Reports

Reports

Even as domestic demand remains subdued, improved export demand, and positive outlook for disinfectants & surfactants are anticipated to boost growth in the global, North America, and Asia Pacific aerospace & defense chemical distribution market. The rising demand for specialty chemicals is helping to create revenue opportunities. Business activities in the global, North America, and Asia Pacific aerospace & defense chemical distribution market are taking place in a staggered manner due to COVID-19 disruptions.

Chemical companies are focusing on key revenue generating products such as paints & coatings and adhesives & sealants to keep economies running during the pandemic. Companies are raising the need for policy support from government to reduce dependence on imported intermediaries and toward establishing better environmental policy & compliance for production activities.

India’s aerospace industry holds lucrative incremental opportunities for companies in the global, North America, and Asia Pacific aerospace & defense chemical distribution market. However, innovation process in the aerospace industry requires high levels of risk, extensive collaboration between researchers and costly investments over a prolonged period of time. In order to ensure that the aerospace industry can fulfill its strategic role for the government’s agenda, chemical companies are expected to use a mixture of broad-based and specific innovation policy tools.

Chemical companies in the Indian aerospace industry are anticipated to capitalize on the need for digitization of manufacturing (DOM), which will create profound changes in the process and the lifecycle of manufactured products. This aligns well with the Digital India movement.

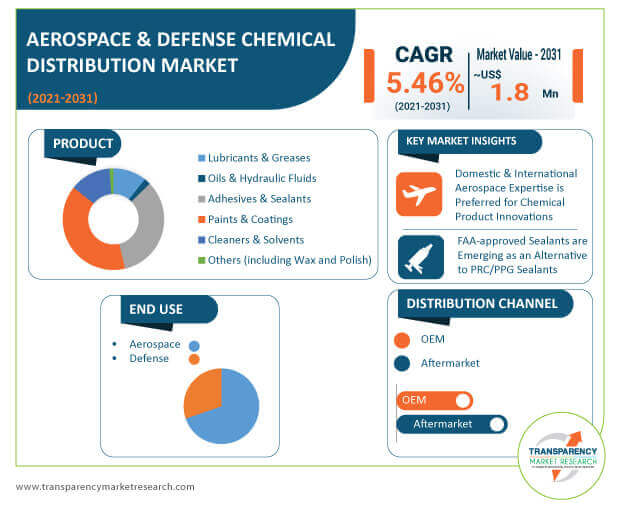

The global, North America, and Asia Pacific aerospace & defense chemical distribution market is expected to cross the valuation of US$ 1.8 Bn by 2031. GracoRoberts - one of the most technically focused specialty chemicals distributor, has announced that it has entered into an agreement to acquire U.K.-based Silmid - a specialist distributor of chemical consumables, to become the most technically-focused aerospace specialty chemicals distributor.

Domestic and international aerospace expertise is preferred for product innovations. With the help of such expertise, companies in the global, North America, and Asia Pacific aerospace & defense chemical distribution market are able to offer the global aerospace community a larger portfolio of products and operational efficiencies in increasing number of warehouse locations.

Custom packaging and custom quantity is being preferred for aerospace adhesives and sealants. NSL Aerospace - an aircraft adhesive and sealant sourcing, packaging, and distribution company, taking advantage of this opportunity to work with small maintenance shops, large corporations and OEMs (Original Equipment Manufacturers). Manufacturers are increasing the availability of FAA (Federal Aviation Administration)-approved sealants.

The global, North America, and Asia Pacific aerospace & defense chemical distribution market is projected to surpass the volume of 5,349.47 kilo tons by 2031. FAA approved sealants are emerging as an alternative to PRC/PPG sealants whilst deploying cost savings and shorter lead times. Manufacturers are making use of high strength PMA silicones to produce sealants.

The global, North America, and Asia Pacific aerospace & defense chemical distribution market is slated to clock a volume CAGR of 5.1% during the forecast period. Aerospace & defense approved and standardized products are storming the market landscape. ADDEV Materials - a specialist supplier to the aeronautics, space, and defense market, offers customized packaging solutions for paints & coatings.

Surface treatments and preparation applications are creating value-grab opportunities for companies in the global, North America, and Asia Pacific aerospace & defense chemical distribution market. There is a growing need for specialty chemicals used in plating, cleaning, and conversion coatings. Lubricants, technical films, and composite materials, among others, are helping in market expansion. On the other hand, there is a demand for paints & coatings for cabin interiors and the exterior & internal structures of aircraft. Apart from custom packaging solutions, value-added services such as on-site technical assistance is helping to upgrade company credentials.

Analysts’ Viewpoint

Manufacturers in the global, North America, and Asia Pacific aerospace & defense chemical distribution market are increasing the production of aircraft structure cleaners & disinfectants to fight germs and COVID-19. On-demand access to aerospace & defense chemicals is growing prominent during the pandemic. India’s aerospace industry is creating revenue opportunities for companies in the global, North America, and Asia Pacific aerospace & defense chemical distribution market. However, increased levels of risk, volume, and cost in a bid to remain competitive is creating challenges for chemical companies. Hence, companies should invest in digitization of manufacturing and remain cognizant of the environment necessity for having an imperative push toward sustainable development practices. This is necessary since India’s aerospace sector is interlinked with environmental considerations over the years.

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 1 Bn |

|

Market Forecast Value in 2031 |

US$ 1.8 Bn |

|

Growth Rate (CAGR) |

5.5% |

|

Forecast Period |

2021-2031 |

|

Quantitative Units |

US$ Mn for Value and Kilo Tons for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porters Five Forces analysis, supply chain analysis, parent industry overview, etc. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Key Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

North America, And Asia Pacific Aerospace & Defense Chemical Distribution Market is expected to Reach US$ 1.8 Bn By 2031

North America, And Asia Pacific Aerospace & Defense Chemical Distribution Market is estimated to rise at a CAGR of 5.5% during forecast period

Increase in manufacture of aircraft, supported by high growth in aviation operations, is projected to drive the global, North America, and Asia Pacific aerospace & defense chemical distribution market

North America, And Asia Pacific is more attractive for vendors in the North America, And Asia Pacific Aerospace & Defense Chemical Distribution Market

Key players of North America, And Asia Pacific Aerospace & Defense Chemical Distribution Market are Univar Solutions Inc., Wesco Aircraft Holdings Inc., Boeing Distribution Services Inc., Jaco Aerospace, AVIOCOM B.V., GracoRoberts, Aviation Chemical Solutions, Inc., Spectrum Aerospace GmbH, Sky Mart Sales Corp, Ellsworth Adhesives, Aerospace Chemical Supplies Ltd, Overlake Oil, Inc., Aviall, Inc., and AirChem Consumables

1. Executive Summary

1.1. Market Outlook

1.2. Key Facts and Figures

1.3. Key Trends

1.4. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Market Definitions

2.3. Market Indicators

3. Market Dynamics

3.1. Drivers and Restraints Snapshot Analysis

3.1.1. Drivers

3.1.2. Restraints

3.1.3. Opportunities

3.2. Porter’s Five Forces Analysis

3.2.1. Threat of Substitutes

3.2.2. Bargaining Power of Buyers

3.2.3. Bargaining Power of Suppliers

3.2.4. Threat of New Entrants

3.2.5. Degree of Competition

3.3. Regulatory Scenario

3.4. Value Chain Analysis

3.4.1. List of Manufacturers

3.4.2. List of Potential Customers

4. COVID-19 Impact Analysis

4.1. Impact of COVID-19 Outbreak on Supply-Demand Scenario of Aerospace & Defense Chemical Distribution Market

5. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis, by Product

5.1. Key Findings and Introduction

5.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Value Share Analysis, by Product, 2020–2031

5.2.1. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Lubricants & Greases, 2020–2031

5.2.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Oils & Hydraulic Fluids, 2020–2031

5.2.3. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Adhesives & Sealants, 2020–2031

5.2.4. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Paints & Coatings, 2020–2031

5.2.5. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Cleaners & Solvents, 2020–2031

5.2.6. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Product

6. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Analysis, by Distribution Channel

6.1. Key Findings and Introduction

6.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Distribution Channel, 2020–2031

6.2.1. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by OEM, 2020–2031

6.2.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Aftermarket, 2020–2031

6.3. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Distribution Channel

7. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Analysis, by End-use

7.1. Key Findings and Introduction

7.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by End-use, 2020–2031

7.2.1. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Aerospace, 2020–2031

7.2.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Defense, 2020–2031

7.3. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by End-use

8. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Analysis, by Region, 2020–2031

8.1. Key Findings

8.2. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Region, 2020–2031

8.3. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Region

9. North America Aerospace & Defense Chemical Distribution Market Analysis, 2020–2031

9.1. Key Findings

9.2. North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Product, 2020–2031

9.3. North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Distribution Channel, 2020–2031

9.4. North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by End-use, 2020–2031

9.5. North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Country, 2020–2031

9.5.1. U.S. Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.5.2. U.S. Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

9.5.3. U.S. Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

9.5.4. Canada Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

9.5.5. Canada Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

9.5.6. Canada Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

9.6. North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Product

9.7. North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Distribution Channel

9.8. North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by End-use

9.9. North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Country

10. Asia Pacific Aerospace & Defense Chemical Distribution Market Analysis, 2020–2031

10.1. Key Findings

10.2. Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Product, 2020–2031

10.3. Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Distribution Channel, 2020–2031

10.4. Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by End-use, 2020–2031

10.5. Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Analysis & Forecast, by Country and Sub-region, 2020–2031

10.5.1. China Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.2. China Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

10.5.3. China Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

10.5.4. India Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.5. India Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

10.5.6. India Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

10.5.7. Japan Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.8. Japan Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

10.5.9. Japan Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

10.5.10. ASEAN Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.11. ASEAN Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

10.5.12. ASEAN Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

10.5.13. Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product, 2020–2031

10.5.14. Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

10.5.15. Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by End-use, 2020–2031

10.6. Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Product

10.7. Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Distribution Channel

10.8. Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by End-use

10.9. Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Country and Sub-region

11. Competition Landscape

11.1. Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Share Analysis, by Company (2020)

11.2. Company Profiles

11.2.1. Univar Solutions Inc.

11.2.1.1. Company Details

11.2.1.2. Company Description

11.2.1.3. Business Overview

11.2.1.4. Financial Overview

11.2.1.5. Strategic Overview

11.2.2. Wesco Aircraft Holdings Inc.

11.2.2.1. Company Details

11.2.2.2. Company Description

11.2.2.3. Business Overview

11.2.2.4. Financial Overview

11.2.2.5. Strategic Overview

11.2.3. Boeing Distribution Services Inc.

11.2.3.1. Company Details

11.2.3.2. Company Description

11.2.3.3. Business Overview

11.2.4. Jaco Aerospace

11.2.4.1. Company Details

11.2.4.2. Company Description

11.2.4.3. Business Overview

11.2.5. AVIOCOM B.V.

11.2.5.1. Company Details

11.2.5.2. Company Description

11.2.5.3. Business Overview

11.2.6. GracoRoberts

11.2.6.1. Company Details

11.2.6.2. Company Description

11.2.6.3. Business Overview

11.2.7. Aviation Chemical Solutions, Inc.

11.2.7.1. Company Details

11.2.7.2. Company Description

11.2.7.3. Business Overview

11.2.8. Spectrum Aerospace GmbH

11.2.8.1. Company Details

11.2.8.2. Company Description

11.2.8.3. Business Overview

11.2.9. Sky Mart Sales Corp

11.2.9.1. Company Details

11.2.9.2. Company Description

11.2.9.3. Business Overview

11.2.10. Ellsworth Adhesives

11.2.10.1. Company Details

11.2.10.2. Company Description

11.2.10.3. Business Overview

11.2.11. Aerospace Chemical Supplies Ltd

11.2.11.1. Company Details

11.2.11.2. Company Description

11.2.11.3. Business Overview

11.2.12. Overlake Oil, Inc.

11.2.12.1. Company Details

11.2.12.2. Company Description

11.2.12.3. Business Overview

11.2.13. Aviall, Inc.

11.2.13.1. Company Details

11.2.13.2. Company Description

11.2.13.3. Business Overview

11.2.14. AirChem Consumables

11.2.14.1. Company Details

11.2.14.2. Company Description

11.2.14.3. Business Overview

12. Primary Research – Key Insights

13. Appendix

13.1. Research Methodology and Assumptions

List of Tables

Table 01: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 02: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 03: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 04: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 05: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 06: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 07: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 08: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 09: North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 10: North America Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 11: North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 12: North America Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 13: North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 14: North America Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 15: North America Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 16: North America Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 17: U.S. Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 18: U.S. Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 19: U.S. Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 20: U.S. Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 21: U.S. Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 22: U.S. Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 23: Canada Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 24: Canada Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 25: Canada Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 26: Canada Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 27: Canada Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 28: Canada Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 29: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 30: Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 31: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 32: Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 33: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 34: Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 35: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 36: Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 37: China Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 38: China Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 39: China Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 40: China Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 41: China Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 42: China Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 43: Japan Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 44: Japan Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 45: Japan Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 46: Japan Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 47: Japan Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 48: Japan Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 49: India Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 50: India Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 51: India Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 52: India Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 53: India Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 54: India Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 55: ASEAN Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 56: ASEAN Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 57: ASEAN Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 58: ASEAN Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 59: ASEAN Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 60: ASEAN Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

Table 61: Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Product, 2020–2031

Table 62: Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Product, 2020–2031

Table 63: Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by Distribution Channel, 2020–2031

Table 64: Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by Distribution Channel, 2020–2031

Table 65: Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Volume (Kilo Tons) Forecast, by End-use, 2020–2031

Table 66: Rest of Asia Pacific Aerospace & Defense Chemical Distribution Market Value (US$ Mn) Forecast, by End-use, 2020–2031

List of Figures

Figure 01: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Product

Figure 02: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Product

Figure 03: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Distribution Channel

Figure 04: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Distribution Channel

Figure 05: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by End-use

Figure 06: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by End-use

Figure 07: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Region

Figure 08: Global, North America and Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Region

Figure 09: North America Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Country, 2020, 2026 and 2031

Figure 10: North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Country

Figure 11: North America Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Product

Figure 12: North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Product

Figure 13: North America Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Distribution Channel

Figure 14: North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Distribution Channel

Figure 15: North America Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by End-use

Figure 16: North America Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by End-use

Figure 17: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Country and Sub-region, 2020, 2026 and 2031

Figure 18: Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Country and Sub-region

Figure 19: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Product

Figure 20: Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Product

Figure 21: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by Distribution Channel

Figure 22: Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by Distribution Channel

Figure 23: Asia Pacific Aerospace & Defense Chemical Distribution Market Volume Share Analysis, by End-use

Figure 24: Asia Pacific Aerospace & Defense Chemical Distribution Market Attractiveness Analysis, by End-use