Reports

Reports

Analysts’ Viewpoint on Market Scenario

Rise in number of hotels and restaurants and expansion in the food & beverage sector are projected to boost the demand for freezers in the near future. Freezers are generally used to store and preserve food products.

Rapid urbanization and surge in number of households are driving the global freezer market size. Increase in concerns about food safety and food waste is projected to offer lucrative opportunities for key players in the industry. Manufacturers are investing in research and development activities to create new and innovative freezer designs, features, and technologies. This is expected to help them stand out from their competitors and attract customers who are looking for the latest products.

Freezers are appliances designed to keep food and other perishable items frozen at sub-zero temperatures. They are available in a variety of sizes and styles, including chest freezers, upright freezers, and built-in freezers.

Various nourishment manufacturing companies and food vendors employ freezers to stock processed and cold nutrient products to increase their lifespan. Freezers work by using a compressor and a refrigerant to remove heat from the interior of the freezer and expel it outside, keeping the temperature inside the freezer at or below freezing. They also feature insulation to prevent heat from entering the freezer from outside.

Consumers are increasingly turning to frozen food products due to their convenience, longer shelf life, and the fact that they can be stored and consumed at any time. This has led to an increase in demand for freezers to store these frozen foods.

The COVID-19 pandemic has also accelerated the trend of consumers buying more frozen food products. With people spending more time at home, many have turned to frozen foods as a convenient and easy meal option. This has led to a surge in demand for freezers, as consumers need more storage space to keep their frozen food products. Thus, rise in consumption of frozen food products is expected to spur the freezer market growth in the near future.

Growth in awareness about the importance of maintaining food quality, reducing greenhouse gas emissions, and using energy-efficient products is likely to drive the freezer market value in the near future.

Rapid expansion in the food & beverage sector is projected to boost the demand for freezers in the next few years. Growth in urban and working population is also fueling market expansion, as freezers are increasingly employed in various food-producing companies. Rise in number of ice cream parlors and bars is fueling the usage of freezers to provide custom cooling range options to store cool drinks and ice creams.

Integration of Internet of Things (IoT) technology in freezers has become increasingly popular in recent years. IoT-enabled freezers allow for remote monitoring, control and data analysis, thus providing several benefits to both consumers and manufacturers.

Manufacturers are investing significantly in R&D of new technologies to increase their global freezer market share. Haier Group offers a 360-degree airflow + dual fan technique for even and multi-directional cooling. The technology allows the cool air to flow throughout the refrigerator and keeps the contents inside the freezer fresh for a long time.

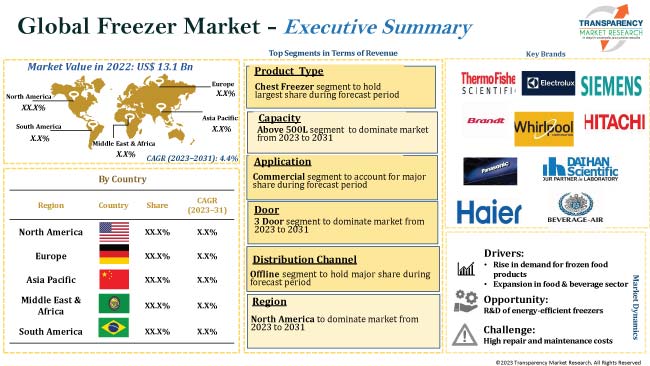

According to the latest freezer market trends, the chest freezer product type segment is projected to account for the largest share from 2023 to 2031. Chest freezers are more cost-effective than other freezers.

Chest freezers are mostly available in rectangular shapes with a hinged lid that opens upwards. Rise in demand for frozen food products is propelling the segment, as chest freezers are primarily designed to store frozen food in large quantities.

According to the latest freezer market analysis, the commercial application segment is anticipated to dominate the industry during the forecast period. Increase in demand for freezers in supermarkets, hypermarkets, and shopping malls, growth in the food & beverage industry, and rise in disposable income of consumers are major factors augmenting the segment.

According to the latest freezer market forecast, North America is estimated to constitute the largest share from 2023 to 2031. Rise in preference for smart appliances, increase in awareness about food safety, and growth in disposable income are boosting market dynamics of the region.

Europe and Asia Pacific are also key markets for freezers. Expansion in the food & beverage industry and rise in e-commerce and online grocery shopping are driving market statistics in these regions.

The global industry is fragmented, with the presence of many local and international players, including Thermo Fisher Scientific, AB Electrolux, BSH Home Appliances Group (Siemens AG), Brandt Electrical, Whirlpool Corporation, Panasonic Corporation, Daihan Scientific, Haier Group, Hitachi Ltd., and Beverage-Air.

Competition is expected to intensify in the next few years due to the entry of local players. Freezer suppliers and manufacturers are focusing on product development and catering to the rise in demand for smart products at reasonable prices.

Key players have been profiled in the freezer market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Value in 2022 (Base Year) |

US$ 13.1 Bn |

|

Market Value in 2031 |

US$ 20.1 Bn |

|

Growth Rate (CAGR) |

4.4% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, technology overview, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, brand analysis and consumer buying behavior analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 13.1 Bn in 2022

It is estimated to reach US$ 20.1 Bn by the end of 2031

It is projected to grow at a CAGR of 4.4% from 2023 to 2031

Rise in demand for frozen food products and expansion in the food & beverage sector

The chest freezer product type segment is likely to account for major share during the forecast period

North America is a more attractive region for vendors, followed by Europe and Asia Pacific

Thermo Fisher Scientific, AB Electrolux, BSH Home Appliances Group (Siemens AG), Brandt Electrical, Whirlpool Corporation, Panasonic Corporation, Daihan Scientific, Haier Group, Hitachi Ltd., and Beverage-Air

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Technology Overview

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Freezer Market Analysis and Forecast, 2017 – 2031

5.9.1. Market Value Projection (US$ Mn)

5.9.2. Market Volume Projection (Thousand Units)

6. Global Freezer Market Analysis and Forecast, By Product Type

6.1. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 – 2031

6.1.1. Chest Freezer

6.1.2. Upright Freezer

6.1.3. Others

6.2. Incremental Opportunity, By Product Type

7. Global Freezer Market Analysis and Forecast, By Capacity

7.1. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 – 2031

7.1.1. Below 200L

7.1.2. 200L - 300L

7.1.3. 300L - 500L

7.1.4. Above 500L

7.2. Incremental Opportunity, By Capacity

8. Global Freezer Market Analysis and Forecast, By Door

8.1. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Door, 2017 – 2031

8.1.1. 1 Door

8.1.2. 2 Door

8.1.3. 3 Door

8.1.4. 4 Door

8.2. Incremental Opportunity, By Door

9. Global Freezer Market Analysis and Forecast, By Application

9.1. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 – 2031

9.1.1. Residential

9.1.2. Commercial

9.1.3. Industrial

9.2. Incremental Opportunity, By Application

10. Global Freezer Market Analysis and Forecast, By Distribution Channel

10.1. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

10.1.1. Online

10.1.1.1. E-commerce Websites

10.1.1.2. Company-owned Websites

10.1.2. Offline

10.1.2.1. Specialty Stores

10.1.2.2. Multi-brand Stores

10.1.2.3. Other Retail Stores

10.2. Incremental Opportunity, By Distribution Channel

11. Global Freezer Market Analysis and Forecast, By Region

11.1. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Region, 2017 – 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Incremental Opportunity, By Region

12. North America Freezer Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Price

12.3. Key Trends Analysis

12.3.1. Demand Side Analysis

12.3.2. Supply Side Analysis

12.4. Brand Analysis

12.5. Consumer Buying Behavior Analysis

12.6. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 – 2031

12.6.1. Chest Freezer

12.6.2. Upright Freezer

12.6.3. Others

12.7. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 – 2031

12.7.1. Below 200L

12.7.2. 200L - 300L

12.7.3. 300L - 500L

12.7.4. Above 500L

12.8. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Door, 2017 – 2031

12.8.1. 1 Door

12.8.2. 2 Door

12.8.3. 3 Door

12.8.4. 4 Door

12.9. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 – 2031

12.9.1. Residential

12.9.2. Commercial

12.9.3. Industrial

12.10. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

12.10.1. Online

12.10.1.1. E-commerce Websites

12.10.1.2. Company-owned Websites

12.10.2. Offline

12.10.2.1. Specialty Stores

12.10.2.2. Multi-brand Stores

12.10.2.3. Other Retail Stores

12.11. Freezer Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 – 2027

12.11.1. U.S.

12.11.2. Canada

12.11.3. Rest of North America

12.12. Incremental Opportunity Analysis

13. Europe Freezer Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Price

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Brand Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 – 2031

13.6.1. Chest Freezer

13.6.2. Upright Freezer

13.6.3. Others

13.7. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 – 2031

13.7.1. Below 200L

13.7.2. 200L - 300L

13.7.3. 300L - 500L

13.7.4. Above 500L

13.8. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Door, 2017 – 2031

13.8.1. 1 Door

13.8.2. 2 Door

13.8.3. 3 Door

13.8.4. 4 Door

13.9. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 – 2031

13.9.1. Residential

13.9.2. Commercial

13.9.3. Industrial

13.10. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

13.10.1. Online

13.10.1.1. E-commerce Websites

13.10.1.2. Company-owned Websites

13.10.2. Offline

13.10.2.1. Specialty Stores

13.10.2.2. Multi-brand Stores

13.10.2.3. Other Retail Stores

13.11. Freezer Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 – 2031

13.11.1. U.K.

13.11.2. Germany

13.11.3. France

13.11.4. Rest of Europe

13.12. Incremental Opportunity Analysis

14. Asia Pacific Freezer Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Price

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Brand Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 – 2031

14.6.1. Chest Freezer

14.6.2. Upright Freezer

14.6.3. Others

14.7. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 – 2031

14.7.1. Below 200L

14.7.2. 200L - 300L

14.7.3. 300L - 500L

14.7.4. Above 500L

14.8. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Door, 2017 – 2031

14.8.1. 1 Door

14.8.2. 2 Door

14.8.3. 3 Door

14.8.4. 4 Door

14.9. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 – 2031

14.9.1. Residential

14.9.2. Commercial

14.9.3. Industrial

14.10. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

14.10.1. Online

14.10.1.1. E-commerce Websites

14.10.1.2. Company-owned Websites

14.10.2. Offline

14.10.2.1. Specialty Stores

14.10.2.2. Multi-brand Stores

14.10.2.3. Other Retail Stores

14.11. Freezer Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 – 2031

14.11.1. China

14.11.2. India

14.11.3. Japan

14.11.4. Rest of Asia Pacific

14.12. Incremental Opportunity Analysis

15. Middle East & Africa Freezer Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Price

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Brand Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 – 2031

15.6.1. Chest Freezer

15.6.2. Upright Freezer

15.6.3. Others

15.7. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 – 2031

15.7.1. Below 200L

15.7.2. 200L - 300L

15.7.3. 300L - 500L

15.7.4. Above 500L

15.8. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Door, 2017 – 2031

15.8.1. 1 Door

15.8.2. 2 Door

15.8.3. 3 Door

15.8.4. 4 Door

15.9. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 – 2031

15.9.1. Residential

15.9.2. Commercial

15.9.3. Industrial

15.10. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

15.10.1. Online

15.10.1.1. E-commerce Websites

15.10.1.2. Company-owned Websites

15.10.2. Offline

15.10.2.1. Specialty Stores

15.10.2.2. Multi-brand Stores

15.10.2.3. Other Retail Stores

15.11. Freezer Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 – 2031

15.11.1. GCC

15.11.2. South Africa

15.11.3. Rest of Middle East & Africa

15.12. Incremental Opportunity Analysis

16. South America Freezer Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Price

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Brand Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Product Type, 2017 – 2031

16.6.1. Chest Freezer

16.6.2. Upright Freezer

16.6.3. Others

16.7. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Capacity, 2017 – 2031

16.7.1. Below 200L

16.7.2. 200L - 300L

16.7.3. 300L - 500L

16.7.4. Above 500L

16.8. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Door, 2017 – 2031

16.8.1. 1 Door

16.8.2. 2 Door

16.8.3. 3 Door

16.8.4. 4 Door

16.9. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Application, 2017 – 2031

16.9.1. Residential

16.9.2. Commercial

16.9.3. Industrial

16.10. Freezer Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 – 2031

16.10.1. Online

16.10.1.1. E-commerce Websites

16.10.1.2. Company-owned Websites

16.10.2. Offline

16.10.2.1. Specialty Stores

16.10.2.2. Multi-brand Stores

16.10.2.3. Other Retail Stores

16.11. Freezer Market Size (US$ Mn and Thousand Units) Forecast, by Country, 2017 – 2031

16.11.1. Brazil

16.11.2. Rest of South America

16.12. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player – Competition Dashboard

17.2. Market Share Analysis – 2022 (%)

17.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

17.3.1. Thermos Fisher Scientific

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Revenue

17.3.1.4. Strategy & Business Overview

17.3.2. AB Electrolux

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Revenue

17.3.2.4. Strategy & Business Overview

17.3.3. BSH Home Appliances Group (Siemens AG)

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Revenue

17.3.3.4. Strategy & Business Overview

17.3.4. Brandt Electrical

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Revenue

17.3.4.4. Strategy & Business Overview

17.3.5. Whirlpool Corporation

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Revenue

17.3.5.4. Strategy & Business Overview

17.3.6. Panasonic Corporation

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Revenue

17.3.6.4. Strategy & Business Overview

17.3.7. Daihan Scientific

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Revenue

17.3.7.4. Strategy & Business Overview

17.3.8. Haier Group

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Revenue

17.3.8.4. Strategy & Business Overview

17.3.9. Hitachi Ltd.

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Revenue

17.3.9.4. Strategy & Business Overview

17.3.10. Beverage-Air

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Revenue

17.3.10.4. Strategy & Business Overview

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. Product Type

18.1.2. Capacity

18.1.3. Door

18.1.4. Application

18.1.5. Distribution Channel

18.1.6. Region

18.2. Understanding Procurement Process of End-users

18.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Freezer Market, by Product Type, Thousand Units 2017-2031

Table 2: Global Freezer Market, by Product Type, US$ Mn 2017-2031

Table 3: Global Freezer Market, by Capacity, Thousand Units 2017-2031

Table 4: Global Freezer Market, by Capacity, US$ Mn 2017-2031

Table 5: Global Freezer Market, by Door, Thousand Units 2017-2031

Table 6: Global Freezer Market, by Door, US$ Mn 2017-2031

Table 7: Global Freezer Market, by Application, Thousand Units, 2017-2031

Table 8: Global Freezer Market, by Application, US$ Mn 2017-2031

Table 9: Global Freezer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 10: Global Freezer Market, by Distribution Channel, US$ Mn 2017-2031

Table 11: Global Freezer Market, by Region, Thousand Units, 2017-2031

Table 12: Global Freezer Market, by Region, US$ Mn 2017-2031

Table 13: North America Freezer Market, by Product Type, Thousand Units 2017-2031

Table 14: North America Freezer Market, by Product Type, US$ Mn 2017-2031

Table 15: North America Freezer Market, by Capacity, Thousand Units 2017-2031

Table 16: North America Freezer Market, by Capacity, US$ Mn 2017-2031

Table 17: North America Freezer Market, by Door, Thousand Units 2017-2031

Table 18: North America Freezer Market, by Door, US$ Mn 2017-2031

Table 19: North America Freezer Market, by Application, Thousand Units, 2017-2031

Table 20: North America Freezer Market, by Application, US$ Mn 2017-2031

Table 21: North America Freezer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 22: North America Freezer Market, by Distribution Channel, US$ Mn 2017-2031

Table 23: Europe Freezer Market, by Product Type, Thousand Units 2017-2031

Table 24: Europe Freezer Market, by Product Type, US$ Mn 2017-2031

Table 25: Europe Freezer Market, by Capacity, Thousand Units 2017-2031

Table 26: Europe Freezer Market, by Capacity, US$ Mn 2017-2031

Table 27: Europe Freezer Market, by Door, Thousand Units 2017-2031

Table 28: Europe Freezer Market, by Door, US$ Mn 2017-2031

Table 29: Europe Freezer Market, by Application, Thousand Units, 2017-2031

Table 30: Europe Freezer Market, by Application, US$ Mn 2017-2031

Table 31: Europe Freezer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 32: Europe Freezer Market, by Distribution Channel, US$ Mn 2017-2031

Table 33: Asia Pacific Freezer Market, by Product Type, Thousand Units 2017-2031

Table 34: Asia Pacific Freezer Market, by Product Type, US$ Mn 2017-2031

Table 35: Asia Pacific Freezer Market, by Capacity, Thousand Units 2017-2031

Table 36: Asia Pacific Freezer Market, by Capacity, US$ Mn 2017-2031

Table 37: Asia Pacific Freezer Market, by Door, Thousand Units 2017-2031

Table 38: Asia Pacific Freezer Market, by Door, US$ Mn 2017-2031

Table 39: Asia Pacific Freezer Market, by Application, Thousand Units, 2017-2031

Table 40: Asia Pacific Freezer Market, by Application, US$ Mn 2017-2031

Table 41: Asia Pacific Freezer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 42: Asia Pacific Freezer Market, by Distribution Channel, US$ Mn 2017-2031

Table 43: Middle East & Africa Freezer Market, by Product Type, Thousand Units 2017-2031

Table 44: Middle East & Africa Freezer Market, by Product Type, US$ Mn 2017-2031

Table 45: Middle East & Africa Freezer Market, by Capacity, Thousand Units 2017-2031

Table 46: Middle East & Africa Freezer Market, by Capacity, US$ Mn 2017-2031

Table 47: Middle East & Africa Freezer Market, by Door, Thousand Units 2017-2031

Table 48: Middle East & Africa Freezer Market, by Door, US$ Mn 2017-2031

Table 49: Middle East & Africa Freezer Market, by Application, Thousand Units, 2017-2031

Table 50: Middle East & Africa Freezer Market, by Application, US$ Mn 2017-2031

Table 51: Middle East & Africa Freezer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 52: Middle East & Africa Freezer Market, by Distribution Channel, US$ Mn 2017-2031

Table 53: South America Freezer Market, by Product Type, Thousand Units 2017-2031

Table 54: South America Freezer Market, by Product Type, US$ Mn 2017-2031

Table 55: South America Freezer Market, by Capacity, Thousand Units 2017-2031

Table 56: South America Freezer Market, by Capacity, US$ Mn 2017-2031

Table 57: South America Freezer Market, by Door, Thousand Units 2017-2031

Table 58: South America Freezer Market, by Door, US$ Mn 2017-2031

Table 59: South America Freezer Market, by Application, Thousand Units, 2017-2031

Table 60: South America Freezer Market, by Application, US$ Mn 2017-2031

Table 61: South America Freezer Market, by Distribution Channel, Thousand Units, 2017-2031

Table 62: South America Freezer Market, by Distribution Channel, US$ Mn 2017-2031

List of Figures

Figure 1: Global Freezer Market Projections, by Product Type, Thousand Units, 2017-2031

Figure 2: Global Freezer Market Projections, by Product Type, US$ Mn 2017-2031

Figure 3: Global Freezer Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 1: Global Freezer Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 2: Global Freezer Market Projections, by Capacity, US$ Mn 2017-2031

Figure 3: Global Freezer Market, Incremental Opportunity, by Capacity, US$ Mn 2023 -2031

Figure 1: Global Freezer Market Projections, by Door, Thousand Units, 2017-2031

Figure 2: Global Freezer Market Projections, by Door, US$ Mn 2017-2031

Figure 3: Global Freezer Market, Incremental Opportunity, by Door, US$ Mn 2023 -2031

Figure 4: Global Freezer Market Projections, by Application, Thousand Units, 2017-2031

Figure 5: Global Freezer Market Projections, by Application, US$ Mn 2017-2031

Figure 6: Global Freezer Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 7: Global Freezer Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 8: Global Freezer Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 9: Global Freezer Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 10: Global Freezer Market Projections, by Region, Thousand Units, 2017-2031

Figure 11: Global Freezer Market Projections, by Region, US$ Mn 2017-2031

Figure 12: Global Freezer Market, Incremental Opportunity, by Region, US$ Mn 2023 -2031

Figure 13: North America Freezer Market Projections, by Product Type, Thousand Units, 2017-2031

Figure 14: North America Freezer Market Projections, by Product Type, US$ Mn 2017-2031

Figure 15: North America Freezer Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 16: North America Freezer Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 17: North America Freezer Market Projections, by Capacity, US$ Mn 2017-2031

Figure 18: North America Freezer Market, Incremental Opportunity, by Capacity, US$ Mn 2023 -2031

Figure 19: North America Freezer Market Projections, by Door, Thousand Units, 2017-2031

Figure 20: North America Freezer Market Projections, by Door, US$ Mn 2017-2031

Figure 21: North America Freezer Market, Incremental Opportunity, by Door, US$ Mn 2023 -2031

Figure 22: North America Freezer Market Projections, by Application, Thousand Units, 2017-2031

Figure 23: North America Freezer Market Projections, by Application, US$ Mn 2017-2031

Figure 24: North America Freezer Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 25: North America Freezer Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Freezer Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 27: North America Freezer Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 28: Europe Freezer Market Projections, by Product Type, Thousand Units, 2017-2031

Figure 29: Europe Freezer Market Projections, by Product Type, US$ Mn 2017-2031

Figure 30: Europe Freezer Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 31: Europe Freezer Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 32: Europe Freezer Market Projections, by Capacity, US$ Mn 2017-2031

Figure 33: Europe Freezer Market, Incremental Opportunity, by Capacity, US$ Mn 2023 -2031

Figure 34: Europe Freezer Market Projections, by Door, Thousand Units, 2017-2031

Figure 35: Europe Freezer Market Projections, by Door, US$ Mn 2017-2031

Figure 36: Europe Freezer Market, Incremental Opportunity, by Door, US$ Mn 2023 -2031

Figure 37: Europe Freezer Market Projections, by Application, Thousand Units, 2017-2031

Figure 38: Europe Freezer Market Projections, by Application, US$ Mn 2017-2031

Figure 39: Europe Freezer Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 40: Europe Freezer Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 41: Europe Freezer Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 42: Europe Freezer Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 43: Asia Pacific Freezer Market Projections, by Product Type, Thousand Units, 2017-2031

Figure 44: Asia Pacific Freezer Market Projections, by Product Type, US$ Mn 2017-2031

Figure 45: Asia Pacific Freezer Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 46: Asia Pacific Freezer Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 47: Asia Pacific Freezer Market Projections, by Capacity, US$ Mn 2017-2031

Figure 48: Asia Pacific Freezer Market, Incremental Opportunity, by Capacity, US$ Mn 2023 -2031

Figure 49: Asia Pacific Freezer Market Projections, by Door, Thousand Units, 2017-2031

Figure 50: Asia Pacific Freezer Market Projections, by Door, US$ Mn 2017-2031

Figure 51: Asia Pacific Freezer Market, Incremental Opportunity, by Door, US$ Mn 2023 -2031

Figure 52: Asia Pacific Freezer Market Projections, by Application, Thousand Units, 2017-2031

Figure 53: Asia Pacific Freezer Market Projections, by Application, US$ Mn 2017-2031

Figure 54: Asia Pacific Freezer Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 55: Asia Pacific Freezer Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Asia Pacific Freezer Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 57: Asia Pacific Freezer Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 58: Middle East & Africa Freezer Market Projections, by Product Type, Thousand Units, 2017-2031

Figure 59: Middle East & Africa Freezer Market Projections, by Product Type, US$ Mn 2017-2031

Figure 60: Middle East & Africa Freezer Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 61: Middle East & Africa Freezer Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Freezer Market Projections, by Capacity, US$ Mn 2017-2031

Figure 63: Middle East & Africa Freezer Market, Incremental Opportunity, by Capacity, US$ Mn 2023 -2031

Figure 64: Middle East & Africa Freezer Market Projections, by Door, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Freezer Market Projections, by Door, US$ Mn 2017-2031

Figure 66: Middle East & Africa Freezer Market, Incremental Opportunity, by Door, US$ Mn 2023 -2031

Figure 67: Middle East & Africa Freezer Market Projections, by Application, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Freezer Market Projections, by Application, US$ Mn 2017-2031

Figure 69: Middle East & Africa Freezer Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 70: Middle East & Africa Freezer Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Freezer Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 72: Middle East & Africa Freezer Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031

Figure 73: South America Freezer Market Projections, by Product Type, Thousand Units, 2017-2031

Figure 74: South America Freezer Market Projections, by Product Type, US$ Mn 2017-2031

Figure 75: South America Freezer Market, Incremental Opportunity, by Product Type, US$ Mn 2023 -2031

Figure 76: South America Freezer Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 77: South America Freezer Market Projections, by Capacity, US$ Mn 2017-2031

Figure 78: South America Freezer Market, Incremental Opportunity, by Capacity, US$ Mn 2023 -2031

Figure 79: South America Freezer Market Projections, by Door, Thousand Units, 2017-2031

Figure 80: South America Freezer Market Projections, by Door, US$ Mn 2017-2031

Figure 81: South America Freezer Market, Incremental Opportunity, by Door, US$ Mn 2023 -2031

Figure 82: South America Freezer Market Projections, by Application, Thousand Units, 2017-2031

Figure 83: South America Freezer Market Projections, by Application, US$ Mn 2017-2031

Figure 84: South America Freezer Market, Incremental Opportunity, by Application, US$ Mn 2023 -2031

Figure 85: South America Freezer Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 86: South America Freezer Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 87: South America Freezer Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023 -2031