Reports

Reports

Rising trend among major global population to follow healthy lifestyle is driving the growth of yogurt market. Growing inclination toward consumption of dairy products is helping to boost the demand for yogurt. Vendors active in yogurt market are using diverse strategies such as launch of innovative products. Incorporation of new and palatable flavors is one of the trending strategies helping companies to attract kids toward yogurt consumption. Thus, these moves are stimulating the growth of the yogurt market.

Many players offer yogurt in different sizes and shapes. Availability of these products in different attractive packaging is one of important factor drawing attention of huge customer base. These initiatives are helping vendors in the global yogurt market to attract new customer base while maintaining the existing one. As a result, the demand for yogurt is stimulated significantly.

Yogurt is one of the important dairy products that have achieved key position in the diet of a wide range of health-conscious population owing to probiotics content in it. Probiotics are known to be helpful in maintaining good gut health of an individual. Thus, this factor is pushing the growth of yogurt market.

Many companies in yogurt market are pouring investments in research activities. The main motive of these efforts is to enhance the nutritional value of yogurt products. Several vendors add nutritional supplements to their products. A case in point here is product by Chobani LLC. The latest product by the firm is a combination of Greek yogurt and nut butters. The latest strategy will help the firm to offer a tasty and protein-packed snack. Besides, this product is expected to gain traction of health enthusiasts owing to less sugar constraints than other yogurts. This move by Chobani is pegged to drive the demand for products available in the global yogurt market.

The high extent of awareness to consume dairy products for their health benefits is primarily driving the North America yogurts market. Yogurt is an important part of the diet of individuals due to probiotics content that helps in good gut health.

In North America, the availability of a few types of yogurt, which includes Greek, Icelandic, Australian, and non-dairy provides consumers a variety of choices. Not only this, yogurt is available in several flavors that adds further choice to the selection. Yogurt available in different sizes and different packaging also makes it a food of choice among consumers. These factors are collectively bolstering the North America yogurt market.

In the region, yogurt is a favored snack among children both for taste and flavor. Kids’ yogurts are generally available in attractive packaging that tempts kids to consume the food.

Lastly, the availability of fortified yogurt is boosting the consumption of yogurts. Dairy companies are introducing yogurts with nutritional supplements that further add to its nutrient quotient. Thus, the yogurt market in the region receives a boost.

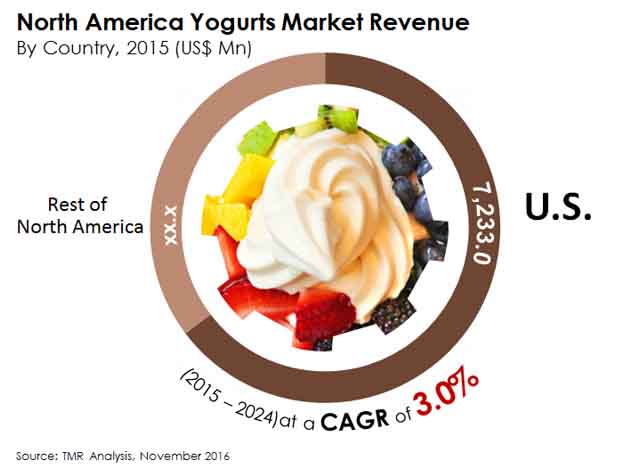

According to a report by Transparency Market Research (TMR), the North America yogurt market is likely to display a tepid 3.0% CAGR between 2016 and 2014, to be worth US$14.59 bn by 2024 vis-à-vis revenue. The market stood at a valuation of US$11.18 bn in 2015.

By product type, the North America yogurt market is segmented into Australian, Greek, kids’, Icelandic, non-dairy, and traditional. Traditional yogurt, among all, displays the leading demand. The indigenous flavor of traditional yogurt from the region it hails from also adds to its popularity. Kids’ yogurt also account for substantial share in the North America yogurt market. Yogurt is a favored snack that health-savvy parents tend to give to their children.

However, Greek yogurt is likely to surpass demand of other yogurt types over the forecast period. Vis-à-vis revenue, Greek and traditional yogurt held more than 75% of North America yogurt market in 2015.

By packaging type, the key segments of the North America yogurt market are tubs, pouch, jars, and cups. In 2015, cups held the leading nearly 70% of the market in 2015. Cups allow ease of consuming the content and are available in attractive designs that grabs consumer attention. Furthermore, low cost of packaging of cups also makes them favored among manufacturers in their interest to minimize overall packaging cost. This, indirectly is favorable for consumers especially frugal consumers, who are not willing to spend extra money for packaging for the same content in alternate packaging. This provides a boost to cups product type segment in the North America yogurt market.

Key companies operating in the North America yogurt market include Dannon Inc., Chobani LLC, Noosa Yogurt LLC, Stonyfield Farm, AtlantaFresh, Fage International S.A., Yoplait USA INC, The Icelandic Milk and Skyr Corporation, Annie’s Homegrown, and Berkely Farms.

Chapter 1 Preface

1.1. Research Scope and Market Segmentation

1.2. Research Highlights

1.3. Research Assumptions and Acronyms Used

1.4. Key Questions Answered

Chapter 2 Executive Summary

2.1. North America Yogurts Market Snapshot

2.2. North America Yogurts Market Key Trends

2.3. Market Opportunity Map

Chapter 3 Market Overview

3.1. Key Findings

3.2. U.S. Per Person Yogurt Consumption

Chapter 4 Market Dynamics

4.1. Driver and Restraints Snapshot Analysis

4.2. Drivers

4.2.1. North America Yogurts Market: Driver 1

4.2.2. North America Yogurts Market: Driver 2

4.2.3. North America Yogurts Market: Driver 3

4.2.4. North America Yogurts Market: Driver 4

4.3. Restraint

4.3.1. North America Yogurts Market: Restraint 1

4.3.2. North America Yogurts Market: Restraint 2

4.4. Opportunity

4.4.1. North America Yogurts Market: Opportunity 1

4.5. North America Yogurts Market Attractiveness Analysis, By Products, 2015

Chapter 5 North America Yogurts Market Analysis, by Packaged Containers

5.1. Overview

5.2. North America Yogurts Market, Value Share Analysis, By Packaged Containers

5.3. North America Yogurt Market Size (USD Mn), Forecast, By Packaged Containers, 2015-2024

5.3.1. North America Yogurt Cup Market Size (USD Mn), Forecast, 2015-2024

5.3.2. North America Yogurts Pouch Market Size (USD Mn), Forecast, 2015-2024

5.3.3. North America Yogurts Tubs Market Size (USD Mn), Forecast, 2015-2024

5.3.4. North America Yogurts Bottles Market Size (USD Mn), Forecast, 2015-2024

5.4. North America Yogurt Market Size (Units Million), Forecast, By Packaged Containers, 2015-2024

5.4.1. North America Yogurt Cup Market Size (Units Million), Forecast, 2015-2024

5.4.2. North America Yogurts Pouch Market Size (Units Million), Forecast, 2015-2024

5.4.3. North America Yogurts Tubs Market Size (Units Million), Forecast, 2015-2024

5.4.4. North America Yogurts Bottles Market Size (Units Million), Forecast, 2015-2024

Chapter 6 North America Yogurts Market Analysis, by Product Types

6.1. Overview

6.2. North America Yogurts Market, Value Share Analysis, By Product Types

6.3. North America Yogurt Market Size (USD Mn), Forecast, By Product Types, 2015-2024

6.3.1. North America Traditional Yogurt Market Size (USD Mn), Forecast, 2015-2024

6.3.2. North America Australian Yogurts Market Size (USD Mn), Forecast, 2015-2024

6.3.3. North America Icelandic Yogurts Market Size (USD Mn), Forecast, 2015-2024

6.3.4. North America Greek Yogurts Market Size (USD Mn), Forecast, 2015-2024

6.3.5. North America Non-Dairy Yogurts Market Size (USD Mn), Forecast, 2015-2024

6.3.6. North America Kids Yogurts Market Size (USD Mn), Forecast, 2015-2024

6.3.7. North America Other Yogurts Market Size (USD Mn), Forecast, 2015-2024

6.4. North America Yogurt Market Size (Units Million), Forecast, By Product Types, 2015-2024

6.4.1. North America Traditional Yogurt Market Size (Unit Million), Forecast, 2015-2024

6.4.2. North America Australian Yogurts Market Size (Unit Million), Forecast, 2015-2024

6.4.3. North America Icelandic Yogurts Market Size (Unit Million), Forecast, 2015-2024

6.4.4. North America Greek Yogurts Market Size (Unit Million), Forecast, 2015-2024

6.4.5. North America Non-Dairy Yogurts Market Size (Unit Million), Forecast, 2015-2024

Chapter 7 North America Yogurts Market Analysis, by Country

7.1.Overview

7.2. U.S. Yogurts Market Analysis

7.2.1. U.S. Yogurts Market Size (US$ Mn) Forecast, by Product Types, 2015–2024

7.2.2. U.S. Yogurts Market Size (Units Million) Forecast, by Product Types, 2015–2024

7.2.3. U.S. Yogurts Market Size (US$ Mn) Forecast, by Packaged Containers, 2015–2024

7.2.4. U.S. Yogurts Market Size (Units Million) Forecast, by Packaged Containers, 2015–2024

7.3. Rest of North America Yogurts Market Analysis

7.3.1. Rest of North America Yogurts Market Size (US$ Mn) Forecast, by Product Type, 2015–2024

7.3.2. Rest of North America Yogurts Market Size (Units Million) Forecast, by Product Type, 2015–2024

7.3.3. Rest of North America Yogurts Market Size (US$ Mn) Forecast, by Packaged Containers, 2015–2024

7.3.4. Rest of North America Yogurts Market Size (Units Million) Forecast, by Packaged Containers, 2015–2024

Chapter 8 Competitive Analysis

8.1. Company Market Share, 2015 vs 2016

8.2. Company Profiles

8.2.1. Dannon Inc.

8.2.1.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.1.2. Market Presence, By Segment and Geography

8.2.1.3. Key Developments

8.2.1.4. Strategy and Historical Roadmap

8.2.1.5. Revenue and Operating Profit

8.2.2. Fage International S.A.

8.2.2.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.2.2. Market Presence, By Segment and Geography

8.2.2.3. Key Developments

8.2.2.4. Strategy and Historical Roadmap

8.2.2.5. Revenue and Operating Profit

8.2.3. Chobani, LLC

8.2.3.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.3.2. Market Presence, By Segment and Geography

8.2.3.3. Key Developments

8.2.3.4. Strategy and Historical Roadmap

8.2.3.5. Revenue and Operating Profit

8.2.4. Yoplait USA, INC

8.2.4.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.4.2. Market Presence, By Segment and Geography

8.2.4.3. Key Developments

8.2.4.4. Strategy and Historical Roadmap

8.2.4.5. Revenue and Operating Profit

8.2.5. Noosa Yogurt LLC

8.2.5.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.5.2. Market Presence, By Segment and Geography

8.2.5.3. Key Developments

8.2.5.4. Strategy and Historical Roadmap

8.2.5.5. Revenue and Operating Profit

8.2.6. The Icelandic Milk and Skyr Corporation

8.2.6.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.6.2. Market Presence, By Segment and Geography

8.2.6.3. Key Developments

8.2.6.4. Strategy and Historical Roadmap

8.2.6.5. Revenue and Operating Profit

8.2.7. Stonyfield Farm

8.2.7.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.7.2. Market Presence, By Segment and Geography

8.2.7.3. Key Developments

8.2.7.4. Strategy and Historical Roadmap

8.2.7.5. Revenue and Operating Profit

8.2.8. Annie's Homegrown

8.2.8.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.8.2. Market Presence, By Segment and Geography

8.2.8.3. Key Developments

8.2.8.4. Strategy and Historical Roadmap

8.2.8.5. Revenue and Operating Profit

8.2.9. AtlantaFresh

8.2.9.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.9.2. Market Presence, By Segment and Geography

8.2.9.3. Key Developments

8.2.9.4. Strategy and Historical Roadmap

8.2.9.5. Revenue and Operating Profit

8.2.10. Berkeley Farms

8.2.10.1. Company Details (HQ, Foundation Year, Employee Strength)

8.2.10.2. Market Presence, By Segment and Geography

8.2.10.3. Key Developments

8.2.10.4. Strategy and Historical Roadmap

8.2.10.5. Revenue and Operating Profit

List of Tables

TABLE 1 North America Yogurts Market Size (US$ Mn) Forecast, by Packaged Containers, 2015–2024

TABLE 2 North America Yogurts Market Size (Units Million) Forecast, by Packaged Containers, 2015–2024

TABLE 3 North America Yogurts Market Size (US$ Mn) Forecast, by Product Types, 2015–2024

TABLE 4 North America Yogurts Market Size (Units Million) Forecast, by Product Types , 2015–2024

TABLE 5 North America Yogurt Market Size (US$ Mn), by Country, 2016 and 2024

TABLE 6 North America Yogurt Market Size (Units Million), by Country, 2016 and 2024

TABLE 7 U.S. Yogurts Market Size (US$ Bn) Forecast, by Product Types, 2015–2024

TABLE 8 U.S. Yogurts Market Size (Units Million) Forecast, by Product Types , 2015–2024

TABLE 9 U.S. Yogurts Market Size (US$ Bn) Forecast, by Packaged Containers, 2015–2024

TABLE 10 U.S. Yogurts Market Size (Units Million) Forecast, by Packaged Containers, 2015–2024

TABLE 11 Rest of North America Yogurts Market Size (US$ Bn) Forecast, by Product Types, 2015–2024

TABLE 12 Rest of North America Yogurts Market Size (Units Million) Forecast, by Product Types , 2015–2024

TABLE 13 Rest of North America Yogurts Market Size (US$ Bn) Forecast, by Packaged Containers, 2015–2024

TABLE 14 Rest of North America Yogurts Market Size (Units Million) Forecast, by Packaged Containers, 2015–2024

List of Figures

FIG. 1 Market Snapshot

FIG. 2 Revenue Share,2015

FIG. 3 Per Capita Yogurt Consumption By Country

FIG. 4 North America Yogurt Market Attractiveness Analysis, by Product Types, 2015

FIG. 5 North America Yogurts Market Value Share Analysis, by Packaged Containers, 2015 and 2024

FIG. 6 Yogurt Cups Market Revenue (US$ Mn), 2015–2024

FIG. 7 Yogurt Pouch Market Revenue (US$ Mn), 2015–2024

FIG. 8 Yogurt Tubs Market Revenue (US$ Mn), 2015–2024

FIG. 9 Yogurt Bottles Market Revenue (US$ Mn), 2015–2024

FIG. 10 Yogurt Cups Market Volume (Units Million), 2015–2024

FIG. 11 Yogurt Pouch Market Volume (Units Million), 2015–2024

FIG. 12 Yogurt Tubs Market Volume (Units Million), 2015–2024

FIG. 13 Yogurt Bottles Market Volume (Units Million), 2015–2024

FIG. 14 North America Yogurts Market Value Share Analysis, by Products Type, 2015 and 2024

FIG. 15 Traditional Yogurts Market Revenue (US$ Mn), 2015–2024

FIG. 16 Australian Yogurts Market Revenue (US$ Mn), 2015–2024

FIG. 17 Icelandic Yogurts Market Revenue (US$ Mn), 2015–2024

FIG. 18 Greek Yogurts Market Revenue (US$ Mn), 2015–2024

FIG. 19 Non-Dairy Yogurts Market Revenue (US$ Mn), 2015–2024

FIG. 20 Kids Yogurt Market Revenue (US$ Mn), 2015–2024

FIG. 21 Other Yogurts Market Revenue (US$ Mn), 2015–2024

FIG. 22 Traditional Yogurt Market Volume (Units Million), 2015–2024

FIG. 23 Australian Yogurt Market Volume (Units Million), 2015–2024

FIG. 24 Icelandic Yogurt Market Volume (Units Million), 2015–2024

FIG. 25 Greek Yogurt Market Volume (Units Million), 2015–2024

FIG. 26Non Dairy Yogurt Market Volume (Units Million), 2015–2024

FIG. 27 Kids Yogurt Market Volume (Units Million), 2015–2024

FIG. 28 Other Yogurt Market Volume (Units Million), 2015–2024

FIG. 29 Company Market Share, 2015

FIG. 30 Company Market Share, 2016