast period, owing to rise in heavy industries in the region. Increase in demand for high efficiency low voltage aluminum motors in industries such as in food & beverages and chemicals & fertilizers is expected to drive the market in Europe.

Increase in demand for high efficiency low voltage aluminum motors in the metal fabrication and automotive industries is driving the market in Asia Pacific. Surge in demand for high efficiency low voltage aluminum motors in the mining and metals industries is likely to propel market expansion in the region during the forecast period.

The global high efficiency low voltage aluminum motors market is fragmented, with the presence of large number of local and global players. Competition is expected to intensify in the next few years due to entry of local players. Various marketing strategies are being adopted by manufacturers of high efficiency low voltage aluminum motors. These are focusing on product development and addressing consumer demand by introducing more efficient products at reasonable price. Prominent players operating in the global high efficiency low voltage aluminum motors business are ABB. Ltd., Toshiba Corporation, Siemens AG, Danfoss A/S, Hitachi. Ltd, General Electric, TECO Electric & Machinery Co. Ltd., Nidec Motor Corporation, Regal Beloit Corporation, and Crompton North America.

Each of these players has been profiled in the report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 3.9 Bn |

|

Market Value in 2031 |

US$ 6.2 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global industry was valued at US$ 3.9 Bn in 2022.

It is expected to reach US$ 6.2 Bn by 2031.

The CAGR is estimated to be 4.9% by 2031.

Shift in focus of manufacturers from low-efficiency motors to high-efficiency motors and increase in demand for automation & rise in environmental concerns are driving the global market.

The induction motors segment accounted for leading share in 2022.

Europe is projected to be a highly attractive market during the forecast period.

ABB Ltd., Toshiba Corporation, Siemens AG, Danfoss A/S, Hitachi Ltd, General Electric, TECO Electric & Machinery Co.Ltd., Nidec Motor Corporation, Regal Beloit Corporation, and Crompton North America are the prominent players in the market.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Market Indicators

5.3. Key Trend Analysis

5.3.1. Supplier Side

5.3.2. Demand Side

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Technology Analysis

5.7. COVID-19 Impact Analysis

5.8. Value Chain Analysis

5.9. Global High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast, 2017- 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast, by Type

6.1. Global High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

6.1.1. Induction Motors

6.1.2. Magnet Motors

6.1.3. Synchronous Motors

6.1.4. Others

6.2. Incremental Opportunity, by Type

7. Global High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast, by Power

7.1. Global High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Power, 2017- 2031

7.1.1. 0 kW to 0.75 kW

7.1.2. 0.75 Kw to 7.5 kW

7.1.3. 7.5 kW to 15.5 kW

7.1.4. 15.5 kW to 29.5 kW

7.1.5. Above 29.5 kW

7.2. Incremental Opportunity, by Power

8. Global High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast, by End-use Industry

8.1. Global High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

8.1.1. Marine

8.1.2. Mining & Metals

8.1.3. Food & Beverages

8.1.4. Water & Wastewater Treatment

8.1.5. Oil & Gas

8.1.6. Paper & Food Processing

8.1.7. Chemicals & Fertilizers

8.1.8. Others

8.2. Incremental Opportunity, by End-use Industry

9. Global High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast, by Distribution Channel

9.1. Global High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Distribution channel, 2017- 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Global High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast, by Distribution Channel

10. Global High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by region, 2017- 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by region

11. North America High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

11.5.1. Induction Motors

11.5.2. Magnet Motors

11.5.3. Synchronous Motors

11.5.4. Others

11.6. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Power, 2017- 2031

11.6.1. 0 kW to 0.75 kW

11.6.2. 0.75 Kw to 7.5 kW

11.6.3. 7.5 kW to 15.5 kW

11.6.4. 15.5 kW to 29.5 kW

11.6.5. Above 29.5 kW

11.7. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

11.7.1. Marine

11.7.2. Mining & Metals

11.7.3. Food & Beverages

11.7.4. Water & Wastewater Treatment

11.7.5. Oil & Gas

11.7.6. Paper & Food Processing

11.7.7. Chemicals & Fertilizers

11.7.8. Others

11.8. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Country, 2017- 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

12.5.1. Induction Motors

12.5.2. Magnet Motors

12.5.3. Synchronous Motors

12.5.4. Others

12.6. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Power, 2017- 2031

12.6.1. 0 kW to 0.75 kW

12.6.2. 0.75 Kw to 7.5 kW

12.6.3. 7.5 kW to 15.5 kW

12.6.4. 15.5 kW to 29.5 kW

12.6.5. Above 29.5 kW

12.7. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

12.7.1. Marine

12.7.2. Mining & Metals

12.7.3. Food & Beverages

12.7.4. Water & Wastewater Treatment

12.7.5. Oil & Gas

12.7.6. Paper & Food Processing

12.7.7. Chemicals & Fertilizers

12.7.8. Others

12.8. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

13.5.1. Induction Motors

13.5.2. Magnet Motors

13.5.3. Synchronous Motors

13.5.4. Others

13.6. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Power, 2017- 2031

13.6.1. 0 kW to 0.75 kW

13.6.2. 0.75 Kw to 7.5 kW

13.6.3. 7.5 kW to 15.5 kW

13.6.4. 15.5 kW to 29.5 kW

13.6.5. Above 29.5 kW

13.7. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

13.7.1. Marine

13.7.2. Mining & Metals

13.7.3. Food & Beverages

13.7.4. Water & Wastewater Treatment

13.7.5. Oil & Gas

13.7.6. Paper & Food Processing

13.7.7. Chemicals & Fertilizers

13.7.8. Others

13.8. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

14.5.1. Induction Motors

14.5.2. Magnet Motors

14.5.3. Synchronous Motors

14.5.4. Others

14.6. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Power, 2017- 2031

14.6.1. 0 kW to 0.75 kW

14.6.2. 0.75 Kw to 7.5 kW

14.6.3. 7.5 kW to 15.5 kW

14.6.4. 15.5 kW to 29.5 kW

14.6.5. Above 29.5 kW

14.7. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

14.7.1. Marine

14.7.2. Mining & Metals

14.7.3. Food & Beverages

14.7.4. Water & Wastewater Treatment

14.7.5. Oil & Gas

14.7.6. Paper & Food Processing

14.7.7. Chemicals & Fertilizers

14.7.8. Others

14.8. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America High Efficiency Low Voltage Aluminum Motors Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Type, 2017- 2031

15.5.1. Induction Motors

15.5.2. Magnet Motors

15.5.3. Synchronous Motors

15.5.4. Others

15.6. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Power, 2017- 2031

15.6.1. 0 kW to 0.75 kW

15.6.2. 0.75 Kw to 7.5 kW

15.6.3. 7.5 kW to 15.5 kW

15.6.4. 15.5 kW to 29.5 kW

15.6.5. Above 29.5 kW

15.7. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

15.7.1. Marine

15.7.2. Mining & Metals

15.7.3. Food & Beverages

15.7.4. Water & Wastewater Treatment

15.7.5. Oil & Gas

15.7.6. Paper & Food Processing

15.7.7. Chemicals & Fertilizers

15.7.8. Others

15.8. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. High Efficiency Low Voltage Aluminum Motors Market Size (US$ Bn) (Thousand Units) Forecast, by Country, 2017- 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2022)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

16.3.1. ABB Ltd.

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information

16.3.1.4. (Subject to Data Availability)

16.3.1.5. Business Strategies / Recent Developments

16.3.2. Toshiba Corporation

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information

16.3.2.4. (Subject to Data Availability)

16.3.2.5. Business Strategies / Recent Developments

16.3.3. Siemens AG

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information

16.3.3.4. (Subject to Data Availability)

16.3.3.5. Business Strategies / Recent Developments

16.3.4. Danfoss A/S

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information

16.3.4.4. (Subject to Data Availability)

16.3.4.5. Business Strategies / Recent Developments

16.3.5. Hitachi Ltd.

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information

16.3.5.4. (Subject to Data Availability)

16.3.5.5. Business Strategies / Recent Developments

16.3.6. General Electric

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information

16.3.6.4. (Subject to Data Availability)

16.3.6.5. Business Strategies / Recent Developments

16.3.7. TECO Electric & Machinery Co.Ltd.

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information

16.3.7.4. (Subject to Data Availability)

16.3.7.5. Business Strategies / Recent Developments

16.3.8. Nidec Motor Corporation

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information

16.3.8.4. (Subject to Data Availability)

16.3.8.5. Business Strategies / Recent Developments

16.3.9. Regal Beloit Corporation

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information

16.3.9.4. (Subject to Data Availability)

16.3.9.5. Business Strategies / Recent Developments

16.3.10. Crompton North America

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information

16.3.10.4. (Subject to Data Availability)

16.3.10.5. Business Strategies / Recent Developments

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Power

17.1.3. End-use Industry

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Procurement Process of the End Users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Type, 2017-2031

Table 2: Global High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Type, 2017-2031

Table 3: Global High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Power, 2017-2031

Table 4: Global High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Power, 2017-2031

Table 5: Global High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by End-use Industry, 2017-2031

Table 6: Global High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by End-use Industry, 2017-2031

Table 7: Global High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Distribution Channel, 2017-2031

Table 8: Global High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Distribution Channel, 2017-2031

Table 9: Global High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Region, 2017-2031

Table 10: Global High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Region, 2017-2031

Table 11: North America High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Type, 2017-2031

Table 12: North America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Type, 2017-2031

Table 13: North America High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Power, 2017-2031

Table 14: North America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Power, 2017-2031

Table 15: North America High Efficiency Low Voltage Aluminum Motors Market by End-use Industry, Thousand Units, 2017-2031

Table 16: North America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by End-use Industry 2017-2031

Table 17: North America High Efficiency Low Voltage Aluminum Motors Market by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Distribution Channel, 2017-2031

Table 19: Europe High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Type, 2017-2031

Table 20: Europe High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Type, 2017-2031

Table 21: Europe High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Power, 2017-2031

Table 22: Europe High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Power, 2017-2031

Table 23: Europe High Efficiency Low Voltage Aluminum Motors Market by End-use Industry, Thousand Units, 2017-2031

Table 24: Europe High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by End-use Industry 2017-2031

Table 25: Europe High Efficiency Low Voltage Aluminum Motors Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: Europe High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Distribution Channel, 2017-2031

Table 27: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Type, 2017-2031

Table 28: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Type, 2017-2031

Table 29: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Power, 2017-2031

Table 30: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Power, 2017-2031

Table 31: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (Thousand Units) by End-use Industry, 2017-2031

Table 32: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by End-use Industry 2017-2031

Table 33: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market by Distribution Channel, Thousand Units, 2017-2031

Table 34: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Distribution Channel, 2017-2031

Table 35: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Type, 2017-2031

Table 36: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Type, 2017-2031

Table 37: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Power, 2017-2031

Table 38: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Power, 2017-2031

Table 39: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market (Thousand Units) by End-use Industry, 2017-2031

Table 40: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by End-use Industry 2017-2031

Table 41: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market by Distribution Channel, Thousand Units, 2017-2031

Table 42: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market by Distribution Channel, US$ Bn 2017-2031

Table 43: South America High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Type, 2017-2031

Table 44: South America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Type, 2017-2031

Table 45: South America High Efficiency Low Voltage Aluminum Motors Market (Thousand Units), by Power, 2017-2031

Table 46: South America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Power, 2017-2031

Table 47: South America High Efficiency Low Voltage Aluminum Motors Market (Thousand Units) by End-use Industry, 2017-2031

Table 48: South America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by End-use Industry 2017-2031

Table 49: South America High Efficiency Low Voltage Aluminum Motors Market by Distribution Channel, Thousand Units, 2017-2031

Table 50: South America High Efficiency Low Voltage Aluminum Motors Market (US$ Bn), by Distribution Channel, 2017-2031

List of Figures

Figure 1: Global High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Type, 2017-2031

Figure 2: Global High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Type, 2017-2031

Figure 3: Global High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Type, 2023 -2031

Figure 4: Global High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Power, 2017-2031

Figure 5: Global High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Power, 2017-2031

Figure 6: Global High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Power, 2023 -2031

Figure 7: Global High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by End-use Industry, 2017-2031

Figure 8: Global High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by End-use Industry, 2017-2031

Figure 9: Global High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by End-use Industry, 2023 -2031

Figure 10: Global High Efficiency Low Voltage Aluminum Motors Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global High Efficiency Low Voltage Aluminum Motors Market Projections, by Distribution Channel, (US$ Bn), 2017-2031

Figure 12: Global High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 -2031

Figure 13: Global High Efficiency Low Voltage Aluminum Motors Market Projections, by Region, Thousand Units, 2017-2031

Figure 14: Global High Efficiency Low Voltage Aluminum Motors Market Projections, by Region, US$ Bn 2017-2031

Figure 15: Global High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity, by Region, US$ Bn 2023 -2031

Figure 16: North America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Type, 2017-2031

Figure 17: North America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Type, 2017-2031

Figure 18: North America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Type, 2023 -2031

Figure 19: North America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Power, 2017-2031

Figure 20: North America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Power, 2017-2031

Figure 21: North America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Power, 2023 -2031

Figure 22: North America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by End-use Industry, 2017-2031

Figure 23: North America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by End-use Industry, 2017-2031

Figure 24: North America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by End-use Industry, 2023 -2031

Figure 25: North America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Distribution Channel, 2017-2031

Figure 26: North America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Distribution Channel, 2017-2031

Figure 27: North America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 -2031

Figure 28: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Type, 2017-2031

Figure 29: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Type, 2017-2031

Figure 30: Europe High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Type, 2023 -2031

Figure 31: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Power, 2017-2031

Figure 32: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Power, 2017-2031

Figure 33: Europe High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Power, 2023 -2031

Figure 34: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by End-use Industry, 2017-2031

Figure 35: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by End-use Industry, 2017-2031

Figure 36: Europe High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by End-use Industry, 2023 -2031

Figure 37: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Distribution Channel , 2017-2031

Figure 38: Europe High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Distribution Channel, 2017-2031

Figure 39: Europe High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 -2031

Figure 40: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Type, 2017-2031

Figure 41: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Type, 2017-2031

Figure 42: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Type, 2023 -2031

Figure 43: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Power, 2017-2031

Figure 44: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Power, 2017-2031

Figure 45: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Power, 2023 -2031

Figure 46: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by End-use Industry , 2017-2031

Figure 47: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by End-use Industry, 2017-2031

Figure 48: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by End-use Industry, 2023 -2031

Figure 49: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Distribution Channel, 2017-2031

Figure 50: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Distribution Channel, 2017-2031

Figure 51: Asia Pacific High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 -2031

Figure 52: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Type, 2017-2031

Figure 53: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Type, 2017-2031

Figure 54: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Type, 2023 -2031

Figure 55: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Power, 2017-2031

Figure 56: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Power, 2017-2031

Figure 57: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Power, 2023 -2031

Figure 58: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by End-use Industry, 2017-2031

Figure 59: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by End-use Industry, 2017-2031

Figure 60: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by End-use Industry, 2023 -2031

Figure 61: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Distribution Channel, 2017-2031

Figure 62: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Distribution Channel, 2017-2031

Figure 63: Middle East & Africa High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 -2031

Figure 64: South America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Type, 2017-2031

Figure 65: South America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Type, 2017-2031

Figure 66: South America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Type, 2023 -2031

Figure 67: South America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Power, 2017-2031

Figure 68: South America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Power, 2017-2031

Figure 69: South America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Power, 2023 -2031

Figure 70: South America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by End-use Industry, 2017-2031

Figure 71: South America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by End-use Industry, 2017-2031

Figure 72: South America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by End-use Industry, 2023 -2031

Figure 73: South America High Efficiency Low Voltage Aluminum Motors Market Projections (Thousand Units), by Distribution Channel, 2017-2031

Figure 74: South America High Efficiency Low Voltage Aluminum Motors Market Projections (US$ Bn), by Distribution Channel, 2017-2031

Figure 75: South America High Efficiency Low Voltage Aluminum Motors Market, Incremental Opportunity (US$ Bn), by Distribution Channel, 2023 -2031