Reports

Reports

The coronavirus outbreak has reinvigorated the need for product protection, shelf life enhancement, and hygiene defense for fresh fruits and vegetables. Such trends are creating revenue opportunities for manufacturers in the Europe punnet trays market.

The increase in sales through eCommerce is another key driver of the Europe punnet trays market during the pandemic, as it has fueled the demand for punnet trays and other functional packaging that complies with recyclability and virgin plastic reduction. Smurfit Kappa Europe is capitalizing on this opportunity to increase the availability of paper-based punnets. Such companies are offering fit-for-purpose packaging solutions to ensure fruits and vegetables reach consumers in a secure and undamaged way. Manufacturers are expanding their revenue streams via protective punnets during the ongoing pandemic.

Easy recycling, decline in waste produced, and less consumption of energy during the manufacturing of biodegradable plastics are grabbing the attention of manufacturers in the Europe punnet trays market. However, disadvantages such as engineering problems, costly equipment for recycling, and risk of contamination within the food are acting as roadblocks for its widespread adoption. The competition for sustainable packaging has compelled manufacturers to invest in R&D of punnets made from biodegradable plastics.

BASF SE - a Germany-based multinational chemical company is in talks for its innovations in bioplastics that not only substitute conventional plastics but also mimic their properties and applications possibilities.

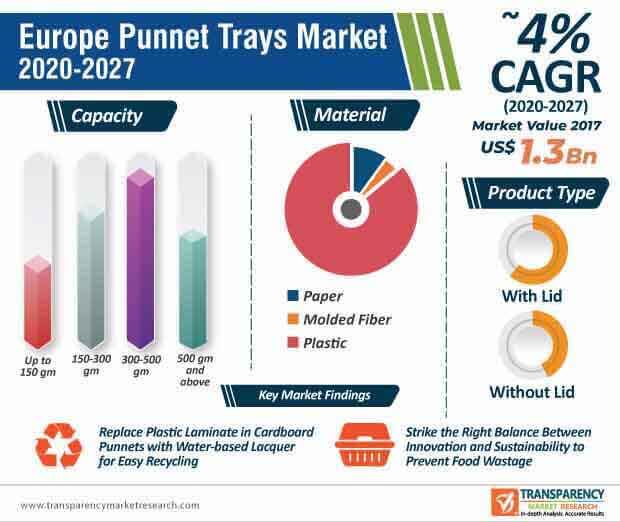

The Europe punnet trays market is expected to surpass ~30,501 Mn units by the end of 2027. Manufacturers are increasing efforts to strike the right balance between innovation and sustainability to prevent food wastage of fruits and vegetables. They are gaining awareness that visibility of food content and sustainability of packaging are important to gain a competitive edge in the highly fragmented market landscape.

Manufacturers in the Europe punnet trays market are increasing their production capabilities in 100% renewable, recyclable, and biodegradable paper-based punnets. They are taking help of surveys and research in order to innovate in sustainable punnets. Premium quality fruit and vegetables brand SanLucar has adopted FSC (Forest Stewardship Council) certified paper-based sustainable punnets that are durable and hygienic for packaging of food items.

Manufacturers are making use of 100% recycled PET (Polyethylene Terephthalate), which is suitable for direct contact with food and can also be heat-sealed with a printable top film. Hybrid punnets by Ilip - a specialist in the production of packaging solutions for fresh produce, called SlipTray, are made from plastic and cardboard.

The FSC-certified cardboard for punnets is being used for branding and communication. Moreover, manufacturers in the Europe punnet trays market are developing packaging that carries a perforated film and enables perfect ventilation for premium fruits and vegetables.

There is a need to replace plastic laminates in punnets with sustainable materials to ensure recyclability of packaging materials. Remmert Dekker Packaging - a specialist in creating and producing custom printed cardboard packaging, has collaborated with its customer Nature’s Pride to replace plastic laminate in cardboard punnets with a water-based lacquer to enable easy recycling of packaging materials. Such innovations are eliminating the need to recycle packaging materials separately, thus saving on operational costs.

The innovative water-repellent lacquer is being incorporated in cardboard punnets by manufacturers in the Europe punnet trays market.

Analysts’ Viewpoint

Even as the expansion of the eCommerce sector is creating revenue opportunities for manufacturers in the Europe punnet trays market during the COVID-19 pandemic, restrictions on transportation, shortage of workforce, and limited working hours in factories are affecting market growth. The Europe punnet trays market is projected to advance at a modest volume CAGR of ~4% during the assessment period. However, disadvantages of biodegradable plastics in punnets such as risk of methane emissions in landfills, contact with food, and high production cost end up making the final product costly for consumers. Hence, manufacturers should increase their research and experiments in new biopolymers that deploy environmental safety and reduce cost of the overall packaging.

1. Executive Summary

1.1. Market Overview

1.2. Market Analysis

1.3. TMR Analysis and Recommendations

2. Market Viewpoint

2.1. Market Definition

2.2. Market Taxonomy

3. Punnet Trays Market Overview

3.1. Introduction

3.2. Europe Punnet Trays Market Overview

3.3. Macro-economic Factors – Correlation Analysis

3.4. Forecast Factors – Relevance & Impact

3.5. Punnet Trays Market Value Chain Analysis

3.5.1. Exhaustive List of Active Participants

3.5.1.1. Manufacturers

3.5.1.2. Distributors/Retailers

3.5.1.3. End Users

3.5.2. Profitability Margins

3.6. Current Statistics and Probable Future Impact

3.7. Impact of COVID-19 on Punnet Trays Market

4. Punnet Trays Market Analysis

4.1. Pricing Analysis

4.1.1. Pricing Assumption

4.1.2. Price Projections By Country

4.2. Market Size (US$ Mn) and Forecast

4.2.1. Market Size and Y-o-Y Growth

4.2.2. Absolute $ Opportunity

5. Punnet Trays Market Dynamics

5.1. Drivers

5.2. Restraints

5.3. Opportunity Analysis

5.4. Trends

6. Europe Punnet Trays Market Analysis and Forecast, By Material

6.1. Introduction

6.1.1. Market share and Basis Points (BPS) Analysis, By Material

6.1.2. Y-o-Y Growth Projections, By Material

6.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, By Material

6.2.1. Paper

6.2.2. Molded Fiber

6.2.3. Plastic

6.2.3.1. Polystyrene (PS)

6.2.3.2. Polypropylene (PP)

6.2.3.3. Polyethylene Terephthalate (PET)

6.2.3.4. Polylactic Acid (PLA)

6.2.3.5. Polyvinyl Chloride (PVC)

6.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2019-2027, By Material

6.3.1. Paper

6.3.2. Molded Fiber

6.3.3. Plastic

6.3.3.1. Polystyrene (PS)

6.3.3.2. Polypropylene (PP)

6.3.3.3. Polyethylene Terephthalate (PET)

6.3.3.4. Polylactic Acid (PLA)

6.3.3.5. Polyvinyl Chloride (PVC)

6.4. Market Attractiveness Analysis, By Material

7. Europe Punnet Trays Market Analysis and Forecast, By Capacity

7.1. Introduction

7.1.1. Market share and Basis Points (BPS) Analysis, By Capacity

7.1.2. Y-o-Y Growth Projections, By Capacity

7.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, By Capacity

7.2.1. Up to 150 gm

7.2.2. 150-300 gm

7.2.3. 300-500 gm

7.2.4. 500 gm and above

7.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2019-2027, By Capacity

7.3.1. Up to 150 gm

7.3.2. 150-300 gm

7.3.3. 300-500 gm

7.3.4. 500 gm and above

7.4. Market Attractiveness Analysis, By Capacity

8. Europe Punnet Trays Market Analysis and Forecast, By Product Type

8.1. Introduction

8.1.1. Market share and Basis Points (BPS) Analysis, By Product Type

8.1.2. Y-o-Y Growth Projections, By Product Type

8.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, By Product Type

8.2.1. With Lid

8.2.2. Without Lid

8.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2019-2027, By Product Type

8.3.1. With Lid

8.3.2. Without Lid

8.4. Market Attractiveness Analysis, By Product Type

9. Europe Punnet Trays Market Analysis and Forecast, By End Use

9.1. Introduction

9.1.1. Market share and Basis Points (BPS) Analysis, By End Use

9.1.2. Y-o-Y Growth Projections, By End Use

9.2. Historical Market Valu e(US$ Mn) and Volume (Mn Units), 2014-2018, By End Use

9.2.1. Fruits & Vegetables

9.2.2. Meat, Poultry, & Seafood

9.2.3. Frozen Food

9.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2019-2027, By End Use

9.3.1. Fruits & Vegetables

9.3.2. Meat, Poultry, & Seafood

9.3.3. Frozen Food

9.4. Market Attractiveness Analysis, By End Use

10. Europe Punnet Trays Market Analysis and Forecast, By Country

10.1. Introduction

10.1.1. Market share and Basis Points (BPS) Analysis By Country

10.1.2. Y-o-Y Growth Projections By Country

10.2. Historical Market Value(US$ Mn) and Volume (Mn Units), 2014-2018, By Country

10.2.1. Germany

10.2.2. Spain

10.2.3. Italy

10.2.4. France

10.2.5. U.K.

10.2.6. BENELUX

10.2.7. Nordic

10.2.8. Russia

10.2.9. Poland

10.2.10. Rest of Europe

10.3. Market Size (US$ Mn) and Volume (Mn Units) Forecast Analysis 2019-2027 By Country

10.3.1. Germany

10.3.2. Spain

10.3.3. Italy

10.3.4. France

10.3.5. U.K.

10.3.6. BENELUX

10.3.7. Nordic

10.3.8. Russia

10.3.9. Poland

10.3.10. Rest of Europe

10.4. Market Attractiveness Analysis By Country

10.5. Prominent Trends

11. Competitive Landscape

11.1. Market Structure

11.2. Competition Dashboard

11.3. Company Market Share Analysis

11.4. Company Profiles (Details – Overview, Financials, Strategy, Recent Developments, SWOT analysis)

11.5. Competition Deep Dive

(Europe Players)

11.5.1. Coveris Holdings SA

11.5.1.1. Overview

11.5.1.2. Financials

11.5.1.3. Strategy

11.5.1.4. Recent Developments

11.5.1.5. SWOT Analysis

(The same will be provided for all the companies)

11.5.2. Smurfit Kappa Group

11.5.2.1. Overview

11.5.2.2. Financials

11.5.2.3. Strategy

11.5.2.4. Recent Developments

11.5.2.5. SWOT Analysis

11.5.3. LC Packaging International BV

11.5.3.1. Overview

11.5.3.2. Financials

11.5.3.3. Strategy

11.5.3.4. Recent Developments

11.5.3.5. SWOT Analysis

11.5.4. Sirane Group

11.5.4.1. Overview

11.5.4.2. Financials

11.5.4.3. Strategy

11.5.4.4. Recent Developments

11.5.4.5. SWOT Analysis

11.5.5. Produce Packaging

11.5.5.1. Overview

11.5.5.2. Financials

11.5.5.3. Strategy

11.5.5.4. Recent Developments

11.5.5.5. SWOT Analysis

11.5.6. JMC Packaging Ltd.

11.5.6.1. Overview

11.5.6.2. Financials

11.5.6.3. Strategy

11.5.6.4. Recent Developments

11.5.6.5. SWOT Analysis

11.5.7. J-Tech Systems

11.5.7.1. Overview

11.5.7.2. Financials

11.5.7.3. Strategy

11.5.7.4. Recent Developments

11.5.7.5. SWOT Analysis

11.5.8. Infia Srl

11.5.8.1. Overview

11.5.8.2. Financials

11.5.8.3. Strategy

11.5.8.4. Recent Developments

11.5.8.5. SWOT Analysis

11.5.9. Quinn Packaging Ltd.

11.5.9.1. Overview

11.5.9.2. Financials

11.5.9.3. Strategy

11.5.9.4. Recent Developments

11.5.9.5. SWOT Analysis

11.5.10. T & B Containers Ltd.

11.5.10.1. Overview

11.5.10.2. Financials

11.5.10.3. Strategy

11.5.10.4. Recent Developments

11.5.10.5. SWOT Analysis

*The list of companies is indicative in nature and is subject to change during the course of research

12. Assumptions and Acronyms Used

13. Research Methodology

List of Tables

Table 1: Europe Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 2: Europe Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 3: Europe Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 4: Europe Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 5: Europe Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 6: Europe Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 7: Europe Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 8: Europe Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 9: Europe Punnet Trays Market Value (US$ Mn) Analysis, By Country, 2014(H)-2027(F)

Table 10: Europe Punnet Trays Market Volume (Mn Units) Analysis, By Country, 2014(H)-2027(F)

Table 11: Germany Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 12: Germany Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 13: Germany Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 14: Germany Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 15: Germany Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 16: Germany Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 17: Germany Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 18: Germany Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 19: Italy Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 20: Italy Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 21: Italy Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 22: Italy Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 23: Italy Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 24: Italy Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 25: Italy Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 26: Italy Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 27: France Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 28: France Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 29: France Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 30: France Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 31: France Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 32: France Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 33: France Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 34: France Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 35: Spain Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 36: Spain Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 37: Spain Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 38: Spain Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 39: Spain Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 40: Spain Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 41: Spain Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 42: Spain Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 43: UK Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 44: UK Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 45: UK Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 46: UK Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 47: UK Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 48: UK Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 49: UK Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 50: UK Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 51: Russia Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 52: Russia Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 53: Russia Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 54: Russia Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 55: Russia Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 56: Russia Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 57: Russia Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 58: Russia Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

Table 59: Poland Punnet Trays Market Value (US$ Mn) Analysis, by Material, 2014(H)-2027(F)

Table 60: Poland Punnet Trays Market Volume (Mn Units) Analysis, by Material, 2014(H)-2027(F)

Table 61: Poland Punnet Trays Market Value (US$ Mn) Analysis, by Capacity, 2014(H)-2027(F)

Table 62: Poland Punnet Trays Market Volume (Mn Units) Analysis, by Capacity 2014(H)-2027(F)

Table 63: Poland Punnet Trays Market Value (US$ Mn) Analysis, by Product Type, 2014(H)-2027(F)

Table 64: Poland Punnet Trays Market Volume (Mn Units) Analysis, by Product Type 2014(H)-2027(F)

Table 65: Poland Punnet Trays Market Value (US$ Mn) Analysis, By End Use, 2014(H)-2027(F)

Table 66: Poland Punnet Trays Market Volume (Mn Units) Analysis, By End Use, 2014(H)-2027(F)

List of Figures

Figure 1: Europe Punnet Trays Market Value (US$ Mn) Analysis, 2014H-2018A

Figure 2: Europe Punnet Trays Market Volume (Mn Units) Analysis, 2014H-2018A

Figure 3: Europe Punnet Trays Market Value (US$ Mn) Analysis, 2019E-2027F

Figure 4: Europe Punnet Trays Market Volume (Mn Units) Analysis, 2019E-2027F

Figure 5: Europe Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 6: Europe Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 7: Europe Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 8: Europe Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 9: Europe Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 10: Europe Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 11: Europe Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 12: Europe Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 13: Europe Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 14: Europe Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 15: Europe Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 16: Europe Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 17: Europe Punnet Trays Market Share Analysis, By Country, 2019E & 2027F

Figure 18: Europe Punnet Trays Market Y-o-Y Analysis, By Country, 2019E - 2027F

Figure 19: Europe Punnet Trays Market Attractiveness Analysis, By Country, 2019E - 2027F

Figure 20: Germany Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 21: Germany Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 22: Germany Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 23: Germany Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 24: Germany Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 25: Germany Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 26: Germany Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 27: Germany Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 28: Germany Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 29: Germany Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 30: Germany Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 31: Germany Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 32: Italy Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 33: Italy Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 34: Italy Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 35: Italy Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 36: Italy Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 37: Italy Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 38: Italy Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 39: Italy Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 40: Italy Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 41: Italy Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 42: Italy Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 43: Italy Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 44: France Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 45: France Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 46: France Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 47: France Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 48: France Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 49: France Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 50: France Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 51: France Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 52: France Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 53: France Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 54: France Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 55: France Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 56: UK Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 57: UK Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 58: UK Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 59: UK Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 60: UK Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 61: UK Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 62: UK Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 63: UK Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 64: UK Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 65: UK Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 66: UK Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 67: UK Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 68: Spain Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 69: Spain Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 70: Spain Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 71: Spain Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 72: Spain Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 73: Spain Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 74: Spain Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 75: Spain Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 76: Spain Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 77: Spain Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 78: Spain Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 79: Spain Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 80: Russia Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 81: Russia Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 82: Russia Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 83: Russia Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 84: Russia Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 85: Russia Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 86: Russia Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 87: Russia Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 88: Russia Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 89: Russia Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 90: Russia Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 91: Russia Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F

Figure 92: Poland Punnet Trays Market Share Analysis, By Material, 2019E & 2027F

Figure 93: Poland Punnet Trays Market Y-o-Y Analysis, By Material, 2019E - 2027F

Figure 94: Poland Punnet Trays Market Attractiveness Analysis, By Material 2019E - 2027F

Figure 95: Poland Punnet Trays Market Share Analysis, By Capacity, 2019E & 2027F

Figure 96: Poland Punnet Trays Market Y-o-Y Analysis, By Capacity 2019E - 2027F

Figure 97: Poland Punnet Trays Market Attractiveness Analysis, By Capacity 2019E - 2027F

Figure 98: Poland Punnet Trays Market Share Analysis, By Product, 2019E & 2027F

Figure 99: Poland Punnet Trays Market Y-o-Y Analysis, By Product 2019E - 2027F

Figure 100: Poland Punnet Trays Market Attractiveness Analysis, By Product 2019E - 2027F

Figure 101: Poland Punnet Trays Market Share Analysis, By End Use, 2019E & 2027F

Figure 102: Poland Punnet Trays Market Y-o-Y Analysis, By End Use, 2019E - 2027F

Figure 103: Poland Punnet Trays Market Attractiveness Analysis, By End Use, 2019E - 2027F